Professional Documents

Culture Documents

Questions 1

Uploaded by

lorrynorry0 ratings0% found this document useful (0 votes)

834 views1 pageOil exploration - Cost of Capital

Original Title

Questions...1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOil exploration - Cost of Capital

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

834 views1 pageQuestions 1

Uploaded by

lorrynorryOil exploration - Cost of Capital

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

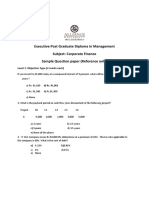

3.

(TCO E) Division Asset Beta Next Period's Expected Free Cash Flow ($mm) Oil Exploration Oil Refining 1.4 1.1 450 525 4.0% 2.5% Expected Growth Rate

Gas & Convenience Stores 0.8 600 3.0%

The risk-free rate of interest is 3% and the market risk premium is 5%. 1) Which is the cost of capital for the oil exploration division closest to? A) 6.0%

B) 7.0% C) 8.5% D) 10.0% Cost of Capital = Risk Free Return + Beta x Market Risk Premium Cost of Capital = 3% + 1.4 x 5% = 10%

You might also like

- Production and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesFrom EverandProduction and Maintenance Optimization Problems: Logistic Constraints and Leasing Warranty ServicesNo ratings yet

- Fluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceFrom EverandFluid Analysis for Mobile Equipment: Condition Monitoring and MaintenanceNo ratings yet

- Problem Set - Cost of CapitalDocument19 pagesProblem Set - Cost of CapitalSagar Bansal100% (1)

- Finance Quiz 2Document4 pagesFinance Quiz 2studentNo ratings yet

- DCF and WACC - Sun by OracleDocument11 pagesDCF and WACC - Sun by OracleAmol Mahajan50% (2)

- Mock Exam Portfolio Theory 2020 With AnswersDocument10 pagesMock Exam Portfolio Theory 2020 With AnswersSamir Ismail100% (1)

- Wind Valuation ModelDocument87 pagesWind Valuation ModelprodiptoghoshNo ratings yet

- Problems-Chapter 3Document4 pagesProblems-Chapter 3An VyNo ratings yet

- BUS322Tutorial8 SolutionDocument10 pagesBUS322Tutorial8 Solutionjacklee1918100% (1)

- DeVry ACCT 434 Final Exam 1 100% Correct AnswerDocument9 pagesDeVry ACCT 434 Final Exam 1 100% Correct AnswerDeVryHelpNo ratings yet

- Capgemini Previous PapersDocument47 pagesCapgemini Previous PapersRHYTHM BHATNAGARNo ratings yet

- PL M18 FM Student Mark Plan WebDocument9 pagesPL M18 FM Student Mark Plan WebIQBAL MAHMUDNo ratings yet

- Cost of Capital in Canadian Utility Regulation 2013Document1 pageCost of Capital in Canadian Utility Regulation 2013DrShweta BhardwajNo ratings yet

- HW 7Document2 pagesHW 7Jordy JordanNo ratings yet

- Economics Final Exam SolutionsDocument4 pagesEconomics Final Exam SolutionsPower GirlsNo ratings yet

- LSE-TMX Merger Weighted Average Cost of CapitalDocument6 pagesLSE-TMX Merger Weighted Average Cost of CapitalMartin YauNo ratings yet

- Multiple Choice ProblemsDocument11 pagesMultiple Choice ProblemsZillur RahmanNo ratings yet

- Workbook 1Document4 pagesWorkbook 1Harshal NaikNo ratings yet

- Analysis of AccountsDocument6 pagesAnalysis of AccountsAutoDefenceNo ratings yet

- ACCT 434 Final Exam (Updated)Document12 pagesACCT 434 Final Exam (Updated)DeVryHelpNo ratings yet

- ExercisestoPractice Chapters34Document2 pagesExercisestoPractice Chapters34JOSEPH MICHAEL MCGUINNESSNo ratings yet

- Soln Cost of CapitalDocument11 pagesSoln Cost of Capitalanshul dyundiNo ratings yet

- CCE Exam Preparation V1.0 Part 2 - Cost Estimating and Control - Closed BookDocument4 pagesCCE Exam Preparation V1.0 Part 2 - Cost Estimating and Control - Closed BookSherif ElkhoulyNo ratings yet

- Untitled DocumentDocument5 pagesUntitled DocumentArif MelsingNo ratings yet

- Exam1 Solutions 40610 2008Document7 pagesExam1 Solutions 40610 2008JordanNo ratings yet

- Corporate Valuation - 16th October 2021Document2 pagesCorporate Valuation - 16th October 2021Shivam ChoudharyNo ratings yet

- HW 1Document27 pagesHW 1Chris OnenNo ratings yet

- 401 Midterm PracticeDocument15 pages401 Midterm PracticeNilanjona BalikaNo ratings yet

- NIIT Aptitude Test EPAF Sample PaperDocument4 pagesNIIT Aptitude Test EPAF Sample PaperManish GujjarNo ratings yet

- FM IntroductionDocument16 pagesFM Introductionapi-3725772No ratings yet

- Cxannual Result enDocument34 pagesCxannual Result endescent3dNo ratings yet

- Proposal-Oil AnalysisDocument8 pagesProposal-Oil AnalysisElvin RathnasamyNo ratings yet

- Fin 9 PDFDocument2 pagesFin 9 PDFChristine AltamarinoNo ratings yet

- Extra Calculation Questions For Final ExamsDocument3 pagesExtra Calculation Questions For Final ExamsSooXueJiaNo ratings yet

- Old Midterm For Posting On Class PageDocument12 pagesOld Midterm For Posting On Class PageJack KlineNo ratings yet

- CHP 10Document3 pagesCHP 10sueNo ratings yet

- Bme1014 Tutorial 1Document3 pagesBme1014 Tutorial 1Robert OoNo ratings yet

- Pro Material Series: 500+ Free Mock Test VisitDocument44 pagesPro Material Series: 500+ Free Mock Test VisitTomNo ratings yet

- Group No. 7 Slp4 Mandeep Singh 108 Ameya Mane 137 Revilla Monteiro 138 Ben Peter 158Document13 pagesGroup No. 7 Slp4 Mandeep Singh 108 Ameya Mane 137 Revilla Monteiro 138 Ben Peter 158Mohit AroraNo ratings yet

- A.angarola Marriott Case Analaysis 5.6.20Document9 pagesA.angarola Marriott Case Analaysis 5.6.20Amy AngarolaNo ratings yet

- Sample Final Exam, FinalDocument11 pagesSample Final Exam, Finaldennis.matienzo29No ratings yet

- Jun18l1-Ep04 QaDocument23 pagesJun18l1-Ep04 Qajuan100% (1)

- Cost of Funding of Campus BiteDocument1 pageCost of Funding of Campus BiteSajawal ManzoorNo ratings yet

- (284604) - A231 - BWFF2043 - Quiz 1Document3 pages(284604) - A231 - BWFF2043 - Quiz 1Edlyn TanNo ratings yet

- QuestionsDocument2 pagesQuestionsrobertvivek2No ratings yet

- Knowledge Check - DCF: Facts: DCF Inc. Relevant Free Cash Flow ItemsDocument1 pageKnowledge Check - DCF: Facts: DCF Inc. Relevant Free Cash Flow ItemsMichael Sho LiuNo ratings yet

- BSR3B AO1 2018 Final - ModeratedDocument8 pagesBSR3B AO1 2018 Final - Moderatedsabelo.j.nkosi.5No ratings yet

- Compre BAV Sol 2019-20 1Document9 pagesCompre BAV Sol 2019-20 1f20211062No ratings yet

- Sample 8Document3 pagesSample 8Ghulam HassanNo ratings yet

- CF Sample QPDocument12 pagesCF Sample QPJATINNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Cost of Capital QuizDocument8 pagesCost of Capital Quizalyanna alanoNo ratings yet

- BFI 220 Cat II - Due On 13th Nov 2023Document2 pagesBFI 220 Cat II - Due On 13th Nov 2023mahmoudfatahabukarNo ratings yet

- GRE Math DI-1Document6 pagesGRE Math DI-1Sandeep PanjwaniNo ratings yet

- Solutions To Cost of Capital ExercisesDocument8 pagesSolutions To Cost of Capital ExercisesZe GramaxoNo ratings yet

- The Investment Setting: True/False QuestionsDocument14 pagesThe Investment Setting: True/False Questionsjigglebots4695No ratings yet

- In Class3Document5 pagesIn Class3mehdiNo ratings yet

- 2 MEK Only Question of Pass PapersDocument7 pages2 MEK Only Question of Pass Papersirfan ali 4895 SE 1 irfan aliNo ratings yet

- Exbondlec 3 NhapDocument2 pagesExbondlec 3 NhapPhương VyNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- True False 16 20Document1 pageTrue False 16 20lorrynorryNo ratings yet

- Abe For - Explanation XDocument2 pagesAbe For - Explanation XlorrynorryNo ratings yet

- ExcelDocument7 pagesExcellorrynorryNo ratings yet

- 20-30 MCQDocument3 pages20-30 MCQlorrynorry100% (1)

- BS 1Document2 pagesBS 1lorrynorryNo ratings yet

- Question 1 of 5Document1 pageQuestion 1 of 5lorrynorryNo ratings yet

- MCQ - PlanningDocument1 pageMCQ - Planninglorrynorry75% (4)

- 5 Biology QuestionsDocument3 pages5 Biology QuestionslorrynorryNo ratings yet

- Question 3 4Document2 pagesQuestion 3 4lorrynorryNo ratings yet

- NPV - Accept/Reject ProjectDocument2 pagesNPV - Accept/Reject ProjectlorrynorryNo ratings yet

- Section ADocument3 pagesSection AArthi Rao KNo ratings yet

- Project ABCDocument2 pagesProject ABClorrynorryNo ratings yet

- Marpor IndustriesDocument1 pageMarpor IndustrieslorrynorryNo ratings yet

- Value of Stock - ScribdDocument1 pageValue of Stock - ScribdlorrynorryNo ratings yet