Professional Documents

Culture Documents

Amendments To 4th & 5th Shedule

Uploaded by

Shafiq UrRehmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amendments To 4th & 5th Shedule

Uploaded by

Shafiq UrRehmanCopyright:

Available Formats

Financial

Reporting

Amendments in the Fourth

and the Fifth Schedule to the

Companies Ordinance, 1984

July 2013

A. F. FERGUSON & CO.

Chartered Accountants

a member firm of the PwC network

Strictly for circulation to clients and

staff of A . F. Ferguson & Co.

Amendments in the Fourth and the Fifth

Schedule to the Companies Ordinance, 1984

On 4 March 2013 the Securities and Exchange Commission of Pakistan has notified

certain amendments in the Fourth and the Fifth Schedule to the Companies

Ordinance, 1984 (the Ordinance) through S.R.O. 183 (I)/2013 and S.R.O. 182 (I)/2013

respectively, which notifications were published in the Gazette of Pakistan

(Extraordinary) on 8 March 2013. As no specific date of such changes coming to force

has been mentioned in the notifications, we understand that such changes are effective

from the date of these notifications.

These amendments principally have (i) clarified certain matters to avoid diversity in

application, (ii) changed some of the presentation requirements, specifically in relation

to the Income Statement (Profit & Loss Account), and (iii) incorporated few additional

disclosure requirements. This document summarises the important amendments, and

is not aimed at capturing or discussing the consequential or minor ones. Themes of

certain amendments are the same in both these Schedules, whereas others maybe

specific to either of the Schedules; and the discussion in this document has accordingly

been grouped into relevant themes.

This document can also be accessed on our website www.pwc.com/pk.

1 July 2013

Table of Contents

Financial reporting framework ................................4

Presentation of the profit and loss account / income

statement................................................................ 7

Disclosures relating to provident fund / trust .........8

Requirements as to balance sheet .............................9

Disclosure of capacity, production and number of

employees..............................................................11

Annexure 1 List of IFRSs notified by the SECP ... 12

Annexure 2 List of IFRSs issued by the IASB but

not notified by the SECP...................................... 13

Annexure 3 Text of Section 227 of the Ordinance,

related rules and notification............................. 14

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 4

Financial reporting

framework

1. The Fourth Schedule

Under the provisions of the

Ordinance, all listed companies and

their subsidiaries (be them private or

non-listed public companies) are

required to comply with the

requirements of the Fourth Schedule in

preparing their annual financial

statements.

Further, requirements of the Fourth

Schedule are mandatory for the

preparation of consolidated financial

statements of every holding company

irrespective of the holding company

being a private or a public company.

Amendments in the Fourth Schedule

are, hence, relevant for all such

companies.

2. The Fifth Schedule

Companies which are neither listed nor

are subsidiaries of a listed company are

required to comply with the

requirements of the Fifth Schedule in

preparing their annual financial

statements.

The Fifth Schedule has these

companies categorised as:

- Small-Sized companies

- Medium-Sized companies

- Economically Significant

companies

A Small-Sized company is a company

that:

i- has a paid up capital plus

undistributed reserves (total equity

after taking into account any

dividend proposed for the year)

not exceeding Rs. 25 million; and

ii- has annual turnover not exceeding

Rs. 250 million, excluding other

income.

A Medium-Sized company is a

company that:

i- is not a listed company or a

subsidiary of a listed company;

ii- has not filed, or is not in the

process of filing, its financial

statements with the Securities and

Exchange Commission of Pakistan

(SECP) or other regulatory

organisation for the purpose of

issuing any class of instruments in

a public market;

iii- does not hold assets in a fiduciary

capacity for a broad group of

outsiders, such as a bank,

insurance company, securities

broker / dealer, pension fund,

mutual fund or investment

banking entity;

iv- is not a public utility or similar

company that provides an essential

public service; and

v- is neither Economically Significant

nor a Small Sized Company.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 5

An Economically Significant company

is a company that has any two of the

following on the basis of previous

years audited financial statements:

i- turnover in excess of Rs. 1 billion,

excluding other income;

ii- number of employees in excess of

750; and

iii- total borrowings (excluding trade

creditors and accrued liabilities) in

excess of Rs. 500 million.

Also, once in this Economically

Significant category, companies can be

excluded from this category where they

do not fall under the aforementioned

criteria for two consecutive years.

3. International Financial

Reporting Standards

The term International Financial

Reporting Standards (IFRS) was

introduced in 2005 by the

International Accounting Standards

Board (IASB) as:

International Financial Reporting

Standards are Standards and

Interpretations adopted by the

International Accounting Standards

Board. They comprise:

( a) International Financial Reporting

Standards; (b) International

Accounting Standards; and

(c)Interpretations developed by the

International Financial Reporting

Interpretations Committee (IFRIC) or

the former Standing Interpretations

Committee (SIC).

The term IFRS has now been

introduced in the Fourth Schedule and

the Fifth Schedule instead of the earlier

term of International Accounting

Standards (IASs) and Generally

Accepted Accounting Principles.

It is interesting to note that the

Ordinance still uses the term IASs and

section 234 provides an explanation

that International Accounting

Standards shall be understood in the

terms in which it is understood in the

accounting circles. Accordingly, we

understand that these terms IAS / IASs

and IFRS / IFRSs would be considered

in the same meaning, and hence have

used the term IFRS / IFRSs in this

document here-in-after.

Section 234 also provides that the

IFRSs and other standards as notified

by the SECP in the official Gazette will

be followed in regard to the accounts

and preparation of the balance-sheet

and profit and loss account. In this

respect, historically the SECP had

notified certain IFRSs for application

by the listed companies only. However,

through S.R.O. 860 (I)/2007 in August

2007, non-listed companies that are

not Medium-Sized companies or

Small-Sized companies were also

required to follow such notified IFRSs.

This requirement of the notification

has now been made part of the Fifth

Schedule.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 6

Accordingly, IFRSs that are notified by

the SECP form part of the financial

reporting framework for:

i- Listed companies;

ii- Subsidiaries of listed companies;

iii- Holding companies preparing

consolidated financial statements;

and

iv- Non-listed companies that are

neither Medium-Sized companies

nor Small-Sized companies.

IFRS issued by the IASB which are not

notified by the SECP do not form part

of the financial reporting framework in

Pakistan.

A complete list of IFRSs notified by the

SECP under the provisions of the

Ordinance is attached as Annexure 1,

whereas a list of IFRSs issued by the

IASB which have not yet been notified

by the SECP is attached as Annexure 2.

4. Accounting and Financial

Reporting Standards (AFRS)

for Medium-Sized Entities

(MSEs) and Small-Sized

Entities (SSEs) issued by the

Institute of Chartered

Accountants of Pakistan

Medium-Sized companies and Small-

Sized companies are required to follow

the Accounting and Financial

Reporting Standards (AFRS) for

Medium-Sized Entities (MSEs) and

Small-Sized Entities (SSEs)

respectively, as issued by the Institute

of Chartered Accountants of Pakistan.

The requirements of using these

standards was first introduced through

S.R.O. 860 (I)/2007 in August 2007

which has now been made part of the

Fifth Schedule.

It is important to note that under the

recent amendments in the Fifth

Schedule, Medium-Sized companies

and Small-Sized companies have been

encouraged to follow the IFRS.

Although the term IFRS used here is

not restrictive to only those IFRSs that

have been notified by the SECP in this

respect, we understand that the

intention is only to have those IFRSs

being encouraged for application that

have been notified by the SECP as

discussed in paragraph 3 above. Also,

such application will be of all the

notified IFRSs as a whole, and not on

specific selective basis.

We would also like to mention that the

wording used in the Fifth Schedule to

refer to the companies that are

required to follow AFRS, and the

reference to AFRS, is slightly

inconsistent i.e. Medium-Sized

Entities and Small-Sized Entities

instead of Medium-Sized companies

and Small-Sized companies, and

Accounting and Financial Reporting

Standards for Medium-Sized

companies and small sized companies

instead of Accounting and Financial

Reporting Standards for Medium-Sized

Entities and Small-Sized Entities.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 7

Presentation of the

profit and loss

account / income

statement

1. Requirement to disclose

separately the manufacturing,

trading and operating results

done away with

There was an age old requirement in

both the Fourth Schedule and the Fifth

Schedule for drawing up the profit and

loss account so as to separately disclose

the manufacturing, trading and

operating results, including disclosing

cost of goods manufactured in case of

manufacturing concerns. These

requirements have now been done

away with.

Considering that final tax regime is

applicable to certain streams of income

(e.g. commercial imports etc.), certain

companies may not change the way

they draw up their profit and loss

account.

2. Classification of expenses by

nature is now possible

Both the Fourth Schedule and the Fifth

Schedule required that expenses be

classified according to their function

into the following sub-heads:

- Cost of sales

- Distribution cost

- Administrative expenses

- Other operating expenses

- Finance cost

IFRS and AFRS provide the entities

option to present the expenses

classified based either on their nature

or on their function within the entity,

whichever provides information that is

reliable and more relevant.

Classification of expenses by nature

has now been allowed by amending

both the Fourth Schedule and the Fifth

Schedule to align with the

requirements of IFRS and AFRS.

This change is particularly relevant for

the companies in service sector where

classification of expenses is either not

captured by function or such

classification does not provide much

relevant information.

However, companies presenting the

classification of expenses by function

are also required to disclose additional

information on the nature of expenses.

An example of expenses classified by

nature as provided by the IFRS is:

- Changes in inventories of finished

goods and work in progress

- Raw materials and consumables

used

- Employee benefits expense

- Depreciation and amortisation

expense

- Other expenses

3. Change of termOther

operating income to Other

income

The word operating has been deleted

from the Other operating income as

appears on the face of the profit and

loss account / income statement, which

term will now be Other income.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 8

Disclosures relating

to provident fund /

trust

Identical sub-clauses have been added

to part III of the Fourth Schedule and

the Fifth Schedule that require all

companies to make certain disclosures

regarding the provident fund / trust,

and a statement of compliance with the

provisions of Section 227 of the

Ordinance and related rules.

Sub-sections (2) and (3) of Section 227

of the Ordinance provide for certain

matters in respect of timing, mode,

nature and kind of investments

regarding the provident fund / trust

constituted by a company for its

employees, or any class of employees.

The Employees Provident fund

(Investment in Listed Securities)

Rules, 1996 (Rules) were formulated

and notified by the SECP (then

Corporate Law Authority) through

S.R.O. 141 (I)/96. These Rules

primarily provide for the conditions for

investment of the provident fund /

trust in the listed securities. SECP also

has powers to relax the conditions

specified in the Rules, under which

power the SECP issued S.R.O. 261

(I)/2002 giving relaxation of

maximum investment for asset

management companies.

Texts of Section 227 of the Ordinance,

Rules and the above referred

notification have been reproduced as

Annexure 3.

1. Size of the fund

Following information is now required

to be disclosed by all companies:

- Size of the fund / trust

- Cost of investments made

- Percentage of investments made

- Fair value of investments

Although definitions of above terms

have not specifically been provided, we

understand that Size of the fund / trust

refers to the total assets as per the

balance sheet of the fund / trust.

2. Breakup of investments

There also has been added a

requirement for all companies to

disclose the breakup of investment

made by the fund / trust into the

categories as provided by the Section

227 of the Ordinance and the Rules.

The above is required to be both in

terms of absolute amounts and in

terms of the percentage of the size of

the fund / trust.

3. Statement of compliance

A requirement has been added for all

the companies to disclose a statement

in their financial statements that

investments out of the provident fund /

trust have been made in accordance

with the provisions of Section 227 of

the Ordinance and the Rules.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 9

Requirements as to

balance sheet

1. Disclosure of reasons where

property or asset acquired

with the funds of the company

in not held in its name or

possession

Where a company has acquired

property or assets with its funds but

such property or asset is not held in the

name of the company or is not in the

possession or control of the company;

the company has been required to

disclose this very fact, the description

and value of the property or asset, and

the person in whose name and

possession or control that property or

asset is held.

Now the Fourth Schedule and the Fifth

Schedule have been amended to

further require all the companies to

disclose the reasons for the property or

asset not being in the name of or in the

possession or control of the company.

2. Presentation of major spare

parts and stand-by equipment

qualifying as property, plant

and equipment

A number of sub-heads for the

classification of property, plant and

equipment in non-current assets are

provided in the Fourth Schedule and

the Fifth Schedule, into which sub-

heads items of property, plant and

equipment are classified. These sub-

heads did not include any specific

classification in respect of major spare

parts and stand-by equipment,

whereas a sub-head stores, spare parts

and loose tools has been specifically

available in the classification for

current assets.

For the sake of clarity and avoidance of

divergent practice, both the Fourth

Schedule and the Fifth Schedule have

been amended to include a sub-head

major spare parts and stand-by

equipment qualifying as property,

plant and equipment in the list of

classifications for property, plant and

equipment.

The determination as to which major

spare parts and stand-by equipment

qualifies as property, plant and

equipment will be in accordance with

the requirements of applicable IFRS or

AFRS for MSEs or SSEs.

3. Additional disclosures in

respect of related party trade

receivables

There has been a requirement for all

the companies to disclose the trade

debts receivable from the related

parties specifying the names. This

requirement has now been enhanced to

disclose the trade debts receivable

from the related parties that are either

past due or impaired, along with their

age analysis.

Age brackets for the analysis have not

been specified. It is considered that any

reasonable age brackets would be

acceptable.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 10

For companies to whom IFRS are

applicable, there has already been a

requirement to disclose an analysis of

(i) age of financial assets that are past

due as at the end of the reporting

period but not impaired, and

(ii) financial assets that are

individually determined to be impaired

at the end of the reporting period

including the factors the entity

considered in determining that they

are impaired.

4. Presentation of redeemable

capital which qualifies for

recognition as a financial

liability

A number of sub-heads for the

classification of non-current liabilities

are specified in the Fourth Schedule

and the Fifth Schedule. Such sub-heads

did not include any specific

classification for that redeemable

capital which qualifies to be recognised

as a financial liability, which has now

been added in both these Schedules.

Redeemable capital in terms of the

Ordinance includes finance obtained

on the basis of participation terms

certificate (PTC), musharika certificate,

terms finance certificate (TFC), or any

other security or obligation not based

on interest, other than an ordinary

share of a company, representing an

instrument or a certificate of specified

denomination, called the face value or

nominal value, evidencing investment

of the holder in the capital of the

company on terms and conditions of

the agreement for the issue of such

instrument or certificate.

It appears that the need to specifically

include this sub-head has been felt to

provide clarity and to avoid divergent

practice to classify all types of

redeemable capital as part of equity.

The determination as to which

redeemable capital qualifies to be

classified as equity will be in

accordance with the requirements of

applicable IFRS or AFRS for MSEs or

SSEs.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 11

Disclosure of

capacity,

production and

number of

employees

1. Information about the

capacity of the industrial unit,

actual production and

reasons for shortfall

The Fourth Schedule requires that

where determinable, a company is to

disclose in its financial statements the

capacity of an industrial unit, actual

production and reasons for shortfall.

A similar requirement has now been

added in the Fifth Schedule where the

paid up share capital of the company is

Rs. 500 million or more.

We however note that (i) the wording

used to introduce the above

requirement in the Fifth Schedule does

not refer to the determinability of the

capacity, and (ii) the threshold of 500

million does not carry monetary units

Rupees (Rs.) with it.

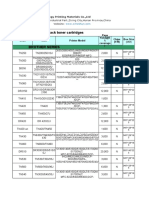

2. Disclosure of the number of

employees

A new requirement has been added in

both the Fourth Schedule and the Fifth

Schedule to disclose information about

the number of employees as follows:

No. of employees

as at

the

year

end

average

during

the year

Companies where

the Fourth

Schedule applies

Economically

Significant

companies

Medium-Sized

companies

Small-Sized

companies

Some years back this requirement of

disclosing the number of employees

was part of IAS 1 Presentation of

financial statements which was

amended to provide option to entities

to disclose this information either in

the financial statements or in other

parts of the annual report. Based on

this option, most of the companies

opted to disclose this information

outside the financial statements.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 12

Annexure 1 List of IFRSs notified

by the SECP

IFRS 2 Share-based payment

IFRS 3 Business combinations

IFRS 5 Non-current assets held for

sale and discontinued

operations

IFRS 4 Insurance contracts

IFRS 6 Exploration for and evaluation

of mineral resources

IFRS 7 * Financial instruments:

Disclosures

IFRS 8 Operating segments

IAS 1 Presentation of financial

statements

IAS 2 Inventories

IAS 7 Statement of cash flows

IAS 8 Accounting policies, changes in

accounting estimates and

errors

IAS 10 Events after the reporting

period

IAS 11 Construction contracts

IAS 12 Income taxes

IAS 16 Property, plant and equipment

IAS 17 Leases

IAS 18 Revenue

IAS 19 Employee benefits

IAS 20 Accounting for

government grants and

disclosure of

government assistance

IAS 21 The effects of changes in

foreign exchange rates

IAS 23 Borrowing costs

IAS 24 Related party disclosures

IAS 26 Accounting and reporting by

retirement benefit plans

IAS 27 Consolidated and separate

financial statements

IAS 28

Investments in associates

IAS 29 Financial reporting in hyper-

inflationary economies

IAS 31 Interests in joint ventures

IAS 32 Financial instruments:

Presentation

IAS 33 Earnings per share

IAS 34 Interim financial reporting

IAS 36 Impairment of assets

IAS 37 Provisions, contingent

liabilities and contingent

assets

IAS 38 Intangible assets

IAS 39 ** Financial instruments:

Recognition and

measurement

IAS 40 ** Investment property

IAS 41 Agriculture

* The implementation of IFRS 7 has been

held in abeyance by the SECP for Banks

and non-banking finance companies

engaged in investment finance services,

discounting services and housing finance

services.

** The Implementation has been held in

abeyance by the SBP for Banks and DFIs.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 13

Annexure 2 List of IFRSs issued by

the IASB but not notified by the SECP

IFRS 1 First-time adoption of

International Financial

Reporting Standards

IFRS 9 Financial instruments

IFRS 10 Consolidated financial statements

IFRS 11 Joint arrangements

IFRS 12 Disclosure of interests in other

entities

IFRS 13 Fair value measurement

These standards are under consideration of

the Institute of Chartered Accountants of

Pakistan prior to recommendation to the

SECP for notification.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 14

Annexure 3

Text of Section 227 of the Ordinance

227. Employees provident funds and securities.

(1) All moneys or securities deposited with a company by its employees in

pursuance of their contracts of service with the company shall be kept or

deposited by the company within fifteen days from the date of deposit in a

special account to be opened by the company for the purpose in a scheduled

bank or in the National Saving Schemes, and no portion thereof shall be

utilized by the company except for the breach of the contract of service on the

part of the employee as provided in the contract and after notice to the

employee concerned.

(2) Where a provident fund has been constituted by a company for its employees

or any class of its employees, all moneys contributed to such funds, whether

by the company or by the employees, or received or accruing by way of

interest, profit or otherwise from the date of contribution, receipt or accrual,

as the case may be, shall either

(a) be deposited

(i) in a National Savings Scheme;

(ii) in a special account to be opened by the company for the

purpose in a scheduled bank; or

(iii) where the company itself is a scheduled bank, in a special

account to be opened by the company for the purpose either

in itself or in any other scheduled bank; or

(b) be invested in Government securities; or

(c) in bonds, redeemable capital, debt securities or instruments issued

by Pakistan Water and Power Development Authority and in listed

securities subject to the conditions as may be prescribed by the

Commission.

(3) Where a trust has been created by a company with respect to any provident

fund referred to in sub-section (2), the company shall be bound to collect the

contributions of the employees concerned and pay such contributions as well

as its own contributions, if any, to the trustees within fifteen days from the

date of collection, and thereupon, the obligations laid on the company by that

sub-section shall devolve on the trustees and shall be discharged by them

instead of the company.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 15

Text of the Employees Provident Fund (Investment In Listed

Securities) Rules, 1996

1. Short title and commencement.

(1) These rules may be called the Employees Provident Fund (Investment in

Listed Securities) Rules, 1996.

(2) They shall come into force at once.

2. Interpretation.

In these rules the words and expressions used shall have the same meanings as are

assigned to them in the Companies Ordinance, 1984 (XLVII of 1984).

3. Conditions for investment in listed securities, etc.

Where it is decided to make investment, out of the provident fund constituted for the

employees of a company, in securities of the companies listed on any stock exchange in

Pakistan, such investment shall be subject to the following conditions, namely:

(i) Total investment in listed securities shall not exceed ten per cent of the

provident fund;

(ii) investment shall not exceed one per cent of the provident fund in the listed

securities of any one company;

(iii) investment in shares or other listed securities of a particular company shall

not exceed five per cent of its paid up capital;

(iv) In the case of investment in the shares of listed companies, it shall be made

only where such companies

(a) have a minimum operational record of five years; and

(b) have paid not less than fifteen per cent dividend to their share

holders during the three preceding consecutive years;

(v) in the case of investment in securities other than shares of listed companies, it

shall not be made unless such securities have been rated as an investment

grade with minimum rating of BBB by a credit rating company registered

with the Authority under the Securities and Exchange Ordinance, 1969 (XVII

of 1969), and the rating is maintained as such at the time of investment; and

(vi) Investment shall not be made in a security if it is publicly known that the

issuer of the security has committed default while availing of any financing

facility.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 16

4. Powers of Authority to relax rules.

Where the Authority is satisfied that it is not practicable to comply with any condition

of these rules in a particular case or class of cases, the Authority may, for reasons to be

recorded and subject to such conditions as it may deem fit, relax any of the conditions

specified in rule 3 in the case of such company or class of companies.

5. Penalty.

Whoever fails or refuses to comply with or contravenes any provision of these rules , or

knowingly and wilfully authorises or permits such failure, refusal or contravention

shall, in addition to any other liability under the ordinance, be also punishable with fine

not exceeding two thousand rupees, and, in case of continuing failure, refusal or

contravention to a further fine not exceeding one hundred rupees for every day after

the first during which such contravention continues.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 17

Text of the S.R.O. 261 (I)/2002

In exercise of powers conferred by rule 4 of the Employees Provident Fund (Investment in

Listed Securities) Rules, 1996, (the Rules) the Securities & Exchange Commission of Pakistan,

in relaxation of the conditions for investment of provident funds in listed securities as prescribed

in rule 3 of the Rules, has been pleased to allow the employees provident funds to be invested in

listed unit trusts schemes registered under Asset Management Companies Rules, 1995 subject to

the following conditions:

(i) That the total investment in unit trust schemes registered under Asset Management

Companies Rules, 1995 shall not exceed fifty percent of the provident fund;

(ii) That the total investment in any one unit trust scheme registered under Asset

Management Companies Rules, 1995 shall not exceed twenty percent of the provident

fund;

(iii) that the Asset Management Companies shall ensure that investment in unit trusts

schemes registered under Asset Management Companies Rules, 1995 shall be in

conformity with the above mentioned conditions, by 31st December, 2002, at the latest;

and

(iv) That the unit trust schemes registered under Asset Management Companies Rules,

1995 shall be subject to credit rating on annual basis by a Credit Rating Company

registered with the Commission and the rating shall be disseminated to the public for

information purposes.

Financial Reporting

A. F. FERGUSON & CO.

a member firm of the PwC network 18

Notes

Financial Reporting

2013. A. F. FERGUSON & CO. All rights reserved. A. F. FERGUSON & CO. is a member firm

of PricewaterhouseCoopers International Limited, each member firm of which is a separate

legal entity.

If you would like to discuss more about the amendments in the Fourth

Schedule and the Fifth Schedule to the Companies Ordinance, 1984,

please speak to your usual contact at A. F. Ferguson & Co.

Karachi Office

State Life Building No. 1-C

I. I. Chundrigar Road

P.O. Box 4716, Karachi-74000

Lahore Office

23-C, Aziz Avenue, Canal Bank

Gulberg V, P.O. Box 39

Shahrah-e-Quaid-e-Azam, Lahore-54000

Islamabad Office

PIA Building, 3

rd

Floor, 49 Blue Area

Fazl-ul-Haq Road, P.O. Box 3021

Islamabad-44000

Kabul Office

House No. 1916, Street No. 1

Behind Cinema Bariqot, Nahar-e-Darsan

Karte-4, Kabul, Afghanistan

Financial Reporting

2013. A. F. FERGUSON & CO. All rights reserved. A. F. FERGUSON & CO. is a member firm

of PricewaterhouseCoopers International Limited, each member firm of which is a separate

legal entity.

Moving forward

You might also like

- Ecat Papers - Aitazaz-Ahsan PDFDocument54 pagesEcat Papers - Aitazaz-Ahsan PDFShafiq UrRehmanNo ratings yet

- Securities and Exchange Commission of Pakistan Chairman'S SecretariatDocument2 pagesSecurities and Exchange Commission of Pakistan Chairman'S SecretariatShafiq UrRehmanNo ratings yet

- Budgeting QuestionsDocument13 pagesBudgeting QuestionsShafiq UrRehmanNo ratings yet

- Amendments To 4th & 5th SheduleDocument20 pagesAmendments To 4th & 5th SheduleShafiq UrRehmanNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentShafiq UrRehmanNo ratings yet

- JALIL Guess Paper, M A FinalDocument6 pagesJALIL Guess Paper, M A FinalShafiq UrRehmanNo ratings yet

- New Microsoft Office Word DocumentDocument1 pageNew Microsoft Office Word DocumentShafiq UrRehmanNo ratings yet

- IFRS Pocket Guide PWC 2010Document78 pagesIFRS Pocket Guide PWC 2010Thiruvali Sadagoapan ShrinivaasanNo ratings yet

- IFRS Pocket Guide PWC 2010Document78 pagesIFRS Pocket Guide PWC 2010Thiruvali Sadagoapan ShrinivaasanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (298048505) 148308699-Credit-Appraisal-of-TJSB-BankDocument47 pages(298048505) 148308699-Credit-Appraisal-of-TJSB-Bankmbm_likeNo ratings yet

- Embracing Change: Enhancing OpportunitiesDocument46 pagesEmbracing Change: Enhancing OpportunitiesTohiroh FitriNo ratings yet

- T. Nanda KumarDocument5 pagesT. Nanda KumarVinit SanghviNo ratings yet

- Strategic Management CH-2Document7 pagesStrategic Management CH-2padmNo ratings yet

- MB 1Document25 pagesMB 1Manoj sainiNo ratings yet

- C. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc.Document2 pagesC. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc.Junmer OrtizNo ratings yet

- Small Business 1Document2 pagesSmall Business 1abrarNo ratings yet

- Introduction of ToshibaDocument6 pagesIntroduction of ToshibaShubham Sogani0% (1)

- Index of CasesDocument7 pagesIndex of CasesAnonymous V9bt14LOtoNo ratings yet

- Chapter 6 Example Trips LogisticsDocument10 pagesChapter 6 Example Trips LogisticsYUSHIHUINo ratings yet

- Branch Accounting PDFDocument18 pagesBranch Accounting PDFSivasruthi DhandapaniNo ratings yet

- Adani Wilmar LTD: Retail Market Research AnalystDocument22 pagesAdani Wilmar LTD: Retail Market Research AnalystRitesh MistryNo ratings yet

- Product List From Heshun-Lynn 2017Document226 pagesProduct List From Heshun-Lynn 2017kswongNo ratings yet

- 6 Ihc Halal ChampionDocument39 pages6 Ihc Halal ChampionCheAzahariCheAhmadNo ratings yet

- Engleski LekcijeDocument10 pagesEngleski LekcijeMariaDevederosNo ratings yet

- Pacific Rehouse Corporation v. Court of Appeals, G.R. No. 199687, March 24, 2014Document11 pagesPacific Rehouse Corporation v. Court of Appeals, G.R. No. 199687, March 24, 2014EdvangelineManaloRodriguezNo ratings yet

- Pertemuan 3 Pemangku KepentinganDocument15 pagesPertemuan 3 Pemangku KepentinganJane AnitaNo ratings yet

- 31 C.F.R. 363.06, .11, .20, .22, .27 (2017 - 08 - 31 22 - 03 - 00 Utc)Document15 pages31 C.F.R. 363.06, .11, .20, .22, .27 (2017 - 08 - 31 22 - 03 - 00 Utc)Ghetto Vader100% (1)

- National Development Corporation v. Court of AppealsDocument1 pageNational Development Corporation v. Court of AppealsReth GuevarraNo ratings yet

- Disclosure On Interested Party TransactionDocument2 pagesDisclosure On Interested Party TransactionoundhakarNo ratings yet

- Certificate of Sale PNBDocument4 pagesCertificate of Sale PNBGirish SharmaNo ratings yet

- MU1 Module 10 NotesDocument38 pagesMU1 Module 10 NotesCGASTUFFNo ratings yet

- External Commercial BorrowingDocument26 pagesExternal Commercial BorrowingpankajnbholeNo ratings yet

- The Coca Cola Company AnalysisDocument35 pagesThe Coca Cola Company AnalysisSalah Uddin50% (2)

- CAPE Accounting Unit 1 2013 P2Document8 pagesCAPE Accounting Unit 1 2013 P2Sachin BahadoorsinghNo ratings yet

- Vintage LingerieDocument4 pagesVintage Lingeriejulie bennett100% (2)

- 1 IbcDocument32 pages1 IbcChandreshNo ratings yet

- LAVCA Inaugural Startup Survey FINAL3 04.30.19Document28 pagesLAVCA Inaugural Startup Survey FINAL3 04.30.19Thomas HeilbornNo ratings yet

- FINAL CLI Annual Meeting ResultsDocument2 pagesFINAL CLI Annual Meeting ResultsWilliam HarrisNo ratings yet