Professional Documents

Culture Documents

Lecture Notes 9

Uploaded by

Liviu Iordache100%(1)100% found this document useful (1 vote)

1K views30 pagesa

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenta

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

1K views30 pagesLecture Notes 9

Uploaded by

Liviu Iordachea

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 30

LECTURE NOTES 9

THE TRAVEL TRADE

A. THE TOURISM PRODUCT MARKET

The tourism product market is composed of goods and services combined into diverse

tourism packages.

A.1 Definition of tourism/travel packages

Travel packages are organized trips following predetermined and detailed

programs involving several tourism services. The packages are sold in advance at a

fixed price.

Preliminary organization

Tourism products are developed and established well before client demand is

actually expressed. The tour operator will choose the destination, the means of

transport, the accommodation, catering services, the level of escorting and guidance

included in the package before offering the product to the public.

Variety of services provided

At the most basic level, the services provided may just consist of the holiday stay.

Most complete products offer several other services. These include return transport,

escorting, transfers, accommodation, provision of meals, entertainment and

insurance. Certain companies offering holidays with a particular focus also provide

specific services.

Fixed prices

The price of the product is set in advance and usually payment is settled before the

journey begins. For certain products (holiday clubs, mixed formulas in which only

parts of the tourism components are provided) credit payment is becoming

increasingly frequent.

A.2 Classification of tourism packages

There are two basic types of tourism packages: all-inclusive and the mixed

formula:

1. The all inclusive package

This is the traditional package in which the operator provides all the services.

Products in this category include full-board holidays, organized tours and cruises.

Full-board holidays. Full-board holidays involve return travel

arrangements and transfers, accommodation and all meals. This type of

holiday has mainly been offered by hotels and resorts, although recently

holiday clubs are providing similar services, including entertainment and

sport facilities.

1

There are several variations on this type of holiday. Products are being

developed offering half-board, breakfast only or the increasingly popular self-

catering holidays in apartment hotels.

Organized tours. Organized tours usually combine accommodation with

excursions. They can be on a FB, HB or BB basis. Certain tours are fully

escorted by tour managers, while others may just include travel and entrance

fees. Transportation during the tours is either by coach, plane or train.

Cruises. Cruises are all inclusive packages. The development of this type of

tourism products is compensating for the decline in the number of sea-

traveling passengers. They can cruise all year round, as the tourist season in

the two major zones (Caribbean and the Mediterranean) falls at different

times.

2. The mixed formula

These are packages which offer transport to and from destination with other

services. Fly and drives combine flights and hire-car at the destination. Flight +

hotel packages include flights to the destination and hotel vouchers which can be

used at a number of tourist resorts and sites. Many innovative products are being

developed offering travel and accommodation with specialized services for special

interest groups: sport holidays, cultural tours, health and spa holidays, adventure

travel, incentive and conference travel etc.

A.3 Economic characteristics of tourism products

Tourism products have three main economic features: inelasticity, complementarity

and heterogeneity

Inelasticity

Tourism products are inelastic because they do not adapt well to changes in short

and long term demand. There cannot be stocked, meaning they are perishable.

Short-term increases and falls in demand for a product will have little influence on

its price. It is the long term fluctuations that affect the composition of the product

and its selling price. Tourism products are dependent on existing superstructures at

destinations such as hospitality facilities, transport and accommodation.

Complementarity

The tourism product is not just one single service. It is composed of several

complementary sub-products. Production of the overall service and the quality of the

service is dependant on the components complementing each other. A shortcoming

in one of the sub-products will undermine the final product. This remains one of the

major difficulties in tourism production.

Heterogeneity

The tourism product is said to be heterogeneous because it is virtually impossible to

produce two identical tourism services. There will always be a difference in quality,

even if the nature of the proposed service remains constant. The heterogeneity

allows the possibility of a certain amount of substitution within the different sub-

products. However, the resulting product will never be exactly the same.

Substituting one hotel for another, even if they are of the same category, will create

a different experience and produce a different final product.

2

B. TRAVEL INTERMEDIARIES

B.1 Tour Wholesalers

The tour wholesaler functions as an intermediary between the supplier, also

known as principal, of the tourist product and the travel agent who acts as the

retailer. The tour wholesaler designs, prepares, promotes, and executes the sale of

tour packages, buying large volumes of products from a variety of travel suppliers.

These products may include air travel, accommodations, meals, entertainment,

ground transportation, sightseeing tours, and special entrance fees for attractions.

The products are grouped by the wholesaler to form attractive tour packages which

are made available to travel agents for sale to the end consumer.

The Role of Wholesaler

Wholesalers generate a large part of the revenues in the travel industry since

purchasing in bulk increases their buying power and ability to negotiate discounts.

In this respect, larger wholesalers have a leveraged advantage over their smaller

competitors. The cost savings is ultimately passed to the consumer by making tour

packages available at prices lower than the sum cost of all components bought

separately at retail.

In addition, wholesalers provide advantages to the suppliers of tourist products who

enjoy the financial security of having advance sales commitments for large blocks of

rooms, seats, or other products.

Wholesalers make a significant contribution to the travel agent and customer alike

by developing and making available an array of tour packages to satisfy different

travel customer tastes and income levels (Gee, Boberg, Choy, & Makens, 1990, p.

49).

Types of Wholesalers

Tour wholesalers can be classified in various ways including the following:

The inbound wholesaler arranges tour packages for tourists visiting the country

where the wholesaler is based. Inbound wholesalers do not necessarily operate only

in the country where they offer tours and some maintain sales branches in other

countries.

The outbound wholesaler arranges packaged travel for tourists who wish to travel

to destinations outside the country where the wholesaler is located. Unlike the

inbound wholesaler, the outbound wholesaler does not usually focus on a single

destination, but may offer a wide variety of packages and destinations.

However, both of these wholesalers tend to cater to the needs of the mass market in

order to have the necessary volume leverage.

The domestic wholesaler designs and packages tours for local residents who travel

within the country where the wholesaler operates.

The specialty wholesaler centralizes its business in making tours available for

special-interest groups (e.g. retirees, singles) or focuses on particular destinations,

3

accommodations, or alternative forms of tourism of interest to adventure travelers,

culture seekers, or nature enthusiasts.

The airline wholesaler can be either a subsidiary selling the seats of a particular

airline or a wholesale business that has formed a brokerage relationship with an

airline.

The wholesale travel agent is a travel agent who puts together customized

versions of tour packages to satisfy the needs of market niches within their customer

base. These travel agents such as American Express Travel Related Services and

Thomas Cook Travel often assume the retail and wholesaler roles at the same time.

Similarly, the wholesaler may sometimes act as a travel agent by operating retail

outlets.

The travel clubs and incentive travel companies arrange travel packages in ways

similar to the wholesalers. However, these packages do not become available for

general consumption and are only offered to their individual members.

The Economics of Wholesalers

Unlike travel retailers which benefit from commissions, wholesalers generate their

gross profits using a 20-25% markup. The markup is applied only in the ground

services portion of the tour. Although 90% of wholesale packages include air

transportation, in general, wholesalers do not make any profit on this part of the

package. This part, which represents almost 50% of the total price of the package,

generates profits that go to the travel agent in the form of commission. For the

wholesaler, after the subtraction of its operating expenses, there remains an average

3% percent before-tax profit out of the total price of an all-inclusive tour.

Consequently, high volumes of sales have to be reached in order for a wholesale

business to be profitable. Additionally, strong sales are required in order to reach

the average break-even point of the industry.

More specifically, before it starts generating a profit, a wholesaler must sell as much

as 85% of its packages (Coltman, 1989, pp. 326-327). In contrast to the low return-

on-sales that characterizes the business, wholesalers benefit by a favorable return-

on-equity ratio. This is due to the low requirements in initial investment.

The travel wholesaler is not required to pay in full when booking from a supplier.

For example, only a minimum deposit is necessary to secure the desired number of

rooms of a hotel for a certain period. Next, the wholesaler can redeem his cash in the

form of deposits and/or payments submitted to him by the travel agent when

individual travelers buy the packages. It should be emphasized that while the

customers pay the wholesaler for their trips in advance, the wholesaler does not

usually pay off the supplier until after the trip is completed.

Thus, the wholesaler can take advantage of the excess funds also called the float,

before it actually pays the supplier in full.

Despite this cash flow benefit, the wholesaler faces considerable risks as well.

Factors such as changing preferences, unfavorable weather conditions, safety

concerns, or political upheavals can destabilize markets and render destinations

unsaleable. Moreover, when making a large number of advance reservations with a

supplier, the wholesaler must enter into a sales contract for which he is bonded.

4

Despite the inclusion of typical cancellation clauses in a contract, the wholesaler

may still incur significant losses from forgone deposits and prepayments, and the

closer the cancellation is to the departure date, the greater the reduction of the

deposits.

Trends Affecting Wholesalers

In the growing tourism market, wholesalers are likely to face increased competition

coming mostly from the suppliers.

For example, after the deregulation of the U.S. airline industry in 1978, airlines

began arranging their own tours by combining their services with those of other

suppliers.

In addition, lower prices offered by various suppliers, such as discount airfares made

available by airlines, have had an impact on the wholesale business. Lower airline

ticket prices allow the option of creating a personalized tour with a total price that

could be comparable to the one offered by wholesalers.

Moreover, wholesalers may be affected by changes in consumer tastes as

experienced travelers move away from the typical group travel that characterized

the last two decades toward independent travel.

In recent years, wholesalers have also been increasingly subject to lawsuits from

consumers who are better educated and aware of their rights. False advertising has

become a problem together with the growth of the tour business, largely attributable

to the exploding demand for tours that has allowed the entrance of many new and

inexperienced wholesalers.

Sometimes, the claims and promises made by the advertising of wholesalers are in

conflict with what the consumer ultimately receives.

Other problems that wholesalers are sued for may be changes in the scheduled

flights or the prices of packages or hotel rooms. Even though wholesalers might not

be the only ones responsible for those changes, which can be the result of airline

schedule changes, exchange rate variation, or hotel errors, they are the ones that

consumers can usually hold liable.

The future of the wholesale business will also be affected by the impact of the

communication revolution in the travel industry.

For example, information experts suggest that a good tour is one that can be booked

quickly, preferably in four minutes.

Inevitably, computers become mandatory for the accomplishment of this task, and

the hiring of more technical personnel by wholesalers has already been observed as

a result of technological changes.

B.2 Tour Operators

In the travel world, the term wholesaler is often used interchangeably with the term

tour operator.

Even though these two terms describe similar types of intermediaries, a distinction

should be made in order to avoid confusion.

In general, the tour operator, also referred to as ground operator, can be thought of

as a tour wholesaler with a smaller scale of operations. The word operator indicates

5

the main function of tour operators which is to operate or run tour packages. In

other words, tour operators are responsible for the delivery of the parts of a tour as

promised to the buyer of the tour. To deliver services, operators may employ their

own ground equipment and facilities, such as motorcoaches and accommodations, or

rent these from other tour operators or individual providers (Gee et al., 1990, p. 50).

In contrast to a wholesaler who designs and offers a large number of tours, the tour

operator can offer only a limited number of tours on a yearly basis.

These tours in combination are referred to as the tour program. While the

wholesaler will typically include transportation to and from a destination, the tour

operator offers his/her services only at the destination itself. The tour operators

defined business is to make the land arrangements at the destination

encompassing hotel transfers, accommodations, sightseeing, prepaid admissions,

and other special arrangements. Much like the wholesaler, the tour operators are

free to design and offer their own packages which can be geared to all travelers. In

some cases, however, operators have to comply with the specific preferences of the

wholesaler interested in buying their services. In other instances, they compete with

wholesalers who operate packages of their own.

In recent years there has been a trend for tour operators to specialize.

For example, companies might concentrate in incentive travel or others may focus on

sailboat charters.

Due to a progressively higher segmentation and the sizable free and independent

traveler (FIT) market whose customers travel independently of a group, the need for

additional specializations of tour operators has increased.

B.3 The Travel Agent

Traditionally, the role of the retailer in the travel industry has been played by the

travel agent. The travel agent is the final link in the consumption process,

connecting the receiver (the consumer) and the source (either the supplier or the

wholesaler) of various tourism goods and services.

The travel agent is also the visible intermediary in the distribution chain selling

transportation, accommodations, meals, activities, attractions, and other travel

elements directly to the public. These products can be sold individually, in various

combinations, or as tour packages to the clients. It is the responsibility of the travel

agent to act on behalf of prospective travelers and understand their desires in order

to satisfy them by arranging the necessary parts of the trip (Gee et al., 1990, p. 48).

Legally, the travel agent is a commissioned agent or an authorized representative

who is approved to sell the products of a company in a certain geographic area.

In terms of distribution, the travel agent maintains a delicate balance between

serving the client and promoting the interests of the principal the agent represents.

Above all, a travel agent has to use knowledge and expertise in responsible ways to

successfully plan and secure a safe and enjoyable trip.

This may involve carrying out numerous detailed activities including but not limited

to preparing individual itineraries, informing about travel insurance, documents,

and immunization requirements, as well as giving descriptions of destinations,

hotels, and local customs. The demands on the agent have increased as the product

6

mix has expanded. Even though almost every agent can sell the products of all sorts

of suppliers, there are agents who choose to specialize in particular areas, and they

play many different roles.

Travel Agents as Counselors

The retail travel agent plays an important role in promoting the efficiency and the

quality of the distribution of the various travel products.

To the customer, the travel agent is the means for researching, organizing, securing,

and realizing a desired trip. The agents goal is to understand what satisfies the

travelers needs and try to provide it. That is why the term counselor is frequently

employed to describe the advising service that the agent provides.

Due to the increasing complexity of the reservation and pricing systems, a client

would have to spend substantial time and money to arrange a trip or tour

individually. Alternatively, the services of a travel agent may be used which are

generally offered free of charge.

The travel agent is a specialist who has developed an expertise in researching and

collecting large amounts of appropriate and reliable information in very little time.

In order to add value to the customers travel experience, the agent is required to

know or have access, at least, to schedules, prices, different types and qualities of

accommodations, airlines, and other travel components.

Moreover, the agent has to personalize the results of this knowledge to fit the

specific needs of the prospective traveler.

Operating as a responsible and trustworthy professional is an integral part of an

agents mission. The travel agents business depends greatly on repeat customers

and is severely affected by word-of-mouth. The significance of customer loyalty for

the industry is indicated by the fact that approximately 85% of an agents clientele

consists of repeat customers.

Travel Agents as Sales Representatives

The travel agent carries out an equally important function as a salesperson.

Ultimately, this is what determines an agencys financial condition.

Most people who seek the travel agents advice already know what they want.

Because the value-conscious consumer does not hesitate to research and shop

around, agents must not only service and sell what he or she requests, but be able to

close the sale as well.

Maintaining a harmonious relationship between serving a client and selling the

products of preferred suppliers has always been a challenge for travel agents.

The deregulation of the field has allowed agents to obtain different commissions and

even overrides (commission rates that increase according to the level of sales) from

different suppliers.

To the supplier, the retail travel agent plays a critical role in promoting and selling

its products to the ultimate consumer. The agent provides three basic elements that

facilitate the suppliers business. These include a location where information can be

obtained for the suppliers products, an outlet where a potential customer can

purchase those products, as well as a place were payments can be collected.

7

In the U.S. and elsewhere, airline deregulation and other developments in the

industry have had a dramatic effect on travel agencies. In 1995, most of the major

U.S. airlines adopted a cap policy limiting commissions in order to cut costs. For

example, Delta Air Lines provides travel agents a 10 percent commission on U.S.

domestic tickets as long as the total commission per ticket does not exceed the

amount of $50. The average commission rates for domestic air sales have declined

for travel agents placing increased pressure on agencies to move larger volumes of

tickets to attain the same profit. Another concern is the low-fare trend for domestic

tickets. When airline price wars are in effect, fares often become so low that the

money an average agent makes selling a ticket may be less than what it costs to

issue it. Even though this situation is not new, it comprises a serious burden,

especially in combination with restricted commissions. Because of the commission

cap, travel agents cannot balance losses incurred in selling cheap air tickets with

higher fare tickets.

B.4 Regulation of Intermediaries

Travel Agents

Historically, travel agents have been affected by regulations, especially from the

airlines which restrict the number of agents because of concern over increased

competition for their own sales offices.

Until 1959, a travel agency could not be established unless it had the sponsorship of

an airline and the approval of two-thirds of the members of the respective domestic

or international travel conference. The subsequent rapid expansion of the airline

industry forced airlines to rely more heavily on travel agents to reach and service

their clientele. Although there has been a relaxation of restrictions since the

deregulation of the airline industry in the U.S., even today an agency has to comply

to certain regulations before and during the time it is in business.

In the U.S., where a travel agency is not legally obliged to be licensed in many

states, certification or accreditation consists of the approval from industry

conferences. A conference is a regulatory body made up of transportation companies

that impose requirements in order to promote certain standards. For the U.S., there

are four major conferences: (1) The Airlines Reporting Corporation (ARC)

responsible for domestic tickets, (2) The International Airline Travel Agency

Network (IATAN) responsible for international tickets, (3) The Cruise Line

International Association (CLIA) responsible for cruises, and (4) The National

Railroad Passenger Corporation responsible for domestic rail tickets (Mill, 1990, p.

321).

An agency which is appointed by one group will usually receive an appointment by

the rest of the conferences. Major requirements of ARC, for example, are that

agencies carry a minimum bond to cover for the possibility of default and maintain a

minimum cash reserve. There are also minimum experience requirements for agency

management, and the agency must be accessible to the general public, actively sell

tickets, and promote travel.

8

Some states in the U.S. require a license. The license can be obtained by passing an

examination given by the state licensing boards.

Additionally, a city license and possibly a county license are required in order for a

travel agency to be operational. Travel agents may also choose to follow the rules

imposed by various trade associations which they have joined as members.

The EC (European Community) Travel Directive was initiated in 1993 to eliminate

differences in laws among member European states related to group or package

travel. The Directive, however, does not replace national laws regarding ground

travel, package holidays, tours, and tour operators and agents and leaves

implementation to each state (Downes, 1993).

Japans travel agency law is considered one of the most organized and advanced, and

its travel agents are divided into three classifications: general, domestic, and sub-

agency. All agencies are required to register with the Ministry of Transport and are

bonded (Travel Journal, Inc., 1995, p. 185).

Travel agents have a legal obligation to perform in a professional manner. They can

be held responsible for the quality of the service they provide. The provided service

has to be in accordance to the promises made to the customer and consistent with

the average industry performance. Agents have to take into consideration any

special factors in the destination that may influence the customer such as political

stability, health care, and other conditions. According to court rulings, agents can be

even held liable in the event a wholesaler goes bankrupt before the trip.

The American Society of Travel Agents (ASTA) in the U.S., the Association of

Canadian Travel Agents (ACTA) in Canada, the Association of British Travel Agents

(ABTA) in the U.K., and the Japan Association of Travel Agents (JATA) in Japan

are some of the groups or organizations which set industry standards. International

organizations include the International Federation of Travel Agents (IFTA) and the

World Association of Travel Agents (WATA).

Wholesalers

For a new wholesaler to enter the industry, usually a local business license and

compliance with governmental and airline regulations are required.

Nevertheless, wholesalers may be subject to additional constraints, some of those

monetary, if they choose to join certain professional associations.

In the U.S., the tour operator industry is largely self-regulated, and most belong to

the U.S. Tour Operators Association (USTOA). The USTOA requires an indemnity

bond from its members. This goes toward the Consumer Payment Protection

Program which helps refund the money to customers in case the wholesaler goes out

of business.

C. PACKAGING THE TOURISM PRODUCT

9

Packaging tourism products involves several stages which can take several months

and sometimes several years. The three main stages are:

1. Market research

2. Negotiation

3. Commercialization of the tourism product

1. Market research

The aim of market research is to understand and analyze the key elements

associated with a particular market and its environment. Because of the specific

nature of the tourism product, each market research survey should be tailor-made to

the aims of the project. However, the research methodology remains the same. It

analyzes the environment of the project, the characteristics of supply and demand,

time schedules, controls and costs.

The strategic aim of market research is to test different hypothesis so as to identify

the most realistic ones. The most important research tool is the questionnaire.

Surveys provide a range of information on consumer behavior towards a specific

product. They reveal attitudes, reactions and prejudices towards destination

countries. Three main questions must be addressed to gather information required

from a market survey:

Who should be questioned? size of the sample to be surveyed and the sampling

method to be used.

What should be observed? nature of the information. It is important to understand

who is the potential clientele and to target it. The aim is to identify a potential group

of customers in order to adapt products to their needs and mount an efficient

promotional campaign.

How should it be undertaken? face-to-face, by telephone, trains, airports etc.

2. Negotiating contracts with different suppliers of tourism products

The product manufacturer assesses the motivation and purchasing power of a

potential market by undertaking market studies. Once he is satisfied that he has

enough information on the target markets demand for tourism products, he must:

- design products that match the demand of the target market

- create packages by negotiating the required services with suppliers of each

of the elements making up the product

- finalize contracts with them

2.1. Designing the product

Faced with intense international competition, the manufacturer must design his

products to meet the requirements of the consumer. He must have a good knowledge

of the tourist-generating market and of the quality-price ratio of the products he

plans to offer

- knowledge of the market

10

This is based on the body of information gathered by the market surveys. It relates

to:

- the clientele segmentation by age, professional category, area, income

bracket, lifestyle, usual holiday preference

- the competition choosing the right elements to differentiate the final

product from that of competitors; having the necessary promotion and

publicity superstructure available to reach the target clientele

- tourism resources at the destination area natural resources, cultural

resources, superstructure and services, entertainment and excursions

- the best quality-price ratio

The manufacturers strategic aim is to offer products that correspond more to

consumer demand than those of his competitors.

To implement this strategy, he must consider three points:

- competitiveness the manufacturer must successfully manage a range of

products catering to different market segments.

- product range extending the product range has several benefits: it offers

the consumer a wider choice of products; it contains competition by

controlling a large enough slice of the market to eventually dissuade

competition; it allows necessary adjustments dictated by changes in the

market tastes or circumstances to the companys supply; it averts commercial

vulnerability to political instability, fluctuations in exchange rates and

competitor actions

- strategy extending the product range must not jeopardize the

competitiveness of prices and the efficiency of management. It is therefore

essential to formulate a product-range strategy. This must be flexible enough

to adapt products to the changing tastes of consumers, to fluctuations in the

exchange rates and to variations in the consumer purchasing-power.

2.2. Negotiating the package

The manufacturer must negotiate with each supplier in order to be able to offer

competitively priced quality products to the market place. He makes arrangements

with several suppliers: transport companies, suppliers of accommodation, catering

and entertainment and those providing services for certain specialized products such

as cultural tourism, health tourism, MICE and so on.

The tour operator must be financially strong to guarantee the operation of the

product and to be in the position to pay his suppliers in advance.

The manufacturer will often choose destinations in low-cost countries because of

their low labor costs, low taxes, government subsidies, incentives designed to attract

foreign visitors or favorable exchange rates. These destinations must however fit

consumer tastes and have a good quality-price ratio.

Certain tour operators avoid being too dependant on suppliers by integrating some

of the services they offer. For instance, an airline company may set up a tour

operator and a hotel chain (BA Holidays top end of the market and city breaks;

Italtour (Al Italia); Caravela Tours (TAP Air Portugal)).

11

Several hotel chains and large tour operators also create subsidiary companies to

provide them with the necessary services. Thomson, the largest tour operator in UK,

distributes its products through its retail arm, Lunn Polly, the largest chain of

travel agencies in UK, and fly their clients on their own airline, Britannia, the

largest charter airline.

The aim of negotiation is to reach the best competitive price for a satisfactory

quality-price ratio. The selling price of the tourism product includes commissions to

travel agents or other distributors, marketing costs, administration costs and the

risk cost of falling short of the forecasted sales volume for the product.

2.3. Finalizing international contracts

Once negotiations have been successfully concluded, international contracts are

drawn up with different service suppliers: agency contracts with travel agencies at

the destination countries; contracts with hotels; charter agreements.

These contracts allocate responsibilities to spread the commercial risk between

suppliers and the operator. Generally, the tour operator is responsible for the

package he has designed. He must pay for services he has ordered (booked), notably

transport and accommodation allocations that he has not used. This risk is built into

catalog prices, which are calculated on an 80-90% take-up rate.

This is one of the biggest risk factors for tour operators. For this reason it is

essential that he develops a range of very diverse products to many different

destinations to compensate for any downfall due to political instability, fluctuations

in the exchange rate etc, as well as bad choices of product or errors committed in

product packaging.

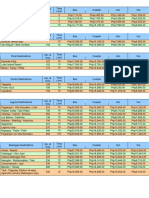

As a general rule, the elements that make up the cost of a trip in Europe can be

broken down as shown in the table below:

Package tour costing example (London-Canary Islands, one week, half board, 3-star

hotel)

Service High season (Euro) Low season (Euro)

7 days HB/person

- transfers

- ground handling

- Sub-total

225

12

6

243

135

12

6

153

Flight

(London Tenerife London)

Other costs

Sub-total

270

15

285

195

15

210

Commissions

Tour operator 8%

Travel agent 10%

42

57

29

39

Total selling price 627 431

Cost elements of an original trip

12

Distribution (travel agent ommission!

"our operator margin

Cost of pro#ution$

- a#ministration%management

- aommo#ation

- transport

Cost

8-12

24-42

30-50

10

8

82

100

However, competition has forced many service suppliers and particularly tour

operators to reduce their margins. Leading tour operators have been compelled to

reduce their margins as low as less than 1% for some products.

Tour operator profit margin in a highly competitive situation (based on an average

price of 411E for a 15-day package to Portugal

Cost (euro)

Travel agency

Airline company

Administration

Transfer

Hotel

Tour operator profit

42

157

30

7

172

3

3. Commercialization of the tourism product

The travel distribution systems

We usually associate a product with its production and consumption stages, often

overlooking an intervening process which moves the product from production to the

consumption stage. This process is called distribution.

Theoretically, the distribution of the tourist product resembles that of other

industries. It involves the participation of wholesalers, retailers, and other

intermediaries or middlemen, all responsible for bringing the product from the

supplier to the consumer in a sales distribution system.

In practice, however, two factors make the distribution of the tourist product

unique.

First, unlike manufactured products which can be transported to the consumer, it is

usually the consumer that has to be transported to the point of consumption for the

tourist product.

Second, unlike tangible products with a shelf-life, the tourist product is highly

perishable. An unsold hotel room, meal or tour bus seat has no income value in the

marketplace the day after.

Collectively, these factors make the selling of the tourist product a challenging task.

Thus, in order to better understand the mechanics of the tourism market and its

economic significance, it is important to gain a basic understanding of the sales

distribution systems and their role in influencing sales.

13

3.1. Historical Background

Todays travel distribution system can trace its origins to the 1840s when Thomas

Cook organized what could be called the ancestor of todays tours. An ambitious

entrepreneur and innovator, Cook also introduced several types of tours including

the first pleasure tour to North America in 1866 and the first around-the-world tour

in 1872.

In the 19

th

century, tours were almost exclusively for the upper classes, but Cook

tried to reduce the cost of traveling by chartering entire ships and booking blocks of

rooms in hotels.

In 1874, Cook was also the first to introduce circular notes to be used by travelers.

These were accepted by foreign banks and hotels and relieved travelers from

carrying large amounts of cash. They were a simple version of the travelers checks

of today (Milne, 1991, p. 78).

Before the introduction of the travel agencies at the end of the 19

th

century, it was

common for hotel porters to make steamship and rail reservations on behalf of hotel

guests. Hotels usually were built close to rail stations and ports where hotel porters

were sent to make reservations and bring back the tickets in return for a

commission by the supplier and a delivery charge from the client.

To compete with the railroads, commercial airlines starting operations in the 1920s

also used hotel porters as their agents, paying them a 5% commission. Later,

airlines began establishing their own sales offices in hotels in an effort to avoid

paying out commissions.

As international and leisure travel increased following World War II, the travel

agency business expanded rapidly. Tours also dramatically increased in popularity

with the introduction of jet aircraft in 1958.

The advent of wide-bodied planes in the 1970s further reduced the price of air travel

which increased the affordability of tour packages. The demand for tours also

expanded as the disposable incomes of people in the U.S., Europe, and parts of Asia

rose, and consumers became aware of the advantages of buying a complete tour

package instead of organizing their own itineraries and bookings.

3.2. Types of Distribution Systems

There are two broad categories of sales distribution systems, direct and indirect,

which involve different variations and combinations, depending on the number of

intermediaries used by suppliers in the distribution pipeline.

Suppliers include hotels, airlines, cruise ship companies, car rental companies,

railroads, and sightseeing operators.

While most of the suppliers are part of the private sector distribution system, many

destinations also have public sector distribution systems in tourism.

Some governments run travel agencies such as Saigontourist and Vietnamtourist in

Vietnam, railways, and hotels. African Tours and Hotels Limited, for example, is a

leading quasi-governmental hotel management company which runs properties

throughout Kenya.

14

Each of the systems offers advantages and disadvantages, depending on the type of

customers to be served.

3.2.1 Direct Distribution System

In the direct distribution system, sales are realized through direct contact

between the supplier and the customer without any intermediary (see Figure). An

example is a prospective traveler who calls the reservation department of a hotel to

book a room or who walks up to the airline ticket counter at the airport to purchase

a ticket.

The advantages of this method include:

Time Savings. There is a direct communication between the two parties and the

transaction is a simple one.

Increased Profits. Suppliers are not required to give a commission to any

middlemen resulting in greater profit per unit.

Flexibility. Direct communication with the supplier offers the traveler the option

to make possible changes in the itinerary. This becomes more complicated or even

impossible when, for example, the traveler buys a tour package from a travel agent

where the itinerary is usually fixed.

Greater Control. For a number of customers, buying from the supplier and

confirming a booking directly provide a feeling of comfort and security in the

transaction. For the supplier, dealing directly with the customer provides an

opportunity for recommendations and promotions of additional products.

There are also some disadvantages of the direct distribution system.

First is the high cost that the supplier faces in order to maintain a permanent

sales force. Another disadvantage is the possible reaction of the dissatisfied

intermediary, since the supplier attracts customers that could otherwise be served

by them.

Finally, if the supplier uses this distribution method exclusively, it risks losing an

opportunity to increase its revenues by selling to travelers who prefer to use an

intermediary (Collier, 1994, p. 198).

3.2.2 Indirect Distribution System

In the indirect distribution system, the supplier makes use of one or more travel

intermediaries in order to reach the consumer. For example, a travel wholesaler can

book a large number of rooms for a certain period, and these rooms are made

available by the wholesaler as part of a tour package. The customer can then book

the tour package through the travel agent who serves as the intermediary between

the supplier and the customer.

Some benefits of this distribution method for the consumer include:

Professional Consultation. Working through intermediaries, the consumer can get

a professional opinion about the comparative advantages of different options. The

travel agent, for example, can provide the traveler with unbiased and personalized

guidance, advice, and expertise.

15

Greater Variety. Dealing with a number of different suppliers allows the

middlemen to offer a wider array of product options that the consumer might not

have the necessary knowledge or resources to explore individually.

Lower Price. Travel intermediaries are often able to negotiate lower rates than

otherwise would be available to the consumer.

Single Payment. The customer is charged in advance and pays for all different

elements of the trip such as the flight, hotel, or car rental. This increases the

convenience of the purchasing process and eliminates the need for the traveler to

remit separate payments to different suppliers.

The indirect distribution system benefits the supplier as well.

The most significant benefit is the savings from not having to hire sales personnel

since the intermediaries function as a sales team.

The collection of sales revenues is also facilitated with the presence of middlemen,

and cooperating with middlemen as preferred suppliers can help the supplier to

generate additional business (Collier, 1994, p. 199).

Variations of indirect distribution may involve two or more intermediaries in moving

the travel product from the supplier to the end consumer.

Where there is a third intermediary, this is usually a specialty channeler. Various

types of middlemen can fit under the term specialty channeler. These include, but

are not limited to, meeting and convention planners, corporate travel offices,

incentive travel agents, and hotel representatives.

The added benefits to the consumer coming from the involvement of the specialty

channelers are based on the easier flow of information, the provision of customized

service (often to large groups of people), and a favorable price of the package.

16

D. MARKETING THE TOURISM PRODUCT

The tour operator will either offer his products directly to the market or sell them

through travel agents. Whichever method of distribution he chooses, sales will hinge

on products being presented in brochures designed by the tour operator and on the

marketing and advertising campaign.

17

1. The brochure

This is the main marketing tool used to sell tourism packages. The largest tour

operators print over 1 million copies of their brochures. These are distributed

through travel agencies and their own retail outlets. Brochures are also sent directly

to past clients that have been identified by market research.

The advantage of the brochure is that it represents the tangible evidence of a service

that will be consumed in the future.

Because of the high expense of designing and producing a brochure, only the largest

tour operators with strong financial power can afford the cost. Therefore, the supply

of tourism packages is concentrated in the hands of a few operators. Furthermore,

the lead time necessary to bring a product to the market can be between six months

and a year. The risks of inflation, fluctuations in exchange rates and the price of gas

makes it difficult to predict prices so far ahead. Tour operators now include the price

list separately from their main brochure in order to react to changes whenever

necessary. However, this reduces the strategic impact of advertising promotional

prices.

2. Marketing by travel agents

Travel agencies are tourism firms whose main activity is to sell tourism products on

a commission basis to consumers. The activity of travel agencies is based around

transport sales and the marketing of tourism packages.

Ticketing is the main activity of most agencies. This involves booking transport

space, but also associated travel services.

Transportation sales are the bulk of the agencys business. To sell airline tickets,

travel agencies must be accredited by IATA or by an airline company member of

IATA. The organization protects both consumers and airline companies against

bankruptcy and also serves to regulate the industry.

3. Advertising and promotion

Marketing and advertising campaigns are often undertaken by different

organizations whose interests are complementary:

- governmental tourism organizations from destination countries are

responsible for general information and promotion of the destination

- tour operators and travel agencies mount marketing campaigns to sell their

products

National tourist organizations cooperate with tour operators and travel agencies

who sell products to their destination. Ultimately, the destinations success in

attracting tourists is linked to the operators and agencies ability to sell products to

the market.

Operators who develop products in destinations which are not promoted by a

government agency bear the total cost of promoting both their products and the

destination.

18

A product made up of several integrated images is promoted on different fronts by

each supplier.

The marketing costs shouldered by tourism firms are mainly made up of:

- brochures and leaflets distributed to travel agencies, at trade fairs and travel

exhibitions

- posters

- advertisements, newspaper features and competitions in the media;

- commercials on the radio, TV and cinema

- postage of brochures to past and potential clients

- the organization of press conferences

- familiarization trips for journalists and travel distributors

E. THE TREND TOWARDS CONSOLIDATION

1. The dominance of conglomerates

Since the distribution network is the last sector of the travel industry to move

towards consolidation and integration, it is only natural to speculate on the

motivations behind the current merger mania.

For many players, consolidation is a wise course, made all the easier by the financial

communitys view that leisure has become a leading industry. Little by little, major

players are divesting themselves of some of their traditional activities to concentrate

more on tourism and travel, considered more profitable because of their ability to

attract capital investment.

To better understand the extent of this consolidation, an overview of the major

conglomerates that make up the distribution network is in order.

Preussag > TUI

German group Preussag is the leading European tour operator, although as recently

as 1997 it was completely absent from the travel market. Having divested itself of

its shipbuilding and mining activities, Preussag has invested heavily to refocus on

the travel industry in the last few years.

The push began in 1997, when Preussag purchased TUI, the top German tour

operator. The company then acquired Thomas Cook and Carlson U.K. of Great

Britain in December 1998. Finally, in May 2000, Preussag took over Thomson

Travel, the number one British agency, for US$2 billion. However, for this purchase

to receive EC approval, Preussag had to promise to sell off Thomas Cook. In France,

Preussag acquired a 6% interest in Nouvelles Frontires in November 2000; this

share gradually increased to 34% by March 2002.

In other transactions, Preussag purchased GTT26, the number one Austrian tour

operator, in February 2000. In Spain, after gaining a foothold with the RIU hotel

chain, Preussag acquired Viajes Marsans in April 2001. That same month, it

acquired all remaining shares of TUI Belgique, thereby becoming sole proprietor. In

May 2001, it purchased a 10% interest in Alpitour, Italys number one tour operator.

19

In February 2001, Preussag (through its subsidiary, TUI), Maritz Travel Company

(U.S.),

Internet Travel Group (Australia), Protravel (France) and Britannic Travel (U.K.)

joined forces to create a global business travel network: TQ3 Travel Solutions. Sales

reached aprox. $9 billion.

In 2002, Preussag changed its name to TUI AG and completes the 100 percent take-

over of France's leading tour operator Nouvelles Frontires.

With effect from 1 January 2003 TUI AG takes over the majority holding in the

incoming agencies of S.C. Danubius Travel Agency, based in Constanta, Romania,

and Mex-Atlntica Tours S.A. de C.V., based in Mexico City.

TUI Hotels & Resorts, which operates the World of TUI hotel shareholdings,

acquires a 50% stake in Sol y Mar Hotels. In France TUI France - the latest tour

operator brand in the World of TUI - starts sales. Discount Travel - the latest retail

brand in the Central Europe source market- is launched.

In 2004, TUI sells its 10% holding in the Italian Alpitour group. The transaction also

includes the sale of the 50% interest in the Italian airline Neos.

TUI sells its share of the vacation ownership provider Anfi del Mar.

TUI takes over with immediate effect the 49% share in TUI Suisse held by Kuoni

Reisen Holding AG. TUI AG again holds a 100% stake in its Swiss subsidiary.

TUI enters the Russian tour operator market and builds up TMR (TUI Mostravel

Russia), a joint venture of TUI and Russian tour operator Mostravel. This company

starts work on 1 August 2004. TUI holds a 34% share in TMR.

In UK, TUI launches a new airline under the brand Thomsonfly on 31 March 2004.

In connection with this new business Coventry airport in central England is aquired.

In Belgium, TUI launches its own carrier TUI Airlines Belgium on 1 April 2004.

TUI increased to 100 percent its holding in the Austrian club holiday provider Magic

Life with effect from 31 October 2004.

TUI increased to 100 percent its holding in the TV Travel Shop Germany GmbH

with effect from 31 December 2004.

In 2005 TUI enters the Indian market and now holds a 50% share in the incoming

agency Le Passage to India Ltd'.

TUI also acquires on the American stock market 9.03 percent of the American

Travel Management Company Navigant International Inc., Denver.

TUI starts with its own airline TUI Airlines Nederland which will operate under

the brand name of Arkefly on 21 April 2005.

TUI acquires a 51% holding in the incoming agency Acampora Travel S.r.l.,

Sorrento, Italy with effect retrospectively from 1 January 2005.

The rail logistics business, pooled under VTG AG, was divested to the Compagnie

Europenne de Wagons in June 2005.

In 2007, TUI AG and First Choice Holidays PLC agree to merge TUI Tourism and

First Choice Holidays PLC to form TUI Travel PLC. In December 2007, TUI Travel

PLC enters FTSE 100 index.

20

In 2008, TUI Travel PLC signs Memorandum of Understanding with S-Group

Capital Management Limited to jointly develop a Russian and CIS leisure tourism

presence.

In 2009, TUI Travel PLC announces a strategic cooperation between Air Berlin and

TUI Travels German aviation business TUIfly

Condor & Neckermann Touristik AG > Thomas Cook

C & N Touristik AG was founded in 1998 when Germany company Karstadt Quelle

decided to create a major tour operator by merging its travel division, NUR

Touristik GmbH (Germanys number two tour operator), with Condor Flugdienst

21

GmbH, Lufthansas charter airline. Each founding company holds a 50% share in

the new group. Karstadt Quelle is Europes largest retail and mail-order corporation.

Its new business activities include travel services, ecommerce and over-the-counter

business.

C & N Touristik AG has made several successful acquisitions in France, notably

Aquatour, Albatros and the leisure travel activities of Havas Tourisme, in April 2000

(American Express acquired Havas Voyage Affaires, the business travel side).

However, C & Ns efforts in Great Britain have not been as successful: failed take-

overs of both Thomson Travel and Airtours.

In December 2000, it did acquire Thomas Cook for 885 million euros when Preussag

was forced to divest itself of this tour operator as a condition of acquiring Thomson

Travel (see above).

In other developments, in early May 2001, the number two German tour operator

abandoned the off-putting name of C & N to adopt the name of Thomas Cook, a

brand within the group that enjoys a higher international profile (see end of

document).

Its acquisition of the French travel group Havas Voyages in July 2000 and its take-

over of the British travel group Thomas Cook Holdings Ltd. in April 2001 have

made the company Europe's second-largest leisure group.

In Germany, the business priorities of the company focus on its tour operators

with the brands Neckermann Reisen, Air Marin, Aldiana, Bucher Reisen, Condor

Individuell, Kreutzer Touristik and Terramar, its own retail business with some

700 travel agencies (Thomas Cook and Holiday Land) and the world's leading

holiday airline Condor. With more than five million customers, Neckermann

Reisen is not only the group's biggest brand but also the strongest tour

operator brand in the European travel market. Terramar is the specialist for

four and five star vacations. Aldiana offers premium club holidays. Kreutzer

Touristik addresses quality-conscious customers in the mid to up-market segment

while Air Marin operates in the low budget segment. Bucher Reisen is the

group's successful last minute specialist. The Condor Individuell program

allows customers to build their own holiday package from a selection of

flights, hotels, car rentals and other travel-related services.

KarstadtQuelle took full control of Thomas Cook AG on 9 February 2007, paying

800m for the halfshare owned by Lufthansa. Lufthansa will, however, maintain a

24.9% stake in Condor, the German charter airline division.

Condor, the leading leisure airline in the world, carriers more than eight

million passengers per year and serves on average more than 60 international

destinations in Europe, Asia, Africa and America. Aside from operating an

extensive route network with flights from 21 airports in Germany, Belgium, the

Netherlands and Switzerland, the 'sunshine carrier' is noted for its superior

service and quality standards as well as its modern fleet of 50 aircraft.

22

Rewe

Based in Cologne, German conglomerate Rewe owns a chain of supermarkets

(Selgros, Fegro, Penny, MiniMal etc.). In the past years, this group has developed an

interest in travel. In 1999, it created Rewe Touristik, its travel subsidiary, by

purchasing German tour operator DER for approximately US$400 million. The

group acquired a 51% interest in LTU Touristik, the third largest German tour

operator, in August 2000 when LTUs primary shareholder, Swissair, was

experiencing financial difficulties. Several years ago it had no interest in the travel

sector and now Rewe ranks third among German tour operators with an impressive

distribution network throughout the country.

The REWE Travel and Tourism division is becoming increasingly important. It

includes more then 695 travel agencies (ATLAS REISEN, DER or DERPART) as

well as tour operators (DERTOUR, ITS Reisen, JAHN REISEN, TJAEREBORG,

smile&fly, ADAC Reisen, Meiers Weltreisen, ITS BILLA).

With AVIGO, the cross-brand travel portal, REWE Travel and Tourism is

committing itself to the future market in new media.

The U.S. market

The U.S. distribution network differs from the European network in a number of

ways. Unlike Europe, the United States has very few vertically integrated groups.

Carlson Companies is one exception, offering a complete array of travel services:

restaurants, hotels, cruises and branded travel agencies.

The U.S. network is also characterized by the dominance of the airlines. Given the

high volume of domestic air traffic, the airlines are constantly deploying various

strategies to maintain or increase their market shares. The major U.S. airlines are

represented by giant corporations capable of exerting pressure on the entire

distribution network. This is why the American Society of Travel Agents (ASTA) is

wary of certain airline initiatives, such as the creation of Orbitz, an e-commerce

travel site controlled by several airline companies.

Strategies involving the electronic distribution network are of crucial importance in

the United States where this market has reached maturity faster than anywhere

else in the world. These conditions helped favor strong market entries of exclusively

electronic distributors such as Travelocity.com and Expedia. The following table

illustrates their rapid ascent to the heights of the U.S. distribution market.

The U.S. market is also noteworthy because of the importance of specialized services

for small businesses and business travelers. Companies like American Express,

Carlson and Rosenbluth devote a considerable portion of their activities to

developing this lucrative market, which explains why they are among the top

American travel services groups. Industry associations like the American Society of

Travel Agents (ASTA) and the American Bus Association also play a key role, acting

as powerful lobbies for their members, much like the influence wielded by

associations of franchisees.

23

Largest US distributors of travel services

Although existing companies have not yet adopted vertical integration to the extent

seen in Europe, the situation seems to be changing. In the last years, several major

European tour operators have attempted to penetrate the U.S. market. British

company Airtours is one such example, strengthening its North American presence

with the acquisition of Travel Services International (TSI) in May 2000. This merger

enabled Airtours to unite its cruise, air transportation, car rental, travel agency and

resort services under a single brand. At the time of the transaction, TSIs estimated

sales were approximately US$1.1 billion. Airtours began its assault on the U.S.

market in 1997 by acquiring Suntrip. It then took over Vacation Express in a 1998

deal carried out by its Canadian subsidiary, North American Leisure Group (NALG).

In other developments, in October 2000 Navigant International, the fourth largest

U.S. travel solutions company, acquired Toronto-based GTS Global Travel Solutions,

which had estimated sales of nearly C$145 million. The deal helped Navigant

strengthen its presence in Canada and position itself as one of the top distributors of

plane tickets. It sells more than US$3 billion in plane tickets yearly through its 635

travel bureaus in the United States, Canada, the United Kingdom and South

America.

Many experts wonder whether deals such as these signal the beginning of a North

American wave of consolidation like that seen in Europe. However, no one seems

certain as yet.

The Asia-Pacific market

The distribution network is extremely fragmented in the Asia-Pacific region, which

has approximately 20,000 travel agencies. Of these, some 9,000 are members of the

IATA. The recent surge in tourists from China, which opened its first travel agency

in 1995, is largely responsible for the explosion in the number of independent

agencies in this part of the world.

It would seem that the Asia-Pacific region is not yet ripe for consolidation, although

the number of new travel agencies has stagnated in most countries in the area, with

the exception of China. While China is the primary source of the overall increase in

agencies in the area, Japan has the most concentrated market: the top three tour

24

operators share over 60% of the market held by the eight largest tour operators in

the country.

3. Alliances, mergers and acquisitions in the distribution network

Although the distribution network was the last tourism sector to move towards

alliances, mergers and acquisitions, it is now undeniably a very concentrated sector

where the primary players hold major market shares. Many corporate entities have

changed and managerial structures themselves have evolved, creating a trend

towards brand-name products.

Vertical integration: Necessary for profitability

Despite sales growth, travel wholesalers are having a hard time increasing their

profit margin, which tends to hover somewhere under 5% and, in certain cases,

under 1%

Tour operators seeking to ensure profits are using vertical integration to better

control the various links in the chain of distribution. An operator can more easily

produce and distribute its vacation packages when it exercises some control over a

fleet of planes (like Airtours, the largest British tour operator), a network of

agencies, cruise lines or an impressive number of hotels. World leaders like German

tour operators Preussag and Condor & Neckermann Touristik control elements

throughout the entire chain of distribution and are constantly increasing their

market share.

Independent operators still offering vacation packages with no specific niche are

finding the major players provide stiff competition. It is nearly impossible to

compete in price while there is no comparison at all in marketing efforts. Even

though consumers remain attached to and appreciate the services of independent

travel agencies, they do look primarily for the low prices offered by major operators.

The domination of Germany and the United Kingdom - the race to

consolidate continues

Efforts to expand and take over the entire chain of distribution really took off in

Europe where almost all the major markets are now controlled by a handful of tour

operators. The five largest European groups account for more than 67% of total tour

operator sales, estimated at US$30 billion. The industry is largely dominated by

colossal German and British companies.

In Germany, five wholesalers control 76% of the market, while in Britain, the four

largest companies generate nearly 80% of travel package sales. By using charter

flights, these tour operators rack up significant profits because they are not subject

to the pricing policies of regular carriers.

The push towards acquisitions should continue as the British market has achieved

maturity and consolidation has reached a peak in Germany. The major tour

operators, in particular the British and German conglomerates, are absorbing major

25

losses in the pursuit of an intensive market penetration strategy to solidify their

future hold on Europe. Integration is also taking place in other European countries

such as France where the industry is less structured.

France has no large conglomerates and the companies there make few foreign

acquisitions.

French tour operators are not truly powerful and are more likely to be bought out by

other companies. Family-run firms are often targeted first by large integrated

foreign groups looking to expand.

For the time being, the United States and Japan are seeing fewer acquisitions

because vacation packages are less popular among consumers there than they are in

Europe.

However, these countries are likely to be targeted by the expansionist designs of a

few major players, notably the German companies TUI the leading European

service provider and Thomas Cook.

The following chart illustrates the market shares of the top five tour operators in the

primary European tourist-generating countries.

In fact, acquiring companies are often willing to pay an inflated share price rather

than see a company go to a competitor. This is exactly what happened when

Preussag purchased Thomson Travel. Since Preussag wanted at all cost to prevent

Thomson from becoming part of Karstadt Quelle (Condor & Neckermann Touristik

A.G.), the price negotiated was equal to twice the earnings per share traditionally

found in the travel sector.

It is difficult to accurately predict who will come out on top in this frantic rush to

consolidate.

For the time being, consumers should enjoy some benefits due to an emerging price

war that could well persist. One thing is certain: the main winners at the moment

are the shareholders of the companies purchased who are seeing their stock values

skyrocket.

26

4. Impacts of consolidation in the distribution network

4.1. Large integrated groups: the goals of consolidation

Economies of scale

Grappling with incredibly slim profit margins and increasing pressure from the

expanding Internet which threatens to cut these margins even further, large travel

groups see economies of scale as the best way to protect themselves against future

upsets. For example, the ability to negotiate a better price for airplane fuel gives one

a major competitive edge when setting prices for ones services. For travel agencies,

being part of a large group means taking advantage of the stronger buying power of

the parent company, which can use the groups size to negotiate exclusive

agreements with clients such as airlines and global distribution systems.

Increased visibility

Consolidation can help companies improve efficiency in activities such as

reservations, accounting, marketing and advertising; it also helps attract many

potential investors to this sector. Large groups can more easily carry out the major

marketing efforts required to increase product recognition among consumers, which,

in turn, contributes to the overall growth of the industry.

Market presence

Many tour operators opt to set up shop in a large number of countries to

significantly minimize the risk of industry upheavals, since structural changes do

not occur at the same rate everywhere. By concentrating their activities within a

single conglomerate, partners have an advantage when it comes to distribution,

which offers a wide variety of channels (travel agencies, the Internet, call centers,

interactive TV, etc.). By integrating the Internet into their operations, tour

operators find they can save time and money even if they continue to make most of

their sales through traditional channels.

Controlling distribution and monitoring the competition

Companies working within a single corporate structure enjoy more flexible payment

terms and better guarantees when it comes to making air travel arrangements. It is

also much easier for an integrated group to follow its clients needs because it

controls each segment in the chain of distribution. It is easy to set up an efficient

process for monitoring the competition by rigorously following up on sales, which is a

major advantage over competitors who are not vertically integrated. By setting up

yield management tools, a company can foresee the capacities required and quickly

produce the relevant brochures.

4.2 impacts on independent agencies

27

Differentiation strategies

Players in the distribution network who are not yet under the thumb of large

conglomerates work to adopt individual differentiation strategies to enable them to

compete where they can.

Personalized service has always been very important in the travel industry. Small

tour operators must therefore focus on specific niches and build on their firms

strengths. They also have the advantage of being able to quickly adapt to change,

especially when it comes to consumer needs.

Price wars

However, small tour operators must deal with barriers that increase with industry

consolidation, in particular price wars. Since they do not belong to an integrated

group with its own fleet of planes, independent operators can be shut out of the

market because of their inability to find cheap chartered seats. Since they are often

obliged to resort to the regular airlines, they have to charge their clients more. Even

worse, in addition to increasing their own sales, integrated groups can control, and

indeed block, the distribution of certain competitive products because their agency

networks also sell packages for other tour operators.

Be that as it may, direct sales are never enough, even for the largest groups.

Thomson makes approximately 68% of its sales through its distribution agency,

Lunn Poly. Tour operators must turn to independent agencies and other competing

networks to sell all their products. Competing tour operators must reach a certain

market balance that enables them to sell all of each others excess inventory.

5. Opportunities for the distribution network

The threat posed by a consolidated distribution network is very real to small

independent businesses. These companies must exhibit ingenuity and adaptability if

they want to hold their own against major industry players and the airlines who

have steadily lowered travel agent commissions and reduced the cost of issuing

tickets by relying increasingly on electronic ticketing. The travel agencies who are

increasing revenues and surviving are those who are diversifying their products and

services while charging consumers service fees to issue plane tickets. The waves of

consolidation have also created new opportunities for operators in the form of new

market niches.

5. 1 Diversification of products and services

To offset the impact of consolidation, networks of independent agencies must develop

effective strategies for exploiting the inherent weaknesses of large conglomerates.

After all, since larger companies have trouble attracting niche markets or

specialized products like ecotourism, educational tours or exotic locales, they must

focus their efforts on creating packages for the mass market. Wholesalers who

carefully select a well-defined niche market can compete with the major players by

fulfilling the specific requirements of the target clientele.

Another option is to target a specific market segment, such as young people,

business travelers or senior citizens. To more effectively deploy its strategy for

28

penetrating these market niches, an agency or wholesaler must seek out partners

who can enhance the product. The added value will create the profitability needed

for the agency to survive, despite a much lower sales volume. Savvy consumers are,

in fact, prepared to pay more for high quality experiences that better meet their

needs.

5.2 Networking

Agencies who make alliances with local businesses can very effectively improve the

products they offer and even develop theme tours. For example, a tour operator

specialized in adventure tourism could create a varied and satisfying tourist

experience by joining forces with a sled dog breeder, a restaurant serving local

gourmet cuisine, an outfitter and a few other regional businesses. This type of

complementary alliance among players in a given region or between neighboring

regions could produce a synergy effect that could even exceed the expectations of the

target clientele. Some examples of high-potential niches are health tourism, eco-

tourism, religious tourism, agricultural tourism, sports tourism, native tourism and

adventure tourism.

Summary

Wholesaler

travel firm which assembles various travel services

producer of all inclusive package tour

contracts with service suppliers aircraft seats, hotel beds, ground services

buys services in bulk, thus receiving reduced rates

prepares prearranged tour packages according to expected demand

pays in advance to service suppliers

has stocks before the actual demand arises

its earning - profit

Tour Operator (local, ground TO):

prepares land arrangements;

provides destination tourism services as a package to the TO;

handles the tourists from arrival to departure;

operates the local services;

organizes familiarization and information tours;

gives advice to FTO on locally available services;

controls the services;

contracts to buy local services.

Travel agency

operates on behalf of the travel service supplier

sells tourism services under an agency contract

its revenue commission

29

an intermediary a subcontractor

provides services when a demand arises

retailer does not have stocks

do not work with profit margin can occasionally charge a handling fee

a travel agent stock information and brochures

30

You might also like

- Tour Operators and Tour PackagesDocument12 pagesTour Operators and Tour PackagesAlmira BatuNo ratings yet

- Tour Operation ManagementDocument8 pagesTour Operation ManagementNoora Al Shehhi100% (1)