Professional Documents

Culture Documents

AIRTHREAD ACQUISITION Revenue Projections and Operating Assumptions

Uploaded by

Alex WilsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AIRTHREAD ACQUISITION Revenue Projections and Operating Assumptions

Uploaded by

Alex WilsonCopyright:

Available Formats

AIRTHREAD ACQUISITION

Revenue Projections:

Operating Assumptions

2008

2009

2010

2011

2012

4,194.3

14.0%

4,781.5

14.0%

5,379.2

12.5%

5,917.2

10.0%

6,331.4

7.0%

Equipment Revenue

Equipment Revenue/Service Revenue (1)

314.8

7.5%

358.8

7.5%

403.7

7.5%

444.1

7.5%

475.2

7.5%

Operating Expenses:

System Operating Expenses

System Operating Exp./Service Revenue

838.9

20.0%

956.3

20.0%

1,075.8

20.0%

1,183.4

20.0%

1,266.3

20.0%

Cost of Equipment Sold

Equipment COGS

755.5

240.0%

861.2

240.0%

968.9

240.0%

1,065.8

240.0%

1,140.4

240.0%

Selling, General & Administrative

SG&A/Total Revenue

1,803.6

40.0%

2,056.2

40.0%

2,313.2

40.0%

2,544.5

40.0%

2,722.6

40.0%

Depreciation & Amortization

705.2

804.0

867.4

922.4

952.9

Tax Rate

40.0%

40.0%

40.0%

40.0%

40.0%

41.67x

154.36x

1.38%

35.54x

14.01x

6.85x

41.67x

154.36x

1.38%

35.54x

14.01x

6.85x

41.67x

154.36x

1.38%

35.54x

14.01x

6.85x

41.67x

154.36x

1.38%

35.54x

14.01x

6.85x

41.67x

154.36x

1.38%

35.54x

14.01x

6.85x

631.3

14.0%

719.7

14.0%

867.4

15.0%

970.1

15.3%

1,055.0

15.5%

1,594.3

4.43

184.53

3,873.7

10.76

448.35

4,357.9

12.11

504.39

4,793.7

13.32

554.83

5,129.2

14.25

593.67

Service Revenue

Service Revenue Growth

Working Capital Assumptions (1):

Accounts Receivable

Days Sales Equip. Rev.

Prepaid Expenses

Accounts Payable

Deferred Serv. Revenue

Accrued Liabilities

Capital Expenditures (2):

Capital Expenditures

Cap-x/Total Revenue

(1) Based on a 360-day year. Days Payable, Deferred Service Revenue, and Days Accrued Liabilities are

based on total cash operating expenses.

(2) Includes investments in property, plant & equipment, as well as licenses and customer lists.

Harvard Business Publishing

AIRTHREAD ACQUISITION

Licensing Agreemts

Total Consolidated Markets:

Region

Population

Central US

65,096

Mid-Atlantic

11,677

New England

2,830

Northwest

2,287

New York

481

Total

82,371

Customers

3,846

1,180

518

431

147

6,122

Penetration

5.9%

10.1%

18.3%

18.8%

30.6%

7.4%

Total Operating Markets:

Region

Population

Central US

32,497

Mid-Atlantic

7,346

New England

2,344

Northwest

2,287

New York

481

Total

44,955

Customers

3,846

1,180

518

431

147

6,122

Penetration

11.8%

16.1%

22.1%

18.8%

30.6%

13.6%

Harvard Business Publishing

AIRTHREAD ACQUISITION

Customer Data:

Net Customer Additions

Cost Per Customer Addition

Cost of New Customer Additions

Cost of Equipment Sold/Equipment Revenue

Monthly Churn Rate

Revenue Per Minute

Monthly ARPU

Customer Minutes Per Month

Revenue Per Minute

Customer Operating Data

2005

2006

2007

301

372

111,972

310

385

119,350

477

487

232,299

251.3%

219.9%

239.8%

2.1%

2.1%

1.7%

2005

2006

2007

45.24

625

0.0724

47.23

704

0.0671

51.13

859

0.0595

Harvard Business Publishing

AIRTHREAD ACQUISITION

Income Statement

Historical Operating Results

Operating Results:

Service Revenue

Plus: Equipment Sales

Total Revenue

Less: System Operating Expenses

Less: Cost of Equipment Sold

Less: Selling, General & Administrative

EBITDA

Less: Depreciation & Amortization

EBIT

Less: Interest Expense

Plus: Equity in Earnings of Affiliates

Plus: Gains (Losses) on Investments

Plus: Other Income

EBT

Less: Taxes

Income Before Minority Interest

Less: Minority Interest

Net Income

2005

2006

2007

2,827.0

203.7

3,030.8

604.1

511.9

1,217.7

697.0

490.1

206.9

84.9

66.7

18.1

54.5

261.3

95.9

165.5

10.5

155.0

3,214.4

258.7

3,473.2

639.7

568.9

1,399.6

865.0

555.5

309.5

93.7

93.1

50.8

(46.6)

313.1

120.6

192.5

13.0

179.5

3,679.2

267.0

3,946.3

717.1

640.2

1,555.6

1,033.3

582.3

451.1

84.7

90.0

83.1

7.0

546.5

216.7

329.8

15.1

314.7

Harvard Business Publishing

AIRTHREAD ACQUISITION

Balance Sheet

Assets:

2005

2006

2007

Cash & Cash Equivalents

Marketable Securities

Accounts Receivable

Inventory

Prepaid Expenses

Deferred Taxes

Other Current Assets

Total Current Assets

29.0

0.0

362.4

92.7

32.1

8.2

15.5

539.9

32.9

249.0

407.4

117.2

35.0

0.0

13.4

854.9

204.5

16.4

435.5

101.0

41.6

18.6

16.2

833.8

2,553.0

1,362.3

47.6

225.4

172.1

4.7

481.2

30.0

5,416.2

2,628.8

1,494.3

26.2

4.9

150.3

4.5

485.5

31.1

5,680.6

2,595.1

1,482.4

15.4

0.0

157.7

4.4

491.3

31.8

5,611.9

254.1

111.4

42.9

36.7

0.0

135.0

0.0

0.0

82.6

662.7

254.9

123.3

47.8

26.9

26.3

35.0

159.9

88.8

93.7

856.7

260.8

143.4

59.2

43.1

0.0

0.0

0.0

0.0

97.7

604.2

1,001.4

159.9

25.8

647.1

90.2

46.2

1,001.8

0.0

0.0

601.5

127.6

62.9

1,002.3

0.0

0.0

554.4

126.8

84.5

41.9

36.7

43.4

1,375.0

1,366.0

5,416.2

1,378.9

1,614.4

5,680.6

1,404.1

1,792.1

5,611.9

Property, Plan & Equipment

Licenses

Customer Lists

Marketable Equity Securities

Investments in Affiliated Entities

Long Term Note Receivable

Goodwill

Other Long Term Assets

Total Assets

Liabilities & Owners' Equity:

Accounts Payable

Deferred Revenue & Deposits

Accrued Liabilities

Taxes Payable

Deferred Taxes

Note Payable

Forward Contract

Derivative Liability

Other Current Liabilities

Total Current Liabilities

Long Term Debt

Forward Contracts

Derivative Liability

Deferred Tax Liability

Asset Retirement Obligation

Other Deferred Liabilities

Minority Interest

Common Stock & Paid-In Capital

Retained Earnings

Total Liabilities & Owners' Equity

Harvard Business Publishing

AIRTHREAD ACQUISITION

Amortization Schedule

Term Loan Amortization

Payment

41

Annual

Interest

5.50%

Principal

Date:

1/31/2008

2/28/2008

3/31/2008

4/30/2008

5/31/2008

6/30/2008

7/31/2008

8/31/2008

9/30/2008

10/31/2008

11/30/2008

12/31/2008

1/31/2009

2/28/2009

3/31/2009

4/30/2009

5/31/2009

6/30/2009

7/31/2009

8/31/2009

9/30/2009

10/31/2009

11/30/2009

12/31/2009

1/31/2010

2/28/2010

3/31/2010

4/30/2010

5/31/2010

6/30/2010

7/31/2010

8/31/2010

9/30/2010

10/31/2010

11/30/2010

12/31/2010

1/31/2011

2/28/2011

3/31/2011

4/30/2011

5/31/2011

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

17

17

17

17

17

17

17

16

16

16

16

16

16

16

16

16

15

15

15

15

15

15

15

15

14

14

14

14

14

14

14

14

14

13

13

13

13

13

13

13

12

24

24

24

24

24

24

24

24

24

25

25

25

25

25

25

25

25

25

26

26

26

26

26

26

26

26

27

27

27

27

27

27

27

27

28

28

28

28

28

28

28

Balance

3,758

Amortization

Period

120

3,734

3,710

3,687

3,663

3,639

3,615

3,590

3,566

3,542

3,517

3,492

3,468

3,443

3,418

3,393

3,367

3,342

3,317

3,291

3,265

3,239

3,214

3,188

3,161

3,135

3,109

3,082

3,055

3,029

3,002

2,975

2,948

2,920

2,893

2,865

2,838

2,810

2,782

2,754

2,726

2,698

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

Payment

41

Annual

Interest

5.50%

Principal

Date:

Balance

2,698

Amortization

Period

84

6/30/2011

7/31/2011

8/31/2011

9/30/2011

10/31/2011

11/30/2011

12/31/2011

1/31/2012

2/28/2012

3/31/2012

4/30/2012

5/31/2012

6/30/2012

7/31/2012

8/31/2012

9/30/2012

10/31/2012

11/30/2012

12/31/2012

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

41

2,176

12

12

12

12

12

12

12

11

11

11

11

11

11

11

10

10

10

10

10

28

29

29

29

29

29

29

29

29

30

30

30

30

30

30

30

31

31

2,166

2,669

2,641

2,612

2,583

2,554

2,525

2,496

2,467

2,437

2,408

2,378

2,348

2,318

2,288

2,257

2,227

2,196

2,166

0

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

Harvard Business Publishing

Harvard Business Publishing

6

AIRTHREAD ACQUISITION

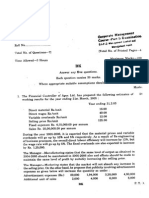

Comparable Companies:

Universal Mobile

Neuberger Wireless

Agile Connections

Big Country Communications

Rocky Mountain Wireless

Average

Wireless Comparables

Equity

Market Value

65,173

94,735

37,942

47,314

5,299

Net

Debt

60,160

27,757

9,144

15,003

2,353

Debt/

Value

48.0%

29.3%

19.4%

24.1%

30.7%

30.3%

Debt/

Equity

92.3%

41.4%

24.1%

31.7%

44.4%

46.8%

Equity

Beta

0.86

0.89

1.17

0.97

1.13

1.00

Revenue

43,882

42,684

34,698

38,896

4,064

EBIT

11,795

7,020

1,631

6,702

510

EBITDA

16,949

14,099

9,914

12,614

1,028

Net

Income

3,794

4,103

(30)

3,384

240

Harvard Business Publishing

You might also like

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDocument24 pagesAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Final AssignmentDocument15 pagesFinal AssignmentUttam DwaNo ratings yet

- HP Case Competition PresentationDocument17 pagesHP Case Competition PresentationNatalia HernandezNo ratings yet

- Sampa VideoDocument24 pagesSampa VideodoiNo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- Sampa Video Financials 2000-2006 Home Delivery ProjectionsDocument1 pageSampa Video Financials 2000-2006 Home Delivery ProjectionsOnal RautNo ratings yet

- Tire City 1997 Pro FormaDocument6 pagesTire City 1997 Pro FormaXRiloXNo ratings yet

- Pacific Grove Spice CompanyDocument1 pagePacific Grove Spice CompanyLauren KlaassenNo ratings yet

- World Wide Paper CompanyDocument2 pagesWorld Wide Paper CompanyAshwinKumarNo ratings yet

- Tire City Case AnalysisDocument10 pagesTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)No ratings yet

- ATC Valuation - Solution Along With All The ExhibitsDocument20 pagesATC Valuation - Solution Along With All The ExhibitsAbiNo ratings yet

- Valuation of Airthread Connections Questions TraductionDocument2 pagesValuation of Airthread Connections Questions TraductionNatalia HernandezNo ratings yet

- Group BDocument10 pagesGroup BHitin KumarNo ratings yet

- Nestle and Alcon - The Value of ADocument33 pagesNestle and Alcon - The Value of Akjpcs120% (1)

- Dakota Office ABC AnalysisDocument11 pagesDakota Office ABC AnalysisShibani Shankar RayNo ratings yet

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyNo ratings yet

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Ceres exhibits balance sheet, income statement, projectionsDocument4 pagesCeres exhibits balance sheet, income statement, projectionsShaarang Begani0% (2)

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Document21 pagesBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoNo ratings yet

- Rosetta Stone 2009 IPO Financial ForecastDocument8 pagesRosetta Stone 2009 IPO Financial ForecastgerardoNo ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- This Study Resource Was: Gain Control of Robertson Tool in May 2003?Document4 pagesThis Study Resource Was: Gain Control of Robertson Tool in May 2003?Pedro José ZapataNo ratings yet

- AMERICAN HOME PRODUCTS CORPORATION Group1.4Document11 pagesAMERICAN HOME PRODUCTS CORPORATION Group1.4imawoodpusherNo ratings yet

- Ameritrade Case SolutionDocument34 pagesAmeritrade Case SolutionAbhishek GargNo ratings yet

- TN 7Document11 pagesTN 7patternprojectNo ratings yet

- Ducati Case ExhibitsDocument10 pagesDucati Case Exhibitslucien_lu0% (1)

- The value of an unlevered firmDocument6 pagesThe value of an unlevered firmRahul SinhaNo ratings yet

- Pacific Grove Spice Company CalculationsDocument12 pagesPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroNo ratings yet

- California Pizza Chicken Share Repurchase AnalysisDocument13 pagesCalifornia Pizza Chicken Share Repurchase AnalysisBerni RahmanNo ratings yet

- Radent Case QuestionsDocument2 pagesRadent Case QuestionsmahieNo ratings yet

- AirThread Acquisition Comparable Companies AnalysisDocument65 pagesAirThread Acquisition Comparable Companies AnalysiskjhathiNo ratings yet

- Cafés Monte Bianco - Questions and Additional DataDocument1 pageCafés Monte Bianco - Questions and Additional DataMarco BolzonelloNo ratings yet

- Tata Corus Acquisition and M&ADocument16 pagesTata Corus Acquisition and M&ASaurabh PaliwalNo ratings yet

- Cafe Monte BiancoDocument21 pagesCafe Monte BiancoWilliam Torrez OrozcoNo ratings yet

- ATC Case SolutionDocument3 pagesATC Case SolutionAbiNo ratings yet

- Does IT Payoff Strategies of Two Banking GiantsDocument10 pagesDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991No ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearAbhishek KumarNo ratings yet

- Wells Fargo CaseDocument58 pagesWells Fargo CaseMeenaNo ratings yet

- FVC Merger Benefits and AlternativesDocument1 pageFVC Merger Benefits and AlternativesStephanie WidjayaNo ratings yet

- Winfield Refuse Management Inc. Raising Debt vs. EquityDocument13 pagesWinfield Refuse Management Inc. Raising Debt vs. EquitynmenalopezNo ratings yet

- ACC to Acquire AirThread for $7.5 BillionDocument16 pagesACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- Clarkson Lumber - Cash FlowDocument1 pageClarkson Lumber - Cash FlowSJNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- Britannia DCF CapmDocument12 pagesBritannia DCF CapmRohit Kamble100% (1)

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Ocean Carriers FinalDocument5 pagesOcean Carriers FinalsaaaruuuNo ratings yet

- XLS EngDocument26 pagesXLS EngcellgadizNo ratings yet

- XLS915-XLS-ENG DesarrolladoDocument10 pagesXLS915-XLS-ENG DesarrolladoYessu Amhed Condori RavichaguaNo ratings yet

- Tire City SolutionDocument4 pagesTire City SolutionUmeshKumarNo ratings yet

- Pacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipDocument9 pagesPacific Grove Spice's acquisition of High Country Seasonings and TV show sponsorshipdiddiNo ratings yet

- M&A - Valuation - Expanded - BV - SS EQUIPODocument3 pagesM&A - Valuation - Expanded - BV - SS EQUIPOGianina Mendoza NestaresNo ratings yet

- Airthread WorksheetDocument21 pagesAirthread Worksheetabhikothari3085% (13)

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745No ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- CMC - ICAI PaperDocument4 pagesCMC - ICAI PaperAlex WilsonNo ratings yet

- Infosys AR 13Document118 pagesInfosys AR 13RamanathanGangadharanNo ratings yet

- Diversification JFDocument26 pagesDiversification JFAlex WilsonNo ratings yet

- ACP CostingDocument1 pageACP CostingAlex WilsonNo ratings yet

- Ready Mix Concrete Industry Perspective Challenges & Growth Opportunities IndiaDocument3 pagesReady Mix Concrete Industry Perspective Challenges & Growth Opportunities IndiaAlex WilsonNo ratings yet

- frm指定教材 risk management & derivativesDocument1,192 pagesfrm指定教材 risk management & derivativeszeno490No ratings yet

- Cambridge University Press, Financial Calculus - An Introduction To Derivative PricingDocument241 pagesCambridge University Press, Financial Calculus - An Introduction To Derivative PricingAlex WilsonNo ratings yet

- Case Study 5Document3 pagesCase Study 5Alex WilsonNo ratings yet

- The Economics of Structured FinanceDocument37 pagesThe Economics of Structured FinancemanyblubsNo ratings yet

- Investment Analysis and Portfolio Management 2010Document166 pagesInvestment Analysis and Portfolio Management 2010johnsm2010No ratings yet

- M&A PharamaDocument9 pagesM&A PharamaAlex WilsonNo ratings yet

- 1Document1 page1Alex WilsonNo ratings yet

- Real OptionsDocument46 pagesReal OptionsAlex WilsonNo ratings yet

- How Do You Think WalmartDocument1 pageHow Do You Think WalmartAlex WilsonNo ratings yet

- IJMRBS 51dd805b0ef71Document16 pagesIJMRBS 51dd805b0ef71Alex WilsonNo ratings yet

- Company ValuationDocument216 pagesCompany ValuationHuy Vu Chi100% (1)

- HindalcoDocument18 pagesHindalcorohit236No ratings yet

- Diversification JFDocument26 pagesDiversification JFAlex WilsonNo ratings yet

- List of Companies - in Progress - 16 FebDocument6 pagesList of Companies - in Progress - 16 FebAlex WilsonNo ratings yet

- CalculationDocument5 pagesCalculationAlex WilsonNo ratings yet

- Fsa Chapter 5Document24 pagesFsa Chapter 59eleven.starproNo ratings yet

- Tutorial 1 (Chapters 1,2,3)Document76 pagesTutorial 1 (Chapters 1,2,3)Alex WilsonNo ratings yet

- Ready Mix Concrete Industry Perspective Challenges & Growth Opportunities IndiaDocument3 pagesReady Mix Concrete Industry Perspective Challenges & Growth Opportunities IndiaAlex WilsonNo ratings yet

- Customised Casebook Cement RMCDocument10 pagesCustomised Casebook Cement RMCAlex WilsonNo ratings yet

- Malkiel. The Efficient-Market Hypothesis and The Financial Crisis 102611Document59 pagesMalkiel. The Efficient-Market Hypothesis and The Financial Crisis 102611Alex WilsonNo ratings yet

- How Do You Think WalmartDocument1 pageHow Do You Think WalmartAlex WilsonNo ratings yet

- MAC Assignment 2 - Group 3-1Document13 pagesMAC Assignment 2 - Group 3-1Alex WilsonNo ratings yet

- Tutorial 1 (Chapters 1,2,3)Document76 pagesTutorial 1 (Chapters 1,2,3)Alex WilsonNo ratings yet

- Case Prep 2Document69 pagesCase Prep 2Blake Toll100% (1)

- Why this bread won't stay quietDocument29 pagesWhy this bread won't stay quietCipto WibowoNo ratings yet

- A Case Study In Financial Brilliance At Teledyne/TITLEDocument37 pagesA Case Study In Financial Brilliance At Teledyne/TITLEioannisramNo ratings yet

- Damworkbook - Derivatives (Advanced) Module - Study Material PDFDocument104 pagesDamworkbook - Derivatives (Advanced) Module - Study Material PDFsunny67% (3)

- The Figures in The Margin On The Right Side Indicate Full MarksDocument8 pagesThe Figures in The Margin On The Right Side Indicate Full MarksManas Kumar SahooNo ratings yet

- "Big Ben" Strategy by Kristian KerrDocument4 pages"Big Ben" Strategy by Kristian Kerrapi-26247058100% (1)

- CH 04Document19 pagesCH 04Charmaine Bernados BrucalNo ratings yet

- DPDCDocument49 pagesDPDCsamuelNo ratings yet

- Unit 1Document50 pagesUnit 1vaniphd3No ratings yet

- Calculate WACC for SCS CoDocument11 pagesCalculate WACC for SCS CoHusnina FakhiraNo ratings yet

- Ans CH5Document16 pagesAns CH5Elsa MendozaNo ratings yet

- Soal Chapter 4Document4 pagesSoal Chapter 4Cherry BlasoomNo ratings yet

- Notice: Investment Company Act of 1940: Chicago Board Options Exchange, Inc.Document2 pagesNotice: Investment Company Act of 1940: Chicago Board Options Exchange, Inc.Justia.comNo ratings yet

- The Effect of Working Capital Management On Cash HoldingDocument79 pagesThe Effect of Working Capital Management On Cash Holdinglenco4eva6390No ratings yet

- CFE VIX Futures Trading StrategiesDocument47 pagesCFE VIX Futures Trading StrategiesMichel Duran100% (1)

- ACCOUNTINGDocument27 pagesACCOUNTINGUzzal HaqueNo ratings yet

- Solution Chapter 16Document99 pagesSolution Chapter 16Sy Him76% (17)

- Rider University PMBA 8020 Module 1 Solutions: ($ Millions)Document5 pagesRider University PMBA 8020 Module 1 Solutions: ($ Millions)krunalparikhNo ratings yet

- Phoenix Finance 1st MF 30.09.2019Document2 pagesPhoenix Finance 1st MF 30.09.2019Abrar FaisalNo ratings yet

- Delhi Science Forum V Union of India 1996Document17 pagesDelhi Science Forum V Union of India 1996Manisha SinghNo ratings yet

- "Cannot Be Determined" Isn't The Answer For Any of The QuestionsDocument7 pages"Cannot Be Determined" Isn't The Answer For Any of The QuestionsVirgileOrsotNo ratings yet

- Fund AccountingDocument43 pagesFund AccountingthisisghostactualNo ratings yet

- Financial reporting questions on consolidated financial statements, discontinued operations, and changes in equityDocument16 pagesFinancial reporting questions on consolidated financial statements, discontinued operations, and changes in equityUlanda2100% (2)

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Capitalism Trojan Horse - Social Investment and Anti Free Market NgosDocument17 pagesCapitalism Trojan Horse - Social Investment and Anti Free Market NgosEphraim DavisNo ratings yet

- Chapter 1 Intro Fin MGTDocument49 pagesChapter 1 Intro Fin MGTMelissa BattadNo ratings yet

- BKM CH 01 AnswersDocument4 pagesBKM CH 01 AnswersDeepak OswalNo ratings yet

- Multiple Choice Question 61Document8 pagesMultiple Choice Question 61sweatangeNo ratings yet

- Capital Structure Slides Plus QuestionsDocument22 pagesCapital Structure Slides Plus QuestionsDishAnt PaTelNo ratings yet

- GF&Co - FHFA's Proposed Capital RuleDocument5 pagesGF&Co - FHFA's Proposed Capital RuleJoshua Rosner100% (1)

- Exam Report June 2011Document5 pagesExam Report June 2011Ahmad Hafid HanifahNo ratings yet