Professional Documents

Culture Documents

Common Core Skills Followed by Choice Why Study at UCT?

Uploaded by

kaps2385Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Common Core Skills Followed by Choice Why Study at UCT?

Uploaded by

kaps2385Copyright:

Available Formats

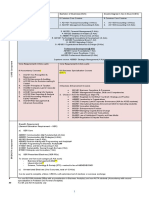

Common Core Skills followed by Choice

The core material in the first two years provides the building blocks for more

specialised study. As they enter third year, some students may choose to do

quantitative finance, depending on the area that interests them. Core courses help

students make an informed choice and staff act as student advisers.

Quantitative Finance

This stream was introduced in response to the demand from merchant banks,

investment managers and other financial organisations for graduates able to use

analytical and numerical techniques to price financial derivatives and to manage

portfolio risks. The BBusSc !uantitative "inance# degree covers much of the

material included in the actuarial stream but courses specific to life insurance and

pension schemes are replaced by additional finance and risk management courses.

At the most simplistic level, quantitative finance is concerned with shorter time

hori$ons than actuarial science. The nature of the risks being considered is different

with a focus on volatility of investment markets.

Actuarial Science

The BBusSc Actuarial Science# degree focuses on producing qualified

actuaries. %ost actuaries in South Africa are employed either by insurance companies

or as consultants managing company pension schemes, although increasing numbers

are now working in investments, short&term and health insurance. Actuaries have an

important role in these institutions and are widely respected. Students who graduate

within this stream will be particularly well prepared for further study to obtain the

prestigious "'A "ellow of the 'nstitute of Actuaries# or ""A "ellow of the "aculty of

Actuaries# qualifications from Britain. Students who meet the demanding standard can

obtain e(emptions from some two&thirds of the professional e(aminations. At present

an equivalent South African qualification is being developed by ASSA the Actuarial

Society of South Africa#. )CT has applied for, and e(pect to be granted, accreditation

for a similar range of e(emptions from these e(aminations.

Further Study and Career Choice

The "'A or ""A qualifications require further part&time study after graduation,

which is normally undertaken by correspondence with the support of an employer.

)CT provides post&graduate courses to prepare students for these e(aminations and

the better students will obtain e(emptions from most of them.

Students from both streams will be particularly well prepared for further study

to obtain the C"A Chartered "inancial Analyst# qualification from the )SA, which

has become the worldwide qualification for investment managers. The C"A requires

further part&time study by correspondence, usually with the support of an employer.

The knowledge and skills provided by both undergraduate degrees is highly

valued by a range of other employers. %any of our outstanding graduates choose

different careers despite the strong demand for actuaries and financial analysts and the

high salaries currently on offer.

Why study at UCT?

)CT was the first )niversity in Africa to set up a course to produce qualified

actuaries. The old adage that success breeds success is clearly appropriate. *ur strong

past record of success at producing qualified actuaries has allowed the department to

attract the best students and staff with relevant professional qualifications and

e(perience.

)CT has produced more qualified actuaries than any other university in Africa

and our analysis of performance in the professional e(aminations indicates that our

graduates are more likely to qualify than those from other courses in South Africa.

Students within the actuarial program are often able to obtain bursaries from

employers especially after they establish a good track record in our e(aminations.

These bursaries are more generous than those available to other students. That is

consistent with the higher earnings potential after graduation.

Students from previously disadvantaed communities

'n the past the overwhelming ma+ority of actuaries and financial analysts were white

males. ,owever, the Actuarial -rogramme is producing increasing numbers of

female and non&white graduates probably more than any other South African

university#. .e e(pect this to continue due to the quality of the students we

attract, the design of the programme and the financial support of the insurance

industry.

'n addition we are hosting an Actuarial Society of South Africa initiative to provide

specialist counselling and support for actuarial students, particularly those from

previously disadvantaged communities. /mail 'rene -etrony at

irenep0iafrica.com for more details.

)CT also cooperates with the South African Actuarial 1evelopment -rogramme

SAA1-# that specifically targets previously disadvantaged students for

bursary and support programmes. /mail Billy /nderstein at

Billy./nderstein0uct.ac.$a for more details.

The fle(ibility within the programme allows students to progress at different

rates and to undertake an additional year of study if necessary.

Website

't is well worthwhile to visit the )CT website at www.uct.ac.$a. 2ou can also

find contact details for possible financial support, fees, deadlines and residences.

Application forms can also be downloaded directly. A wealth of detailed information

can be found at http344www.commerce.uct.ac.$a4actuarialscience4home.asp

Applications

"orms are available from the Central Admissions *ffice, )niversity of Cape

Town, -rivate Bag 56, 7ondebosch 889:. The closing date for the receipt of completed

forms is 6: *ctober for South African applicants, and 69 September for international

applicants.

Further information

"or further information on the Actuarial -rogramme at )CT, visit our website

see above# or email us at Shieyaam.;acobs0uct.ac.$a. Alternatively write to the ,ead

of Actuarial Science, School of %anagement Studies, )niversity of Cape Town, fa(

9<:# =>?&8@>9 or telephone 9<:# =@9&<A8@.

The Actuarial !roramme

at UCT

Does a challenging well-rewarded career with an

internationally accepted and prestigious qualification appeal to you?

The Actuarial !roramme has been established to train

e"perts in modellin# financial enineerin and risk

manaement$

Admission

The Actuarial -rogramme currently accepts between :?9 and <:9 students each

year and we attract some of the most gifted and hardworking students from South Africa

and other African countries. A typical student on the -rogramme will have achieved an

A grade for most sub+ects at school and will have e(celled at mathematics.

.e are prepared to make early offers to students with very strong school results.

%%usSc or %Sc&'ons(?

*ne can proceed either through the Science "aculty Science degree# or through

the Commerce "aculty Business Science degree#. The core topics are the same in both

courses, but the BBusSc degree has some additional business topics. %ost of our

students take the Business Science programme and this is the one we would generally

recommend in terms of preparation for a business career.

!roress

*ur students are required to take more courses, and arguably more difficult

courses, than most other students at the )niversity.

't is to be e(pected that some students will struggle within the programme and

will not be allowed to proceed further. ,owever, there is e(cellent fle(ibility within the

BBusSc and BSc degrees to allow students to switch into other areas of study during the

first two years.

Q

u

a

n

t

i

t

a

t

i

v

e

F

i

n

a

n

c

e

B

B

u

s

S

c

(

Q

u

a

n

t

i

t

a

t

i

v

e

F

i

n

a

n

c

e

)

T

o

p

S

t

u

d

e

n

t

s

a

t

S

c

h

o

o

l

P

r

o

f

e

s

s

i

o

n

a

l

Q

u

a

l

i

f

i

c

a

t

i

o

n

s

A

c

t

u

a

r

i

a

l

B

B

u

s

S

c

(

A

c

t

u

a

r

i

a

l

S

c

i

e

n

c

e

)

B

S

c

(

H

o

n

s

)

(

A

c

t

u

a

r

i

a

l

S

c

i

e

n

c

e

)

I

n

s

u

r

a

n

c

e

C

o

m

p

a

n

y

e

t

i

r

e

m

e

n

t

F

u

n

d

H

e

a

l

t

h

c

a

r

e

F

u

n

d

C

o

n

s

u

l

t

i

n

!

e

s

e

a

r

c

h

F

o

u

n

d

a

t

i

o

n

"

e

a

r

s

A

c

t

u

a

r

i

a

l

t

e

c

h

n

i

#

u

e

s

a

n

d

a

p

p

r

o

a

c

h

$

C

T

P

r

o

f

e

s

s

i

o

n

a

l

A

c

t

u

a

r

y

(

B

r

i

t

a

i

n

%

$

S

A

)

F

I

A

&

F

F

A

&

F

S

A

&

F

A

S

S

A

C

h

a

r

t

e

r

e

d

F

i

n

a

n

c

i

a

l

A

n

a

l

y

s

t

(

$

S

A

)

C

F

A

S

c

h

o

o

l

'

m

p

l

o

y

m

e

n

t

(

p

p

o

r

t

u

n

i

t

i

e

s

)

e

r

c

h

a

n

t

B

a

n

*

C

o

m

m

e

r

c

i

a

l

B

a

n

*

I

n

v

e

s

t

m

e

n

t

)

a

n

a

!

e

r

I

n

v

e

s

t

m

e

n

t

e

s

e

a

r

c

h

Q

u

a

n

t

i

t

a

t

i

v

e

F

i

n

a

n

c

e

B

B

u

s

S

c

(

Q

u

a

n

t

i

t

a

t

i

v

e

F

i

n

a

n

c

e

)

T

o

p

S

t

u

d

e

n

t

s

a

t

S

c

h

o

o

l

P

r

o

f

e

s

s

i

o

n

a

l

Q

u

a

l

i

f

i

c

a

t

i

o

n

s

A

c

t

u

a

r

i

a

l

B

B

u

s

S

c

(

A

c

t

u

a

r

i

a

l

S

c

i

e

n

c

e

)

B

S

c

(

H

o

n

s

)

(

A

c

t

u

a

r

i

a

l

S

c

i

e

n

c

e

)

I

n

s

u

r

a

n

c

e

C

o

m

p

a

n

y

e

t

i

r

e

m

e

n

t

F

u

n

d

H

e

a

l

t

h

c

a

r

e

F

u

n

d

C

o

n

s

u

l

t

i

n

!

e

s

e

a

r

c

h

F

o

u

n

d

a

t

i

o

n

"

e

a

r

s

A

c

t

u

a

r

i

a

l

t

e

c

h

n

i

#

u

e

s

a

n

d

a

p

p

r

o

a

c

h

$

C

T

P

r

o

f

e

s

s

i

o

n

a

l

A

c

t

u

a

r

y

(

B

r

i

t

a

i

n

%

$

S

A

)

F

I

A

&

F

F

A

&

F

S

A

&

F

A

S

S

A

C

h

a

r

t

e

r

e

d

F

i

n

a

n

c

i

a

l

A

n

a

l

y

s

t

(

$

S

A

)

C

F

A

S

c

h

o

o

l

'

m

p

l

o

y

m

e

n

t

(

p

p

o

r

t

u

n

i

t

i

e

s

)

e

r

c

h

a

n

t

B

a

n

*

C

o

m

m

e

r

c

i

a

l

B

a

n

*

I

n

v

e

s

t

m

e

n

t

)

a

n

a

!

e

r

I

n

v

e

s

t

m

e

n

t

e

s

e

a

r

c

h

You might also like

- Practical Risk Theory For ActuariesDocument1 pagePractical Risk Theory For ActuariesCesar JvNo ratings yet

- A-Z of Careers and JobsDocument464 pagesA-Z of Careers and JobsKirsty SmithNo ratings yet

- Notes IAS 19Document18 pagesNotes IAS 19Nasir IqbalNo ratings yet

- CHAPTER+10+Section+10.6,+10.7+ Fully+Annotated+Class+NotesDocument22 pagesCHAPTER+10+Section+10.6,+10.7+ Fully+Annotated+Class+NotesLi CarinaNo ratings yet

- Age and Sex Structure of Population (2) AssignmentDocument24 pagesAge and Sex Structure of Population (2) Assignmenteman azharNo ratings yet

- Craig Turnbull (Auth.) - A History of British Actuarial Thought-Palgrave Macmillan (2017)Document350 pagesCraig Turnbull (Auth.) - A History of British Actuarial Thought-Palgrave Macmillan (2017)PolelarNo ratings yet

- Ucc Thesis SubmissionDocument4 pagesUcc Thesis Submissiondonnacastrotopeka100% (2)

- The Benefits of Postgraduate StudyDocument3 pagesThe Benefits of Postgraduate StudyRatnam SankarNo ratings yet

- Actuarial ScienceDocument3 pagesActuarial ScienceKathryn SmithNo ratings yet

- Masters by Coursework RmitDocument5 pagesMasters by Coursework Rmitbcr9srp4100% (2)

- J1711 KHEI Professional Diploma in Accounting Financial Service Individual Pages LowresDocument6 pagesJ1711 KHEI Professional Diploma in Accounting Financial Service Individual Pages LowresjeffreymacaseroNo ratings yet

- Commonwealth Supported Postgraduate Coursework Programs UqDocument6 pagesCommonwealth Supported Postgraduate Coursework Programs Uqafjweyxnmvoqeo100% (1)

- CAPE EntrepreneurshipDocument125 pagesCAPE Entrepreneurshipiesha95% (21)

- Cdcs BrochureDocument2 pagesCdcs BrochureReajul Hasan ShohagNo ratings yet

- Coursework Scholarships Office RmitDocument7 pagesCoursework Scholarships Office Rmitfzdpofajd100% (2)

- CXC CAPE Entrepreneurship Syllabus 2015Document60 pagesCXC CAPE Entrepreneurship Syllabus 2015Kyle Chadee71% (7)

- Aston University Coursework Office Opening TimesDocument5 pagesAston University Coursework Office Opening Timesafaydoter100% (1)

- Nus Coursework Application StatusDocument5 pagesNus Coursework Application Statusbdg72wjj100% (1)

- EEC's Guaranteed Admission ServicesDocument9 pagesEEC's Guaranteed Admission Servicestushar3010@gmail.comNo ratings yet

- Ched Thesis GrantsDocument6 pagesChed Thesis Grantsfjmzktm7100% (2)

- Coursework Scholarships UnitDocument5 pagesCoursework Scholarships Unitbcqxqha3100% (2)

- Postgraduate Coursework ScholarshipsDocument5 pagesPostgraduate Coursework Scholarshipsfupbxmjbf100% (2)

- Revisededuscheme21092012 04 10 12Document9 pagesRevisededuscheme21092012 04 10 12Rupesh MoreNo ratings yet

- Master Curriculm For Acct and FinanceDocument20 pagesMaster Curriculm For Acct and FinanceIsmael HusseinNo ratings yet

- Courses DescriptionDocument35 pagesCourses Descriptionandrew_90No ratings yet

- Masters Coursework SydneyDocument7 pagesMasters Coursework Sydneypudotakinyd2100% (2)

- Central University of Technology, Free State: Student Registration Guide Bloemfontein & Welkom CampusDocument14 pagesCentral University of Technology, Free State: Student Registration Guide Bloemfontein & Welkom CampusIQaba DyosiNo ratings yet

- Victoria Masters by Thesis ScholarshipDocument6 pagesVictoria Masters by Thesis Scholarshipafbsbvoak100% (1)

- A Globally Recognized Designation of Professional ExcellenceDocument7 pagesA Globally Recognized Designation of Professional ExcellenceDEEPAK KUMAR MALLICKNo ratings yet

- Junior Investment Analyst (JIA)Document3 pagesJunior Investment Analyst (JIA)ديفولوبرز للإستشارات والتدريبNo ratings yet

- Masters Degree Coursework AustraliaDocument5 pagesMasters Degree Coursework Australiaafazapfjl100% (2)

- 2018 Handbook14 FinancialAssistance PGandPostdocDocument107 pages2018 Handbook14 FinancialAssistance PGandPostdocSimon TemboNo ratings yet

- Kca University Course WorkDocument5 pagesKca University Course Workfupbxmjbf100% (2)

- Kenyatta University Thesis FormatDocument5 pagesKenyatta University Thesis Formatmarilynmarieboston100% (1)

- Sources Finance: A Guide For Postgraduate StudentsDocument16 pagesSources Finance: A Guide For Postgraduate StudentsorangecherthalaNo ratings yet

- Rmit Coursework Scholarships OfficeDocument8 pagesRmit Coursework Scholarships Officebcqxqha3100% (2)

- DBF Rules Syllabus 2003 Revised 1.8.2003Document25 pagesDBF Rules Syllabus 2003 Revised 1.8.2003dharmesh_mbaNo ratings yet

- Nus Graduate Coursework Application StatusDocument5 pagesNus Graduate Coursework Application Statusvtdvkkjbf100% (2)

- Master Thesis Financial AccountingDocument4 pagesMaster Thesis Financial Accountingdeanavillanuevabridgeport100% (2)

- University of Derby ThesisDocument6 pagesUniversity of Derby Thesisbsh6df70100% (2)

- Commonwealth Scholarship Thesis GrantDocument7 pagesCommonwealth Scholarship Thesis Grantafjrtdoda100% (2)

- Short Course in Social Work at UnisaDocument8 pagesShort Course in Social Work at Unisaafjwftijfbwmen100% (2)

- Concordia Graduate Studies Thesis SubmissionDocument8 pagesConcordia Graduate Studies Thesis SubmissionHelpWritingAPaperUK100% (1)

- CQF BrochureDocument28 pagesCQF Brochurejaleusemia22No ratings yet

- D5904-11 Acco Fin Prog WEBDocument6 pagesD5904-11 Acco Fin Prog WEBMoyo ZibangNo ratings yet

- 605ca47d48991df6419ac38c DCO4 BrochureDocument9 pages605ca47d48991df6419ac38c DCO4 BrochureSuman AminNo ratings yet

- Finance Major: Fall 2020 Operating Status: Newark CampusDocument13 pagesFinance Major: Fall 2020 Operating Status: Newark CampusDhruv PatelNo ratings yet

- Monash University Masters by CourseworkDocument5 pagesMonash University Masters by Courseworkf5e28dkq100% (2)

- Cba CatalogDocument36 pagesCba CatalogTrung TranNo ratings yet

- Certified Information Systems Auditor Programmes: WWW - Bcu.ac - Uk/auditDocument2 pagesCertified Information Systems Auditor Programmes: WWW - Bcu.ac - Uk/auditMassawe Michael BarakaNo ratings yet

- Cofa International Coursework ScholarshipDocument7 pagesCofa International Coursework Scholarshipafaydebwo100% (2)

- CAPE Entrepreneurship SyllabusDocument125 pagesCAPE Entrepreneurship SyllabusOckouri BarnesNo ratings yet

- 2014 Small Grants Programme For Thesis WritingDocument6 pages2014 Small Grants Programme For Thesis WritingafktmeiehcaktsNo ratings yet

- Acceptability of Bachelor of Science in Accounting TechnologyDocument6 pagesAcceptability of Bachelor of Science in Accounting TechnologyJade Ballado-Tan100% (2)

- 2 - School of Accounting FAQ BookletDocument7 pages2 - School of Accounting FAQ BookletHenry Sicelo NabelaNo ratings yet

- World Bank Dissertation FellowshipDocument4 pagesWorld Bank Dissertation FellowshipUK100% (1)

- Victoria University Masters by Thesis ScholarshipDocument8 pagesVictoria University Masters by Thesis Scholarshipfc2fqg8j100% (2)

- Uct Thesis Submission DatesDocument4 pagesUct Thesis Submission DatesKarla Long100% (2)

- Unsw Postgraduate Coursework ScholarshipsDocument6 pagesUnsw Postgraduate Coursework Scholarshipsbd9gjpsn100% (2)

- Cdcsqualificationspecification2014 15 Finalv4Document15 pagesCdcsqualificationspecification2014 15 Finalv4mohitNo ratings yet

- CfaDocument6 pagesCfaRohan HaldankarNo ratings yet

- CITY UNI 7229 Actuarial Management AWDocument2 pagesCITY UNI 7229 Actuarial Management AWBruno DominguesNo ratings yet

- Undergraduate Thesis Funding in The PhilippinesDocument6 pagesUndergraduate Thesis Funding in The PhilippinesAshley Smith100% (2)

- Economics for Investment Decision Makers: Micro, Macro, and International EconomicsFrom EverandEconomics for Investment Decision Makers: Micro, Macro, and International EconomicsNo ratings yet

- Student Name: Kapembwa Nakazwe Student Number: 08N0375 Supervisor: Pro Hugo NelDocument12 pagesStudent Name: Kapembwa Nakazwe Student Number: 08N0375 Supervisor: Pro Hugo Nelkaps2385No ratings yet

- District Financial Report 2013Document22 pagesDistrict Financial Report 2013kaps2385No ratings yet

- Harvard Referencing ManualsDocument29 pagesHarvard Referencing ManualsUdithaKekulawalaNo ratings yet

- Function Hire Booking Form 2013Document1 pageFunction Hire Booking Form 2013kaps2385No ratings yet

- APL Service LTD: TradingDocument2 pagesAPL Service LTD: Tradingkaps2385No ratings yet

- UK Size GuideDocument3 pagesUK Size Guidekaps2385No ratings yet

- Risk-Return Relationship Is An Important Topic in The Field of Financial EconomicsDocument1 pageRisk-Return Relationship Is An Important Topic in The Field of Financial Economicskaps2385No ratings yet

- Companies To Look atDocument4 pagesCompanies To Look atkaps2385No ratings yet

- Application Form Oppidan Sub WardenDocument3 pagesApplication Form Oppidan Sub Wardenkaps2385No ratings yet

- Myuk Rates 2013 RebasedDocument1 pageMyuk Rates 2013 Rebasedkaps2385No ratings yet

- A Woman Purchases The Security of Marriage With Her Name, Her Privacy and Her CareerDocument1 pageA Woman Purchases The Security of Marriage With Her Name, Her Privacy and Her Careerkaps2385No ratings yet

- Apl Letter Head New 1Document2 pagesApl Letter Head New 1kaps2385No ratings yet

- Sexual Healing-Marvin GayeDocument2 pagesSexual Healing-Marvin Gayekaps2385No ratings yet

- Visa FormDocument1 pageVisa Formkaps2385No ratings yet

- AMO Potential Membership ListDocument1 pageAMO Potential Membership Listkaps2385No ratings yet

- LearnerRecordStandard - PDF - Adobe ReaderDocument2 pagesLearnerRecordStandard - PDF - Adobe Readerkaps2385No ratings yet

- Sub: Visitation To The HospitalDocument1 pageSub: Visitation To The Hospitalkaps2385No ratings yet

- APL Trading Service Ltd - Importers & Distributors of Electrical, Mechanical Spares & Industrial ChemicalsDocument1 pageAPL Trading Service Ltd - Importers & Distributors of Electrical, Mechanical Spares & Industrial Chemicalskaps2385No ratings yet

- APL Blank Quote NEW 2Document1 pageAPL Blank Quote NEW 2kaps2385No ratings yet

- South African Rally 2Document1 pageSouth African Rally 2kaps2385No ratings yet

- Apl Letter Head NewDocument2 pagesApl Letter Head Newkaps2385No ratings yet

- APL Trading Service Ltd - Electrical, Mechanical and Mining Equipment SuppliesDocument1 pageAPL Trading Service Ltd - Electrical, Mechanical and Mining Equipment Supplieskaps2385No ratings yet

- District Financial Report 2013Document22 pagesDistrict Financial Report 2013kaps2385No ratings yet

- Seventh Day Adventist Church AMO Report Q4 2012Document2 pagesSeventh Day Adventist Church AMO Report Q4 2012kaps2385No ratings yet

- Adventist Men's Organization 1st Quarter Report 2013Document3 pagesAdventist Men's Organization 1st Quarter Report 2013kaps2385No ratings yet

- Freedom Park Sda Departmental Plan For Amo 2013Document4 pagesFreedom Park Sda Departmental Plan For Amo 2013kaps2385No ratings yet

- Amo Plan 2014Document4 pagesAmo Plan 2014kaps2385No ratings yet

- AMO Membership EldersDocument1 pageAMO Membership Elderskaps2385No ratings yet

- FREEDOM PARK SDA MEMBERSHIP FORMDocument3 pagesFREEDOM PARK SDA MEMBERSHIP FORMkaps2385No ratings yet

- Actuarial Funding MethodsDocument32 pagesActuarial Funding MethodsAbraham ArandaNo ratings yet

- Formula Sheet (Time Value of Money)Document3 pagesFormula Sheet (Time Value of Money)Allan CabreraNo ratings yet

- Deep Dive Into IEV and Views From The Market: Sanket KawatkarDocument62 pagesDeep Dive Into IEV and Views From The Market: Sanket Kawatkarankur taunkNo ratings yet

- PAS 19 (Revised) Employee BenefitsDocument35 pagesPAS 19 (Revised) Employee BenefitsReynaldNo ratings yet

- IAS 19 Employee Benefits OverviewDocument8 pagesIAS 19 Employee Benefits OverviewAANo ratings yet

- On Epidemologic MeasurmentsDocument53 pagesOn Epidemologic MeasurmentsPriya SharmaNo ratings yet

- 1 - Population iGCSEDocument5 pages1 - Population iGCSEAndy FunnellNo ratings yet

- Acc 106 P3 LessonDocument6 pagesAcc 106 P3 LessonRowella Mae VillenaNo ratings yet

- Kia NewDocument10 pagesKia NewFadhilah UlfahNo ratings yet

- CV (1-4-12)Document2 pagesCV (1-4-12)Donna Marie CatapangNo ratings yet

- Template For PHIL IRI Post TestDocument4 pagesTemplate For PHIL IRI Post TestAiza QuelangNo ratings yet

- Time Value of Money (New)Document22 pagesTime Value of Money (New)NefarioDMNo ratings yet

- Modelling PensionsDocument416 pagesModelling PensionsAllister Hodge100% (1)

- Actuarial Mathematics II - APV of Cash Flows, Premiums and ReservesDocument18 pagesActuarial Mathematics II - APV of Cash Flows, Premiums and ReservesFion TayNo ratings yet

- Epidemilogy Measurment MethodsDocument100 pagesEpidemilogy Measurment MethodsKailash NagarNo ratings yet

- Population Projection at Wereda Level From 2014 - 2017Document118 pagesPopulation Projection at Wereda Level From 2014 - 2017gm29100% (1)

- Fourth Years Teaching TimetableDocument17 pagesFourth Years Teaching Timetablejoshuamokuaa001No ratings yet

- PVIF FVIF TableDocument2 pagesPVIF FVIF TableYaga Kangga0% (1)

- Curve Fitting Linear 1Document43 pagesCurve Fitting Linear 1WipharatNo ratings yet

- Econometrics - Qualitative Response ModelsDocument17 pagesEconometrics - Qualitative Response ModelsalvarezxpatriciaNo ratings yet

- PGM Structure - For Year 1 Students Admitted in 2019Document5 pagesPGM Structure - For Year 1 Students Admitted in 2019C.TangibleNo ratings yet

- Naskah PublikasiDocument23 pagesNaskah PublikasiRima MunandaNo ratings yet

- IFoA Qualification Handbook 2021Document54 pagesIFoA Qualification Handbook 2021MANU kNo ratings yet

- Key scholarships for 2015/2016 academic yearsDocument10 pagesKey scholarships for 2015/2016 academic yearshafis82No ratings yet