Professional Documents

Culture Documents

CFPB Mortgage Request-Error-Resolution

Uploaded by

marief86Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFPB Mortgage Request-Error-Resolution

Uploaded by

marief86Copyright:

Available Formats

Requesting your servicer correct

errors template

Use the sample letter on the third page if you want to contact your mortgage servicer to correct

an error.

How to use this template:

1. Read the background below.

2. Fill in your information on the template letter and edit it as needed to fit your situation.

. !rint and mail the letter. "eep a copy for your records.

Background

#ew federal mortgage servicing rules re$uire servicers to correct errors related to the servicing

of mortgage loans.

%f you think your servicer has made an error& you can:

'all your servicer. (hey may be able to help you over the phone. )ee your monthly

mortgage statement or coupon book for the phone number.

*rite a letter. %f your servicer was unable to resolve your issue over the phone& you

may have additional protections if you write your servicer a letter.

Submitting a letter:

%nclude your name& home address& and mortgage account number.

o Use the name that is on your mortgage and include your spouse or other co+

borrower if they are on the mortgage.

%dentify the error. (ell your servicer e,actly what error you believe occurred. (ips:

o -ive important details: .% made my /anuary payment on time. % paid 01&122

on /anuary 1 but was still charged a late fee.3

o 4e specific. Rather than writing .you did not apply my payment correctly&3

e,plain how you believe the payment was incorrectly applied.

5o not write your letter on your payment coupon or other payment form you get

from your servicer.

)end the letter to the proper address. 6 servicer may use a special address for

borrowers sending re$uests to correct errors. (his can be found on your monthly

mortgage statement or coupon book or on the servicer7s website. 8ou can also call

your servicer and ask them for the proper address. #ote that the proper address for

error corrections may be different than the address to which you send your monthly

payments. 4e sure to use the proper address for error correction re$uests.

What to expect:

%f you follow these instructions& the servicer must acknowledge receipt of your

re$uest and either:

o 'orrect the error and confirm that the error was corrected& or

o %nvestigate and determine that no error occurred& and send you a notice

e,plaining why.

-enerally& servicers are prohibited from charging you a fee for responding to error

re$uests.

8our servicer might ask you for more information about the error& but your servicer

can7t refuse to investigate or determine that no error occurred because you didn7t

provide the information.

6 servicer does not have to investigate your re$uest for error resolution if:

o (he re$uest is overly broad&

o 8ou are sending in the same re$uest repeatedly& or

o 8ou are re$uesting help with a loan that was transferred to another servicer or

paid off more than a year ago.

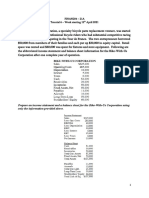

Timelines:

(he servicer must acknowledge your letter within five business days of receiving it.

%f you are writing to say your servicer improperly started or scheduled a foreclosure:

o (he servicer must respond to your letter before the foreclosure sale or within 2

business days of receiving it& whichever is earlier& if your servicer receives your

letter more than seven days before the sale.

o (he servicer should make a good+faith effort to respond to your letter& if your

servicer receives your letter seven days or less before the sale.

%f you are writing to say the servicer gave you an inaccurate payoff balance& the

servicer must respond within seven business days of receiving your letter.

For all other errors& the service must respond within 2 business days of receiving

your letter.

%n some cases the servicer may come back to you in writing and ask for additional

information or re$uest an additional 11 business days to investigate and respond to

your re$uest.

If you are not satisfied with the result:

%f you believe your servicer did not follow the procedures above in responding to your

letter& you can contact the 'F!4. *e will work with the company to get a response.

'ontact us at 9:11; <11+2=2 or www.consumerfinance.gov>complaint.

%f you need help to understand your foreclosure prevention options& you can find a

HU5+approved housing counselor at www.consumerfinance.gov>mortgagehelp or by

calling :::+??1+H@!A 9<B=;.

Template letter begins on the next page

Date:

To:

[Your mortgage servicer

Your mortgage servicers address]

From:

[Your full name

Your street address

Your city, state, and ZIP Code]

Re: Error Resolution Notice under 12 C.F.R. 1024.35

Mortae !oan Num"er: [Your loan number]

# am $ritin to re%uest correction o& t'e error descri"ed "elo$ in reard to t'e mortae on m(

)ro)ert( at [Your home address].

[IN!"#C!I$N% Provide a full descri&tion of the error. You may ada&t the sam&le language

for some common servicing errors, &rovided belo', or 'rite your o'n descri&tion. Delete the

sample language for errors that dont apply. Please note that this is not a com&lete list of all

&ossible errors, such as errors regarding your servicers failure to &rovide accurate information

about loss mitigation o&tions, foreclosure, or transfers of the servicing of your loans( your

servicers foreclosure activity against you that may violate the rules( or any other error relating

to the servicing of your loan. Your servicer may have obligations to res&ond to your letter even if

it is not as detailed as the model belo', but including these details 'ill increase the chances that

your servicer 'ill be able to investigate your issue and res&ond )uic*ly.]

*a(ment Errors:

+our com)an( re,ected t'e &ull )a(ment # made on [+ate] in t'e amount o& [, dollars].

[If this 'as not e)ual to your regularly scheduled &ayment, e-&lain 'hy.]

+our com)an( did not )ro)erl( credit t'e )a(ment t'at # made on [+ate] in t'e amount

o& [, dollars]. T'is )a(ment s'ould 'a-e "een credited to:

o [!ell the servicer ho' the &ayment should have been credited to &rinci&al,

interest, escro', or other charges .]

+our com)an( &ailed to credit t'e )a(ment # made on [+ate] as o& t'e date o& recei)t.

Escro$ Errors:

# 'a-e "een noti&ied "( [ource of information, e.g., ta-ing authority, homeo'ners

insurance com&any] t'at (our com)an( &ailed to )a( t'e &ollo$in e.)enses &rom m(

escro$ account:

o *ro)ert( ta.es: [Include amount and date due. Include evidence, if available.]

o #nsurance )remiums: [Include ty&e of insurance, name of insurance com&any,

account number, amount, and date due. Include evidence, if available.]

o /t'er c'ares: [.e s&ecific.]

# "elie-e t'at # am entitled to a re&und o& e.cess &unds in m( escro$ account and # 'a-e

not recei-ed t'em. [Include evidence or describe 'hy you believe you are entitled to

e-cess escro' funds.]

Fee Errors:

+our com)an( incorrectl( im)osed a [+escribe ty&e of fee / late fee or other] on [+ate]

in t'e amount o& [, dollars]. [+escribe or include evidence that you have been charged

this fee.]

*a(o&& Errors:

+our com)an( &ailed to )ro-ide an accurate mortae )a(o&& "alance t'at # re%uested on

[+ate].

#& (ou need to contact me0 # can "e reac'ed at [Include the best contact information, 'hich may

be your home address, 'or* or mobile &hone, or email address.]

1incerel(0

[Your name

Co0borro'ers name]

You might also like

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- DTC RulesDocument176 pagesDTC RulesMr Cutsforth100% (1)

- Attorney Questions For Opposing AttyDocument5 pagesAttorney Questions For Opposing AttyDex MailNo ratings yet

- 31 U.S.C. What Must Be Provided by CS To Offset TaxesDocument3 pages31 U.S.C. What Must Be Provided by CS To Offset TaxesSteve Smith0% (1)

- Lien On Greenville WaterDocument5 pagesLien On Greenville WaterYaqub El Hamid Gamb'l-BeyNo ratings yet

- Notary E & O PolicyDocument4 pagesNotary E & O PolicyMARK MENO©™No ratings yet

- Customer Copy: KYC HandoutDocument20 pagesCustomer Copy: KYC HandoutSourav BiswasNo ratings yet

- Foreclosure Prevention Process AgreementDocument3 pagesForeclosure Prevention Process AgreementAnthonyHansenNo ratings yet

- American Securitization Forum - Assignee LiabilityDocument40 pagesAmerican Securitization Forum - Assignee LiabilityMaster ChiefNo ratings yet

- Domestic Mail Manual (DMM Sec. 503) - Additional ServicesDocument4 pagesDomestic Mail Manual (DMM Sec. 503) - Additional ServicesNick SchrauderNo ratings yet

- Old Debts That Won't Die: Andrew MartinDocument4 pagesOld Debts That Won't Die: Andrew MartinSimply Debt SolutionsNo ratings yet

- A Is May 012015 DeclareDocument10 pagesA Is May 012015 DeclarepaulaNo ratings yet

- Letter To Attorney General PennyMac ModDocument3 pagesLetter To Attorney General PennyMac Modboytoy 9774No ratings yet

- Fw8ce PDFDocument2 pagesFw8ce PDFSpiritually Gifted100% (2)

- Virginia Quit Claim Deed FormDocument2 pagesVirginia Quit Claim Deed FormLj PerrierNo ratings yet

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuNo ratings yet

- IMCh 02Document13 pagesIMCh 02Sakub Amin Sick'L'No ratings yet

- Management of TrustsDocument4 pagesManagement of Trustsnikhil jkcNo ratings yet

- 2negotiable InstrumentDocument8 pages2negotiable Instrumenttanjimalomturjo1No ratings yet

- 2014-10-08 - Wallace - Educational Package ExhibitsDocument42 pages2014-10-08 - Wallace - Educational Package Exhibitsapi-339692598100% (1)

- Ga. Criminal Foreclosure Fraud-O.C.G.a. 16-8-102. and SB123Document8 pagesGa. Criminal Foreclosure Fraud-O.C.G.a. 16-8-102. and SB123Richard TogartNo ratings yet

- Treasury New-Agent-Welcome-BookletDocument10 pagesTreasury New-Agent-Welcome-BookletOrlando David MachadoNo ratings yet

- Mers Bailee LetterDocument3 pagesMers Bailee LetterHelpin HandNo ratings yet

- Mail Management: HandbookDocument24 pagesMail Management: HandbookAinil HawaNo ratings yet

- The Company's Debts Were Too Much To BearDocument8 pagesThe Company's Debts Were Too Much To BearHana100% (1)

- Accepted For Value Birth CertificateDocument1 pageAccepted For Value Birth CertificatelandmarkchurchofhoustonNo ratings yet

- Jay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Document13 pagesJay S. Zeltzer, On Behalf of Himself and All Others Similarly Situated v. Carte Blanche Corporation, 514 F.2d 1156, 3rd Cir. (1975)Scribd Government DocsNo ratings yet

- FDIC Deposit Insurance CoverageDocument2 pagesFDIC Deposit Insurance CoverageSucreNo ratings yet

- Historical Background of "General Post-Office"Document13 pagesHistorical Background of "General Post-Office"kronnickjohn26No ratings yet

- Harbor Medallion Signature GuaranteeDocument1 pageHarbor Medallion Signature Guaranteecsmith9100% (1)

- Securitization Is Illegal Securitization Is IllegalDocument55 pagesSecuritization Is Illegal Securitization Is IllegalPAtty BarahonaNo ratings yet

- Creditor VerificationDocument2 pagesCreditor VerificationWen' George BeyNo ratings yet

- Request For Withdrawal of ApplicationDocument2 pagesRequest For Withdrawal of ApplicationregalNo ratings yet

- Third Party PresenterDocument1 pageThird Party PresenterAndre Duke CoulterNo ratings yet

- This Letter Is A QWRDocument3 pagesThis Letter Is A QWRCharlton PeppersNo ratings yet

- AP 302 Cert Non ResponseDocument1 pageAP 302 Cert Non ResponseJason HenryNo ratings yet

- (A) Immediate Payment On DemandDocument3 pages(A) Immediate Payment On DemandJunnieson BonielNo ratings yet

- Creditor Bond - $12,348,000 Living Clerk Tribunal Ministries 236003062 - Bond-Created-MARCH 12-2024Document15 pagesCreditor Bond - $12,348,000 Living Clerk Tribunal Ministries 236003062 - Bond-Created-MARCH 12-2024akil kemnebi easley elNo ratings yet

- Complaint Foreclosure With Restitution CoaDocument28 pagesComplaint Foreclosure With Restitution Coajoelacostaesq100% (1)

- Constitution of TrustDocument11 pagesConstitution of Trustasmi.k524No ratings yet

- SovereignDocument151 pagesSovereignlenorescribdaccountNo ratings yet

- Affidavit of SuccessionDocument1 pageAffidavit of SuccessiongetitqwikNo ratings yet

- Debt Validation LetterDocument1 pageDebt Validation LetterRichardNo ratings yet

- Litchfield Hills Probate District LettersDocument31 pagesLitchfield Hills Probate District LettersRepublican-AmericanNo ratings yet

- Federal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Document24 pagesFederal Deposit Insurance Corporation, A United States Corporation, Plaintiff v. Bank of Boulder, A Colorado Corporation, 865 F.2d 1134, 10th Cir. (1988)Scribd Government DocsNo ratings yet

- NMTDocument174 pagesNMTsfirleyNo ratings yet

- Foreclosue Defenses Points Required in MDDocument25 pagesForeclosue Defenses Points Required in MDMikeNo ratings yet

- Consumer ManualDocument61 pagesConsumer ManualZain NabiNo ratings yet

- The Note Sample KaronDocument1 pageThe Note Sample KaronYarod YisraelNo ratings yet

- Complaint Against James McNeile and Andrew Duncan (May 16, 2016)Document5 pagesComplaint Against James McNeile and Andrew Duncan (May 16, 2016)Conflict GateNo ratings yet

- Differences Between Chapters 7, 11, 12, & 13Document3 pagesDifferences Between Chapters 7, 11, 12, & 13prubiouk100% (1)

- Securities Review 101Document6 pagesSecurities Review 101Mike DogNo ratings yet

- Letter To CFPB On A Mortgage Consumer Complaint SystemDocument6 pagesLetter To CFPB On A Mortgage Consumer Complaint SystemThe Partnership for a Secure Financial Future100% (1)

- Florida Attorney General "Unfair, Deceptive and Unconscionable Acts in Foreclosure Cases"Document98 pagesFlorida Attorney General "Unfair, Deceptive and Unconscionable Acts in Foreclosure Cases"DinSFLANo ratings yet

- Affidavi BeneficiaryDocument1 pageAffidavi Beneficiaryferryberryhill100% (1)

- Secured Transactions Reading Notes and Cases - Week 2Document3 pagesSecured Transactions Reading Notes and Cases - Week 2BG215No ratings yet

- Constitution of the State of Minnesota — 1974 VersionFrom EverandConstitution of the State of Minnesota — 1974 VersionNo ratings yet

- AFAR - Mastery Class Batch 2Document5 pagesAFAR - Mastery Class Batch 2Antonette Eve CelomineNo ratings yet

- Part 4B Investment Decision Analysis 216 QuestionsDocument62 pagesPart 4B Investment Decision Analysis 216 QuestionsFernando III PerezNo ratings yet

- CA Casualty Educational ObjectivesDocument40 pagesCA Casualty Educational ObjectiveshasupkNo ratings yet

- Application: Account Receivables Title: Receipt Remittance: OracleDocument31 pagesApplication: Account Receivables Title: Receipt Remittance: OraclesureshNo ratings yet

- 2Nd Floor, Palm Spring Centre, Next To D-Mart Shopp - Centre, Link Road, Malad (West), Mumbai, Maharashtra-400064 Phone-022-30801000 Fax-022-28449002Document1 page2Nd Floor, Palm Spring Centre, Next To D-Mart Shopp - Centre, Link Road, Malad (West), Mumbai, Maharashtra-400064 Phone-022-30801000 Fax-022-28449002Brandon WilliamsNo ratings yet

- Ensuring The Integrity of Financial InformationDocument24 pagesEnsuring The Integrity of Financial InformationGaluh Boga KuswaraNo ratings yet

- Chapter 6Document9 pagesChapter 6Villanueva, Jane G.No ratings yet

- FINAN204-21A - Tutorial 6 Week 7Document10 pagesFINAN204-21A - Tutorial 6 Week 7Danae YangNo ratings yet

- Paper 3 Revenue Cycle PDFDocument46 pagesPaper 3 Revenue Cycle PDFNeema EzekielNo ratings yet

- Practical Auditing Empleo Sol Man Chapter 3Document6 pagesPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNo ratings yet

- Fundamentals of ABM 2 - MELCSDocument3 pagesFundamentals of ABM 2 - MELCSEngelie Pillado100% (5)

- 8.handbook On Microfinance InstitutionsDocument122 pages8.handbook On Microfinance InstitutionsAditya100% (1)

- 00 AnnualDocument50 pages00 AnnualMaheeshNo ratings yet

- BBA FMI Unit 2 - NoDocument34 pagesBBA FMI Unit 2 - NoRuhani AroraNo ratings yet

- W4 Module 4 FINANCIAL RATIOS Part 2BDocument12 pagesW4 Module 4 FINANCIAL RATIOS Part 2BDanica VetuzNo ratings yet

- Home Assignment - JUNK BOND Subject: Corporate FinanceDocument3 pagesHome Assignment - JUNK BOND Subject: Corporate FinanceAsad Mazhar100% (1)

- RL360° FundsDocument4 pagesRL360° FundsRL360°100% (2)

- JAIIB Paper 4 Module E Additional Reading Material On Home Loans PDFDocument31 pagesJAIIB Paper 4 Module E Additional Reading Material On Home Loans PDFAssr MurtyNo ratings yet

- Customer No.: 23558690 IFSC Code: DBSS0IN0811 MICR Code: Branch AddressDocument3 pagesCustomer No.: 23558690 IFSC Code: DBSS0IN0811 MICR Code: Branch Addresschandan naiduNo ratings yet

- Virtual PE & VC Conference Attendee List - 23-6-2020 PDFDocument8 pagesVirtual PE & VC Conference Attendee List - 23-6-2020 PDFKadri UgandNo ratings yet

- Appendix 4Document4 pagesAppendix 4Rajesh ShirwatkarNo ratings yet

- Activity 1 Subsidiary Ledger General LedgerDocument50 pagesActivity 1 Subsidiary Ledger General LedgerJoanne MendozaNo ratings yet

- ADCB WBG TCs English Sep2017 - tcm9 103698Document70 pagesADCB WBG TCs English Sep2017 - tcm9 103698Pulsara RajarathneNo ratings yet

- NIR AP Network (Banks)Document1,410 pagesNIR AP Network (Banks)Binay Pradhan0% (1)

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- Account Statement PDFDocument12 pagesAccount Statement PDFPradeep ChandraNo ratings yet

- 10-03-31 Union Bank's Response To Office of Comptroller of The Currency On DR Zernik's Complaints #00974775 & #01036676 SDocument7 pages10-03-31 Union Bank's Response To Office of Comptroller of The Currency On DR Zernik's Complaints #00974775 & #01036676 SHuman Rights Alert - NGO (RA)No ratings yet

- Insolvency Law and Corporate RehabilitationDocument33 pagesInsolvency Law and Corporate RehabilitationElizar JoseNo ratings yet

- Auditing Theory Test BankDocument9 pagesAuditing Theory Test BankCezanne Pi-ay EckmanNo ratings yet

- Value Added Subscription PlansDocument1 pageValue Added Subscription PlansChetna SharmaNo ratings yet