Professional Documents

Culture Documents

WSJ Risk of Flood

Uploaded by

tpobrien101Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WSJ Risk of Flood

Uploaded by

tpobrien101Copyright:

Available Formats

EE

P1JW321044-4-D00200-1---SA

**** BLACK P1JW321044-4-D00200-1---SA P1JW321044-4-D00200-1---SA CH,LG

11/16/2004

D2 T U ES DAY, NOV E M BE R 1 6, 2 0 04 T H E WA L L ST R E E T J O U R NA L . * * * *

PERSONAL FINANCE

Underwater, With No Insurance

U.S. Pushes Homeowners

To Expand Flood Coverage

In Wake of Recent Storms

By JEFF D. OPDYKE

Go home for

In the wake of one of the biggest hurri-

the holidays cane seasons in memory, the Federal

Emergency Management Agency is push-

(Stay comfortably elsewhere) ing homeowners—even those far re-

moved from typical flood zones—to reas-

a ming G˜ome h´re. sess their risk of being washed out of

their homes.

ø

Hel¬o, Th´ R ding in the ˙o†el Check out our Nearly 90% of all declared disasters in

the U.S. include a flooding component.

exclusive holiday rates.

I was s†ån ´ø˜e caµe up Yet even though between eight million

and 11 million homeowners live in flood

løb∫y wh en som. M¥ word, this Atlanta from

zones, only 4.4 million carry federal flood

insurance. And 25% of flood claims are

å˜d kißs´d me ˙tful am´ni†ˆes. Comfort Inn and Suites Galleria

$40 paid to victims living outside an estab-

lished flood zone and in zones labeled

UPI/Landov

p¬ace hås †houg Charlotte

La Quinta Coliseum

from

low-to-moderate risk for flooding. The up-

shot is that homeowners are generally

Weighing Your Flood Risk

Homeowners who want to know if they live in or near a flood zone, or who want to know

more about flood-zone maps, can go to these Web sites:

⁄

$49 ill-prepared for the most common disas-

ter they will likely ever face. Worse, n www.floodsmart.gov

many wrongly assume their standard The National Flood Insurance Program’s site provides an assessment of flood risk

Orlando from homeowner’s policy will cover a flood. for a specific address—though the assessment can seem puzzling, since it places

Best Western Plaza International

$52 Amid a surge in flood-damage claims into moderate flood zones some homes that would seem to be well away from any

with the National Flood Insurance Pro- flooding possibility. Part of the reason is that flood zones can change over time,

Philadelphia gram, FEMA, the program’s administra- based on development and other factors.

from tor, is appealing to millions of homeown-

Wyndham Franklin Plaza Hotel n www.fema.gov

$72* ers at risk for flooding but who don’t have

Fema’s Web site offers tutorials on reading and understanding flood-insurance

flood insurance. Earlier this year, the

agency launched a Web site, television ad rate maps.

Raleigh/Durham

La Quinta Inn & Suites from campaign and a toll-free number to help

homeowners assess their flood risk. And hasn’t seen water in centuries, and there billion in property is lost each year to

Research Triangle Park $76 while the so-called FloodSmart campaign are lots of uncovered losses because of it.” flooding, of which the flood program has

seems an obvious tactic in coastal and Even wildfires can spark flooding, paid out $773 million annually in claims,

low-lying communities routinely drowned prompting the agency to note that homes on average, in the past decade.

Nashville from by hurricanes and river overflow, federal in mountainous areas are also at risk for Homeowners often don’t discover that

Holiday Inn Nashville Downtown

$84* officials say folks living well outside estab- flooding. Flood claims are pouring in their home-insurance policies are useless

lished flood zones—like up the side of a from Southern California homeowners when it comes to floods until their posses-

mountain—are also potential victims. whose property has been damaged by wa- sions are underwater.

One group of homeowners FEMA ter and mudslides running off denuded Only flood insurance covers flood dam-

hopes to reach: Homeowners who bought hillsides in the aftermath of the big wild- age, and the only place to buy it is

their house entirely with cash—such as fires there last year. The flood-insurance through the National Flood Insurance Pro-

retirees relocating to places like Florida program handled roughly 50 claims in gram. Because flooding is so unpredict-

and other Southern coastal states. These October from Californians living no- able and so catastrophic, traditional insur-

homeowners often skip flood insurance where near a river or the ocean. ers don’t underwrite flood coverage, they

because they aren’t forced to buy it, Still, companies specializing in assess- just sell and service policies for the Na-

whereas home buyers who rely on a mort- ing flood risk say just because a home lies tional Flood Insurance Program. The poli-

gage are required by a mortgage com- within a flood zone doesn’t necessarily cies cost as much as $1,800 a year for a

pany to purchase flood insurance for a mean it is at risk. Dan Freudenthal, presi- house situated in a known flood zone.

house in a flood zone. dent of Flood Zone Correction Inc. in West Prices drop to just a few hundred dollars

1-888-TRAVELOCITY More than 41,000 homeowners from Lou-

isiana to Connecticut have filed for flood

Palm Beach, Fla., says flood maps as-

sume every home within a flood zone is at

a year for homes in zones labeled low-to-

moderate risk.

travelocity.com/holidays damage with the flood-insurance program risk when, depending on how a home was Still, flood insurance isn’t a panacea.

due to the hurricanes that stormed ashore built, its elevation and the drainage Flood coverage taps out after $250,000 of

America Online Keyword: Travel this year. That nearly matches the number around it, “your house may not be at risk damage to a home, and $100,000 of dam-

of claims the agency receives in an average for flooding at all.” Flood Zone Correction age to contents. Homeowners who need

year for all types of floods. With Hurricane helps homeowners remove their homes more coverage will have to look to the

Ivan, homeowners have filed claims in 60 of from the list of so-called Special Flood Haz- private market, through companies like

*Some properties have special offers, including free breakfast or room upgrades. Some restrictions apply. See site for details. Prices are in USD, per room, per night, based on the 67 counties in Pennsylvania—not rou- ard Areas, which carry the highest insur- Lloyds of London.

double occupancy. Prices do not include taxes and/or fees. Room rates are subject to availability. Book by 12/31/04. Please visit travelocity.com to confirm availability of current tinely considered a part of the flood belt. ance rates in terms of flood coverage.

Journal Link: WSJ.com subscrib-

offerings. ©2004 Travelocity.com LP. All rights reserved. TRAVELOCITY, the Stars Design and The Roaming Gnome are trademarks of Travelocity.com LP. CST# 2056372-50. Jeff Grady, president and CEO of the Insurance officials say homeowners

1

Û

Florida Association of Insurance Agents, anywhere within a flood zone should be ers can see Consumer Reports’

In other wø®ds, fa lå la la lå la lå la la... says in the panhandle town of Pensacola particularly careful about eliminating guide and ratings for homeowners

“water from Ivan got into areas that their coverage. In all, an estimated $3 insurance, at WSJ.com/JournalLinks.

‘Virtual Debit Card’ Aims to Combat Online Fraud

By JENNIFER SARANOW nerable to fraud. credit cards, they are directly tied to bank

If an unauthorized person obtains a cus- accounts. But online use of debit cards is

Consumers typically have been wary tomer’s eSpend number, only the specified starting to grow. In the first quarter of this

of using bank cards online. One bank’s daily limit could be taken out of a custom- year, Visa debit cards were used for 46%

solution is to get rid of the cards. er’s bank account. If this occurs, PNC says of online purchases, up from 43% a year

In an effort to ease customers’ con- customers aren’t liable for the charges. earlier, according to Visa International.

cerns about fraud and identity theft Purchases made with the eSpend card Analysts are skeptical about how ex-

when shopping online, PNC Bank has show up separately on bank statements. cited consumers will be about PNC’s new

launched a new checking account with a The account, which is aimed at online- card. “I think it’s an interesting idea but

“virtual debit card.” In addition to a regu- banking customers, also comes with iden- if you look at consumer usage, consum-

lar debit card that can be used at auto- tity-theft reimbursement insurance, a ers are using their debit cards online to-

mated teller machines and in stores, the debit card rewards program and no fee for day in increasing numbers, so it’s un-

“Digital Checking” account comes with using non-PNC ATMs. The account has a clear how much of a demand there would

an “eSpend” card. The card is basically a monthly $11 service fee unless customers be for a card with that unique applica-

piece of paper with an account number, opt for direct deposit of paychecks or gov- tion,” says Tony Hayes, a Dove analyst.

expiration date and verification code for ernment checks such as Social Security, Other banks have long offered similar

making purchases online, over the phone and pay at least three bills online. credit-card products as a way to encour-

and by mail order. Customers can set a The eSpend card comes as debit cards age purchases on the Internet and reduce

daily limit for their eSpend card (say are quickly overtaking cash and checks the amount of fraud they are liable for. In

$1,000) and once that amount is spent, as preferred methods of payment. Accord- June of 2002, for example, Citigroup Inc.’s

additional purchases won’t be approved. ing to a report from the American Bank- Citibank launched free, downloadable soft-

PNC Bank, a unit of PNC Financial ers Association and Boston-based Dove ware that allows credit-card customers to

Services Group Inc., Pittsburgh, hopes Consulting, 31% of in-store purchases obtain a new disposable account number

the eSpend card will attract people who were made with a debit card last year, up each time they make a purchase online. A

want to make purchases online with their from 21% in 1999. downside: Such “virtual account num-

debit card but are uncomfortable doing so Consumers typically have been wary bers” can’t be used when a credit card

for fear of making their bank account vul- of using debit cards online because, unlike must be shown at pickup.

SmartMoney

7

Fund Screen/Health-Care Funds

T HE PROSPECT OF a second term for George W.

Bush has proved to be good medicine for health-care

funds. For the week that included Election Day, the

still seem inexpensive. The group as a whole gained just

2.8% in 2004, as of Nov. 9, compared with 6.2% for the S&P

500. And the long-term prognosis for the industry remains

group jumped 4.2%, compared with 3% for the Standard strong. You’ve heard it before, but it bears repeating: As

& Poor’s 500-stock index, according to data from invest- the enormous baby-boomer generation marches toward re-

ment-research firm Lipper Inc. tirement, demand for health-care products and services is

The Bush victory—which calmed investor fears of expected to increase greatly.

Although some funds slice the health-care universe

greater involvement by the federal government in

quite thin, a broad health-care fund is the most suitable

health care—is a bright spot in an otherwise tough

investment for most investors. “The narrower you go, the

year for the industry, particularly among pharmaceuti-

more risk you take on,” says Phil Edwards, managing di-

cals companies, which have faced obstacles including

rector of investment services at Standard & Poor’s.

pricing pressures, weak research pipelines and patent We screened for top-performing no-load health-care

expirations, analysts say. Rising litigation risk is also funds. Our criteria: three- and five-year annualized re-

a major concern, as investors fear that Merck & Co., turns in the top 50% of the classification and expense ra-

whose stock was pummeled when it withdrew its tios in the bottom 50%. We also looked for net assets of

Vioxx painkilling drug, might portend future problems at least $50 million, a minimum initial investment of

for the sector. $5,000 or less, and availability to new investors. Seven

Despite the recent run-up, many health-care stocks funds made the cut. —Dawn Smith

Lock in the prime rate. Seven Top-Performing Health-Care Funds

We screened for high returns, low expenses and net assets of at least $50 million.

MINIMUM

ANNUALIZED ANNUALIZED INITIAL

FUND (TICKER) 5-YEAR RETURN 3-YEAR RETURN EXPENSE RATIO INVESTMENT

Introducing the new Capital One PrimeLock Card. Fidelity Select Medical Delivery (FSHCX) 19.89% 16.44% 1.30% $2,500

Finally, a credit card that’s always as low as the Prime Rate – now 4.75%.* Avoid introductory rates that Fidelity Select Medical Equipment & Systems (FSMEX) 18.46 14.43 1.18 2,500

expire after a limited time. With the PrimeLock Card from Capital One, your rate is set at prime for as long as Exeter Life Sciences (EXLSX) 18.34 4.52 1.18 2,000

you have the card. Get in on the rate other banks only give their biggest customers. Get the new Capital One Icon Healthcare (ICHCX) 15.98 11.24 1.34 1,000

PrimeLock Card. No more rate-watching. No more worries. No more hassles. Pimco RCM Biotechnology (DRBNX) 15.28 0.31 1.61 5,000

Pimco RCM Global Health Care (DGHCX) 14.14 2.15 1.61 5,000

T. Rowe Price Health Sciences (PRHSX) 11.11 5.78 1.00 2,500

Note: All data as of Nov. 9, 2004 Sources: Lipper Inc.; company reports

*Prime Rate as of 10/1/04. By mail only. Applies only to new and qualified applicants. Rates subject to change if the account is not kept in good standing.

Additional restrictions apply. Terms subject to change without notice. © 2004 Capital One Services, Inc. All rights reserved. To learn more about Fund Screens, including how to create your own, visit www.smartmoney.com/wsj_fund.

BLACK P1JW321044-4-D00200-1---SA 3695603

You might also like

- Are You Prepared For A Hurricane?Document1 pageAre You Prepared For A Hurricane?tpobrien101No ratings yet

- Increase The Cost Efficiency of Quality CoverageDocument1 pageIncrease The Cost Efficiency of Quality Coveragetpobrien101No ratings yet

- AIU Holdings KeypointsDocument1 pageAIU Holdings Keypointstpobrien101No ratings yet

- Family Blanket Policy PAM July 2009Document2 pagesFamily Blanket Policy PAM July 2009tpobrien101No ratings yet

- 10-01-09 Independent Agent High End SolutionsDocument6 pages10-01-09 Independent Agent High End Solutionstpobrien101No ratings yet

- 10-01-09 Independent Agent High End SolutionsDocument6 pages10-01-09 Independent Agent High End Solutionstpobrien101No ratings yet

- The Legal Hazards of GolfDocument5 pagesThe Legal Hazards of Golftpobrien101No ratings yet

- AIG Restructuring News ReleaseDocument6 pagesAIG Restructuring News Releasetpobrien101No ratings yet

- ACE Financial Facts Flyer 091808Document1 pageACE Financial Facts Flyer 091808tpobrien101No ratings yet

- Something New For 2007Document1 pageSomething New For 2007tpobrien101No ratings yet

- AIU Holdings KeypointsDocument1 pageAIU Holdings Keypointstpobrien101No ratings yet

- O'Brien Confirm LetterDocument3 pagesO'Brien Confirm Lettertpobrien101100% (1)

- WSJ Jan 29Document2 pagesWSJ Jan 29tpobrien101No ratings yet

- Flyer EMK Seminar 0804Document1 pageFlyer EMK Seminar 0804tpobrien101No ratings yet

- Homeowners Insurance Losses by CauseDocument1 pageHomeowners Insurance Losses by Causetpobrien101100% (1)

- Evaluations Summary 3-19-08Document2 pagesEvaluations Summary 3-19-08tpobrien101No ratings yet

- NJ Biz D&O With R SobelDocument2 pagesNJ Biz D&O With R Sobeltpobrien101No ratings yet

- NYSBA Trust & Estates Fall 2007Document3 pagesNYSBA Trust & Estates Fall 2007tpobrien101No ratings yet

- Excess Claims Examples 10-17-07Document1 pageExcess Claims Examples 10-17-07tpobrien101100% (1)

- CPA Journal MAY 2008Document4 pagesCPA Journal MAY 2008tpobrien101No ratings yet

- Practical Tax LawyerDocument4 pagesPractical Tax Lawyertpobrien101No ratings yet

- USFires 05Document1 pageUSFires 05tpobrien101No ratings yet

- CE ProgramDocument1 pageCE Programtpobrien101No ratings yet

- Northern HurricanesDocument1 pageNorthern Hurricanestpobrien101No ratings yet

- Treaster NYTDocument2 pagesTreaster NYTtpobrien101No ratings yet

- Water Loss Devices02010286Document2 pagesWater Loss Devices02010286tpobrien101No ratings yet

- WSJ Nanny TaxDocument3 pagesWSJ Nanny Taxtpobrien101No ratings yet

- Practical Tax LawyerDocument4 pagesPractical Tax Lawyertpobrien101No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- High Voltage - WikipediaDocument7 pagesHigh Voltage - WikipediaMasudRanaNo ratings yet

- Crew Resource Management Phil O'DonnellDocument39 pagesCrew Resource Management Phil O'DonnellMostafaNo ratings yet

- Review Related LiteratureDocument3 pagesReview Related LiteratureHanz EspirituNo ratings yet

- (Clinical Sociology - Research and Practice) Howard M. Rebach, John G. Bruhn (Auth.), Howard M. Rebach, John G. Bruhn (Eds.) - Handbook of Clinical Sociology-Springer US (2001) PDFDocument441 pages(Clinical Sociology - Research and Practice) Howard M. Rebach, John G. Bruhn (Auth.), Howard M. Rebach, John G. Bruhn (Eds.) - Handbook of Clinical Sociology-Springer US (2001) PDFMuhammad AliNo ratings yet

- 084 - ME8073, ME6004 Unconventional Machining Processes - NotesDocument39 pages084 - ME8073, ME6004 Unconventional Machining Processes - NotesA. AKASH 4001-UCE-TKNo ratings yet

- FISPQ - Innova - Force - ADY - EN - 7143812336Document6 pagesFISPQ - Innova - Force - ADY - EN - 7143812336Talia EllaNo ratings yet

- of Biology On Introductory BioinformaticsDocument13 pagesof Biology On Introductory BioinformaticsUttkarsh SharmaNo ratings yet

- Peoria County Booking Sheet 03/01/15Document8 pagesPeoria County Booking Sheet 03/01/15Journal Star police documentsNo ratings yet

- Mercury II 5000 Series Encoders: High Performance Encoders With Digital OutputDocument21 pagesMercury II 5000 Series Encoders: High Performance Encoders With Digital OutputRatnesh BafnaNo ratings yet

- iGCSE Biology Section 1 Lesson 1Document44 pagesiGCSE Biology Section 1 Lesson 1aastha dograNo ratings yet

- Ws - Mea Millennium Ecosystem AssessmentDocument3 pagesWs - Mea Millennium Ecosystem Assessmentapi-305791685No ratings yet

- HRM Report CIA 3Document5 pagesHRM Report CIA 3SUNIDHI PUNDHIR 20221029No ratings yet

- Handover Paper Final 22 3 16 BJNDocument13 pagesHandover Paper Final 22 3 16 BJNsisaraaah12No ratings yet

- 1 PBDocument16 pages1 PBRaffi GigiNo ratings yet

- Trust His Heart: - J - J J - . JDocument10 pagesTrust His Heart: - J - J J - . JJa-Cy R4o15se04roNo ratings yet

- Unit 8 Ethics and Fair Treatment in Human Resources ManagementDocument56 pagesUnit 8 Ethics and Fair Treatment in Human Resources Managementginish12No ratings yet

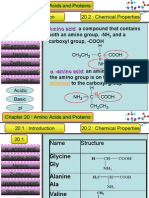

- Matriculation Chemistry Amino Acids-Part-1Document24 pagesMatriculation Chemistry Amino Acids-Part-1iki292No ratings yet

- Switching Power Supply Design: A Concise Practical Handbook: February 2022Document5 pagesSwitching Power Supply Design: A Concise Practical Handbook: February 2022Juan Gil RocaNo ratings yet

- Case Study MMDocument3 pagesCase Study MMayam0% (1)

- FPSB 2 (1) 56-62oDocument7 pagesFPSB 2 (1) 56-62ojaouadi adelNo ratings yet

- Steel Scrap Recycling Policy 06.11.2019 PDFDocument31 pagesSteel Scrap Recycling Policy 06.11.2019 PDFAnshul SableNo ratings yet

- Banco de Oro (Bdo) : Corporate ProfileDocument1 pageBanco de Oro (Bdo) : Corporate ProfileGwen CaldonaNo ratings yet

- Teri MicorisaDocument7 pagesTeri MicorisabiodieselnetNo ratings yet

- Ujian Diagnostik Ting 2 EnglishDocument9 pagesUjian Diagnostik Ting 2 EnglishJ-Gie JaulahNo ratings yet

- A Little BookDocument75 pagesA Little Bookfati_cenNo ratings yet

- Kolano - Plastrowanie DynamiczneDocument9 pagesKolano - Plastrowanie DynamiczneRobert WadlewskiNo ratings yet

- Cwts ThesisDocument7 pagesCwts Thesisbufukegojaf2100% (2)

- B1 SpeakingDocument5 pagesB1 SpeakingHoàng Nam Thắng100% (2)

- Baseline Capacity Assessment For OVC Grantee CSOsDocument49 pagesBaseline Capacity Assessment For OVC Grantee CSOsShahid NadeemNo ratings yet

- Affidavit: IN WITNESS WHEREOF, I Have Hereunto Affixed MyDocument2 pagesAffidavit: IN WITNESS WHEREOF, I Have Hereunto Affixed Myceleste LorenzanaNo ratings yet