Professional Documents

Culture Documents

R.J. Reynolds Internation Financing

Uploaded by

Umair ShaikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R.J. Reynolds Internation Financing

Uploaded by

Umair ShaikhCopyright:

Available Formats

Finding the Implicit Interest Rate on Loans Using the Swap Rates

Assume the following rates are quoted in the yen/dollar swap market:

Yen/LIBOR 5year yen rates ! "#5$% &i#e#' pay "#5$% yen rate to get LIBOR(

)ollar/LIBOR 5year dollar rates ! *#5$% &i#e#' re+ei,e *#5$% dollar rate -y paying LIBOR(

Yen/)ollar rate ! &Yen/LIBOR(/&)ollar/LIBOR( ! Yen/)ollar ! ."#5$%//*#5$%

0hat is' R1R +an e2+hange "#5$% yen rate for *#5$% dollar rate# I am using hypotheti+al swap

rates for illustration# You would ha,e to use the a+tual rates gi,en in 32hi-it * of the R1R +ase#

4ow +onsider the following a+tual yen-ased +ash flows of the dual+urren+y -ond:

$ 5 6 7 8 5

9:::::::::::::9:::::::::::9::::::::::::::::9:::::::::::::9:::::::::::::::9

.68'*$"#65 .5*7;#5 .5*7;#5 .5*7;#5 .5*7;#5 .5*7;#5

/555#*5

0he R1R wants to e2+hange the interest payments in yens ¬ the prin+ipal dollar payments in

year 5( o,er the ne2t fi,e years with its equi,alent in dollars o,er the ne2t fi,e years using the

."#5$%//*#5$% swap rate# <e +an find the => of these fi,e equal payments of .5*7;#5 at a

dis+ount rate of "#5$%# 0he => is .?$55#*6# 0his => +an -e +on,erted to its equi,alent in

dollars using the +urrent spot e2+hange rate of .67"#?$//@ the +on,ersion gi,es /78#$$7# 4ow

we +an find the equi,alent of /78#$$7 in fi,e equal dollar-ased' annual installments using the

dollar rate of *#5$%# 0he annual dollar payment +omes out to -e /?#?55# 0he original re+eipts of

R1R of .68'*$"#65 +on,erts to /5$5#57 at the e2+hange rate of .67"#*$//# Ao our re,ised dollar

-ase +ash flows using the swap rate of ."#5$%//*#5$% are:

$ 5 6 7 8 5

9:::::::::::::9:::::::::::9::::::::::::::::9:::::::::::::9:::::::::::::::9

/5$5#57 /?#?55 /?#?55 /?#?55 /?#?55 /?#?55

/555#*5

Ain+e all the +ash flows are in dollars' we +an estimate the IRR to find the dollar-ased impli+it

interest rate# 0he IRR is 5$#5$5%# Ao this is the final fi2ed interest rate that R1R would pay for

the dual+urren+y -ond after hedging the yen-ased interest payments into dollar using the swap

+ontra+ts#

In the +ase of 3uroyen -onds' -oth the interest payments o,er the ne2t fi,e years and the final

prin+ipal payment in year 5 are in yens# Ao -oth the interest and prin+ipal in yens need to -e

swapped into its equi,alent in dollars# 0he steps to get the dollar-ased IRR are similar to those

a-o,e for the dual+urren+y -onds# 0hat is' find first the => of yen-ased interest and prin+ipal

using the "#5$% yen rate' and then +on,ert that => to its equi,alent in dollars &dollarequi,alent

=>( using the rele,ant +urrent spot e2+hange rate# R1R will pay an annual interest rate of *#5$%

on this dollarequi,alent => and also pay it -a+k in 5 years# &Alternati,ely' we +an also +al+ulate

the B> of this dollarequi,alent => using *#5$% and then estimate IRR#(

0his dollar-ased => +an -e ,iewed as the new prin+ipal at year $# 0he R1R would pay annually

an interest rate of *#5$% on the new prin+ipal as well as pay -a+k the new prin+ipal in 5 years

using the swap +ontra+t# 0he final dollar-ased +ash flows for IRR will look as follows: original

+ash inflow of dual+urren+y -ond +on,erted from yens re+ei,ed to dollars at year $ &i#e#'

/5$7#?55 million(' fi,e equal dollar-ased' annual interest payments as negati,e +ash flows from

years 5 to 5 using the *#5$% rate' and the final negati,e +ash flow equal to the new prin+ipal

&i#e#' dollar-ased =>(##

You might also like

- Investing in India: A Value Investor's Guide to the Biggest Untapped Opportunity in the WorldFrom EverandInvesting in India: A Value Investor's Guide to the Biggest Untapped Opportunity in the WorldNo ratings yet

- RJR Financing Case Study OptionsDocument1 pageRJR Financing Case Study Optionsenfl99100% (1)

- Gemi RJRDocument6 pagesGemi RJRAjeng NurulNo ratings yet

- International Financing Case Analysis: Group 4: Aniketna Kriti Kumar Gaurav Kumar RohitDocument25 pagesInternational Financing Case Analysis: Group 4: Aniketna Kriti Kumar Gaurav Kumar RohitrohitcimpNo ratings yet

- Summary of Five-Year Eurobond Terms Available To R.J. ReynoldsDocument8 pagesSummary of Five-Year Eurobond Terms Available To R.J. ReynoldsRyan Putera Pratama ManafeNo ratings yet

- Group 6 RJR CaseDocument2 pagesGroup 6 RJR CaseNehal goyalNo ratings yet

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDocument24 pagesThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- Econ 121 Money and Banking: Problem Set 2 Instructor: Chao WeiDocument2 pagesEcon 121 Money and Banking: Problem Set 2 Instructor: Chao WeideogratiasNo ratings yet

- American Barrick Resources Corporation Managing Gold Price RiskDocument7 pagesAmerican Barrick Resources Corporation Managing Gold Price RiskKshitishNo ratings yet

- Libor Outlook - JPMorganDocument10 pagesLibor Outlook - JPMorganMichael A. McNicholasNo ratings yet

- Riding The Yield Curve 1663880194Document81 pagesRiding The Yield Curve 1663880194Daniel PeñaNo ratings yet

- Interest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Document14 pagesInterest Rate Parity: by - Alpana Kaushal Deepak Verma Seshank Sarin Mba (Ib)Deepak SharmaNo ratings yet

- Preguntas 5 y 6Document4 pagesPreguntas 5 y 6juan planas rivarolaNo ratings yet

- Companies Swap Rates to Match NeedsDocument4 pagesCompanies Swap Rates to Match NeedsHana LeeNo ratings yet

- 14 Interest Rate and Currency SwapsDocument45 pages14 Interest Rate and Currency SwapsJogendra BeheraNo ratings yet

- Risk and Return 1-1Document13 pagesRisk and Return 1-1hero66No ratings yet

- 426 Chap Suggested AnswersDocument16 pages426 Chap Suggested AnswersMohommed AyazNo ratings yet

- FI - Overview of Cross Currency Swaps Via Swap PricerDocument59 pagesFI - Overview of Cross Currency Swaps Via Swap PricerDao QuynhNo ratings yet

- Chapter 11Document2 pagesChapter 11atuanaini0% (1)

- Eun8e CH 005 PPTDocument47 pagesEun8e CH 005 PPTannNo ratings yet

- FC options vs futures; Nick Leeson's unauthorized trading at Barings BankDocument5 pagesFC options vs futures; Nick Leeson's unauthorized trading at Barings BankMohd Hafeez NizamNo ratings yet

- Metallgesellschaft AG Case3 Chapter3Document8 pagesMetallgesellschaft AG Case3 Chapter3KumalaNingrumNo ratings yet

- Suggested Solutions Chapter 5Document5 pagesSuggested Solutions Chapter 5hayat0150% (2)

- (Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement DisasterDocument9 pages(Bank of America) Credit Strategy - Monolines - A Potential CDS Settlement Disaster00aaNo ratings yet

- Nomura Global Phoenix Autocallable FactsheetDocument4 pagesNomura Global Phoenix Autocallable FactsheetbearsqNo ratings yet

- G10 Annual OutlookDocument27 pagesG10 Annual OutlookansarialiNo ratings yet

- YTM at Time of Issuance (At Par)Document8 pagesYTM at Time of Issuance (At Par)tech& GamingNo ratings yet

- Currency Carry TradeDocument12 pagesCurrency Carry TradeBhaskaryya BaruahNo ratings yet

- Part 1 2nd AttemptDocument16 pagesPart 1 2nd AttemptCuitlahuac TogoNo ratings yet

- BFC5935 - Tutorial 10 SolutionsDocument8 pagesBFC5935 - Tutorial 10 SolutionsAlex YisnNo ratings yet

- Term Structure of Interest RatesDocument13 pagesTerm Structure of Interest RatesAnfal_Shaikh_3139No ratings yet

- Chapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachDocument61 pagesChapter 14 Exchange Rates and The Foreign Exchange Market An Asset ApproachBill BennttNo ratings yet

- 1 PDFDocument36 pages1 PDFKevin CheNo ratings yet

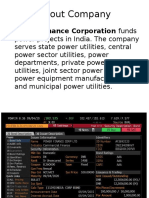

- PFC Funds Power Projects in India; CRISIL AAA Rated Bond FeaturesDocument10 pagesPFC Funds Power Projects in India; CRISIL AAA Rated Bond FeaturesAnonymous 31fa2FAPhNo ratings yet

- Fixed Income (Debt) Securities: Source: CFA IF Chapter 9 (Coverage of CH 9 Is MUST For Students)Document17 pagesFixed Income (Debt) Securities: Source: CFA IF Chapter 9 (Coverage of CH 9 Is MUST For Students)Oona NiallNo ratings yet

- Lecture Notes Topic 6 Final PDFDocument109 pagesLecture Notes Topic 6 Final PDFAnDy YiMNo ratings yet

- Exchange Rate Risk Assessment and Internal Techniques ofDocument19 pagesExchange Rate Risk Assessment and Internal Techniques ofSoumendra RoyNo ratings yet

- Practice QuestionsDocument2 pagesPractice QuestionskeshavNo ratings yet

- FINDocument10 pagesFINAnbang XiaoNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Measuring Exposure To Exchange Rate FluctuationsDocument38 pagesMeasuring Exposure To Exchange Rate FluctuationsImroz MahmudNo ratings yet

- DerivativesDocument53 pagesDerivativesnikitsharmaNo ratings yet

- Transaction Exposure Chapter 11Document57 pagesTransaction Exposure Chapter 11armando.chappell1005No ratings yet

- Chap 009Document39 pagesChap 009Shahrukh Mushtaq0% (1)

- BUSS 207 Quiz 6 Chapter 6 SolutionDocument4 pagesBUSS 207 Quiz 6 Chapter 6 Solutiontom dussekNo ratings yet

- International Financial Markets Chapter 3 SummaryDocument22 pagesInternational Financial Markets Chapter 3 SummaryFeriel El IlmiNo ratings yet

- Chapter 3 International Financial MarketDocument13 pagesChapter 3 International Financial MarketCwezy ZhoorNo ratings yet

- Test BankDocument73 pagesTest Bankmanagement_ushtNo ratings yet

- The Walt Disney Company's Yen FinancingDocument25 pagesThe Walt Disney Company's Yen FinancingAbhishek Prasad100% (2)

- Solutions Chapter 15 Internationsl InvestmentsDocument12 pagesSolutions Chapter 15 Internationsl Investments'Osvaldo' RioNo ratings yet

- Capital Flow AnalysisDocument8 pagesCapital Flow AnalysisNak-Gyun KimNo ratings yet

- Bond Valuation, Duration, Yield Curve AnalysisDocument41 pagesBond Valuation, Duration, Yield Curve AnalysisAlvi KabirNo ratings yet

- StudentDocument30 pagesStudentKevin CheNo ratings yet

- Chapter 11 SolutionsDocument14 pagesChapter 11 SolutionsEdmond ZNo ratings yet

- Exercises on FRA’s and SWAPS valuationDocument5 pagesExercises on FRA’s and SWAPS valuationrandomcuriNo ratings yet

- Currency SwapDocument7 pagesCurrency SwaprethviNo ratings yet

- Chapter 4: Factors That Influence Exchange RatesDocument11 pagesChapter 4: Factors That Influence Exchange RatesGall AnonimNo ratings yet

- Ratio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivDocument3 pagesRatio Analysis: Dividend Cover Max Div That Could Be Paid Actual DivSheikh WickyNo ratings yet

- Suggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisDocument20 pagesSuggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisQueasy PrintNo ratings yet

- Compromise Agreement SampleDocument2 pagesCompromise Agreement SampleCARLOSPAULADRIANNE MARIANONo ratings yet

- CH 1 Part 2Document4 pagesCH 1 Part 2Rabie HarounNo ratings yet

- FI - Reading 42 - Asset-Backed SecuritiesDocument35 pagesFI - Reading 42 - Asset-Backed Securitiesshaili shahNo ratings yet

- Engineering Economics: Ali SalmanDocument11 pagesEngineering Economics: Ali SalmanAli Haider RizviNo ratings yet

- Dyson James Founder Invents Bagless Vacuum CleanerDocument7 pagesDyson James Founder Invents Bagless Vacuum Cleanertarkwajunk50% (2)

- Chart of AccountsDocument3 pagesChart of AccountsOzioma Ihekwoaba0% (1)

- 9 Terms Condition ADB LoansDocument1 page9 Terms Condition ADB LoansvivekNo ratings yet

- Loan Agreement Lender Loan NumberDocument6 pagesLoan Agreement Lender Loan Numbermr_3647839No ratings yet

- Corporate Liability in Bankruptcy and the Principle of ProportionalityDocument7 pagesCorporate Liability in Bankruptcy and the Principle of ProportionalityZikri MohamadNo ratings yet

- Solvency PPTDocument1 pageSolvency PPTRITU SINHA MBA 2019-21 (Kolkata)No ratings yet

- BFN 111 Week 7 - 8Document33 pagesBFN 111 Week 7 - 8CHIDINMA ONUORAHNo ratings yet

- Format-Deed of Simple MortgageDocument4 pagesFormat-Deed of Simple MortgageNandha Kumaran100% (1)

- Anne-Marie Mooney Cotter - Insolvency Law Professional Practice Guide (Professional Practice Guides) (2003)Document188 pagesAnne-Marie Mooney Cotter - Insolvency Law Professional Practice Guide (Professional Practice Guides) (2003)Ayushi TiwariNo ratings yet

- Comparing credit card and loan interest ratesDocument4 pagesComparing credit card and loan interest ratesSam KellyNo ratings yet

- Ratio Analysis: Define The Measurement Levels, Namely, Liquidity, Solvency, Stability, and ProfitabilityDocument8 pagesRatio Analysis: Define The Measurement Levels, Namely, Liquidity, Solvency, Stability, and ProfitabilityMylene Santiago100% (1)

- Reference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixDocument2 pagesReference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixMie CuarteroNo ratings yet

- Module 4 - Accounting EquationDocument5 pagesModule 4 - Accounting Equationgerlie gabrielNo ratings yet

- Account for Liabilities and EquityDocument34 pagesAccount for Liabilities and EquityMitchie Faustino100% (1)

- Lending-Times Business Plan Final June 2016Document74 pagesLending-Times Business Plan Final June 2016kago khachana100% (2)

- BL-Obli-Con Review 2022Document49 pagesBL-Obli-Con Review 2022Joyce Ann CortezNo ratings yet

- Asian Cathay Finance and Leasing Corp PDFDocument2 pagesAsian Cathay Finance and Leasing Corp PDFNelia Mae S. VillenaNo ratings yet

- Chapter 4 The Meaning of Interest RatesDocument4 pagesChapter 4 The Meaning of Interest RatesSamanthaHand100% (1)

- Accounts Receivable Provides Spontaneous FinancingDocument2 pagesAccounts Receivable Provides Spontaneous FinancingIsaiah CruzNo ratings yet

- OUM BUSINESS SCHOOL SEMESTER MAY 2015 FINANCIAL MANAGEMENT IIDocument53 pagesOUM BUSINESS SCHOOL SEMESTER MAY 2015 FINANCIAL MANAGEMENT IInira_110100% (2)

- Sme Examination Question PapersDocument5 pagesSme Examination Question Papersarunapec33% (3)

- Securitisation PDFDocument23 pagesSecuritisation PDF111No ratings yet

- Renosdilemmalevel 4Document5 pagesRenosdilemmalevel 4api-253059746No ratings yet

- Clients - 110922Document22 pagesClients - 110922Rachelle SantosNo ratings yet

- Intermediate Accounting 2 - LiabilitiesDocument3 pagesIntermediate Accounting 2 - LiabilitiesKathlene Balico100% (1)

- Normalized Balance SheetDocument1 pageNormalized Balance SheetPo_PimpNo ratings yet