Professional Documents

Culture Documents

125 S-Payroll Accounting R

Uploaded by

api-250674550Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

125 S-Payroll Accounting R

Uploaded by

api-250674550Copyright:

Available Formats

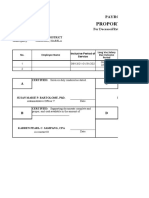

Contestant Number: ________________

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 1 of 7

Time: _________ Rank: _________

PAYROLL ACCOUNTING

(125)

Secondary

REGIONAL 2014

Multiple Choice & Short Answer: Multiple Choice (15 @ 2 points each) Short Answers (24 @ 2 points each) Production: Job 1: Payroll Register TOTAL POINTS ______________ (73 points) ______________ (151 points) ______________ (30 points) ______________ (48 points)

Failure to adhere to any of the following rules will result in disqualification: 1. Contestant must hand in this test booklet and all printouts. Failure to do so will result in disqualification. 2. No equipment, supplies, or materials other than those specified for this event are allowed in the testing area. No previous BPA tests and/or sample tests or facsimile (handwritten, photocopied, or keyed) are allowed in the testing area. 3. Electronic devices will be monitored according to ACT standards.

No more than ten (10) minutes orientation No more than 90 minutes testing time No more than ten (10) minutes wrap-up

Property of Business Professionals of America. May be reproduced only for use in the Business Professionals of America Workplace Skills Assessment Program competition.

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 2 of 7

General Instructions You have been hired as a Financial Assistant and will be keeping the accounting records for Professional Business Associates, located at 5454 Cleveland Avenue, Columbus, Ohio 43231. Professional Business Associates provides accounting and other financial services for clients. You will complete jobs for Professional Business Associates own accounting records, as well as for clients. You will have 90 minutes to complete your work. The test is divided into two parts. The multiple choice and short answer questions should be completed first, and then the accounting problems may be completed in any order. Your name and/or school name should NOT appear on any work you submit for grading. Write your contestant number in the provided space. Staple all pages in order before you turn in your test. Assumptions to make when taking this assessment: Round all rates per hour and payroll calculations to two decimal places Assume employees earn overtime for any hours worked over 40 hours in a week unless otherwise instructed All time calculations are rounded to the nearest quarter hour Income Tax Withholding Tables are provided at the end of the assessment Use 6.2% for Social Security Tax and 1.45% for Medicare Tax Use 5.4% for State Unemployment Tax and 0.8% for Federal Unemployment Tax Assume that no employee has accumulated earnings in excess of the social security tax, SUTA, or FUTA base

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 3 of 7

Multiple Choice: Select the best answer and record the answer on the Scantron provided. 1. The net pay to employees is commonly known as a. Gross Pay b. Take Home Pay c. Salary Compensation d. Payroll Expense 2. _______ - deductions = Net Pay is a basic formula to determine net pay for each employee for each pay period a. Non-taxable Earnings b. Yearly Earnings c. Gross Earnings d. Cumulative Earnings 3. The form filled out by a new employee to determine the amount of income tax to be withheld from their paycheck a. Form W-2 b. Form W-4 c. Form 1040 d. Form I-9 4. If an employee works 33.5 hours and is paid $9.13 per hour, how much is their gross pay? a. $305.85 b. $301.29 c. $305.86 d. $303.57 5. Which group of employees has the highest amount of federal income tax generally withheld? a. Married, 3 exemptions b. Single, 2 exemptions c. Married, 0 exemptions d. Single, 0 exemptions 6. The Employees Earnings Record shows an employee which of the following information for the year a. Promotions and reviews history b. Who is garnishing wages from them c. Cumulative earnings d. Emergency contacts 7. The payroll register is used to produce a. W-2s b. Employee total wages for the year c. Journal entries for the current payroll period d. 1099s to be issued to vendors

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 4 of 7

8. Bert has 43 hours in the current payroll period and his hourly wage is $9.35 per hour. If Bert earns time and a half for all hours over 40, how much is his gross pay? a. $402.05 b. $416.09 c. $416.06 d. $374.00 9. Social security tax is paid by a. Employee only b. Employer only c. Employee and employer d. Federal government 10. From which of the following are federal income taxes withheld? a. Vacation Pay b. Bonus Pay c. Personal Day Pay d. All of the above 11. Which statement is true a. There will always be federal income tax withheld from every employee b. Employers are only ones that pay the employees social security tax c. Every time that a payroll occurs, there is a journal entry for the employees earnings and a journal entry for the employers payroll tax expense. d. You can choose to never pay any income tax legally 12. FMLA refers to the a. Future and Medical Leave Act b. Family and Medical Leave Act c. Family and Medical Leave Accounting d. None of the above 13. Employees W-2 amounts are for a. Current calendar year wages paid to the employee b. Current calendar year hours and wages worked by the employee c. Show the amount of non-employee compensation received by the employee d. Show this year and last years wages paid to the employee. 14. If the maximum amount of taxable wages for Federal Unemployment Tax is $7,000 per employee and the employers rate is .8% of this, what is the most an employer will be liable to pay for each employee? a. $560.00 b. $5.60 c. $56.00 d. None of these are correct

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 5 of 7

15. If an employer has total wages of $103,990 paid to employees during a period and $43,000 of these are exempt (not taxable) from SUTA, how much will the employers liability be if their SUTA rate is 3.14%? a. $19,150.86 b. $1,915.09 c. $32,652.86 d. $3,265.29

Short Answer: 1. Rob Jason is paid bi-weekly. His yearly salary is $36,000 and is paid time and a half for any hours worked over 40 in a week. During the payroll period, he had 4 hours of overtime. Calculate Robs pay and overtime rate for the bi-weekly period. Regular Salary $_______________________

Overtime Rate

$____________

Overtime Pay

$_______________________

Gross Pay

$_______________________

2. Gwen Mann is paid every week. Gwen is paid on a piece rate system of $.86 per piece produced during the week. Last week Gwen produced the following units in her 40 hour work week: Monday 155 Tuesday 154 Wednesday 164 Thursday 150 Friday 144 Total Pieces Total Pay

3. Will Grey is a salaried sales person with a bonus incentive plan for sales above his quota. His quota for sales is $1,000,000 per year. He earns 4% on all sales above this quota. His yearly sales are $2,000,000 with a base salary of $75,000 per year. Calculate his total yearly earnings?

$______________________________________

If another company offered him a similar position with the same amount of sales but no base salary or quota (just commission on sales), what % commission must he receive in order to equal his present total yearly earnings?

____________%

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 6 of 7

4. You current job pays an annual salary of $112,630. Assuming you are paid bi-weekly and work a normal 40-hour week, calculate the following.

Earnings per pay period $______________________

Pay rate per hour

$______________________

5. Using the following time card, calculate the regular, overtime, and total earnings for Gia Nelson. Gia takes a 30 minute lunch period each day she works more than 5 hours. In addition, she is not docked hours or given additional hours for punch-in/out times +/- 6 minutes or less. Her regular work day is 8 am 4:30 pm and she receives time and a half for all hours over 40 for the week.

Time Card Employee No. 120765 Name: Nelson, Gia Social Security No.: 393-65-8821 Day In 8:03 AM Monday 7:56 AM Tuesday 8:15 AM Wednesday

Week Ending March 12, 2013 Exemptions: 2 Hourly Rate: $8.90 Out Hours 4:33 PM 4:30 PM 5:01 PM 6:03 PM 5:31 PM 12:33 PM Rate Earnings

Thursday Friday Saturday

Regular Overtime Totals

8:00 AM 8:00 AM 9:01 AM Hours

N/A

PAYROLL ACCOUNTING (S) - REGIONAL 2014 Page 7 of 7

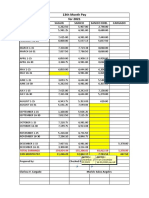

Problem #1: Payroll Register (73 Points) Complete the following payroll register for Chickadee Company. All employees are paid weekly at an hourly rate, and Federal Income Tax is withheld at a flat rate of 25% instead of using the taxes.

Payroll Register Reg. NAME Hours Reg. Rate OT Hours OT Rate Gross Wages Social Security Med FIT Deductions SIT (5%) Health Insurance Net Pay

Johnson Andrews Barker Benson O'Mally Severson Smit Tagert Wagner TOTALS

35 40 40 37.5 34.5 40 36 38 40

12.25 12.30 9.65 11.45 9.65 12.25 9.65 11.45 12.97 XXX

25.00 60.00 5 15.00 30.00 5.00 17.00 50.00 XXX

4.5

3.25

You might also like

- 190 Financial Math and Analysis Concepts-Open R 2014Document10 pages190 Financial Math and Analysis Concepts-Open R 2014api-250674550No ratings yet

- 160 S-Economic Research Team Technical Rubric 2014Document1 page160 S-Economic Research Team Technical Rubric 2014api-250674550No ratings yet

- 191 Insurance Concepts-Open R 2014Document6 pages191 Insurance Concepts-Open R 2014api-250674550No ratings yet

- 145 Banking Finance R 2014Document6 pages145 Banking Finance R 2014api-250674550No ratings yet

- 155 S-Economic Research Individual Presentation Rubric 2014Document3 pages155 S-Economic Research Individual Presentation Rubric 2014api-250674550No ratings yet

- 445 S-Broadcast News Production Team Rubric 2014Document4 pages445 S-Broadcast News Production Team Rubric 2014api-250674550No ratings yet

- Balance Sheet 8-31Document1 pageBalance Sheet 8-31api-250674550No ratings yet

- 430 Video Production Team Presentation Rubric 2014Document3 pages430 Video Production Team Presentation Rubric 2014api-250674550No ratings yet

- 435 Web Site Design Team Technical Rubric 2014Document1 page435 Web Site Design Team Technical Rubric 2014api-250674550No ratings yet

- 100 S-Fundamental Accounting R 2014Document9 pages100 S-Fundamental Accounting R 2014api-250674550No ratings yet

- 405 Fundamentals of Web Design R 2014Document6 pages405 Fundamentals of Web Design R 2014api-250674550No ratings yet

- 420 Digital Media Production Presentation Rubric 2014Document3 pages420 Digital Media Production Presentation Rubric 2014api-250674550No ratings yet

- 215 Integrated Office Applications R 2014Document9 pages215 Integrated Office Applications R 2014api-250674550No ratings yet

- 250 Medical Office Procedures R 2014Document6 pages250 Medical Office Procedures R 2014api-250674550No ratings yet

- 400 Fundamental Desktop Publishing R 2014Document5 pages400 Fundamental Desktop Publishing R 2014api-250674550No ratings yet

- 230 Fundamental Spreadsheet Applications R 2014Document5 pages230 Fundamental Spreadsheet Applications R 2014api-250674550No ratings yet

- 240 Database Applications R 2014Document5 pages240 Database Applications R 2014api-250674550No ratings yet

- 245 Legal Office Procedures R 2014Document6 pages245 Legal Office Procedures R 2014api-250674550No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Department:: Oberlin College Controller's Office Weekly Employment Record - Miscellaneous Hourly EmployeesDocument1 pageDepartment:: Oberlin College Controller's Office Weekly Employment Record - Miscellaneous Hourly EmployeesSuvan AgarwalNo ratings yet

- Lecture 7 - Conditions of Employment Pt. 2Document55 pagesLecture 7 - Conditions of Employment Pt. 2Steps RolsNo ratings yet

- Order in That To: The AldDocument2 pagesOrder in That To: The Aldumesh221No ratings yet

- GRVSP00700530000014298 NewDocument3 pagesGRVSP00700530000014298 NewRakesh PatnaikNo ratings yet

- Tamilnadu Pension Calculation ARREARS SoftwareDocument13 pagesTamilnadu Pension Calculation ARREARS Softwarejayakumarbalaji50% (4)

- GA55Document1 pageGA55Raghuveer Rathore Jetmalot AlniyawasNo ratings yet

- CaseDocument4 pagesCaseEzra Joy Angagan CanosaNo ratings yet

- MOS Rate of HPL and HREL-UpdatedDocument31 pagesMOS Rate of HPL and HREL-UpdatedDebasmita DasNo ratings yet

- Payslip 25 09 2020 1Document1 pagePayslip 25 09 2020 1Monica SzollosiNo ratings yet

- Chapter - 10 - Pay - For - Performance - Incentive - Rewards - 9eDocument17 pagesChapter - 10 - Pay - For - Performance - Incentive - Rewards - 9ePriyanjaliNo ratings yet

- Deaconess Homecare Inc: Payroll Advice OnlyDocument4 pagesDeaconess Homecare Inc: Payroll Advice OnlyDREE DREENo ratings yet

- 6 PF Declaration Form 11Document1 page6 PF Declaration Form 11danishtamboli123No ratings yet

- (See Rule 120) : FORM No. 14Document2 pages(See Rule 120) : FORM No. 14manoj_yadav7000No ratings yet

- Payslip For March 2023 - TORM ARAWA (Closed Payroll) : Torm A/S Torm A/SDocument1 pagePayslip For March 2023 - TORM ARAWA (Closed Payroll) : Torm A/S Torm A/SRodelio TomasNo ratings yet

- Truly Admin Payroll 2021Document50 pagesTruly Admin Payroll 2021Truly ClarissaNo ratings yet

- Thomas Co LTD Payroll 2019Document2 pagesThomas Co LTD Payroll 2019MaxineNo ratings yet

- PVP PayrollDocument4 pagesPVP Payrollkim berlyNo ratings yet

- Binder1 PDFDocument5 pagesBinder1 PDFSaad Raza KhanNo ratings yet

- CGAL-StaffingCost - DraftDocument4 pagesCGAL-StaffingCost - DraftMitchie Binarao BaylonNo ratings yet

- Variable Pay and Executive Compensation: Section 4Document46 pagesVariable Pay and Executive Compensation: Section 4Manraj kaurNo ratings yet

- Questions A B C D SolutionDocument3 pagesQuestions A B C D SolutionNIDHI KOTIANNo ratings yet

- Karnataka Revised Rates of VDA Under Minimum Wages Act 1948Document4 pagesKarnataka Revised Rates of VDA Under Minimum Wages Act 1948maheshreddysNo ratings yet

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspSarthakNo ratings yet

- Bus Math Worksheet - SalariesDocument1 pageBus Math Worksheet - SalariesSheilaMarieAnnMagcalas100% (1)

- Full Time Employee Vs Independent ContractorDocument1 pageFull Time Employee Vs Independent ContractorMaria Anisia Jennifer MenezNo ratings yet

- Dayworks - January 2013Document2 pagesDayworks - January 2013swamydceNo ratings yet

- Activity 12Document2 pagesActivity 12api-432026155No ratings yet

- Canara Bank Employees Pension Regulations, 1995Document84 pagesCanara Bank Employees Pension Regulations, 1995Latest Laws TeamNo ratings yet

- PF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)Document4 pagesPF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)maninder_10No ratings yet