Professional Documents

Culture Documents

SL Banking Sector Report - Two Bulls Weather The Storm - 02 May 2014

Uploaded by

Randora LkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SL Banking Sector Report - Two Bulls Weather The Storm - 02 May 2014

Uploaded by

Randora LkCopyright:

Available Formats

1

SL BANKING SECTOR

Two bulls weather the storm

See page 87 for important disclaimer

UDEESHAN JONAS

CHRISTEEN SILVA

CAL RESEARCH

MAY 2014

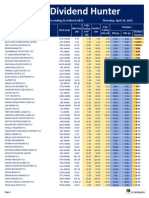

Bank

Current

Price

Recommen

dation

Target

Price

Price

upside

2014E

ROE

2014E

ROA

Core

profit

growth

2014E

Net

profit

growth

2014E

PBV

2014E

(x)

PER

2014E

(x)

Dividend

yield

2014E

Total

Return

Nations Trust Bank 66.9 BUY 80 19.6% 18.85% 1.60% 18.6% 12.1% 1.1 6.3 3.7% 23.3%

Sampath Bank 192.8 BUY 221 14.6% 16.98% 1.38% 20.0% 56.3% 0.9 5.4 6.9% 21.5%

Hatton National Bank - Non

Voting

126.8 HOLD 131 3.3% 14.37% 1.57% 9% 13.1% 0.8 5.5 7.5% 10.8%

Hatton National Bank - Voting 157.9 HOLD 160 1.3% 14.37% 1.57% 9% 13.1% 1.0 7.0 6.0% 7.3%

Commercial Bank- Non Voting 97 HOLD 104 7.2% 17.17% 1.76% 12.7% 6.3% 1.2 7.5 6.9% 14.2%

National Development Bank 194.5 HOLD 171 -12.1% 12.96% 1.50% 26.1% 26.9% 1.1 8.8 5.7% -6.38%

Commercial Bank- Voting 127.4 SELL 123 -3.8% 17.17% 1.76% 12.7% 6.3% 1.6 9.8 5.3% 1.4%

CALs top picks among the banking sector stocks are

NTB & SAMP (avg. 22.4% 1-yr total return)

2

Source: CAL Research

SL BANKING SECTOR Two bulls weather the storm

I. 2014E banking sector loan growth to remain flat at 15%

II. NIMs are likely to fall to 4.2% in 2014 due to lower interest rates (-

20bps lower)

III. Individual banks may need to emphasize on ROE improvement (2013

avg. 14% vs. 2014E 16%)

IV. 2014E bottom-line growth may stem from lower impairment charges

& improving CIRs (profit growth 2013 -22% vs. 18% in 2014E)

V. CALs Top picks in the Banking sector are SAMP (TP LKR 221, +14.6%)

and NTB (TP LKR 80, +19.6%)

VI. Appendices

3

4

20

34

49

58

68

Pg

I. 2014E banking sector loan growth to

remain flat at 15%

4

I. 2014E banking sector loan growth to remain flat at

15%

SL private sector credit to GDP still one of the lowest among the lower-middle income countries (31% vs. avg. 41%)

SL private sector credit has grown at an avg. 2.7x of GDP over 1997-2013

CAL expects medium term private credit to grow at a 15% Cagr through 2018E (2.5x GDP)

However in 2013, private sector credit grew a marginal 7.2% YoY despite an easing monetary stance (-430bps YoY

AWPLR)

Loan growth of local private commercial banks (+15.3% YoY) outperformed private credit growth (7.2% YoY)

as govt. banks drastically lost market share (-270bps to 48%)

Loans to external trade was lackluster in 2013; may turnaround on improving global trade in 2014 (+15% YoY)

A slowdown in the pawning book also had an adverse impact on private credit growth (c.20% of pvt. credit growth

2010-12)

Further, the housing market did not pick up despite the dip in rates (+9% YoY)

and the leasing sector slowed down during 2013 as vehicle registrations dipped (-18% YoY)

However, construction and tourism have been growing contributors to loan book growth in 2013 (37% in 2013 vs.

19% in 2012)

Agriculture loans (12% of the sector loans) may see a further slowdown in 2014 with the prevailing drought

CAL believes corporate debt issuances of LKR 11bn had a minimal negative impact on private sector credit growth

CAL expects 2014E private sector credit to grow 8% YoY and listed private commercial banks loan book to grow

15% YoY

5

SL private sector credit to GDP still one of the lowest among

the lower-middle income countries (31% vs. avg. 41%)

6

Figure 1: Private sector credit to GDP % (Lower middle

income countries) - 2012

Source: World Bank & CAL Research

31.1%

35.0%

38.8%

47.5%

49.4%

51.5%

0%

10%

20%

30%

40%

50%

60%

Figure 2: Private sector credit growth vs. GDP growth

of peer Asian countries (2009-12 Cagr)

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

0% 2% 4% 6% 8% 10% 12%

P

r

i

v

a

t

e

s

e

c

t

o

r

c

r

e

d

i

t

g

r

o

w

t

h

Singapore

Bangladesh

India

Malaysia

USA

Nepal

China

Vietnam

Indonesia Brazil

Sri Lanka

Philippines

South Africa

Bhutan

Turkey

Cambodia

Real GDP growth

Regional comparison of GDP growth vs. private credit growth

may indicate that a 7% GDP growth may lead to a c.14%

private credit growth (2x GDP)

Lower middle income country avg. 41%

SLs private sector credit to GDP declined

to 29% due to lower credit growth in 2013

-2%

0%

2%

4%

6%

8%

10%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

40%

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Private sector credit growth Real GDP growth

(LHS) (RHS)

SL private sector credit has grown at an avg. 2.7x of GDP

over 1997-2013

7

230

2,534

1,068

732

0

500

1,000

1,500

2,000

2,500

3,000

3,500

1996 2013

Real GDP (LKR mn) Credit to Private sector (LKR mn)

Figure 3: Private sector credit growth vs. GDP growth Figure 4: Private sector credit growth vs. GDP growth

Absolute correlation = +0.98

Correlation on differentials = +0.84

Source: CBSL & CAL Research

CAL expects medium term private credit to grow at a

15% Cagr through 2018E (2.5x GDP)

8

Figure 5: Real GDP growth 2011-13 & 2014-16E Figure 6: SL private sector credit

8.2%

6.3%

7.3%

7.0%

6.0% 6.0% 6.0% 6.0%

2011 2012 2013 2014E 2015E 2016E 2017E 2018E

2.5

5.1

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

2013 2018E

L

K

R

t

n

Source: CBSL & CAL Research

CAL expects a 6% Cagr GDP growth through 2018E which may lead to private sector

credit growing at a 15% Cagr, (2.5x GDP growth)

However, if SL were to reach the lower middle income country avg. private sector credit

to GDP of 41% by 2018E, SL private sector credit should grow at a 20% Cagr.

However in 2013, private sector credit grew a marginal 7.2%

YoY despite an easing monetary stance (-430bps YoY AWPLR)

9

Figure 7: Private sector credit growth YoY (2013-present)

15.5%

13.3%

10.9%

10.2%

9.3%

8.9%

8.4%

7.9%

7.6%

7.4%

7.3%

7.5%

5.6%

14.3% 14.4%

13.8%

13.5%

12.8%

12.1%

11.8% 11.8%

11.9%

11.3%

10.5%

9.9%

9.7%

4%

6%

8%

10%

12%

14%

16%

18%

Credit growth YoY Interest rates

Source: CBSL & CAL Research

CBSL cut policy rates by 50bps in May 2013 and 50bps in Oct 2013

CBSL also cut SRR by 200bps in July 2013 in order to boost liquidity

Drastic reduction in pawning advances and a decline in consumer spending

were the key reasons for lower private sector credit during 2013

- AWPLR

Loan growth of local private commercial banks (+15.3%

YoY) outperformed private credit growth (7.2% YoY)

10

Figure 8: Local private sector commercial banks loan growth - 2013

Source: Company data & CAL Research

26.5%

18.6%

17.4%

16.9%

11.6%

10.3%

8.4%

4.5%

0%

5%

10%

15%

20%

25%

30%

SAMP NDB UBC HNB NTB COMB SEYB PABC

Avg loan growth 15.3%

Local private commercial banks include the 8 listed commercial banks

while overall private sector credit includes government and foreign

commercial banks as well.

26.5%

25.4%

24.5%

22.9%

13.8%

14.1%

11.5%

12.2%

8.0%

9.1%

4.4% 4.7%

4.6% 4.6%

2.8% 2.8%

1.6%

1.5%

0.8%

0.8%

1.6%

1.8%

2012 2013

BOC PB COMB HNB SAMP NDB

SEYB NTB PABC UBC DFCC

as govt. banks drastically lost market share (-270bps

to 48%)

11

Source: Company data & CAL Research

Figure 10: Loan growth of state banks (2010-2013) Figure 9: Commercial banks market share 2012 & 2013*

382

553

715

755

406

508

661

681

35%

30%

4%

0%

5%

10%

15%

20%

25%

30%

35%

40%

0

200

400

600

800

1000

1200

1400

1600

2010 2011 2012 2013

L

K

R

b

n

BOC People's Bank Loan growth

*Market share calculation includes the pawning portfolio of banks and excludes foreign banks

Peoples Bank & BOCs loan book slowed down in 2013 as

pawning and loans to the govt took a hit which accounted for

62% of the total loan book in 2012.

51% 48%

Excluding the pawning portfolio, the govt banks market share

declined from 46% in 2012 to 44% in 2013

Loans to external trade was lackluster in 2013; may

turnaround on improving global trade in 2014 (+15% YoY)

12

-12.6%

21.8% 22.4%

-7.4%

6.3%

-27.6%

31.8%

50.7%

-5.3% -6.2%

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

2009 2010 2011 2012 2013

Exports Imports

Source: Company data & CBSL

Figure 12: Banks lending exposure to trading

Figure 11: SL external trade growth YoY (2009-13)

IMF expects US GDP to grow

2.8% and EU GDP to grow 1.6%

in 2014E (vs. 1.9% & 0.2% in

2013) which together account

for c.55% of SL exports

However, recovery in import

growth might depend on how

fast SL consumer spending

picks up in 2014

23.0%

19.2%

15.4%

16.0% 16.0%

14.4%

9.3%

27.3%

22.4%

21.6%

18.4%

15.5%

14.3%

11.2%

UBC SAMP SEYB HNB PABC COMB NDB

2012 2013

A slowdown in the pawning book also had an adverse impact

on private credit growth (c.20% of pvt. credit growth 2010-12)

Figure 14: Pawning advances of banks

Source: Company data & CAL Research

Figure 13: Components of credit growth 2009-13

-

10

20

30

40

50

60

SAMP HNB SEYB COMB PABC NTB NDB

L

K

R

b

n

2012 2013

The two state banks: Peoples Banks pawning portfolio

declined LKR 54bn to LKR 197bn in 2013 while BOCs

portfolio declined LKR 15bn to LKR 132bn

13

21%

9%

17%

-10%

13%

7%

17%

32%

5%

10%

7%

30%

9%

10%

1%

18%

22% 17%

-27%

35% 36%

38%

67%

2010 2011 2012 2013

Agriculture and Fishing Construction (includes housing)

Wholesale and Retail Trade Textile & apparel

Tourism Financial and Business Services

Pawning Others

Further, the housing market did not pick up despite the

dip in rates (+9% YoY)

14

112.8

136.1

133.4

160.1

174.6

17.4%

14.8%

13.4%

16.0%

15.2%

12%

13%

14%

15%

16%

17%

18%

0

20

40

60

80

100

120

140

160

180

200

2009 2010 2011 2012 2013

L

K

R

b

n

Housing AWLR

+9% YoY

(LHS) (RHS)

Figure 15: Private sector housing loan exposure vs.

AWLR

Source: CBSL & CAL Research

Figure 16: Loan book exposure to housing loans

Despite the decline in interest rates, housing loan rates have only declined 150bps YoY

as banks are unwilling to lock-in yields at current levels

6.6%

7.4%

4.7%

6.8%

4.2%

1.9%

0.3%

7.3%

6.9%

4.4%

6.0%

3.4%

1.7%

0.5%

0

5

10

15

20

25

30

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

COMB HNB SAMP PABC SEYB NDB NTB

2012-RHS 2013-RHS 2012 Exposure-LHS 2013 Exposure-LHS

L

K

R

b

n

and the leasing sector slowed down during 2013 as

vehicle registrations dipped (-18% YoY)

15

Figure 17: New vehicle registrations 2010 present

76%

46%

-24%

-18%

0%

-40%

-20%

0%

20%

40%

60%

80%

100%

-

100k

200k

300k

400k

500k

600k

2010 2011 2012 2013 Jan-Mar 2014

Y

o

Y

g

r

o

w

t

h

N

e

w

v

e

h

i

c

l

e

r

e

g

i

s

t

r

a

t

i

o

n

s

New vehicle registrations Growth

53%

110%

23%

2%

0%

20%

40%

60%

80%

100%

120%

0

50

100

150

2010 2011 2012 2013

Y

o

Y

g

r

o

w

t

h

L

K

R

b

n

Leasing & HP agreements Tractors & Motor vehicles Growth

Figure 18: Loans to leasing & hire purchase agreements and motor vehicles 2010-2013

Source: CBSL & Department of Motor Traffic

6.0%

3.2%

3.6%

1.8%

2.3%

1.4%

1.0%

5.9%

4.9%

3.8%

2.4%

2.0%

1.9%

1.8%

HNB SAMP COMB NDB SEYB UBC PABC

2012 2013

However, construction and tourism have been growing contributors to

loan book growth in 2013 (37% in 2013 vs. 19% in 2012)

16

Figure 22: Bank exposure to the tourism sector Figure 21: Bank exposure to the construction sector

Figure 20:Private sector loans to tourism &

contribution to loan growth

Figure 19:Private sector loans to construction &

contribution to loan growth

1%

3%

2%

5%

0%

1%

2%

3%

4%

5%

6%

25

35

45

55

65

2010 2011 2012 2013

Tourism Contribution to loan growth

L

K

R

b

n

%

e

x

p

o

s

u

r

e

13%

7%

17%

32%

0%

5%

10%

15%

20%

25%

30%

35%

200

250

300

350

400

2010 2011 2012 2013

Construction Contribution to loan growth

L

K

R

b

n

%

e

x

p

o

s

u

r

e

Source: CBSL & Company data

17.1%

12.6%

12.0%

9.5%

8.6% 8.6%

1.0%

16.3%

14.1%

11.5%

9.6%

9.4%

8.2%

1.7%

SEYB HNB UBC SAMP COMB NDB PABC

2012 2013

Agriculture loans (12% of the sector loans) may see a

further slowdown in 2014 with the prevailing drought

17

Source: Company data & CBSL

Figure 24: Banks lending exposure to agriculture

Figure 23: Commercial banks exposure to agriculture loans

12.7%

14.4%

13.0%

13.6%

12.0%

11%

12%

13%

14%

15%

100

150

200

250

300

350

2009 2010 2011 2012 2013

Agriculture loans Exposure to Agriculture

L

K

R

b

n

E

x

p

o

s

u

r

e

%

-5% YoY

Banks with heavy exposure to

agriculture may also see NPLs

rising with the drought

conditions in the country

14.8%

10.7%

10.0%

11.0%

9.4%

10.1%

6.2%

16.9%

12.6%

10.0% 10.0%

9.2%

8.7%

6.7%

NDB SAMP PABC COMB UBC HNB SEYB

2012 2013

CAL believes corporate debt issuances of LKR 11bn had a

minimal negative impact on private sector credit growth

Figure 25:Total debentures issued 2012-2013

18

18

Source: CBSL

Out of the LKR 68.3bn

debentures, only LKR 11bn was

issued by non finance

companies. Hence debentures

were not a major reason for

lower private credit growth

644

11000

0.18%

6.43%

0%

1%

2%

3%

4%

5%

6%

7%

-1000

1000

3000

5000

7000

9000

11000

13000

15000

2012 2013

Debentures As a % of Private credit growth

L

K

R

m

n

%

o

f

p

r

i

v

a

t

e

c

r

e

d

i

t

CAL expects 2014E private sector credit to grow 8% YoY and

listed private commercial banks loan book to grow 15% YoY

19

Figure 26: 2014E private sector credit growth &

listed banks loan book growth

Figure 27: Loan growth estimates for CALs banking

universe

18% 18%

16%

13%

12%

SAMP NDB HNB COMB NTB

Source: Company data & CAL Research

CAL expects the state banks to continue to lose market share in 2014E as growth remains slow in the pawning book which may

result in a 8% YoY growth in private sector credit. The foreign banks may also see their loan books shrinking as they curtail their

exposure to retail banking.

However, listed private commercial banks may see loan book growing 15% YoY in 2014E (vs. 15% in 2013) with growth stemming

from construction, renewable energy, external trade, tourism & infrastructure development projects.

1,465

1,684

2,534

1,053

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2,400

2,600

2,800

3,000

2013 2014E

L

K

R

b

n

Private commercial banks' loan book Private sector credit

+8%

+15%

II. NIMs are likely to fall to 4.2% in 2014

due to lower interest rates (-20bps lower)

20

II. NIMs are likely to fall to 4.2% in 2014E due to lower

interest rates (c.-20bps lower)

SL banks NIMs averaged 4.4% in 2013 down from 4.7% in 2012

Banks with a larger CASA base may see pressure on NIMs with the reduction in interest rates (-380bps YoY)

Margins may shrink for banks with heavy corporate loan exposure as competition intensifies

2013 deposits grew 17% YoY, despite a fall in interest rates as consumer spending slowed down

outpacing loan book growth (17% YoY vs.15% YoY)

Banks have cut deposit rates faster than NBFIs (-500bps vs. 345bps) due to excess liquidity

Govt banks have been losing CASA share to private banks

Banks may cut deposit rates further if excess liquidity continues to prevail & private credit remains lackluster

Overall interest rates may remain on the low side for 2014E (<10% AWPLR)

Supported by low inflation and reduced govt borrowings

However, rates may rise over the medium term when private credit picks up

CAL expects an uptick in private sector credit growth during 2H2014

21

SL banks NIMs averaged 4.4% in 2013 down from 4.7%

in 2012

22

Figure 28: Bank Net Interest Margins

Source: Company data & CAL Research

5.1%

5.3%

5.1%

4.8%

4.2%

3.8%

4.8%

4.7%

5.8%

5.1%

4.9%

4.5%

4.3%

3.7%

3.8%

3.5%

NTB HNB SEYB COMB SAMP NDB UBC PABC

2012 2013

Avg. 4.4%

Banks with a larger CASA base may see pressure on

NIMs with the reduction in interest rates (-380bps YoY)

23

Figure 29: Bank CASA base

Figure 30: Bps changes in NIMs in 2013

80

-1 -4 -22

-27 -27

-80

-128 -150

-100

-50

0

50

100

NTB SAMP NDB HNB COMB SEYB UBC PABC

Source: Company data & CAL Research

NTBs NIMs improved 80bps due to

c.40% of NTBs loan book being fixed at

higher rates, an improvement in the

CASA base and reclassification of swap

costs under trading costs.

44%

38%

33%

33%

25% 24%

19% 18%

15%

20%

25%

30%

35%

40%

45%

50%

COMB HNB SAMP SEYB NTB NDB PABC UBC

2012 2013

Avg. 29%

Savings deposits rates remain unadjusted irrespective of

the movement in interest rates

Hence, when lending rates decline, the margins on

savings and demand deposits decline

LKR 196bn 148bn 100bn 55bn 2bn 31bn 10bn 5bn

Margins may shrink for banks with heavy corporate

loan exposure as competition intensifies

24

55%

42%

36%

34%

34%

22%

21%

0%

10%

20%

30%

40%

50%

60%

NDB HNB COMB SAMP PABC SEYB NTB

Figure 33: Bank corporate loan book exposure Figure 34: AWPLR Vs. AWLR 2009-present

10.9%

9.3%

10.8%

14.4%

10.1%

8.8%

17.4%

14.8%

13.4%

16.0%

15.2%

14.7%

8%

10%

12%

14%

16%

18%

2009 2010 2011 2012 2013 Mar-14

AWPLR AWLR

Source: Company data & CBSL

Banks are lending at close to AWPLR to the corporates with the AWPLR declining

560bps since 2012 vs. a 130bps reduction in AWLR

2013 deposits grew 17% YoY, despite a fall in interest

rates as consumer spending slowed down

25

23.6% 22.7%

21.5%

20.5%

15.5%

14.1%

13.0%

12.4%

11.3%

11.0%

0%

5%

10%

15%

20%

25%

SAMP UBC BOC NDB COMB SEYB HNB PABC PBC NTB

Avg. deposit growth 17%

Figure 35: 2013 Banks Deposits growth

Source: Company data & CBSL

Figure 36: SL private consumption expenditure Figure 37: Domestic savings as a % of GDP

11.0%

18.4%

7.9%

3.0%

17.2%

25.1%

15.5%

9.9%

2010 2011 2012 2013

Total private consumption expenditure growth (nominal)

Total private consumption expenditure growth (real)

* Real consumption growth is after deducing inflation rates

19.3%

15.4%

16.9%

20.0%

2010 2011 2012 2013

outpacing loan book growth (17% YoY vs. 15% YoY)

26

Figure 38: Loan book growth vs. deposit growth Figure 39: Bank Loan to Deposit ratio- 2012-13

Source: Company data, CBSL & CAL Research

23.6%

20.5%

22.7%

13.0%

11.0%

15.5%

14.1%

12.4%

26.5%

18.6%

17.4%

16.9%

11.6%

10.3%

8.4%

4.5%

SAMP NDB UBC HNB NTB COMB SEYB PABC

Deposit growth Loan growth

Loan growth 15% YoY

Deposit growth 17% YoY

106%

93%

92%

89%

86% 86%

83%

82%

NDB COMB HNB SAMP NTB UBC PABC SEYB

2012 2013

13.0%

13.5% 13.5% 13.5% 13.5% 13.5%

14.0% 14.0%

15.0%

12.0%

12.5%

13.0%

13.5%

14.0%

14.5%

15.0%

15.5%

NDB HNB COMB SAMP DFCC NTB PABC SEYB UBC

Avg. 1-yr FD rates for banks - 13.7%

7

5

b

p

s

Maximum cap for 1-yr deposit rates for NBFCs - 14.45%

Banks have cut deposit rates faster than NBFIs (-500bps

vs. 345bps) due to excess liquidity

27

8.0%

7.5%

7.8%

8.3%

8.0%

7.5%

8.0%

8.5% 8.5%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

NDB COMB NTB DFCC HNB SAMP SEY UBC PABC

Avg. 1-Yr FD rate for Banks- 8%

Maximum cap for 1-yr deposit rates for NBFCs - 11%

3

0

0

b

p

s

Figure 31: Deposit rate gap in Apr 2013

Figure 32: Deposit rate gap in Apr 2014

Source: Company data, CBSL & CAL Research

Govt banks have been losing CASA share to private

banks

28

44.4%

42.4%

41.7%

44.0%

10.8% 9.9%

2.6% 2.9%

2010 2013

Others

Licensed Finance Co's

NSB

Private commercial banks

Govt commercial banks

Figure 40: Market share breakdown of savings

deposits

Figure 41: Market share breakdown of demand

deposits

Source: CBSL & company data

56%

43%

44%

57%

2010 2013

Private commercial banks

Govt commercial banks

Banks may cut deposit rates further if excess liquidity

continues to prevail & private credit remains lackluster

29

25.4%

21.5%

21.5% 22.0%

25.9%

21.0%

21.8%

21.6%

33.7%

27.2%

26.7%

26.2%

25.3%

23.8%

22.9%

22.0%

0%

5%

10%

15%

20%

25%

30%

35%

40%

COMB SAMP SEYB NDB NTB PABC HNB UBC

2012 2013

Figure 42: Bank statutory liquid ratio 2012 & 2013

Source: Company data

Overall interest rates may remain on the low side for

2014E (<10% AWPLR)

30

-115

-95

-75

-55

-35

-15

5

Figure 45: Net Injection/absorption (LKR bn)

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

Real interest rates have declined by

c.200bps since Jan 2012

Figure 43: Treasury bill Vs Inflation rates Figure 44: Real interest rates (2012-present)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

1 yr t-bill rates Inflation rate

Source: CBSL

Liquidity in the treasury

market has been on the rise,

which may keep treasury

rates at current levels.

6

8

10

12

14

16

J

a

n

-

1

3

F

e

b

-

1

3

M

a

r

-

1

3

A

p

r

-

1

3

M

a

y

-

1

3

J

u

n

-

1

3

J

u

l

-

1

3

A

u

g

-

1

3

S

e

p

-

1

3

O

c

t

-

1

3

N

o

v

-

1

3

D

e

c

-

1

3

J

a

n

-

1

4

F

e

b

-

1

4

M

a

r

-

1

4

A

p

r

-

1

4

%

1-yr t-bill yield AWPLR

Figure 46: Treasury bill Vs AWPLR

Supported by low inflation and reduced govt

borrowings

31

572

429

543

867

793

400

600

800

1000

2009 2010 2011 2012 2013

L

K

R

b

n

Figure 47: Incremental government borrowings 2009-2013

Figure 48: Inflation rates 2009- present

Source: CBSL

The loss reduction in CEB & CPC

post-price revisions. However risk

of higher government borrowings

remain due to higher thermal

power generation.

3.5%

6.2%

6.7%

7.6%

6.9%

4.2%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

2009 2010 2011 2012 2013 Mar-14

However, rates may rise over the medium term when

private credit picks up

32

6%

7%

8%

9%

10%

11%

12%

13%

2009 2010 2011 2012 2013

Tbill Tbond

T

r

e

a

s

u

r

y

r

a

t

e

s

%

4%

6%

8%

10%

12%

14%

16%

2009 2010 2011 2012 2013

AWDR AWPLR

Figure 49: 3mos avg. T-bill yield (1977-present)

Figure 50: Average deposit rates and Average prime lending rates 2009-2013

Source: CBSL

6.58

5.0

7.0

9.0

11.0

13.0

15.0

17.0

19.0

21.0

23.0

25.0

Simple Avg 1977-present = 12.9%

Current = 6.58%

%

3 month treasury

bills rates are at one

of the lowest point

in history

CAL expects an uptick in private sector credit growth

during 2H2014

33

Figure 51: GDP rates 2009-2013

3.5%

8.0%

8.2%

6.3%

7.3%

2009 2010 2011 2012 2013

Figure 52: Perceived Economic Opportunity Index (PEOI)

Figure 53: LMD-Nielson Business Confidence Index Figure 54: Private sector credit growth YoY

108

121

122

135

134

139

158

140

147

140

131

125

111

129

119

130

138

130

139

124

140

100

110

120

130

140

150

160

170

1.64

1.58

1.69

1.57

1.61

1.57

1.67

1.6

1.7

1.6

1.71

1.68

1.71

1.56

1.58

1.6

1.62

1.64

1.66

1.68

1.7

1.72

Mar-13 Apr-13 Jun-13 Aug-13 Sep-13 Nov-13 Jan-14 Feb-14 Apr-14

Source: CBSL & LMD

15.5%

13.3%

10.9%

10.2%

9.3%

8.9%

8.4%

7.9%

7.6%

7.4% 7.3%

7.5%

5.6%

4.4%

III. Individual banks may need to emphasize on

ROE improvement (2013 avg. 14% vs. 2014E

16%)

34

III. Individual banks may need to emphasize on ROE

improvement (2013 avg. 14% vs. 2014E 16%)

SL banks ROAs and ROEs have been trending downwards (-400bps YoY ROE)...

and have been unable to compensate for higher COEs compared to regional peers

Sri Lanka bank NIMs (avg 4.4% vs. regional avg 3.1%) have not been the reason for lower ROEs

Regional banks hold a higher fee & non-interest income component relative to SL banks

Banks are now increasingly focusing on improving fee income to compensate for possible

declines in NIMs

CIRs* of SL banks on the higher side electronic banking should be emphasized more

Larger banks CIR may improve further in 2014 as branch networks are consolidated

However, smaller banks may see pressure on CIR due to aggressive branch additions

SL banks credit cost ratio may revert to historical 0.5% vs. 1.1% in 2013 once impairment on

pawning subsides

SL banks may need to leverage further to improve ROEs (avg 10.6x Vs. regional avg. 16x)

as capital adequacy stands well above minimum requirement of 10% (avg 17%)

and ROAs remain sufficient (1.7% for 2014E)

CAL expects banking sector ROEs to average 16% in 2014E

35

* Cost to Income Ratio

SL banks ROAs and ROEs have been trending

downwards (-400bps YoY ROE)...

36

Figure 55: ROA & ROE of the commercial banking sector* Figure 56: Avg ROAEs of listed private

commercial banks

Source: Company data, CBSL & CAL Research

Figure 57: Average ROEs of listed banks 2012-13

*Figures include state & foreign banks

16.9%

18.0%

14.1%

2011 2012 2013

20.8% 20.7%

17.4%

21.3%

14.5%

10.4%

21.7%

9.8%

19.7%

18.2%

14.0%

12.2%

10.6% 10.5%

2.8%

1.9%

NTB COMB HNB SAMP NDB SEYB PABC UBC

2012 2013

1.1

1

1.8

1.7 1.7

1.3

13.4

11.8

22

19.8

20.3

16

0

5

10

15

20

25

0

1

2

3

4

5

2008 2009 2010 2011 2012 2013

Return on Assets-LHS Return on Equity-RHS

and have been unable to compensate for higher COEs

compared to regional peers

37

Figure 58: Regional Banking sector ROAE

Source: CAL Research & Maybank-Kimeng

Figure 59: 2013 COE vs. ROE gap

19.4%

20.0%

16.4%

15.1%

11.9%

14.7%

11.3%

14.1%

18.8%

17.0%

15.4% 15.3%

13.9%

13.2%

10.3%

16.0%

Indonesia China Thailand Malaysia Hong Kong Philippine Singapore Sri Lanka

2013 2014E

10 yr govt. bond rates have been taken as RFR and a

6% risk premium has been applied to calculate banking

sector COEs of countries.

2014E figures have been used for SL instead of 2013

due to the one-off impairment charges which diluted

the ROEs in 2013

14.0%

10.3%

9.5%

10.1%

8.2%

9.5%

8.5%

16.0%

5.4%

9.7%

6.9%

5.0%

3.7%

5.2%

2.8%

0.0%

COE Excess over COE

Sri Lanka bank NIMs (avg 4.4% Vs. regional avg 3.1%)

have not been the reason for lower ROEs

38

Figure 60: Regional banking sector NIMs

Source: CAL Research & Maybank-Kimeng

5.7%

4.4%

3.0%

2.7%

2.4%

1.7%

0%

1%

2%

3%

4%

5%

6%

Indonesia Sri Lanka Thailand China Malaysia Singapore

Regional avg. 3.1%

Regional banks hold a higher fee & non-interest

income component relative to SL banks

39

Figure 61: Regional fee income as a % of Gross

income

21%

20%

14%

12%

10%

7%

Thailand Singapore Malaysia Philippines Indonesia Sri Lanka

Avg. 14%

Source: Maybank-Kimeng & CAL Research

SL banks may need to focus more on wealth management products,

internet & mobile banking, investment banking, guarantees and

treasury products to grow their fee income and hence improve ROEs

Figure 62: Regional Non-Interest income as a % of

Gross income

41%

38%

37%

28%

20%

14%

Philippines Thailand Singapore Malaysia Indonesia Sri Lanka

Avg. 30%

Banks are now increasingly focusing on improving fee

income to compensate for possible declines in NIMs

40

25%

21%

17%

16%

13%

12%

12%

10%

0%

5%

10%

15%

20%

25%

30%

NTB NDB PABC SEYB SAMP HNB COMB UBC

2012 2013

Figure 63: Banks fee income as a % of operating income

Source: Company data & CAL Research

CIRs of SL banks on the higher side electronic banking

should be emphasized more

41

Figure 64: Regional banks cost-to-income ratio

Source: Company data, Maybank-Kimeng & CAL Research

51% 51%

46%

43%

43%

39%

0%

10%

20%

30%

40%

50%

60%

Sri Lanka Indonesia Malaysia Singapore Thailand China

Avg. 46%

CIR Old method-Operating expenses/Operating income

CAL uses the conventional cost-to-income ratio to compare cost-efficiency on a likely to like basis.

However, CAL uses the new CIR ratio [Operating costs/ (NII + Fee income)] for company comparisons

to exclude the impact from extra-ordinary items (e.g. forex gains)

Larger banks CIR may improve further in 2014 as

branch networks are consolidated

42

51%

60%

63%

60%

67% 67%

68%

82%

49%

57%

58%

59%

61%

62%

83%

106%

0%

20%

40%

60%

80%

100%

120%

COMB NTB HNB NDB SEYB SAMP PABC UBC

2012 2013

Avg. 67%

Figure 65: Bankscost-to-income ratio*

CIR = Operating costs/ (NII + Fee income)

See appendix 4 for comparison of operational

efficiencies of banks

Source: Company data & CAL Research

Large banks (COMB, HNB & SAMP) which rapidly expanded their

branch network during the last 3 years are now consolidating

their branch network and will see CIRs improving as new

branch additions start breaking-even.

However, smaller banks may see pressure on CIR due to

aggressive branch additions

43

250

236

212

151

77

78

72

58

0

50

100

150

200

250

0

10

20

30

40

50

60

70

80

HNB COMB SAMP SEYB PABC NDB NTB UBC

2009-2012 Branch additions 2013 branch additions Current branch network - RHS - LHS - LHS

Figure 66: Bank branch additions 2009-2012 & branch additions in 2013

Source: Company data & CAL Research

Smaller banks late in growing their

branch additions have started to increase

branch additions in recent times

SL banks credit cost ratio may revert to its historical 0.5%

vs. 1.1% in 2013 once impairment on pawning subsides

44

Figure 67: Regional banks credit cost ratio 2013*

Source: Maybank-Kimeng & CAL Research

Impact on ROE from higher impairment

charges may correct during 2014E when

impairment on pawning advances reduce

*Credit cost ratio = impairment charge/ Gross Loans

1.2%

1.1%

0.8%

0.4%

0.3%

0.2%

Indonesia Sri Lanka Thailand Philippines malaysia Singapore

Avg. 0.67%

SL banks may need to leverage further to improve ROEs

(avg 10.6x s. regional avg. 16x)

45

7.5x

8.4x

9.1x

9.6x

9.9x

12.1x

12.4x

16.0x

0

2

4

6

8

10

12

14

16

18

UBC NDB HNB SEYB COMB NTB SAMP PABC

Leverage Ratio as at 31st Dec 2012

Leverage Ratio as at 31st Dec 2013

Avg. Leverage 10.6x

Figure 69: Leverage of SL banks (x)

Source: McKinsey Research & CAL Research

Figure 68: Leverage Ratio* of regional banks

SL banks should be able to increase leverage to

12-14x vs avg. 10.6x in 2013

*Leverage ratio = Assets/Equity

as capital adequacy stands well above minimum

requirement of 10% (avg 17%)

46

Figure 70: 2013 Tier 1 capital Figure 71: 2013 Tier 2 capital

10.1%

10.3%

13.3% 13.3%

14.8%

15.0%

15.2%

18.1%

SAMP PABC COMB HNB NTB SEYB NDB UBC

Avg. 14%

Minimum requirement = 5%

21.0%

20.0%

17.0% 16.9% 16.9%

16.1%

14.1%

11.9%

NDB NTB UBC COMB HNB SEYB SAMP PABC

Source: Company data & CAL Research

Avg. 17%

Minimum requirement = 10%

and ROAs remain sufficient (1.7% for 2014E)

47

1.9%

2.1%

1.9%

1.7%

1.9%

1.2%

1.7% 1.7%

1.6%

1.9%

1.0%

1.6%

1.4%

1.2%

0.2%

0.3%

HNB COMB SAMP NTB NDB SEYB PABC UBC

2012 2013

Figure 72 : Average ROAs for listed banks 2012-13

Source: Company data & CAL Research

Figure 73 : Average ROAs for regional banks

2.4%

1.8%

1.3%

1.2%

1.8%

1.2%

2.5%

1.7%

1.5%

1.2%

1.2%

1.0%

Indonesia Phillipines Thailand Malaysia Sri Lanka Singapore

2012 2013

SL banks 2014E ROAs may avg. 1.7%

when impairment on pawning advances

subside

CAL expects banking sector ROEs to average 16% in

2014E

48

16.9%

18.0%

14.1%

16.0%

2011 2012 2013 2014E

Figure 74: ROEs of listed private commercial banks

Source: Company data & CAL Research

Figure 75: 2014E ROEs for CAL coverage banks

18.8%

17.2%

17.0%

14.4%

13.0%

NTB COMB SAMP HNB NDB

IV. 2014E bottom-line growth may stem from lower

impairment charges & improving CIRs (profit growth

2013 -22% vs. 18% in 2014E)

49

IV. 2014E bottom-line growth may stem from lower impairment

charges & improving CIRs (profit growth 2013 -22% vs. 18% in 2014E)

Local private commercial banks earnings declined 22% YoY in 2013 on the back of

higher impairment charges (+158% YoY)

Declining gold prices led to the recognition of large impairment charges on pawning

advances

Growing NPLs were also a contributor to higher impairment charges (+110bps YoY)

Nevertheless, core profit growth has been robust for NTB (42% YoY) & SAMP (39%

YoY)

We expect our banking coverage universe to provide a 23% YoY earnings growth

NPLs may edge down once pawning portfolio stabilizes amidst stress

Banks may be able to withstand impairment charges on pawning advances up to a

15% YoY reduction in gold prices (USD 1044/Oz )

50

Local private commercial banks earnings declined 22% YoY

in 2013 on the back of higher impairment charges (+158%

YoY)

51

Figure 76: Banks 2013 net profit growth

Source: Company data & CAL Research

13%

10%

3%

-4%

-11%

-33%

-80%

-87%

SEYB NTB COMB HNB NDB SAMP UBC PABC

SAMP provided LKR 3bn as

impairment charge for pawning

advances which resulted in bottom-

line declining 33% YoY

LKR 2bn was provided as impairment

for pawning as well as for a large

ticker Maldivian hotelier

NDBs earnings were down 11% YoY

mainly due to a c. LKR 700mn one-

off impairment charge on a single

borrower

Declining gold prices led to the recognition of large

impairment charges on pawning advances

52

Figure 77: 2013 vs. 2012 impairment charges

Source: Company data & CAL Research

3,574

3,305

1,362

-743

451

4,600

1,261

292

20.2%

12.9%

10.5%

6.7%

2.9%

1.7% 1.6%

-1%

4%

9%

14%

19%

24%

-2000

-1000

0

1000

2000

3000

4000

5000

SAMP HNB SEYB PABC NTB COMB NDB UBC

L

K

R

m

n

Impairment Charges 2012 Impairment Charges 2013 Exposure to Gold

Growing NPLs (net of impairment) were also a contributor

to higher impairment charges (+110bps YoY)

53

Figure 78: Banking sector gross NPLs 2013

Source: Company data & CAL Research

384

281

230

156

117

69

61

51

-2

-241

-300

-200

-100

0

100

200

300

400

500

PABC UBC PBC BOC NDB NTB SAMP COMB HNB SEYB

Figure 79: Growth in NPLs 2013 (bps)

9.96%

5.90%

7.25%

3.62% 3.50% 3.15%

2.15% 2.31%

SEYB UBC PABC COMB HNB NTB SAMP NDB

NPLs Net of pawning Gross NPL

10.58

8.24%

8.01%

3.88% 3.64% 3.52%

3.68%

2.48%

Nevertheless, core profit growth has been robust for

NTB (42% YoY) & SAMP (39% YoY)

54

42%

39%

29%

26%

18%

13%

-53%

-134%

NTB SAMP SEYB NDB COMB HNB PABC UBC

Figure 80: Banks core profit growth 2013

Source: Company data

We expect our banking coverage universe to provide a

23% YoY earnings growth

55

Source: Company data & CAL Research

26%

20%

19%

13%

9%

NDB SAMP NTB COMB HNB

Even amidst strong core profit growth,

CAL does not recommend a BUY on

NDB due to inadequate ROEs (12%)

Figure 82: 2014E core profit growth Figure 81: 2014E earnings profit growth

56%

27%

13%

12%

6%

SAMP NDB HNB NTB COMB

SAMP may see the highest growth as

impairments from gold loans reduce

NPLs may edge down once pawning portfolio stabilizes

amidst stress

56

6.3%

8.5%

5.4%

3.8%

3.7%

5.6%

4.5%

3.4%

5.0%

3.0%

2.1%

2.2%

3.8%

2.9%

2008 2009 2010 2011 2012 2013 2014E

Gross NPLs Net NPLs

Source: CBSL & CAL Research

Figure 83: Gross & Net NPLs of banks 2013 & 2014E

NPLs on the pawning

portfolio was 12% in 2013

Banks may be able to withstand impairment charges on pawning

advances up to a 15% YoY reduction in gold prices (USD 1044/Oz )

57

Figure 84: 2014E impairment charge sensitivity to different gold price assumptions

1050

1200

1292 1300

Goldman Sachs CAL's estimate HSBC UBS

Figure 85: 2014 gold price estimates Figure 86: Global gold prices 2011-present (USD/Oz)

Source: Bloomberg and CAL research

1000

1400

1800

2200

Column1 COMB HNB SAMP NTB NDB

-10%

0 0 0 0 0

-15%

32 - 214 - 250 - 11 - 10 -

-20%

128 - 844 - 983 - 44 - 41 -

-25%

223 - 1,473 - 1,717 - 77 - 71 -

-30%

318 - 2,102 - 2,450 - 110 - 102 - G

o

l

d

p

r

i

c

e

r

e

d

u

c

t

i

o

n

IS Impairment charge (LKR mn)

CAL assumes that banks lent pawning

advances at a 65% LTV post May 2013 (vs.

80% before) and assumes a 20% default rate.

CAL believes that banks may need not

provide any further large impairment charges

on pawning advances unless there is a 15%+

reduction in gold prices (USD 1044/Oz)

V. CALs Top picks in the Banking sector are

SAMP (TP LKR 221, +14.6%) and NTB (TP LKR 80,

+19.6%)

58

Banks trade on avg. 2013 PER of 8.8x and PBV of 1.3x

59

Source: Company data & CAL Research

0.6x

0.9x

0.9x

1.0x

1.1x

1.2x

1.2x 1.2x

1.3x

1.3x

1.7x

5.4x

6.4x

8.8x

8.4x

7.9x

41.2x

6.7x

11.2x

55.7x

7.8x

9.6x

0

10

20

30

40

50

60

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

SEYB.X HNB.X SEYB SAMP HNB PABC NTB NDB UBC COMB.X COMB

PBV PER

- RHS - LHS

Figure 87: Private commercial banks 2013 PER & PBV (x)

and provided an avg. 5% dividend yield for 2013

60

Source: Company data & CAL Research

Figure 88: Dividend yield for banks - 2013

7.6%

6.9%

6.5%

6.1%

5.3%

5.3%

3.6%

HNB.X COMB.X SAMP HNB NDB COMB.N NTB

HNB.N

Figure 89: 2014E dividend yield for CALs coverage

7%

7%

6% 6% 6%

6%

4%

3%

3%

2%

0%

0%

1%

2%

3%

4%

5%

6%

7%

8%

Avg. 4.8%

CALs top picks among the banking sector stocks are

NTB & SAMP (avg. 22.4% 1-yr total return)

Bank

Current

Price

Recommen

dation

Target

Price

Price

upside

2014E

ROE

2014E

ROA

Core

profit

growth

2014E

Net

profit

growth

2014E

PBV

2014E

(x)

PER

2014E

(x)

Dividend

yield

2014E

Total

Return

Nations Trust Bank 66.9 BUY 80 19.6% 18.85% 1.60% 18.6% 12.1% 1.1 6.3 3.7% 23.3%

Sampath Bank 192.8 BUY 221 14.6% 16.98% 1.38% 20.0% 56.3% 0.9 5.4 6.9% 21.5%

Hatton National Bank - Non

Voting

126.8 HOLD 131 3.3% 14.37% 1.57% 9% 13.1% 0.8 5.5 7.5% 10.8%

Hatton National Bank - Voting 157.9 HOLD 160 1.3% 14.37% 1.57% 9% 13.1% 1.0 7.0 6.0% 7.3%

Commercial Bank- Non Voting 97 HOLD 104 7.2% 17.17% 1.76% 12.7% 6.3% 1.2 7.5 6.9% 14.2%

National Development Bank 194.5 HOLD 171 -12.1% 12.96% 1.50% 26.1% 26.9% 1.1 8.8 5.7% -6.38%

Commercial Bank- Voting 127.4 SELL 123 -3.8% 17.17% 1.76% 12.7% 6.3% 1.6 9.8 5.3% 1.4%

61

Source: CAL Research

Sampath Bank [SAMP.N0000] to deliver 1-year total

return of +21.5%-BUY

Sampath Bank PLC (SAMP LKR 192.8; Market Cap USD 245mn): is the third

largest commercial bank in Sri Lanka. SAMPs 2013 net interest income

grew 25% YoY to LKR 15.1bn on the back of a 26% YoY net loan growth

(vs. CALs 23% YoY). CAL expects lower private sector credit growth in

2014 to keep SAMPs loan growth at 18% YoY and NIMs to contract 25bps

as the banks CASA (33% in 2013) does not reprice to the decline in interest

rates which may result in NII growing 12% YoY to LKR 17bn in 2014E.

Fee income growth (+19% YoY) primarily stemming from the card business

aided the NII growth and led to core profits growing 39% YoY to LKR 6.6bn

in 2013. Cost-to-income ratio of the bank improved from 67% in 2012 to

62% in 2013 as the bank benefited from recent branch additions breaking-

even. CAL expects SAMPs core profits to grow 20% YoY to LKR 8bn in

2014E.

With SAMP reducing LTVs on new pawning advances to c.65%, CAL

expects no major impairment provisioning for pawning advances during

2014. Pawning advances lent at an avg. price of USD 1300/Oz may provide

a cushion down to a gold price of USD 997/Oz (-22% fall from current level

of USD 1283/ Oz). The banks NPLs may remain flat at 2.7% (vs. 2.1% in

2012) for 2014E.

CAL expects SAMPs 2014E earnings to reach LKR 5.7bn (includes a LKR

1.5bn impairment provision) as impairment on gold loans subsides during

2014. SAMP currently trades on a 5.4x PER and 0.9x PBV on 2014E

financials vs. BFI sector PER of 9.3x and PBV of 1.2x and may provide a

17% ROE for 2014E. CAL maintains a BUY on SAMP based on a justified

PBV based target price of LKR 221 (vs. its previous LKR 219). The counter

may provide an LKR 12.5 DPS for 2014E which may translate into a

dividend yield of 6.9% (may include scrip dividends). BUY

62

70

80

90

100

110

120

SAMP ASPI (Source- www.cse.lk)

Market Cap (USD): 245mn

6 mos Avg. Daily T/O (USD): 199k

6mos H/L LKR 195/163

Free Float : 85%

Current Price (LKR): 192.9

YEAR END DEC (LKR mn) 2012

CAL's

2013E

Actual

2013

Revised

2014E

Revised

2015E

Net interest income 12,039 15,773 15,095 16,931 19,900

Net interest income growth 31% 25% 12% 18%

Core Profit 4,770 7,405 6,647 7,980 10,442

Core Profit growth 55% 39% 20% 31%

Profit attributable to equity holders 5,440 3,726 3,638 5,687 6,991

Profit growth -32% -33% 56% 23%

EPS (LKR) 32.4 22.2 21.7 33.9 41.6

NAVPS (LKR) 165.4 177.3 188.8 209.9 236.1

DPS (LKR) 12.0 8.2 8.0 12.5 15.4

PER (x) 6.0 8.7 8.9 5.4 4.4

P/BV (x) 1.2 1.1 1.0 0.9 0.8

Dividend Yield % 6.2% 4.3% 4.1% 6.9% 8.5%

Nations Trust Bank[NTB.N0000] to deliver 1-year total

return of +23%-BUY

Nations Trust Bank PLC (NTB LKR 66.9; Market Cap USD 116mn):

NTB is one of the fastest growing banks in SL with a loan book of

LKR 82bn (+12% YoY) and a deposit base of LKR 95bn (+11% YoY)

representing a market share of c.6% among private sector banks.

NTBs net interest margins expanded from 5.1% in 2012 to 5.8% in

2013 as NTBs CASA base improved to 25% (vs. 22% in 2012). NTBs

exposure to high yield fixed products such as leasing and credit

cards may continue to benefit from declining interest rates enabling

NIMs to remain stable at current levels (5.7% for 2014E). CAL

expects NTBs loan book to grow 12% YoY in 2014E and NII to grow

12% to LKR 8.6bn.

A 21% YoY growth in fee based income originating from the card

business (+31% YoY) and an improving cost-to-income ratio (57% in

2013 vs. 60% in 2012) led to 2013 core profits growing 42% YoY to

LKR 4.4bn. CAL expects NTBs 2014E fee income to grow 20% YoY

and core profits to reach LKR 5.2bn (+19% YoY). The bank may

continue its aggressive branch expansion program adding another

15 branches in 2014E. CAL expects credit costs to be c.0.6% of

gross loans which may result in an LKR 530mn impairment charge

for 2014E while bottom-line is expected to grow 12% YoY to LKR

2.4bn.

On 2014E financials, NTB trades on a 6.3x PER & 1.1x PBV vs. BFI

sector PER of 9.3x & PBV of 1.2x. CAL maintains a BUY on NTB

based on higher ROEs (19% in 2014E vs. sector avg. 15%), stable

NIMs, moderate growth in core profits (+19% YoY) and a 1-year

target price of LKR 80 (+19.6%) which may provide a total return of

23.3% including dividends. NTB may declare an LKR 2.4 DPS for

2014E which may translate into a 3.7% dividend yield. BUY

63

90

95

100

105

110

115

NTB ASPI

(Source- www.cse.lk)

Market Cap (USD): 116mn

6 mos Avg. Daily T/O (USD): 65k

6mos H/L (LKR): 69/59.5

Free Float: 80%

Current Price (LKR): 66.9

YEAR END DEC (LKR mn) 2012

CAL's

2013E

Actual

2013

Revised

2014E

Revised

2015E

Net interest income 5,755 7,150 7,675 8,621 9,711

Net interest income growth 24% 33% 12% 13%

Core Profits 3,102 4,139 4,400 5,217 6,112

Core Profit growth 33% 42% 19% 17%

Profit attributable to equity holders 1,935 2,116 2,136 2,394 2,875

Profit growth 9% 10% 12% 20%

EPS (LKR) 8.4 9.2 9.3 10.4 12.5

NAVPS (LKR) 43.2 50.6 50.9 59.3 68.9

DPS (LKR) 2.1 2.4 2.1 2.4 2.9

PER (x) 7.7 7.1 7.0 6.3 5.2

P/BV (x) 1.5 1.3 1.3 1.1 0.9

Dividend Yield % 3.2% 3.7% 3.2% 3.7% 4.4%

Hatton National Bank[HNB.X0000] to deliver 1-year total

return of +10.8%-HOLD

Hatton National Bank PLC (HNB V/NV LKR 157.9/126.8; Market Cap USD

382mn). HNB is the second largest private commercial bank, with a loan

book of LKR 353bn (+16% YoY) and a c.24% private bank market share.

HNBs net loan book grew 16% YoY in 2013 to LKR 353bn with growth

mainly stemming from the corporate loan portfolio (c.40% of the loan

book). A larger CASA base (38%) not re-pricing for the reduction in interest

rates and corporate lending rates being squeezed by stiff competition may

lead to HNBs NIMs shrinking by c.25bps to 4.8% in 2014E. CAL expects

HNBs loan book to grow 16% YoY to LKR 409bn whilst NII to grow 9% YoY

to LKR 27bn.

The banks 2013 fee based income grew 15% YoY to LKR 4bn with strong

growth being witnessed in fee commissions from cards and guarantees.

Cost-to income ratio of the bank reduced from 63% in 2012 to 58% in 2013

(63% recurring CIR) as personnel costs declined 17% YoY. CAL expects

recurring CIR to remain flat at 63% for 2014E due to slower income growth

while core profits are anticipated to grow 9% YoY to LKR 11.7bn.

HNBs 2013 earnings declined 4% YoY to LKR 7.7bn as the bank provided

LKR 1.2bn as impairment provisioning for pawning advances. With the

banks exposure to pawning advances now reduced to 11% from 15% in

2012 and LTVs on new gold loans reducing to c.60%, CAL expects HNBs

earnings to grow 13% YoY to LKR 8.7bn as impairment charges decline.

On CALs 2014E financials, HNB.X trades on a 5.9x PER and 0.8x PBV (vs.

BFI sector PER of 9.3x & PBV of 1.2x). CAL maintains a HOLD on HNB.X at

a 1-year target price of LKR 131/share (vs. its previous LKR 148), narrowing

discounts to the voting share (18% current vs. avg. 30% in 2012-13)

attractive valuation multiples (5.5x PER & 0.8x PBV) and a dividend yield of

7.5% for 2014E. HOLD

64

80

90

100

110

120

HNB V HNB NV ASPI (Source- www.cse.lk)

Market Cap (USD): 382mn

6 mos Avg. Daily T/O V & NV (USD): 218K/37k

6mos H/L (LKR) -V: 162/141

6mos H/L (LKR) -NV: 109.9/128.4

Free Float V & NV: 67%/99%

Current Price V/NV (LKR): 157.9/126.8

YEAR END DEC (LKR mn) 2012 CAL's 2013E Actual 2013

Revised

2014E

Revised

2015E

Net interest income 22,424 26,094 25,050 27,193 31,117

Net interest income growth 16% 12% 9% 14%

Core profit 9,802 11,680 10,739 11,746 14,277

Core Profit growth 19% 10% 9% 22%

Profit attributable to equity holders 7,942 8,836 7,650 8,654 10,408

Profit growth 11% -4% 13% 20%

EPS (LKR) 19.9 22.1 19.1 21.6 26.0

NAVPS (LKR) 130.1 142.6 143.9 157.2 173.2

DPS (LKR) 8.5 9.8 8.5 9.5 11.4

PER (x) - Voting/ Non-voting 8 / 6.4 7.1 / 5.7 8.3 / 6.6 7.3 / 5.9 6.1 / 4.9

P/BV (x)- Voting/ Non-voting 1.2 / 1 1.1 / 0.9 1.1 / 0.9 1 / 0.8 0.9 / 0.7

Dividend Yield % - Voting/ Non-voting 5.4%/6.7% 6.2%/7.7% 5.4%/6.7% 6%/7.5% 7.3%/9.0%

90

100

110

120

ASPI COMB.X0000 COMB.N0000

Commercial Bank [COMB.X] to deliver 1-year total return

of +14.2%-HOLD

Commercial Bank of Ceylon PLC (COMB V/NV LKR 127.4/97; Market

Cap USD 777mn): COMB is the largest private commercial bank in

SL with a loan book of LKR 379bn (+10% YoY) and a c.26% private

bank market share. Growth in the loan portfolio primarily stemmed

from the corporate book (c.40% exposure). CAL expects 2014E NIMs

to avg. 4.4% (vs. 4.5% in 2013) as the banks CASA base (44%)

remains unadjusted to the decline in interest rates and expects loan

book to grow 13% YoY to LKR 429bn which may result in NII

growing marginally by 10% YoY to LKR 27.9bn.

The banks 2013 fee income rose 18% YoY supported by strong

growth in the card business (+28% YoY). CAL expects 2014E fee

income to grow by 15% YoY and CIR to be 48%, which may lead to

core profits growing 13% YoY to LKR 17.1bn. COMBs 2013 net

earnings rose 5% YoY to LKR 10.6bn despite core profits growing

18% YoY. COMB recorded a trading loss of LKR 1.6bn vs. a gain of

LKR 2.5bn in 2012 as the bank swapped USD 140mn for currency

exchange rate risk. CAL expects 2014E earnings to grow marginally

by 6% YoY to LKR 11.2bn as one-off gains (forex revaluation gain)

subside.

COMB.X trades at a 7.8x PER and 1.2x PBV (vs. BFI PER of 9.2x and

1.2x PBV). CAL downgrades COMB.X to a HOLD based on a 1-year

target price of LKR 104 (+7.2%) factoring in a reversion to 2013 avg.

discount of 18% to the voting share (vs. current 24%) and a

reasonable dividend yield (6.9%). HOLD COMB.X; SELL COMB.N

65

Market Cap (USD): 777mn

6 mos Avg. Daily T/O (USD) V/NV: 439k/44k

6mos Price H/L V (LKR): 131.5/ 112

6mos Price H/L NV (LKR): 99/ 87.9

Free Float V/NV: 85%/100%

Current Price V/NV (LKR): 127.4/97

YEAR END DEC (LKR mn) 2012

CAL's

2013E

Actual

2013

Revised

2014E

Revised

2015E

Net interest income 22,852 24,964 25,322 27,905 30,781

Net interest income growth 9% 11% 10% 10%

Core Profits* 12,882 14,635 15,211 17,140 18,858

Core Profit growth 14% 18% 13% 10%

Profit attributable to equity holders 10,080 9,798 10,563 11,229 12,243

Profit growth -3% 5% 6% 9%

EPS (LKR) 12.1 11.5 12.4 13.0 13.9

NAVPS (LKR) 63.6 69.9 72.4 80.3 88.7

DPS (LKR) 6.5 6.2 6.5 6.7 7.0

PER (x) - Voting/ Non-voting 10.5 / 8 11.1 / 8.4 10.2 / 7.8 9.8 / 7.5 9.1 / 7

P/BV (x)- Voting/ Non-voting 2 / 1.5 1.8 / 1.4 1.8 / 1.3 1.6 / 1.2 1.4 / 1.1

Dividend Yield % - Voting/ Non-voting 5.6%/7.2% 6.5%/8.3% 5.1%/6.7% 5.3%/6.9% 5.5%/7.2%

National Development Bank[NDB.N0000]-HOLD

National development Bank (NDB LKR 194.5; Market Cap USD 242mn):

Despite NDBs loan book only growing 6% Jan-Sep 2013, aggressive

lending during 4Q2013 resulted in the loan book closing at LKR 137bn

(+18% YoY vs. industrys 15% YoY). Higher growth came from loans to

renewable energy, export financing, agriculture and infrastructure lending

segments. In addition, the banks NIMs remained almost flat (3.7% in 2013

vs. 3.8% in 2012) as the bank enacted minimum lending rates and benefited

from declining deposit rates.

The bank witnessed a 40% YoY robust growth in fee income primarily

materializing from wealth management, bank assurance, guarantees and

charges for loans and deposits which supported the growth in NII. Further,

the cost-to-income ratio of the bank improved from 60% in 2012 to 59% in

2013 even amidst the bank adding 9 branches during the year and

operating costs rising 24% YoY. NDBs 2013 net earnings were down 15%

YoY to LKR 2.6bn mainly due to impairment charges rising from LKR 51mn

in 2012 to LKR 1.3bn in 2013. However, c.LKR 800mn out of the LKR 1.2bn

impairment charge was one-off and was provided for a single corporate

client. Nevertheless, the banks NPLs rose from 1.3% in 2012 to 2.5% in

2013 and CAL expects 2014E NPLs to be close to 3% as the agri segment

may be impacted by the drought.

NDB currently trades on a 2014E PER of 8.8x & PBV of 1.1x vs. banking

sector avg. PER of 9.3x and PBV of 1.2x. If the proposed merger with DFCC

goes ahead, the combined entity may have LKR 378bn in assets, LKR

243bn in loans, LKR 63bn in equity and c.210 branches, making the

combined entity the fourth largest among the private sector commercial

banks. CAL maintains a HOLD on NDB due to lower ROEs (13% for 2014E)

being insufficient to compensate for a higher COE (c.16%). CALs target

price for NDB is LKR 171 (-12.1% YoY) and may provide an LKR 10 DPS

which may translate into a dividend yield of 5.7%. HOLD.

66

Market Cap (USD): 242mn

6 mos Avg. Daily T/O (USD) : 207k

6mos Price H/L (LKR): 188/145

Free Free Float :76%

Current Price : 194.5

70

80

90

100

110

120

NDB.N0000 ASPI

YEAR END DEC (LKR mn) 2012

CAL's

2013E

Actual

2013

Revised

2014E

Revised

2015E

Net interest income 5,819 7,251 7,012 8,405 10,174

Net interest income growth 25% 20% 20% 21%

Core Profits 3,043 3,881 3,859 4,881 6,196

Core Profit growth 28% 27% 26% 27%

Profit attributable to equity holders 3,103 3,249 2,642 3,353 4,086

Profit growth 5% -15% 27% 22%

EPS (LKR) 18.8 19.7 16.0 20.3 24.8

NAVPS (LKR) 150.9 153.4 148.7 165.2 185.1

DPS (LKR) 15.0 7.9 10.0 10.2 12.4

PER (x) 10.3 9.9 12.1 8.8 7.2

P/BV (x) 1.3 1.3 1.3 1.1 1.0

Dividend Yield % 7.7% 4.1% 5.1% 5.7% 7.0%

Key ratios for CALs banking universe

67

SAMP NTB HNB COMB NDB

2012 2013 2014E 2012 2013 2014E 2012 2013 2014E 2012 2013 2014E 2012 2013 2014E

Yield Ratios

Net interest margins 4.9% 4.8% 4.6% 5.8% 6.4% 6.3% 6.1% 5.8% 5.5% 5.4% 5.0% 4.8% 4.2% 4.0% 4.0%

Yield on avg. earning assets 4.2% 4.3% 4.1% 5.1% 5.8% 5.8% 5.3% 5.1% 4.8% 4.8% 4.5% 4.4% 3.8% 3.7% 3.8%

Average cost of funding 8.3% 8.7% 7.4% 9.6% 8.9% 6.9% 7.2% 7.6% 6.4% 7.2% 7.6% 6.4% 9.0% 8.6% 6.8%

Fee Income as a % of NII 18.3% 17.3% 18.3% 35.5% 32.6% 35.1% 15.6% 16.1% 17.2% 18% 19% 20% 29.6% 34.4% 34.3%

Core profit margin 14.6% 15.7% 18.1% 20.5% 24.6% 29.7% 19.8% 21.6% 20.3% 25.5% 25.5% 28.2% 17.7% 18.6% 22.9%

Liquidity & Balance Sheet composition

Liquid assets/Customer deposits 23.1% 21.1% 15.9% 36.3% 46.2% 43.0% 27.5% 26.9% 26.8% 19.0% 28.3% 26.0% 21.4% 19.1% 20.6%

Avg. customer deposits/Avg. total

funding 77% 77% 79% 69% 69% 68% 74% 74% 74% 75% 75% 75% 59.8% 62.2% 63.0%

CASA Ratio 34% 33% 35% 22% 25% 26% 39% 38% 40% 45% 44% 44% 24% 24% 27%

Loan-to-deposit ratio 88% 89% 89% 85% 86% 86% 89% 92% 91% 96% 93% 93% 109% 106% 106%

Leverage Ratio 11.3 12.3 12.2 12.3 12.1 11.5 8.7 9.0 9.4 9.7 9.9 9.7 6.8 8.2 8.6

Efficiency Ratios

Cost-to-income ratio (Old)* 52% 54% 53% 56% 58% 58% 56% 52% 56% 41% 40% 43% 30% 48% 49%

Cost-to-income ratio (New) 67% 62% 60% 60% 57% 55% 63% 58% 63% 51% 49% 48% 60% 59% 57%

Personnel cost/ total op. expenses 44% 42% 43% 45% 43% 44% 44% 36% 41% 58% 58% 58% 52% 48% 47%

Operating cost/branch 45,312 52,198 56,324 82,411 80,257 73,928 36,981 43,105 46,539 55,605 58,390 63,035 31,355 37,226 38641

Asset Quality

Gross NPL ratio 2.1% 2.7% 2.5% 2.8% 3.1% 3.3% 3.7% 3.6% 3.8% 3.4% 3.9% 3.8% 1.3% 2.4% 2.7%

Credit cost ratio 0.04% 1.44% 0.44% 0.6% 0.6% 0.6% 0.4% 1.0% 0.4% 0.9% 1.1% 0.6% 0.0% 1.0% 0.5%

Loan loss provisions/ Gross Loans 3.2% 3.6% 0.0% 2.4% 2.1% 2.2% 2.4% 2.9% 2.9% 3.5% 3.6% 3.3% 2.5% 3.0% 3.0%

Growth rates (%)

Net interest income YoY 30% 25% 12% 54% 19% -2% 33% 12% 9% 22% 11% 10% 19% 20% 20%

Net loans book YoY 24% 26% 18% 20% 12% 12% 18% 16% 16% 19% 12% 13% 24% 17% 18%

Core profit YoY 34% 39% 20% 48% 42% 19% 53% 13% 9% 23% 18% 13% 223% -70% 26%

Net profit YoY 48% -33% 56% 14% 10% 12% 16% -4% 13% 27% 5% 6% 250% -70% 27%

Source: CAL Research

CIR Old method-Operating expenses/Operating income

CIR New method-Operating expenses/Net interest and fee income

VI. APPENDICES

68

Appendix 1 : DuPont analysis for banks - 2013

69

Dupont

Analysis

ROAE - Net Profit/Average

Equity

ROAA- Net Profit/Average

Assets

Operating profit margin-

Net Operating

Income/Average Assets

Core profits margin- Core

profits/ Average Assets

Net interest Margin- Net

interest income/Average

assets

Net fee and commission %-

Net fee and commission/

Average assets

(-) Operating expense %-

Operating expenses/

Average assets

Other operating income

margin- Other operating

income/ Average Assets

Net loss from trading %-Net

loss from trading/ Average

assets

(+) Net gain from financial

investments %-Net gain

from fin. inv/ Average

assets

(+) Other operating income

% (including translation

gains) %-Other operating

income/ Average assets

Impairment multiplier-

Profit before VAT & Income

tax/Net Operating Income

Tax multiplier-Net profit/

Profit before VAT and

income tax

Leverage - Average

Assets/Average Equity

Calculation methodology

Du Pont Analysis 2013 HNB COMB SAMP NTB NDB SEYB PABC UBC

Average Return on Equity 13.99% 18.22% 11.45% 19.68% 10.62% 10.50% 2.77% 1.90%

Average Return on Assets 1.59% 1.86% 1.03% 1.61% 1.42% 1.17% 0.19% 0.29%

Leverage 8.82 9.78 11.12 12.19 7.46 8.99 14.61 6.58

Average Return on Equity 13.99% 18.22% 11.45% 19.68% 10.62% 10.50% 2.77% 1.90%

Average Return on Assets 1.59% 1.86% 1.03% 1.61% 1.42% 1.17% 0.19% 0.29%

Operating profit margin 3.20% 3.77% 2.63% 3.12% 3.14% 2.78% 1.61% 1.29%

Impairment multiplier (impact from impairment) 79.02% 78.21% 61.54% 89.09% 78.94% 75.71% 23.51% 33.99%

Tax multiplier (impact from VAT & Income tax) 62.76% 63.16% 63.59% 58.04% 57.41% 55.41% 50.28% 65.80%

Average Return on Assets 1.59% 1.86% 1.03% 1.61% 1.42% 1.17% 0.19% 0.29%

Operating Profit margin 3.20% 3.77% 2.63% 3.12% 3.14% 2.78% 1.61% 1.29%

Core profits margin 2.49% 2.69% 1.88% 3.33% 2.03% 2.31% 0.73% -0.28%

Other operating income margin 0.71% 1.08% 0.75% -0.20% 1.12% 0.48% 0.87% 1.57%

Operating profit margin 3.20% 3.77% 2.63% 3.12% 3.14% 2.78% 1.61% 1.29%

Core Profit Margin 2.49% 2.69% 1.88% 3.33% 2.03% 2.31% 0.73% -0.28%

Net interest margins % 5.09% 4.52% 4.27% 5.80% 3.68% 4.90% 3.46% 3.76%

Net fee and commission % 0.82% 0.76% 0.74% 1.89% 1.27% 1.05% 0.89% 0.56%

(-) Operating expense % 3.42% 2.59% 3.13% 4.37% 2.92% 3.64% 3.62% 4.60%

Core profit margin 2.49% 2.69% 1.88% 3.33% 2.03% 2.31% 0.73% -0.28%

Tax multiplier 62.76% 63.16% 63.59% 58.04% 57.41% 55.41% 50.28% 65.80%

Income tax multiplier 71.57% 71.68% 75.96% 67.80% 70.21% 67.27% 92.70% 91.99%

VAT multiplier 87.69% 88.12% 83.72% 85.61% 81.77% 82.36% 54.24% 71.52%

Tax multiplier 62.76% 63.16% 63.59% 58.04% 57.41% 55.41% 50.28% 65.80%

Appendix 2: Summary of DuPont analysis for 2013

Source: CAL Research

- Positive factor

- Negative factor

71

Dupont Analysis COMMERCIAL BANK

Dupont Analysis SAMPATH BANK

SAMP

ROAE -11.45%

ROAA- 1.03%

Operating profit

margin- 2.63%

Core profits

margin- 1.88%

Net interest

Margin- 4.27%

Net fee and

commission %-

0.74%

(-) Operating

expense- 3.13%

Other operating

income margin-

0.75%

Net loss from

trading %-(0.02%)

(+) Other

operating income

%-0.77%

Impairment

multiplier-

61.54%

Tax multiplier-

63.59%

Leverage - 11.12

Dupont Analysis NATIONS TRUST BANK

NTB

ROAE -19.68%

ROAA- 1.61%

Operating profit

margin- 3.12%

Core profits

margin- 3.33%

Net interest Margin-

5.80%

Net fee and commission

%- 1.89%

(-) Operating expense

%- 4.37%

Other operating

income margin-

-0.20%

Net loss from trading %-

(0.36%)

(+) Net gain from

financial investments %-

0.00%

(+) Other operating

income % -0.16%

Impairment

multiplier-

89.09%

Tax multiplier-

58.04%

Leverage - 12.19

72

Dupont Analysis COMMERCIAL BANK

Dupont Analysis HATTON NATIONAL BANK

COMB

ROAE -18.22%

ROAA- 1.86%

Operating profit

margin- 3.77%

Core profits margin-

2.69%

Net interest Margin-

4.52%

Net fee and

commission %- 0.76%

(-) Operating expense

%-2.59%

Other operating

income margin- 1.08%

Net loss from trading

%-(0.29%)

(+) Net gain from

financial investments

%-0.24%

(+) Other operating

income % -1.13%

Impairment multiplier-

78.21%

Tax multiplier-63.16%

Leverage - 9.78

HNB

ROAE -13.99%%

ROAA- 1.59%

Operating profit margin-

3.20%

Core profits margin-

2.49%

Net interest Margin-

5.09%

Net fee and commission

%- 0.82%

(-) Operating expense %-

3.42%

Other operating income

margin- 0.71%

Net loss from trading %-

(0.36%)

(+) Net gain from

financial investments %-

0.06%

(+) Other operating

income % (including

translation gains) %-

1.01%

Impairment multiplier-

79.02%

Tax multiplier- 62.76%

Leverage - 8.82

73

Dupont Analysis NATIONAL DEVELOPMENT BANK

SEYB

ROAE -10.50%

ROAA- 1.17%

Operating

profit margin-

2.78%

Core profits

margin-

2.31%

Net interest

Margin- 4.90%

Net fee and

commission

%- 1.05%

(-) Operating

expense %-

3.64%

Other

Operating

income

margin-

0.48%

Net loss from

trading %-

0.35%

(+) Net gain from

financial

investments %-

0.09%

(+) Other

operating income

% -0.04%

Impairment

multiplier-

75.71%

Tax multiplier-

55.41%

Leverage - 8.99

Dupont Analysis SEYLAN BANK

NDB

ROAE -10.62%

ROAA- 1.42%

Operating profit

margin- 3.14%

Core profits

margin- 2.03%

Net interest

Margin- 3.68%

Net fee and

commission %-

1.27%

(-) Operating

expense %-

2.92%

Other operating

income margin-

1.12%

Net loss from

trading %-0.98%

(+) Other

operating income

% -0.14%

Impairment

multiplier-

78.94%

Tax multiplier-

57.41%

Leverage - 7.46

74

Dupont Analysis PANASIA BANK

PABC

ROAE -2.77%

ROAA- 0.19%

Operating profit

margin- 1.61%

Core profits

margin- 0.73%

Net interest

Margin- 3.46%

Net fee and

commission %-

0.89%

(-) Operating

expense %-3.62%

Other operating

income margin- -

0.87%

Net loss from

trading %-0.39%

(+) Other

operating income

% -0.48%

Impairment

multiplier-

23.51%

Tax multiplier-

50.28%

Leverage - 14.61

Dupont Analysis UNION BANK OF COLOMBO

UBC

ROAE -1.90%

ROAA- 0.29%

Operating profit

margin- 1.29%

Core profits

margin- (0.28%)

Net interest

Margin- 3.76%

Net fee and

commission %-

0.56%

(-) Operating

expense %-4.60%

Other operating

income margin-

1.57%

Net loss from

trading %-0.35%

(+) Other

operating

income % -1.22%

Impairment

multiplier-

33.99%

Tax multiplier-

65.80%

Leverage - 6.58

S

A

M

P

A

T

H

B

A

N

K

I

N

C

O

M

E

S

T

A

T

E

M

E

N

T

75

SAMP - SLFRS INCOME STATEMENT (LKR mn) 2012 2013 2014E 2015E

Income 39,728 48,066 50,653 58,667

Interest income 32,712 42,320 44,196 51,224

Less: Interest expenses 20,673 27,226 27,266 31,324

Net interest income 12,039 15,095 16,931 19,900

Fee and commission income 2,877 3,099 3,694 4,341

Less: Fee and commission expenses 675 480 591 695

Net fee and commission income 2,202 2,619 3,103 3,646

Net interest, fee and commission income 14,241 17,713 20,033 23,546

Net trading income 6 70 - 56 - 57 -

Net gain from financial investments - - - -

Other operating income 4,133 2,716 2,763 3,102

Total Operating income 18,380 20,360 22,741 26,591