Professional Documents

Culture Documents

ch04 Managerial Accounting

Uploaded by

shaileshkumarguptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ch04 Managerial Accounting

Uploaded by

shaileshkumarguptaCopyright:

Available Formats

Name____________________

Section__________________

Chapter 4

Exercises 1-4

Exercise 4-1

Fixed and variable costs

Exercise 4-2

Cost structure at Microsoft

Exercise 4-3

Contribution margin from the Men's Wearhouse annual report

Exercise 4-4

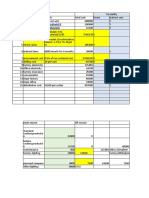

$540,000

480000

420,000

360,000

300,000

240,000

180, 000

120,000

60,000

30,000

0

Units Produced 3,000 4,000 5,000 6,000

56

Name____________________

Section__________________

Chapter 4

Exercises 5-6

Exercise 4-5

High $ 20,000 - low $ =

High machine hours 8,000 - low machine hours =

Change in $ divided by change in machine units= per unit cost

Total cost High Low

Variable costs

Fixed costs

Exercise 4-6

a.

High $ 28,000 - low $ =

High cost - low cost =

Change in $ divided by change in cost units= per unit cost

Total cost High Low

Variable costs

Fixed costs

b.

c.

57

Name____________________

Section__________________

Chapter 4

Exercises 7-8

Exercise 4-7

a.

$11,000

9,000

7,000

0

$100,000 $150,000 $200,000 $250,000

Sales

b.

Exercise 4-8

a. Account analysis

Variable Cost Estimate

Staff salaries

Production

Variable cost per unit

Fixed Cost Estimate

Depreciation

Share of building cost

b. 60 more employeed in June

c. 10 more employeed in May

58

Name____________________

Section__________________

Chapter 4

Exercises 9-10

Exercise 4-9

a. Account analysis

Variable Cost Estimate

Cleaning supplies

Production

Variable cost per unit

Fixed Cost Estimate

Rent

Utilities

Depreciation

b. Contribution margin?

Exercise 4-10

Variable Cost Fixed Cost

Material $ 30,000

Direct labor 20,000

Depreciation

Phone

Other Utilities

Supervisory salaries

Equipment repair

Indirect materials

Factory maintenance

Total

Production 1,000 units

Variable cost per unit

59

Name____________________

Section__________________

Chapter 4

Exercises 11-13

Exercise 4-11

a.

Selling price = $800

Variable cost = 300

Contribution margin $500

Fixed cost per month $50,000

b.

Exercise 4-12

a.

Fixed costs per month $200,000/ variable cost per dollar or contribution margin ratio

b.

c.

Exercise 4-13

a. Selling price = $800

Variable cost = 300

Contribution margin

b.

60

Name____________________

Section__________________

Chapter 4

Exercises 14-17

Exercise 4-14

a.

Selling price = $800

Variable cost = 300

Contribution margin $500/Sales $800

b.

Exercise 4-15

a.

b.

Exercise 4-16

Selling price = $1,000

Exercise 4-17

a.

b. Breakeven Fixed 178,000/ ? =

c.

61

Name____________________

Section__________________

Chapter 4

Exercises 18-21

Exercise 4-18

a.

Fixed costs 103,000/ ? =

b.

c.

Exercise 4-20

a.

Dept. A Dept. B Dept C Total

Profit $99,000 $255,000 $88,000 $442,000

Divided by

Sales $265,000 $850,000 $900,000 $2,015,000

Percentage of sale 37.3%

b.

Dept. A Dept. B Dept C Total

Profit

Divided by

Sales $265,000 $850,000 $900,000 $2,015,000

Percentage of sale

Exercise 4-21

a.

b.

62

Name____________________

Section__________________

Chapter 4

Problem 4-1

Royal Desert Hotel

Fixed (F) variable (V) or mixed (M)

a. Depreciation

b. Salaries of staff

c. Salaries of administrative staff

d. Soap, shampoo

e. Laundry costs

f. Food and beverage

g. Grounds maintenance

63

Name____________________

Section__________________

Chapter 4

Problem 4-2

Rykor Electronics

a. 140 units

Variable costs

Component costs $68,000

Supplies

Assembly labor

Shipping

Total

Fixed Costs

Rent

Supervisor salary

Electricity

Telephone

Gas

Advertising

Administrative costs

Total fixed

b.

c. Sales $1,200

Less variable costs

Contribution margin

d. Sales 150 units x $1,200

Less part b

Total profit

e.

64

Name____________________

Section__________________

Chapter 4

Problem 4-3

Rykor Electronics

a.

High cost $134,700 - low cost = change in cost

High units sold 165 - low units = change in units

b.

Sales $1,200

Less variable costs

Contribution margin

c.

d. Sales of 150 units

e.

65

Name____________________

Section__________________

Chapter 4

Problem 4-4

a.

Use regression analysis on the data

Fixed = $

Variable = $

b.

Variable Fixed

Account analysis

High-Low

Regression

66

Name____________________

Section__________________

Chapter 4

Problem 4-5

Peterson Island Air

a.

Number of current round trips 6 per week x 52 weeks=

Total revenue

Total revenue per trip __________

Variable costs:

Fuel

Maintenance

Variable cost per trip _________

Contribution margin per trip __________

Fixed costs:

Salary

Depreciation of plane 20,000

Depreciation of office equipment

Rent expense

Insurance

Miscellaneous

Total fixed costs

===========

Breakeven trips

b.

c.

d.

67

Name____________________

Section__________________

Chapter 4

Problem 4-6

Regal Hotel

a. Account analysis

Fixed Costs

Depreciation $10,000

Day manager salary $4,000

Night manger salary $

Variable costs

Cleaning staff $15,000

Food & beverages

Total variable

Number of rooms 1,500

Variable costs per room

b.

High -low

c. April revenue per occupied room $85

Less variable costs

Contribution margin per occupied room

68

Name____________________

Section__________________

Chapter 4

Problem 4-7

Cindy Mathers Jewlery

a.

Consider which costs are variable and fixed

b.

Forecast plus 20%

Sales $18,624

Cost of Jewlery sold

Gross margin

Registration fee 1,000

Booth rental (5% of sales)

Salary of Jane Kramer 300

Before tax profit

=========

69

Name____________________

Section__________________

Chapter 4

Problem 4-8

Premier Custom Computers

Sales $1,000,000 1,100,000 1,200,000 1,300,000 1,400,000

Cost of sales 700,000

70%

Gross Profit

Staff salaries 180,000 180,000 180,000 180,000 180,000

Rent 24,000

Utilities 3,600

Advertising 2,000

Operating profit 90,400

before bonuses

Staff bonuses 40% 36,160

Profit before taxes and

Owner's drawing:$54,240

======= ====== ========= ======== ==========

70

Name____________________

Section__________________

Chapter 4

Problem 4-9

Xeroc, Inc.

a.

High units in sales and production 150 - low units =

High units in production costs $95,000 - low units =

High units in selling costs $16, 000 - low units =

Change in $/change in units = variable costs

High Production Low High Selling Low

Total costs 95,000 16,000

Variable costs

Per unit x high

Per unit x low

Total fixed costs

b.

1,400 units x $800 = revenues

d. Profit of $1,500,000

e. Break out each department

71

Name____________________

Section__________________

Chapter 4

Problem 4-10

Ballard HiFi

Profitability Analysis

For the Year Ended 12/31/03

a.

Audio Video Car Total

Contribution margin $1,080, 000 460,000 570,000 $2,110,000

Divided by

Sales $3,000,000 1,800,000 1,200,000 6,000,000

CM ratio 36.00% 35.16%

b.

$100,000 times the applicable CM ratio

c.

Fixed costs $690,000/contribution margin ratio

d. Profit of $1,500,000

e. Break out each department

72

Name____________________

Section__________________

Chapter 4

Problem 4-11

RealTime Service

a.

Consulting Training Repair Total

Sales $600,000 $480,000 $360,000 $1,440,000

Less variable costs

Salaries 300,000

Supplies parts 24,000

Other 1,200

Total costs 325,200

Contribution margin 274,800

Less fixed common costs 263,000

Profit

=========

b.

73

Name____________________

Section__________________

Chapter 4

Problem 4-12

Sercon, Inc. and Zercon, Inc.

a.

Which company has the highest operating leverage?

b.

Sercon, Inc. 10% increase 10% decrease in sales

Sales $80,000,000 88,000,000

Less variable costs 20,000,000

Less fixed costs 50,000,000 50,000,000 50,000,000

Profit $10,000,000

========== =========== ==============

Zercon, Inc. 10% increase 10% decrease in sales

Sales $80,000,000 88,000,000

Less variable costs 50,000,000

Less fixed costs 20,000,000 20,000,000 20,000,000

Profit $10,000,000

========== =========== ==============

c.

74

Name____________________

Section__________________

Chapter 4

Problem 4-13

Xenoc, Inc.

a.

Current profit $400,000 /2,000 units = $200 profit per unit

$200 profit per unit/$50 assembly per hour = 4 hours per unit

b.

c.

75

Name____________________

Section__________________

Chapter 4

Problem 4-14

Pacer Running Shoes

a.

110,000 assembly hours available to produce two lines: Master & Finisher

How many pairs of each model should be produced in the coming year?

b.

Suppose management decises that at least 4,00 pairs of each model must be

produced. What is the opportunity cost of this decision versus only 2,000 pairs?

76

Name____________________

Section__________________

Chapter 4

Problem 4-15

Casper's Seafood

Based on the limited information provided, provide Bob with an estimate of the

net effect of the coupon campaign on annual profit (ignore taxes).

Increase in normal sales $2,500,000

Less discount

Increase in sales after discount

Less incremental costs

Incremental profit

=================

77

Name____________________

Section__________________

Chapter 4

Case 4-1

WENDELL ROBERTS CONSULTING

Required

Explain why William's assumption leads to a higher claim. Is his behavior ethical?

78

Name____________________

Section__________________

Chapter 4

Case 4-2

ROTHMUELLER MUSEUM

a.

Revenue:

b.

Breakeven point

Fixed costs:

Contribution margin

79

Name____________________

Section__________________

Chapter 4

Case 4-3

MAYFIELD SOFTWARE CUSTOMER TRAINING

a.

Consider the fixed costs:

b.

Calculate the contribution margin

Revenue:

Less:

Variable costs

Contribution margin

c.

Consider trainer costs.

d.

80

Name____________________

Section__________________

Chapter 4

Case 4-4

KROG'S METALFAB, INC.

a.

Step 1

Step 2

Step 3

b.

c.

81

Name____________________

Section__________________

Chapter 4

Case 4-5

SEATTLE ESPRESSO, INC.

Forecast with more labor

Jan. Feb. March April May June

Revenues

Costs of goods sold

Labor

Utilities

Net profit

July Aug. Sept Oct. Nov. Dec.

Revenues

Costs of goods sold

Labor

Utilities

Net profit

82

You might also like

- Doulci Activator For IOS 9Document2 pagesDoulci Activator For IOS 9Syafiq Aiman100% (2)

- Grade 4 Science Quiz Bee QuestionsDocument3 pagesGrade 4 Science Quiz Bee QuestionsCecille Guillermo78% (9)

- APFC Accountancy Basic Study Material For APFCEPFO ExamDocument3 pagesAPFC Accountancy Basic Study Material For APFCEPFO ExamIliasNo ratings yet

- Emilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFDocument262 pagesEmilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFMihaela Ioana MoldovanNo ratings yet

- 3 - Cost Volume Profit AnalysisDocument1 page3 - Cost Volume Profit AnalysisPattraniteNo ratings yet

- Script For The FiestaDocument3 pagesScript For The FiestaPaul Romano Benavides Royo95% (21)

- P5 Acca - 11 Divisional Performance Evaluation BeckerDocument30 pagesP5 Acca - 11 Divisional Performance Evaluation BeckerDanesh Kumar Rughani100% (1)

- F5 Division Roi RiDocument16 pagesF5 Division Roi RiMazni Hanisah100% (1)

- Ch14. Target CostingDocument16 pagesCh14. Target CostingVivek AnandanNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- History of Early ChristianityDocument40 pagesHistory of Early ChristianityjeszoneNo ratings yet

- Company Situation AnalysisDocument25 pagesCompany Situation AnalysisJeremy WongNo ratings yet

- ACCA F5 Activity Based Costing NotesDocument206 pagesACCA F5 Activity Based Costing NotesAmanda7100% (2)

- Portfolio Management Services-Hrithik JainDocument73 pagesPortfolio Management Services-Hrithik Jain8784100% (1)

- Uk GeographyDocument9 pagesUk GeographyStainbok MihaiNo ratings yet

- Ch5Probset Bonds+Interest 13ed. - MasterDocument8 pagesCh5Probset Bonds+Interest 13ed. - Masterpratiksha1091No ratings yet

- CVP Analysis SolutionsDocument23 pagesCVP Analysis SolutionsAdebayo Yusuff AdesholaNo ratings yet

- Pearson LCCI Level 2 Certifi Cate in Cost Accounting (ASE20094)Document60 pagesPearson LCCI Level 2 Certifi Cate in Cost Accounting (ASE20094)Pinky PinkyNo ratings yet

- FinalexamDocument12 pagesFinalexamJoshua GibsonNo ratings yet

- 2019 Caf-8 ST PDFDocument452 pages2019 Caf-8 ST PDFAbdurrehman Shaheen100% (1)

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Rothmueller Museum Group Analyzes Break Even PointDocument4 pagesRothmueller Museum Group Analyzes Break Even PointManpal Singh Julka ੴNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- 12mba32 Om NotesDocument68 pages12mba32 Om NotessanthoshNo ratings yet

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- Mba504 SaDocument18 pagesMba504 SaJacob SmithNo ratings yet

- HorngrenIMA14eSM ch05Document67 pagesHorngrenIMA14eSM ch05Zarafshan Gul Gul MuhammadNo ratings yet

- Chapter 4 CVP AnalysisDocument40 pagesChapter 4 CVP Analysisthrust_xone100% (1)

- Transfer Pricing MethodsDocument5 pagesTransfer Pricing MethodsApatheticWarNo ratings yet

- Understand Support Department Cost Allocation MethodsDocument27 pagesUnderstand Support Department Cost Allocation Methodsluckystar251095No ratings yet

- BITS Pilani MBA Financial Accounting Mid-Semester TestDocument3 pagesBITS Pilani MBA Financial Accounting Mid-Semester Testritesh_aladdinNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Cost-Volume-Profit AnalysisDocument50 pagesCost-Volume-Profit AnalysisMarkiesha StuartNo ratings yet

- CH 8 - Competitive DynamicsDocument24 pagesCH 8 - Competitive DynamicsMilindMalwade100% (1)

- HorngrenIMA14eSM ch10Document64 pagesHorngrenIMA14eSM ch10Piyal Hossain100% (2)

- Harsh ElectricalsDocument7 pagesHarsh ElectricalsR GNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- 0fa74module 1bDocument2 pages0fa74module 1bDev Sharma100% (1)

- Applications and Solutions of Linear Programming Session 1Document19 pagesApplications and Solutions of Linear Programming Session 1Simran KaurNo ratings yet

- Financial and Management Accounting: BITS PilaniDocument41 pagesFinancial and Management Accounting: BITS PilaniPunitNo ratings yet

- MBA 504 Managerial Accounting: Winter Quarter 2005 ScheduleDocument5 pagesMBA 504 Managerial Accounting: Winter Quarter 2005 ScheduleHasen BebbaNo ratings yet

- HW 4Document6 pagesHW 4SARAN PRASANTHNo ratings yet

- BITS Pilani Cost-Volume Profit Analysis PresentationDocument47 pagesBITS Pilani Cost-Volume Profit Analysis Presentationarpit kumar0% (1)

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- Dispensers of California, IncDocument9 pagesDispensers of California, IncHimanshu PatelNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- 4587 2261 10 1487 54 BudgetingDocument46 pages4587 2261 10 1487 54 BudgetingDolly BadlaniNo ratings yet

- Short-Run Decision Making and CVP AnalysisDocument43 pagesShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Part B Notes: CVP AnalysisDocument31 pagesPart B Notes: CVP AnalysisZakariya PkNo ratings yet

- MBA 504 Ch3 SolutionsDocument22 pagesMBA 504 Ch3 SolutionsMohit Kumar GuptaNo ratings yet

- Topic-1: Course Objectives Learning Outcome StatementsDocument84 pagesTopic-1: Course Objectives Learning Outcome Statementsakalya eceNo ratings yet

- Profit and Loss Appropriation AccountDocument1 pageProfit and Loss Appropriation AccountDeisha SzNo ratings yet

- Baldwin PDFDocument14 pagesBaldwin PDFAli Zaigham AghaNo ratings yet

- Profitability, turnover, liquidity and solvency ratios 2018-2020Document3 pagesProfitability, turnover, liquidity and solvency ratios 2018-2020Mohit VermaNo ratings yet

- Marginal CostingDocument13 pagesMarginal CostingKUNAL GOSAVINo ratings yet

- ch07 Operation Management Roberta Russell & Bernard W. TaylorDocument47 pagesch07 Operation Management Roberta Russell & Bernard W. TaylorkiruthigNo ratings yet

- Whether to operate a second production shiftDocument4 pagesWhether to operate a second production shiftMeghan Kaye LiwenNo ratings yet

- Wilkerson ABC at CapacityDocument1 pageWilkerson ABC at CapacityTushar DuaNo ratings yet

- Fin ZC415 Ec-3r First Sem 2019-2020Document5 pagesFin ZC415 Ec-3r First Sem 2019-2020srideviNo ratings yet

- ACCOUNTING FOR CORPORATES (BBBH233) - 003 Module 3 - 1573561029351Document78 pagesACCOUNTING FOR CORPORATES (BBBH233) - 003 Module 3 - 1573561029351Harshit Kumar GuptaNo ratings yet

- Management AccountingDocument112 pagesManagement AccountingSugandha Sethia100% (1)

- Torrington, Hall & Taylor, Human Resource Management 6e, © Pearson Education Limited 2005Document27 pagesTorrington, Hall & Taylor, Human Resource Management 6e, © Pearson Education Limited 2005adil0% (1)

- Accountancy SQP PDFDocument21 pagesAccountancy SQP PDFSuyash YaduNo ratings yet

- The Cross-Price Elasticity of Demand For The Two Is CalculatedDocument3 pagesThe Cross-Price Elasticity of Demand For The Two Is CalculatedhaNo ratings yet

- Wages ( (Accounting For Labour)Document18 pagesWages ( (Accounting For Labour)Jitendra Patel100% (1)

- Problem 1Document57 pagesProblem 1rockleeNo ratings yet

- S2 CMA c02 Cost-Volume-Profit AnalysisDocument25 pagesS2 CMA c02 Cost-Volume-Profit Analysisdiasjoy67No ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Factor Affecting Rural MarketingDocument5 pagesFactor Affecting Rural Marketingshaileshkumargupta100% (1)

- Segmentation, Targeting and PositioningDocument38 pagesSegmentation, Targeting and PositioningIcicle NmNo ratings yet

- Downloads Questionpapers New SemI Marketing Management Sem1Document6 pagesDownloads Questionpapers New SemI Marketing Management Sem1shaileshkumarguptaNo ratings yet

- Ruralmarketing 120111025304 Phpapp01Document240 pagesRuralmarketing 120111025304 Phpapp01shaileshkumarguptaNo ratings yet

- Chapter 07Document39 pagesChapter 07shaileshkumarguptaNo ratings yet

- Bet For Success DonDocument6 pagesBet For Success DonshaileshkumarguptaNo ratings yet

- 7 STPDocument37 pages7 STPshaileshkumarguptaNo ratings yet

- VAR EssayDocument18 pagesVAR EssayshaileshkumarguptaNo ratings yet

- ch03 Time Value and MoneyDocument87 pagesch03 Time Value and MoneyshaileshkumarguptaNo ratings yet

- GA in TimetablingDocument6 pagesGA in Timetablingvasu100% (2)

- Elastic Settlement in SoilDocument20 pagesElastic Settlement in SoilAbhrankash Nit DgpNo ratings yet

- Managing Remuneration MCQDocument5 pagesManaging Remuneration MCQlol100% (1)

- 1 Minute Witness PDFDocument8 pages1 Minute Witness PDFMark Aldwin LopezNo ratings yet

- Recommender Systems Research GuideDocument28 pagesRecommender Systems Research GuideSube Singh InsanNo ratings yet

- Script - TEST 5 (1st Mid-Term)Document2 pagesScript - TEST 5 (1st Mid-Term)Thu PhạmNo ratings yet

- Brochure For Graduate DIploma in Railway Signalling 2019 v1.0 PDFDocument4 pagesBrochure For Graduate DIploma in Railway Signalling 2019 v1.0 PDFArun BabuNo ratings yet

- Q3 Week 7 Day 2Document23 pagesQ3 Week 7 Day 2Ran MarNo ratings yet

- Pharmacology of GingerDocument24 pagesPharmacology of GingerArkene LevyNo ratings yet

- RQQDocument3 pagesRQQRazerrdooNo ratings yet

- Guerrero vs Benitez tenancy disputeDocument1 pageGuerrero vs Benitez tenancy disputeAb CastilNo ratings yet

- Credit Suisse AI ResearchDocument38 pagesCredit Suisse AI ResearchGianca DevinaNo ratings yet

- Visual AnalysisDocument4 pagesVisual Analysisapi-35602981850% (2)

- Amnesia: A Game of Remembering YourselfDocument11 pagesAmnesia: A Game of Remembering YourselfNina JonesNo ratings yet

- Model Test Paper Maths CBSE Class IX - IIIDocument8 pagesModel Test Paper Maths CBSE Class IX - IIIAnanthakrishnan Tinneveli VNo ratings yet

- Size, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsDocument17 pagesSize, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsJabbar AljanabyNo ratings yet

- Burton Gershfield Oral History TranscriptDocument36 pagesBurton Gershfield Oral History TranscriptAnonymous rdyFWm9No ratings yet

- Natural Science subject curriculumDocument15 pagesNatural Science subject curriculum4porte3No ratings yet

- Postmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarDocument4 pagesPostmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarAbdennour MaafaNo ratings yet

- RPP Microteaching TaruliDocument9 pagesRPP Microteaching TaruliTaruli Sianipar 165No ratings yet

- Insecticide Mode of Action Classification GuideDocument6 pagesInsecticide Mode of Action Classification GuideJose Natividad Flores MayoriNo ratings yet

- All EscortsDocument8 pagesAll Escortsvicky19937No ratings yet

- Analysis of Cocoyam Utilisation by Rural Households in Owerri West Local Government Area of Imo StateDocument11 pagesAnalysis of Cocoyam Utilisation by Rural Households in Owerri West Local Government Area of Imo StatePORI ENTERPRISESNo ratings yet

- AIESEC - Exchange Participant (EP) GuidebookDocument24 pagesAIESEC - Exchange Participant (EP) GuidebookAnonymous aoQ8gc1No ratings yet