Professional Documents

Culture Documents

Pro and Cons of Good and Service Tax and Its Implication To The Engineers

Uploaded by

Jamilah MrafiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pro and Cons of Good and Service Tax and Its Implication To The Engineers

Uploaded by

Jamilah MrafiCopyright:

Available Formats

ASSIGNMENT 2 JAMILAH BINTI MOHD RAFI (AM100193) SME4901 PROFESSIONAL ENGINEERING PRACTICE

FACULTY OF MECHANICAL ENGINEERING UNIVERSITI TEKNOLOGI MALAYSIA MARCH 2014

PROF WAN KHAIRUDDIN

Pro and Cons of Good and Service Tax

Good and Service Tax is a consumption tax based on the value-added tax (VAT) concept. GST is imposed on goods and services at every production and distribution stage in the supply chain including importation of goods and services. Goods and Services Tax (GST) will be implemented with effective from 1 April 2015 and GST rate is fixed at 6 (%) per cent. GST can be classified under the cluster of indirect taxes and if it is to be implemented in Malaysia, the jurisdiction to collect this tax will be under the Royal Customs Department. Globally, around 146 nations are noted for implementing GST as one of the tax regimes. The percentage of GST varies amongst countries, from as little as 5% to as high as 50%. Currently there are 160 countries that are implementing the GST according to regions are as follows[1]: No. 1 2 3 4 5 6 7 Region ASEAN Asia Europe Oceania Africa South America Caribbean, Central & North America No. of Country 7 19 53 7 44 11 19

Sales tax and service tax will be abolished. Currently, Sales tax and service tax rates are 10% and 6% respectively. GST will not be imposed on piped water and first 200 units of electricity per month for domestic consumers and Transportation services such as bus, train, LRT, taxi, ferry, boat, highway tolls as well as education and health services are exempted from GST.

GST is charged and collected on all taxable goods and services produced in the country including imports. Only businesses registered under GST can charge and collect GST. GST collected on output must be remitted to the government. However, businesses are allowed to claim the input tax credit through the following mechanism and method: 1) GST collected on output (output tax) is deducted against the GST paid on input (input tax). 2) If there is excess, the amount shall be remitted to the government within the stipulated period. 3) If there is deficit, businesses can claim for refund from the government GST can only be charged if the business is registered under GST. A business is not liable to be registered if its annual turnover of taxable supplies does not reach the prescribed threshold. Therefore, such businesses cannot charge and collect GST on the supply of goods and services made to their customers. Nevertheless, businesses can apply to be registered voluntarily.

The pie chart above shows that out of the total votes (1,213), 924 votes or 76% were disagreed with the implementation of GST, while 262 votes or 22% agreed with it.[2] As mentioned in Royal Malaysian Custom Department (RMCD), GST is going to replace current consumption tax such as sales tax and also service tax. The purpose is to provide a more efficient way to enhance the government existing taxing system. It is more

efficient tax system besides generates a more stable source of revenue to the nation as its more susceptible to economic fluctuations. Various benefits that GST can provide to Malaysia are noted as follows. 1) Improved Standard of Living The revenue from GST could be used for development purposes for social infrastructure like health facilities and institutions, educational infrastructures and public facilities to further improve the standard of living. 2) Lower Cost of Doing Business Under the current system, some businesses pay multiple taxes and higher levels of tax-on-tax (cascading tax). With GST, businesses can benefit from recovering input tax, thus reducing cost of doing business. 3) Nation-Building GST is a better and more efficient method of revenue collection for the government. More funds can be channeled into nation-building projects for progress towards achieving a high income nation. 4) Fairness and Equality With the GST, taxes are levied fairly among all the businesses involved, whether they are in the manufacturing, wholesaling, retailing or service sectors. 5) Enhanced Delivery System GST will be administrated in a fully computerized environment, therefore speeding up the delivery, especially for refund claims. This makes it faster, more efficient and reliable.

6) Increase Global Competitiveness

Prices of Malaysian exports will become more competitive on the global stage as no GST is imposed on exported goods and services, while GST incurred on inputs can be recovered along the supplies chain. This will strengthen our export industry, helping the country progress even further. 7) Enhanced Compliance The current SST has many inherent weaknesses making administration difficult. GST system has in-built mechanism to make the tax administration self-policing and therefore will enhance compliance. 8) Reduces Red Tape Under the present SST, businesses must apply for approval to get tax-free materials and also for special exemption for capital goods. Under GST, this system is abolished as businesses can offset the GST on inputs in their returns. 9) Fair Pricing to Consumers GST eliminates double taxation under SST. Consumers will pay fairer prices for most goods and services compared to SST. 10) Greater Transparency Unlike the present sales tax, consumers would benefit under GST as they will know exactly whether the goods they consume are subject to tax and the amount they pay for. Moreover, according to president of the Federation of Sabah Manufacturers (FSM) Datuk Wong Khen Thau said the tax will also not burden the people, but lead to a partnership concept in respect of the economic development. Meanwhile, the president of the Malay Chamber of Commerce Malaysia Labuan (DPMML) Datuk Yussof Mohammad said implementation of the GST or also known as a consumption tax, would see a regulatory system that is efficient and effective in respect of tax collection. It can be said as GST can be an advantage to economy to Malaysia from the above statement. All these statement above are expectation and assumption by the higher authorities and here some pro and cons views from the public according to NBC on 2010 are as follows [2]:

The reasons for the public to support GST are : 1. Increase national/government revenue and mitigate the heavy reliance on income tax and petroleum tax, in which income taxes contributed 44.4% of government revenue in 2010. 2. Tax burden will not increase when income level increased. 3. Everyone will pay tax and tax burden is spread over, instead of just relying on income taxes derived from 15% of the working population. 4. Overcome the loopholes of current sales and services tax systems. 5. Eliminate over-lapping tax at different stages, as GST is generally charged on the consumption of goods and services at every stage of the supply chain, with the tax burden ultimately borne by the end consumer. 6. More stable for government revenue with GST as a consumption tax based, compared to direct income taxes and minimise the impact of economic cycles, particularly during recessions. 7. Corporate tax and individual tax rates could be reduced. 8. Minimise the occurrences of tax evasions. The reasons for public to disagree with GST: 1. May result in inflation as general products prices may go up. 2. Increase the tax burden on low income working group (the other 85% as described item 3 above) 3. The government may possibly increase the GST rate from 4% to 15% to increase revenue. 4. Worry that the GST tax may even higher than current sales tax 10% and service tax 5%. 5. Worry that the effect of tax revenue re-distribution may not be achieved. From above statements, we can conclude that GST can be worth in managing our country taxing system in more systematic and professional way. Besides that GST is a broad based consumption tax and generally most goods and services will be subject to GST. It would appear that it could lead to inflationary pressures for taxpayers if it is not implemented properly. At present, there are uncertainties over this new tax to be imposed and proper rules and regulations needs to be wisely formulated. In addition, proper guidance and early planning shall be required to prepare the taxpayers for the smooth implementation.

You might also like

- Grim Reapers and Shinigami in Comics and MangaDocument37 pagesGrim Reapers and Shinigami in Comics and MangaJamilah MrafiNo ratings yet

- Ray Kolonay 1 Computational AeroelasticityDocument56 pagesRay Kolonay 1 Computational AeroelasticityAngel Villalonga MoralesNo ratings yet

- Comparing How Entrepreneurs and Managers Represent The Elements of The Business Model CanvasDocument30 pagesComparing How Entrepreneurs and Managers Represent The Elements of The Business Model CanvasJamilah MrafiNo ratings yet

- Chinese Character Stroke Practice Sheets PDFDocument4 pagesChinese Character Stroke Practice Sheets PDFsaiyuki004100% (1)

- Study of flutter on UAV composite wingDocument12 pagesStudy of flutter on UAV composite wingJamilah MrafiNo ratings yet

- Study of flutter on UAV composite wingDocument12 pagesStudy of flutter on UAV composite wingJamilah MrafiNo ratings yet

- DiscussionDocument6 pagesDiscussionJamilah MrafiNo ratings yet

- Co A Report 9712Document33 pagesCo A Report 9712Jamilah MrafiNo ratings yet

- How To Create Aeroplane WingsDocument8 pagesHow To Create Aeroplane WingsJamilah MrafiNo ratings yet

- Sme3212 Flight Mechani1Document2 pagesSme3212 Flight Mechani1Jamilah MrafiNo ratings yet

- Conception Aero Aeroelastic It eDocument35 pagesConception Aero Aeroelastic It ebrennomourabmcNo ratings yet

- Engine SpecificationDocument7 pagesEngine SpecificationJamilah MrafiNo ratings yet

- 6132SE Install InstructionsDocument11 pages6132SE Install InstructionsHema SundaramNo ratings yet

- DATCOM 8.1, Aircraft Mass & InertiaDocument28 pagesDATCOM 8.1, Aircraft Mass & InertiaJamilah MrafiNo ratings yet

- Tutorial Gas TurbineDocument2 pagesTutorial Gas TurbineJamilah Mrafi0% (1)

- EAS309 Flight Dynamics ControlDocument2 pagesEAS309 Flight Dynamics ControlJamilah MrafiNo ratings yet

- Weight Vs Wing LoadingDocument2 pagesWeight Vs Wing LoadingJamilah MrafiNo ratings yet

- ASSEMBLY AirplaneDocument11 pagesASSEMBLY Airplanesunil481No ratings yet

- How To Create Aeroplane WingsDocument8 pagesHow To Create Aeroplane WingsJamilah MrafiNo ratings yet

- Numerical Method For Engineering-Chapter 1Document16 pagesNumerical Method For Engineering-Chapter 1Mrbudakbaek100% (1)

- 2.1 Two Possible Versions Can Be DevelopedDocument15 pages2.1 Two Possible Versions Can Be DevelopedJamilah MrafiNo ratings yet

- Tutorial 5Document4 pagesTutorial 5Jamilah MrafiNo ratings yet

- 551791819.BAK No RestrictionDocument58 pages551791819.BAK No RestrictionBharath Chandra ReddyNo ratings yet

- Aerodynamics Chapter 1Document12 pagesAerodynamics Chapter 1Jamilah MrafiNo ratings yet

- Aeroelasticity An Introduction To Fundamental Problems With An Historical Perspective Examples and Homework Problems Chapter 1Document28 pagesAeroelasticity An Introduction To Fundamental Problems With An Historical Perspective Examples and Homework Problems Chapter 1Jamilah MrafiNo ratings yet

- Aeroelasticity An Introduction To Fundamental Problems With An Historical Perspective Examples and Homework Problems Chapter 1Document28 pagesAeroelasticity An Introduction To Fundamental Problems With An Historical Perspective Examples and Homework Problems Chapter 1Jamilah MrafiNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Excel Crash Course - Book1 - Blank: Strictly ConfidentialDocument4 pagesExcel Crash Course - Book1 - Blank: Strictly ConfidentialtehreemNo ratings yet

- Details of The Offer:: "Spend Rs. 1,500 On Domestic E-Commerce Transactions and Get Rs. 250 Cashback" Terms & ConditionsDocument3 pagesDetails of The Offer:: "Spend Rs. 1,500 On Domestic E-Commerce Transactions and Get Rs. 250 Cashback" Terms & ConditionsMohamedNo ratings yet

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- To Be Filled Up by BIRDocument2 pagesTo Be Filled Up by BIRmay1st200867% (6)

- Form 7Document45 pagesForm 7meet312312312No ratings yet

- Rrs Formulir Pendaftaran CBN Mail Rev - 1.1Document1 pageRrs Formulir Pendaftaran CBN Mail Rev - 1.1arma puteraNo ratings yet

- Pramod Cash BookDocument9 pagesPramod Cash BookBrad McgeeNo ratings yet

- Concept of e-Money ExplainedDocument14 pagesConcept of e-Money ExplainedLakshay KocherNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- 80.deductions or Allowances Allowed To Salaried EmployeeDocument11 pages80.deductions or Allowances Allowed To Salaried Employeehustlerstupid737No ratings yet

- Phil. Guaranty Co. Taxation of Reinsurance Premiums Ceded AbroadDocument1 pagePhil. Guaranty Co. Taxation of Reinsurance Premiums Ceded AbroadRhyz Taruc-ConsorteNo ratings yet

- Q2 Taxes Tax Laws and Tax Administration 3Document5 pagesQ2 Taxes Tax Laws and Tax Administration 3MJ GabrilloNo ratings yet

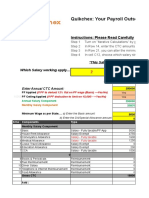

- Quikchex CTC Calculator AprilDocument8 pagesQuikchex CTC Calculator Aprilravipati46No ratings yet

- India AUG 2018Document1 pageIndia AUG 2018vsharsha100% (1)

- Catenary SpliceDocument2 pagesCatenary SpliceSSE TRD JabalpurNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Treasury DutiesDocument28 pagesTreasury DutiesShasha DansoNo ratings yet

- HDFC Bank Foreign Remittance TermsDocument4 pagesHDFC Bank Foreign Remittance TermsRavi Kishore PaturiNo ratings yet

- Tax Case List DizonDocument5 pagesTax Case List DizonGel MaulionNo ratings yet

- Chapter 18 Spr. 24Document12 pagesChapter 18 Spr. 24Asad HanifNo ratings yet

- Advising - Payslip - 20309012 - Shamim Ara Jahan SharnaDocument2 pagesAdvising - Payslip - 20309012 - Shamim Ara Jahan SharnaFardin Ibn ZamanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviteja tankalaNo ratings yet

- Best Credit Pay Bcpay Digital PVT - LTDDocument28 pagesBest Credit Pay Bcpay Digital PVT - LTDFree Time Online EarningNo ratings yet

- Assignment 2 Revenue RecognitionDocument2 pagesAssignment 2 Revenue RecognitionJuvy DimaanoNo ratings yet

- Republic of The Philippines - Docx DEPEDDocument2 pagesRepublic of The Philippines - Docx DEPEDTata Duero LachicaNo ratings yet

- Quiz on Simple and Compound InterestDocument4 pagesQuiz on Simple and Compound InterestZahra BatoolNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- RMC No. 82-2020 PDFDocument3 pagesRMC No. 82-2020 PDFnathalie velasquezNo ratings yet

- How to calculate FBT in the PhilippinesDocument69 pagesHow to calculate FBT in the PhilippinesLeandrix Billena Remorin Jr75% (4)

- RMC 21-2018Document3 pagesRMC 21-2018Abs AcoonNo ratings yet