Professional Documents

Culture Documents

Evaluate The Contribution of Fdi in Industrial Sector in Malaysia

Uploaded by

A Ayie AzhariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Evaluate The Contribution of Fdi in Industrial Sector in Malaysia

Uploaded by

A Ayie AzhariCopyright:

Available Formats

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 1 | 30

Contents

1. INTRODUCTION ................................................................................................................................ 2

GLOBALIZATION OF FDI (AFTA) ....................................................................................................... 4

GLOBALIZATION OF FDI (NAFTA) .................................................................................................... 5

GLOBALIZATION OF FDI (WTO) ........................................................................................................ 6

2. FACTOR INFLUENCING FDI TO MALAYSIA ............................................................................... 7

3. CONTRIBUTION OF FDI IN MALAYSIA ...................................................................................... 11

3.1 FDI CONTRIBUTION TOWARDS INVESTMENT ................................................................ 14

3.2 FDI CONTRIBUTION TOWARDS CURRENCY .................................................................... 17

3.3 FDI CONTRIBUTION TOWARDS UNEMPLOYMENT .............................................................. 20

3.4 FDI CONTRIBUTION TOWARDS ECONOMIC GROWTH ........................................................ 23

3.5 FDI CONTRIBUTION TOWARDS STABILITY ........................................................................... 24

4. CONCLUSION ................................................................................................................................... 26

5. REFERENCES ........................................................................................................................................ 28

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 2 | 30

1. INTRODUCTION

FDI is the direct investment reflects the objective of obtaining a lasting

interest by a resident entity of the economy (direct investor) in the enterprise

resident in another economy. "The importance of sustainable" implies the existence

of a long-term relationship between the direct investor and the direct investment

enterprise and a significant degree of influence on the management of both.

Investment involves both the initial transaction establishing the relationship between

investors and companies and all subsequent capital transactions between them and

among affiliated enterprises, incorporated and unincorporated. It should be noted that

capital transactions that do not pose such a solution, such as a stock exchange, bonds,

capital investment and others. As we known in class, FDI plays a major role in our

economic contribution and what it is?

One of the primary benefits is that it allows money to freely go to whatever

business has the best prospects for growth anywhere in the world. That's because

investors aggressively seek the best return for their money with the least risk. This

motive is color-blind, doesn't care about religion or form of government. This can be

proven by Adam Smith theory of perfect competition, you try to imagine two

countries, Malaysia and China where Malaysia has a high skill in the production of

rubber and China have expertise in the manufacture of iron in terms of quantity and

price of manufacturing. Between the occurrences of the effect of FDI is to get items at

a lower cost and give benefit to all. go back to the example if Malaysia wants to

produce iron source because it will detrimental Malaysia does not have the

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 3 | 30

technology, skilled manpower and other factors to make steel, as well as China if you

want to produce rubber. In perfect competition there thats goes to another theory is

competitive advantage where Malaysia can export rubber to marginal cost is more

Efficient to China and China can supply iron to Malaysia cost efficient and could

benefit being on both sides.

FDI also can bring the economic balance through the globalization.

Globalization is not a single concept that can be defined and encompassed within a

set time frame, nor is it a process that can be defined clearly with a beginning and an

end. Furthermore, it cannot be expounded upon with certainty and be applicable to all

people and in all situations. Globalization involves economic integration; the transfer

of policies across borders; the transmission of knowledge, cultural stability, the

reproduction, relations, and discourses of power, it is a global process, a concept, a

revolution, and an establishment of the global market free from sociopolitical

control. Globalization encompasses all of these things. It is a concept that has been

defined variously over the years, with some connotations referring to progress,

development and stability, integration and cooperation, and others referring to

regression, colonialism, and destabilization. Despite these challenges, this term brings

with it a multitude of hidden agendas. An individuals political ideology, geographic

location, social status, cultural background, and ethnic and religious affiliation

provide the background that determines how globalization is interpreted. But how

generally we can see the GLOBALIZATION through the FDI??

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 4 | 30

GLOBALIZATION OF FDI (AFTA)

FDI plays an important role in the rapid economic development of the newly

industrializing and developing economies of Southeast Asia. Among the components

of resource flows to the ASEAN countries, FDI constitutes a considerable share,

indicating the importance of FDI as a major source of finance for economic

development. Between 1990 and 1997, FDI represented an annual average of 40% of

the net resource flows to the ASEAN countries, with Malaysia, Myanmar and

Vietnam having more than 50% FDI composition (United Nations, 2001a). A high

percentage of FDI to net private capital flows in the 1990s is almost the norm for

many developing countries, and this is true for ASEAN. This suggests the increasing

importance of net private capital flows, particularly FDI, to official flows for

development finance. The ASEAN region is a leading recipient of FDI flows in the

developing world, with five ASEAN countries in the top 20 developing-countries

recipients of long-term global capital flows from 1997 to 1998. Between 1993 and

1998, ASEAN received about 17.4% of the US$760 billion in cumulative global net

FDI flows to developing countries. Over the same period, ASEAN received an annual

average of US$22 billion in net FDI flows, compared with an annual average of

US$7.8 billion in the period between 1986 and 1991. FDI flows in ASEAN increased

on average by about 14% annually from 1996 to 1998, while FDI stock in ASEAN

grew tenfold from US$23.8 billion in 1980 to US$233.8 billion in 1998

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 5 | 30

Despite the region's successes in attracting sizeable FDI flows, the countries

in the region continue to undertake collective as well as individual measures to

further liberalize their investment regimes and to provide competitive and attractive

investment environments. Further policy measures have been introduced to attract

greater FDI flows as a means to helping the countries recover from the economic

crisis.

GLOBALIZATION OF FDI (NAFTA)

(FDI) in Mexico and Canada has surged in the wake of NAFTA and the recent

depreciations of the Mexican peso and Canadian dollar. In 1994 the year NAFTA

took effect FDI in Mexico increased by 150%. It has remained strong ever since,

despite the economic problems caused by the peso crisis. FDI in Canada has more

than doubled since 1993, increasing 44% in 1998 alone. Canada and Mexico have

absorbed more than $116 billion in FDI from all sources since 1993.

Inflows of FDI, along with bank loans and other types of foreign financing,

have funded the construction of thousands of Mexican and Canadian factories

producing goods for export to the United States. The growth of U.S. imports from

these factories is a major factor contributing to the United States growing trade

deficit, resulting in the loss of 440,172 high-paying U.S. jobs in the manufacturing,

hi-tech, automotive, and apparel sectors since 1994.

Moreover, the recent growth of the U.S. trade deficit with its North American

neighbors shows no sign of slowing. Whereas the total U.S. trade deficit with the

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 6 | 30

world increased by 39% in the first half of 1999 (relative to the same period in 1998),

the U.S. deficit with Mexico increased by 72% and the deficit with Canada more than

doubled (121%) in this same period.

GLOBALIZATION OF FDI (WTO)

The General Agreement on Tariffs and Trade (GATT) and its successor,

the World Trade Organization (WTO), are under debate. Andrew Rose has claimed

that there is no compelling evidence that the GATT/WTO system has been effective

in increasing aggregate bilateral trade or liberalizing trade policy (Rose, 2004a, b).

Critics of Rose have argued that the GATT/WTO does promote trade, when taking

into account: a impact of accession on the investment decisions of multinational

enterprises (MNEs) complicates the interpretation of reduced-form estimates of the

effect of accession on aggregate trade. In fact, when accession affects the extensive

margin of FDI, the multilateral tariff reductions associated with GATT/WTO

accession cannot be identified with the aggregate trade measures. Since roughly two

thirds of world trade is administered by MNEs. To illustrate this, the GATT/WTO

principles require a reduction in the import tariffs that the accession country imposes

against incumbent countries - as well as a reduction of the incumbent countries

tariffs used against the accession country. With lower incumbent tariffs, MNEs will

more frequently invest in affiliates which are used as an export platform to supply

incumbent countries from the accession country. More numerous and more export-

oriented foreign affiliates will then increase the aggregate exports in the host country

after accession.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 7 | 30

2. FACTOR INFLUENCING FDI TO MALAYSIA

Foreign direct investment is the key driver underlying the string growth

performances experienced by the Malaysian economy. The presence of a well-

functioning financial system and sustained economic growth had made Malaysia an

attractive country for FDI. Other than that, the government policy reforms such as the

introduction of establishment of free trade zones in the early 1970 and the provision

of export incentives alongside the acceleration of open policy in the 1980s has

attracted a large amount of FDI inflow in the late 1980s (Ang, 2008). The sharp

increase in FDI of Malaysia was due to the coincidence of the foreign investment

regime which was further liberalized as part of the structural adjustment reforms

implemented in response to the macroeconomics crisis in the mid-1980. The move by

firms from Japan, South Korea, United States and Taiwan in relocating their

production bases to low cost countries due to the rising wages in the domestic

countries also plays a part in the increment of FDI in Malaysia (Athukorala&Wagle,

2011).

According to Karimi, Yusop, and Law (2010), based on the result of TOPSIS

method which is used in ranking ASEAN countries in term of attraction and capacity

for FDI in 2005, Malaysia was at the second place where the first ranking is

Singapore. This shows that Malaysia is the most attractive country for FDI among the

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 8 | 30

ASEAN countries right after Singapore. FDI plays several crucial roles in Malaysia

economy. One of the roles is to promote export growth. Investing in firms which have

its own product reputation and brand image in the international market reduces the

need for domestic firms to spend resources and time to penetrate and acquire foreign

markets.

Market size or market attractiveness can be assessed or measured by

examining host countrys GDP, population, growth of GDP and even GDP per capita.

Empirical evidence investigating market size and attractiveness in the host country as

a variable influencing FDI has shown mixed results although most findings support

the theoretical view that large markets attract FDI. In the internalization of hotels, the

size and rate of growth of the tourism sector in the host country was found to be an

important determinant of FDI in the travel business (Dunning & McQueen 1981).

They found the size of domestic markets to be positively related to FDI inflow.

Hasan (2004) in his empirical investigation on FDI in the Malaysian

manufacturing sector found exports a crucial determinant in attracting investment. He

found that a 1% rise in export is likely to increase FDI inflow by around RM120

million. He further reiterates that FDI tends to boost exports from home country and

imports from host country to home country. In this case, the market size may not be

so important for manufacturing multinational companies (MNC) as compared to

service MNCs.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 9 | 30

Malaysia is one of the fastest growing economies in the South East Asian

region after Singapore. The service sectors share of GDP in Malaysia is currently

close to 57%. Therefore, Malaysia has the potential to attract FDI into the service

sector. Most service MNCs are commercially present and are not export oriented

which they cater and serve the growing domestic market. This factor is likely to

enhance the future growth of service MNCs.

Workforce factors refer to variables such as cost of labour-wages, education

level and also skill level. In the Malaysian scenario, some service industries such as

banking, insurance, information technologies, telecommunication and BPO are

capital and knowledge intensive. These industries depend on semi-skilled and

educated labour. Malaysia is able to supply such workforce at relatively lower cost

compared to established service economies such as Singapore. Furthermore, factors

such as availability of high quality English speaking, educated work force which

highly important in the sector. For example, a report by Bernama (2004) said that

Shells success in Malaysia was largely due to the availability of cheap, highly

talented, highly trainable and capable Information Technology (IT) workforce.

Theoretically, the degree of interaction between customers and producers are

normally high and the quality of the companys human resources becomes a critical

or key factor in their ability to deliver the services.

Additionally, government factor does an important influence for Malaysia.

Variables that will come under government factors are government incentives,

economic policies, political environment and government promotions towards FDI.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 10 | 30

The Malaysian government has provided numerous incentives to attract FDI over the

years. However, most of our competitors have also provided similar incentives.

Vietnam, Thailand, Indonesia and Philippines have been successful in pulling FDIs

away from Malaysia by coming up with similar incentive packages. So, it is worth

examining whether tax incentives and government policies are significant factors in

attracting FDI.

Another important development in Malaysia is the establishment of the

Multimedia Super Corridor (MSC) in 1995. Malaysia was the first country in the

region to create the MSC. The MSC has attracted world class MNCs both in the

services sector and manufacturing sectors. Numerous incentives such as tax

exemptions, government grants were provided to attract foreign firms especially in

the information technology field to set up their offices in the MSC. According to

Ramasamy (n.d) the success of MSC is yet to be seen since the level of investment

flowing into the MSC is not substantial enough.

Moreover, the level of infrastructure in the host country refers to the quality of

roads, railroad, dependable energy and telecommunication, availability, credit and

banking facilities and other financial, legal and transport systems (Wilhelms, 1998;

Griffin & Pustay, 1999). Malaysia has one of the most developed infrastructures in

this region after Singapore. It has developed high quality infrastructure in the

financial, telecommunication and transportation sector. An efficient and developed

infrastructure can reduce cost of doing business not only in the services sector but

also manufacturing sector. Therefore, good quality infrastructure is necessary to lure

FDI.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 11 | 30

Lastly, according to Grunbaugh (1987) and Culem (1988), large firms are

more likely than small firms to be foreign investors. In the case of Malaysia, variables

such as reputation, experience effect, brand image and size of firm are considered to

be important for MNCs. For example in the banking sectors, some of the foreign

banks in Malaysia such as HSBC and Standard Chartered have been here for more

than a century and also have presence all over the world. Their reputation, experience

and size may definitely give them an edge over new players in the industry but might

not be true for new and small service MNCs because it will take time for them to

establish themselves internationally. They may have certain managerial expertise that

others do not have which gives an edge over the rivals.

3. CONTRIBUTION OF FDI IN MALAYSIA

Traditionally, we often think one of the factor influence and giving impact

on Gross Domestic Product (GDP) is the international trade and Foreign Direct

Investment (FDI) also the factors that influence the level of productivity growth. For

some country, the development of technology and the open economy policy can be

measure by how the international trade to promote the economy growth and

encourage the FDI inflows. Economy growth sometimes affected particularly for

developing countries by international linkages or technology transfer. In Malaysia,

according to research by Taylor (2002), the international trade trend over economy

growth is vary across country and changed over time.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 12 | 30

Malaysia has a lot abundant in nature resources such as palm oil, tin, rubber

and so on which still not being fully utillized. Years back, In 2007, Malaysia

economy of was third largest economy in South East Asia. Malaysia is an upper-

middle income economy with a gross national income of USD 8,770 per capita

(2011). Currently, it is a highly open economy (exports comprise over 100 percent of

GDP) and a leading exporter of electrical appliances, electronic parts and

components, palm oil, and natural gas (World Bank, 2013). Malaysia is expected to

register real GDP growth of 5.1 percent in 2012, 5.0 percent in 2013, 5.0-5.5 percent

in 2014. Propelled by domestic demand, Malaysias economy is likely to weather a

weak global environment. High and sustained economic growth, typically in

conjunction with more opening up to international trade, is a central objective of

economic movement policy. Involving in international trade is important to increase

productivity through maximum utilization of scale economies.

Based on my study in ECO 546 on factor influence GDP with numerical

regression of GDP=345.848 + 0.340G + 2.210FDI - 0.0000004809CN - 0.003E

shows that, increase in 1 dollar of Foreign Direct Investment will increase GDP by

$2.210 million. The purpose of this paper was to test the Impact and causality

correlation between government spending, FDI, consumption and export in Malaysia.

By done this paper the results shows that GDP had positive correlation with

government spending and FDI where have proven by perform the OLS estimator.

Besides that, there is no significance evidence to prove that growth rate last period of

FDI, import and export does not affect current GDP. Malaysia GDP does not react to

the changes of international trade or FDI. This paper also found that Malaysian

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 13 | 30

economic growth strong domestically and not much depends on globally inflow. This

is supported by the plenty of resources such as oil palm, cruel oil, rubber and other

comparative advantage product. Beside that Malaysia economic can conclude as

strong sustainability in term of economics. Remark U.S financial rescission 2008 and

Greece debt financial crisis where most of country aware but Malaysia one of country

that not effected much. This results support the general findings of Darrat (1986) for

the Gang of Four Countries of Asia Export, Import and FDI has no influence on

growth in GDP of Malaysia. The results shows that when Government of Malaysia

implements fiscal policy by changing the amount of export or through spending for

FDI facilities in order to encourage more investment inflow to Malaysia, the

economic growth will not change thereby ensuring that no effects of fiscal policy are

used to change the growth rate in Malaysia.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 14 | 30

3.1 FDI CONTRIBUTION TOWARDS INVESTMENT

Historically, in 2012, New Straits Times reported that Malaysia attracted

RM32.9 billion FDI in 2011 which the highest amount ever recorded, announce by

the International Trade and Industry Minister Datuk Seri Mustapa Mohamed. The

biggest industry that contribute is the manufacturing sector which increased by 12 %

from RM29.3 billion in 2010. 72% of the FDIs came from Asian countries and for the

countrys total trade was the highest ever accounted at RM1.269 trillion which was

underpinned by inter-Asian trade. Resulted from this, Malaysia had done reasonably

well, considering the challenging external environment, and had exceeded its

investment target. For the first time, Malaysia Investment Trade Authority (MIDAs )

statistics captured the total investments approved in the manufacturing, services and

primary sectors, which showed a 40.7 per cent rise to RM105.6 billion from 4,368

projects. The primary sector, comprising agriculture, mining and plantation, and

commodities sub-sectors were previously not included in Midas total investment

figures. It also indicates that Malaysia is on track to attaining the investment targets

set under the Economic Transformation Programmed by 2020.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 15 | 30

Currently domestic investors played an important role and were as active as

their foreign counter parts in private investments. The manufacturing sector continued

to be a significant source of growth. The total investments approved for the sector

RM34.2 billion=61%, were by foreign investments in new projects. Domestic

investments accounted for 55.4% of total approved investments. On the performance

of the states in terms of the number of projects approved, Selangor, Johor and

Penang topped the list with 156 projects, 133 projects and 81 projects. By value of

investments, Johor was first with RM 10,590516, 187 followed by Sarawak with

RM65, 600,433,204, and Selangor with RM3, 872,034,409 in 2013. Infrastructure

development in Malaysia especially to Penang are having great times because of done

ell not only for the past two years but strong enough for the last 30 years, due to the

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 16 | 30

strong support of the Federal Government which continues to spend money to

improve its infrastructure with a new bridge and airport.

For the international country contribution, Japan led the pack of foreign

investors with investments totaling RM10.1 billion, followed by South Korea by

RM5.2 billion, the United States by RM2.5 billion, Singapore by RM2.5 billion and

Saudi Arabia by RM2.2 billion. By the regional area which not left behind,

government has distribute by the regional program, such as The Northern Corridor

Economic Region registered the largest number of investments in projects with

RM15.3 billion of approved manufacturing licenses, followed by Sarawak Corridor of

Renewable Energy (RM8.2 billion), Iskandar Malaysia (RM5.7 billion), East Coast

Economic Region (RM4.6 billion) and Sabah Development Corridor (RM900

million).

As the conclusion, by generating FDI at the same time will generate our GDP

so this will accounted to our economic growth and development. This revenue can be

used in upgrading our country facilities, opportunity toward the citizens and the

country revenue itself as it has many positive effects like encourage foreign direct

business relationships give rise to multinational corporations.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 17 | 30

3.2 FDI CONTRIBUTION TOWARDS CURRENCY

Malaysia is applying floating/flexible exchange rate system, therefore leading

a Currency fluctuations, a natural outcome. The exchange rate of one currency versus

the other is influenced by numerous fundamental and technical factors. These include

relative supply and demand of the two currencies, economic performance and so on.

According to the classical economic thought system, in case that any country

specializes in the fields, in which it will have its respective comparable superiority,

and makes a trade in the international exchange rate, it will record an increase in its

real incomes, and the country will get richer. In the classical economic thought

system, the first thinkers emphasizing the importance of trade are A. Smith and D.

Ricardo. Especially, A. Smith concentrated on the relationships between trade, market

size, and economic growth.

Asias economic fundamentals currently are much stronger than in prior crisis

periods (1997/98 and 2008/09) which Malaysia have the ability to handle it and are

backed by a more stable and better regulated financial sector and economists believe

that some countries in the region will be able to withstand the effects because of

strong fundamentals. Bank Negara Malaysia governor Tan Sri Dr Zeti Akhtar Aziz,

said the country has the strength and capability to manage the current volatility for

one, has over the week assuaged concerns over the effects of destabilising capital

flows on Malaysia. Currently Malaysia, is the third-largest economy in South-East

Asia has not been immune to the recent capital outflows, as evident in the movement

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 18 | 30

of the ringgit, yet policymakers and economists alike believe that the country could

be able to hold its ground.

. Malaysia has strong and sound financial intermediaries operating in a well-

developed market also countrys robust foreign exchange reserves level, which stood

at US$137.9bil (RM456.5bil) as at Aug 15,2013 and low levels of foreign-currency

debt at around 1% to 2% of the countrys gross domestic product (GDP) should also

serve to protect Malaysia from the impact of disruptive capital flows as well as the

financial stability also to achieve a more developed foreign exchange market. The

movement of the ringgit remained orderly and driven by two-way flows of funds,

with the currency recording a mixed performance against major and regional

currencies last. The annual report revealed that Malaysia continued to experience

two-way capital flows last year, with foreign fund inflows registering RM59.2bil,

mainly attracted to the country's resilient growth in 2012.

In the long-term, a persistent fall in FDI may have an impact on the stock

market and the ringgit because if a country is able to attract investments this will lead

to the reflection of competitiveness. Besides, FDI also has been considered as one of

the major factors underlying the economic growth experienced by many developing

countries. In Malaysia, FDI has played an important role not only in stimulating

economic growth, but also contributed significantly to the growth of the industrial

sector and the transformation of the Malaysian economic structure from agricultural

into major producer and exporter of manufactured goods. (Idris Jajri, 2003)

The establishment of an enterprise by a foreigner are helping which more

specifically, foreign direct investment is a cross-border corporate governance

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 19 | 30

mechanism through which a company obtains productive assets in another country.

Its definition can be extended to include investments made to acquire lasting interest

in enterprises operating outside of the economy of the investor.

Meanwhile, low interest rate in the home country relatively will lead to higher

tendency of outward FDI. Indeed abroad investments require sound financially

support and capital abundance in term of low interest rate enable firms to access to

capital market. Therefore, firms can obtain necessary funding to finance their abroad

investment. In related to that, exchange rate also has significant impacts towards the

outward FDI. Although countries with stronger currencies in relative to firms from

countries with weak currencies, will discourage exports, however this will lead to

higher propensity to perform abroad investment due to appreciation of the currencies.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 20 | 30

3.3 FDI CONTRIBUTION TOWARDS UNEMPLOYMENT

In the early years, the economic growth was focused on agriculture and

mining sector which occurring in rural area. Somehow, the intense competition of

globalization has caused the transformation from agriculture and mining sector to

manufacturing and service sectors. From the statistic given by

Tradingeconomics.com, Unemployment rate in Malaysia increases 3.30% in October

2013 from 3.10% in September 2013 reported by the Department of Statistic

Malaysia. Unemployment rate in Malaysia averaged about 3.31% from 1998 until

2013, reaching all time high of 4.50% in March 1999 and a record low of 2.70% in

August 2012. In Malaysia, the unemployment rate measures the number of people

actively looking for a job percentage of the labor force.

Table 1: Unemployment rate from January 2012-July 2013.

In Asia region, the economy growth trend and labor market outcomes

normally similar because labor market development is one of the most important

components of economic transition. Rural and urban areas is the aim of the labor

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 21 | 30

market development Malaysia's unemployment rate decreased notably in June to the

lowest level in ten months, data released by the Department of Statistics.

In (2012) recorded the unadjusted unemployment rate dropped to 2.8 percent

in June from 3.3 percent in May. A lower figure was last recorded in August 2012,

when the jobless rate stood at 2.7 percent. At the same time, the number of persons in

employment grew by around 430,000 month-on-month to about 13.47 million in

June. This is because employment was driven by the sectors of manufacturing,

construction, agriculture, forestry and fishing. However, it were around 392,700

unemployed persons in Malaysia at the end of June, lower by about 46,700 than in the

previous month which June's improvement in the job market reflected a rise in the

labor force participation rate, which advanced to 67.8% from May's 66%.

Since the last few decades since its independence in 1957 to achieve the

present status of an industrializing economy. Malaysia is now host to more than 5000

foreign companies, including multinational corporations due to the rapid

industrialization of the country is attributed in part to the inflow of FDI in

manufacturing sector. Increasing manufacturers use our countrys capabilities by

outsourcing their manufacturing activities to Malaysian companies also by setting up

their own operations in Malaysia. Environment and market in Malaysia has giving

them such a large opportunity to make profit also can lead to increasing our country

revenues.

Due to the rapid industrialization Malaysia continues to be one of the largest

producers and exporters of top quality, and now has emerged as the worlds largest

natural latex consumer and fifth in natural rubber uptake which can lead to the

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 22 | 30

increasing growth and economic development of Malaysia. Our rubber is world-class

manufacturer of the highest quality rubber products that conform to world

specifications and standards which also becoming a competitive source of raw

materials including natural rubber, and chemical suppliers. Moreover, mostly small

and medium-scale enterprises of rubber products industry is made up of more than

300 manufacturers, producing a vast range of latex products, tyres, industrial and

general rubber products, footwear and footwear components. Obviously in 2002,

Malaysia manage to employs more than 60,000 workers and recorded sales worth

RM6.9 billion (US$1.8 billion) in the industry. It is expected that there will be a

significant growth in the industrial and general rubber goods sub-sector due to greater

usage of rubber for the manufacture of components for the automobile industry and

construction industries.

Besides becoming a dynamic economy and ranked the 17th largest trading

nation in the world, Malaysias economic growth exceeded nine percent per annum

over the last decade and the main impetus to this growth continues to come from the

manufacturing sector. In terms of world competitiveness, Malaysia has been ranked

fourth amongst countries with over 20 million people, based on criteria such as

economic performance, government efficiency, business efficiency and infrastructure.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 23 | 30

3.4 FDI CONTRIBUTION TOWARDS ECONOMIC GROWTH

For the past decade Malaysia has been in the state of increasing level of

development which also factor by the elasticity of the estimated production function

of FDI was found to be significant in explaining the economic growth of. Estimated

foreign capital elasticity was contributed into growth in the case of Malaysia so it can

be conclude that both FDI and imports had a significant impact on growth. many

studies on the role of FDI in host countries suggests that FDI: is an important source

of capital, complements domestic private investment which is usually associated with

new job opportunities; enhances both technology transfer and spillover and human

capital (knowledge and skill) enhancement boosts overall economic growth in host

countries. Concerning developing countries, macro-empirical work on the FDI-

growth relationship has shown that the trade regime, the human capital base in the

host country, financial market regulations, banking system and the degree of

openness in the economy FDI has a positive impact for the economic growth. As the

many job opportunities provided it can lead to the decreasing unemployment

growth.in the matter of fact, this may lead to the decreasing of social economic cost

such as fraud, thief and other socials activities. Technologies transfer and the

spillover of knowledge can helps improving our very own workers which then lead it

benefit our country movement of growth if being fully utilized. Foreign direct

investment (FDI) has been seen as a key driver underlying the strong growth

performance experienced by the Malaysian economy. 5% IN 2011 (central tendency

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 24 | 30

of 4.5%) after a 5.1% expansion in 2011. Again, domestic demand is expected to

remain the key pillar that holds the economy against headwinds from the external

sector. In this regard, MARCs GDP growth projection for 2012 is just a shade lower

than BNMs projection (2012: 4.4%) while our forecast for 2013 stands at 5%. Major

economic challenges in 2012 are very much related to the weakening export sector

following a downdraft in regional external trade.

3.5 FDI CONTRIBUTION TOWARDS STABILITY

Political stability- despite other country, Malaysia enjoys a politically stable

environment, led by a democratically-elected coalition Government committed to the

development of its economy. Through measures such as the Economic

Transformation Programmed (ETP), the Government has also pledged to implement

the appropriate policies and provide its support for the creation of a conducive

environment for business and investment. This allows investors to rest assured of a

Government that is firm yet flexible enough to accommodate their needs. Increasing

more FDI has lead our political stability at a safety level and vice versa.

Economic Stability- Foreign direct investment (FDI) has been an important source of

economic growth for Malaysia, bringing in capital investment, technology and

management knowledge needed for economic growth. Thus, this paper aims to study

the relationship between FDI and economic growth in Malaysia for the period 1970-

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 25 | 30

2005 using time series data. The paper used annual data from IMF International

Financial Statistics tables, published by International Monetary Fund to find out the

relationship between FDI and economic growth in Malaysia case series. There is

sufficient evidence to show that there are significant relationship between economic

growth and foreign direct investment inflows (FDI) in Malaysia. FDI has direct

positive impact on RGDP, which FDI rate increase will lead to the growth rate

increase Furthermore, FDI also has direct positive impact on RGNI because when

FDI rate increase, this will lead the growth to increase

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 26 | 30

4. CONCLUSION

Malaysia was one of the most open countries in the developing world to

foreign investment. Malaysia has also once been regarded as one of the newly

industrializing economies. Considering the importance of FDI, Malaysian

government should emphasize on diffusion aspect in formulating FDI policies.

Policies directed towards attracting FDI should go hand in hand. With, not precede,

policies that aims at promoting financial market developments as suggested by

Azman-Saini et al. (2010) in their study. The review of the literature and findings

from the past studies also indicate that the continent needs a targeted approach to

FDI, increase absorption capacity of local firms, and cooperation between

government and firms or companies to promote their mutual benefit. These issues

also have been raised by Adams (2009) in his study.

Generally the relationship between FDI and economic growth has been

studied by examining the determinants of economic growth, determinants of FDI,

long-run integration or relationship, and the direction or causality pattern. Though

there is much on the relationship between FDI and economic growth, there are still

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 27 | 30

unclear evidences concerning the long-run integration relationship as well as the

direction or causality pattern between FDI and economic growth.

In summary, A causal effect exists running from FDI to economic growth

implying that FDI influences economic growth. As a result the importance of the FDI

as a paramount factor to accelerate the economic development of a country especially

in Malaysia and could be taken as one of the key factors to stimulate the economy and

for future economic development policy. This perhaps could enlighten the direction

of future study on the essential relationship between FDI and economic growth while

considering the possibilities of other factors that could together stimulate and sustain

economic growth via FDI.

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 28 | 30

5. REFERENCES

Anand, I. & Kogut, B. (1997). Technological capabilities of countries, firm and rivalry and

FDI, Journal of International Business Studies, 28(3), 445-467

Ang, J. B. (2008). Determinants of foreign direct investment in Malaysia. Journal of Policy

Modeling 30: 185-189

Ariff, M. (1991). The Changing Role of FDI in Malaysia, in Yokohama, H. and Tamin, M

(eds), The Malaysian Economy in Transition, Institute of Developing Economies,

Tokyo.

Borensztein, E. & De Gregorio, J. & J.W. Lee. (1998). How does foreign investment affect

growth? Journal of International Economics, 45.

Brewer, T.L. (1993). Government policies, market imperfections and Fdi. Journal of

International Business Studies, 24(1), 101-121

Charette, D. E. (2006). Malaysian in the Global Economy: Crisis, Recovery, and the road

ahead, New England Journal of Public Policy

Grunbaugh, S. G. (1987). Determinants of foreign direct investment. Review of Economics &

Statistics, 69 (1), 149-152

Jorge, R. (1985). Towards the theory of foreign direct investment. Oxford Economic Papers

37: 282-291

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 29 | 30

Kozo, K. & Urata, S. (2004). Exchange rate, exchange rate volatility and foreign direct

investment. The World Economy 27 (10): 15011536

Madevan, R. (2002). A DEA approach to understanding the productivity growth of

Malaysias manufacturing industries, Asia Pacific Journal of Management, 19, 587-

600

Mohd, N. I. (2001). Foreign direct investment and development: The Malaysian electronics

sector. WP 2001:4. Chr.Michelsen Institute Development Studies and Human Rights.

Poon, Wai Ling. (2004). The Development of the Malaysian Economy, Kuala Lumpur:

Prentice Hall

Tham, S. Y. (1997). Determinants of productivity growth in the Malaysian manufacturing

sector, ASEAN Economics Bulletin, 13, 333-430

http://www.tarrc.co.uk/pages/fdi.htm

http://www.mida.gov.my/env3/index.php?page=projects-approved-by-major-location

http://www.nst.com.my/top-news/highest-ever-fdi-for-malaysia-1.50269

EVALUATE THE CONTRIBUTION OF FDI IN INDUSTRIAL SECTOR IN MALAYSIA

P a g e 30 | 30

You might also like

- Motives For FDIDocument34 pagesMotives For FDIhneufvil100% (2)

- Role of FDI in SMEDocument94 pagesRole of FDI in SMESanjay NgarNo ratings yet

- Determinants of Fdi Case of Mauritius PDFDocument106 pagesDeterminants of Fdi Case of Mauritius PDFain_bemisal13100% (1)

- Samsung LN55C610N1FXZA Fast Track Guide (SM)Document4 pagesSamsung LN55C610N1FXZA Fast Track Guide (SM)Carlos OdilonNo ratings yet

- Accomplishment Report Filipino Values MonthDocument4 pagesAccomplishment Report Filipino Values MonthIan Santos B. Salinas100% (10)

- Thetford c250 InstallationDocument19 pagesThetford c250 InstallationCatalin Bejan100% (1)

- Rise and Fall of FDI in Vietnam and Its Impacts On Local Manufacturing UpgaradingDocument23 pagesRise and Fall of FDI in Vietnam and Its Impacts On Local Manufacturing UpgaradinghungNo ratings yet

- Full Paper 1Document20 pagesFull Paper 1Inara JayasooriyaNo ratings yet

- The Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaDocument21 pagesThe Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaTanay SoniNo ratings yet

- Trade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamDocument14 pagesTrade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamTRn JasonNo ratings yet

- Multi National Enterprises and Their Significance in Economic Growth in Emerging EconomisDocument11 pagesMulti National Enterprises and Their Significance in Economic Growth in Emerging Economisdevam chandraNo ratings yet

- Asian Foreign Direct InvestmentDocument14 pagesAsian Foreign Direct Investmentadrian retardoNo ratings yet

- The Impact of Foreign Direct Investment (FDI) On Stock Market Development in GCC CountriesDocument16 pagesThe Impact of Foreign Direct Investment (FDI) On Stock Market Development in GCC Countrieshazemsamman83No ratings yet

- Submited By: Shaikh Umair Saleem Registration:1735132 (MBA Ev 36 E) Submited To: DR - ManzoorDocument11 pagesSubmited By: Shaikh Umair Saleem Registration:1735132 (MBA Ev 36 E) Submited To: DR - ManzoorShaikh Mamoon HameedNo ratings yet

- FDI and FDI SubtainDocument12 pagesFDI and FDI SubtainfendaicaNo ratings yet

- The Role of Foreign Direct Investment (Fdi) in Development and Growth in Oic Member CountriesDocument29 pagesThe Role of Foreign Direct Investment (Fdi) in Development and Growth in Oic Member CountriesFiraol BelayNo ratings yet

- WDI08 Section6 IntroDocument3 pagesWDI08 Section6 IntroAnavi135No ratings yet

- Anwar, Nguyen (2010) Foreign Direct Investment and Economic Growth in VietnamDocument21 pagesAnwar, Nguyen (2010) Foreign Direct Investment and Economic Growth in VietnamNajaha GasimNo ratings yet

- R R R R Resear Esear Esear Esear Esearch Ar CH Ar CH Ar CH Ar CH Articles Ticles Ticles Ticles TiclesDocument26 pagesR R R R Resear Esear Esear Esear Esearch Ar CH Ar CH Ar CH Ar CH Articles Ticles Ticles Ticles TiclesChangez KhanNo ratings yet

- Foreign Direct Investment in Ows and The Industrialization of African CountriesDocument15 pagesForeign Direct Investment in Ows and The Industrialization of African CountriesMuhammadShoaibNo ratings yet

- Asia Crisis Chap2Document13 pagesAsia Crisis Chap2Vishal GautamNo ratings yet

- Article 1Document20 pagesArticle 1Elly WooNo ratings yet

- Best Practices in MergerDocument47 pagesBest Practices in MergerAileen ReyesNo ratings yet

- Globalization and Developing Countries: Foreign Direct Investment and Growth and Sustainable Human DevelopmentDocument35 pagesGlobalization and Developing Countries: Foreign Direct Investment and Growth and Sustainable Human DevelopmentOradeeNo ratings yet

- G 0341052058Document7 pagesG 0341052058inventionjournalsNo ratings yet

- Assignment FDIDocument19 pagesAssignment FDIVikrant GargNo ratings yet

- Foreign Direct Investment in Southeast Asia: Is Malaysia Falling Behind?Document24 pagesForeign Direct Investment in Southeast Asia: Is Malaysia Falling Behind?Arun Kumar Yadav100% (1)

- 1.lingkages Between Foreign Direct Investment and Its Determinants in MalaysiaDocument11 pages1.lingkages Between Foreign Direct Investment and Its Determinants in MalaysiaAzan RasheedNo ratings yet

- Economic Reforms, Regionalism, and Exports:: Comparing China and IndiaDocument100 pagesEconomic Reforms, Regionalism, and Exports:: Comparing China and IndiaYopie ShinodaNo ratings yet

- Essay Course: UWBS038g Name SubjectDocument9 pagesEssay Course: UWBS038g Name SubjectBisma FhNo ratings yet

- Research On Relationship Between China and Ghana Trade and Foreign Direct Investment (FDI)Document12 pagesResearch On Relationship Between China and Ghana Trade and Foreign Direct Investment (FDI)Alexander DeckerNo ratings yet

- (GFMA2023) AssignmentDocument24 pages(GFMA2023) AssignmentYong EowNo ratings yet

- Foreign Direct Investments and Economic Growth: The Primary DriversDocument14 pagesForeign Direct Investments and Economic Growth: The Primary DriversAmmara NawazNo ratings yet

- The Role of Human Capital in The Relationship Between Foreign Direct Investment and Exports in The Association of Southeast Asian NationsDocument16 pagesThe Role of Human Capital in The Relationship Between Foreign Direct Investment and Exports in The Association of Southeast Asian NationsdiaNo ratings yet

- Globalization: An Indian PerspectiveDocument10 pagesGlobalization: An Indian Perspectivesaurabh dixitNo ratings yet

- The Effect of Foreign Capital and Imports On Economic Growth: Further Evidence From Four Asian Countries (1970-1998)Document20 pagesThe Effect of Foreign Capital and Imports On Economic Growth: Further Evidence From Four Asian Countries (1970-1998)marhelunNo ratings yet

- 16 - Harish Babu FinalPaperDocument9 pages16 - Harish Babu FinalPaperiisteNo ratings yet

- Trends and Determinants of Fdi Flows in Developed and Developing NATIONS 1990-94 TO 2011Document12 pagesTrends and Determinants of Fdi Flows in Developed and Developing NATIONS 1990-94 TO 2011International Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- Asia Labor PriceDocument15 pagesAsia Labor PriceMehmed DavudoğluNo ratings yet

- The Dynamic Situation of Foot Loose Industry in Indonesia Artha Yudilla, S.I.P, M.ADocument6 pagesThe Dynamic Situation of Foot Loose Industry in Indonesia Artha Yudilla, S.I.P, M.AwhyyoumakeitsohardNo ratings yet

- Benefits of FDI For Developing CountriesDocument13 pagesBenefits of FDI For Developing Countriesthi100% (1)

- Economic Diplomac1Document5 pagesEconomic Diplomac1Sangbetta ChakrabortyNo ratings yet

- FDI in IndiaDocument7 pagesFDI in IndiaROHITH S 22MIB051No ratings yet

- Final GlobalizationDocument53 pagesFinal GlobalizationShah AzeemNo ratings yet

- Anjum AqeelDocument12 pagesAnjum AqeelPoptani GeetaNo ratings yet

- Punit - (UK Raju Rijen) Resit MKT744.editedDocument16 pagesPunit - (UK Raju Rijen) Resit MKT744.editedJiya BajajNo ratings yet

- Regression Analysisi MariaDocument11 pagesRegression Analysisi MariaInnocent escoNo ratings yet

- Impact of Investment Activities On Economic Growth of PakistanDocument9 pagesImpact of Investment Activities On Economic Growth of PakistanMuhammad ImranNo ratings yet

- FDI and Economic Growth: The Role of Local Financial MarketsDocument37 pagesFDI and Economic Growth: The Role of Local Financial MarketsLaura Alfaro MaykallNo ratings yet

- Globalization and Development Revisited in The Light of Asian ExperienceDocument25 pagesGlobalization and Development Revisited in The Light of Asian ExperienceRobs TenefranciaNo ratings yet

- Action Programme On Productivity ImprovementDocument39 pagesAction Programme On Productivity ImprovementEnrique SilvaNo ratings yet

- Economics and Political Economy: The Rewards and Challenges of Export-Led StrategiesDocument6 pagesEconomics and Political Economy: The Rewards and Challenges of Export-Led StrategiesbintangNo ratings yet

- Impactof Foreign Direct Investmenton Economic Growthofthe SAARCCountriesDocument10 pagesImpactof Foreign Direct Investmenton Economic Growthofthe SAARCCountriesHumama Bano M. SadiqNo ratings yet

- Human Capital, Trade, FDI and Economic Growth in Thailand: What Causes What?Document28 pagesHuman Capital, Trade, FDI and Economic Growth in Thailand: What Causes What?zaxaxazNo ratings yet

- Determinants of Foreign Direct Investment in ASEANDocument10 pagesDeterminants of Foreign Direct Investment in ASEANnguyenthanhtien200300No ratings yet

- GE CW2 Video Podcast - 22094111Document11 pagesGE CW2 Video Podcast - 22094111San Thida SweNo ratings yet

- 19305c0003 RM Project SakibDocument11 pages19305c0003 RM Project SakibMohd sakib hasan qadriNo ratings yet

- Foreign Direct Investment and Its Role in The Development of GreeceDocument12 pagesForeign Direct Investment and Its Role in The Development of GreeceHilotescu MarianNo ratings yet

- Final Essay - U7596796 - JoeDocument5 pagesFinal Essay - U7596796 - JoeRobert JoeNo ratings yet

- Macroeconomic Variables and FDI in Pakistan: Iqbal MahmoodDocument6 pagesMacroeconomic Variables and FDI in Pakistan: Iqbal Mahmoodnadeem_skNo ratings yet

- A Literature Review On The Relationship Between Foreign Direct Investment and Economic GrowthDocument4 pagesA Literature Review On The Relationship Between Foreign Direct Investment and Economic GrowthvipultandonddnNo ratings yet

- Resurgent Africa: Structural Transformation in Sustainable DevelopmentFrom EverandResurgent Africa: Structural Transformation in Sustainable DevelopmentNo ratings yet

- School Earthquake Preparedness Evaluation FormDocument2 pagesSchool Earthquake Preparedness Evaluation FormAdrin Mejia75% (4)

- Rapid History Taking: 1. Patient ProfileDocument3 pagesRapid History Taking: 1. Patient ProfileTunio UsamaNo ratings yet

- Fluid Management in NicuDocument56 pagesFluid Management in NicuG Venkatesh100% (2)

- Musical InstrumentsDocument23 pagesMusical Instrumentssirius scottNo ratings yet

- CH 6 Answers (All) PDFDocument29 pagesCH 6 Answers (All) PDFAhmed SideegNo ratings yet

- Different Models of EIDocument13 pagesDifferent Models of EIneena686236No ratings yet

- Far Eastern University Mba - Thesis 060517Document2 pagesFar Eastern University Mba - Thesis 060517Lex AcadsNo ratings yet

- Glorious Mysteries 1Document5 pagesGlorious Mysteries 1Vincent safariNo ratings yet

- Data Iep Goals and Objectives ExampleDocument4 pagesData Iep Goals and Objectives Exampleapi-455438287100% (2)

- High Performance ComputingDocument294 pagesHigh Performance Computingsorinbazavan100% (1)

- Data Processing and Management Information System (AvtoBərpaEdilmiş)Document6 pagesData Processing and Management Information System (AvtoBərpaEdilmiş)2304 Abhishek vermaNo ratings yet

- LADA Niva 1600rebuild1Document39 pagesLADA Niva 1600rebuild1Douglas Antonio Paredes MarquinaNo ratings yet

- Course: Consumer Behaviour: Relaunching of Mecca Cola in PakistanDocument10 pagesCourse: Consumer Behaviour: Relaunching of Mecca Cola in PakistanAnasAhmedNo ratings yet

- Healthy Body CompositionDocument18 pagesHealthy Body CompositionSDasdaDsadsaNo ratings yet

- Project Report - Performance Anaylysis of Mutual Funds in IndiaDocument52 pagesProject Report - Performance Anaylysis of Mutual Funds in Indiapankaj100% (1)

- UW Mathematics Professor Evaluations For Fall 2011Document241 pagesUW Mathematics Professor Evaluations For Fall 2011DPNo ratings yet

- Draft Plant Design PaperDocument65 pagesDraft Plant Design Paper202040336No ratings yet

- A Child With Fever and Hemorrhagic RashDocument3 pagesA Child With Fever and Hemorrhagic RashCynthia GNo ratings yet

- Term Paper Gender RolesDocument5 pagesTerm Paper Gender Rolesea8d1b6n100% (1)

- Scan 03-Jan-2020 PDFDocument2 pagesScan 03-Jan-2020 PDFPavanSharmaNo ratings yet

- A Single-Stage Asymmetrical Half-Bridge Flyback CoDocument16 pagesA Single-Stage Asymmetrical Half-Bridge Flyback CoSantosh KumarNo ratings yet

- 1 Kane Equations - Example 1Document8 pages1 Kane Equations - Example 1Khisbullah HudhaNo ratings yet

- My TestDocument18 pagesMy TestBlessmore Chitanha100% (1)

- Pre-Socratic Pluralism AtomismDocument1 pagePre-Socratic Pluralism AtomismpresjmNo ratings yet

- Another Look at Pistis ChristouDocument17 pagesAnother Look at Pistis Christouakimel100% (1)

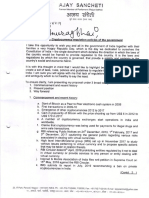

- Former Rajya Sabha MP Ajay Sancheti Appeals Finance Minister To Create New Laws To Regulate Cryptocurrency MarketDocument3 pagesFormer Rajya Sabha MP Ajay Sancheti Appeals Finance Minister To Create New Laws To Regulate Cryptocurrency MarketNation NextNo ratings yet

- Otis C. Mitchell - Hitler-s-Stormtroopers-and-the-Attack-on-the-German-Republic-1919-1933 PDFDocument201 pagesOtis C. Mitchell - Hitler-s-Stormtroopers-and-the-Attack-on-the-German-Republic-1919-1933 PDFbodyfull100% (2)