Professional Documents

Culture Documents

7 - Declaration and Payment of Dividend

Uploaded by

Prasad KhopkarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 - Declaration and Payment of Dividend

Uploaded by

Prasad KhopkarCopyright:

Available Formats

www.taxmann.

com

Page 1 of 2

- Whether dividend declaration/payment barred if company is in default of repayment of deposits

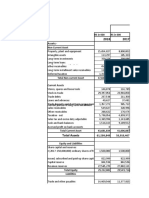

7 DECLARATION AND PAYMENT OF DIVIDEND* Points of comparison ( 1) Whether dividend declaration/payment barred if company is in default of repayment of deposits? Dividend only from free reserves Companies Act, 2013 (2) Companies Act, 1956 (3)

Yes. A company which fails to comply with sections 73 and 74 of No such bar in the 1956 Act. the 2013 Act (repayment of deposits accepted before commencement of the Act) shall not, so long as such failure continues, declare any dividend on its equity shares. Third proviso to section 123(1) of the 2013 Act provides that no No express provisions in this regard in the 1956 Act. dividend shall be declared or paid by a company from its reserves other than free reserves.

Whether past losses required to be set Not required. No express provisions along the lines of clause (b) Yes. Clause (b) of the first proviso to section 205(1) of off before declaring dividend of the first proviso to section 205(1) to the 1956 Act. the 1956 Act requires that company must provide, in respect of each previous financial year, the loss for that year (after providing for depreciation) or the amount of depreciation provided, whichever is lower. Power of Central Government to No such power conferred on the Central Government by the 2013 permit in public interest declaration Act. of dividend without providing depreciation The Central Government may, in the public interest, allow any company to declare or pay dividend for any financial year out of the profits for that year or any previous financial year or years without providing for depreciation. [See clause (b) of the first proviso to section 205(1) of the 1956 Act] Yes. Where the company proposes to declare dividend for any financial year (at a rate exceeding 10% of the paid-up capital) out of the profits for that year, the company has to transfer to reserve such percentage of profits (not exceeding 10 per cent) as prescribed in the Companies (Transfer of Profit to Reserves) Rules, 1975. No express provisions allowing this.

Whether transfer compulsory?

to

reserves No. A company may, before the declaration of any dividend in any financial year, transfer such percentage of its profits for that financial year as it may consider appropriate to the reserves of the company.

Payment of dividend through Expressly allowed. electronic mode to registered shareholder Unpaid Dividend Account Section 124(6) of the 2013 Act goes a step further than section 205C of the 1956 Act and provides that all shares in respect of which unpaid or unclaimed dividend has been transferred to the Investor Education and Protection Fund shall also be transferred by the company in the name of Investor Education and Protection Fund along with a statement containing such details as may be prescribed. Any claimant of shares transferred above shall be entitled to claim the transfer of shares from Investor Education and Protection Fund in accordance with such procedure and on submission of such documents as may be prescribed.

Section 205C of the 1956 Act provides that amounts in the unpaid dividend accounts of companies which have remained unclaimed and unpaid for a period of seven years from the date they became due for payment shall be transferred by a company to the Investor Education and Protection Fund.

Right of investor to make a claim to Section 125 of the 2013 Act provides that claim of an investor Investor/Depositor/share- holder/debentureholder cannot Investor Education and Protection over a dividend or benefit from a security not claimed for more claim the amount from the Fund/the Company after the Fund than 7 years would not be extinguished. expiry of the 7 years period as above. In other words, any person claiming to be entitled to such dividend or money may apply to the authority administering the fund for payment. SCHEDULE II OF THE 2013 ACT : USEFUL LIVES TO COMPUTE DEPRECIATION CORRESPONDING TO SCHEDULE XIV OF 1956 ACT The following are the differences between Schedule II of 2013 Act and Schedule XIV of 1956 Act : Sl. Schedule II of the 2013 Act No. 1. 2. 3. Schedule II deals with amortization of intangible assets also. Schedule XIV of the 1956 Act Schedule XIV dealt with only depreciation of tangible assets

Schedule II contains only useful lives of tangible assets and does Schedule XIV contained rates of depreciation of tangible assets. not prescribe depreciation rates. Schedule II omits the provision for 100% depreciation on Schedule XIV provided that 100% depreciation shall be charged on assets whose actual cost immaterial items - i.e. on assets whose actual cost does not does not exceed Rs. 5,000 exceed Rs. 5,000

http://localhost:7758/fileopen.aspx?Page=companiesacttopics&isxml=N&id=107010000...

24/10/2013

www.taxmann.com

Page 2 of 2

4.

Extra Shift depreciation (ESD) not applicable to items marked Extra Shift depreciation (ESD) not applicable to (i) items marked NESD in the Schedule (ii) NESD in the Schedule. ESD will apply to plant and machinery specified items of plant and machinery to which general rate of depreciation was applicable items subject to general rate - i.e. useful life of 15 years ESD working simplified by the 2013 Act-50% more depreciation for that period for which asset used for double shift and 100% more depreciation for that period for which asset used for triple shift. ESD for double shift and triple shift was to be made separately in proportion which number of days for which concern worked second shift or triple shift bears to normal number of working days in a year (greater of actuals and 180 days for seasonal factory; greater of actuals and 240 days in other cases)

5.

http://localhost:7758/fileopen.aspx?Page=companiesacttopics&isxml=N&id=107010000...

24/10/2013

You might also like

- Set OffDocument9 pagesSet OffAditya MehtaniNo ratings yet

- Rich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o oDocument11 pagesRich Dad Poor Dad by Robert Kiyosaki (BOOK SUMMARY & PDF) : o o o o o o o o o o o o odchandra15100% (2)

- Guide For Private Wealth ManagementDocument248 pagesGuide For Private Wealth Managementvotchen2008No ratings yet

- In Brief: Recent DevelopmentsDocument7 pagesIn Brief: Recent DevelopmentsScar IceNo ratings yet

- Dow Theory.Document39 pagesDow Theory.AdilFahimSiddiqi100% (6)

- Payment of Bonus Act, 1965Document28 pagesPayment of Bonus Act, 1965Apoorva JhaNo ratings yet

- Project AppraisalDocument3 pagesProject AppraisalnailwalnamitaNo ratings yet

- Trend Hunter EA ManualDocument14 pagesTrend Hunter EA ManualFrado SibaraniNo ratings yet

- Declaration and Payment On DividendDocument12 pagesDeclaration and Payment On DividendChiranjeev RoutrayNo ratings yet

- Declaration and Payment of Dividend: A Project OnDocument12 pagesDeclaration and Payment of Dividend: A Project OnOwaisWarsiNo ratings yet

- Dividend & Divisible ProfitDocument5 pagesDividend & Divisible ProfitRUDRAKANT PANDEYNo ratings yet

- Abhinay Saket & Associates: Source For Payment of DividendDocument2 pagesAbhinay Saket & Associates: Source For Payment of DividendAbhinay KumarNo ratings yet

- Declaration and Payment of Dividend-Compliance RequirementsDocument8 pagesDeclaration and Payment of Dividend-Compliance RequirementsSherin BabuNo ratings yet

- Union Budget 2013-14 - Highlights of Direct Tax ProposalsDocument5 pagesUnion Budget 2013-14 - Highlights of Direct Tax Proposalsankit403No ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- Tax Issues in Demarger & AmalgamationDocument25 pagesTax Issues in Demarger & AmalgamationMohit MishuNo ratings yet

- Company Law, Governance and Social Responsibility: Observations From The Companies Act, 1956 - 2013Document6 pagesCompany Law, Governance and Social Responsibility: Observations From The Companies Act, 1956 - 2013sureshNo ratings yet

- Establishment: Factory Industry Establishment Central Government EstablishmentDocument9 pagesEstablishment: Factory Industry Establishment Central Government EstablishmentPayal PurohitNo ratings yet

- Payment of Bonus ActDocument9 pagesPayment of Bonus ActPradnya Ram PNo ratings yet

- Chapter XXVI Nidhis Rules, 2014Document32 pagesChapter XXVI Nidhis Rules, 2014Jitendra RavalNo ratings yet

- Taxation Aspect of Mergers and AmalgamationDocument14 pagesTaxation Aspect of Mergers and AmalgamationRakesh PrajapatiNo ratings yet

- Symbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)Document8 pagesSymbiosis Law School, Pune: Subject: Company Law I (SEM V) Batch 2017-22 B.A.LL.B (Hons)vipin gautamNo ratings yet

- Pay Bonus ActDocument30 pagesPay Bonus ActAaju KausikNo ratings yet

- Dividend & Accounts of ComplanyDocument38 pagesDividend & Accounts of ComplanySrikant0% (1)

- Corporate and Other Law Amendment Notes 1690271793Document12 pagesCorporate and Other Law Amendment Notes 1690271793AbhiNo ratings yet

- Compliances: Overview of Year End Under Companies Act, 2013Document89 pagesCompliances: Overview of Year End Under Companies Act, 2013Vijay MelwaniNo ratings yet

- Interim Dividend From ReservesDocument2 pagesInterim Dividend From Reservesaashish vermaNo ratings yet

- Duties of An AuditorDocument4 pagesDuties of An AuditorAtul GuptaNo ratings yet

- CSR As Per Companies Act, 2013Document7 pagesCSR As Per Companies Act, 2013Meghna S NedumpurathuNo ratings yet

- Guidance Note On Accounting For Depreciation in CompaniesDocument25 pagesGuidance Note On Accounting For Depreciation in CompaniesMANISH SINGHNo ratings yet

- Ep Os Module 1 Dec 20Document93 pagesEp Os Module 1 Dec 20Monika SinghNo ratings yet

- Karanam 14b PDFDocument101 pagesKaranam 14b PDFGovind BharathwajNo ratings yet

- Karanam 14b PDFDocument101 pagesKaranam 14b PDFGovind BharathwajNo ratings yet

- Paper14b PDFDocument101 pagesPaper14b PDFGovind BharathwajNo ratings yet

- GR - III: Paper 14: Indirect and Direct Tax Management December 2011 Direct TaxationDocument101 pagesGR - III: Paper 14: Indirect and Direct Tax Management December 2011 Direct TaxationGovind BharathwajNo ratings yet

- Divisible ProfitsDocument45 pagesDivisible Profitsalizai khanNo ratings yet

- Trust Registration With McaDocument6 pagesTrust Registration With McaCA Amresh VashishtNo ratings yet

- Budget 2013 - 2014Document11 pagesBudget 2013 - 2014sdfdhgtj894No ratings yet

- Assignment On Exempted Income of CompaniesDocument19 pagesAssignment On Exempted Income of CompaniesDipti SahuNo ratings yet

- Recent Amendments Companies Act 2013Document39 pagesRecent Amendments Companies Act 2013warner313No ratings yet

- Taxguru - In-Guide To Approved Gratuity FundDocument12 pagesTaxguru - In-Guide To Approved Gratuity FundnanuNo ratings yet

- A Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingDocument12 pagesA Book: Integrated Professional Competency Course (IPCC) Paper - 1: AccountingSipoy SatishNo ratings yet

- Chapter 10 Set Off and Carry Forward of Losses PMDocument12 pagesChapter 10 Set Off and Carry Forward of Losses PMMohammad Yusuf NabeelNo ratings yet

- The Payment of Bonus Act 1965Document8 pagesThe Payment of Bonus Act 1965Abhishek ShahNo ratings yet

- Business Laws Vol 1Document27 pagesBusiness Laws Vol 1Sriram_VNo ratings yet

- Law Old Nov18 Suggested AnsDocument22 pagesLaw Old Nov18 Suggested Ansrshetty066No ratings yet

- Companies Act, 2013 - PPT 2Document33 pagesCompanies Act, 2013 - PPT 2raj kumarNo ratings yet

- Insolvency Resolution and Liquidation For Corporate PersonsDocument12 pagesInsolvency Resolution and Liquidation For Corporate PersonsMishika PanditaNo ratings yet

- MTP 19 49 Answers 1712387474Document9 pagesMTP 19 49 Answers 1712387474Nitin KumarNo ratings yet

- Revision Test Paper... RTP - Nov14 - Ipcc-6Document34 pagesRevision Test Paper... RTP - Nov14 - Ipcc-6Sai ArjunNo ratings yet

- Tax Planning With Respect To Amalgamation and MergersDocument18 pagesTax Planning With Respect To Amalgamation and Mergerssadathnoori83% (18)

- Beneficial OwnerDocument36 pagesBeneficial OwnermsmilansenNo ratings yet

- Company Law AmendmentsDocument25 pagesCompany Law AmendmentskhushaaliNo ratings yet

- Law2 PDFDocument9 pagesLaw2 PDFPushkar PriyamNo ratings yet

- 64 Amendmntnotes 10 18 PDFDocument9 pages64 Amendmntnotes 10 18 PDFkhusbu jainNo ratings yet

- 34564rtp Nov14 Ipcc-4Document59 pages34564rtp Nov14 Ipcc-4Deepal DhamejaNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Bus (1) (1) - Inc.-3Document46 pagesBus (1) (1) - Inc.-3api-3758832No ratings yet

- Draft File (Shafin)Document11 pagesDraft File (Shafin)MD Shafin AhmedNo ratings yet

- MACR-06 - I-Tax ActDocument10 pagesMACR-06 - I-Tax ActVivek KuchhalNo ratings yet

- LAPD IntR in 2012 09 Arc 11 IN9 Issue 4 Archived On 14 October 2009Document17 pagesLAPD IntR in 2012 09 Arc 11 IN9 Issue 4 Archived On 14 October 2009sibiyazukiswa27No ratings yet

- Sunil Sir Paper FinalDocument38 pagesSunil Sir Paper FinalOkkishoreNo ratings yet

- Creation of Charges Under Companies Act, 2013 - Taxguru - inDocument6 pagesCreation of Charges Under Companies Act, 2013 - Taxguru - inRyan Denver MendesNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- DelistingDocument33 pagesDelistingPrasad KhopkarNo ratings yet

- DelistingDocument33 pagesDelistingPrasad KhopkarNo ratings yet

- Competition BillDocument17 pagesCompetition BillPrasad KhopkarNo ratings yet

- Sebi Clause 49-Textoftheclause49ofthelistingagreementDocument19 pagesSebi Clause 49-Textoftheclause49ofthelistingagreementPrasad KhopkarNo ratings yet

- Sbi, 1Q Fy 2014Document14 pagesSbi, 1Q Fy 2014Angel BrokingNo ratings yet

- Bcbs 279Document37 pagesBcbs 279남상욱No ratings yet

- Balance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMDocument1 pageBalance Sheet: 07 - Standalone Financial - 28-06-2019.indd 206 7/5/2019 6:36:18 PMharshit abrolNo ratings yet

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Chapter 6 Foreign Currency TransactionsDocument10 pagesChapter 6 Foreign Currency Transactionsfitsum tesfayeNo ratings yet

- Assignment Farm AccountsDocument6 pagesAssignment Farm AccountsCharles ChikumbiNo ratings yet

- Georgetown University Public Real Estate Fund Valuation ModelDocument35 pagesGeorgetown University Public Real Estate Fund Valuation Modelmzhao8No ratings yet

- Ujaannagar ppt-1Document14 pagesUjaannagar ppt-1chayan2.exprolabNo ratings yet

- Cybercash - The Coming Era of Electronic Money (Preview)Document22 pagesCybercash - The Coming Era of Electronic Money (Preview)Bayu HerkuncahyoNo ratings yet

- INTERCO ProjectDocument60 pagesINTERCO ProjectFougnigue Serin SilueNo ratings yet

- (Kotak) Insurance, February 02, 2023Document11 pages(Kotak) Insurance, February 02, 2023Deepak KhatwaniNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- 33 - 11. Unit 10 (Solved)Document12 pages33 - 11. Unit 10 (Solved)Rana Zafar ArshadNo ratings yet

- Homework 7 Problems and SolutionsDocument17 pagesHomework 7 Problems and Solutionswasif ahmedNo ratings yet

- Degree of Bachelor of Business Administration (Finance and International Business) CHRIST (Deemed To Be University)Document47 pagesDegree of Bachelor of Business Administration (Finance and International Business) CHRIST (Deemed To Be University)Manjot singh raina100% (1)

- Bank Performance Ratios - 2Document29 pagesBank Performance Ratios - 2Shiba Prasad MohantyNo ratings yet

- May Bank Kim Eng PDFDocument19 pagesMay Bank Kim Eng PDFFerry PurwantoroNo ratings yet

- Rajiv Project On Study On Effectiveness of Employee Role in Service DeliveryDocument68 pagesRajiv Project On Study On Effectiveness of Employee Role in Service Deliveryrajivranjan1988No ratings yet

- Individual Assignment Bui Van Thanh MMDocument9 pagesIndividual Assignment Bui Van Thanh MMThanh BuiNo ratings yet

- Lecture 1 - Cash and Cash EquivalentsDocument18 pagesLecture 1 - Cash and Cash EquivalentsJim Carlo ChiongNo ratings yet

- Hypothesis Testing ExampleDocument11 pagesHypothesis Testing ExampleAayush SisodiaNo ratings yet

- ACCA F5 Revision NotesDocument40 pagesACCA F5 Revision Notesclmc83No ratings yet

- Basel IIIDocument8 pagesBasel IIISai VaasavNo ratings yet

- Asset Class RotationDocument9 pagesAsset Class RotationsumughanNo ratings yet

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraNo ratings yet