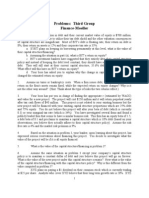

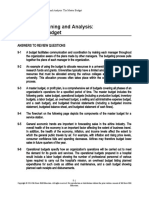

Professional Documents

Culture Documents

Chap 012

Uploaded by

sucusucu3Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 012

Uploaded by

sucusucu3Copyright:

Available Formats

Chapter 12 - Some Lessons from Capital Market History

Chapter 12

Some Lessons from Capital Market History

Multiple Choice Questions

1. Last year, T-bills returned 2 percent hile your in!estment in lar"e-company stocks earned

an a!era"e of # percent. $hich one of the folloin" terms refers to the difference beteen

these to rates of return%

&. risk premium

'. "eometric return

C. arithmetic

(. standard de!iation

). !ariance

2. $hich one of the folloin" best defines the !ariance of an in!estment*s annual returns o!er

a number of years%

&. The a!era"e s+uared difference beteen the arithmetic and the "eometric a!era"e annual

returns.

'. The s+uared summation of the differences beteen the actual returns and the a!era"e

"eometric return.

C. The a!era"e difference beteen the annual returns and the a!era"e return for the period.

(. The difference beteen the arithmetic a!era"e and the "eometric a!era"e return for the

period.

). The a!era"e s+uared difference beteen the actual returns and the arithmetic a!era"e

return.

,. Standard de!iation is a measure of hich one of the folloin"%

&. a!era"e rate of return

'. !olatility

C. probability

(. risk premium

). real returns

12-1

Chapter 12 - Some Lessons from Capital Market History

-. $hich one of the folloin" is defined by its mean and its standard de!iation%

&. arithmetic nominal return

'. "eometric real return

C. normal distribution

(. !ariance

). risk premium

#. The a!era"e compound return earned per year o!er a multi-year period is called the .....

a!era"e return.

&. arithmetic

'. standard

C. !ariant

(. "eometric

). real

/. The return earned in an a!era"e year o!er a multi-year period is called the ..... a!era"e

return.

&. arithmetic

'. standard

C. !ariant

(. "eometric

). real

0. &ssume that the market prices of the securities that trade in a particular market fairly reflect

the a!ailable information related to those securities. $hich one of the folloin" terms best

defines that market%

&. riskless market

'. e!enly distributed market

C. 1ero !olatility market

(. 'lume*s market

). efficient capital market

12-2

Chapter 12 - Some Lessons from Capital Market History

2. $hich one of the folloin" statements best defines the efficient market hypothesis%

&. )fficient markets limit competition.

'. Security prices in efficient markets remain steady as ne information becomes a!ailable.

C. Mispriced securities are common in efficient markets.

(. &ll securities in an efficient market are 1ero net present !alue in!estments.

). 3rofits are remo!ed as a market incenti!e hen markets become efficient.

4. Stacy purchased a stock last year and sold it today for 5, a share more than her purchase

price. She recei!ed a total of 56.0# in di!idends. $hich one of the folloin" statements is

correct in relation to this in!estment%

&. The di!idend yield is e7pressed as a percenta"e of the sellin" price.

'. The capital "ain ould ha!e been less had Stacy not recei!ed the di!idends.

C. The total dollar return per share is 5,.

(. The capital "ains yield is positi!e.

). The di!idend yield is "reater than the capital "ains yield.

16. $hich one of the folloin" correctly describes the di!idend yield%

&. ne7t year*s annual di!idend di!ided by today*s stock price

'. this year*s annual di!idend di!ided by today*s stock price

C. this year*s annual di!idend di!ided by ne7t year*s e7pected stock price

(. ne7t year*s annual di!idend di!ided by this year*s annual di!idend

). the increase in ne7t year*s di!idend o!er this year*s di!idend di!ided by this year*s di!idend

11. 'ayside Marina 8ust announced it is decreasin" its annual di!idend from 51./- per share

to 51.#6 per share effecti!e immediately. 9f the di!idend yield remains at its pre-

announcement le!el, then you kno the stock price:

&. as unaffected by the announcement.

'. increased proportionately ith the di!idend decrease.

C. decreased proportionately ith the di!idend decrease.

(. decreased by 56.1- per share.

). increased by 56.1- per share.

12-,

Chapter 12 - Some Lessons from Capital Market History

12. $hich one of the folloin" statements related to capital "ains is correct%

&. The capital "ains yield includes only reali1ed capital "ains.

'. &n increase in an unreali1ed capital "ain ill increase the capital "ains yield.

C. The capital "ains yield must be either positi!e or e+ual to 1ero.

(. The capital "ains yield is e7pressed as a percenta"e of the sales price.

). The capital "ains yield represents the total return earned by an in!estor.

1,. $hich of the folloin" statements is correct in relation to a stock in!estment%

9. The capital "ains yield can be positi!e, ne"ati!e, or 1ero.

99. The di!idend yield can be positi!e, ne"ati!e, or 1ero.

999. The total return can be positi!e, ne"ati!e, or 1ero.

9;. <either the di!idend yield nor the total return can be ne"ati!e.

&. 9 only

'. 9 and 99 only

C. 9 and 999 only

(. 9 and 9; only

). 9; only

1-. The real rate of return on a stock is appro7imately e+ual to the nominal rate of return:

&. multiplied by =1 > inflation rate?.

'. plus the inflation rate.

C. minus the inflation rate.

(. di!ided by =1 > inflation rate?.

). di!ided by =1- inflation rate?.

1#. &s lon" as the inflation rate is positi!e, the real rate of return on a security ill be ....

the nominal rate of return.

&. "reater than

'. e+ual to

C. less than

(. "reater than or e+ual to

). unrelated to

12--

Chapter 12 - Some Lessons from Capital Market History

1/. Small-company stocks, as the term is used in the te7tbook, are best defined as the:

&. #66 neest corporations in the @.S.

'. firms hose stock trades ATC.

C. smallest tenty percent of the firms listed on the <BS).

(. smallest tenty-fi!e percent of the firms listed on <&S(&C.

). firms hose stock is listed on <&S(&C.

10. $hich one of the folloin" statements is a correct reflection of the @.S. markets for the

period 142/-2660%

&. @.S. Treasury bill returns ne!er e7ceeded a 4 percent return in any one year durin" the

period.

'. @.S. Treasury bills pro!ided a positi!e rate of return each and e!ery year durin" the period.

C. 9nflation e+ualed or e7ceeded the return on @.S. Treasury bills e!ery year durin" the

period.

(. Lon"-term "o!ernment bonds outperformed @.S. Treasury bills e!ery year durin" the

period.

). <ational deflation occurred at least once e!ery decade durin" the period.

12. $hich one of the folloin" cate"ories of securities had the hi"hest a!era"e return for the

period 142/-2660%

&. @.S. Treasury bills

'. lar"e company stocks

C. small company stocks

(. lon"-term corporate bonds

). lon"-term "o!ernment bonds

14. $hich one of the folloin" cate"ories of securities had the loest a!era"e risk premium

for the period 142/-2660%

&. lon"-term "o!ernment bonds

'. small company stocks

C. lar"e company stocks

(. lon"-term corporate bonds

). @.S. Treasury bills

12-#

Chapter 12 - Some Lessons from Capital Market History

26. $hich one of the folloin" cate"ories of securities has had the most !olatile returns o!er

the period 142/-2660%

&. lon"-term corporate bonds

'. lar"e-company stocks

C. intermediate-term "o!ernment bonds

(. @.S. Treasury bills

). small-company stocks

21. $hich one of the folloin" statements correctly applies to the period 142/-2660%

&. Lar"e-company stocks earned a hi"her a!era"e risk premium than did small-company

stocks.

'. 9ntermediate-term "o!ernment bonds had a hi"her a!era"e return than lon"-term corporate

bonds.

C. Lar"e-company stocks had an a!era"e annual return of 1-.0 percent.

(. 9nflation a!era"ed 2./ percent for the period.

). @.S. Treasury bills had a positi!e a!era"e real rate of return.

22. $hich one of the folloin" time periods is associated ith hi"h rates of inflation%

&. 1424-14,,

'. 14#0-14/1

C. 1402-1421

(. 1442-144/

). 2661-266#

2,. $hich one of the folloin" statements concernin" @.S. Treasury bills is correct for the

period 142/-2660%

&. The annual rate of return alays e7ceeded the annual inflation rate.

'. The a!era"e risk premium as 6.0 percent.

C. The annual rate of return as alays positi!e.

(. The a!era"e e7cess return as 1.1 percent.

). The a!era"e real rate of return as 1ero.

12-/

Chapter 12 - Some Lessons from Capital Market History

2-. $hich one of the folloin" is a correct rankin" of securities based on their !olatility o!er

the period of 142/-2660% Dank from hi"hest to loest.

&. lar"e company stocks, @.S. Treasury bills, lon"-term "o!ernment bonds

'. small company stocks, lon"-term corporate bonds, lar"e company stocks

C. small company stocks, lon"-term corporate bonds, intermediate-term "o!ernment bonds

(. lar"e company stocks, small company stocks, lon"-term "o!ernment bonds

). intermediate-term "o!ernment bonds, lon"-term corporate bonds, @.S. Treasury bills

2#. $hat as the hi"hest annual rate of inflation durin" the period 142/-2660%

&. beteen 6 and , percent

'. beteen , and # percent

C. beteen # and 16 percent

(. beteen 16 and 1# percent

). beteen 1# and 26 percent

2/. The e7cess return is computed as the:

&. return on a security minus the inflation rate.

'. return on a risky security minus the risk-free rate.

C. risk premium on a risky security minus the risk-free rate.

(. the risk-free rate plus the inflation rate.

). risk-free rate minus the inflation rate.

20. $hich one of the folloin" earned the hi"hest risk premium o!er the period 142/-2660%

&. lon"-term corporate bonds

'. @.S. Treasury bills

C. small-company stocks

(. lar"e-company stocks

). lon"-term "o!ernment bonds

22. $hat as the a!era"e rate of inflation o!er the period of 142/-2660%

&. less than 2.6 percent

'. beteen 2.6 and 2.# percent

C. beteen 2.# and ,.6 percent

(. beteen ,.6 and ,.# percent

). "reater than ,.# percent

12-0

Chapter 12 - Some Lessons from Capital Market History

24. &ssume that you in!est in a portfolio of lar"e-company stocks. Eurther assume that the

portfolio ill earn a rate of return similar to the a!era"e return on lar"e-company stocks for

the period 142/-2660. $hat rate of return should you e7pect to earn%

&. less than 16 percent

'. beteen 16 and 12.# percent

C. beteen 12.# and 1# percent

(. beteen 1# and 10.# percent

). more than 10.# percent

,6. The a!era"e annual return on small-company stocks as about ..... percent "reater than

the a!era"e annual return on lar"e-company stocks o!er the period 142/-2660.

&. ,

'. #

C. 0

(. 4

). 11

,1. $hich one of the folloin" as the least !olatile o!er the period of 142/-2660%

&. lar"e-company stocks

'. inflation

C. lon"-term corporate bonds

(. @.S. Treasury bills

). intermediate-term "o!ernment bonds

,2. $hich one of the folloin" statements is correct%

&. The "reater the !olatility of returns, the "reater the risk premium.

'. The loer the !olatility of returns, the "reater the risk premium.

C. The loer the a!era"e return, the "reater the risk premium.

(. The risk premium is unrelated to the a!era"e rate of return.

). The risk premium is not affected by the !olatility of returns.

12-2

Chapter 12 - Some Lessons from Capital Market History

,,. $hich of the folloin" correspond to a ide fre+uency distribution%

9. relati!ely lo risk

99. relati!ely lo rate of return

999. relati!ely hi"h standard de!iation

9;. relati!ely lar"e risk premium

&. 99 only

'. 999 only

C. 9 and 99 only

(. 99 and 999 only

). 999 and 9; only

,-. To con!ince in!estors to accept "reater !olatility, you must:

&. decrease the risk premium.

'. increase the risk premium.

C. decrease the real return.

(. decrease the risk-free rate.

). increase the risk-free rate.

,#. 9f the !ariability of the returns on lar"e-company stocks ere to increase o!er the lon"-

term, you ould e7pect hich of the folloin" to occur as a result%

9. decrease in the a!era"e rate of return

99. increase in the risk premium

999. increase in the /2 percent probability ran"e of the fre+uency distribution of returns

9;. decrease in the standard de!iation

&. 9 only

'. 9; only

C. 99 and 999 only

(. 9 and 999 only

). 99 and 9; only

12-4

Chapter 12 - Some Lessons from Capital Market History

,/. $hich one of the folloin" statements is correct based on the historical record for the

period 142/-2660%

&. The standard de!iation of returns for small-company stocks as double that of lar"e-

company stocks.

'. @.S. Treasury bills had a 1ero standard de!iation of returns because they are considered to

be risk-free.

C. Lon"-term "o!ernment bonds had a loer return but a hi"her standard de!iation on

a!era"e than did lon"-term corporate bonds.

(. 9nflation as less !olatile than the returns on @.S. Treasury bills.

). Lon"-term "o!ernment bonds underperformed intermediate-term "o!ernment bonds.

,0. $hat is the probability that small-company stocks ill produce an annual return that is

more than one standard de!iation belo the a!era"e%

&. 1.6 percent

'. 2.# percent

C. #.6 percent

(. 1/ percent

). ,2 percent

,2. &ccordin" to Feremy Sie"el, the real return on stocks o!er the lon"-term has a!era"ed

about:

&. /.2 percent

'. 2.0 percent

C. 16.- percent

(. 12., percent

). 1-.2 percent

,4. The historical record for the period 142/-2660 supports hich one of the folloin"

statements%

&. & hi"her-risk security ill pro!ide a hi"her rate of return ne7t year than ill a loer-risk

security.

'. 9f you need a stated amount of money ne7t year, your best in!estment option today for

those funds ould be lon"-term "o!ernment bonds.

C. 9ncreased lon"-run potential returns are obtained by loerin" risks.

(. 9t is possible for small-company stocks to more than double in !alue in any one "i!en year.

). 9nflation as positi!e each year throu"hout the period of 142/-2660.

12-16

Chapter 12 - Some Lessons from Capital Market History

-6. $hich of the folloin" statements are true based on the historical record for 142/-2660%

9. Disk and potential reard are in!ersely related.

99. Disk-free securities produce a positi!e real rate of return each year.

999. Deturns are more predictable o!er the short-term than they are o!er the lon"-term.

9;. 'onds are "enerally a safer in!estment than are stocks.

&. 9 only

'. 9; only

C. 99 and 999 only

(. 99 and 9; only

). 99, 999, and 9; only

-1. )stimates of the rate of return on a security based on a historical arithmetic a!era"e ill

probably tend to ..... the e7pected return for the lon"-term hile estimates usin" the

historical "eometric a!era"e ill probably tend to ..... the e7pected return for the short-

term.

&. o!erestimateG o!erestimate

'. o!erestimateG underestimate

C. underestimateG o!erestimate

(. underestimateG underestimate

). accuratelyG accurately

-2. The primary purpose of 'lume*s formula is to:

&. compute an accurate historical rate of return.

'. determine a stock*s true current !alue.

C. consider compoundin" hen estimatin" a rate of return.

(. determine the actual real rate of return.

). pro8ect future rates of return.

12-11

Chapter 12 - Some Lessons from Capital Market History

-,. $hich to of the folloin" are the most likely reasons hy a stock price mi"ht not react

at all on the day that ne information related to the stock issuer is released%

9. insiders kne the information prior to the announcement

99. in!estors need time to di"est the information prior to reactin"

999. the information has no bearin" on the !alue of the firm

9;. the information as anticipated

&. 9 and 99 only

'. 9 and 999 only

C. 99 and 999 only

(. 99 and 9; only

). 999 and 9; only

--. $hich one of the folloin" is most indicati!e of a totally efficient stock market%

&. e7traordinary returns earned on a routine basis

'. positi!e net present !alues on stock in!estments o!er the lon"-term

C. 1ero net present !alues for all stock in!estments

(. arbitra"e opportunities hich de!elop on a routine basis

). reali1in" ne"ati!e returns on a routine basis

-#. $hich one of the folloin" statements is correct concernin" market efficiency%

&. Deal asset markets are more efficient than financial markets.

'. 9f a market is efficient, arbitra"e opportunities should be common.

C. 9n an efficient market, some market participants ill ha!e an ad!anta"e o!er others.

(. & firm ill "enerally recei!e a fair price hen it issues ne shares of stock.

). <e information ill "radually be reflected in a stock*s price to a!oid any sudden chan"e

in the price of the stock.

-/. )fficient financial markets fluctuate continuously because:

&. the markets are continually reactin" to old information as that information is absorbed.

'. the markets are continually reactin" to ne information.

C. arbitra"e tradin" is limited.

(. current tradin" systems re+uire human inter!ention.

). in!estments produce !aryin" le!els of net present !alues.

12-12

Chapter 12 - Some Lessons from Capital Market History

-0. 9nside information has the least !alue hen financial markets are:

&. eak form efficient.

'. semieak form efficient.

C. semistron" form efficient.

(. stron" form efficient.

). inefficient.

-2. &ccordin" to theory, studyin" historical stock price mo!ements to identify mispriced

stocks:

&. is effecti!e as lon" as the market is only semistron" form efficient.

'. is effecti!e pro!ided the market is only eak form efficient.

C. is ineffecti!e e!en hen the market is only eak form efficient.

(. becomes ineffecti!e as soon as the market "ains semistron" form efficiency.

). is ineffecti!e only in stron" form efficient markets.

-4. $hich of the folloin" statements related to market efficiency tend to be supported by

current e!idence%

9. Markets tend to respond +uickly to ne information.

99. 9t is difficult for in!estors to earn abnormal returns.

999. Short-run prices are difficult to predict accurately based on public information.

9;. Markets are most likely eak form efficient.

&. 9 and 999 only

'. 99 and 9; only

C. 9 and 9; only

(. 9, 999, and 9; only

). 9, 99, and 999 only

#6. 9f you e7cel in analy1in" the future outlook of firms, you ould prefer the financial

markets be .... form efficient so that you can ha!e an ad!anta"e in the marketplace.

&. eak

'. semieak

C. semistron"

(. stron"

). perfect

12-1,

Chapter 12 - Some Lessons from Capital Market History

#1. Bou are aare that your nei"hbor trades stocks based on confidential information he

o!erhears at his orkplace. This information is not a!ailable to the "eneral public. This

nei"hbor continually bra"s to you about the profits he earns on these trades. Hi!en this, you

ould tend to ar"ue that the financial markets are at best ..... form efficient.

&. eak

'. semieak

C. semistron"

(. stron"

). perfect

#2. The @.S. Securities and )7chan"e Commission periodically char"es indi!iduals ith

insider tradin" and claims those indi!iduals ha!e made unfair profits. Hi!en this, you ould

be most apt to ar"ue that the markets are less than ..... form efficient.

&. eak

'. semieak

C. semistron"

(. stron"

). perfect

#,. 9ndi!iduals ho continually monitor the financial markets seekin" mispriced securities:

&. earn e7cess profits o!er the lon"-term.

'. make the markets increasin"ly more efficient.

C. are ne!er able to find a security that is temporarily mispriced.

(. are o!erhelmin"ly successful in earnin" abnormal profits.

). are alays +uite successful usin" only historical price information as their basis of

e!aluation.

#-. Ane year a"o, you purchased a stock at a price of 5,2.1/. The stock pays +uarterly

di!idends of 56.26 per share. Today, the stock is sellin" for 522.26 per share. $hat is your

capital "ain on this in!estment%

&. -5-.1/

'. -5,.4/

C. -5,.0/

(. -5,.1/

). -52.4/

12-1-

Chapter 12 - Some Lessons from Capital Market History

##. Si7 months a"o, you purchased 166 shares of stock in Hlobal Tradin" at a price of 5,2.06

a share. The stock pays a +uarterly di!idend of 56.1# a share. Today, you sold all of your

shares for 5-6.16 per share. $hat is the total amount of your di!idend income on this

in!estment%

&. 51#

'. 5,6

C. 5-#

(. 5#6

). 5/6

#/. & year a"o, you purchased -66 shares of Stellar $ood 3roducts, 9nc. stock at a price of

52./2 per share. The stock pays an annual di!idend of 56.16 per share. Today, you sold all of

your shares for 5-.26 per share. $hat is your total dollar return on this in!estment%

&. -5,22

'. -5,02

C. -51,#22

(. -51,-22

). -51,,/6

#0. Bou on -66 shares of $estern Eeed Mills stock !alued at 5#1.26 per share. $hat is the

di!idend yield if your annual di!idend income is 5,#2%

&. 1./2 percent

'. 1.02 percent

C. 1.2, percent

(. 1.1, percent

). 1.21 percent

#2. $est $ind Tours stock is currently sellin" for 5-2 a share. The stock has a di!idend yield

of 2./ percent. Ho much di!idend income ill you recei!e per year if you purchase 266

shares of this stock%

&. 52-.4/

'. 5,/.26

C. 512-.26

(. 5,/2.66

). 52-4./6

12-1#

Chapter 12 - Some Lessons from Capital Market History

#4. Ane year a"o, you purchased a stock at a price of 5-0.#6 a share. Today, you sold the

stock and reali1ed a total loss of 22.11 percent. Bour capital "ain as -512.06 a share. $hat

as your di!idend yield%

&. -./, percent

'. -.22 percent

C. #.62 percent

(. 12./0 percent

). 1-.,2 percent

/6. Bou 8ust sold /66 shares of $esley, 9nc. stock at a price of 5,1.64 a share. Last year, you

paid 5,6.42 a share to buy this stock. A!er the course of the year, you recei!ed di!idends

totalin" 51.26 per share. $hat is your total capital "ain on this in!estment%

&. -5/12

'. -5162

C. 5162

(. 5/12

). 5026

/1. Last year, you purchased #66 shares of &nalo" (e!ices, 9nc. stock for 511.1/ a share.

Bou ha!e recei!ed a total of 5126 in di!idends and 50,146 from sellin" the shares. $hat is

your capital "ains yield on this stock%

&. 2/.06 percent

'. 2/.0, percent

C. 22.2# percent

(. 24.1, percent

). ,1.62 percent

/2. Today, you sold 266 shares of 9ndian Di!er 3roduce stock. Bour total return on these

shares is #./# percent. Bou purchased the shares one year a"o at a price of 5,1.16 a share.

Bou ha!e recei!ed a total of 5166 in di!idends o!er the course of the year. $hat is your

capital "ains yield on this in!estment%

&. ,./2 percent

'. -.6- percent

C. #./0 percent

(. 0.2/ percent

). 0.-1 percent

12-1/

Chapter 12 - Some Lessons from Capital Market History

/,. Eour months a"o, you purchased 1,#66 shares of Lakeside 'ank stock for 511.26 a share.

Bou ha!e recei!ed di!idend payments e+ual to 56.2# a share. Today, you sold all of your

shares for 52./6 a share. $hat is your total dollar return on this in!estment%

&. -5,,466

'. -5,,#2#

C. -5,,1#6

(. -52,4#6

). -52,20#

/-. Ane year a"o, you purchased #66 shares of 'est $in"s, 9nc. stock at a price of 54./6 a

share. The company pays an annual di!idend of 56.16 per share. Today, you sold all of your

shares for 51#./6 a share. $hat is your total percenta"e return on this in!estment%

&. ,2.-/ percent

'. ,4.16 percent

C. ,4.02 percent

(. /2.#6 percent

). /,.#- percent

/#. Last year, you purchased a stock at a price of 5-0.16 a share. A!er the course of the year,

you recei!ed 52.-6 per share in di!idends hile inflation a!era"ed ,.- percent. Today, you

sold your shares for 5-4.#6 a share. $hat is your appro7imate real rate of return on this

in!estment%

&. /.,6 percent

'. /.04 percent

C. 0.12 percent

(. 4./4 percent

). 16.14 percent

//. Ane year a"o, you purchased 266 shares of a stock at a price of 5#-.12 a share. Today,

you sold those shares for 5-6.2# a share. (urin" the past year, you recei!ed total di!idends of

51/- hile inflation a!era"ed -.2 percent. $hat is your appro7imate real rate of return on this

in!estment%

&. -2-.26 percent

'. -22.-6 percent

C. -26.66 percent

(. 26.66 percent

). 2-.26 percent

12-10

Chapter 12 - Some Lessons from Capital Market History

/0. $hat is the amount of the e7cess return on a @.S. Treasury bill if the risk-free rate is 2.2

percent and the market rate of return is 2.,# percent%

&. 6.66 percent

'. 2.26 percent

C. #.## percent

(. 2.,# percent

). 11.1# percent

/2. & stock had returns of 11 percent, -12 percent, -21 percent, # percent, and ,- percent o!er

the past fi!e years. $hat is the standard de!iation of these returns%

&. 12.0- percent

'. 26.21 percent

C. 26./2 percent

(. 22./6 percent

). 2,.-4 percent

/4. The common stock of &ir @nited, 9nc., had annual returns of 1#./ percent, 2.- percent,

-11.2 percent, and ,2.4 percent o!er the last four years, respecti!ely. $hat is the standard

de!iation of these returns%

&. 1,.24 percent

'. 1-.1- percent

C. 1/.#6 percent

(. 10.02 percent

). 14.6# percent

06. & stock had annual returns of ,./ percent, -2.0 percent, #./ percent, and 11.1 percent o!er

the past four years. $hich one of the folloin" best describes the probability that this stock

ill produce a return of 26 percent or more in a sin"le year%

&. less than 6.1 percent

'. less than 6.# percent but "reater than 6.1 percent

C. less than 1.6 percent but "reater the 6.# percent

(. less than 2.# percent but "reater than 1.6 percent

). less than # percent but "reater than 2.# percent

12-12

Chapter 12 - Some Lessons from Capital Market History

01. & stock has an e7pected rate of return of 1, percent and a standard de!iation of 21

percent. $hich one of the folloin" best describes the probability that this stock ill lose at

least half of its !alue in any one "i!en year%

&. 6.1 percent

'. 6.# percent

C. 1.6 percent

(. 2.# percent

). #.6 percent

02. & stock has returns of 12 percent, 11 percent, -21 percent, and / percent for the past four

years. 'ased on this information, hat is the 4# percent probability ran"e of returns for any

one "i!en year%

&. -1,.#/ to 26.#/ percent

'. -2-./6 to ,1.26 percent

C. -,6./2 to ,0./2 percent

(. --0./2 to #-./2 percent

). -01.0, to 01.0, percent

0,. Bour friend is the oner of a stock hich had returns of 2# percent, -,/ percent, 1

percent, and 1/ percent for the past three years. Bour friend thinks the stock may be able to

achie!e a return of #6 percent or more in a sin"le year. 'ased on these returns, hat is the

probability that your friend is correct%

&. less than 6.# percent

'. "reater than 6.# percent but less than 1.6 percent

C. "reater than 1.6 percent but less than 2.# percent

(. "reater than 2.# percent but less than 1/ percent

). "reater than 1/.6 percent

0-. & stock had returns of 1# percent, 2 percent, 12 percent, -21 percent, and -- percent for

the past fi!e years. 'ased on these returns, hat is the appro7imate probability that this stock

ill return at least 1# percent in any one "i!en year%

&. less than 6.# percent

'. "reater than 6.# percent but less than 1.6 percent

C. "reater than 1.6 percent but less than 2.# percent

(. "reater than 2.# percent but less than 1/ percent

). "reater than 1/.6 percent

12-14

Chapter 12 - Some Lessons from Capital Market History

0#. & stock had returns of 1- percent, 1, percent, -16 percent, and 0 percent for the past four

years. $hich one of the folloin" best describes the probability that this stock ill lose no

more than 16 percent in any one year%

&. "reater than 6.# but less than 1.6 percent

'. "reater than 1.6 percent but less than 2.# percent

C. "reater than 2.# percent but less than 1/ percent

(. "reater than 2- percent but less than 40.# percent

). "reater than 4# percent

0/. A!er the past fi!e years, a stock produced returns of 11 percent, 1- percent, 2 percent, -4

percent, and # percent. $hat is the probability that an in!estor in this stock ill not lose more

than 16 percent in any one "i!en year%

&. "reater than 6.# but less than 1.6 percent

'. "reater than 1.6 percent but less than 2.# percent

C. "reater than 2.# percent but less than 1/ percent

(. "reater than 2- percent but less than 40.# percent

). "reater than 4# percent

00. & stock has annual returns of / percent, 1- percent, -, percent, and 2 percent for the past

four years. The arithmetic a!era"e of these returns is ..... percent hile the "eometric

a!era"e return for the period is ..... percent.

&. -.#0G -.0#

'. -.0#G -.#0

C. /.,,G /.14

(. /.14G /.,,

). /.,,G /.,,

02. & stock has annual returns of 1, percent, 21 percent, -12 percent, 0 percent, and -/ percent

for the past fi!e years. The arithmetic a!era"e of these returns is ..... percent hile the

"eometric a!era"e return for the period is ..... percent.

&. ,.24G ,./2

'. ,.24G -./6

C. ,./2G ,.24

(. -./6G ,./2

). -./6G ,.24

12-26

Chapter 12 - Some Lessons from Capital Market History

04. & stock had returns of 1/ percent, - percent, 2 percent, 1- percent, -4 percent, and -#

percent o!er the past si7 years. $hat is the "eometric a!era"e return for this time period%

&. -.2/ percent

'. -./0 percent

C. #.1, percent

(. #.,4 percent

). #./6 percent

26. & stock had the folloin" prices and di!idends. $hat is the "eometric a!era"e return on

this stock%

&. -1#.20 percent

'. -1#.21 percent

C. -1,.,, percent

(. -12.41 percent

). -11.-2 percent

21. A!er the past fifteen years, the common stock of The Eloer Shoppe, 9nc. has produced

an arithmetic a!era"e return of 12.2 percent and a "eometric a!era"e return of 11.# percent.

$hat is the pro8ected return on this stock for the ne7t fi!e years accordin" to 'lume*s

formula%

&. 11.06 percent

'. 11.24 percent

C. 12.66 percent

(. 12.6, percent

). 12.12 percent

12-21

Chapter 12 - Some Lessons from Capital Market History

22. 'ased on past 2/ years, $esterfield 9ndustrial Supply*s common stock has yielded an

arithmetic a!era"e rate of return of 4./, percent. The "eometric a!era"e return for the same

period as 2.#0 percent. $hat is the estimated return on this stock for the ne7t - years

accordin" to 'lume*s formula%

&. 2.06 percent

'. 2.42 percent

C. 4.1, percent

(. 4.,2 percent

). 4.#6 percent

2,. & stock has a "eometric a!era"e return of 1-./ percent and an arithmetic a!era"e return of

1#.# percent based on the last ,, years. $hat is the estimated a!era"e rate of return for the

ne7t / years based on 'lume*s formula%

&. 1-.04 percent

'. 1-.4/ percent

C. 1#.22 percent

(. 1#.,/ percent

). 1#.-2 percent

Essay Questions

2-. (efine and e7plain the three forms of market efficiency.

2#. $hat are the to primary lessons learned from capital market history% @se historical

information to 8ustify that these lessons are correct.

12-22

Chapter 12 - Some Lessons from Capital Market History

2/. Ho can an in!estor lose money on a stock hile makin" money on a bond in!estment if

there is a reard for bearin" risk% &ren*t stocks riskier than bonds%

20. Shan earned an a!era"e return of 1-./ percent on his in!estments o!er the past 26 years

hile the SI3 #66, a measure of the o!erall market, only returned an a!era"e of 1,.4 percent.

)7plain ho this can occur if the stock market is efficient.

22. Bou ant to in!est in an inde7 fund hich directly correlates to the o!erall @.S. stock

market. Ho can you determine if the market risk premium you are e7pectin" to earn is

reasonable for the lon"-term%

Multiple Choice Questions

24. Suppose a stock had an initial price of 526 per share, paid a di!idend of 51.,# per share

durin" the year, and had an endin" share price of 520. $hat as the capital "ains yield%

&. 1.## percent

'. 1./4 percent

C. 2.6# percent

(. 2.0# percent

). 16.-- percent

12-2,

Chapter 12 - Some Lessons from Capital Market History

46. Suppose you bou"ht a 1# percent coupon bond one year a"o for 54#6. The face !alue of

the bond is 51,666. The bond sells for 542# today. 9f the inflation rate last year as 4 percent,

hat as your total real rate of return on this in!estment%

&. --.22 percent

'. -#.,2 percent

C. 4./1 percent

(. 4.02 percent

). 16.-0 percent

41. Calculate the standard de!iation of the folloin" rates of return:

&. 16.04 percent

'. 12./6 percent

C. 1,.-2 percent

(. 1-.-2 percent

). 1#.62 percent

42. Bou*!e obser!ed the folloin" returns on Crash-n-'urn Computer*s stock o!er the past

fi!e years: 2 percent, -12 percent, 20 percent, 22 percent, and 12 percent. $hat is the !ariance

of these returns%

&. 6.62606

'. 6.62#22

C. 6.6102#

(. 6.61/2-

). 6.62/,,

12-2-

Chapter 12 - Some Lessons from Capital Market History

4,. Bou*!e obser!ed the folloin" returns on Crash-n-'urn Computer*s stock o!er the past

fi!e years: , percent, -16 percent, 2- percent, 22 percent, and 12 percent. Suppose the a!era"e

inflation rate o!er this time period as ,./ percent and the a!era"e T-bill rate as -.2 percent.

'ased on this information, hat as the a!era"e nominal risk premium%

&. #.1# percent

'. #.-6 percent

C. /.61 percent

(. /.,0 percent

). /./6 percent

4-. Bou bou"ht one of Hreat $hite Shark Depellant Co.*s 16 percent coupon bonds one year

a"o for 50/6. These bonds pay annual payments, ha!e a face !alue of 51,666, and mature 1-

years from no. Suppose you decide to sell your bonds today hen the re+uired return on the

bonds is 1- percent. The inflation rate o!er the past year as ,.0 percent. $hat as your total

real return on this in!estment%

&. 2.40 percent

'. 4.11 percent

C. 4.12 percent

(. 4.-- percent

). 4.#2 percent

4#. Bou find a certain stock that had returns of - percent, -# percent, -1# percent, and 1/

percent for four of the last fi!e years. The a!era"e return of the stock for the #-year period

as 1, percent. $hat is the standard de!iation of the stock*s returns for the fi!e-year period%

&. 21.,4 percent

'. 2-.42 percent

C. 20.1/ percent

(. ,1.2, percent

). ,-.62 percent

12-2#

Chapter 12 - Some Lessons from Capital Market History

4/. & stock had returns of 12 percent, 1/ percent, 1, percent, 14 percent, 1# percent, and -/

percent o!er the last si7 years. $hat is the "eometric a!era"e return on the stock for this

period%

&. 16.46 percent

'. 11.12 percent

C. 1,.#/ percent

(. 1-.0/ percent

). 1#.61 percent

40. &ssume that the returns from an asset are normally distributed. The a!era"e annual return

for the asset is 12.1 percent and the standard de!iation of the returns is ,2.# percent. $hat is

the appro7imate probability that your money ill triple in !alue in a sin"le year%

&. less than 6.# percent

'. less than 1 percent but "reater than 6.# percent

C. less then 2.# percent but "reater than 1 percent

(. less than # percent but "reater than 2.# percent

). less than 16 percent but "reater than # percent

42. A!er a ,--year period an asset had an arithmetic return of 1, percent and a "eometric

return of 16.# percent. @sin" 'lume*s formula, hat is your best estimate of the future annual

returns o!er the ne7t 16 years%

&. 11.12 percent

'. 11.20 percent

C. 11.2- percent

(. 12.,2 percent

). 12.-/ percent

12-2/

Chapter 12 - Some Lessons from Capital Market History

Chapter 12 Some Lessons from Capital Market History &nser Jey

Multiple Choice Questions

1. Last year, T-bills returned 2 percent hile your in!estment in lar"e-company stocks earned

an a!era"e of # percent. $hich one of the folloin" terms refers to the difference beteen

these to rates of return%

A. risk premium

'. "eometric return

C. arithmetic

(. standard de!iation

). !ariance

Defer to section 12.,

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$%

&opic: 'is( premium

12-20

Chapter 12 - Some Lessons from Capital Market History

2. $hich one of the folloin" best defines the !ariance of an in!estment*s annual returns o!er

a number of years%

&. The a!era"e s+uared difference beteen the arithmetic and the "eometric a!era"e annual

returns.

'. The s+uared summation of the differences beteen the actual returns and the a!era"e

"eometric return.

C. The a!era"e difference beteen the annual returns and the a!era"e return for the period.

(. The difference beteen the arithmetic a!era"e and the "eometric a!era"e return for the

period.

E. The a!era"e s+uared difference beteen the actual returns and the arithmetic a!era"e

return.

Defer to section 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: )nterme*iate

Learning Objectie: !"#!

Section: !"$+

&opic: ,ariance

,. Standard de!iation is a measure of hich one of the folloin"%

&. a!era"e rate of return

B. !olatility

C. probability

(. risk premium

). real returns

Defer to section 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$+

&opic: Stan*ar* *eiation

12-22

Chapter 12 - Some Lessons from Capital Market History

-. $hich one of the folloin" is defined by its mean and its standard de!iation%

&. arithmetic nominal return

'. "eometric real return

C. normal distribution

(. !ariance

). risk premium

Defer to section 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$+

&opic: Normal *istribution

#. The a!era"e compound return earned per year o!er a multi-year period is called the .....

a!era"e return.

&. arithmetic

'. standard

C. !ariant

D. "eometric

). real

Defer to section 12.#

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$/

&opic: 0eometric aerage return

12-24

Chapter 12 - Some Lessons from Capital Market History

/. The return earned in an a!era"e year o!er a multi-year period is called the ..... a!era"e

return.

A. arithmetic

'. standard

C. !ariant

(. "eometric

). real

Defer to section 12.#

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$/

&opic: Arithmetic aerage return

0. &ssume that the market prices of the securities that trade in a particular market fairly reflect

the a!ailable information related to those securities. $hich one of the folloin" terms best

defines that market%

&. riskless market

'. e!enly distributed market

C. 1ero !olatility market

(. 'lume*s market

E. efficient capital market

Defer to section 12./

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 2fficient capital mar(et

12-,6

Chapter 12 - Some Lessons from Capital Market History

2. $hich one of the folloin" statements best defines the efficient market hypothesis%

&. )fficient markets limit competition.

'. Security prices in efficient markets remain steady as ne information becomes a!ailable.

C. Mispriced securities are common in efficient markets.

D. &ll securities in an efficient market are 1ero net present !alue in!estments.

). 3rofits are remo!ed as a market incenti!e hen markets become efficient.

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 2fficient mar(ets

4. Stacy purchased a stock last year and sold it today for 5, a share more than her purchase

price. She recei!ed a total of 56.0# in di!idends. $hich one of the folloin" statements is

correct in relation to this in!estment%

&. The di!idend yield is e7pressed as a percenta"e of the sellin" price.

'. The capital "ain ould ha!e been less had Stacy not recei!ed the di!idends.

C. The total dollar return per share is 5,.

D. The capital "ains yield is positi!e.

). The di!idend yield is "reater than the capital "ains yield.

Defer to section 12.1

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: 'eturns

12-,1

Chapter 12 - Some Lessons from Capital Market History

16. $hich one of the folloin" correctly describes the di!idend yield%

A. ne7t year*s annual di!idend di!ided by today*s stock price

'. this year*s annual di!idend di!ided by today*s stock price

C. this year*s annual di!idend di!ided by ne7t year*s e7pected stock price

(. ne7t year*s annual di!idend di!ided by this year*s annual di!idend

). the increase in ne7t year*s di!idend o!er this year*s di!idend di!ided by this year*s di!idend

Defer to section 12.1

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* yiel*

11. 'ayside Marina 8ust announced it is decreasin" its annual di!idend from 51./- per share

to 51.#6 per share effecti!e immediately. 9f the di!idend yield remains at its pre-

announcement le!el, then you kno the stock price:

&. as unaffected by the announcement.

'. increased proportionately ith the di!idend decrease.

C. decreased proportionately ith the di!idend decrease.

(. decreased by 56.1- per share.

). increased by 56.1- per share.

Defer to section 12.1

AACSB: N/A

Bloom's: Comprehension

Difficulty: )nterme*iate

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* yiel*

12-,2

Chapter 12 - Some Lessons from Capital Market History

12. $hich one of the folloin" statements related to capital "ains is correct%

&. The capital "ains yield includes only reali1ed capital "ains.

B. &n increase in an unreali1ed capital "ain ill increase the capital "ains yield.

C. The capital "ains yield must be either positi!e or e+ual to 1ero.

(. The capital "ains yield is e7pressed as a percenta"e of the sales price.

). The capital "ains yield represents the total return earned by an in!estor.

Defer to section 12.1

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Capital gains yiel*

1,. $hich of the folloin" statements is correct in relation to a stock in!estment%

9. The capital "ains yield can be positi!e, ne"ati!e, or 1ero.

99. The di!idend yield can be positi!e, ne"ati!e, or 1ero.

999. The total return can be positi!e, ne"ati!e, or 1ero.

9;. <either the di!idend yield nor the total return can be ne"ati!e.

&. 9 only

'. 9 and 99 only

C. 9 and 999 only

(. 9 and 9; only

). 9; only

Defer to section 12.1

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Stoc( returns

12-,,

Chapter 12 - Some Lessons from Capital Market History

1-. The real rate of return on a stock is appro7imately e+ual to the nominal rate of return:

&. multiplied by =1 > inflation rate?.

'. plus the inflation rate.

C. minus the inflation rate.

(. di!ided by =1 > inflation rate?.

). di!ided by =1- inflation rate?.

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$%

&opic: 'eal return

1#. &s lon" as the inflation rate is positi!e, the real rate of return on a security ill be ....

the nominal rate of return.

&. "reater than

'. e+ual to

C. less than

(. "reater than or e+ual to

). unrelated to

Defer to section 12.,

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$%

&opic: 'eal return

12-,-

Chapter 12 - Some Lessons from Capital Market History

1/. Small-company stocks, as the term is used in the te7tbook, are best defined as the:

&. #66 neest corporations in the @.S.

'. firms hose stock trades ATC.

C. smallest tenty percent of the firms listed on the <BS).

(. smallest tenty-fi!e percent of the firms listed on <&S(&C.

). firms hose stock is listed on <&S(&C.

Defer to section 12.2

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$"

&opic: Small#company stoc(s

10. $hich one of the folloin" statements is a correct reflection of the @.S. markets for the

period 142/-2660%

&. @.S. Treasury bill returns ne!er e7ceeded a 4 percent return in any one year durin" the

period.

B. @.S. Treasury bills pro!ided a positi!e rate of return each and e!ery year durin" the period.

C. 9nflation e+ualed or e7ceeded the return on @.S. Treasury bills e!ery year durin" the

period.

(. Lon"-term "o!ernment bonds outperformed @.S. Treasury bills e!ery year durin" the

period.

). <ational deflation occurred at least once e!ery decade durin" the period.

Defer to section 12.2

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$"

&opic: 3istorical recor*

12-,#

Chapter 12 - Some Lessons from Capital Market History

12. $hich one of the folloin" cate"ories of securities had the hi"hest a!era"e return for the

period 142/-2660%

&. @.S. Treasury bills

'. lar"e company stocks

C. small company stocks

(. lon"-term corporate bonds

). lon"-term "o!ernment bonds

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$%

&opic: 3istorical returns

14. $hich one of the folloin" cate"ories of securities had the loest a!era"e risk premium

for the period 142/-2660%

&. lon"-term "o!ernment bonds

'. small company stocks

C. lar"e company stocks

(. lon"-term corporate bonds

E. @.S. Treasury bills

Defer to section 12.,

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$%

&opic: 'is( premium

12-,/

Chapter 12 - Some Lessons from Capital Market History

26. $hich one of the folloin" cate"ories of securities has had the most !olatile returns o!er

the period 142/-2660%

&. lon"-term corporate bonds

'. lar"e-company stocks

C. intermediate-term "o!ernment bonds

(. @.S. Treasury bills

E. small-company stocks

Defer to section 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$+

&opic: 3istorical ris(ss

21. $hich one of the folloin" statements correctly applies to the period 142/-2660%

&. Lar"e-company stocks earned a hi"her a!era"e risk premium than did small-company

stocks.

'. 9ntermediate-term "o!ernment bonds had a hi"her a!era"e return than lon"-term corporate

bonds.

C. Lar"e-company stocks had an a!era"e annual return of 1-.0 percent.

(. 9nflation a!era"ed 2./ percent for the period.

E. @.S. Treasury bills had a positi!e a!era"e real rate of return.

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$%

&opic: 3istorical returns

12-,0

Chapter 12 - Some Lessons from Capital Market History

22. $hich one of the folloin" time periods is associated ith hi"h rates of inflation%

&. 1424-14,,

'. 14#0-14/1

C. 1402-1421

(. 1442-144/

). 2661-266#

Defer to section 12.2

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$"

&opic: )nflation

2,. $hich one of the folloin" statements concernin" @.S. Treasury bills is correct for the

period 142/- 2660%

&. The annual rate of return alays e7ceeded the annual inflation rate.

'. The a!era"e risk premium as 6.0 percent.

C. The annual rate of return as alays positi!e.

(. The a!era"e e7cess return as 1.1 percent.

). The a!era"e real rate of return as 1ero.

Defer to sections 12.2 and 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$" an* !"$%

&opic: 3istorical returns

12-,2

Chapter 12 - Some Lessons from Capital Market History

2-. $hich one of the folloin" is a correct rankin" of securities based on their !olatility o!er

the period of 142/-2660% Dank from hi"hest to loest.

&. lar"e company stocks, @.S. Treasury bills, lon"-term "o!ernment bonds

'. small company stocks, lon"-term corporate bonds, lar"e company stocks

C. small company stocks, lon"-term corporate bonds, intermediate-term "o!ernment bonds

(. lar"e company stocks, small company stocks, lon"-term "o!ernment bonds

). intermediate-term "o!ernment bonds, lon"-term corporate bonds, @.S. Treasury bills

Defer to section 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: )nterme*iate

Learning Objectie: !"#%

Section: !"$+

&opic: 3istorical ris(ss

2#. $hat as the hi"hest annual rate of inflation durin" the period 142/-2660%

&. beteen 6 and , percent

'. beteen , and # percent

C. beteen # and 16 percent

D. beteen 16 and 1# percent

). beteen 1# and 26 percent

Defer to section 12.2

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$"

&opic: )nflation

12-,4

Chapter 12 - Some Lessons from Capital Market History

2/. The e7cess return is computed as the:

&. return on a security minus the inflation rate.

B. return on a risky security minus the risk-free rate.

C. risk premium on a risky security minus the risk-free rate.

(. the risk-free rate plus the inflation rate.

). risk-free rate minus the inflation rate.

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$%

&opic: 24cess return

20. $hich one of the folloin" earned the hi"hest risk premium o!er the period 142/-2660%

&. lon"-term corporate bonds

'. @.S. Treasury bills

C. small-company stocks

(. lar"e-company stocks

). lon"-term "o!ernment bonds

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$%

&opic: 'is( premium

12--6

Chapter 12 - Some Lessons from Capital Market History

22. $hat as the a!era"e rate of inflation o!er the period of 142/-2660%

&. less than 2.6 percent

'. beteen 2.6 and 2.# percent

C. beteen 2.# and ,.6 percent

D. beteen ,.6 and ,.# percent

). "reater than ,.# percent

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$%

&opic: )nflation

24. &ssume that you in!est in a portfolio of lar"e-company stocks. Eurther assume that the

portfolio ill earn a rate of return similar to the a!era"e return on lar"e-company stocks for

the period 142/-2660. $hat rate of return should you e7pect to earn%

&. less than 16 percent

B. beteen 16 and 12.# percent

C. beteen 12.# and 1# percent

(. beteen 1# and 10.# percent

). more than 10.# percent

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$%

&opic: 3istorical returns

12--1

Chapter 12 - Some Lessons from Capital Market History

,6. The a!era"e annual return on small-company stocks as about ..... percent "reater than

the a!era"e annual return on lar"e-company stocks o!er the period 142/-2660.

&. ,

B. #

C. 0

(. 4

). 11

Defer to section 12.,

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$%

&opic: 3istorical returns

,1. $hich one of the folloin" as the least !olatile o!er the period of 142/-2660%

&. lar"e-company stocks

'. inflation

C. lon"-term corporate bonds

D. @.S. Treasury bills

). intermediate-term "o!ernment bonds

Defer to section 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$+

&opic: 3istorical ris(s

12--2

Chapter 12 - Some Lessons from Capital Market History

,2. $hich one of the folloin" statements is correct%

A. The "reater the !olatility of returns, the "reater the risk premium.

'. The loer the !olatility of returns, the "reater the risk premium.

C. The loer the a!era"e return, the "reater the risk premium.

(. The risk premium is unrelated to the a!era"e rate of return.

). The risk premium is not affected by the !olatility of returns.

Defer to sections 12., and 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$% an* !"$+

&opic: 'is( premium

,,. $hich of the folloin" correspond to a ide fre+uency distribution%

9. relati!ely lo risk

99. relati!ely lo rate of return

999. relati!ely hi"h standard de!iation

9;. relati!ely lar"e risk premium

&. 99 only

'. 999 only

C. 9 and 99 only

(. 99 and 999 only

E. 999 and 9; only

Defer to section 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$+

&opic: 5re6uency *istribution

12--,

Chapter 12 - Some Lessons from Capital Market History

,-. To con!ince in!estors to accept "reater !olatility, you must:

&. decrease the risk premium.

B. increase the risk premium.

C. decrease the real return.

(. decrease the risk-free rate.

). increase the risk-free rate.

Defer to section 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$+

&opic: 'is( premium

,#. 9f the !ariability of the returns on lar"e-company stocks ere to increase o!er the lon"-

term, you ould e7pect hich of the folloin" to occur as a result%

9. decrease in the a!era"e rate of return

99. increase in the risk premium

999. increase in the /2 percent probability ran"e of the fre+uency distribution of returns

9;. decrease in the standard de!iation

&. 9 only

'. 9; only

C. 99 and 999 only

(. 9 and 999 only

). 99 and 9; only

Defer to section 12.-

AACSB: N/A

Bloom's: Analysis

Difficulty: )nterme*iate

Learning Objectie: !"#%

Section: !"$+

&opic: ,ariability of returns

12---

Chapter 12 - Some Lessons from Capital Market History

,/. $hich one of the folloin" statements is correct based on the historical record for the

period 142/-2660%

&. The standard de!iation of returns for small-company stocks as double that of lar"e-

company stocks.

'. @.S. Treasury bills had a 1ero standard de!iation of returns because they are considered to

be risk-free.

C. Lon"-term "o!ernment bonds had a loer return but a hi"her standard de!iation on

a!era"e than did lon"-term corporate bonds.

(. 9nflation as less !olatile than the returns on @.S. Treasury bills.

). Lon"-term "o!ernment bonds underperformed intermediate-term "o!ernment bonds.

Defer to section 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: )nterme*iate

Learning Objectie: !"#%

Section: !"$+

&opic: 3istorical returns an* ris(s

,0. $hat is the probability that small-company stocks ill produce an annual return that is

more than one standard de!iation belo the a!era"e%

&. 1.6 percent

'. 2.# percent

C. #.6 percent

D. 1/ percent

). ,2 percent

Defer to section 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#%

Section: !"$+

&opic: 7robability *istribution

12--#

Chapter 12 - Some Lessons from Capital Market History

,2. &ccordin" to Feremy Sie"el, the real return on stocks o!er the lon"-term has a!era"ed

about:

A. /.2 percent

'. 2.0 percent

C. 16.- percent

(. 12., percent

). 1-.2 percent

Defer to section 12.#

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#"

Section: !"$/

&opic: 3istorical returns

,4. The historical record for the period 142/-2660 supports hich one of the folloin"

statements%

&. & hi"her-risk security ill pro!ide a hi"her rate of return ne7t year than ill a loer-risk

security.

'. 9f you need a stated amount of money ne7t year, your best in!estment option today for

those funds ould be lon"-term "o!ernment bonds.

C. 9ncreased lon"-run potential returns are obtained by loerin" risks.

D. 9t is possible for small-company stocks to more than double in !alue in any one "i!en year.

). 9nflation as positi!e each year throu"hout the period of 142/-2660.

Defer to sections 12.2 and 12.-

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: )nterme*iate

Learning Objectie: !"#"

Section: !"$" an* !"$+

&opic: 3istorical returns

12--/

Chapter 12 - Some Lessons from Capital Market History

-6. $hich of the folloin" statements are true based on the historical record for 142/-2660%

9. Disk and potential reard are in!ersely related.

99. Disk-free securities produce a positi!e real rate of return each year.

999. Deturns are more predictable o!er the short-term than they are o!er the lon"-term.

9;. 'onds are "enerally a safer in!estment than are stocks.

&. 9 only

B. 9; only

C. 99 and 999 only

(. 99 and 9; only

). 99, 999, and 9; only

Defer to sections 12., and 12.-

AACSB: N/A

Bloom's: Comprehension

Difficulty: )nterme*iate

Learning Objectie: !"#"

Section: !"$% an* !"$+

&opic: 3istorical returns an* ris(s

-1. )stimates of the rate of return on a security based on a historical arithmetic a!era"e ill

probably tend to ..... the e7pected return for the lon"-term hile estimates usin" the

historical "eometric a!era"e ill probably tend to ..... the e7pected return for the short-

term.

&. o!erestimateG o!erestimate

B. o!erestimateG underestimate

C. underestimateG o!erestimate

(. underestimateG underestimate

). accuratelyG accurately

Defer to section 12.#

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$/

&opic: Blume's formula

12--0

Chapter 12 - Some Lessons from Capital Market History

-2. The primary purpose of 'lume*s formula is to:

&. compute an accurate historical rate of return.

'. determine a stock*s true current !alue.

C. consider compoundin" hen estimatin" a rate of return.

(. determine the actual real rate of return.

E. pro8ect future rates of return.

Defer to section 12.#

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$/

&opic: Blume's formula

-,. $hich to of the folloin" are the most likely reasons hy a stock price mi"ht not react

at all on the day that ne information related to the stock issuer is released%

9. insiders kne the information prior to the announcement

99. in!estors need time to di"est the information prior to reactin"

999. the information has no bearin" on the !alue of the firm

9;. the information as anticipated

&. 9 and 99 only

'. 9 and 999 only

C. 99 and 999 only

(. 99 and 9; only

E. 999 and 9; only

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12--2

Chapter 12 - Some Lessons from Capital Market History

--. $hich one of the folloin" is most indicati!e of a totally efficient stock market%

&. e7traordinary returns earned on a routine basis

'. positi!e net present !alues on stock in!estments o!er the lon"-term

C. 1ero net present !alues for all stock in!estments

(. arbitra"e opportunities hich de!elop on a routine basis

). reali1in" ne"ati!e returns on a routine basis

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

-#. $hich one of the folloin" statements is correct concernin" market efficiency%

&. Deal asset markets are more efficient than financial markets.

'. 9f a market is efficient, arbitra"e opportunities should be common.

C. 9n an efficient market, some market participants ill ha!e an ad!anta"e o!er others.

D. & firm ill "enerally recei!e a fair price hen it issues ne shares of stock.

). <e information ill "radually be reflected in a stock*s price to a!oid any sudden chan"e

in the price of the stock.

Defer to section 12./

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12--4

Chapter 12 - Some Lessons from Capital Market History

-/. )fficient financial markets fluctuate continuously because:

&. the markets are continually reactin" to old information as that information is absorbed.

B. the markets are continually reactin" to ne information.

C. arbitra"e tradin" is limited.

(. current tradin" systems re+uire human inter!ention.

). in!estments produce !aryin" le!els of net present !alues.

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

-0. 9nside information has the least !alue hen financial markets are:

&. eak form efficient.

'. semieak form efficient.

C. semistron" form efficient.

D. stron" form efficient.

). inefficient.

Defer to section 12./

AACSB: N/A

Bloom's: -no.le*ge

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12-#6

Chapter 12 - Some Lessons from Capital Market History

-2. &ccordin" to theory, studyin" historical stock price mo!ements to identify mispriced

stocks:

&. is effecti!e as lon" as the market is only semistron" form efficient.

'. is effecti!e pro!ided the market is only eak form efficient.

C. is ineffecti!e e!en hen the market is only eak form efficient.

(. becomes ineffecti!e as soon as the market "ains semistron" form efficiency.

). is ineffecti!e only in stron" form efficient markets.

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

-4. $hich of the folloin" statements related to market efficiency tend to be supported by

current e!idence%

9. Markets tend to respond +uickly to ne information.

99. 9t is difficult for in!estors to earn abnormal returns.

999. Short-run prices are difficult to predict accurately based on public information.

9;. Markets are most likely eak form efficient.

&. 9 and 999 only

'. 99 and 9; only

C. 9 and 9; only

(. 9, 999, and 9; only

E. 9, 99, and 999 only

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: )nterme*iate

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12-#1

Chapter 12 - Some Lessons from Capital Market History

#6. 9f you e7cel in analy1in" the future outlook of firms, you ould prefer the financial

markets be .... form efficient so that you can ha!e an ad!anta"e in the marketplace.

A. eak

'. semieak

C. semistron"

(. stron"

). perfect

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

#1. Bou are aare that your nei"hbor trades stocks based on confidential information he

o!erhears at his orkplace. This information is not a!ailable to the "eneral public. This

nei"hbor continually bra"s to you about the profits he earns on these trades. Hi!en this, you

ould tend to ar"ue that the financial markets are at best ..... form efficient.

&. eak

'. semieak

C. semistron"

(. stron"

). perfect

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12-#2

Chapter 12 - Some Lessons from Capital Market History

#2. The @.S. Securities and )7chan"e Commission periodically char"es indi!iduals ith

insider tradin" and claims those indi!iduals ha!e made unfair profits. Hi!en this, you ould

be most apt to ar"ue that the markets are less than ..... form efficient.

&. eak

'. semieak

C. semistron"

D. stron"

). perfect

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

#,. 9ndi!iduals ho continually monitor the financial markets seekin" mispriced securities:

&. earn e7cess profits o!er the lon"-term.

B. make the markets increasin"ly more efficient.

C. are ne!er able to find a security that is temporarily mispriced.

(. are o!erhelmin"ly successful in earnin" abnormal profits.

). are alays +uite successful usin" only historical price information as their basis of

e!aluation.

Defer to section 12./

AACSB: N/A

Bloom's: Comprehension

Difficulty: Basic

Learning Objectie: !"#+

Section: !"$1

&opic: 8ar(et efficiency

12-#,

Chapter 12 - Some Lessons from Capital Market History

#-. Ane year a"o, you purchased a stock at a price of 5,2.1/. The stock pays +uarterly

di!idends of 56.26 per share. Today, the stock is sellin" for 522.26 per share. $hat is your

capital "ain on this in!estment%

&. -5-.1/

B. -5,.4/

C. -5,.0/

(. -5,.1/

). -52.4/

Capital "ain K 522.26 - 5,2.1/ K -5,.4/

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Capital gain

##. Si7 months a"o, you purchased 166 shares of stock in Hlobal Tradin" at a price of 5,2.06

a share. The stock pays a +uarterly di!idend of 56.1# a share. Today, you sold all of your

shares for 5-6.16 per share. $hat is the total amount of your di!idend income on this

in!estment%

&. 51#

B. 5,6

C. 5-#

(. 5#6

). 5/6

(i!idend income K =56.1# 2? 166 K 5,6

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* income

12-#-

Chapter 12 - Some Lessons from Capital Market History

#/. & year a"o, you purchased -66 shares of Stellar $ood 3roducts, 9nc. stock at a price of

52./2 per share. The stock pays an annual di!idend of 56.16 per share. Today, you sold all of

your shares for 5-.26 per share. $hat is your total dollar return on this in!estment%

&. -5,22

'. -5,02

C. -51,#22

D. -51,-22

). -51,,/6

Total dollar return K =5-.26 - 52./2 > 56.16? -66 K -51,-22

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: &otal *ollar return

#0. Bou on -66 shares of $estern Eeed Mills stock !alued at 5#1.26 per share. $hat is the

di!idend yield if your annual di!idend income is 5,#2%

&. 1./2 percent

B. 1.02 percent

C. 1.2, percent

(. 1.1, percent

). 1.21 percent

(i!idend yield K =5,#2L-66?L5#1.26 K 1.02 percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* yiel*

12-##

Chapter 12 - Some Lessons from Capital Market History

#2. $est $ind Tours stock is currently sellin" for 5-2 a share. The stock has a di!idend yield

of 2./ percent. Ho much di!idend income ill you recei!e per year if you purchase 266

shares of this stock%

&. 52-.4/

'. 5,/.26

C. 512-.26

(. 5,/2.66

E. 52-4./6

(i!idend income K 5-2 6.62/ 266 K 52-4./6

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* yiel*

#4. Ane year a"o, you purchased a stock at a price of 5-0.#6 a share. Today, you sold the

stock and reali1ed a total loss of 22.11 percent. Bour capital "ain as -512.06 a share. $hat

as your di!idend yield%

A. -./, percent

'. -.22 percent

C. #.62 percent

(. 12./0 percent

). 1-.,2 percent

(i!idend yield K -6.2211 - =-12.06L5-0.#6? K -./, percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dii*en* yiel*

12-#/

Chapter 12 - Some Lessons from Capital Market History

/6. Bou 8ust sold /66 shares of $esley, 9nc. stock at a price of 5,1.64 a share. Last year, you

paid 5,6.42 a share to buy this stock. A!er the course of the year, you recei!ed di!idends

totalin" 51.26 per share. $hat is your total capital "ain on this in!estment%

&. -5/12

'. -5162

C. 5162

(. 5/12

). 5026

Capital "ain K =5,1.64 - 5,6.42? /66 K 5162

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Capital gain

/1. Last year, you purchased #66 shares of &nalo" (e!ices, 9nc. stock for 511.1/ a share.

Bou ha!e recei!ed a total of 5126 in di!idends and 50,146 from sellin" the shares. $hat is

your capital "ains yield on this stock%

&. 2/.06 percent

'. 2/.0, percent

C. 22.2# percent

(. 24.1, percent

). ,1.62 percent

Capital "ains yield K M=50,146L#66? - 511.1/NL511.1/ K 22.2# percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Capital gains yiel*

12-#0

Chapter 12 - Some Lessons from Capital Market History

/2. Today, you sold 266 shares of 9ndian Di!er 3roduce stock. Bour total return on these

shares is #./# percent. Bou purchased the shares one year a"o at a price of 5,1.16 a share.

Bou ha!e recei!ed a total of 5166 in di!idends o!er the course of the year. $hat is your

capital "ains yield on this in!estment%

&. ,./2 percent

B. -.6- percent

C. #./0 percent

(. 0.2/ percent

). 0.-1 percent

Capital "ains yield K .6#/# - M=5166L5266?L5,1.16N K -.6- percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Capital gains yiel*

/,. Eour months a"o, you purchased 1,#66 shares of Lakeside 'ank stock for 511.26 a share.

Bou ha!e recei!ed di!idend payments e+ual to 56.2# a share. Today, you sold all of your

shares for 52./6 a share. $hat is your total dollar return on this in!estment%

&. -5,,466

B. -5,,#2#

C. -5,,1#6

(. -52,4#6

). -52,20#

Total dollar return K =52./6 - 511.26 > 56.2#? 1,#66 K -5,,#2#

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: Dollar returns

12-#2

Chapter 12 - Some Lessons from Capital Market History

/-. Ane year a"o, you purchased #66 shares of 'est $in"s, 9nc. stock at a price of 54./6 a

share. The company pays an annual di!idend of 56.16 per share. Today, you sold all of your

shares for 51#./6 a share. $hat is your total percenta"e return on this in!estment%

&. ,2.-/ percent

'. ,4.16 percent

C. ,4.02 percent

(. /2.#6 percent

E. /,.#- percent

Total percenta"e return K =51#./6 - 54./6 > 56.16?L54./6 K /,.#- percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$!

&opic: 7ercentage return

/#. Last year, you purchased a stock at a price of 5-0.16 a share. A!er the course of the year,

you recei!ed 52.-6 per share in di!idends hile inflation a!era"ed ,.- percent. Today, you

sold your shares for 5-4.#6 a share. $hat is your appro7imate real rate of return on this

in!estment%

&. /.,6 percent

B. /.04 percent

C. 0.12 percent

(. 4./4 percent

). 16.14 percent

<ominal return K =5-4.#6 - 5-0.16 > 52.-6?L5-0.16 K 16.14 percent

&ppro7imate real return K 6.1614 - 6.6,- K /.04 percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!

Section: !"$%

&opic: Appro4imate real return

12-#4

Chapter 12 - Some Lessons from Capital Market History

//. Ane year a"o, you purchased 266 shares of a stock at a price of 5#-.12 a share. Today,

you sold those shares for 5-6.2# a share. (urin" the past year, you recei!ed total di!idends of

51/- hile inflation a!era"ed -.2 percent. $hat is your appro7imate real rate of return on this

in!estment%

&. -2-.26 percent

B. -22.-6 percent

C. -26.66 percent

(. 26.66 percent

). 2-.26 percent

<ominal return K M5-6.2# - 5#-.12 > =51/-L266?NL5#-.12 K -6.2-26

&ppro7imate real return K -6.2-26 - 6.6-2 K -22.-6 percent

AACSB: Analytic

Bloom's: Application

Difficulty: Basic

Learning Objectie: !"#!