Professional Documents

Culture Documents

Patil Rasika Somnath - Human Resources Management

Uploaded by

rasikapatil111Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Patil Rasika Somnath - Human Resources Management

Uploaded by

rasikapatil111Copyright:

Available Formats

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

1

Table of contents

Chapter no. Title Page no.

1. Introduction

2. Project details

Title of the project

Aims and objectives of the

study

Problem statement

Scope of the study

Significance of the study

3. Literature review

4. Methodology used

Data collection method

Research tools

Sampling methodology

Validity of the data

5. Data analysis and research

findings

6. Recommendations and conclusions

7. Limitations of the study

8. References/bibliography

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

2

Executive summary

Introduction:

A general term insurance is related to service sector. Insurance is concerned

with the protection of economic value of assets. For example in case of a

factory or a cow, the product generated by it is sold and income is generated. In

this project the Bharti AXA Life Insurance Company is undertaken which is one

of the popular sector insurance sectors. The analysis of Bharti AXA Life

Insurance is taken from different sectors. For creating strong relationship and

for a successful business every insurance company requires financial planner.

Objective of the problem:

How to recruit agents for Bharti-AXA Life Insurance.

The detailed study of the life advisors of Bharti AXA Life Insurance.

To understand the process of the selection of agents and the work they do

in life insurance.

Why people are not willing to work s an agent in life insurance sector

especially with private companies.

outcome of the study:

In the current scenario every organization expects their employees to

perform at their peak potential. Though monetary aspects play an important

role in motivating employees, organization around the world have come to

understand that there are many other aspects that contributes better employee

performance. The study is undertaken to know how many people are

interested to work as life insurance agent in Bharti AXA and their thinking

about the Bharti AXA Life Insurance Company and the whole study of life

advisors. This study will be used as feedback from employees to know their

current perspective of workplace and also to identify the areas of

improvement for the organization.

Recommendations: In India, there is cut throat competition in the market of

Life insurance that brand services which adopts new strategies for sales. So I

hereby conclude that the people are much aware about the aspects of Life

insurance and also have knowledge about the role and act of agent but

mostly people willing to work as life insurance agent and mostly people

prefer to work with LIC because it is a semi government corporation.

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

3

Introduction

The quality of work life is the degree of excellence brought about work and

working conditions that contributes to the overall satisfaction and performance

primarily at individual level and finally at organizational level. It refers to the

level of satisfaction, motivation, commitment and involvement an individual

experience with respect to their line at the work.

Quality of work life (QWL) has become one of the most important issues these

days in every organization. Employees are the force that is behind every

successful organization. No organization can become successful with

technology only because for the use of technology also, organizations need to

have strong work force. Quality of work life was the term actually introduced in

the late 1960s. From that period till now the term is gaining more and more

importance everywhere, at every work place. Initially quality of work life was

focusing on the effects of employees on the general well being and the health of

the workers. But now its focus has been changed. Every organization need to

give good environment to their workers including all financial and non financial

incentives so that they can retain their employees for the longer period and for

the achievement of the organization goals. At the end we can say that a happy

and healthy employee will give better turnover, make good decisions and

positively contribute to the organization goal.

1.1 Overview of industry

With largest number of life insurance policies in force in the world, Insurance

happens to be a mega opportunity in India. Its a business growing at the rate of

15-20 percent annually and presently is of the order of Rs 450 billion. Together

with banking services, it adds about 7 percent to the countrys GDP (Gross

Premium collection). GDP is nearly 2 percent of GDP and funds available with

LIC for investments are 8 percent of GDP.

Yet, nearly 80 percent of Indian population is without life insurance cover while

health insurance and non-life insurance continues to be below international

standards. And this part of the population is also subject to weak social security

and pension systems with hardly any old age income security. This it is an

indicator that growth potential for the insurance sector is immense.

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

4

A well developed and evolved insurance sector is needed for economic

development as it provides long term funds for infrastructure development and

at the same time strengthens the risk taking ability. It is estimated that over the

next ten years India would require investments of the order of one trillion US

dollar. The insurance sector, to some extent, can enable investments in

infrastructure development to sustain economic growth of the country.

Insurance is a federal subject in India. There are two legislations that govern the

sector- The Insurance Act-1938 and the IRDA Act-1999.

In India, insurance is generally considered as a tax-saving device instead of its

other implied long term financial benefits. Indian people are prone to investing

in properties and gold followed by bank deposits. They selectively invest in

shares also but the percentage is very small. Even to this day, Life Insurance

Corporation of India dominates Indian insurance sector. With the entry of

private sector players backed by foreign expertise, Indian insurance market has

become more vibrant.

Historical Perspective

The history of life insurance in India dates back to 1818 when it was conceived

as a means to provide for English Windows. Interestingly in those days a higher

premium was charged for Indian lives than the non-Indian lives as Indian lives

were considered more riskier for coverage.

The Bombay Mutual life Insurance Society started its business in 1870. It was

the first company to charge same premium for both Indian and non-Indian lives.

The Oriental assurance Company was established in 1880. The General

insurance business in India, on the other hand, can trace its roots to the Triton

(Tital) Insurance Company Limited, the first general insurance company

established in the year 1850 in Calcutta by the British. Till the end of nineteenth

century insurance business was almost entirely in the hands of overseas

companies.

Insurance regulation formally began in India with the passing of the Life

Insurance Companies Act of 1912 and the provident fund act of 1912. Several

frauds during 20s and 30s sullied insurance business in India. By 1938 there

were 176 insurance companies. The first comprehensive legislation was

introduced with the Insurance Act of 1938 that provided strict state Control over

insurance business. The insurance business grew at a faster pace after

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

5

independence. Indian companies strengthened their hold on this business but

despite the growth that was witnessed, insurance remained an urban

phenomenon.

The Government of India in 1956, brought together over 240 private life

insurers and provident societies under one nationalized monopoly corporation

and life Insurance Corporation (LIC) was born. Nationalization was justified on

the grounds that is would create much needed funds for rapid industrialization.

This was in conformity with the Governments chosen path of State lead

planning and development.

The (non-life) insurance business continued to thrive with the private sector till

1972. Their operations were restricted to organized trade and industry in large

cities. The general insurance industry was nationalized in 1972. With this,

nearly 107 insurers were amalgamated and grouped into four companies-

National Insurance Company, New India Assurance Company, Oriental

Insurance Company and United India Insurance Company. These were

subsidiaries of the general Insurance Company (GIC).

Indian federal government considers insurance as one of major sources of funds

for infrastructure development. The government has identified the following as

major thrust areas:

A detailed study of quality work life of LIFE ADVISORS OF BHARTI AXA LIFE INSURANCE

6

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mini Project 2Document9 pagesMini Project 2gunjan_pattnayak2007No ratings yet

- German Specification BGR181 (English Version) - Acceptance Criteria For Floorings R Rating As Per DIN 51130Document26 pagesGerman Specification BGR181 (English Version) - Acceptance Criteria For Floorings R Rating As Per DIN 51130Ankur Singh ANULAB100% (2)

- Erich FrommDocument2 pagesErich FrommTina NavarroNo ratings yet

- Ecg Quick Guide PDFDocument7 pagesEcg Quick Guide PDFansarijavedNo ratings yet

- ExamDocument10 pagesExamjohn ivan100% (1)

- W2 - Fundementals of SepDocument36 pagesW2 - Fundementals of Sephairen jegerNo ratings yet

- Monitoring AlkesDocument41 pagesMonitoring AlkesEndangMiryaningAstutiNo ratings yet

- 5L ReductionsDocument20 pages5L ReductionsCarlos Javier Orellana OrtizNo ratings yet

- Rahu Yantra Kal Sarp Yantra: Our RecommendationsDocument2 pagesRahu Yantra Kal Sarp Yantra: Our RecommendationsAbhijeet DeshmukkhNo ratings yet

- Narrative ReporDocument3 pagesNarrative ReporMARK LUKE ULITNo ratings yet

- Durock Cement Board System Guide en SA932Document12 pagesDurock Cement Board System Guide en SA932Ko PhyoNo ratings yet

- Chapter 11-15Document172 pagesChapter 11-15Mansoor AhmadNo ratings yet

- CRM McDonalds ScribdDocument9 pagesCRM McDonalds ScribdArun SanalNo ratings yet

- Kebersihan, Fungsi Sanitasi Dan Drainase - BAHASA INGGRIS - VII - Semester IDocument5 pagesKebersihan, Fungsi Sanitasi Dan Drainase - BAHASA INGGRIS - VII - Semester IRiska AyuNo ratings yet

- Ainsworth, The One-Year-Old Task of The Strange SituationDocument20 pagesAinsworth, The One-Year-Old Task of The Strange SituationliliaNo ratings yet

- Lohmann GuideDocument9 pagesLohmann GuideRomulo Mayer FreitasNo ratings yet

- 13 Alvarez II vs. Sun Life of CanadaDocument1 page13 Alvarez II vs. Sun Life of CanadaPaolo AlarillaNo ratings yet

- INTELLECTUAL DISABILITY NotesDocument6 pagesINTELLECTUAL DISABILITY Notesshai gestNo ratings yet

- Citizen's 8651 Manual PDFDocument16 pagesCitizen's 8651 Manual PDFtfriebusNo ratings yet

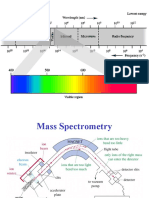

- Mass SpectrometryDocument49 pagesMass SpectrometryUbaid ShabirNo ratings yet

- US Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistDocument114 pagesUS Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistGeorges100% (2)

- MAIZEDocument27 pagesMAIZEDr Annie SheronNo ratings yet

- Lathe Operators Manual 96-8900 Rev A English January 2014Document458 pagesLathe Operators Manual 96-8900 Rev A English January 2014coyoteassasin0% (1)

- Rar Vol11 Nro3Document21 pagesRar Vol11 Nro3Valentine WijayaNo ratings yet

- Optical Fiber Communication Unit 3 NotesDocument33 pagesOptical Fiber Communication Unit 3 NotesEr SarbeshNo ratings yet

- Data Sheet FC SIDocument2 pagesData Sheet FC SIAndrea AtzeniNo ratings yet

- Fin e 59 2016Document10 pagesFin e 59 2016Brooks OrtizNo ratings yet

- Aircaft Avionics SystemDocument21 pagesAircaft Avionics SystemPavan KumarNo ratings yet

- Quinta RuedaDocument20 pagesQuinta RuedaArturo RengifoNo ratings yet

- Mental Status ExaminationDocument34 pagesMental Status Examinationkimbomd100% (2)