Professional Documents

Culture Documents

BetterInvesting Weekly Stock Screen 4-28-14

Uploaded by

BetterInvesting0 ratings0% found this document useful (0 votes)

146 views1 pageBetterInvesting's weekly stock screen featuring a screen from MyStockProspector.com on April 28.

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBetterInvesting's weekly stock screen featuring a screen from MyStockProspector.com on April 28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

146 views1 pageBetterInvesting Weekly Stock Screen 4-28-14

Uploaded by

BetterInvestingBetterInvesting's weekly stock screen featuring a screen from MyStockProspector.com on April 28.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

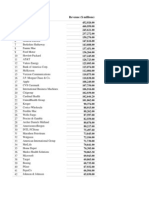

Company Name

AmTrust Financial Services

Ametek

Credit Acceptance

CACI International

Comcast

Cognizant Technology Solutions

Dollar Tree Stores

Fossil Group

HDFC Bank

Heico

Intuitive Surgical

51job

Life Time Fitness

Mercadolibre

NetEase

Oceaneering International

Oracle

O'Reilly Automotive

Panera Bread

Portfolio Recovery Associates

Sturm Ruger & Company

Ralph Lauren

ResMed

Ross Stores

Syntel

Texas Roadhouse

Valmont Industries

WEEK OF APRIL 28, 2014

Sales

Hist 10 Yr Hist 10 Yr Rev R2

Symbol Industry

(million $)

Rev Gr

EPS Gr

10 Yr

AFSI

Insurance - Property & Casualty

$2,697.9

34.2%

27.9%

0.98

AME Diversified Industrials

$3,594.1

11.7%

16.7%

0.92

CACC Credit Services

$682.1

17.3%

28.1%

0.99

CACI Information Technology Services

$3,682.0

14.0%

12.1%

0.95

CMCSA Pay TV

$64,657.0

14.5%

27.3%

0.97

CTSH Information Technology Services

$8,843.2

34.5%

30.1%

0.98

DLTR Discount Stores

$7,840.3

11.1%

23.4%

1.00

FOSL Footwear & Accessories

$3,260.0

14.8%

24.5%

0.98

HDB

Banks - Regional - Asia

$4,087.4

31.2%

22.9%

0.95

HEI.A Aerospace & Defense

$1,008.8

17.2%

18.3%

0.94

ISRG

Medical Devices

$2,265.1

36.6%

38.9%

0.95

JOBS Staffing & Outsourcing Services

$261.6

17.9%

30.5%

0.97

LTM

Leisure

$1,205.9

15.7%

13.5%

0.94

MELI Specialty Retail

$472.6

46.0%

121.1%

0.95

NTES Internet Content & Information

$1,495.3

33.1%

49.7%

0.98

OII

Oil & Gas Equipment & Services

$3,287.0

15.0%

22.6%

0.92

ORCL Software - Infrastructure

$37,180.0

16.7%

18.8%

0.97

ORLY Auto Parts

$6,649.2

17.9%

20.3%

0.95

PNRA Restaurants

$2,385.0

18.5%

20.7%

0.97

PRAA Business Services

$735.1

21.8%

19.3%

0.99

RGR

Aerospace & Defense

$688.3

18.0%

72.5%

0.88

RL

Apparel Manufacturing

$6,944.8

10.4%

18.3%

0.95

RMD Medical Instruments & Supplies

$1,514.5

17.5%

21.8%

0.96

ROST Apparel Stores

$10,230.4

10.0%

25.9%

0.99

SYNT Information Technology Services

$824.8

17.9%

22.6%

0.99

TXRH Restaurants

$1,422.6

15.3%

15.8%

0.95

VMI

Metal Fabrication

$3,304.2

14.2%

26.9%

0.97

Screen Notes

MyStockProspector screen on April 28

10-year sales, EPS growth of 10% or more

10-year sales, EPS growth R2 of at least 0.80

Projected 5-year EPS growth of 10% and higher

Ratio of P/E to both projected and historical EPS growth of 1.5 and below

Trend of pre-tax income rate and return on equity of even or better

EPS R2 Proj 5 Yr PE/Hist PE/Proj

10 Yr

EPS Gr EPS Gr EPS Gr

0.91

12.2%

0.39

0.88

0.94

16.8%

1.48

1.47

0.93

14.7%

0.47

0.90

0.86

14.2%

0.97

0.83

0.93

13.7%

0.69

1.37

0.98

18.4%

0.81

1.33

0.97

16.8%

0.80

1.12

0.94

18.5%

0.67

0.89

0.95

30.0%

1.18

0.90

0.98

18.6%

1.33

1.31

0.93

18.0%

0.57

1.23

0.86

20.0%

0.86

1.32

0.91

15.5%

1.26

1.10

0.83

28.3%

0.28

1.19

0.85

13.3%

0.29

1.07

0.86

18.3%

0.98

1.21

0.99

12.4%

0.89

1.34

0.93

17.0%

1.21

1.44

0.97

18.1%

1.21

1.38

0.91

12.0%

0.88

1.41

0.83

17.1%

0.15

0.65

0.95

12.8%

1.04

1.49

0.94

15.4%

0.96

1.35

0.99

12.5%

0.68

1.41

0.94

17.0%

0.64

0.85

0.96

14.8%

1.39

1.48

0.89

19.5%

0.57

0.79

Trend Trend

PTI

ROE

++

-+

++

+

Even Even

+

++

++

++

Even Even

++

++

Even

++

++

++

Even

+

Even Even

++

+

++

Even

+

+

Even Even

Even

+

Even

+

++

++

++

+

+

++

++

++

+

++

+

+

++

+

++

+

Even

++

++

+

You might also like

- BetterInvesting Weekly Stock Screen 10-28-13Document1 pageBetterInvesting Weekly Stock Screen 10-28-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-6-14Document1 pageBetterInvesting Weekly Stock Screen 10-6-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 091012Document6 pagesBetterInvesting Weekly Stock Screen 091012BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-28-14Document1 pageBetterInvesting Weekly Stock Screen 7-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-17-13Document1 pageBetterInvesting Weekly Stock Screen 6-17-13BetterInvestingNo ratings yet

- BetterInvesting Weekly - Stock Screen - 3-5-12Document1 pageBetterInvesting Weekly - Stock Screen - 3-5-12BetterInvestingNo ratings yet

- Small Companies in USADocument11 pagesSmall Companies in USAsayeedkhan00767% (6)

- BetterInvesting Weekly Stock Screen 8-12-13Document1 pageBetterInvesting Weekly Stock Screen 8-12-13BetterInvestingNo ratings yet

- Fortune 100 Companies ListDocument46 pagesFortune 100 Companies Listsayeedkhan007No ratings yet

- Connectservices: Softskills Hard Work PlacementDocument3 pagesConnectservices: Softskills Hard Work PlacementManish TiwariNo ratings yet

- BetterInvesting Weekly Stock Screen 6-11-12Document1 pageBetterInvesting Weekly Stock Screen 6-11-12BetterInvestingNo ratings yet

- Monthly 25 Stocks For October 2014Document10 pagesMonthly 25 Stocks For October 2014Stephen CastellanoNo ratings yet

- Infosys Financial RatiosDocument2 pagesInfosys Financial RatiosvaasurastogiNo ratings yet

- VG CompaniesDocument132 pagesVG CompaniessatsriniNo ratings yet

- BetterInvesting Weekly Stock Screen 12-9-13Document1 pageBetterInvesting Weekly Stock Screen 12-9-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-25-16Document1 pageBetterInvesting Weekly Stock Screen 7-25-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-17-14Document1 pageBetterInvesting Weekly Stock Screen 2-17-14BetterInvestingNo ratings yet

- S. No. Name of The Company Selections: Company Wise Placement Details 2012 13Document5 pagesS. No. Name of The Company Selections: Company Wise Placement Details 2012 13Abhinav AroraNo ratings yet

- 2012 Inc.5000 Companies Located in Washington DC.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateDocument2 pages2012 Inc.5000 Companies Located in Washington DC.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateWilliam HarrisNo ratings yet

- US SAP Users ListDocument9 pagesUS SAP Users ListmanishmotsNo ratings yet

- Ascendere Associates LLC Innovative Long/Short Equity ResearchDocument10 pagesAscendere Associates LLC Innovative Long/Short Equity ResearchStephen CastellanoNo ratings yet

- BetterInvesting Weekly Stock Screen 11-28-16Document1 pageBetterInvesting Weekly Stock Screen 11-28-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-14-14Document1 pageBetterInvesting Weekly Stock Screen 4-14-14BetterInvestingNo ratings yet

- Nse Future Lot SizeDocument10 pagesNse Future Lot SizePrasanta DebnathNo ratings yet

- Study Of: Prof. Neeraj AmarnaniDocument20 pagesStudy Of: Prof. Neeraj Amarnanipankil_dalalNo ratings yet

- BetterInvesting Weekly Stock Screen 3-3-14Document1 pageBetterInvesting Weekly Stock Screen 3-3-14BetterInvestingNo ratings yet

- Mutual Fund Portfolio and ReturnsDocument3 pagesMutual Fund Portfolio and ReturnsVishwa Prasanna KumarNo ratings yet

- HCL Technologies LTD Industry:Computers - Software - LargeDocument2 pagesHCL Technologies LTD Industry:Computers - Software - LargevaasurastogiNo ratings yet

- BetterInvesting Weekly Stock Screen 12-1-14Document1 pageBetterInvesting Weekly Stock Screen 12-1-14BetterInvestingNo ratings yet

- Harsh Jain Mpa PTPDocument11 pagesHarsh Jain Mpa PTPJatin JainNo ratings yet

- BetterInvesting Weekly Stock Screen 11-07-16Document1 pageBetterInvesting Weekly Stock Screen 11-07-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-30-13Document1 pageBetterInvesting Weekly Stock Screen 9-30-13BetterInvestingNo ratings yet

- Name: Yash K. Gudadhe Name: Farhaan ShaikDocument14 pagesName: Yash K. Gudadhe Name: Farhaan ShaikFarhaan HaiderNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-17Document1 pageBetterInvesting Weekly Stock Screen 1-23-17BetterInvestingNo ratings yet

- All Companies in PuneDocument14 pagesAll Companies in PuneAshutosh PatoleNo ratings yet

- 2012 Inc.5000 Companies Located in Massachusetts.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateDocument4 pages2012 Inc.5000 Companies Located in Massachusetts.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateWilliam HarrisNo ratings yet

- BetterInvesting Weekly Stock Screen 11-30-15Document1 pageBetterInvesting Weekly Stock Screen 11-30-15BetterInvestingNo ratings yet

- NSDC ProjectsDocument2 pagesNSDC ProjectsAnand Daniel0% (1)

- Fidelity Fund Management Private LimitedDocument28 pagesFidelity Fund Management Private LimitedsubudaniNo ratings yet

- BetterInvesting Weekly Stock Screen 4-30-12Document1 pageBetterInvesting Weekly Stock Screen 4-30-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-2-15Document1 pageBetterInvesting Weekly Stock Screen 2-2-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-18-16Document1 pageBetterInvesting Weekly Stock Screen 4-18-16BetterInvestingNo ratings yet

- Corporate ListDocument5 pagesCorporate ListShashikant ZarekarNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-16Document1 pageBetterInvesting Weekly Stock Screen 5-16-16BetterInvestingNo ratings yet

- ValuEngine Weekly Newsletter April 22, 2011Document11 pagesValuEngine Weekly Newsletter April 22, 2011ValuEngine.comNo ratings yet

- BetterInvesting Weekly Stock Screen 6-20-16Document1 pageBetterInvesting Weekly Stock Screen 6-20-16BetterInvestingNo ratings yet

- Austin&HoustonDocument44 pagesAustin&HoustonYogesh PaigudeNo ratings yet

- BetterInvesting Weekly Stock Screen 9-11-17Document1 pageBetterInvesting Weekly Stock Screen 9-11-17BetterInvesting100% (1)

- 2012 MBA/IMBA Salary Survey: Career Development CentreDocument9 pages2012 MBA/IMBA Salary Survey: Career Development CentreLaura MontgomeryNo ratings yet

- He Watched Tech Stocks Scream Higher With Little InvolvementDocument37 pagesHe Watched Tech Stocks Scream Higher With Little InvolvementShankhadeep Mukherjee100% (1)

- 100 Best Companies To WorkDocument4 pages100 Best Companies To WorkjovihodrialNo ratings yet

- BetterInvesting Weekly Stock Screen 3-27-17Document1 pageBetterInvesting Weekly Stock Screen 3-27-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-27-17Document1 pageBetterInvesting Weekly Stock Screen 2-27-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-15-13Document1 pageBetterInvesting Weekly Stock Screen 7-15-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-25-13Document1 pageBetterInvesting Weekly Stock Screen 11-25-13BetterInvestingNo ratings yet

- Profit 100 Next 100 DownloadableDocument42 pagesProfit 100 Next 100 DownloadableritwikunhaleNo ratings yet

- Global FundsDocument74 pagesGlobal FundsArmstrong CapitalNo ratings yet

- BetterInvesting Weekly Stock-Screen 9-22-14Document1 pageBetterInvesting Weekly Stock-Screen 9-22-14BetterInvestingNo ratings yet

- Software Transparency: Supply Chain Security in an Era of a Software-Driven SocietyFrom EverandSoftware Transparency: Supply Chain Security in an Era of a Software-Driven SocietyNo ratings yet

- The Power of Mobility: How Your Business Can Compete and Win in the Next Technology RevolutionFrom EverandThe Power of Mobility: How Your Business Can Compete and Win in the Next Technology RevolutionRating: 1 out of 5 stars1/5 (1)

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-27-2020Document3 pagesBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-9-19Document1 pageBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- Financial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrDocument2 pagesFinancial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrBetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-19-18Document1 pageBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-5-18Document1 pageBetterInvesting Weekly Stock Screen 11-5-18BetterInvestingNo ratings yet

- Exceptions To The Law of DemandDocument8 pagesExceptions To The Law of Demandinvincible_soldierNo ratings yet

- Chapter 30 Impairment of AssetDocument15 pagesChapter 30 Impairment of AssetCrizel Dario0% (1)

- Romer Model of GrowthDocument2 pagesRomer Model of GrowthPhilip KotlerNo ratings yet

- Course Name: Microeconomics Course Code: PEC1133 Duration: 1 HOUR (6.00 PM - 7.00 PM)Document7 pagesCourse Name: Microeconomics Course Code: PEC1133 Duration: 1 HOUR (6.00 PM - 7.00 PM)Amir BasirNo ratings yet

- Salient Features of Keynes Theory of Income & EmploymentDocument8 pagesSalient Features of Keynes Theory of Income & EmploymentHabib urrehmanNo ratings yet

- J. Dimaampao Notes PDFDocument42 pagesJ. Dimaampao Notes PDFAhmad Deedatt Kalbit100% (1)

- Case StudyDocument30 pagesCase Studykenneth.oliver2002No ratings yet

- Limits: Types of Risk Monitored in Forex MarketsDocument3 pagesLimits: Types of Risk Monitored in Forex MarketsPrasad NayakNo ratings yet

- 7e - Chapter 10Document39 pages7e - Chapter 10WaltherNo ratings yet

- Mobile Banking Literature ReviewDocument7 pagesMobile Banking Literature Reviewea3h1c1p100% (1)

- True and False Monetary EconomicsDocument8 pagesTrue and False Monetary EconomicsniddsterNo ratings yet

- Convergence in EconomicsDocument6 pagesConvergence in EconomicsIshrar KibriaNo ratings yet

- Options Strategy PosterDocument1 pageOptions Strategy PosterMark Taylor86% (7)

- Timetable (Version 1) .XLSBDocument17 pagesTimetable (Version 1) .XLSBwinniebearbearNo ratings yet

- Topic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Document4 pagesTopic 3 - Todaro, Economic Development - Ch.3 (Wiscana AP)Wiscana Chacha100% (1)

- Eco Prakash PDFDocument10 pagesEco Prakash PDFPanwar SurajNo ratings yet

- 1 - ST Benedicts Teaching Hospital - Case QuestionsDocument1 page1 - ST Benedicts Teaching Hospital - Case QuestionsJM LopezNo ratings yet

- Yoshino and Helble - The Housing Challenge in Emerging Asia PDFDocument397 pagesYoshino and Helble - The Housing Challenge in Emerging Asia PDFSheilaNo ratings yet

- (Applicable From The Academic Session 2018-2019) : Syllabus For B. Tech in Information TechnologyDocument17 pages(Applicable From The Academic Session 2018-2019) : Syllabus For B. Tech in Information Technologyamit phadikarNo ratings yet

- Caie As Level Business 9609 Theory v1Document44 pagesCaie As Level Business 9609 Theory v1Angelos LazaruNo ratings yet

- Mercantilism - Practice of State Dirigism and ProtectionismDocument12 pagesMercantilism - Practice of State Dirigism and ProtectionismAbraham L ALEMUNo ratings yet

- Management Accounting/Series-4-2011 (Code3024)Document18 pagesManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Itl 528 Assignment 2b 5day ExtendedDocument14 pagesItl 528 Assignment 2b 5day Extendedapi-470484168No ratings yet

- Business Cycles and Growth - From M.i.tugan-BaranovskyDocument14 pagesBusiness Cycles and Growth - From M.i.tugan-BaranovskyKaio VitalNo ratings yet

- CliqueDocument2 pagesCliqueManvita KotianNo ratings yet

- Basic Economic Problem PDFDocument3 pagesBasic Economic Problem PDFMarvin Angcay AmancioNo ratings yet

- Comprehensive Problem 4 Solutions ManualDocument9 pagesComprehensive Problem 4 Solutions Manualfarsi786No ratings yet

- Oligopoly ExercisesDocument18 pagesOligopoly Exercisesalekin100% (1)

- Arbitrage Pricing TheoryDocument8 pagesArbitrage Pricing Theorysush_bhatNo ratings yet

- REAL 4000 Ch3 HW SolutionsDocument6 pagesREAL 4000 Ch3 HW SolutionsnunyabiznessNo ratings yet