Professional Documents

Culture Documents

Liberty Securities Individual Account Strategy Factsheet - May 2014

Uploaded by

LibertySecuritiesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liberty Securities Individual Account Strategy Factsheet - May 2014

Uploaded by

LibertySecuritiesCopyright:

Available Formats

Individual Account Strategy | High Yield | Georgia | May 2014

GEL/US$ 1.7700

Not a bank deposit or a regulated investment product | Not insured | May lose value

2/5/2014

I

N

D

I

V

I

D

U

A

L

A

C

C

O

U

N

T

S

T

R

A

T

E

G

Y

H

I

G

H

Y

I

E

L

D

G

E

O

R

G

I

A

I

N

D

I

V

I

D

U

A

L

A

C

C

O

U

N

T

S

T

R

A

T

E

G

Y

H

I

G

H

Y

I

E

L

D

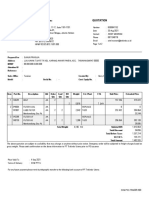

Strategy Details

Inception date 1/11/2013

Base currency US$, , or GEL

Total net assets ~GEL 1 million

Target annualised return (net of all fees & expenses) US$ 12.5%/GEL 17.5%

Maximum maturity of the underlying assets

1

5 years

Management fee (% of the NAV p.a.)

2

1.5%

Performance fee (% of the annualised net return above the Hurdle Rate)

3

10%

Hurdle rate (regardless of the Base Currency) 10%

Expenses (% of the NAV)

4

<0.25%

Minimum investment US$10,000

5

Maximum investment US$250,000

Frequency of valuation reports Monthly

Minimum holding period 180 days

Redemption notice 90 days

Redemption FX rate The NBG rate as of the settlement date

6

Portfolio Construction & Limits

Maximum permissible % of the NAV

Georgian issued instruments >80%

Georgian Treasury bills <25%

US$ denominated bank deposits & CDs <25%

GEL denominated bank deposits & CDs <50%

Promissory notes issued by non-bank lenders (GEL & US$) <75%

Loans to non-bank lenders (GEL & US$) <90%

Working capital credit facilities <75%

Managed P2P lending opportunities (GEL) <75%

Preferred shares <25%

Similar instruments in Azerbaijan & Armenia <20%

Other instruments <10%

Long only, no leverage, no derivatives, no currency hedging

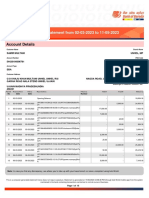

Top Five Holdings As of 30 April 2014

Instrument Currency Yield

7

% of NAV

Managed P2P lending GEL 104% 17%

Structured working capital facility GEL 46% 13%

Loan to a non-bank lender US$ 15% 12%

Structured working capital facility GEL 37% 9%

Structured working capital facility GEL 37% 9%

Total 60%

# of instruments held 19

Investment Team

Relevant experience

Investment Committee

Lado Gurgenidze 19 years

Goga Melikidze 9 years

Tengiz Lashkhi 7 years

Victor Meskhi 5 years

Investment Manager

Vano Barbakadze 8 years

Vano Barbakadze served, from July 2008 through June 2013, as portfolio manager at Abbey Asset

Management, a leading asset management company in Georgia, managing Aldagi Pension Fund, the

largest pension fund in Georgia by AUM.

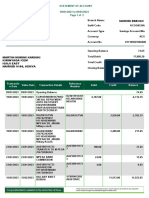

2H 08 2009 2010 2011 2012 1H 13

Gross Returns (GEL) -16.6% 81.6% 17.1% 17.2% 15.4% 7.8%

Net Returns (GEL) -18.1% 68.8% 13.2% 13.4% 11.7% 5.9%

Gross Returns (US$) -29.0% 79.6% 11.4% 24.4% 16.4% 8.1%

Net Returns (US$) -30.3% 66.9% 7.6% 20.3% 12.6% 6.2%

AUM

8

, US$ mln 1.0 2.2 2.8 4.1 4.9 5.5

Georgian CPI 1.0% 3.0% 11.2% 2.0% -1.4% 0.3%

JPM EMBI+ -9.1% 25.9% 11.8% 9.2% 18.0% -9.4%

MSCI FM 100 -55.2% 4.2% 21.1% -22.5% 4.1% 7.2%

S&P Frontier BMI -52.4% 9.1% 18.9% -18.7% 5.4% 7.6%

FTSE Frontier 50 -51.7% 2.2% 12.6% -27.1% 12.4% 6.4%

MSCI EM -47.8% 74.5% 16.4% -20.4% 15.1% -10.9%

Contact Details

Liberty Securities Ltd

The Liberty Tower, 74 I. Chavchavadze Ave., Tbilisi 0162 Georgia

www.libertysecurities.ge

Sales

Temur Iremashvili, Director Mobile: +995 591 158 877

temur.iremashvili@libertysecurities.ge

sales@libertysecurities.ge

Skype: temur_75

Investment Manager

Vano Barbakadze Mobile: +995 591 604 040

vano.barbakadze@libertysecurities.ge

Skype: vano_barbakadze

1. Except for preferred shares

2. Annual fees charged by Liberty Securities accrued daily and paid quarterly in arrears

3. Payable annually in arrears or upon withdrawal of funds by the investor, whichever occurs earlier, if

the annualised net rate of return for the year or on the funds withdrawn, as the case may be, exceeds

the annualised Hurdle Rate

4. Annual operating expenses other than the fees charged by Liberty Securities

5. Investments less than US$10,000 or equivalent in GEL, may be accepted by Liberty Securities in its

discretion, subject to the GEL 300 administration fee charged upon inception

6. Accessible at http://www.nbg.ge/index.php?m=582&lng=eng

7. Gross annualised yield

8. As at period end

Investment Objective & Philosophy

The Liberty Securities High Yield: Georgia Individual Account Strategy (the IAS) seeks to provide high total

return from current income through investment in a range of fixed-income assets situated principally in

Georgia, and mostly denominated in the local currency.

Why Georgian High Yield Strategy?

Georgia, a top reformer in the world in 2006-2011 according to the World Bank, has experienced a long period

of high economic growth rates in 2004-2012 and has evolved into an attractive low-tax jurisdiction with full

currency convertibility and attractive business climate (currently ranked by the World Bank as No. 8 in the

Ease of Doing Business global rankings and No. 22 in the WSJ-Heritage Foundation Economic Freedom Index).

Georgias economic openness, attractive location, and liberal visa and trade regime have contributed to

Georgias ongoing transformation into a regional tourism, trade and financial hub.

Due to the growing receipts from tourism and remittances, export growth and stable FDI, portfolio and donor

inflows, Georgia has been comfortably financing its current account deficit in the past decade. Its currency, the

Lari (GEL), has depreciated by less than 10% against the US$ since the beginning of 2009, and inflation is

currently at 3.4%, down from the historical high single-digits level.

The Georgian banking sector is among the most stable, dynamic and innovative in the FSU/SEE and has grown

by over 1,000% since 2003; nonetheless, the banking penetration rate remains low, with bank credit to GDP at

37% and bank credit to individuals to GDP at 17% at YE 2013.

The historically high interest rates on bank loans and deposits have decreased considerably in the past 12

months, with 12-month bank term deposits in US$ currently yielding no more than 5%-6% (compared with

8%-10% attainable in 2002-2012).

The current outstanding stock of private banking deposits in Georgia is estimated at US$500 mln, with at least

half of this amount contributed by non-resident clients. As these term deposits expire, it will be impossible to

reinvest the funds in bank term deposits at anywhere near the yield levels of 2010-2012.

The Georgian non-bank lending sector has experienced robust growth in the past five years, with the

aggregate loan book of non-bank lenders exceeding US$400 mln in 2013 (up from less than US$30 mln in

2006). The non-bank lending sector comprises over 70 microfinance companies licensed by the National Bank

of Georgia, and up to 20 other traditional and newly-established online lenders that do not require a

regulatory license. Given their lending rates that typically reach or even exceed 30% p.a. for secured loans and

60% for unsecured loans, these lenders attract funds at the rates reaching, and sometimes exceeding, 10%

p.a.

Why Liberty Securities?

Founded and managed by individuals at the forefront of the financial services sector development in Georgia

for over 10 years

Rigorous bottom-up driven investment screening process to identify the best reward-risk opportunities based

on the investment teams superior understanding of the banking and non-bank lending markets in Georgia

Investment discipline and risk controls ensuring the diversification insofar as possible within the set

boundaries of the investment strategy

Access to attractive opportunities, such as, for instance, certificates of deposit issued by Liberty Bank,

promissory notes and loans yielding over 10% in selected leading non-bank lenders, and access to the

managed P2P lending platform (eLoan.ge) owned and operated by eCapital, a Liberty Securities affiliate

Why the Individual Account Strategy?

Convenience and liquidity

Low investment minimums

Diversification

Return History NAV per notional IAS Investment Unit*

GEL US$ GEL US$

October 2013 100.0 59.9

November 2013 2.6% 1.4% 102.6 60.6

December 2013 3.7% 1.1% 106.4 61.3

January 2014 3.5% 0.9% 110.1 61.8

February 2014 1.9% 3.8% 112.3 64.2

March 2014 2.9% 3.0% 115.4 66.0

April 2014 2.7% 1.4% 118.6 66.9

Performance, since inception

GEL US$ EUR GBP

Cumulative 18.6% 11.9% 10.3% 6.7%

Annualised 37.4% 24.1% 20.8% 13.5%

Risk Metrics

GEL US$

Volatility 0.10% 0.14%

Sharpe Ratio** 0.8 0.3

NAV per notional IAS Investment Unit* (rebased)

*The notional IAS Investment Units are set out for illustrative purposes only for the ease of tracking and assessing the

historical performance of the Individual Account Strategy. The NAV per notional IAS Investment Unit is calculated on a daily

basis and equals the aggregate NAV of the Individual Account Strategy divided by the total number of the notional IAS

Investment Units

**The current yield (6.895%) of the 12-month Georgian Treasury Bills used as the risk-free rate

100

104

108

112

116

120

Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14

NAV per Unit, GEL NAV per Unit, US$

Individual Account Strategy | High Yield | Georgia | May 2014

Not a bank deposit or a regulated investment product | Not insured | May lose value

2/5/2014

I

N

D

I

V

I

D

U

A

L

A

C

C

O

U

N

T

S

T

R

A

T

E

G

Y

H

I

G

H

Y

I

E

L

D

G

E

O

R

G

I

A

I

N

D

I

V

I

D

U

A

L

A

C

C

O

U

N

T

S

T

R

A

T

E

G

Y

Individual Account Strategy Operational Details and Key Terms & Conditions

Base Currency

Investments into the IAS can be made in GEL, US$, EUR or GBP, with the valuation reports and redemptions also denominated in the Base Currency chosen by the investor.

Investment size:

Minimum Investment: US$10,000 or equivalent in GEL, EUR or GBP (investments less than US$10,000 or equivalent in other currencies, may be accepted by Liberty Securities in its discretion)

Maximum Investment: US$250,000 or equivalent in GEL, EUR or GBP

Redemptions and Cash Distributions

The Minimum Holding Period prior to the submission of the Redemption Notice is 180 days, following which the Redemption Notice may be submitted by the investor at any time.

Redemption Notice: 90 days.

Withdrawal of the funds by the investor will occur at the effective NAV per notional IAS Investment Unit as of the withdrawal date.

The Redemption Notice Template can be accessed at http://bit.ly/1b1Hv3t.

The Management Fee and Other Expenses

Management Fee: 1.50% p.a.

Accrued on a daily basis and paid quarterly in arrears to Liberty Securities, by way of debiting the Management Fee from the investors Asset Management Account.

If funds are contributed into the investors Asset Management Account or a withdrawal of funds is made before the end of the calendar quarter, the Management Fee in respect of such

funds will be calculated and accrued daily based on the number of calendar days during the calendar quarter in question during which such funds had been invested in the investors Asset

Management Account.

Performance Fee: 10% of the annualised net return above the annualised Hurdle Rate.

Payable annually in arrears or upon withdrawal of funds by the investor, whichever occurs earlier. The Performance Fee will be calculated and debited from the investors Asset

Management Account on the last day of the calendar year or on the date of the withdrawal, as the case may be. In case the last day of the calendar year is not a business day, the

Performance Fee shall be paid on the next business day.

Hurdle Rate: 10% p.a., regardless of the Base Currency

Audit, legal and all other expenses incurred in connection with the IAS will not exceed 0.25% p.a. and will be accrued on a daily basis and debited quarterly from the investors Asset Management

Account.

If funds are contributed or withdrawn by the investor during the calendar quarter, the expenses in respect of such contributed or withdrawn funds, as the case may be, will be calculated

and accrued on a daily basis based on the number of calendar days during which such funds had been invested in the investors Asset Management Account in the given quarter.

Valuation Reports

Valuation reports will be provided to the IAS investors monthly via email.

Taxation

The following discussion summarises certain Georgian tax considerations that may be relevant to the IAS Clients. This summary is limited to Georgian taxation issues, does not purport to be

comprehensive, does not constitute tax advice or opinion, and prospective investors are strongly encouraged to consult their tax advisors and to read carefully Article 10.1 of the Investment

Management Agreement prior to investing in the IAS. No assurance is made that the considerations summarised below may not be challenged by the Revenue Service of Georgia.

Tax on Interest & Dividends

Interest is defined in Article 8.19 of the Georgian Tax Code as payments related to obligations arising from debt, including, inter alia, loans, promissory notes, deposits and securities. Interest income

received from non-financial institutions is taxed at tax rate of 5%. This tax will be withheld at the source, and, accordingly, the net amount will be credited to the IAS investors Asset Management

Account. A fiscal report will be provided to the investors annually, certifying the amounts withheld, on a pro rata basis, from all relevant investments held during the year in the Master Account.

Liberty Securities believes that the investor will thus not be liable for any additional tax on interest received. Dividends are also subject to a 5% tax withheld at the source. As the relevant tax on

both interest and dividends will be withheld at the source, Liberty Securities believes that the investor in the IAS will face no tax filing requirements in Georgia. Interest and dividend income are

excluded from the taxable income of resident and non-resident legal entities and individuals.

Tax on the Payment of Principal

The principal amount received by resident and non-resident legal entities and individuals is not included in their taxable income and, therefore, is not subject to corporate profit or personal income

taxation in Georgia to the extent that the redemption or sale price at the maturity does not exceed the original purchase price (see Taxation of Capital Gains below).

Taxation of Capital Gains

There is no separate capital gains tax in Georgia. Realised capital gains on the sale (or exchange) of assets are included in the taxable income of resident and non-resident legal entities and

individuals. Accordingly, in the event that the IAS realises any capital gains from the disposal of any assets held in the Master Account on behalf of all IAS investors, the relevant tax will be withheld

at the source on behalf of each IAS investor by Liberty Securities, which believes that no tax filing requirements in Georgia will be triggered as a result (however, the circumstances of each investor

may vary). The applicable rates are as follows:

Resident individuals 20% Non-resident individuals 10%

Resident legal entities 15% Non-resident legal entities 10%

Account Opening and Investment Subscription (by invitation only, enquiries are welcome)

An investor fills out the Account Opening Application Form, signs an Asset Management Agreement and opens an Asset Management Account with Liberty Securities. These documents can be

accessed at http://bit.ly/1b1Hv3t.

The investor wires the funds into his/her Asset Management Account and instructs Liberty Securities that the funds are earmarked for the High Yield: Georgia Individual Account Strategy.

After receiving the investors funds, Liberty Securities places the cash in the Master Account, designated specifically for the IAS purposes.

Currently, the IAS is closed for new subscriptions.

Master Account and the Safekeeping of Investments

The Master Account is an account where all investors cash earmarked for the IAS is pooled, and into which all the cash distributions from the instruments in which the IAS is invested are made.

The IAS investors funds pooled into the Master Account may only be used for the IAS purposes and are completely segregated from all other client or proprietary accounts of Liberty Securities.

Liberty Securities will keep all investments made for the IAS in a separate Liberty Securities nominee account created for the purposes of safekeeping the IAS investments.

Liberty Securities will also open accounts with any counterparty for the purposes of the IAS to hold and safekeep any cash, securities and investments associated with the IAS separately from any

of its other accounts at such counterparties.

This document has been produced by Liberty Securities Ltd (Liberty Securities). Liberty Securities and/or persons connected with it may effect or may have effected a transaction or transactions for their own account in the

securities or instruments or strategies (collectively, the Instruments) referred to in this document or any related investment before the material is published to Liberty Securities clients, may have a position in the securities

and/or any related investment and may make a purchase and/or sale, or offer to make a purchase and/or sale, of the Instruments and/or any related investment from time to time, in the open market or otherwise, in each case

either as principal or as agent. Persons connected with Liberty Securities may provide or have provided corporate finance and other services to the issuer(s) of the Instruments and may seek to do so in the future. Accordingly,

information may be available to Liberty Securities and/or persons connected with it which is not reflected in this document. This document is not, and should not be construed as an offer to sell or solicitation of an offer to buy any

securities. The information and opinions contained in this document have been compiled or arrived at by Liberty Securities from sources believed to be reliable and in good faith, but no representation or warranty, express or

implied, is made as to their accuracy, completeness or correctness. All opinions and estimates contained in this document constitute Liberty Securities judgment as of the date hereof and are subject to change without notice. The

information contained in this document is published for the assistance of the intended recipients, but is not to be relied upon as authoritative or be the basis for an investment decision. Liberty Securities accepts no liability

whatsoever for any direct or consequential loss arising from any use of this document or its contents. This document may include estimates, projections and other forward-looking statements. Due to numerous factors, actual

events may differ substantially from those presented. Liberty Securities assumes no duty to update any such statements. Any holdings of a particular Instrument discussed herein are under periodic review by the investment team

and are subject to change at any time, without notice. Nothing contained herein should be considered a recommendation or advice to purchase or sell any security. This document may not be reproduced, distributed or published

for any purpose. It is not intended for and must not be distributed to private customers. Further information may be obtained and for this purpose the intended recipients hereof should contact Liberty Securities at the address

given above. This document is not to be distributed in the United States and the United Kingdom, and in any other jurisdiction where such distribution is unlawful. An investment in the Instruments has risks, including the risk of

losing some or all of the invested capital. Performance includes reinvestment of all distributions. Past performance is not indicative of future results. Prior to investing, a prospective investor should carefully consider the risks and

suitability of the Instruments based on his/her own investment objectives and financial position. Some of the Instruments described herein may not be a regulated financial instrument and, as such, may not require the publication

of a prospectus or similar document. An investor should carefully review all the relevant information and factors and consult with his/her financial, legal and tax advisors.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- Insurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Document16 pagesInsurance Commission Licensure Examination Reviewer Variable Universal Life (Vul)Dave Panulaya100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Analisis Kasus Rogue Trader Societe GeneraleDocument2 pagesAnalisis Kasus Rogue Trader Societe GeneraleWulan NurjannahNo ratings yet

- Receipt PDFDocument2 pagesReceipt PDFObi ToNo ratings yet

- JSC Liberty Finance Factsheet June 2015Document2 pagesJSC Liberty Finance Factsheet June 2015LibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet June 2015Document2 pagesJSC Liberty Finance Factsheet June 2015LibertySecuritiesNo ratings yet

- HY IAS Factsheet June 2015Document2 pagesHY IAS Factsheet June 2015LibertySecuritiesNo ratings yet

- HY IAS Factsheet June 2015Document2 pagesHY IAS Factsheet June 2015LibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet June 2015Document2 pagesJSC Liberty Finance Factsheet June 2015LibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet 20141031Document2 pagesJSC Liberty Finance Factsheet 20141031LibertySecuritiesNo ratings yet

- HY IAS Factsheet June 2015Document2 pagesHY IAS Factsheet June 2015LibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q3 2014 and 9M 2014 ResultsDocument3 pagesLiberty Bank Research Note - Q3 2014 and 9M 2014 ResultsLibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q2 2014 and 1H 2014 ResultsDocument3 pagesLiberty Bank Research Note - Q2 2014 and 1H 2014 ResultsLibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet - June 2014Document2 pagesJSC Liberty Finance Factsheet - June 2014LibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet 20141031Document2 pagesJSC Liberty Finance Factsheet 20141031LibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet - May 2014Document2 pagesJSC Liberty Finance Factsheet - May 2014LibertySecuritiesNo ratings yet

- Liberty Securities Individual Account Strategy Factsheet - June 2014Document2 pagesLiberty Securities Individual Account Strategy Factsheet - June 2014LibertySecuritiesNo ratings yet

- Liberty Securities Individual Account Strategy Factsheet - April 2014Document2 pagesLiberty Securities Individual Account Strategy Factsheet - April 2014LibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q1 2013 ResultsDocument3 pagesLiberty Bank Research Note - Q1 2013 ResultsLibertySecuritiesNo ratings yet

- JSC Liberty Finance Factsheet - April 2014Document2 pagesJSC Liberty Finance Factsheet - April 2014LibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q4 2013 and 2013 ResultsDocument3 pagesLiberty Bank Research Note - Q4 2013 and 2013 ResultsLibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q3 2013 and 9M 2013 ResultsDocument3 pagesLiberty Bank Research Note - Q3 2013 and 9M 2013 ResultsLibertySecuritiesNo ratings yet

- Liberty Bank Research Note - Q2 2013 and 1H 2013 ResultsDocument3 pagesLiberty Bank Research Note - Q2 2013 and 1H 2013 ResultsLibertySecuritiesNo ratings yet

- Syllabus Credit Transactions 2017 18Document9 pagesSyllabus Credit Transactions 2017 18JoeMagsNo ratings yet

- Corporate StrategyDocument15 pagesCorporate StrategyAbhilasha BagariyaNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocument16 pagesXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNo ratings yet

- Account Statement UnlockedDocument12 pagesAccount Statement UnlockedDeepeNo ratings yet

- Advancements in BankingDocument16 pagesAdvancements in BankingGaneshan ParamathmaNo ratings yet

- CH 5 MCQ AccDocument7 pagesCH 5 MCQ AccabiNo ratings yet

- Lynx Fund Performance SummaryDocument2 pagesLynx Fund Performance Summarymrobertson3890No ratings yet

- Midterm Exam I Solution KeyDocument3 pagesMidterm Exam I Solution KeyyarenNo ratings yet

- Analysis of General Banking Activities of Standard Bank LimitedDocument69 pagesAnalysis of General Banking Activities of Standard Bank LimitedJerin TasnimNo ratings yet

- CFS ExplanationDocument13 pagesCFS ExplanationDELFIN, LORENA D.No ratings yet

- Fact Finding - UT TakafulDocument1 pageFact Finding - UT TakafulcaptkhairulnizamNo ratings yet

- Financial Statement, Taxes and Cash Flow (With Answers)Document16 pagesFinancial Statement, Taxes and Cash Flow (With Answers)Haley James ScottNo ratings yet

- Commercial Bank - Definition, Function, Credit Creation and SignificancesDocument19 pagesCommercial Bank - Definition, Function, Credit Creation and SignificancesAhmar AbbasNo ratings yet

- Cebuply Balance Sheet YTD TEMPLATEDocument2 pagesCebuply Balance Sheet YTD TEMPLATEedsylkhu.cebuplyNo ratings yet

- Transfer Price MechanismDocument5 pagesTransfer Price MechanismnikhilkumarraoNo ratings yet

- PT Trakindo Utama: QuotationDocument2 pagesPT Trakindo Utama: QuotationHuda HudaNo ratings yet

- Investment Option Through BajajDocument57 pagesInvestment Option Through BajajSiddiqua AnsariNo ratings yet

- "Financial Statement Analysis of Bank of Maharashtra": A Project Report OnDocument65 pages"Financial Statement Analysis of Bank of Maharashtra": A Project Report OnShashi RanjanNo ratings yet

- Tsgli All FormsDocument29 pagesTsgli All FormsSlns Acpt50% (2)

- Loans and Advances (Mba Finance Internship Project)Document84 pagesLoans and Advances (Mba Finance Internship Project)Niki niki83% (6)

- Account Statement: Description DateDocument11 pagesAccount Statement: Description DateBoni MondalNo ratings yet

- Balance Sheet - The Coca-Cola Company (KO)Document1 pageBalance Sheet - The Coca-Cola Company (KO)vijayNo ratings yet

- Paytm CaseDocument9 pagesPaytm CaseSHREY BAZARINo ratings yet

- Martin Murimi KariukiDocument2 pagesMartin Murimi KariukiKameneja LeeNo ratings yet

- Income Taxes: Sri Lanka Accounting Standard - LKAS 12Document46 pagesIncome Taxes: Sri Lanka Accounting Standard - LKAS 12Sineth NeththasingheNo ratings yet