Professional Documents

Culture Documents

Checklist On Related Party-188

Uploaded by

AMITAV GANGULY50%(2)50% found this document useful (2 votes)

1K views8 pagesRelated Party law under new Indian Companies Act 2013

Original Title

Checklist on Related Party-188

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRelated Party law under new Indian Companies Act 2013

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

50%(2)50% found this document useful (2 votes)

1K views8 pagesChecklist On Related Party-188

Uploaded by

AMITAV GANGULYRelated Party law under new Indian Companies Act 2013

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

Ansal Properties & Infrastructure Limited

Checklist on Section 188 of Companies Act, 2013 - Related Party

Transactions

(Corresponding Sections- 297 & 314 of Companies Act, 1956)

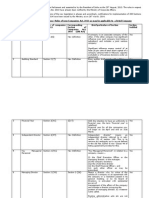

Section Provisions of Sections Checklist

188(1)

Except with the consent of the Board

of Directors given by a resolution at a

meeting of the Board and subject to

such conditions as may be prescribed,

no company shall enter into any

contract or arrangement with a

related party with respect to:

a) sale, purchase or supply of any

goods or materials.

b) selling or otherwise disposing of ,

or buying, property of any kind,

c) leasing of property of any kind

d) availing or rendering of any

services

e) appointment of any agent for

purchase or sale of goods,

materials, services or property.

Provisions of Section 188 shall apply if

any of the sub points within point no. 2

plus any of the sub points within both

points No. 3 and point No 4 is YES

YES NO

1. Whether there is

contract or

arrangement

2. whether the Contract or

arrangement is in relation to:-

Sale, purchase or supply

of any goods

Sale, purchase or supply

of any materials

Selling or otherwise

disposing of

property of any kind

Buying property of any

kind

Leasing of property of

any kind

Availing of any service

Rendering of any service

Appointment of any

agent for purchase

of goods, materials,

services or property

Appointment of any

agent for sale

of goods, materials,

services or property

f) such related partys appointment

to any office or place of profit in

the company, its subsidiary

company or associate company;

Explanation:-

The expression office or place of

profit means any office or place-

(i) where such office or place is held

by a director, if the director

holding it receives from the

company anything by way of

remuneration over and above the

remuneration to which he is

entitled as director, by way of

salary, fee, commission,

perquisites, any rent-free

accommodation, or otherwise;

(ii) where such office or place is held

by an individual other than a

director or by any firm, private

company or other body corporate,

if the individual, firm, private

company or body corporate

holding it receives from the

company anything by way of

remuneration, salary, fee,

commission, perquisites, any

rent-free accommodation, or

otherwise;

g) underwriting the subscription of

any securities or derivatives

thereof, of the company

YES NO

Related partys appoint-

ment to any office or

place of profit in the

company.

Related partys appoint-

ment to any office or

place of profit in the

subsidiary company

Related partys appoint-

ment to any office or

place of profit in the

associate Company

Underwriting the subs-

cription of any securit-

ies or derivatives.

Resolution of the Board should be passed

only in a duly convened Board Meeting

and not otherwise {i.e. not by way of

Resolution by Circulation/Directors

committee meeting}

As per Section 2(76)related party,

with reference to a company,

means

(i) a director or his relative;

(ii) a key managerial personnel or his

relative;

(iii) a firm, in which a director,

manager or his relative is a partner;

(iv) a private company in which a

director or manager is a member or

director;

(v) a public company in which a

director or manager is a director or

holds along with his relatives, more

than two per cent of its paid-up share

capital;

YES NO

3. Whether the contract or

arrangement entered by the

company with :

(i) a director or his relative

(ii) a key managerial

personnel or his relative;

(iii) a firm in which

director or his relative

is a partner

(iv)a firm in which Manager

or his relative is a partner

(v) a pvt. Co. in which

director is a member

(vi) a pvt. Co. in which

director is a director

(vii) a pvt. Co. in which

Manager is a member

(vii) a pvt. Co. in which

Manager is a Director

(vii) a public Co. in which

director of the company

is a Director; or

(viii) a public Co. in which

director of the company

holds along with his relatives

more than 2% of its paid up

share capital

(ix) a public Co. in which

Manager of the Company

is a Director; or

(x) a public Co. in which

Manager of the company

holds along with his relatives

more than 2% of its

(vi) any body corporate whose Board

of Directors, managing director or

manager is accustomed to act in

accordance with the advice, directions

or instructions of a director or

manager;

(vii) any person on whose advice,

directions or instructions a director or

manager is accustomed to act.

Provided that nothing in sub-clauses

(vi) and (vii) shall apply to the

advice, directions or instructions

given in a professional capacity;

(viii) any company which is

(A) a holding, subsidiary or an

associate company of such

company; or

(B) a subsidiary of a holding

company to which it is also a

subsidiary;

(ix) such other person as may be

prescribed;

Provided also that nothing in this sub-

section shall apply to any transactions

entered into by the company in the

ordinary course of business other

than transactions which are not on

arms length basis

paid up share capital

3. Whether the contract or

arrangement entered by the

company with:

YES NO

(xi)any BODY CORPORATE

whose BOD/MD/Manager

is accustomed to act

in accordance with the

advice, directions or

instructions of a director/

manager of the company;

(xii)any PERSON on whose

advice/ directions/

instructions the director/

manager of the company is

accustomed to act;

(excludes advice/ directions/ instructions

given aforesaid in professional capacity)

(xiii) its holding,

subsidiary or an

associate company

(xiv) its fellow subsidiary/

chain subsidiary

(xv) any other person

as prescribed by way

of rules

4. whether the

transaction has NOT

been entered into by

the Company in its

ordinary course of

business AND on

arms length basis

[

Third

Proviso to

section

188(1)

Proviso to

Section

188(1)

Provided that no contract or

arrangement, in the case of a

company having a paid-up share

capital of not less than such amount,

or transactions not exceeding such

sums, as may be prescribed, shall be

entered into except with the prior

approval of the company by a special

resolution

Text of the Draft Rules

(1) For the purposes of first proviso

to sub-section (1) of section

188,

(i) a company having a paid-up

share capital of rupees one

crore or more shall not enter

into a contract or

arrangement with any

related party; or

(ii) a company shall not enter

into a transaction or

transactions, where the

transaction or transactions to

be entered into:

(a) individually or taken

together with previous

transactions during a

financial year, exceeds

five percent of the annual

turnover or twenty

percent of the net worth

of the company as per

the last audited financial

statements of the

company, whichever is

higher, for contracts or

arrangements as

mentioned in clauses (a)

to (e) of sub-section (1)

of section 188;

or

YES NO

5. In case of Related Party

Transactions compliance has to

be done on above points and

further where any of the

following sub points is YES

SPECIAL RESOLUTION is

required for entering contract

/arrangement with related party

(in terms of the Draft Rules) :-

(i) company has a

paid-up share

capital of rupees

1 crore or more

(ii) where the

transaction or

transaction(s)

individually or

taken together

with previous

transactions

during a financial

year:

a. exceeds 5%

of the annual

turnover.

OR

b. 20% percent

of the net worth

of the company

as per the last

audited financial

statements of the

company;

whichever is

higher

Second

Proviso to

section

188(1)

Section

188(2)

Section

188(3)

(b) relates to appointment to

any office or place of

profit in the company, its

subsidiary company or

associate company at a

monthly remuneration

exceeding one lakh

rupees as mentioned in

clause (f) of sub-section

(1) of section 188; or

(c) is for a remuneration for

underwriting the

subscription of any

securities or derivatives

thereof of the company

exceeding ten lakh rupees

as mentioned in clause

(g) of sub-section (1) of

section 188;

Provided further that no member of

the company shall vote on such

special resolution, to approve any

contract or arrangement which may

be entered into by the company, if

such member is a related party:

Every contract or arrangement

entered into under sub-section (1)

shall be referred to in the Boards

report to the shareholders along with

the justification for entering into such

contract or arrangement.

Where any contract or arrangement is

entered into by a director or any

other employee, without obtaining the

consent of the Board or approval by a

YES NO

(iii) Related party is

appointed to any

office or place of

profit in the

company its

subsidiary/associate

at a monthly

remuneration

exceeding 1 lakh

rupees

(iv) Remuneration

for underwriting the

subscription of any

securities or

derivatives thereof

of the company

exceeding 10 lakh

rupees

A Shareholder who is a related party is

not allowed to vote on such special

resolution

For the purposes of second proviso to sub-

section (1) of section 188, in case of

wholly owned subsidiary, the special

resolution passed by the holding

company shall be sufficient for the

purpose of entering into the

transactions between wholly owned

subsidiary and holding company.

Contract / arrangement mentioned in

188(1) should be referred in Boards

Report along with its justification.

Contract/ arrangement entered into by

director/employee of the company

should be approved by the Board/

shareholders as the case may be or

Section

188(4)

Section

188(5)

special resolution in the general

meeting under sub-section (1) and if

it is not ratified by the Board or, as

the case may be, by the shareholders

at a meeting within three months

from the date on which such contract

or arrangement was entered into,

such contract or arrangement shall be

voidable at the option of the Board

and if the contract or arrangement is

with a related party to any director,

or is authorised by any other director,

the directors concerned shall

indemnify the company against any

loss incurred by it.

Without prejudice to anything

contained in sub-section (3), it shall

be open to the company to proceed

against a director or any other

employee who had entered into such

contract or arrangement in

contravention of the provisions of this

section for recovery of any loss

sustained by it as a result of such

contract or arrangement.

Any director or any other employee of

a company, who had entered into or

authorised the contract or

arrangement in violation of the

provisions of this section shall,

(i) in case of listed company,

be punishable with

imprisonment for a term

which may extend to one

year or with fine which shall

not be less than twenty-five

thousand rupees but which

may extend to five lakh

rupees, or with both; and

(ii) in case of any other

company, be punishable

with fine which shall not be

less than twenty-five

thousand rupees but which

may extend to five lakh

rupees.

should be ratified by the Board/

shareholders within three months from

the date of contract/ arrangement.

Otherwise such contract/ arrangement is

voidable at the option of Board and if

entered with related party to any

director/ authorised by any other

director, the concerned director shall

indemnify the loss to the company.

Penal Provisions:-

Company may recover any losses

incurred by the Company from the

director or any other employee who had

entered into the contract/arrangement

in contravention of the provisions of this

section. (Where the Company has

avoided the Contract/arrangement which

was voidable)

Imprisonment upto 1 yr or fine between

Rs. 25000 and Rs. 500,000 or with both

in case of listed companies

Fine between Rs. 25000 and

Rs. 500,000 in case of unlisted

companies

PLEASE NOTE THAT PROHIBITIONS ARE ABSOLUTE AND NO RATIFICATION OR APPROVAL OF

CENTRAL GOVERNMENT IS PERMITTED.

Date : 30

th

December, 2013

You might also like

- Code of Conduct For DirectorsDocument9 pagesCode of Conduct For DirectorsAMITAV GANGULYNo ratings yet

- Investment Agreement TemplateDocument9 pagesInvestment Agreement TemplateJohnNo ratings yet

- Statutory Compliances - GeneralDocument25 pagesStatutory Compliances - GeneralajaydhageNo ratings yet

- Divisible Profit: DividendDocument10 pagesDivisible Profit: Dividendsameerkhan855No ratings yet

- Environmental Law LagosDocument265 pagesEnvironmental Law Lagosoluwademiladeadejola100% (1)

- Swing State Consulting Georgia Certificate of AuthorityDocument2 pagesSwing State Consulting Georgia Certificate of AuthorityWashington ExaminerNo ratings yet

- Published United States Court of Appeals For The Fourth CircuitDocument11 pagesPublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNo ratings yet

- Going Concern Issues in Financial ReportingDocument74 pagesGoing Concern Issues in Financial ReportingshantipNo ratings yet

- Derivatives Notes and Tutorial 2017Document16 pagesDerivatives Notes and Tutorial 2017Chantelle RamsayNo ratings yet

- Performance Evaluation of BoardDocument12 pagesPerformance Evaluation of BoardAMITAV GANGULYNo ratings yet

- Landlord Tenant Law OutlineDocument6 pagesLandlord Tenant Law OutlineSarah McPherson100% (1)

- Sec 7A EPF Act-FinalDocument72 pagesSec 7A EPF Act-FinalMANOJ PANDEYNo ratings yet

- The Code On Wages, 2019 No. 29 of 2019Document29 pagesThe Code On Wages, 2019 No. 29 of 2019Awinash Kumar GuptaNo ratings yet

- Agency ContractDocument7 pagesAgency ContractSaubhagya100% (1)

- Unit 3&4Document11 pagesUnit 3&4chethanraaz_66574068No ratings yet

- Nego Outline (Colored) 2Document18 pagesNego Outline (Colored) 2wuanabananaNo ratings yet

- Corporate Governance in Terms With SEC GuidelinesDocument13 pagesCorporate Governance in Terms With SEC Guidelinesasif29mNo ratings yet

- ASND Anti Bribery Corruption PolicyDocument14 pagesASND Anti Bribery Corruption PolicyElisha WankogereNo ratings yet

- Letter of Appointment As Independent DirectorDocument11 pagesLetter of Appointment As Independent DirectorrajNo ratings yet

- Secretarial AuditDocument30 pagesSecretarial AuditSiddhart GuptaNo ratings yet

- Sales, Agency, Labor & BailmentsDocument5 pagesSales, Agency, Labor & Bailmentsroxanne57% (7)

- Platform Agreement-API Keys-Updated 4.26.22Document14 pagesPlatform Agreement-API Keys-Updated 4.26.22Ankur VermaNo ratings yet

- Powers of Directors General Powers Vested Under Section 179Document7 pagesPowers of Directors General Powers Vested Under Section 179yogesh_96No ratings yet

- Corporate Governance Disclosure Practices in IndiaDocument29 pagesCorporate Governance Disclosure Practices in IndiasabyavgsomNo ratings yet

- Restricted Options AgreementDocument18 pagesRestricted Options AgreementAnonymous sIy4b6No ratings yet

- Concept Builders v. NLRC: GR. No. 108734, May 29, 1996Document2 pagesConcept Builders v. NLRC: GR. No. 108734, May 29, 1996AM100% (2)

- ESOP and Sweat EquityDocument7 pagesESOP and Sweat EquityShehana RenjuNo ratings yet

- Uniform Guidelines For BlacklistingDocument7 pagesUniform Guidelines For BlacklistingKaJong JaclaNo ratings yet

- Mergers and Acquisitions in IndiaDocument8 pagesMergers and Acquisitions in IndiaripzNo ratings yet

- Post Merger Review Report - 29 Aug 06Document9 pagesPost Merger Review Report - 29 Aug 06api-3717615100% (2)

- Liabilities and Duties of A Director Under Companies Act 2013Document2 pagesLiabilities and Duties of A Director Under Companies Act 2013anvit seemanshNo ratings yet

- ALM Policy of HFCDocument13 pagesALM Policy of HFCSrinivasan IyerNo ratings yet

- Private Placement of SecuritiesDocument5 pagesPrivate Placement of SecuritiesAkanksha BohraNo ratings yet

- Law 05 Company Law 02 Classification of Companies Notes 20170314 ParabDocument20 pagesLaw 05 Company Law 02 Classification of Companies Notes 20170314 ParabarshiNo ratings yet

- Corporate Governance Reforms in India PDFDocument64 pagesCorporate Governance Reforms in India PDFAnkit YadavNo ratings yet

- M&A - Subtask 2 (Extended Instructions)Document2 pagesM&A - Subtask 2 (Extended Instructions)Aviral Arun100% (1)

- Mercy Daviz Project Report Secretarial Audit RevisedDocument60 pagesMercy Daviz Project Report Secretarial Audit Revisedmercydaviz100% (1)

- Corporate Disclosure and Investor ProtectionDocument26 pagesCorporate Disclosure and Investor ProtectionMatharu Knowlittle100% (1)

- Constructive NoticeDocument13 pagesConstructive NoticeAbhishek SinghNo ratings yet

- Indian Depository RecieptDocument24 pagesIndian Depository Recieptadilfahim_siddiqi100% (1)

- BCS Code of ConductDocument5 pagesBCS Code of ConductsmlrthNo ratings yet

- Prenuptial Agreements (Semester 3 Family Law - 1) Rough DraftDocument7 pagesPrenuptial Agreements (Semester 3 Family Law - 1) Rough DraftAanchal SrivastavaNo ratings yet

- The Companies Ordinance, 1984 (XLVII of 1984)Document8 pagesThe Companies Ordinance, 1984 (XLVII of 1984)Salman KhanNo ratings yet

- IRDAI (Registration of Corporate Agents) Regulations 2015Document39 pagesIRDAI (Registration of Corporate Agents) Regulations 2015LovelyKumarVermaNo ratings yet

- Impact of GST On Stock MarketDocument14 pagesImpact of GST On Stock MarketSiddhartha0% (1)

- CHAPTER 6 Constitution of CompanyDocument16 pagesCHAPTER 6 Constitution of CompanyNahar SabirahNo ratings yet

- Sample Handbook - From Allan CaneteDocument112 pagesSample Handbook - From Allan CaneteCrystal Cold StorageNo ratings yet

- The Personal Data Protection Bill 2018Document8 pagesThe Personal Data Protection Bill 2018megvik-1No ratings yet

- Secretarial Audit Report-Form MR3Document5 pagesSecretarial Audit Report-Form MR3Amitesh AgarwalNo ratings yet

- Lecture 8 - Winding Up of A CompanyDocument24 pagesLecture 8 - Winding Up of A CompanyManjare Hassin RaadNo ratings yet

- Company AuditDocument56 pagesCompany Audithiral mitaliaNo ratings yet

- Prospectus, Allotment of Securities and Private Placement Co Act 2013 BGDocument5 pagesProspectus, Allotment of Securities and Private Placement Co Act 2013 BGachuthan100% (1)

- Compliance of Buy Back of SharesDocument18 pagesCompliance of Buy Back of Sharesswaraj_chaw1485No ratings yet

- Edwards V Skyways LTDDocument2 pagesEdwards V Skyways LTDWan Farzana100% (1)

- 26.2a Schedule-I (Karnataka Model Standing Order)Document14 pages26.2a Schedule-I (Karnataka Model Standing Order)Yogesh MugaliNo ratings yet

- Study Paper On Holding Company ValuationsDocument40 pagesStudy Paper On Holding Company ValuationssdNo ratings yet

- The Responsibilities and Duties of A Company DirectorDocument10 pagesThe Responsibilities and Duties of A Company Directorberliana26No ratings yet

- IDEA Installation GuideDocument75 pagesIDEA Installation Guidemonteroh2No ratings yet

- BG Raw Material Agreement UpdatedDocument9 pagesBG Raw Material Agreement UpdatedSuman KumarNo ratings yet

- Retrenchment DocumentsDocument11 pagesRetrenchment DocumentsfizaNo ratings yet

- 7-7.GTB-Declaration of Conflict of Interest Form (1) - EditedDocument5 pages7-7.GTB-Declaration of Conflict of Interest Form (1) - EditedRazif LamkihNo ratings yet

- Indian Partnership Act 1932 Final 1588092479681Document42 pagesIndian Partnership Act 1932 Final 1588092479681Gayatri Prasad BirabaraNo ratings yet

- On Uganda Partnership ActDocument18 pagesOn Uganda Partnership ActVidhi MehtaNo ratings yet

- Example: Investment Analysis Using A Legal Due Diligence Checklist by Ryland HamletDocument9 pagesExample: Investment Analysis Using A Legal Due Diligence Checklist by Ryland HamletRyland Hamlet100% (13)

- D Post Trial Reply BriefDocument18 pagesD Post Trial Reply BriefJames Bailey BrislinNo ratings yet

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- Divorce in Connecticut: The Legal Process, Your Rights, and What to ExpectFrom EverandDivorce in Connecticut: The Legal Process, Your Rights, and What to ExpectNo ratings yet

- Loving RivalryDocument6 pagesLoving RivalryAMITAV GANGULYNo ratings yet

- Story Telepathic TelephonyDocument6 pagesStory Telepathic TelephonyAMITAV GANGULYNo ratings yet

- Story Beyond ExplanationDocument7 pagesStory Beyond ExplanationAMITAV GANGULYNo ratings yet

- Jimmy Rubbed His Face in Fatigue. This Job of Being Police ForensicDocument3 pagesJimmy Rubbed His Face in Fatigue. This Job of Being Police ForensicAMITAV GANGULYNo ratings yet

- Forward Dealings by Directors & KMPDocument6 pagesForward Dealings by Directors & KMPAMITAV GANGULYNo ratings yet

- Auditor Attending AGMDocument5 pagesAuditor Attending AGMAMITAV GANGULYNo ratings yet

- Power Point Presentation Duties of DirectorsDocument11 pagesPower Point Presentation Duties of DirectorsAMITAV GANGULYNo ratings yet

- Disqualification of A Whole Time Director On ConvictionDocument3 pagesDisqualification of A Whole Time Director On ConvictionAMITAV GANGULYNo ratings yet

- Companies Amendment Bill 2014Document4 pagesCompanies Amendment Bill 2014AMITAV GANGULYNo ratings yet

- Analysis of New Insider Trading LawsDocument6 pagesAnalysis of New Insider Trading LawsAMITAV GANGULYNo ratings yet

- New SEBI Insider Trading CodeDocument27 pagesNew SEBI Insider Trading CodeAMITAV GANGULYNo ratings yet

- Companies Act - Relevant Sections - With ClarificationsDocument65 pagesCompanies Act - Relevant Sections - With ClarificationsAMITAV GANGULYNo ratings yet

- Payment To Non Executive DirectorsDocument3 pagesPayment To Non Executive DirectorsAMITAV GANGULYNo ratings yet

- New Companies Act 2013Document2 pagesNew Companies Act 2013AMITAV GANGULYNo ratings yet

- Comparison For New Clause 49 - With Old Clause 49Document30 pagesComparison For New Clause 49 - With Old Clause 49AMITAV GANGULYNo ratings yet

- Check List Section 194Document5 pagesCheck List Section 194AMITAV GANGULYNo ratings yet

- Check List On SECTION 195Document3 pagesCheck List On SECTION 195AMITAV GANGULYNo ratings yet

- Check List Section 185 of Companies Act 2013Document3 pagesCheck List Section 185 of Companies Act 2013AMITAV GANGULY100% (1)

- Check List Section 192Document3 pagesCheck List Section 192AMITAV GANGULYNo ratings yet

- Exercise Chap 3 Isb548Document4 pagesExercise Chap 3 Isb548Atiqah AzmanNo ratings yet

- Mr. Badal Raj PDFDocument3 pagesMr. Badal Raj PDFBadal RajNo ratings yet

- Bài Luyện KTGKDocument8 pagesBài Luyện KTGKBích ChâuNo ratings yet

- Virgin Offshore Chapter 11 Reorp Plan 1-31-13 PDFDocument44 pagesVirgin Offshore Chapter 11 Reorp Plan 1-31-13 PDFlonghorn4lifNo ratings yet

- DSEO Order Dated 31.05.2023Document15 pagesDSEO Order Dated 31.05.2023Sandy SinghNo ratings yet

- Mcqs On Transfer of Property Act (With Answers)Document24 pagesMcqs On Transfer of Property Act (With Answers)rabbani bagwanNo ratings yet

- Examiners' Reports 2015: LA3021 Company Law - Zone ADocument18 pagesExaminers' Reports 2015: LA3021 Company Law - Zone AdaneelNo ratings yet

- Second Mortgage TemplateDocument8 pagesSecond Mortgage Templatekensfisher_90809116No ratings yet

- OMB Approval No. 2502-0265Document3 pagesOMB Approval No. 2502-0265api-26440138No ratings yet

- Done - 11. Guingona, Jr. v. City Fiscal of Manila - 1984Document2 pagesDone - 11. Guingona, Jr. v. City Fiscal of Manila - 1984sophiaNo ratings yet

- MOU - AgreementDocument3 pagesMOU - AgreementSathya MandyaNo ratings yet

- Contract of Lease: WitnessethDocument4 pagesContract of Lease: WitnessethMico Duñas Cruz100% (1)

- Mind Map Pad363 Chap 1Document1 pageMind Map Pad363 Chap 1NURUL KHAIRUNNISA YUSRINo ratings yet

- Vinayak GulganjiDocument6 pagesVinayak GulganjivinayakNo ratings yet

- Contract of Lease-Bir EditedDocument6 pagesContract of Lease-Bir EditedCHARLES RONALD GENATONo ratings yet

- Force Majeure Clause in Aviation Industry ContractsDocument6 pagesForce Majeure Clause in Aviation Industry ContractsYash TyagiNo ratings yet

- Fort Bonifacio Development Corporation vs. Yllas Lending CorporationDocument20 pagesFort Bonifacio Development Corporation vs. Yllas Lending CorporationAmerigo VespucciNo ratings yet

- Debts and Liabilities Owed by MeDocument5 pagesDebts and Liabilities Owed by MeNasrin AktherNo ratings yet

- File Tinh Huong CLDocument23 pagesFile Tinh Huong CLltbtran010903No ratings yet

- Ucp 600Document5 pagesUcp 600Mujahid FidaNo ratings yet

- Registration of Mortgages and Charges FinalDocument34 pagesRegistration of Mortgages and Charges FinalEisha MahamNo ratings yet

- ACTIONS FOR BREACH OF CONTRACT OF SALE OF GOODS Case DigestsDocument29 pagesACTIONS FOR BREACH OF CONTRACT OF SALE OF GOODS Case DigestsJerome LeañoNo ratings yet