Professional Documents

Culture Documents

Syllabus Central Banking

Uploaded by

Rafiul Munir0 ratings0% found this document useful (0 votes)

50 views1 pageSyllabus of Basics of Central Banking Course for MBM Students

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSyllabus of Basics of Central Banking Course for MBM Students

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views1 pageSyllabus Central Banking

Uploaded by

Rafiul MunirSyllabus of Basics of Central Banking Course for MBM Students

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

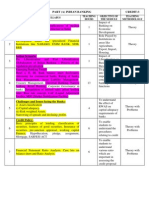

Central Banking & Regulations (BNKG 4302)

1. Financial System of Bangladesh

Markets (Money Market, Capital Market & Foreign Exchange Market), Regulators (BB, BSEC, MRA, IDRA),

Banks in Bangladesh, NBFIs in BD, Difference between Bank & NBFI, Recent Developments in Financial

Sector of Bangladesh (Technological, Institutional & Regulatory Developments)

2. Central Bank

Evolution of Central Banks, Events Contributing to Develop Various Roles, Functions of Central Banks,

Principles of modern central bank operations, Departments of BB, Central Bank Independence

3. Monetary & Fiscal Policy

Considerable Factors in Monetary Policy Formulation, MP Types, Policy Tools, MP in Developing Countries,

Zero Bound MP, Money Multiplier, Monetary Policy in BD, Monetary Survey, Money in Circulation,

Monetary Financing, Treasury Bill/Bond Auction & Repo/Reverse Repo in BD, Crowding Out Effect

4. Reserve Management

Reserve and its Components, Guiding Principles of Reserve Management, Reserve Adequacy

5. Bangladesh Bank Order 1972

Important Sections

6. Banking Supervision

Reasons for supervising banks, Mechanisms used to supervise banks

7. Basel Regulations

History of Basel (Basel I, II & III), Pillars of Basel II, Regulatory/Eligible Capital, ECAI, Risk Weights for Assets,

Supervisory Review Process (SRP), Market Discipline (MD), Implementation of Basel II: Effects, Challenges,

and Risks, New Requirements under Basel III compared To Basel II, Phase-in arrangements for Basel III

8. Loan Classification, Provisioning and Rescheduling

Categories of Loans and Advances, Basis for Loan Classification, Accounting of the Interest of Classified

Loans, Maintenance of Provision, Base for Provision, Eligible Collateral, Reporting, Guidelines for

Considering Application for Loan Rescheduling, Time Limit for Rescheduling, Down Payment, Classification

and Interest Suspense of Rescheduled Loans, New Loan Facility after Rescheduling, Special Conditions for

Loan Rescheduling, Restriction on Extending Term to Maturity of a Term Loan

9. Foreign Exchange Regulation

Objectives of Regulating Forex Transactions, Deregulatory Measures taken by BB, Regulations Governing

Foreign Exchange Transactions in BD, Related Organizations and Their Major Roles, FER Act and Power of

BB, Necessity of Supervising Forex, Departments in BB Relating with Fx Regulation and Fx Monitoring and

their Major Functions, Submission of Returns, Frequently Asked Q&A: Rules of Fx Transactions in various

sectors of BD

10. CAMELS Rating

Performance Ratings, Individual Ratings for Components of CAMELS, Composite Ratings

11. Anti Money Laundering and Terrorist Financing Issues

Stages of Money Laundering, Reasons for Money Laundering, Necessity of combating Money laundering,

Predicate Offences, KYC (Know Your Customer), TP (Transaction Profile), Risk Grading, PEP (Politically

Exposed Persons), CTR & STR

12. Green Banking

Policy Guidelines for Green Banking, BRPD Circular No.02, February 27, 2011

13. SLR (Statutory Liquidity Requirement) and CRR (Cash Reserve Ratio)

Rates for Banks & NBFIs, Eligible Liquid Assets, Submission of Returns, Penalty

14. BACH (Bangladesh Automated Clearing House)

Features of BACH, Type of Functions in BACPS, Superiority of BACH over Manual System, BEFTN- Features,

Deposit & Payment Entries, Advantages

15. Prudential Regulation for Banks: Selected Issues

Deposit Insurance Scheme, Bank Charges, Financial Inclusion, Single Borrower Exposure, Writing off Loans,

Interest Rates on Deposit & Lending etcetera.

You might also like

- Emerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansFrom EverandEmerging Market Bank Lending and Credit Risk Control: Evolving Strategies to Mitigate Credit Risk, Optimize Lending Portfolios, and Check Delinquent LoansRating: 3 out of 5 stars3/5 (3)

- Principles and Practices of BankingDocument2 pagesPrinciples and Practices of BankingPuja DuaNo ratings yet

- CAIIBITDocument27 pagesCAIIBITMLastTryNo ratings yet

- Curr 04Document2 pagesCurr 04bharatNo ratings yet

- Module A - Indian Financial SystemDocument14 pagesModule A - Indian Financial SystemRavi kumar MishraNo ratings yet

- BNK211 Banking LawDocument2 pagesBNK211 Banking LawdhitalkhushiNo ratings yet

- Jaiib DBF Syllabus June 2017 PDFDocument15 pagesJaiib DBF Syllabus June 2017 PDFacpscribdNo ratings yet

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Document490 pagesUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SNo ratings yet

- Money and Banking2Document2 pagesMoney and Banking2Mohammad Abdullah NabilNo ratings yet

- Banking SyllabusDocument7 pagesBanking SyllabusAnonymous BW3xfMZJ3No ratings yet

- Indian Banking System and ConceptsDocument42 pagesIndian Banking System and ConceptsKaran AroraNo ratings yet

- Topik 1 Rangka Kerja PerundanganDocument28 pagesTopik 1 Rangka Kerja PerundanganBenjamin Goo KWNo ratings yet

- 6 Central Bank RoleDocument43 pages6 Central Bank RoleRAUSHAN KUMARNo ratings yet

- Overview of Banking: ObjectiveDocument3 pagesOverview of Banking: ObjectivePratik SawalaniNo ratings yet

- Indian Institute of Banking & Finance: CAIIB SyllabusDocument15 pagesIndian Institute of Banking & Finance: CAIIB Syllabusveeresh2907No ratings yet

- Jaiib Exam SyllabusDocument19 pagesJaiib Exam SyllabusRupesh RanjanNo ratings yet

- Central Banking SolutionDocument2 pagesCentral Banking SolutionrupalNo ratings yet

- Paper 1 - Principles & Practices of Banking Module A - Indian Financial SystemDocument4 pagesPaper 1 - Principles & Practices of Banking Module A - Indian Financial Systemakranjan888No ratings yet

- General Awareness and Banking Awareness IBPS PO 2015 Study PlanDocument18 pagesGeneral Awareness and Banking Awareness IBPS PO 2015 Study PlanRajaDurai RamakrishnanNo ratings yet

- Program: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Document3 pagesProgram: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Ann DeeNo ratings yet

- Commercial Banking Credit Units: 03 Course ObjectivesDocument2 pagesCommercial Banking Credit Units: 03 Course ObjectivesAman DhawanNo ratings yet

- MAFS and General Banking LawsDocument5 pagesMAFS and General Banking Lawsmuhit jishanNo ratings yet

- Block B (Fm4) - PrefinalDocument36 pagesBlock B (Fm4) - PrefinalBryce ApitNo ratings yet

- Commercial BankingDocument2 pagesCommercial BankingGajendra JaiswalNo ratings yet

- Central BankDocument35 pagesCentral BankanujNo ratings yet

- Finance NotesDocument9 pagesFinance NotesGANESH SHAHNo ratings yet

- Seminar TopicsDocument12 pagesSeminar TopicsAshwini MunirathnamNo ratings yet

- Morb2 PDFDocument801 pagesMorb2 PDFthesupersecretsecretNo ratings yet

- NRB Regulation of Bank. Group BBBBBBBBBBBBBBDocument37 pagesNRB Regulation of Bank. Group BBBBBBBBBBBBBBMohan BanjaraNo ratings yet

- Bwbb2013 Topic 2Document22 pagesBwbb2013 Topic 2myteacheroht.managementNo ratings yet

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avNo ratings yet

- Cooperative and Banking DetailsDocument5 pagesCooperative and Banking DetailsmanorajcvNo ratings yet

- Part (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching MethodologyDocument3 pagesPart (A) Indian Banking Credit:3: MOD NO. Detailed Syllabus Teaching Hours Objective of The Module Teaching Methodologyrajat_177229No ratings yet

- Banking Current AffairsDocument4 pagesBanking Current AffairsAbhishek P BenjaminNo ratings yet

- Session Plan - Banking - Class of 2022Document6 pagesSession Plan - Banking - Class of 2022ZeusNo ratings yet

- Training Course: Banking Law ObjectivesDocument4 pagesTraining Course: Banking Law ObjectivesAnil LamichhaneNo ratings yet

- Banking and Insurance OverviewDocument27 pagesBanking and Insurance OverviewRajeshwariNo ratings yet

- 01.08.2022 FIM Outline 3 CreditDocument3 pages01.08.2022 FIM Outline 3 CreditRAUSHAN KUMARNo ratings yet

- Regulation & Supervision of Banks: Shrimrdas DGMDocument17 pagesRegulation & Supervision of Banks: Shrimrdas DGMsanjay aravindakshanNo ratings yet

- Regulatory Framework For IBIs-ZahidDocument43 pagesRegulatory Framework For IBIs-Zahidski_leo82No ratings yet

- Master Circular On Kyc AmlDocument70 pagesMaster Circular On Kyc AmlMeghendra MalviNo ratings yet

- ibfsd04 (1)Document17 pagesibfsd04 (1)Sivakumar BNo ratings yet

- Why To Study Banking? Reserve Bank of IndiaDocument2 pagesWhy To Study Banking? Reserve Bank of IndiasathishNo ratings yet

- DocumentDocument2 pagesDocumentTisha DuttNo ratings yet

- Syllabus Banking Diploma, IBB 5Document2 pagesSyllabus Banking Diploma, IBB 5sohanantashaNo ratings yet

- Long Form Audit ReportDocument34 pagesLong Form Audit ReportAshish SaxenaNo ratings yet

- Master Circular Û Know Your Customer (KYC) NormsDocument64 pagesMaster Circular Û Know Your Customer (KYC) NormsShaswat RaiNo ratings yet

- Guidelines For InspectionDocument132 pagesGuidelines For InspectiondineshmarginalNo ratings yet

- Banking Course OutlineDocument3 pagesBanking Course OutlineRabia SamdaniNo ratings yet

- Ba7026 Banking Financial Services ManagemntDocument122 pagesBa7026 Banking Financial Services ManagemntRithesh RaNo ratings yet

- BSPDocument159 pagesBSPHoneyleth TinamisanNo ratings yet

- MGT226 Financial Systems FoundationDocument3 pagesMGT226 Financial Systems FoundationArju LamsalNo ratings yet

- SBP-Financial StatementsDocument24 pagesSBP-Financial StatementsAHMAD RANANo ratings yet

- CRR and SLR Requirements for BanksDocument25 pagesCRR and SLR Requirements for BanksSamhitha KandlakuntaNo ratings yet

- Terms To Learn - Chapter 1Document2 pagesTerms To Learn - Chapter 1Sayon DasNo ratings yet

- Regulation and Supervision of Financial Market Infrastructures Regulated by Reserve Bank of IndiaDocument20 pagesRegulation and Supervision of Financial Market Infrastructures Regulated by Reserve Bank of IndiaSanket GarjeNo ratings yet

- FIN 251 Commercial Bank ManagementDocument3 pagesFIN 251 Commercial Bank ManagementAnshu BashisthaNo ratings yet

- Islamic Finance: The New Regulatory ChallengeFrom EverandIslamic Finance: The New Regulatory ChallengeRating: 1 out of 5 stars1/5 (1)

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Practice: A. B. C. D. eDocument2 pagesPractice: A. B. C. D. eRafiul MunirNo ratings yet

- Recommended Mathematical Training To Prepare For Graduate School in EconomicsDocument3 pagesRecommended Mathematical Training To Prepare For Graduate School in EconomicsRafiul MunirNo ratings yet

- 101 Most Commonly Misused GRE Words - CrunchPrep GREDocument18 pages101 Most Commonly Misused GRE Words - CrunchPrep GRERafiul MunirNo ratings yet

- Case - Street ChildrenDocument7 pagesCase - Street ChildrenRafiul MunirNo ratings yet

- An overview of the secondary market mechanismDocument50 pagesAn overview of the secondary market mechanismRafiul Munir100% (1)

- Idioms GMAT SCDocument18 pagesIdioms GMAT SCRafiul MunirNo ratings yet

- ACS CASE STUDY by Prof. Avadhesh YadavDocument10 pagesACS CASE STUDY by Prof. Avadhesh YadavMUKESH PRABHUNo ratings yet

- O/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Document8 pagesO/W: Mayne To Reward The Willing: Mayne Pharma Group (MYX)Muhammad ImranNo ratings yet

- SyllabusDocument42 pagesSyllabusvasudevprasadNo ratings yet

- InfosysDocument44 pagesInfosysSubhendu GhoshNo ratings yet

- ZACL Annual Report 2022 FinalDocument115 pagesZACL Annual Report 2022 FinalStefano PatoneNo ratings yet

- Marine Assignment 2 - Article ReviewDocument4 pagesMarine Assignment 2 - Article ReviewTerrie JohnnyNo ratings yet

- Comparative Economic SystemsDocument8 pagesComparative Economic SystemsDan GregoriousNo ratings yet

- Greek Law Digest The Official Guide To Greek LawDocument727 pagesGreek Law Digest The Official Guide To Greek LawDEMETRIOS 02100% (1)

- Management AccountingDocument24 pagesManagement AccountingRajat ChauhanNo ratings yet

- MCQ - 202 - HRMDocument7 pagesMCQ - 202 - HRMjaitripathi26No ratings yet

- G9 AP Q3 Week 3 Pambansang KitaDocument29 pagesG9 AP Q3 Week 3 Pambansang KitaRitchelle BenitezNo ratings yet

- Uttar Pradesh Budget Analysis 2019-20Document6 pagesUttar Pradesh Budget Analysis 2019-20AdNo ratings yet

- Tax Invoice for Monitor PurchaseDocument1 pageTax Invoice for Monitor PurchaseBijendraNo ratings yet

- Retail InvoiceDocument1 pageRetail InvoiceAmit SinghNo ratings yet

- Topic 3 International Convergence of Financial Reporting 2022Document17 pagesTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcNo ratings yet

- Interest-The Islamic PerspectiveDocument4 pagesInterest-The Islamic PerspectiveShahinsha HcuNo ratings yet

- Assignment-UNIQLO Group-Marketing MaestroDocument57 pagesAssignment-UNIQLO Group-Marketing MaestroMonir KhanNo ratings yet

- Assignment 1 Malaysian EconomyDocument15 pagesAssignment 1 Malaysian EconomyRoslyna khanNo ratings yet

- KEY Level 2 QuestionsDocument5 pagesKEY Level 2 QuestionsDarelle Hannah MarquezNo ratings yet

- Executive Chic Inc. custom uniform tailoring strategyDocument90 pagesExecutive Chic Inc. custom uniform tailoring strategyMA MallariNo ratings yet

- Human Resource Management Mid-term Chapter ReviewDocument5 pagesHuman Resource Management Mid-term Chapter ReviewChattip KorawiyothinNo ratings yet

- ACE Variable IC Online Mock Exam - 08182021Document11 pagesACE Variable IC Online Mock Exam - 08182021Ana FelicianoNo ratings yet

- Car Wash Marketing Plan SummaryDocument16 pagesCar Wash Marketing Plan Summarymohsrour100% (1)

- JOB CONTRACTING VS. LABOR-ONLY CONTRACTING GUIDELINESDocument7 pagesJOB CONTRACTING VS. LABOR-ONLY CONTRACTING GUIDELINESIscoDiazIINo ratings yet

- 4 Preparing A Bank ReconciliationDocument9 pages4 Preparing A Bank ReconciliationSamuel DebebeNo ratings yet

- Cola Wars and Porter Five Forces AnalysisDocument10 pagesCola Wars and Porter Five Forces Analysisshreyans_setNo ratings yet

- New Accountant Appointment LetterDocument2 pagesNew Accountant Appointment Letterkeeran100% (1)

- HdiDocument13 pagesHdiAmeya PatilNo ratings yet

- Gr08 History Term2 Pack01 Practice PaperDocument10 pagesGr08 History Term2 Pack01 Practice PaperPhenny BopapeNo ratings yet

- Chapter 2 Strategy and ProductivityDocument46 pagesChapter 2 Strategy and ProductivityAngel LyxeiaNo ratings yet