Professional Documents

Culture Documents

Tariff and Customs Code

Uploaded by

Dayday AbleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff and Customs Code

Uploaded by

Dayday AbleCopyright:

Available Formats

On-Line Bar Reviewer

on Taxation

Reynaldo G. Geronimo

Partner

1

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Tariff and Customs Code

of the Philipppines

(TCCP)

2

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

A. Fundamental Principles

1. What is meant by tariff?

Tariff means a book of rates. More

precisely, it means the rate of tax

imposed upon importation of goods.

2. What is meant by duty or customs

duty?

Duty or customs duty refers to the tax

that is collected when good are imported.

3

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

3. What goods are subject to customs

duties when imported?

All articles, when imported from any

foreign country into the Philippines,

shall be subject to duty upon each

importation except as otherwise

specifically provided for in TCCP or

in other laws.

4

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

4. Are goods imported by the government

subject to customs duty?

Generally, yes. But, upon certification of

the head of the department or political

subdivision concerned, with the approval

of the Auditor General, that the imported

article is actually being used by the

government or any of its political

subdivision concerned, the amount of

duty, tax, fee or charge is refunded to the

entity which paid it.

5

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

5. What is meant by the flexible tariff clause in the

Constitution? Has it been implemented?

It is that clause in the Constitution that authorizes

Congress to empower the President, under certain

conditions, to fix import duties and tariff rates. Such

Congressional authorization was given under the

TCCP which allows the President to reduce by not

more than fifty per cent or to increase by not more

than five times the rates of import duty expressly fixed

by statute when in his judgment such modification in

the rates of import duty is necessary in the interest of

national economy, general welfare and/or national

defense.

6

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

6. Is the President authorized to modify tariff rates

in order to promote foreign trade?

Yes. For the purpose of expanding foreign

markets for Philippine products as a means of

assisting in the economic development of the

country, in overcoming domestic unemployment,

in increasing the purchasing power of the

Philippine peso, and in establishing and

maintaining better relationship between the

Philippines and other countries, the President

maymodify import duties the increase not to

exceed by five times or the decrease be more

than fifty per cent of the rate of duty expressly

fixed by the TCCP.

7

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

B. The Process of Importation

1. When does importation begin and end?

Importation begins when the carrying vessel or

aircraft enters the jurisdiction of the Philippines

with intention to unlade therein.

Importation is deemed terminated upon payment

of the duties, taxes and other charges due upon

the articles, or secured to be paid, at a port of

entry and the legal permit for withdrawal shall

have been granted, or in the case of tax free

importations, until they have legally left the

jurisdiction of the customs.

8

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

2. Where may importation be effected?

All articles imported into the Philippines,

whether subject to duty or not, shall be entered

through a customhouse at a port of entry.

3. Who is deemed the owner of imported goods?

The owner of an imported article is the person

to whom the same is consigned. The holder of

a bill of lading duly indorsed by the consignee

therein named, or, if consigned to order, by the

consignor, shall be deemed the consignee

thereof.

9

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

B. Importations violative of TCCP

What are the common kinds of

importations violative of the Tariff and

Customs Code?

Common Violations:

a. Smuggling

b. Other frauds against customs

10

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

C. Classification of Goods

Imported goods are classified into:

a. Regular importations those permitted to be

imported. Ex: flour wheat

b. Prohibited importations those NOT permitted

to be imported. Ex: pornographic materials

c. Conditionally free importations those exempt

from the payment of import duties upon

compliance with the formalities prescribed in

accordance with law, or with the regulations

which shall be promulgated by the

Commissioner of Customs with the approval of

the Secretary of Finance.

11

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Determination of Tax Base

The tax base is either:

a. Ad valorem or dutiable value- which is

determined on the basis of (a) the

transaction value over the importation

itself; (b) transaction value of identical

goods; (c ) of transaction value of similar

good; (d) deductive value; (e) computed

value; (f) fallback value;

b. Specific - which is usually based on

dutiable weight

12

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Classification of Duties

Duties are classified into:

a. Regular or Ordinary those on the

mere fact of importation and based on

dutiable value or dutiable weight

b. Special Duties those imposed when

certain conditions are present, such as,

when the importation, because of factors

other than its intrinsic worth, is considered

either harmful to the economy, or

incompatible with our national interest.

13

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Kinds of Special Duties

1. Dumping duty- imposed by the

Secretary of Financewhen the imported

articles are being sold or likely to be sold

in the Philippines, at a price less than its

fair value and the importation or sale of

which might injure, or prevent the

establishment of, or is likely to injure an

industry in the Philippines;

14

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

2. Countervailing duty Imposed by the

Secretary of Finance, after investigation,

on articles upon the production,

manufacture or export of which any

bounty, subsidy or subvention is directly or

indirectly granted in the country of origin

and/or exportation, and the importation is

likely to materially injure an established

industry, or prevent or considerably retard

the establishment of an industry in the

Philippines;

15

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

3. Discriminatory Duty Imposed by the

President, in the amount not exceeding 50 per

cent of the existing rates upon articles from any

foreign country that

(1) Imposes any unreasonable charge, exaction,

regulation or limitation on Philippine goods

which is not equally enforced upon the like

articles of every foreign country; or .

(2) Discriminates in fact against the commerce

of the Philippines in respect to any customs,

tonnage, or port duty, fee, charge, exaction,

classification, regulation, condition, restriction or

prohibition, in such manner as to place the

commerce of the Philippines at a disadvantage

compared with the commerce of any foreign

country.

16

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

4. Marking Duty Imposed by the

Commissioner of Customs on every article

of foreign origin imported into the

Philippines requiring their being marked in

any official language of the Philippines and

in a conspicuous place as legibly, indelibly

and permanently as the nature of the

article (or container) will permit in such

manner as to indicate to an ultimate

purchaser in the Philippines the name of

the country of origin of the article.

17

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

5. Safeguard duty-

a. General safeguard duty duty

imposed by the Secretary of Finance

after positively determining that a product

is being imported in increased quantities,

whether absolute or relative to domestic

production, as to be a substantial cause

of injury or threat thereof to the domestic

industry;

18

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

b. Special safeguard duty for agriculture-

imposed by the Commissioner of

Customs, upon request of the Secretary of

Agriculture through the Secretary of

Finance, on an agricultural product,

consistent with our international

obligations, either (a) when its cumulative

import volume exceeds the trigger volume,

or (b), even if trigger volume is not

exceeded, it fails the price test.

19

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

What are drawbacks?

A drawback is a refund or tax credit

granted on duties that had been paid on

products that are subsequently exported,

such as on all fuel imported into the

Philippines used for propulsion of vessels

engaged in trade with foreign countries, or

in the coastwise trade, or articles used as

raw materials for items subsequently

exported.

20

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Describe the process of

paying the regular customs duties.

Step One: Making of the entry (formal or

informal) -Imported articles must be entered

in the customhouse at the port of entry within

fifteen days from date of discharge of the last

package from the vessel by the importer, etc.

The Collector may grant an extension of not

more than fifteen days.

Step Two: Examination, classification and

appraisal of the imported articles.

Step Three: Liquidation (payment) of duties

and withdrawal of the articles from customs.

21

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

REMEDIES

Advisory

The remedies of the government and

of the taxpayer will be discussed in

another section where the tax

remedies will be discussed all

together.

22

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

Thank You

and

Good Luck

23

ChanRobles Internet Bar Review : ChanRobles Professional Review, Inc.

www.chanroblesbar.com : www.chanroblesbar.com.ph

You might also like

- Bioenzyme BrochureDocument1 pageBioenzyme BrochureDayday AbleNo ratings yet

- S Medical Center, Inc., G.R. No. 195909, September 26, 2012Document5 pagesS Medical Center, Inc., G.R. No. 195909, September 26, 2012Dayday Able50% (2)

- Plastic Shredder BrochureDocument1 pagePlastic Shredder BrochureDayday AbleNo ratings yet

- Glass Pulverizer BrochureDocument1 pageGlass Pulverizer BrochureDayday AbleNo ratings yet

- Civil Law - Tuazon v. Del Rosario-Suarez, Et Al.. G.R. No. 168325, December 8, 2010Document2 pagesCivil Law - Tuazon v. Del Rosario-Suarez, Et Al.. G.R. No. 168325, December 8, 2010Dayday Able0% (1)

- Constitutional Law - Willem Beumer v. Avelina Amores. G.R. No. 195670. December 3, 2012Document2 pagesConstitutional Law - Willem Beumer v. Avelina Amores. G.R. No. 195670. December 3, 2012Dayday AbleNo ratings yet

- Political Law - ABC Party List v. Comelec, G.R. No. 193256, March 22, 2011Document2 pagesPolitical Law - ABC Party List v. Comelec, G.R. No. 193256, March 22, 2011Dayday Able100% (1)

- Republic Act n1Document225 pagesRepublic Act n1Dayday AbleNo ratings yet

- Korea Tech Vs LermaDocument3 pagesKorea Tech Vs LermaDayday AbleNo ratings yet

- Remedial Law - Yu v. Reyes-Carpio Et Al G.R. No. 189207 June 15, 2011Document3 pagesRemedial Law - Yu v. Reyes-Carpio Et Al G.R. No. 189207 June 15, 2011Dayday AbleNo ratings yet

- Political Law - Federico v. COMELEC, G.R. No. 199612, January 22, 2013Document3 pagesPolitical Law - Federico v. COMELEC, G.R. No. 199612, January 22, 2013Dayday Able100% (1)

- Executive Power to Enforce Administrative SubpoenasDocument2 pagesExecutive Power to Enforce Administrative Subpoenasactuarial_researcher100% (1)

- Philippine Law Subjects Reading GuideDocument2 pagesPhilippine Law Subjects Reading GuideDayday AbleNo ratings yet

- Case Digest on Improperly Sworn COCDocument3 pagesCase Digest on Improperly Sworn COCDayday Able100% (1)

- Remedial Law - City of Cebu v. Dedamo, Jr.,G.R. No. 172852, January 30, 2013Document2 pagesRemedial Law - City of Cebu v. Dedamo, Jr.,G.R. No. 172852, January 30, 2013Dayday AbleNo ratings yet

- Vitarich v Losin Case DigestDocument2 pagesVitarich v Losin Case DigestDayday AbleNo ratings yet

- Civil Law - Yuchengco v. Manila Chronicle, G.R. No. 184315, November 28, 2011 PDFDocument2 pagesCivil Law - Yuchengco v. Manila Chronicle, G.R. No. 184315, November 28, 2011 PDFDayday AbleNo ratings yet

- Political Law - Ermita v. Aldecoa-Delorino G.R. No. 177130. June 7, 2011Document2 pagesPolitical Law - Ermita v. Aldecoa-Delorino G.R. No. 177130. June 7, 2011Dayday Able0% (1)

- Political Law - Tobias v. Limsiaco, JR., A.M. No. MTJ-09-1734, January 19, 2011Document2 pagesPolitical Law - Tobias v. Limsiaco, JR., A.M. No. MTJ-09-1734, January 19, 2011Dayday AbleNo ratings yet

- Civil Law - Garcia v. Garcia, G.R. No. 169157, November 14, 2011Document2 pagesCivil Law - Garcia v. Garcia, G.R. No. 169157, November 14, 2011Dayday AbleNo ratings yet

- Coronel Vs Court of AppealsDocument1 pageCoronel Vs Court of AppealsMarianne DomalantaNo ratings yet

- Agan DigestDocument4 pagesAgan DigestDayday AbleNo ratings yet

- Civil Law - Pascua, v. G & G Realty Corporation, G.R. No. 196383, October 15, 2012 PDFDocument2 pagesCivil Law - Pascua, v. G & G Realty Corporation, G.R. No. 196383, October 15, 2012 PDFDayday AbleNo ratings yet

- Labor Law - Goya, Inc. v. Goya, Inc. Employees Union-FFW, G.R. No. 170054, January 21, 2013Document2 pagesLabor Law - Goya, Inc. v. Goya, Inc. Employees Union-FFW, G.R. No. 170054, January 21, 2013Dayday AbleNo ratings yet

- Legal Ethics - Magtibay v. Judge Indar, A.M. No. RTJ-11-2271, September 24, 2012Document2 pagesLegal Ethics - Magtibay v. Judge Indar, A.M. No. RTJ-11-2271, September 24, 2012Dayday AbleNo ratings yet

- Commercial Law - Skechers, USA v. Inter Pacific Industrial Trading, G.R. No. 164321, March 28, 2011Document2 pagesCommercial Law - Skechers, USA v. Inter Pacific Industrial Trading, G.R. No. 164321, March 28, 2011Dayday AbleNo ratings yet

- Legal Ethics - Judge Adlawan, V. Capilitan, A.M. No. P-12-3080, August 29, 2012Document1 pageLegal Ethics - Judge Adlawan, V. Capilitan, A.M. No. P-12-3080, August 29, 2012Dayday AbleNo ratings yet

- Commercial Law - Skechers, USA v. Inter Pacific Industrial Trading, G.R. No. 164321, March 28, 2011Document2 pagesCommercial Law - Skechers, USA v. Inter Pacific Industrial Trading, G.R. No. 164321, March 28, 2011Dayday AbleNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- Mercantile Law - Paramount Insurance Corp. v. Sps. Remondeulaz, G.R. No. 173773, November 28, 2012Document2 pagesMercantile Law - Paramount Insurance Corp. v. Sps. Remondeulaz, G.R. No. 173773, November 28, 2012Dayday Able0% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

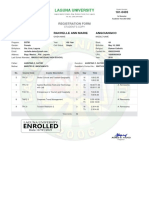

- Laguna University: Registration FormDocument1 pageLaguna University: Registration FormMonica EspinosaNo ratings yet

- Behaviour Social Relations and Solidarity Between Friends On Adolescent Lifestyle BehaviorsDocument4 pagesBehaviour Social Relations and Solidarity Between Friends On Adolescent Lifestyle BehaviorsmvickeyNo ratings yet

- Indian LegionDocument10 pagesIndian LegionJean-pierre Negre100% (1)

- A Guide To The Characters in The Buddha of SuburbiaDocument5 pagesA Guide To The Characters in The Buddha of SuburbiaM.ZubairNo ratings yet

- Critical Theory and Authoritarian Populism PDFDocument299 pagesCritical Theory and Authoritarian Populism PDFNstv Corcoran100% (1)

- Justice and FairnessDocument35 pagesJustice and FairnessRichard Dan Ilao ReyesNo ratings yet

- Philippine Declaration of IndependenceDocument2 pagesPhilippine Declaration of Independenceelyse yumul100% (1)

- Capital PunishmentDocument3 pagesCapital PunishmentAnony MuseNo ratings yet

- Gulliver's Travels to BrobdingnagDocument8 pagesGulliver's Travels to BrobdingnagAshish JainNo ratings yet

- Bias and PrejudiceDocument16 pagesBias and PrejudiceLilay BarambanganNo ratings yet

- Law New ReleasesDocument34 pagesLaw New ReleasesPankajNo ratings yet

- Love Is FleetingDocument1 pageLove Is FleetingAnanya RayNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, Lucknow.: Topic: Decline of The Mauryan EmpireDocument11 pagesDr. Ram Manohar Lohiya National Law University, Lucknow.: Topic: Decline of The Mauryan EmpiredivyavishalNo ratings yet

- Slavery - The West IndiesDocument66 pagesSlavery - The West IndiesThe 18th Century Material Culture Resource Center100% (2)

- Equal Remuneration Act, 1976Document9 pagesEqual Remuneration Act, 1976Shilpi KulshresthaNo ratings yet

- April 26Document7 pagesApril 26Jon CampbellNo ratings yet

- Missionary Correlation and Preach My GospelDocument17 pagesMissionary Correlation and Preach My GospelRyan ValidoNo ratings yet

- 201437735Document68 pages201437735The Myanmar TimesNo ratings yet

- Why Bharat Matters Mapping Indias Rise As A Civilisational StateDocument2 pagesWhy Bharat Matters Mapping Indias Rise As A Civilisational Statevaibhav chaudhariNo ratings yet

- It ACT IndiaDocument3 pagesIt ACT IndiarajunairNo ratings yet

- The Political Strategies of The Moro Islamic LiberDocument26 pagesThe Political Strategies of The Moro Islamic LiberArchAngel Grace Moreno BayangNo ratings yet

- Walder - The Remaking of The Chinese Working ClassDocument47 pagesWalder - The Remaking of The Chinese Working ClassWukurdNo ratings yet

- Wagaw-Ethnicty and EducationDocument13 pagesWagaw-Ethnicty and EducationStephen BikoNo ratings yet

- NPM - A New Paradigm in Health Service in NepalDocument6 pagesNPM - A New Paradigm in Health Service in NepalRajendra KadelNo ratings yet

- Edward Feser (@FeserEdward) TwitterDocument1 pageEdward Feser (@FeserEdward) TwittermatthewmayuiersNo ratings yet

- Ari The Conversations Series 1 Ambassador Zhong JianhuaDocument16 pagesAri The Conversations Series 1 Ambassador Zhong Jianhuaapi-232523826No ratings yet

- Edfd261 Assignment 2Document7 pagesEdfd261 Assignment 2api-253728480No ratings yet

- Referencias DynaSand ETAP.01.06Document19 pagesReferencias DynaSand ETAP.01.06ana luciaNo ratings yet

- Monday, May 05, 2014 EditionDocument16 pagesMonday, May 05, 2014 EditionFrontPageAfricaNo ratings yet

- BRICS Summit 2017 highlights growing economic cooperationDocument84 pagesBRICS Summit 2017 highlights growing economic cooperationMallikarjuna SharmaNo ratings yet