Professional Documents

Culture Documents

Internal Control Document 1

Uploaded by

hossainmzCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Internal Control Document 1

Uploaded by

hossainmzCopyright:

Available Formats

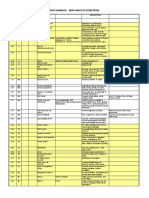

Sales & Credit Control Daily

Material Management Compare the production orders in SAP on a daily basis for top 10 variance items. Compare the production orders (In SAP / ERP) with that uploaded in CF2000E for the period under review. Investigate into differences. (orders available in SAP/ERP and not in CF2000e should be seriously looked into. Likewise orders in CF2000e not available in SAP/ERP should get special attention).

Purchasing

Payroll

HR

General Accounting

Fixed Assets & CAPEX

Weekly

Order types used are appropriate to the nature of transactions (e.g. deliveries to be billed, free samples, replacements against goods returned, defective goods, etc.). ZFSO is used for CCE, FOC supplies and appropriately approved through a block & release strategy.

Weekly

Proof of delivery information is available - both carrier's and customer's acknowledgement (signed and dated). Wherever a shortage/excess is noted on the deliver documents, is there a All failed lots or cheeses from Dyehouse and Finishing have procedure to trace the reasons for such to be transferred to the FAIL storage location from the excess/shortages and initiate recovery if required, production orders. from the freight carrier. Check the process to ensure that goods are not diverted to other customers inadvertently (or) intentionally to provide unintended extended credit. Goods returned are properly recorded and stock records promptly updated. Orders received are checked against credit limits & overdue prior to dispatch of goods and except those that had been properly authorized; other breaches are "stopped". Are these parameters appropriately defined in SAP (or other systems) and reviewed at periodic intervals? Check delays between date of cheques/cash collections from customers and date of deposits into bank for EPZ customers only. Check if there is any COD from customers which is prohibited. Cut-off procedures are clearly identified and strictly adhered to. What is the process to ensure Check the process followed for quality inspection for items that all goods delivered are invoiced and all goods received on consignment basis. invoiced are delivered? All materials & services received are routed through Purchase Orders and comply with the Payments to casual workers are Group guidelines. Any exceptions are identified authorised and correctly and escalated for approval (e.g. auditors fees, controlled. royalty payments). Clear policy guideline exists with regard to lease/hire of vehicles and other amenities given Is the Balance Sheet review process in place? to employees and periodic monitoring of such expenses. Are assets (including real estate) adequately insured as instructed in the Capital Expenditure Policy? Check whether production is issueing GT to cost centre other than approved cases.

Weekly

Weekly

Weekly

Weekly

Monthly

Monthly

All prices (ZPRO & ZPNT) are updated in SAP and available for raising invoices? Is there authorization matrix with regard to the gross margins to be earned. Wherever sales are made to GKA customers, are GKA price lists available to confirm that prices charged are appropriate?

Is there a database of items which were rejected due to Pool vehicle usages are restricted for business defect (or quality complaints) and the actions taken to close Purchase invoices, GRN and orders are recorded All deductions are authorised and purpose only and log books are properly them (e.g. replacements received/credit notes issued by and matched. calculated correctly. maintained. vendor).

Are Control accounts in agreement with subsidiary ledger balances.

Monthly

Access to change rates/terms at the time of order entry is restricted and appropriately authorized. Are all cycle count & physical stock take differences posted Purchase ledger is reconciled at least monthly to Control accounts are reconciled YPCM Report is generated on a monthly basis to into SAP only after approval through a park and release the purchase ledger control in the nominal monthly for net pay, statutory review all changes made at the order level and strategy? Is the access to post stock adjustments restricted? ledger. deductions such as PF, tax etc. appropriately authorized as per authority matrix.

Monitoring fuel consumption of company provided vehicle including pool cars.

Are suspense accounts, Inter Office balances etc. periodically reconciled.

Monthly

Reasons for credit notes are analysed and exceptions are reported to management.

The level of blocked stocks should be reviewed on a weekly basis. Stocks should be blocked due to following reasons only: - Returns from customers during quality check; - Inventory differences identified but not processed;

Check for double payment/invoicing.

All statutory deductions are paid in line with Government policy.

Other debtors and prepayments are reviewed All employees related expenses (including monthly and are fully realizable and appropriate MDs) are approved as per one up principle and documents are available (wherever required) to expenses approval policy. substantiate its recoverability.

Monthly

Overdue account collection systems exist and are Confirm whether appropriate NRV provision is carried in the strictly adhered to. Supplies to overdue customers books and complied with Group Policy requirements. are strictly regulated.

All non-statutory deductions are paid on a timely basis and/or in line with Group policy (e.g. pension fund). All discontinued employees are removed from payroll register and bank instructions letter.

Business travel expenses must be incurred in line with policy and any exceptions are approved by MD.

Other creditors and accruals (e.g. Inbound & outbound delivery, commissions, incentives, discounts & rebates, etc.) are reviewed monthly and are fully stated. Any excess accruals/amounts no longer required are identified and reversed. An aged creditors ledger is produced and reviewed monthly. Outstanding items in suspense and other clearing accounts (GRIR & consignment clearing & Employee Suspense) are current and valid. Provisions for known liabilities (e.g. bad and doubtful debts, customers claims, irrecoverable VAT, etc.) are adequate, comply with Group/Division policy and regularly reviewed.

Monthly

Confirm that WIP value as per FICO is supported by open production orders which are current and appropriately valued. Check whether all items are enabled for backflush and manual backflush is disabled for movement type 261. All issues to cost centre are appropriately approved. Compare the approved conversion factors with the factors set in the SAP and inquire into differences (greater than 5%).

Monthly

Monthly

Sales & Credit Control Monthly

Material Management Inquire whether an input-output reco is performed on a monthly basis. Independently compute the waste. Compare order quantity with production quantity. In case of MTO, ensure that excess production is considered for dormancy / slow moving provision.

Purchasing

Payroll

HR

General Accounting Are all known expenses/liabilities accrued/provided for while preparing the unit results. Bank reconciliation is prepared and reviewed regularly with explanation of unreconciled items.

Fixed Assets & CAPEX

Monthly

Quarterly

Outstanding debts are fully supported by relevant sales documentation (invoices, despatch notes).

Monitoring of OTV to check multiple purchase are not being done from them.

Employee insurance such as medical & life coverage premium is calculated correctly and updated for all employees.

Have all local statutory accounts/tax filing deadline been met.

Any missing assets are appropriately charged off after such investigation and approvals.

Quarterly

Unadjusted credits (collections, credit notes) are periodically reviewed and matched against the customer dues to reflect current and correct status of the customers balances.

Supplier statements reconciled & differences actioned.

Quarterly Quarterly

Are prices negotiated for MuM linked to the cost of base raw materials and inflation thereof? Are purchases following three quotations principle? Any shipment received other than by sea route (Air, courier, etc.) are appropriately approved as per the authority matrix, after appropriate review. Are all freight transactions substantiated by a freight contract (inward as per group negotiated terms) and outward (as per local contracts)? Evaluate open PO and resolve long pending cases. Where suppliers' credit is taken, it is evaluated against alternative funding cost and appropriate advice is sought before incurring such additional costs re advance to suppliers should be restricted. Vendor background data are updated and reviewed for accuracy. Physical stock count is done twice a year as per group norms. Insure that count is done by a multifunctional team, instructions have been issued, and count sheets do not contain quantity. Enquire into the differences and whether the explanations sound reasonable. PO authorization matrix defined in SAP for approval of purchase orders is in line with local authorization matrix within the ambit of All pay changes are approved and delegation of authority (DOA) matrix issued by aligned with policy Group. How does one ensure that the purchase orders are not split to violate authorization limits? A supplier database is maintained and regular suppliers are periodically evaluated for price, delivery and quality. The evaluation process should be evidenced. All items have multiple sources of supply and in case of single source, action plans are in place to address supply disruption and is flagged off in Risk Questionnaire. Group cut-off levels are observed for Code of business conduct has been signed as capitalisation of small value items and spare required by Group HR policy and conflicts If any Leased assets are separately identified and recorded. parts. SAP functionality is used for monitoring have been disclosed & appropriately actioned stocks at the same time writing off low value by Unit? assets.

Quarterly

Quarterly

Quarterly

Quarterly

Credit limits are regularly reviewed as per Group Credit Policy (twice a year review) and changes are Half yearly properly authorised. Credit limits are aligned to average sales for past 12 months and forecast sales.

Customers credit limits > $200k are approved as per Group Credit Policy prior to posting these credit limits in SAP (or other systems). Also data Half yearly on credit limit and balances >$200k and overdue in those accounts are reported in BCS on a monthly basis.

Holiday pay provisions are adequate.

Systems are adequate to monitor funds committed (e.g. POs, contracts) and estimate total project cost to assure early warning of potential overruns or scope changes and provide the basis for a supplemental authorisation request before authorised funds are fully expended.

Half yearly

Fund management such as Is purchase committee is functioning as per ToR accounts preparation, balance including location based committee? circulation etc of PF/WPPF/SAF are properly done and updated.

Capital WIP accounts are periodically reviewed and followed up with user departments for timely capitalization and providing depreciation.

Half yearly

Provision for payroll related costs Payment terms are optimised. Access to change are adequate such as credit terms at the time of PO creation or PF/Gratuity/WPPF/SAF/Insurance Invoice Verification (MIRO) is restricted. etc.

Formal procedures have been defined for asset disposal (such as, obtaining competitive quotes, regulatory approval, internal approval etc) and are followed.

Half yearly

Half yearly

Annual

Payroll accounting captured all payroll related costs appropriately to reflect correct employee costs.

All assets are marked/tagged with the asset number corresponding to that shown in the fixed asset ledger. Impairment test is done annualy to comply IAS 36.

Annual

Costing Daily

Treasury

Accounts Payable

Accounts Receivable

Regulatory

Weekly

Weekly

Weekly

Weekly

Weekly

Weekly

Monthly

Additive costs are captured in SAP to What is the net exposure? if it is more Supplier statements are reconciled to the reflect real price variances (freight, duty than US$ 2.5 million, have you hedged creditors ledger and the reconciliations are and C&F charges). your net forex exposure? checked by senior financial management.

Are all customer bills of exchange discounted with recourse added back to debtors.

Monthly

All price & manufacturing variances (including revaluation reserve) are For treasury deals, have you obtained appropriately capitalized (or charged to multiple quotes prior to finalization of results) as per FIFO template prescribed the deal? by Global Management Accounting Team.

Where sales are given away free, the costs needs to be recognized in variable SDA costs.

Monthly

Spare parts older than 2 years are written off from the book

Aged lists of debtors to be produced at least monthly

Monthly

Provisions for obsolete, slow-moving stocks and NRV basis are adequate, comply with Group/Division policy and regularly reviewed.

Debtors overdue by more than 6 months must be fully provided, including the associated output tax/VAT. Provision is required against the output tax/VAT regardless of whether or not it is expected to be recovered (and should only be released when actual recovery has been achieved).

Monthly

Sales are recognized as per group policy.

Monthly

Monthly

Monthly

Costing Monthly

Treasury

Accounts Payable

Accounts Receivable

Regulatory

Monthly

Quarterly

Accounts payable should review debit Have bank mandates been updated to balance accounts at least quarterly and remove all personnel who have left the request remittance of old debit amounts company? outstanding. Such remittance should be submitted directly to the cash function. Is there any cash forecasting in practice to minimise the instances of outstanding borrowing and cash in hand?

Review of pending legal proceedings status

Quarterly

Tax, VAT & other fiscal charge compliance

Quarterly Quarterly

Review of remittance & transfer pricing compliance

Quarterly

Quarterly

Quarterly

Quarterly

Half yearly

Original invoices should be used as the basis for payment. Where the original invoice is not available a copy can be used only if it is properly authorized.

Review of bonded warehouse operations

Half yearly

The suppliers invoice should be matched and compared to an approved purchase requisition, purchase order, and appropriate receiving information before payment. The absence of any of the referenced information or discrepancies between the information (e.g. price quantity etc.) must be resolved before payment is made. Invoices for which a purchase order or receiving report does not exist (e.g. non production services, cheque requests, onetime purchases etc.) must be approved by management in accordance with the company approval authorization limits before payment. Ensure withholding tax/VAT are charged as per requirement of law. Approved payments must be made within the agreed terms. Signed cheques ready for handover must be delivered to persons independent of invoice processing and maintenance of accounts payable records.

Review of labour law compliance

Half yearly

Half yearly

Half yearly

Half yearly

Annual

Review of BOI activities

Annual

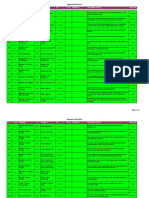

Details of test Frequency Order types used are appropriate to the nature of transactions (e.g. deliveries to be billed, free samples, replacements against goods returned, defective goods, etc.). ZFSO Weekly is used for CCE, FOC supplies and appropriately approved through a block & release strategy. Proof of delivery information is available - both carrier's and customer's acknowledgement (signed and dated). Wherever a shortage/excess is noted on the delivered documents, is there a procedure to trace the reasons for such excess/shortages and initiate recovery if required, from the freight carrier. Check the process to ensure that goods are not diverted to other customers inadvertently (or) intentionally to provide unintended extended credit.

Monthly

Cut-off procedures are clearly identified and strictly adhered to. What is the process to Monthly ensure that all goods delivered are invoiced and all goods invoiced are delivered. All prices (ZPRO & ZPNT) are updated in SAP and available for raising invoices? Is there authorization matrix with regard to the gross margins to be earned. Wherever sales are Quarterly made to GKA customers, are GKA price lists available to confirm that prices charged are appropriate. Access to change rates/terms at the time of order entry is restricted and appropriately authorized. YPCM Report is generated on a monthly basis to review all changes made at Monthly the order level and appropriately authorized as per authority matrix. Goods returned are properly recorded and stock records promptly updated. Monthly

Outstanding debts are fully supported by relevant sales documentation (invoices, despatch notes etc.). Unadjusted credits (collections, credit notes) are periodically reviewed and matched against the customer dues to reflect current and correct status of the customers balances. Reasons for credit notes are analysed and exceptions are reported to management.

Quarterly

Quarterly

Monthly

Credit limits are regularly reviewed as per Group Credit Policy (twice a year review) and changes are properly authorised. Credit limits are aligned to average sales for past 12 Half yearly months and forecast sales. Customers credit limits > $200k are approved as per Group Credit Policy prior to posting these credit limits in SAP (or other systems). Also data on credit limit and Half yearly balances >$200k and overdue in those accounts are reported in BCS on a monthly basis.

Orders received are checked against credit limits & overdue prior to dispatch of goods and except those that had been properly authorized; other breaches are "stopped". Are Weekly these parameters appropriately defined in SAP (or other systems) and reviewed at periodic intervals? Check delays between date of cheques/PO/DD collections from customers and date of Weekly deposits into bank for EPZ customers only. Check if there is any COD from customers which is prohibited. Weekly

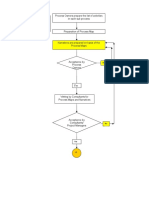

Responsibility Remarks Customer Every Saturday report will be service manager circulated

Sign off

SC role

Customer First week of May'14 we will service manager circulate first report

Finance Controller Credit Controller

Reporting to be completed by 3rd day of month closing

Week 4 April'14

Credit Controller

Week 4 April'14

Further discussion and Customer alternative solution to be service manager developed AR executive Week 3 April'14

Complaint goods return report from CWH on a monthly basis

SOP for goods return to share with CWH

Credit Controller Credit Controller Credit Controller Credit Controller

Reporting is in place Reporting from 1st week May'14 with the help of FC. Quarterly review at local level with documentation Pending approval to be obtained a s a p

Credit Controller Billing Billing

Weekly report from May'14 1st week onward Reporting from 16th April onward

Add disclaimer to the DN copy as printed that all claim should be lodged with 72 hours

GP margin issue to deal with CC

s return report from CWH on a monthly basis

eturn to share with CWH

Details of test Check the process followed for quality inspection for items received on consignment basis. Is there a database of items which were rejected due to defect (or quality complaints) and the actions taken to close them (e.g. replacements received/credit notes issued by vendor). Are all cycle count & physical stock take differences posted into SAP only after approval through a park and release strategy? Is the access to post stock adjustments restricted? Check whether all items are enabled for backflush and manual backflush is disabled for movement type 261. All issues to cost centre are appropriately approved.

T-code ME23N

Frequency Monthly

Monthly

MB51/BW

Monthly

Monthly

Compare the approved conversion factors with the factors set in SE16 - table MARM the SAP and inquire into differences (greater than 5%) Inquire whether an input-output reco is performed on a monthly Worksheet exercise basis. Independently compute the waste. Compare the production orders in SAP on a daily basis for top 10 COOIS/yprodvar variance items. Compare the production orders (In SAP / ERP) with that uploaded in CF2000E for the period under review. Investigate into differences. (orders available in SAP/ERP and not in CF2000e should be seriously looked into. Likewise orders in CF2000e not available in SAP/ERP should get special attention) All failed lots or cheeses from Dyehouse and Finishing have to be transferred to the FAIL storage location from the production orders. Check whether production is issueing GT to cost centre other than approved cases.

Monthly Monthly Daily

MB51 , movement types 261,262, ( for CF2000 materials) storage Weekly location 45 and 201,202 for other chemicals used ( effluent plant etc.) MC.1 for storage location FAIL Weekly

MB51 (movement type Weekly 201, 202)

Responsibility Remarks Plant Finance

Sign off

Plant Finance

Plant Finance

Plant Finance

Plant Finance Plant Finance Plant Finance

Plant Finance

Plant Finance Plant Finance

Details of test PO authorization matrix defined in SAP for approval of purchase orders is in line with local authorization matrix within the ambit of delegation of authority (DOA) matrix issued by Group. How does one ensure that the purchase orders are not split to violate authorization limits?

T-code

Frequency

Half yearly

Vendor background data are updated and reviewed for accuracy. Vendor master

Half yearly

A supplier database is maintained and regular suppliers are periodically evaluated for price, delivery and quality. The evaluation process should be evidenced. All critical items have Half yearly multiple sources of supply and in case of single source, action plans are in place to address supply disruption and is flagged off in Risk Questionnaire. All materials & services received are routed through Purchase Orders and comply with the Group guidelines. Any exceptions are Check for direct invoice Monthly identified and escalated for approval (e.g. auditors fees, royalty entry payments). Where suppliers' credit is taken, it is evaluated against alternative funding cost and appropriate advice is sought before incurring such additional costs re advance to suppliers should be restricted. ME2L/Queries of User Group Coats_RO_MD, transaction SQ01/BW report Quarterly

Evaluate open PO and resolve long pending cases

Quarterly

Purchase invoices, GRN and orders are recorded and matched. Check for double payment/invoicing Any shipment received other than by sea route (Air, courier, etc.) are appropriately approved as per the authority matrix, after appropriate review. Are all freight transactions substantiated by a freight contract (inward as per group negotiated terms) and outward (as per local contracts)? Is purchase committee is functioning as per ToR including location based committee? Are prices negotiated for identified MuM linked to the cost of base raw materials and inflation thereof?

ME2L/ME80FN/ME23N/ YFI_GRIR/F.19/BW Monthly report/MB5S S_ALR_87012341/S_ALR Monthly _87009879/78

Quarterly

Half yearly MCE3 Quarterly

Are purchases following three quotations principle? Purchase ledger is reconciled at least monthly to the purchase ledger control in the nominal ledger. Supplier statements reconciled & differences actioned. Payment terms are optimised. Access to change credit terms at the time of PO creation or Invoice Verification (MIRO) is restricted. Monitoring of OTV to check multiple purchase are not being done from them.

Random basis F.42 F.42 BW/SAP SAP

Quarterly Monthly Quarterly Half yearly Quarterly

Responsibility Remarks

Sign off

FM

PM

There are gaps exist in SAP. From now onward Musfiq will be responsible for updating all backgraond data. All data will be updated by Q3 2014.

PM

FM

FM

PM & FM

We will get a report and follow up by end of April'14.

PM & FM FM

GR/IR report to be generated every month end.

Process to simplified

Commercial Manager

April'14 end

FD PM Plastic negotiation has been done, card board will be done by end of this year

PM FM FM FM PM

PR comparative report to be generated quarterly

April'14 end

Details of test Payroll accounting captured all payroll related costs appropriately to reflect correct employee costs. All pay changes are approved and aligned with policy Payments to casual workers are authorised and correctly controlled. All deductions are authorised and calculated correctly. Control accounts are reconciled monthly for net pay, statutory deductions such as PF, tax etc. All statutory deductions are paid in line with Government policy.

Frequency Responsibility Annual FM

Half yearly COMBEN Monthly Monthly Monthly Monthly COMBEN FM COMBEN COMBEN COMBEN

All non-statutory deductions are paid on a timely basis and/or Monthly in line with Group policy (e.g. pension fund). Holiday pay provisions are adequate.

Half yearly COMBEN COMBEN

Employee insurance such as medical & life coverage premium Quarterly is calculated correctly and updated for all employees. Fund management such as accounts preparation, balance circulation etc of PF/WPPF/SAF are properly done and updated. Provision for payroll related costs are adequate such as PF/Gratuity/WPPF/SAF/Insurance etc. All discontinued employees are removed from payroll register and bank instructions letter. Code of business conduct has been signed as required by Group HR policy and conflicts If any have been disclosed & appropriately actioned by Unit? Clear policy guideline exists with regard to lease/hire of vehicles and other amenities given to employees and periodic monitoring of such expenses. Pool vehicle usages are restricted for business purpose only and log books are properly maintained. Monitoring fuel consumption of company provided vehicle including pool cars. All employees related expenses (including MDs) are approved as per one up principle and expenses approval policy. Business travel expenses must be incurred in line with policy and any exceptions are approved by MD.

Half yearly COMBEN/Finance Half yearly FM Monthly COMBEN

Half yearly HR

Monthly Monthly Monthly Monthly Monthly

HR ADMN ADMN COMBEN ADMN

Remarks GL input, Reconciliation with Salary Sheet.

Sign off

Details of test General Accounting: Balance Sheet review process is in place once in a month Are Control accounts in agreement with subsidiary ledger balances. GL

T-code

Frequency Monthly Monthly Monthly Monthly

Are suspense accounts, Inter Office balances etc. periodically reconciled. GL Other debtors and prepayments are reviewed monthly and are fully realizable and appropriate documents are available (wherever required) to substantiate its recoverability. GL

Other creditors and accruals (e.g. Inbound & outbound delivery, commissions, incentives, discounts & rebates, etc.) are reviewed monthly GL and are fully stated. Any excess accruals/amounts no longer required are identified and reversed. An aged creditors ledger is produced and reviewed monthly. Outstanding items in suspense and other clearing accounts (GRIR & consignment clearing & Employee Suspense) are current and valid. Provisions for known liabilities (e.g. bad and doubtful debts, customers claims, irrecoverable VAT, etc.) are adequate, comply with Group/Division policy and regularly reviewed. Royalty and GKA commissions are accounted on cash basis as per group guidelines, except at the year end when it should be accrued and reconciled as part of schedule J reconciliation. Any unbranded items sold and whether it is excluded for royalty calculations. Leased assets are separately identified and recorded. Are all known expenses/liabilities accrued/provided for while preparing the unit results. Have all local statutory accounts/tax filing deadline been met. Bank reconciliation is prepared and reviewed regularly with explanation of unreconciled items. Fixed assets & CAPEX: Group cut-off levels are observed for capitalisation of small value items and spare parts. SAP functionality is used for monitoring stocks at the same time writing off low value assets. All assets are marked/tagged with the asset number corresponding to that shown in the fixed asset ledger. Systems are adequate to monitor funds committed (e.g. POs, contracts) and estimate total project cost to assure early warning of potential overruns or scope changes and provide the basis for a supplemental authorisation request before authorised funds are fully expended. Capital WIP accounts are periodically reviewed and followed up with user AUC from departments for timely capitalization and providing depreciation. Y_FAM

Monthly

Monthly ME23N/YFI _GRIR/F.19/ Monthly MB5S Monthly

Quarterly

Half yearly Monthly Quarterly Excel workings Monthly

Half yearly Annual

Half yearly

Half yearly

Formal procedures have been defined for asset disposal (such as, obtaining competitive quotes, regulatory approval, internal approval etc) and are followed. Any missing assets are appropriately charged off after such investigation and approvals. Impairment test is done annualy to comply IAS 36. Are assets (including real estate) adequately insured as instructed in the Capital Expenditure Policy? Costing: Additive costs are captured in SAP to reflect real price variances (freight, duty and C&F charges). All price & manufacturing variances (including revaluation reserve) are appropriately capitalized (or charged to results) as per FIFO template prescribed by Global Management Accounting Team. Excel workings

Half yearly Quarterly Annual Monthly

Monthly y_cd2_8900 0030/BW Monthly report Monthly Annual Monthly Quarterly Monthly Quarterly

Provisions for obsolete, slow-moving stocks and NRV basis are adequate, BW report comply with Group/Division policy and regularly reviewed. Activity costs calculation and run in SAP in time. Treasury: What is the net exposure? if it is more than US$ 2.5 million, have you hedged your net forex exposure? Is there any cash forecasting in practice to minimise the instances of outstanding borrowing and cash in hand? For treasury deals, have you obtained multiple quotes prior to finalization of the deal? Have bank mandates been updated to remove all personnel who have left the company? Payable: Original invoices should be used as the basis for payment. Where the original invoice is not available a copy can be used only if it is properly authorized. The suppliers invoice should be matched and compared to an approved purchase requisition, purchase order, and appropriate receiving information before payment. The absence of any of the referenced BW report information or discrepancies between the information (e.g. price quantity etc.) must be resolved before payment is made. Invoices for which a purchase order or receiving report does not exist (e.g. non production services, cheque requests, one-time purchases etc.) must be approved by management in accordance with the company approval authorization limits before payment. Ensure withholding tax/VAT are charged as per requirement of law. Approved payments must be made within the agreed terms.

Half yearly

Half yearly

Half yearly

S_P00_0700 Half yearly 0134 Half yearly

Signed cheques ready for handover must be delivered to persons independent of invoice processing and maintenance of accounts payable records. Supplier statements are reconciled to the creditors ledger and the F.42 reconciliations are checked by senior financial management. Accounts payable should review debit balance accounts at least quarterly and request remittance of old debit amounts outstanding. Such F.42 remittance should be submitted directly to the cash function. Accounts Receivable: Sales are recognized as per group policy. Are all customer bills of exchange discounted with recourse added back to debtors. Where sales are given away free, the costs needs to be recognized in variable SDA costs. Aged lists of debtors to be produced at least monthly Debtors overdue by more than 6 months must be fully provided, including the associated output tax/VAT. Provision is required against the output tax/VAT regardless of whether or not it is expected to be recovered (and should only be released when actual recovery has been achieved).

Half yearly Monthly

Quarterly

Monthly Monthly BW report of FOC Monthly Monthly Excel workings

Monthly

Responsibility FC FC FC FC

Remarks

Sign off

FC

Management Accounting Manager Management Accounting Manager

FC

FC

FM FC FM FC

Management Accounting Manager FM

FM

FM

FM FM FM FM

Management Accounting Manager

Management Accounting Manager

Management Accounting Manager Management Accounting Manager FC FC FC FC

FM

FM

FM

FM FM

FM FM

FM

FC AR executive FC AR executive

FC

Details of test Review of bonded warehouse operations Review of BOI activities Review of remittance & transfer pricing compliance Tax, VAT & other fiscal charge compliance Review of labour law compliance Review of pending legal proceedings status Status review of different type of agreements

Frequency Half yearly Annual Quarterly Quarterly Half yearly Quarterly Monthly

Responsibility FM FM FM FM HR HR FM

Remarks

Sign off

Quarterly

Monthly

Order No of rep

Original or der

Status Date Return stat Rep deliverd 4/4/2014 Not returned

You might also like

- Inventory RCM - Version 1Document16 pagesInventory RCM - Version 1talktopuneet100% (4)

- SAP Sales Business Objectives Risk & Control MatrixDocument4 pagesSAP Sales Business Objectives Risk & Control Matrixmani197100% (3)

- Financial Close Process Controls QuestionnaireDocument8 pagesFinancial Close Process Controls Questionnairesaurabhmjn100% (1)

- Segregation of Duties MatrixDocument13 pagesSegregation of Duties MatrixForumnoj100% (1)

- IA BalancedScorecard & SWOTDocument6 pagesIA BalancedScorecard & SWOThossainmz100% (1)

- IA BalancedScorecard & SWOTDocument6 pagesIA BalancedScorecard & SWOThossainmz100% (1)

- Unwinding InterestDocument8 pagesUnwinding InterestpalmkodokNo ratings yet

- Finance Policies and Procedures Manual - TEMPLATEDocument60 pagesFinance Policies and Procedures Manual - TEMPLATEHassan Liquat100% (2)

- SOD MatrixDocument1 pageSOD MatrixAjai SrivastavaNo ratings yet

- Audit Universe and Risk Assessment ToolDocument10 pagesAudit Universe and Risk Assessment ToolAsis KoiralaNo ratings yet

- JDE - Segregation of Duties To Comply With Sarbanes-OxleyDocument3 pagesJDE - Segregation of Duties To Comply With Sarbanes-OxleygapepiNo ratings yet

- Close ChecklistDocument6 pagesClose ChecklistShifan Ishak100% (1)

- Risk ID Risk Level Description of Risk Function 1Document12 pagesRisk ID Risk Level Description of Risk Function 1preeti singh100% (1)

- Segregation of Duties MatrixDocument10 pagesSegregation of Duties MatrixAnonymous c1nF8A100% (1)

- E7 - TreasuryRCM TemplateDocument30 pagesE7 - TreasuryRCM Templatenazriya nasarNo ratings yet

- SOP For Fixed Assets MainagementDocument12 pagesSOP For Fixed Assets MainagementJAK Group100% (1)

- List of SOD Conflicts - 1.29.18Document16 pagesList of SOD Conflicts - 1.29.18fanoustNo ratings yet

- SOX Activity FlowchartDocument3 pagesSOX Activity Flowchartnarasi64100% (1)

- Physical Inventory GuidelinesDocument15 pagesPhysical Inventory GuidelinesVinay Chugh100% (1)

- GRC Training - TerminologyDocument13 pagesGRC Training - TerminologyhossainmzNo ratings yet

- 06-03 GRC Training - Risk OwnersDocument35 pages06-03 GRC Training - Risk OwnershossainmzNo ratings yet

- Release StrategyDocument18 pagesRelease StrategyEl Hag Shalata100% (1)

- How Landed Cost Management and Accounts Payable Accounting FlowDocument5 pagesHow Landed Cost Management and Accounts Payable Accounting Flowjazharscribd100% (1)

- 11.8.23 Security Union OpeningDocument36 pages11.8.23 Security Union Openingbergrenc0% (1)

- Week 3 Illustrative Lecture QuestionsDocument4 pagesWeek 3 Illustrative Lecture QuestionsKristel AndreaNo ratings yet

- Segregation of Duties Framework OverviewDocument2 pagesSegregation of Duties Framework OverviewChinh Lê ĐìnhNo ratings yet

- SOD Risk Summary SAP With MitigatingDocument16 pagesSOD Risk Summary SAP With Mitigatingpreeti singhNo ratings yet

- I General: Internal Audit ChecklistDocument33 pagesI General: Internal Audit ChecklistHimanshu GaurNo ratings yet

- Procurement and AP - SoD FinalDocument4 pagesProcurement and AP - SoD FinalManishNo ratings yet

- GRC RulesetDocument6 pagesGRC RulesetDAVIDNo ratings yet

- Segregation of Duties OverviewDocument1 pageSegregation of Duties OverviewKarthik EgNo ratings yet

- Order To Cash FRDDocument104 pagesOrder To Cash FRDyoginderNo ratings yet

- Purchase-To-Payment Process Assessment - Sample 2Document36 pagesPurchase-To-Payment Process Assessment - Sample 2viswaja100% (1)

- P2p Risk by DeloitteDocument16 pagesP2p Risk by Deloittevijaya lakshmi Anna Srinivas100% (1)

- ERP Controls Integration - Sustaining Compliance While Implementing ChangeDocument16 pagesERP Controls Integration - Sustaining Compliance While Implementing ChangehuongmuaheNo ratings yet

- Sod AnalyzeDocument9 pagesSod AnalyzeChim RaNo ratings yet

- Procure To Pay OverviewDocument13 pagesProcure To Pay Overviewmohamedrizkibrahim100% (6)

- Segregation of Duties QuestionnaireDocument25 pagesSegregation of Duties QuestionnaireManna MahadiNo ratings yet

- Audit CheclistDocument34 pagesAudit CheclistYoga Guru100% (1)

- Segregation of DutiesDocument1 pageSegregation of DutiesjadfarranNo ratings yet

- Best Practices SOD Remediation ISACA V2 06.12.15Document12 pagesBest Practices SOD Remediation ISACA V2 06.12.15Norman AdimoNo ratings yet

- Segregation of DutiesDocument8 pagesSegregation of DutiesmanishmestryNo ratings yet

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- P2P SOD List PDFDocument27 pagesP2P SOD List PDFfaridfarzanaNo ratings yet

- Checklist of Fixed Asset RegisterDocument2 pagesChecklist of Fixed Asset RegisterRojan ShresthaNo ratings yet

- Accounts Payable ReviewDocument36 pagesAccounts Payable ReviewirfanNo ratings yet

- Purchasing Payables ControlDocument9 pagesPurchasing Payables ControljenjenheartsdanNo ratings yet

- Milky Mist Risk & Control Matrix - Procure To Pay: COSO Principle Process Name Control Activity No. Coso ComponentDocument20 pagesMilky Mist Risk & Control Matrix - Procure To Pay: COSO Principle Process Name Control Activity No. Coso ComponentAswath S100% (1)

- SOD and Critical Action Ruleset Review - Feedback Received - Consolidatedv6-RACM ReviewDocument1 pageSOD and Critical Action Ruleset Review - Feedback Received - Consolidatedv6-RACM ReviewDenys Pavez VeraNo ratings yet

- RCM FSCPDocument16 pagesRCM FSCPvikrant durejaNo ratings yet

- Segregation of Duties MatrixDocument48 pagesSegregation of Duties MatrixMariano SanchezNo ratings yet

- 03 Procure To PayDocument22 pages03 Procure To PayKalaignar ThangarajuNo ratings yet

- Audit Program Budgeting & MISDocument7 pagesAudit Program Budgeting & MISSarang SinghNo ratings yet

- Sap R 3 Accounts Payable MatrixDocument19 pagesSap R 3 Accounts Payable Matrixpaichowzz100% (1)

- Segregation of DutiesDocument5 pagesSegregation of DutiesShailendra Singh100% (1)

- Audit Objectives & Risks Work Done With Observations Observations Noted Management's Response ObjectiveDocument3 pagesAudit Objectives & Risks Work Done With Observations Observations Noted Management's Response Objectiveusmanafzalacca100% (2)

- Procure To PayDocument2 pagesProcure To PaySanjeewa PrasadNo ratings yet

- Expense PurchasesDocument29 pagesExpense PurchasesAshNo ratings yet

- CS - Authorization Matrix V1.0Document4 pagesCS - Authorization Matrix V1.0anupam0022No ratings yet

- Detailed Observation and Issue On Account Payable1Document35 pagesDetailed Observation and Issue On Account Payable1Aor020815No ratings yet

- Internal Audit Reporting SPDocument45 pagesInternal Audit Reporting SPRajesh Mahesh Bohra100% (1)

- Study Unit TwoDocument6 pagesStudy Unit TwoDong-Kyun RyuNo ratings yet

- Segregation of DutiesDocument46 pagesSegregation of DutiesYai Ibrahim100% (2)

- Record-to-Report Risk Control MatrixDocument30 pagesRecord-to-Report Risk Control MatrixAswath SNo ratings yet

- Procedure Manual - Procure To Pay - Final PDFDocument50 pagesProcedure Manual - Procure To Pay - Final PDFAmaldev VasudevanNo ratings yet

- C23 - Segregation of DutiesDocument16 pagesC23 - Segregation of Dutieskannie_bNo ratings yet

- AU Locks Auditing Services: Audit Program Batangas Bestfeeds Multipurpose CooperativeDocument5 pagesAU Locks Auditing Services: Audit Program Batangas Bestfeeds Multipurpose CooperativeMirai KuriyamaNo ratings yet

- Apps Segregation of DutiesDocument31 pagesApps Segregation of DutiesMahmoud Fawzy100% (1)

- Auditing Income Statement and Balance Sheet ItemsDocument27 pagesAuditing Income Statement and Balance Sheet ItemsNantha KumaranNo ratings yet

- Draft Racm Cupipl - FaDocument56 pagesDraft Racm Cupipl - FaPrateekNo ratings yet

- General Internal Audit ModelDocument5 pagesGeneral Internal Audit ModelSoko A. KamaraNo ratings yet

- Stock ControlDocument8 pagesStock ControlhossainmzNo ratings yet

- Activity Monitoring OrderDocument5 pagesActivity Monitoring OrderhossainmzNo ratings yet

- Internal Control ChecklistDocument27 pagesInternal Control ChecklistVituli Musukuma100% (1)

- Machines DescriptionDocument17 pagesMachines DescriptionhossainmzNo ratings yet

- Cls01 ExcelDocument30 pagesCls01 ExcelhossainmzNo ratings yet

- Advanced Excel: Multiple WorksheetsDocument9 pagesAdvanced Excel: Multiple WorksheetsGajendra TodakarNo ratings yet

- GRC SOD Analysis StepsDocument9 pagesGRC SOD Analysis Stepshossainmz100% (1)

- Definition of Internal AuditingDocument10 pagesDefinition of Internal AuditinghossainmzNo ratings yet

- VETASSESS General Occupation ListDocument17 pagesVETASSESS General Occupation ListhossainmzNo ratings yet

- Balance Scorecard Internal Audit1Document10 pagesBalance Scorecard Internal Audit1hossainmzNo ratings yet

- Using The Balanced Scorecard: Using BSC For Performance AuditsDocument11 pagesUsing The Balanced Scorecard: Using BSC For Performance AuditshossainmzNo ratings yet

- GRC Guide NoteDocument4 pagesGRC Guide NotehossainmzNo ratings yet

- What Are Authorization ObjectsDocument1 pageWhat Are Authorization ObjectshossainmzNo ratings yet

- Job Application Form: Concern Worldwide BangladeshDocument6 pagesJob Application Form: Concern Worldwide Bangladeshhossainmz100% (1)

- 3 Tiers of RoleDocument2 pages3 Tiers of RolehossainmzNo ratings yet

- 3 Tiers of RoleDocument2 pages3 Tiers of RolehossainmzNo ratings yet

- GRC Training RiskODocument151 pagesGRC Training RiskOhossainmzNo ratings yet

- Concern Worldwide & BracDocument4 pagesConcern Worldwide & BrachossainmzNo ratings yet

- Basic of BudgetingDocument23 pagesBasic of BudgetinghossainmzNo ratings yet

- Payroll Withholding TaxDocument3 pagesPayroll Withholding TaxhossainmzNo ratings yet

- Payroll ProcessDocument4 pagesPayroll ProcesshossainmzNo ratings yet

- Bank Reconciliation Best PracticesDocument3 pagesBank Reconciliation Best Practiceshossainmz100% (1)

- Convertible Bond ValuationDocument15 pagesConvertible Bond Valuationuser121821No ratings yet

- Rights Issue Calculations MethodsDocument6 pagesRights Issue Calculations MethodshossainmzNo ratings yet

- Account TitlesDocument7 pagesAccount TitlesMenggay Arzaga100% (1)

- Act 110 Activity 8Document8 pagesAct 110 Activity 8Norkan DimalawangNo ratings yet

- Descriptions For NAHB COA AccountsDocument67 pagesDescriptions For NAHB COA AccountsdumpNo ratings yet

- Oracle Fusion HCM (Autosaved)Document219 pagesOracle Fusion HCM (Autosaved)jaya kumar100% (1)

- Income Tax All Chapter CA Inter V05 PDFDocument203 pagesIncome Tax All Chapter CA Inter V05 PDFSubhamNo ratings yet

- Accrual BasisDocument2 pagesAccrual BasisRosemarie CruzNo ratings yet

- Quiz 1&2 - IiDocument29 pagesQuiz 1&2 - IiJenz Crisha PazNo ratings yet

- ING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Document2 pagesING Bank N.V. vs. CIR, 763 SCRA 359 (2015)Anonymous MikI28PkJc100% (2)

- 54 HCL Technologies B.V. 2018-19Document22 pages54 HCL Technologies B.V. 2018-19Vikas JNo ratings yet

- University of The Cordilleras Accounting 1/2 Lecture AidDocument3 pagesUniversity of The Cordilleras Accounting 1/2 Lecture AidJesseca JosafatNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesGille Rosa Abajar100% (1)

- Cwopa Sers Comprehensive Annual Financial Report 1999Document81 pagesCwopa Sers Comprehensive Annual Financial Report 1999EHNo ratings yet

- Study Unit C - Gross Income General DeductionsDocument44 pagesStudy Unit C - Gross Income General DeductionsEverjoyNo ratings yet

- Cae05-Chapter 1 Current LiabilitiesDocument15 pagesCae05-Chapter 1 Current LiabilitiesSteffany RoqueNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- Financial and Banking VocabularyDocument264 pagesFinancial and Banking VocabularyTaim AdeebNo ratings yet

- Policy On Accounts ReceivableDocument8 pagesPolicy On Accounts ReceivableMazhar Hussain Ch.No ratings yet

- TheoriesDocument13 pagesTheoriesZee RoeNo ratings yet

- 05 TPDocument4 pages05 TPLaiza MalazarteNo ratings yet

- Abc Co. Statement of Financial Position As of December 31, 20x0 AssetsDocument37 pagesAbc Co. Statement of Financial Position As of December 31, 20x0 AssetsJonnafe Almendralejo IntanoNo ratings yet

- MC and Problems-AE221 (Quiz 2)Document6 pagesMC and Problems-AE221 (Quiz 2)Nhel AlvaroNo ratings yet

- Week 3 Adjusting EntriesDocument17 pagesWeek 3 Adjusting EntriesShiellai Mae PolintangNo ratings yet

- 07 Accounting Methods and PeriodsDocument26 pages07 Accounting Methods and PeriodsLuis Felipe RodriguezNo ratings yet

- CIT-DTA - Jun 2021Document292 pagesCIT-DTA - Jun 2021achmad agungNo ratings yet

- CH 3Document45 pagesCH 3Ella ApeloNo ratings yet