Professional Documents

Culture Documents

Prac - Ex1 Sversion

Uploaded by

abhijeet_rahate36Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prac - Ex1 Sversion

Uploaded by

abhijeet_rahate36Copyright:

Available Formats

The University of Western Australia

School of Mathematics and Statistics

STAT33644: PRACTICE EXERCISES 1 (2011)

Deterministic interest rates. 1. In parts (a) (d) assume that interest is compounded (i) annually

and (ii) continuously, and compare the results you nd.

(a) A zero-coupon bond with face value $100 is now worth $97 and it expires in four months (i.e. 1/3 of

a year). Find the annualized (risk-free) interest rate.

(b) If the annual rate is 6%, what is the fair price of a zero-coupon bond which has face value $100 and

maturity 6 months?

(c) A zero-coupon bond has face value $100, maturity 2.65 years and its fair price is $87. Find the annual

rate.

(d) Find the fair price of a zero-coupon bond with face value $1000, maturity 3.2 years, and the annual

risk-free rate is 6%.

(e) The rst prize of a lottery is $10

7

which is to be payed in 20 annual instalements of $500,000. What

is the present value of the rst prize if the risk-free rate is 10%.

(f) The seller of a cash-ow C

N

wants to make a prot so the price you pay for it probably is larger than

its fair price. Another way of valuing C

N

, in addition to its PV, is by its internal rate of return (IRR)

dened as the rate, r say, giving zero PV.

(i) Determine the PVs and IRRs of the cash-ows {100, 30, 30, 30, 30, 30}, and {150, 42, 42, 42, 42, 42},

assuming for each that r = 0.05. (Regard each cash-ow as an investment with initial cost 100 and 150,

repectively, and annual payments as shown. You will have to solve a polynomial equation using either

trial solutions or a suitable package.)

(ii) Which cash-ow do you prefer? Can you think of scale-free measures of comparison?

Warning: This is a discrete-time problem, so think about how you should represent the force of interest.

Answers. (a). (i) For discrete-time compounding the growth factor for 4 months is 1 + r/3, so solve

the equation 97 = 100/(1 + r/3), giving r = 9.28%. (ii) For continuous-time compounding, solve

97 = 100e

r/3

, i.e. r = 3 log 0.97, or 9.14%. The continuously compounded rate will always be smaller

because e

r

> 1 +r if r > 0.

(b) The interest rate for 6 months is 3%. Hence the discrete compounding price of the bond is

B = 100/1.03 = 97.09. The price with continuous compounding is B = 100e

0.03

= 97.04.

(c) (i) The growth factor for 2.65 years is (1 + r)

2

(1 + 0.65 r), and hence you have to solve the

equation

87 = 100[(1 +r)

2

(1 + 0.65r)]

1

.

This is a cubic equation which can be solved by trial and error. A trial starting value r

0

can be obtained

by replacing 1 + 0.65r with (1 +r)

0.65

, giving r

0

= (100/87)

1/2.65

1 = 0.05396. This is larger than the

true value, so work down through smaller values to solve (1+r)

2

(1+0.65r) = 1.149425. The table shows

my calculations.

r (1 +r)

2

(1 + 0.65r)

0.054 1.149909

0.053 1.147007

0.0538 1.149328

0.05383 1.149416

0.05384 1.149445

Either of the last two values of r is acceptable, or averaging, we obtain r = 5.3835%. (ii) Continuous

compounding is much easier to handle for this problem: Solve 87 = 100e

2.65r

, so r = 5.255%.

1

(d) (i) For discrete compounding, B = 1000[(1 + r)

3

(1 + r/5)]

1

= 829.66. (ii) For continuous com-

pounding, B = 1000e

3.20.06

= 825.31.

(e) Working in millions of dollars, the prize is 10 and annual payments start immediately, c

0

= =

c

19

=

1

2

. Hence their present value is

PV =

1

2

19

n=0

1.1

n

=

1

2

1 1.1

20

1 1.1

1

= 4.68246,

i.e., the present value is $4, 682, 460, much less than the nominal value.

(f). (i) The IRR r solves the equation c

0

=

N

n=1

c

n

(1 + r)

n

= (c/r)

_

1 (1 +r)

N

_

, where the

second equality follows if c

n

c for n = 1, . . . , N. This can be written as a polynomial equation for

a = 1 +r:

(1 c

0

/c +ac

0

/c)a

N

= 1.

Note that c

0

< 0 in this question. The equation can be solved either by using an equation solver or by

guessing and calculation.

Cash ow 1: The equation reduces to (13 10a)a

5

= 3, giving r = 15.24% and the PV = 29.8843.

Cash ow 2: The equation reduces to (13 10a)a

5

= 3, giving r = 12.38% and the PV = 31.8380.

(ii) You probably should prefer Cash ow 1. A PV can be scaled up or down according to the unit of

monetary value. A scale-free comparison could be made through PV/|c

0

|, i.e. 0.30 and 0.2125, respec-

tively. The nice feature of the IRR is that it too is a scale-free measure of return, and Cash ow 1 looks

better on both measures.

2. You have just bought a house which you and your descendents will occupy in perpetuity. The

building is in perfect condition, and remains so forever, except for the roof. The roof must be replaced

within ve years, and then every 20 years after that. The cost of each replacement is $20,000, and the

annual risk-free rate is 5% (forever). What value should you attribute to the roof at the time you buy

the house? Note: The answer cannot exceed the price of immediate replacement.]

Answer. The vital clue is that the house will be occupied in perpetuity by your descendants. The

value of the roof really is the value you should impute to the ve years of use until the current roof has

to be replaced. This is simply the dierence between PVs calculated if you immediately replace the roof

or wait ve years.

Suppose the roof will last l = 0, 1, . . . years when it will be replaced and then every 20th year thereafter.

The PV of the cash ow of expenditure (in $ 10

3

) is

PV (l) = 20

n0

(1 +r)

l20n

=

20

(1 +r)

l

1

1 (1 +r)

20

.

The value attributable now to the roof (i.e. its remaining lifetime) is

(l) := PV (0) PV (l) =

20

1 (1 +r)

20

_

1 (1 +r)

l

.

With l = 5 and r = 0.05, you obtain (5) = (20/0.6231)(1 0.7835) = 6.9482, i.e. the value of the

remaining ve years of life is $6948.20.

3. Consider Example 2.1.2 (loan repayments). (a) Recalling that N = mn, let t = 1, 2, . . . , N count

the months and R

t

be the amount owing after the repayment at time t. (i) Show that R

t+1

= R

t

A

m

where = 1 +r

and r

is the monthly lending rate, i.e. r

= r/m. (ii) Solve this dierence equation to

obtain

R

t

=

t

B A

m

t

1

1

,

2

and hence derive the lecture-note expression for the monthly repayment A

m

.

(b) The total cash repayment over the life of the loan is NA

m

, a value which usually is between 2 to 3

times larger than the amount borrowed, B. Anyone about to buy a house and who does this calculation

usually gets a shock. However this calculation should take account of the smaller present value of future

repayments due to ination. So suppose the annual rate of ination is 0 < r. Calculate the present

value PV

N

() of all the monthly repayments, and write it in the form PV

N

() = N

A

m

, where the

multiplier N

can be regarded as the eective or ination adjusted lifetime of the loan. Determine the

form of N

. (It depends on and N, only, and its obvious that N

< N if > 0.)

(c) Assume a thirty year loan of B = $10

5

(a small loan but the scale doesnt matter), constant borrowing

rate r = 9% and monthly repayments (i.e. m = 12). Compute values of N

and PV

N

() for constant

ination rates = 1, 2, . . . , 6%. Present your answers in a table.

Answer. (a). Use a conservation of money argument for (i): the amount R

t

owing at t inates through

interest to R

t

at t+1. Paying A

m

at t+1 leaves a balance R

t+1

, i.e. R

t+1

= R

t

A

m

. Clearly R

N

= 0.

(ii) To solve for R

t

multiply through by

t1

to get the simple dierence equation for Q

t

:=

t

R

t

,

Q

t+1

= Q

t

t1

A

m

, (t = 0, . . . , N 1),

and Q

0

= R

0

= B. Replace t with j in the dierence equation and then sum it:

t1

j=0

(Q

j+1

Q

j

) = A

m

t1

j=0

j1

.

The left-hand side is called a telescoping sum and its value is Q

0

Q

t

= B Q

t

. The right-hand side is

a geometric sum:

A

m

1

t1

j=0

j

= A

m

1

1

t

1

1

= A

m

1

t

1

.

Hence Q

t

= B A

m

(1

t

)/( 1), i.e.

R

t

=

t

B A

m

t

1

1

. ()

Setting R

N

= 0 yields A

m

= rB/(1 (1 +r)

N

).

1

(b) Let = /m denote the monthly ination rate. The ination adjusted present value of N monthly

payments is

PV

N

() = A

m

N

t=1

(1 +)

t

= A

m

1

_

1 (1 +)

N

_

,

and it follows that

N

=

_

1 (1 +)

N

__

.

As a check, it is clear from the sum with = 0 that N

0

= N.

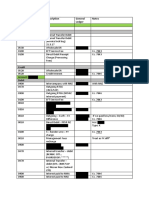

(c) The monthly borrowing rate is 0.09/12 = 0.0075. The monthly repayments with N = 360 is

A

m

= $804.62. The following results can be computed:

N

(months) PV

N

() ($)

0 360.0 289,664

1 310.9 250,163

2 270.5 217,68

3 237.2 190,848

4 209.5 168,537

5 186.3 149,886

6 166.8 134,204

1

Substitution into (*) gives Rt = B(1

(Nt)

)/(1

N

) and the amount of the loan repaid by t is B Rt =

B(

(Nt)

N

)/(1

N

). This increases as t increases, but slowly when t is small.

3

4. The present value PV

N

of a discrete-time cash-ow C

N

can be interpreted as dening an equivalent

cash-ow {PV

N

, 0, 0, . . . , 0}. Another way of comparing cash-ows is through their annual (or per-

period) worth dened as that value making the N-period cash-ow {0, , . . . , } equivalent to C

N

. (a)

Determine in terms of PV

N

. (b) A cash-ow C

N

= {c

0

, . . . , c

N

} determines an innite cash-ow C

dened by successively repeating (i.e. concatenating) C

N

. Show that C

can equally well be valued by

its present value or the annual worth

N

of C

N

.

Answer. (a). By denition the PV of {0, , . . . , } is PV

N

=

N

n=1

(1+r)

n

, giving = rPV

N

/

_

1 (1 +r)

N

.

This is the coupon of a bond with F = 0 which is equivalent to {PV

N

, 0, . . . , 0}, and hence equivalent

to C

N

.

(b) C

is equivalent to a perpetuity paying PV

N

every Nth year. Hence

PV (C

) = PV

N

n=0

(1 +r)

nN

=

PV

N

1 (1 +r)

N

= /r.

5. Consider a coupon bond with maturity N, coupons c and face value F. Let r denote the risk-free

interest rate (per period in the case of discrete-time interest accrual). One method for comparing the

values of dierent bonds is through the par yield r

p

of a bond. This is dened as the interest rate which

makes the present value of the bond equal to its face value.

Calculate r

p

assuming (i) discrete-time compounding, and (ii) continuous-time compounding.

Answer. If a is the per-period discount factor, then the price of a coupon bond is (from the lecture

notes)

B =

c

a 1

(1 a

N

) +Fa

N

.

The par yield is computed from the value of a which makes B = F. Substitute F for B on the left-hand

side, and subtract Fa

N

from both sides. This gives

F(1 a

N

) =

c

a 1

(1 a

N

).

Cancelling the common factor gives the solution a

1 = c/F. (i) For discrete-time compounding the

accumulation factor is a = 1 +r, so the par-yield turns out to be the coupon rate:

r

p

= a

1 =

c

F

.

(ii) The continuous-time version of the accumulation factor is a = e

r

, so a

= e

rp

, i.e., r

p

= log(1 +c/F).

[The right-hand side is approximately c/F, since this quantity is typically small. Coupons are never paid

continuously, so there is no actual continuous-time version of a coupon bond.]

6. The continuous-time instantaneous (short) interest rate varies in a secular manner, r(t) = r +

c sin(t), where |c| < r. Determine the following:

(a) The spot rate for the interval (0, t];

(b) The (future) value C(t) at t for a xed amount C invested at time zero;

(c) The long-term spot rate sr() and the long-term geometric mean of C(t). (With reference to the

discrete-time case, think of a denition of geometric mean for the continuous-time case.)

Answer. (a). The spot rate for the interval (0, t] is sr(t) = R(t)/t, where

R(t) =

_

t

0

r(u)du = rt + (c/)(1 cos t).

The average value of 1 cos t over a period is unity. So the force of interest R has a linear component

rt +c/ with a superposed (co)sinusoidal modulation.

(b) By denition, the future value of C invested at t = 0 is

C(t) = Ce

R(t)

= Ce

rt+(c/)(1cos t)

. (1)

4

(c) The long-term spot rate by denition is sr() = lim

t

sr(t) = r. (This long-term average lters

out the secular variation which always is present.)

Adapting the denition of geometric mean for the discrete-time case, you should dene the geometric

mean of C(t) as

C(t) = (C(t))

1/t

= C

1/t

e

R(t)/t

. Hence

C(t) = C

1/t

e

r+(c/t)(1cos t)

( e

r

if t 1.

7. Mr A has made a non-refundable deposit of the rst months rent (equal to $2000) on a six-month

apartment lease. Later in the day he nds a dierent apartment that he likes just as well, but its monthly

rent is $1800. He plans to rent for only six months. (a) Given an interest rate of 12%, decide whether

Mr A should switch to the second apartment.

(b) What if the monthly rent for the second apartment is $1650?

Answer. (a) There are two cash-ows:

C

1

= {2000, 2000, 2000, 2000, 2000, 2000} & C

2

= {3800, 1800, 1800, 1800, 1800, 1800}.

The monthly interest rate is 1%, so the aggregate discount factor you need to calculate the PV of C

1

is

5

n=0

1.01

n

=

1 1.01

6

1 1.01

1

= 5.8534.

Hence PV

1

= 11, 706.86. You can write C

2

= {2000, 0, . . . , 0} + {1800, . . . , 1800}, so it should be clear

that

PV

2

= 2000 + 1800 5.8534 = 12, 536.18.

So Mr A should not switch.

(b) A similar calculation with 1650 replacing 1800 gives PV

2

= 11, 658.16, so it is marginally better to

switch.

Note: The price of 1600 in the question sheet gives, with zero interest rate, PV

2

= 11, 600, and this

reduces for any positive interest rate.]

5

You might also like

- Solution Manual For Investment Science by David LuenbergerDocument94 pagesSolution Manual For Investment Science by David Luenbergerkoenajax96% (28)

- Chapter 3 Part 1Document55 pagesChapter 3 Part 1Raphael RazonNo ratings yet

- Jun18l1-Ep02 QaDocument29 pagesJun18l1-Ep02 Qajuan0% (1)

- Disputes Assessment TestDocument21 pagesDisputes Assessment Testshakg0% (1)

- Chapter 2 Principles of Corporate FinanceDocument4 pagesChapter 2 Principles of Corporate Financeandreaskarayian8972100% (4)

- Settlement LetterDocument2 pagesSettlement LetterKirtan PatelNo ratings yet

- Chapter 2 MS&E 242Document44 pagesChapter 2 MS&E 242arthur_adisusantoNo ratings yet

- Recitation 7: Problem 1Document6 pagesRecitation 7: Problem 1Ashish MalhotraNo ratings yet

- Actuarial Notation: AnnuitiesDocument12 pagesActuarial Notation: AnnuitiesCallum Thain BlackNo ratings yet

- ACTL10001 Mid - Semester-Test - 2019+solutionsDocument5 pagesACTL10001 Mid - Semester-Test - 2019+solutionsCheravinna Angesti MawarNo ratings yet

- Anual 1Document18 pagesAnual 1Gussyck Agus PsicologistaNo ratings yet

- FM423 Practice Exam III SolutionsDocument10 pagesFM423 Practice Exam III SolutionsruonanNo ratings yet

- Moi Chapter-III AnnuitiesDocument36 pagesMoi Chapter-III AnnuitiesGabriel LagranaNo ratings yet

- Solutions Review Problems Chap002Document4 pagesSolutions Review Problems Chap002andreaskarayian8972No ratings yet

- Labs TP3y06Document48 pagesLabs TP3y06api-3856799No ratings yet

- Deferred AnnuityDocument13 pagesDeferred AnnuitySteven Baculanta100% (2)

- AnnuityDocument18 pagesAnnuityMelba Mae GalapiaNo ratings yet

- MA3269 1314S1 Chapter 1Document18 pagesMA3269 1314S1 Chapter 1Stephen BaoNo ratings yet

- 1 Business Mathemetics - AFB Module-ADocument22 pages1 Business Mathemetics - AFB Module-Awaste mailNo ratings yet

- Solutions To Practice Problem Set #1: Time Value of MoneyDocument18 pagesSolutions To Practice Problem Set #1: Time Value of MoneyraymondNo ratings yet

- Seminar Questions: General Term Structure and Interest RatesDocument3 pagesSeminar Questions: General Term Structure and Interest RatesAranSinghKailaNo ratings yet

- Mini CaseDocument18 pagesMini CaseZeeshan Iqbal0% (1)

- You Want To Compare The Present Value of $1000 Yearly For 13 Years With $10 000 Now. So You Want To Calculate The Present Value of An AnnuityDocument5 pagesYou Want To Compare The Present Value of $1000 Yearly For 13 Years With $10 000 Now. So You Want To Calculate The Present Value of An AnnuityBikram ChitrakarNo ratings yet

- Compound Interest Quiz 1-1 PDFDocument10 pagesCompound Interest Quiz 1-1 PDFSurayyaNo ratings yet

- Examples GradientsDocument5 pagesExamples GradientsRhean Mikee AbneNo ratings yet

- Math 149 Problem Set (Assignment)Document8 pagesMath 149 Problem Set (Assignment)raddy.tahilNo ratings yet

- PracEx2 SversionDocument8 pagesPracEx2 Sversionabhijeet_rahate36No ratings yet

- Coporate FinanceDocument6 pagesCoporate Financeplayjake18No ratings yet

- Class Resources Cribsheet1Document2 pagesClass Resources Cribsheet1Praveen Kumar DusiNo ratings yet

- Homeassingment 170529085404Document7 pagesHomeassingment 170529085404rabia khanNo ratings yet

- The Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsDocument9 pagesThe Basics of Capital Budgeting: Solutions To End-Of-Chapter ProblemsTayeba AnwarNo ratings yet

- Compound Interest Quiz 6-1 PDFDocument9 pagesCompound Interest Quiz 6-1 PDFSurayyaNo ratings yet

- Chapter 2 Principles of Corporate Finance PDFDocument4 pagesChapter 2 Principles of Corporate Finance PDFchatuuuu123No ratings yet

- Week 6 Tutorial SolutionsDocument8 pagesWeek 6 Tutorial SolutionsManoaNo ratings yet

- Stats Hons SidDocument5 pagesStats Hons SidSiddh JainNo ratings yet

- ErrataDocument5 pagesErrataPeter ZhouNo ratings yet

- Exam FM Practice Exam With Answer KeyDocument71 pagesExam FM Practice Exam With Answer KeyAki TsukiyomiNo ratings yet

- Time Value of Money II - SolutionsDocument4 pagesTime Value of Money II - SolutionsraymondNo ratings yet

- Simple AnnuityDocument28 pagesSimple AnnuityKelvin BarceLon33% (3)

- Team4 FmassignmentDocument10 pagesTeam4 FmassignmentruchirNo ratings yet

- Midterm Exam I Solution KeyDocument3 pagesMidterm Exam I Solution KeyyarenNo ratings yet

- Quarter 2 - Week 1Document42 pagesQuarter 2 - Week 1Ma Joy E BarradasNo ratings yet

- Pre-"Derivatives" Basics: 1.1.1 Time Value of MoneyDocument6 pagesPre-"Derivatives" Basics: 1.1.1 Time Value of MoneyowltbigNo ratings yet

- Actuarial Mathematics II Solutions To Exercises OnDocument4 pagesActuarial Mathematics II Solutions To Exercises Onshashalom77No ratings yet

- Annuities and Perpetuities: Present Value: William L. SilberDocument3 pagesAnnuities and Perpetuities: Present Value: William L. SilberdrakowamNo ratings yet

- Exercises - 2 (Solutions) Chapter 6, Practice QuestionsDocument5 pagesExercises - 2 (Solutions) Chapter 6, Practice QuestionsFoititika.netNo ratings yet

- BMA4106 Investment and Asset Management Lecture 2Document21 pagesBMA4106 Investment and Asset Management Lecture 2Dickson OgendiNo ratings yet

- Time Value of Money: Objectives: After Reading This Chapter, You Should Be Able ToDocument20 pagesTime Value of Money: Objectives: After Reading This Chapter, You Should Be Able Tovikash KumarNo ratings yet

- The Theory of Interest - Solutions ManualDocument13 pagesThe Theory of Interest - Solutions ManualFaiz MehmoodNo ratings yet

- Option To Abandon The ProjectDocument26 pagesOption To Abandon The ProjectJulia RobertNo ratings yet

- 4 6 Spreadsheets Financial Calculators Solving For Cash FlowsDocument6 pages4 6 Spreadsheets Financial Calculators Solving For Cash Flowskarimotarike77No ratings yet

- TVM ProblemsDocument7 pagesTVM ProblemsBala SudhakarNo ratings yet

- Objective Test Questions Are Awarded 2 Marks Each. Explanations Follow For Answers To Objective Test Questions Involving CalculationsDocument13 pagesObjective Test Questions Are Awarded 2 Marks Each. Explanations Follow For Answers To Objective Test Questions Involving CalculationsrokkodscribeNo ratings yet

- Compound InterestDocument20 pagesCompound InterestKarla Anexine ValenciaNo ratings yet

- Oyewale FIN 233 Mathematics of FinanceDocument23 pagesOyewale FIN 233 Mathematics of Financeadeniyimustapha46No ratings yet

- OrdinaryAnnuities NOV2020Document23 pagesOrdinaryAnnuities NOV2020meepNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- GCSE Maths Revision: Cheeky Revision ShortcutsFrom EverandGCSE Maths Revision: Cheeky Revision ShortcutsRating: 3.5 out of 5 stars3.5/5 (2)

- A-level Maths Revision: Cheeky Revision ShortcutsFrom EverandA-level Maths Revision: Cheeky Revision ShortcutsRating: 3.5 out of 5 stars3.5/5 (8)

- ECON Topic 1 Reading GuideDocument1 pageECON Topic 1 Reading Guideabhijeet_rahate36No ratings yet

- Course Reader Petr3511 2013Document125 pagesCourse Reader Petr3511 2013abhijeet_rahate36No ratings yet

- PracEx2 SversionDocument8 pagesPracEx2 Sversionabhijeet_rahate36No ratings yet

- Poe AnswersDocument78 pagesPoe AnswersNguyen Xuan Nguyen100% (2)

- Chapter 10 SolutionsDocument19 pagesChapter 10 Solutionsabhijeet_rahate36No ratings yet

- Ebook ChaptersDocument86 pagesEbook Chaptersabhijeet_rahate36No ratings yet

- Capitalism, Socialism and CommunismDocument28 pagesCapitalism, Socialism and CommunismDumindu Katuwala100% (1)

- Investment Banking - Securities Dealing in The US Iexpert Report PDFDocument8 pagesInvestment Banking - Securities Dealing in The US Iexpert Report PDFJessyNo ratings yet

- Working Capital ManagementDocument8 pagesWorking Capital ManagementNickNo ratings yet

- Symbiosis Institute of Management Studies: Topic-Credit RatingDocument20 pagesSymbiosis Institute of Management Studies: Topic-Credit Ratingriya bhowmikNo ratings yet

- Group 2 (Money Market)Document28 pagesGroup 2 (Money Market)Abdullah Al NomanNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Bond ValuationDocument35 pagesBond ValuationVijay SinghNo ratings yet

- Understanding Financial StatementsDocument36 pagesUnderstanding Financial StatementsDurga PrasadNo ratings yet

- PayPal ProspectusDocument56 pagesPayPal ProspectussamclerryNo ratings yet

- Project On Mutual Funds As An Investment AvenueDocument18 pagesProject On Mutual Funds As An Investment AvenueRishi vardhiniNo ratings yet

- Statement 78537738 EUR 2024-02-29 2024-03-28Document2 pagesStatement 78537738 EUR 2024-02-29 2024-03-28radostnyyrefundNo ratings yet

- Deegan5e SM Ch11Document22 pagesDeegan5e SM Ch11Rachel TannerNo ratings yet

- Prime Bank LimitedDocument29 pagesPrime Bank LimitedShouravNo ratings yet

- Adobe Scan Feb 11, 2024Document20 pagesAdobe Scan Feb 11, 2024DEVIL RDXNo ratings yet

- 2 Obligation Request & StatusDocument2 pages2 Obligation Request & Statusjoan dalilisNo ratings yet

- Pdic Ri 2021-01 Annex CDocument4 pagesPdic Ri 2021-01 Annex ChohoDanielleXDXSNo ratings yet

- Project Proposal SampleDocument2 pagesProject Proposal SampleliujinxinljxNo ratings yet

- Classification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-BaiDocument25 pagesClassification of Riba: (A) Riba-un-Nasiyah or Riba-al-Jahiliya (B) Riba-al-Fadl or Riba-al-Baiatifkhan890572267% (3)

- Sap Guide 2 0 1Document13 pagesSap Guide 2 0 1api-359265393No ratings yet

- Central University of South Bihar: Submitted To Course Instructor Submitted by StudentDocument8 pagesCentral University of South Bihar: Submitted To Course Instructor Submitted by StudentDivya MeghnaNo ratings yet

- Orix 1Document11 pagesOrix 1haroonameerNo ratings yet

- 01 FM Book Questions Main BookDocument156 pages01 FM Book Questions Main Bookprince soniNo ratings yet

- Banking - Term Project: Running Head: Silk Bank - Final ReportDocument45 pagesBanking - Term Project: Running Head: Silk Bank - Final ReportAman Ahmad UrfiNo ratings yet

- C U S T O M S: Boc Single Administrative DocumentDocument2 pagesC U S T O M S: Boc Single Administrative DocumentGwen CondezNo ratings yet

- Questionnaire SampleDocument7 pagesQuestionnaire Sampleraazoo19No ratings yet

- Sterling N ComputingDocument2 pagesSterling N ComputingSwagBeast SKJJNo ratings yet

- ABC - Homework 02 - JaguinesDocument5 pagesABC - Homework 02 - JaguinesHannah Mae JaguinesNo ratings yet

- Appendix II - Consent For Disclosure of Credit Information - Individual (BMEng) (16.10Document2 pagesAppendix II - Consent For Disclosure of Credit Information - Individual (BMEng) (16.10keyrie88No ratings yet