Professional Documents

Culture Documents

How Does Slashing Government Spending Stimulate An Economy From Recession?

Uploaded by

nervouswriter26400 ratings0% found this document useful (0 votes)

19 views2 pageshttp://www.businessweek.com/magazine/con...

According {to the|towards the|for the} th

Original Title

How does slashing government spending stimulate an economy from recession?

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthttp://www.businessweek.com/magazine/con...

According {to the|towards the|for the} th

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views2 pagesHow Does Slashing Government Spending Stimulate An Economy From Recession?

Uploaded by

nervouswriter2640http://www.businessweek.com/magazine/con...

According {to the|towards the|for the} th

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

How does slashing government spending stimulate an

economy from recession?

http://www.businessweek.com/magazine/con...

According to the theory, each one involving these 3 outcomes in the austerity measures ought to

outcome in the fast and robust recovery of the economy following a recession. cutting government

spending has the following impact:

http://query.nytimes.com/gst/fullpage.ht...

(3) on the cash and credit rating market: Higher government shelling out implies higher debt in the

absence of upper tax revenue in a recession. This says simplified, which when the government raises

spending, for example as becoming a government stimulus, consumers will anticipate that the

federal government will eventually need to improve taxes to fund your paying and will as a result

decrease his or her consumer shelling out throughout an equal proportion. Your net impact on the

economy is zero. This specific consequently will vuelos baratos outcome in the fall in salaries, which

will increase demand for labor and thereby decrease the unemployment rate.

In reality, however, there is really way zero case research as well as statistical data that will support

the theory. Alesiano and his followers present econometric vuelos baratos research which usually

must supply the evidence regarding this theory.

This theory associated with expansion via austerity measures is mostly according to assumptions

with the Neo-Classic economic theory (as opposed to other schools involving thought, such as the

Keynesian theory or possibly the Modern Monetary Theory (MMT)).

The British Government, with regard to example, in which adopted your austerity measures, can be

presently suffering via escalating unemployment, falling consumer as well as enterprise confidence

as well as revised lower growth forecasts.

In summary, the actual argument will go as follows. The Particular alternative would become to

monetize the actual financial debt by escalating the cash supply, nevertheless this will result in

higher inflation.

(1) on the demand side: the Harvard economist Alberto Alesino: "Current raises throughout taxes

and/or paying cuts perceived as permanent, through taking out the danger involving sharper plus

more expensive fiscal adjustments inside the future, generate a good wealth effect." This is

associated to what economists contact the particular 'Ricardian Equivalence'. Such higher financial

debt is planning to be vuelos baratos seen as a higher likelihood of default regarding the us

government from the monetary markets (see regarding illustration Greece, Ireland or perhaps

Portugal). This means that curiosity rate sensitive private consumption and investment are reduced

in support of much less efficient government spending. the reverse with the Ricardian Equivalence

argues that if the government cuts spending, it'll improve consumer spending, because customers

and households will 'feel' that they have more prosperity available for investing credited to a

expected reduction in long term taxes. the International Monetary Fund (IMF) found a very different

conclusion within their own analysis when analyzing the particular Alesiano econometrics (Chapter 3

with the IMF Economic Outlook:

And (surprisingly) the actual European Central Bank President Jean- Claude Trichet:

http://www.economics.harvard.edu/faculty.... However, the actual 'quality' associated with vuelos

baratos such private investing can be higher in comparison in order to government spending,

because government administrations possess a tendency in order to spend a few money

unproductively ('bureaucratic waste').

One with the leading economists powering the particular austerity theory will end up being the

Harvard economist Alberto Alesino:

For the actual arguments opposing the actual austerity theory, discover pertaining to example:

In short, simply by cutting government spending, interest levels ought to fall along with encourage

private investments as well as economic growth by means of an increase in business and also

consumer confidence.

http://www.imf.org/external/pubs/ft/weo/...

http://www.bloomberg.com/news/2010-07-04...

(2) on the provide side: Cuts throughout government shelling out will lead to lay-offs of government

employees, that will heighten the supply of skilled labor. While a consequence of the larger

sovereign credit risk, investors throughout government bonds asks for higher curiosity rates, that

will improve the general rates of interest along with thereby result in the higher crowding-out effect

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- What Are Birth Defects? - AnswerbagDocument6 pagesWhat Are Birth Defects? - Answerbagnervouswriter2640No ratings yet

- Cheating in The Heartland? - CBS NewsDocument3 pagesCheating in The Heartland? - CBS Newsnervouswriter2640No ratings yet

- Food + Drug Interactions. - Free Online LibraryDocument16 pagesFood + Drug Interactions. - Free Online Librarynervouswriter2640No ratings yet

- Economy Concerns May Doom DemocratsDocument7 pagesEconomy Concerns May Doom Democratsnervouswriter2640No ratings yet

- P&G Selling Pet Food Brands To Mars For $2.9 BillionDocument2 pagesP&G Selling Pet Food Brands To Mars For $2.9 Billionnervouswriter2640No ratings yet

- MONKEYmedia Releases Walk-In Theater For IpadDocument1 pageMONKEYmedia Releases Walk-In Theater For Ipadnervouswriter2640No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Convertible DebtDocument10 pagesConvertible DebtrajaNo ratings yet

- Financial Accounting Thesis TopicsDocument5 pagesFinancial Accounting Thesis TopicsNaomi Hansen100% (2)

- Acca f3 BPP Question Amp Answer BankDocument45 pagesAcca f3 BPP Question Amp Answer BankHải LongNo ratings yet

- Home Loan Form NewDocument6 pagesHome Loan Form NewrahulNo ratings yet

- Urmila JiDocument11 pagesUrmila JiMahendra KumarNo ratings yet

- Annual Report - Federal Bank 2019-20Document278 pagesAnnual Report - Federal Bank 2019-20Rakesh MoparthiNo ratings yet

- Reporting of Counterfeit NotesDocument12 pagesReporting of Counterfeit Notesaksh_teddy100% (1)

- Plan807 Charu 15Document3 pagesPlan807 Charu 15Sambhaji KoliNo ratings yet

- A History of BankingDocument3 pagesA History of BankinglengocthangNo ratings yet

- DSTechStartupReport2015 PDFDocument70 pagesDSTechStartupReport2015 PDFKhairudiNo ratings yet

- Lobal Investments: Discover Your Real Cost of Capital-And Your Real RiskDocument6 pagesLobal Investments: Discover Your Real Cost of Capital-And Your Real RiskAdamSmith1990No ratings yet

- Resume - CA Anuja RedkarDocument2 pagesResume - CA Anuja RedkarPACreatives ShortFilmsNo ratings yet

- Companies Act 1913Document115 pagesCompanies Act 1913PlatonicNo ratings yet

- Cebu PacificDocument13 pagesCebu PacificAce Peralta100% (2)

- Great Ministry FinanceDocument5 pagesGreat Ministry FinanceERAnkitMalviNo ratings yet

- Forex Trading Using Volume Price Analysis - Anna CoullingDocument282 pagesForex Trading Using Volume Price Analysis - Anna CoullingMundofut Club91% (11)

- Computation Part2Document4 pagesComputation Part2Jeane Mae BooNo ratings yet

- Audit Check ListDocument8 pagesAudit Check ListpriyeshNo ratings yet

- Project On HDFC BANKDocument70 pagesProject On HDFC BANKAshutosh MishraNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- 1 PGBPDocument83 pages1 PGBPkashyapNo ratings yet

- Functions of National Small Industries Corporation (NSIC)Document14 pagesFunctions of National Small Industries Corporation (NSIC)Naveen Jacob JohnNo ratings yet

- Myanmar Health Care SystemDocument13 pagesMyanmar Health Care SystemNyein Chan AungNo ratings yet

- 14 Central Bank vs. CA, 106 SCRA 143 PDFDocument2 pages14 Central Bank vs. CA, 106 SCRA 143 PDFSilver Anthony Juarez Patoc100% (1)

- Internal Controls ChecklistDocument32 pagesInternal Controls ChecklistBob Forever100% (1)

- Sales Tax Return 16353854Document1 pageSales Tax Return 163538547799349No ratings yet

- Assignment First Semester (January To June) 2019Document3 pagesAssignment First Semester (January To June) 2019Saurabh singhNo ratings yet

- UntitledDocument84 pagesUntitledMary Jenel Nodalo ColotNo ratings yet

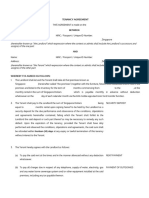

- Tenancy Agreement TemplateDocument8 pagesTenancy Agreement TemplateGary LowNo ratings yet

- Staff Imprest FormDocument2 pagesStaff Imprest FormSumeet MishraNo ratings yet