Professional Documents

Culture Documents

Lecture 2 - How Time and Interest Affect Money

Uploaded by

Danar AdityaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 2 - How Time and Interest Affect Money

Uploaded by

Danar AdityaCopyright:

Available Formats

HowTime and Interest HowTime and Interest How Time and Interest How Time and Interest

Affect Money Affect Money Affect Money Affect Money

Engineering Economy Engineering Economy

Lecture no. 2 Lecture no. 2

Thursday, J une 13, 2013 Thursday, J une 13, 2013

ECONOMIC EQUIVALENCE ECONOMIC EQUIVALENCE

Two sums of money at two different points Two sums of money at two different points

in time can be made economically

equivalent if: equivalent if:

We consider an interest rate and,

No. of time periods between the two

sums

Equality in terms of Economic Value

Interest Rate Interest Rate

INTEREST - MANIFESTATION OF THE

TIME VALUE OF MONEY. THE AMOUNT

PAID TO USE MONEY.

INVESTMENT INVESTMENT

INTEREST = VALUE NOW - ORIGINAL AMOUNT

LOAN LOAN

INTEREST = TOTAL OWED NOW - ORIGINAL

AMOUNT

RENTAL FEE PAID FOR THE USE OF SOMEONE

ELSESMONEY EXPRESSEDASA% ELSES MONEYEXPRESSED AS A %

Interest Rates and Returns Interest Rates and Returns

AMOUNT ORIGINAL

UNIT TIME PER INTEREST

RATE INTEREST =

Interest can be viewed from two

perspectives:

Lending situation e d gs tuat o

Investing situation

I t t L di E l Interest Lending: Example

You borrow $10,000 for one full year

Must pay back $10 700 at the endof one year Must pay back $10,700 at the end of one year

Interest Amount (I) = $10,700 - $10,000

Interest Amount = $700 for the year

Interest rate (i) = 700/ $10,000 = 7%/ Yr Interest rate (i) 700/ $10,000 7%/ Yr

I t t R t N t ti Interest Rate - Notation

the interest rate is Expressed as a per cent

per year per year

Notation

I = the interest amount is $

i = the interest rate (%/ interest period)

N= No. of interest periods (1 for this problem)

Interest Investing Perspective Interest Investing Perspective

Assume you invest $20,000 for one year in a

venture that will return to you, 9% per year.

At the end of one year, you will have:

Original $20,000 back Original $20,000 back

Plus..

The 9% return on $20 000 = $1 800 The 9% return on $20,000 = $1,800

We say that you earned 9%/ year on the investment!

This is your RATE of RETURNon the investment This is your RATE of RETURNon the investment

Engineering Economy Factors

1. F/ P and P/ F Factors

2 P/ AandA/ PFacto s 2. P/ A and A/ P Factors

3. F/ A and A/ F Factors

4. Interpolate Factor Values

5. P/ G and A/ G Factors

6. Geometric Gradient

F/P factor F/P factor

To find F given P To find F given P

F

n

To FindFgiven P To Find F given P

N

.

P

0

Compound forward in time

F/P factor

F

1

= P(1+i)

F/P factor

1

( )

F

2

= F

1

(1+i)..but:

F

2

=P(1+i)(1+i) =P(1+i)

2

F

2

P(1+i)(1+i) P(1+i)

F

3

= F

2

(1+i) =P(1+i)

2

(1+i)

=P(1+i)

3

= P(1+i)

3

In general:

F P(1 i)

n

F

N

= P(1+i)

n

F

N

= P(F/P,i%,n)

N

( )

P/F factor discounting back in time P/F factor discounting back in time

Discounting back fromthe future Discounting back from the future

F

n

N

.

P/ Ffactor brings a single

P

P/ F factor brings a single

future sum back to a specific

point in time.

Present Worth Factor fromF/P Present Worth Factor from F/P

Since F

N

=P(1+i)

n

Since F

N

P(1+i)

We solve for P in terms of F

N

P = F{1/ (1+i)

n}

= F(1+i)

-n

Thus: Thus:

P = F(P/F,i%,n) where

(P/F,i%,n) = (1+i)

-n

Example F/P Analysis Example- F/P Analysis

Example: P=$1,000;n=3;i=10% Example: P $1,000;n 3;i 10%

What is the future value, F?

F ??

0 1 2 3

F = ??

0 1 2 3

P=$1,000

i=10%/ year

F

3

= $1,000[F/ P,10%,3] = $1,000[1.10]

3

= $1,000[1.3310] = $1,331.00 $ , [ ] $ ,

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Annuity Cash Flow

P ?? P = ??

0

..

n

1 2 3 .. .. n-1

$A per period

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Write a Present worth expression

1 2 1

1 1 1 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

(

= + + + +

(

+ + + +

[1]

1 2 1

(1 ) (1 ) (1 ) (1 )

n n

i i i i

(

+ + + +

Term inside the brackets is a geometric progression.

Mult. This equation by 1/ (1+i) to yield a second equation

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

The second equation

1 1 1 1 P (

[2]

2 3 1

1 1 1 1

..

1 (1 ) (1 ) (1 ) (1 )

n n

P

A

i i i i i

+

(

= + + + +

(

+ + + + +

To isolate an expression for P in terms of A, subtract

Eq [1] from Eq. [2]. Note that numerous terms will

ddrop out.

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Setting up the subtraction

1 1 1 1

P A

(

= + + + +

(

[2]

1 1 1 1 (

2 3 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

+

= + + + +

(

+ + + +

[2]

1 2 1

1 1 1 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

(

= + + + +

(

+ + + +

[1]

-

1

1 1

1 (1 ) (1 )

n

i

P A

i i i

+

(

=

(

+ + +

=

[3]

1 (1 ) (1 ) i i i + + +

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Simplifying Eq. [3] further

(

1

1 1

1 (1 ) (1 )

n

i

P A

i i i

+

(

=

(

+ + +

( ) ( )

1

1

A

P

(

=

(

(1 ) 1

0

n

i

P A f i

(

+

=

(

1

1

(1 )

n

P

i i

+

=

(

+

( )

0

(1 )

n

P A for i

i i

= =

(

+

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

This expression will convert an annuity cash

flow to an equivalent present worth amount one

period to the left of the first annuity cash flow.

(

(1 ) 1

0

(1 )

n

n

i

P A for i

i i

(

+

= =

(

+

/ %, P A i n factor

Capital Recovery Factor: Capital Recovery Factor:

A/P, i%, n

The present worth point of

an annuity cash flow is

always one periodto the

Given the P/A factor

(1 ) 1

0

n

i

P A f i

(

+

=

(

Solve for Ain terms of P

always one period to the

left of the first A amount

( )

0

(1 )

n

P A for i

i i

= =

(

+

Solve for A in terms of P

Yielding.

(1 )

n

i i

A P

(

+

=

(

Yielding.

A/ P i% f t

(1 ) 1

n

A P

i

=

(

+

A/ P,i%,n factor

F/A and A/F Derivations

$F

F/A and A/F Derivations

Annuity Cash Flow

$F

Annuity Cash Flow

0

..

N

0

$A per period

Find $A given the

Future amt. - $F

Si ki F d d S i C d Sinking Fund and Series Compound

amount factors (A/F and F/A)

Recall:

Al

1

P F

(

=

(

Substitute P and

simplify!

Also:

(1 )

n

P F

i

=

(

+

(

(1 )

(1 ) 1

n

n

i i

A P

i

(

+

=

(

+

A/F F t A/F Factor

1 (1 )

n

i i

( ( +

By substitution we

see:

1 (1 )

(1 ) (1 ) 1

n

n n

i i

A F

i i

( ( +

=

( (

+ +

Simplifying we have:

(

Which is the

(A/F,i%,n) factor

(1 ) 1

n

A

i

i

F =

(

(

+

(1 ) 1 i +

F/A f t f th A/F F t F/A factor from the A/F Factor

i

(

Given:

(1 ) 1

n

i

A F

i

(

=

(

+

Solve for F in terms of

) (1 1

n

i

(

A

)

=A

(1 1

F

n

i

i

(

+

(

i

(

F/A and A/F Derivations

$F

F/A and A/F Derivations

Annuity Cash Flow

$F

Annuity Cash Flow

0

..

N

0

$A per period

Find $F given thethe

$A amounts

E l Example

Formasa Plastics has major fabrication j

plants in Texas and Hong Kong.

It is desired to know the future worth of

$1,000,000 invested at the end of each year

for 8 years, starting one year from now.

The interest rate is assumed to be 14% per

year.

E l Example

A= $1 000 000/ yr; n = 8 yrs i = 14%/ yr A = $1,000,000/ yr; n = 8 yrs, i = 14%/ yr

F

8

= ??

E l Example

Solution:

Solution:

The cash flow diagram shows the annual

payments starting at the end of year 1 and

ending in the year the future worth is desired.

Cash flows are indicated in $1000 units. The F

value in 8 years is value in 8 years is

F = l000(F/ A,14%,8) = 1000( 13.23218)

$13 232 80 13 232 illi 8 = $13,232.80 = 13.232 million 8 years

from now/

Interpolation of Factors

All texts on Engineeringeconomy will provide All texts on Engineering economy will provide

tabulated values of the various interest factors

usually at the end of the text in an appendix

Refer to the back of your text for those tables.

I t l ti f F t Interpolation of Factors

Typical Format for Tabulated Interest Tables

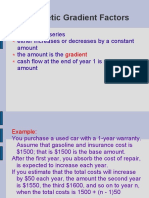

Arithmetic Gradient Factors

In applications the annuity cash flowpattern is In applications, the annuity cash flow pattern is

not the only type of pattern encountered

Two other types of endof periodpatterns are Two other types of end of period patterns are

common

The Linear or arithmetic gradient g

The geometric (% per period) gradient

An arithmetic (linear) Gradient is a cash flow

Arithmetic Gradient Factors

An arithmetic (linear) Gradient is a cash flow

series that either increases or decreases by a

contestant amount over n time periods.

A linear gradient is always comprised of TWO

components:

The Gradient component

The base annuity component y p

The objective is to find a closed form expression

for the Present Worth of an arithmetic gradient

Linear Gradient Example

A +n 1G

Linear Gradient Example

Assume the following:

A

1

+n-2G

A

1

+n-1G

g

A +2G

A

1

+G

A

1

+2G

0 1 2 3 n-1 N

This represents a positive, increasing arithmetic gradient

E l Li G di t Example: Linear Gradient

Typical Negative IncreasingGradient: G=$50 Typical Negative, Increasing Gradient: G=$50

The Base Annuity

= $1500

A ith ti G di t F t Arithmetic Gradient Factors

The G amount is the constant arithmetic change

from one time period to the next.

The G amount may be positive or negative!

The present worth point is always one time The present worth point is always one time

period to the left of the first cash flow in the

series or,

Two periods to the left of the first gradient cash

flow!

The A/G Factor

Convert G to an equivalent A

( / , , )( / , , ) A G P G i n A P i n =

How to do it

Gradient Example Gradient Example

Consider the followingcash flow Consider the following cash flow

$300

$400

$500

$100

$200

$300

0 1 2 3 4 5

Present Worth Point is here!

Find the present worth if i = 10%/yr; n = 5 yrs

And the Gamt. = $100/ period

Gradient Example- Base Annuity Gradient Example Base Annuity

First The Base Annuity of $100/ period First, The Base Annuity of $100/ period

A = +$100

0 1 2 3 4 5

PW(10%) of the base annuity = $100(P/ A,10%,5)

PW

Base

= $100(3.7908)= $379.08

Not Finished: We need the PW of the gradient component

and then add that value to the $379.08 amount

The Gradient Component The Gradient Component

$300

$400

$0

$100

$200

$300

0 1 2 3 4 5

We desire the PW of the Gradient Component at t = 0

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5) P

G@t=0

G(P/ G,10%,5) $100(P/ G,10%,5)

Th G di t C t The Gradient Component

$300

$400

$0

$100

$200

$300

0 1 2 3 4 5

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5)

G (1 ) 1

N

i N

(

Couldsubstituten=5, i=10%

G (1 ) 1

P=

i (1 ) (1 )

N

N N

i N

i i i

(

+

(

+ +

Could substitute n 5, i 10%

and G = $100 into the P/ G

closed form to get the value

of the factor.

PW f th G di t C t PW of the Gradient Component

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5)

P/ G,10%,5)

Sub. G=$100;i=0.10;n=5

G (1 ) 1

P=

i (1 ) (1 )

N

N N

i N

i i i

(

+

(

+ +

6.8618

Calculating or looking up the P/ G,10%,5 factor

yields the following:

P

t=0

= $100(6.8618) = $686.18 for the gradient

PW

G di t E l Fi l R lt Gradient Example: Final Result

PW(10%)

BaseAnnuity

= $379.08 ( )

Base Annuity

PW(10%)

Gradient Component

= $686.18

T t l PW(10%) $379 08 $686 18 Total PW(10%) = $379.08 + $686.18

Equals $1065.26

Note: The two sums occur at t =0 and can be

added together concept of equivalence

Example Summarized Example Summarized

$500

This Cash Flow

$200

$300

$400

$500

This Cash Flow

$100

$200

0 1 2 3 4 5

Is equivalent to $1065.26 at time 0 if the interest rate

is 10% per year!

Wh th i t i k When the i rate is unknown

A class of problems may deal with all of the p y

parameters know except the interest rate.

For many application-type problems, this can

become a difficult task

Termed, rate of return analysis

In some cases:

i can easily be determined y

In others, trial and error must be used

E l i k Example: i unknown

Assume one can invest $3000 now in a venture $

in anticipation of gaining $5,000 in five (5)

years.

If these amounts are accurate, what interest

rate equates these two cash flows?

$5,000

0 1 2 3 4 5

F = P(1+i)

n

$3,000

( )

5,000 = 3,000(1+i)

5

(1+i)

5

= 5,000/ 3000 = 1.6667

E l i k Example: i unknown

Assume on can invest $3000 now in a venture in $

anticipation of gaining $5,000 in five (5) years.

If these amounts are accurate, what interest

rate equates these two cash flows?

$5,000

0 1 2 3 4 5

(1+i)

5

= 5,000/ 3000 = 1.6667

$3,000

( ) , /

(1+i) = 1.6667

0.20

i = 1.1076 1 = 0.1076 = 10.76%

F i k For i unknown

In general, solving for i in a time value g , g

formulation is not straight forward.

More often, one will have to resort to some form

of trial and error approach as will be shown in

future sections.

l d h d l f hi bl A sample spreadsheet model for this problem

follows.

U k N b f Y Unknown Number of Years

Some problems require knowing the number of p q g

time periods required given the other

parameters

Example:

How long will it take for $1,000 to double in

l if h di i value if the discount rate is 5% per year?

Draw the cash flow diagram as.

F

n

= $2000

i = 5%/ year; n is unknown!

0 1 2 . . . . . . . n

P = $1,000

U k N b f Y Unknown Number of Years

Solving we have..

F = $2000

g

F

n

= $2000

0 1 2 . . . . . . . n

P $1 000 P = $1,000

F

n=?

= 1000(F/ P,5%,x): 2000 = 1000(1.05)

x

Solve for x in closed form

U k N b f Y Unknown Number of Years

Solving we have.. g

(1.05)

x

= 2000/ 1000

Xln(1.05) =ln(2.000)

X = ln(1.05)/ ln(2.000)

X = 0.6931/ 0.0488 = 14.2057 yrs

With discrete compoundingit will take 15 With discrete compounding it will take 15

years to amass $2,000 (have a little more that

$2,000)

You might also like

- Lesson 3 - AnnuitiesDocument58 pagesLesson 3 - AnnuitiesCarlo EdolmoNo ratings yet

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocument5 pagesAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNo ratings yet

- 5 Time Value of Money 1Document33 pages5 Time Value of Money 1jnfzNo ratings yet

- CONSTRUCTION EconomicsDocument27 pagesCONSTRUCTION Economicshema16100% (1)

- GE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1Document14 pagesGE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1John ZhaoNo ratings yet

- Chapter 2Document13 pagesChapter 2ObeydullahKhanNo ratings yet

- Dec 4 MeetingDocument45 pagesDec 4 MeetingTrice GelineNo ratings yet

- Factors: How Time and Interest Affect MoneyDocument64 pagesFactors: How Time and Interest Affect MoneyOrangeNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- AnnuityDocument29 pagesAnnuityChristed aljo barroga100% (1)

- D076288233Document20 pagesD076288233Sulaim Al KautsarNo ratings yet

- Chapter 2 Engineering EconomyDocument33 pagesChapter 2 Engineering Economymudassir ahmadNo ratings yet

- Factors: How Time and Interest Affect Money: Engineering EconomyDocument33 pagesFactors: How Time and Interest Affect Money: Engineering Economymudassir ahmadNo ratings yet

- GL4102-07-Equivalence and Compound Interest-BaruDocument34 pagesGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanNo ratings yet

- ENGINEERING ECONOMY CHAPTER 4 KEY CONCEPTSDocument39 pagesENGINEERING ECONOMY CHAPTER 4 KEY CONCEPTSKhánh ngân Lê vũNo ratings yet

- Week 4 PDFDocument23 pagesWeek 4 PDFKHAKSARNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneygar fieldNo ratings yet

- Lesson 6 Compound InterestDocument14 pagesLesson 6 Compound InterestDaniela CaguioaNo ratings yet

- How time and interest affect the value of moneyDocument11 pagesHow time and interest affect the value of moneyBeverly PamanNo ratings yet

- Economics (AF and FA, PG and AG)Document14 pagesEconomics (AF and FA, PG and AG)api-26367767No ratings yet

- Chapter 2 BDocument29 pagesChapter 2 BKenDaniswaraNo ratings yet

- Engineering Economics: Presented by Dr. ZahoorDocument38 pagesEngineering Economics: Presented by Dr. ZahoorumairNo ratings yet

- 9) Lecture 9) Combining Costs Benefits Using LCCADocument46 pages9) Lecture 9) Combining Costs Benefits Using LCCAasad04354No ratings yet

- Module 4: Time Value of MoneyDocument79 pagesModule 4: Time Value of MoneySyafiq JaafarNo ratings yet

- ENGINEERING ECONOMY Chapter 4: Time Value of MoneyDocument39 pagesENGINEERING ECONOMY Chapter 4: Time Value of Moneythuy duongNo ratings yet

- Energy EconomicsDocument27 pagesEnergy EconomicsJemuel MarkNo ratings yet

- AnnuityDocument43 pagesAnnuityJoeron Caezar Del Rosario (Joe)No ratings yet

- AnnuityDocument23 pagesAnnuityCathleen Ann TorrijosNo ratings yet

- The Interest Formulas Derived in This Section Apply To The CommonDocument30 pagesThe Interest Formulas Derived in This Section Apply To The CommonBelay ShibruNo ratings yet

- PDF-Chapter 4 The Time Value of MoneyDocument36 pagesPDF-Chapter 4 The Time Value of MoneyMinh AnhNo ratings yet

- Chapter 3 Understanding Money and Its Management Last PartDocument28 pagesChapter 3 Understanding Money and Its Management Last PartSarah Mae WenceslaoNo ratings yet

- Topic 2 Time Value of MoneyDocument6 pagesTopic 2 Time Value of Moneysalman hussainNo ratings yet

- Engineering Economy Factors: How Time and Interest Affect MoneyDocument48 pagesEngineering Economy Factors: How Time and Interest Affect Moneymichelleromac100% (1)

- Chapter 2 Part 1 of 2 PDFDocument49 pagesChapter 2 Part 1 of 2 PDFASAD ULLAHNo ratings yet

- Module 2 FactorsDocument45 pagesModule 2 FactorsMeifrinaldiGamaBizenNo ratings yet

- EconomyDocument11 pagesEconomyJoanna Luz BagnolNo ratings yet

- EMP5102B - Week 6 PresentationDocument66 pagesEMP5102B - Week 6 PresentationUdhaykiran RangineniNo ratings yet

- Civil Engineering Cost Analysis ReviewDocument67 pagesCivil Engineering Cost Analysis ReviewAnonymous PkeI8e84Rs100% (1)

- Engineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دDocument45 pagesEngineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دRommelBaldagoNo ratings yet

- Money - Time Relationships & Equivalence: Harris Widya Adi Nugroho Fauzan Very Budiman Erny Apriany SylwanaDocument25 pagesMoney - Time Relationships & Equivalence: Harris Widya Adi Nugroho Fauzan Very Budiman Erny Apriany SylwanaErny A Sylwana RasulongNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of MoneyMinh HiếuNo ratings yet

- Lecture2-1 231011 123124Document60 pagesLecture2-1 231011 123124duygualsan1No ratings yet

- Mng111 Lecture 2Document17 pagesMng111 Lecture 2Alexis ParrisNo ratings yet

- MNG111 Financial Math Lecture 2Document17 pagesMNG111 Financial Math Lecture 2Alexis ParrisNo ratings yet

- Module 3 InterestDocument11 pagesModule 3 InterestGurtejSinghChana100% (1)

- Business Investment Appraisal (3375)Document54 pagesBusiness Investment Appraisal (3375)Armudin PurbaNo ratings yet

- Simple AnnuitiesDocument33 pagesSimple Annuitieselma anacletoNo ratings yet

- 5.1 Usage of Compound Interest Tables. Feb 8-12 - 1Document11 pages5.1 Usage of Compound Interest Tables. Feb 8-12 - 1John GarciaNo ratings yet

- CV6216 2123 S2 TPwwf1A-FundamentalsDocument10 pagesCV6216 2123 S2 TPwwf1A-FundamentalsZJ XNo ratings yet

- How Time and Interest Affect MoneyDocument11 pagesHow Time and Interest Affect MoneySevilla, Jazelle Kate Q.No ratings yet

- Introduction e 2010Document34 pagesIntroduction e 2010catherinen_65No ratings yet

- Review CH - 02 AnnuityDocument30 pagesReview CH - 02 AnnuityNelson Cabingas100% (1)

- 604 ch3Document72 pages604 ch3Hazel Grace SantosNo ratings yet

- 411_Chapter02_66-761520-16911405009257Document85 pages411_Chapter02_66-761520-16911405009257Ken TheeraNo ratings yet

- CHAPTER 2 - Presentation - For - TeachersDocument125 pagesCHAPTER 2 - Presentation - For - TeachersReffisa JiruNo ratings yet

- Kuliah Ekonomi Teknik: Ir. Sidharta Sahirman MS, Msie, PHDDocument22 pagesKuliah Ekonomi Teknik: Ir. Sidharta Sahirman MS, Msie, PHDAdham KurniawanNo ratings yet

- CALCULATING ANNUITIES AND FUTURE VALUESDocument10 pagesCALCULATING ANNUITIES AND FUTURE VALUESLyzette LeanderNo ratings yet

- CE 561 Lecture Notes: Engineering Economic AnalysisDocument21 pagesCE 561 Lecture Notes: Engineering Economic AnalysisIyoi ShumiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2006 Euromonitor Packaged Foods - IndonesiaDocument252 pages2006 Euromonitor Packaged Foods - IndonesiaDanar Aditya100% (2)

- Transesterifikasi Menggunakan NaOHDocument12 pagesTransesterifikasi Menggunakan NaOHDanar AdityaNo ratings yet

- Shutoku High School CaseDocument4 pagesShutoku High School CaseDanar AdityaNo ratings yet

- Petrobras Biofuels May2007Document18 pagesPetrobras Biofuels May2007Danar AdityaNo ratings yet

- Personal Development Planning and Career Planning FinalDocument19 pagesPersonal Development Planning and Career Planning FinalDanar AdityaNo ratings yet

- Review Jur Nal 2012Document12 pagesReview Jur Nal 2012Danar AdityaNo ratings yet

- Jurnal 3 - EP Titanium Oksida Pada Tegangan RendahDocument2 pagesJurnal 3 - EP Titanium Oksida Pada Tegangan RendahDanar AdityaNo ratings yet

- Final Process DescriptionDocument2 pagesFinal Process DescriptionDanar AdityaNo ratings yet

- Calculating covariance and correlation between variables using sample dataDocument6 pagesCalculating covariance and correlation between variables using sample dataDanar AdityaNo ratings yet

- Katalis HDODocument4 pagesKatalis HDODanar AdityaNo ratings yet

- HT Model Liquid Density Deviations for Nitrogen, Methane, AmmoniaDocument122 pagesHT Model Liquid Density Deviations for Nitrogen, Methane, AmmoniaPhilip GloverNo ratings yet

- Name: Iago Adhyaksa Class: 2-B: French Beans LettuceDocument1 pageName: Iago Adhyaksa Class: 2-B: French Beans LettuceDanar AdityaNo ratings yet

- Final Process DescriptionDocument2 pagesFinal Process DescriptionDanar AdityaNo ratings yet

- Katalis HDODocument4 pagesKatalis HDODanar AdityaNo ratings yet

- Emission and Fuel Consumption Characteristics of A Heavy Duty Diesel Engine Fueled With Hydroprocessed Renewable Diesel and Biodiesel PDFDocument7 pagesEmission and Fuel Consumption Characteristics of A Heavy Duty Diesel Engine Fueled With Hydroprocessed Renewable Diesel and Biodiesel PDFDanar AdityaNo ratings yet

- Blankchapter 17Document137 pagesBlankchapter 17Danar AdityaNo ratings yet

- PetroBowl Regional Qualifiers 2015 Schedule and LocationsDocument1 pagePetroBowl Regional Qualifiers 2015 Schedule and LocationsDanar AdityaNo ratings yet

- Supply Chain Bagian DanarDocument39 pagesSupply Chain Bagian DanarDanar AdityaNo ratings yet

- Misc Subroutine For StudentsDocument12 pagesMisc Subroutine For StudentsDanar AdityaNo ratings yet

- PP Lect 01 Pendahuluan & NeedsDocument55 pagesPP Lect 01 Pendahuluan & NeedsDanar AdityaNo ratings yet

- Drilling ProblemsDocument13 pagesDrilling ProblemsDanar AdityaNo ratings yet

- Lecture 1 - Introduction To Engineering EconomyDocument38 pagesLecture 1 - Introduction To Engineering EconomyDanar AdityaNo ratings yet

- Oil & Gas GlossaryDocument31 pagesOil & Gas Glossarytulks100% (2)

- Benefit Cost Analysis and Public Sector Economics: Session IxDocument45 pagesBenefit Cost Analysis and Public Sector Economics: Session IxDanar AdityaNo ratings yet

- Pengolahan Data Percobaan 1 FluidisasiDocument2 pagesPengolahan Data Percobaan 1 FluidisasiDanar AdityaNo ratings yet

- Assignments4 Kelas02 DanarAditya PDFDocument18 pagesAssignments4 Kelas02 DanarAditya PDFDanar AdityaNo ratings yet

- Tugas EkotekDocument9 pagesTugas EkotekElvansyah FajriNo ratings yet

- Data PPDocument2 pagesData PPDanar AdityaNo ratings yet

- Upstream Oil and Gas ArticleDocument2 pagesUpstream Oil and Gas ArticleDanar AdityaNo ratings yet

- A Particular Fund, Fund 501.: Requisites of Negotiability An Instrument To Be Negotiable Must Contain An UnconditionalDocument2 pagesA Particular Fund, Fund 501.: Requisites of Negotiability An Instrument To Be Negotiable Must Contain An UnconditionalMichelle Ann AsuncionNo ratings yet

- Interoffice MemorandumDocument2 pagesInteroffice Memorandumnioriatti8924No ratings yet

- Icici Bank Home Finance Limited - Kandepu Subhash ChandraboseDocument3 pagesIcici Bank Home Finance Limited - Kandepu Subhash ChandraboseBhanu GNo ratings yet

- Filipino Entrepreneurs Economic IssuesDocument34 pagesFilipino Entrepreneurs Economic IssuesLuna LedezmaNo ratings yet

- Government Receipt Portal SystemDocument1 pageGovernment Receipt Portal Systempetergr8t1No ratings yet

- Translations 26 Caselaws of Vietnam - by Caselaw Vietnam - Online Version PDFDocument195 pagesTranslations 26 Caselaws of Vietnam - by Caselaw Vietnam - Online Version PDFLiêm QuốcNo ratings yet

- Installation: Grand Re-Opening Specials Grand Re-Opening SpecialsDocument24 pagesInstallation: Grand Re-Opening Specials Grand Re-Opening SpecialstodaysshopperNo ratings yet

- An Indian Perspective On New Development Bank & Asian Infrastructure Investment BankDocument11 pagesAn Indian Perspective On New Development Bank & Asian Infrastructure Investment BankCFA IndiaNo ratings yet

- Pre - Closing Trial Balance: Barangay LAWY Municipality of CapasDocument79 pagesPre - Closing Trial Balance: Barangay LAWY Municipality of CapasErish Jay ManalangNo ratings yet

- Time ValueDocument28 pagesTime ValueANKIT GUPTANo ratings yet

- MSU-CBA Receivables Financing Pre-Review ProgramDocument2 pagesMSU-CBA Receivables Financing Pre-Review ProgramAyesha RGNo ratings yet

- Adjusting Entries Practice QuestionsDocument7 pagesAdjusting Entries Practice QuestionsmianwaseemNo ratings yet

- Practical Accounting 1Document13 pagesPractical Accounting 1Sherrizah Ferrer MaribbayNo ratings yet

- UAE Real Estate - 12 Sep 08 1443Document44 pagesUAE Real Estate - 12 Sep 08 1443Islam GoudaNo ratings yet

- Wipro ProjectDocument91 pagesWipro ProjectDeepak DineshNo ratings yet

- CA Final DTL Amendments For May 2014 by CA Manish Dafria IndoreDocument25 pagesCA Final DTL Amendments For May 2014 by CA Manish Dafria Indored_gehlodNo ratings yet

- What Is MoneyDocument9 pagesWhat Is Moneymariya0% (1)

- Operating Costs in Hotel IndustryDocument38 pagesOperating Costs in Hotel IndustryRajVishwakarmaNo ratings yet

- Assignment #1 Tri Pack Film Limited: Analysis of Solvency RatiosDocument4 pagesAssignment #1 Tri Pack Film Limited: Analysis of Solvency RatiossooperusmanNo ratings yet

- PIS ReportDocument1 pagePIS ReportSamar ahmedNo ratings yet

- Equitable Savings Bank v. PalcesDocument2 pagesEquitable Savings Bank v. PalcesHezroNo ratings yet

- 32 Machuca V ChuidanDocument2 pages32 Machuca V ChuidanFrancis FlorentinNo ratings yet

- Capital Structure - UltratechDocument6 pagesCapital Structure - UltratechmubeenNo ratings yet

- Marshall PlanDocument22 pagesMarshall Planapi-26307249No ratings yet

- FInance and Accounts ManualDocument129 pagesFInance and Accounts ManualPalaniyandi KuppanNo ratings yet

- Casibang Final Exam in Credit TransactionsDocument2 pagesCasibang Final Exam in Credit TransactionsAnjung Manuel CasibangNo ratings yet

- Associate Consultant - Iradar PDFDocument3 pagesAssociate Consultant - Iradar PDFAnonymous c9VBjLIJNo ratings yet

- AT&T NegotiationDocument29 pagesAT&T NegotiationEbube Anizor100% (5)

- Basic Acctg MidtermDocument8 pagesBasic Acctg MidtermLouie De La Torre100% (3)

- Amortization vs Depreciation: Key DifferencesDocument2 pagesAmortization vs Depreciation: Key DifferenceshumaidjafriNo ratings yet