Professional Documents

Culture Documents

Pinkerton

Uploaded by

David HartleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pinkerton

Uploaded by

David HartleCopyright:

Available Formats

Pinkerton Assignment

1)

a. Pinkertons tax benefits of debt are higher or lower?

Compared to a average firm, Pinkertons tax benefits are way higher, since it is

mainly financed by debt.

b. Pinkertons probability of financial distress is higher or lower?

The probability of financial distress of Pinkerton is higher than an average firm,

since it has high leverage. Perhaps even bankruptcy.

c. Pinkertons costs of financial distress if the firm actually finds itself in financial

distress are higher or lower? What do you think is the most important cost of

financial distress for Pinkerton

The cost of financial distress is way higher because they have a higher debt. Plus,

they decided to allow Berkley to buy shares and to MHTC the right to purchase up to

5% of the common stock. The most important cost of financial distress is that they

are not able to acquire new security firms. They do not have the required funds to

invest into positive NPV projects. They are already losing clients due to premium

pricing. They also have underinvestment due to the debt overhang.

d. The incentive benefits of debt are higher or lower?

Higher, because the higher the debt, the higher the incentive benefits of it

e. Based on the above, should Pinkerton take on more or less debt relative to

anaverage firm?

Since Pinkerton get a higher incentive of benefits of debt, it should take more debt

than an average firm.

f. Do you think Pinkerton has too much or too little debt as of January 1, 1990?

Even thought they should have more debt than the average, they have way too much

debt.

2.

a. Do you think Berkeley is likely to use its warrants?

Yes of course, they have the opportunity to buy a share for 0,0007$ while its market

value is of the shares in 1989 is : 23709000 / 4719569 = 5,0235.

(total equity / number of shares ). Plus, as the end of 1989, 152279 warrants were

already vested.

b. If Pinkerton does not pay down the Berkeley debt within five years (and does not

go ahead with the IPO), what will be the number of shares outstanding as of January

1, 1994?

As in 1989, already has 4719569. Berkley are allowed to get 507597 and already

vested 152279. They will vest all of them, so (507597-152279 = 355318)

In 1994, there will be 4719569 + 355318 = 5,074,887 shares.

c. If Berkeley uses its warrants, how does this affect Pinkertons other shareholders

in qualitative terms?

There will be more shares, thus the value of the shares will decrease by a lot.

Therefore, other shareholders will lose money if Berkley uses it warrants.

3.

a) Calculate Pinkertons asset cost of capital. Assume that the beta given for

Wackenhut is the firms equity beta and that the market risk premium (E(rm) rf) is

6%.

B = 1,3

Rm-rf = 6%

Rf = 10,5 %

10,5 + 1,3 ( 6 ) = 18,30%

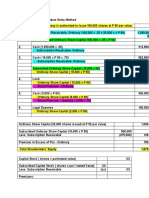

Estimate Pinkertons free cash flows between 1990 and 1999. To do this,

use the financial assumptions on page 5. Your valuation should also assume

that (a) the corporate tax rate is 37%; (b) the growth rates Pinkerton is using

are nominal rates (i.e. not inflation adjusted); (c) the valuation date is

December 31, 1989. Dont forget to deduct depreciation and (tax deductible)

amortization before you arrive at EBIT. Page 5 and footnote 4 details

depreciation, tax deductible amortization and non-tax deductible

amortization.

You might also like

- Analyzing Mercury Athletic Footwear AcquisitionDocument5 pagesAnalyzing Mercury Athletic Footwear AcquisitionCuong NguyenNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Dixon's Purchase On Collinsville: The Victory of LaminateDocument9 pagesDixon's Purchase On Collinsville: The Victory of LaminateJing LuoNo ratings yet

- case-UST IncDocument10 pagescase-UST Incnipun9143No ratings yet

- DYOD Financial AnalysisDocument13 pagesDYOD Financial AnalysisSabyasachi Sahu100% (1)

- Pinkerton (A)Document14 pagesPinkerton (A)Namita Dey33% (3)

- Pinkerton-Case-Study-ivane IosebashviliDocument14 pagesPinkerton-Case-Study-ivane IosebashviliI Iva100% (1)

- Ferrera Gann Angles FormulaDocument29 pagesFerrera Gann Angles FormulaNeoHooda100% (2)

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalNo ratings yet

- Southland Case StudyDocument7 pagesSouthland Case StudyRama Renspandy100% (2)

- New York Times Paywall Group 7Document17 pagesNew York Times Paywall Group 7Amisha LalNo ratings yet

- Midland Energy Resources Case Study: FINS3625-Applied Corporate FinanceDocument11 pagesMidland Energy Resources Case Study: FINS3625-Applied Corporate FinanceCourse Hero100% (1)

- Wk8 Laura Martin REPORTDocument18 pagesWk8 Laura Martin REPORTNino Chen100% (2)

- Corporate Finance UST CaseDocument7 pagesCorporate Finance UST Casepradhu1100% (1)

- Valuing Leveraged Buyouts with the Adjusted Present Value ApproachDocument5 pagesValuing Leveraged Buyouts with the Adjusted Present Value ApproachFelipe Kasai MarcosNo ratings yet

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- Trader Joe'sDocument10 pagesTrader Joe'sShiladitya SwarnakarNo ratings yet

- PinkertonDocument10 pagesPinkertonAlok RajNo ratings yet

- Berkshire - IntroDocument2 pagesBerkshire - IntroRohith ThatchanNo ratings yet

- MEG CV 2 CaseDocument10 pagesMEG CV 2 Casegabal_m50% (2)

- Business Case: Monmouth IncDocument20 pagesBusiness Case: Monmouth IncShamsuzzaman Sun100% (1)

- Assignment #2 Workgroup E IttnerDocument8 pagesAssignment #2 Workgroup E IttnerAziz Abi AadNo ratings yet

- RJR Nabisco 1Document6 pagesRJR Nabisco 1gopal mundhraNo ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Debt Policy at Ust Inc Case StudyDocument7 pagesDebt Policy at Ust Inc Case StudyAnton Borisov100% (1)

- Pinkerton Case QuestionsDocument7 pagesPinkerton Case QuestionsFarrah ZhaoNo ratings yet

- UST IncDocument16 pagesUST IncNur 'AtiqahNo ratings yet

- Winfield ManagementDocument5 pagesWinfield Managementmadhav1111No ratings yet

- Corp Finance HBS Case Study: Debt Policy at UST IncDocument4 pagesCorp Finance HBS Case Study: Debt Policy at UST IncTang LeiNo ratings yet

- RJRJRJJRJRJRJJR111111Document4 pagesRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Statement of Cash Flows Quiz Set ADocument5 pagesStatement of Cash Flows Quiz Set AImelda lee0% (1)

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Master of Business Administration Case 1 - Pinkerton Group 7Document8 pagesMaster of Business Administration Case 1 - Pinkerton Group 7ndiazlNo ratings yet

- JetBlue 2012 Fuel Hedging StrategyDocument3 pagesJetBlue 2012 Fuel Hedging StrategyPritam Karmakar0% (1)

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Saito Solar Teaching NoteDocument8 pagesSaito Solar Teaching NoteANKIT AGARWAL100% (1)

- Trade AcronymsDocument5 pagesTrade AcronymsAnderson FernandesNo ratings yet

- Case Study Debt Policy Ust IncDocument10 pagesCase Study Debt Policy Ust IncWill Tan80% (5)

- True or False Conceptual Framework Set 2Document2 pagesTrue or False Conceptual Framework Set 2Demi Pardillo100% (1)

- Entrepreneurship: Quarter 2 - Module 8 Computation of Gross ProfitDocument23 pagesEntrepreneurship: Quarter 2 - Module 8 Computation of Gross ProfitBergonsolutions Aingel83% (18)

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangNo ratings yet

- Ethical Dilemma of Conflict On Trading FloorDocument10 pagesEthical Dilemma of Conflict On Trading FloorManpreet0711No ratings yet

- Calculate Value at Risk (VaR) for a diversified portfolioDocument11 pagesCalculate Value at Risk (VaR) for a diversified portfolioRashmiroja SahuNo ratings yet

- Boston Beer ValuationDocument7 pagesBoston Beer ValuationAniket Kaushik100% (1)

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Answer 1Document4 pagesAnswer 1steveNo ratings yet

- ONSET VENTURES CASE STUDYDocument4 pagesONSET VENTURES CASE STUDYMichel AbdelmassihNo ratings yet

- Pinkerton (A) - Assignment and Questions For ConsiderationDocument1 pagePinkerton (A) - Assignment and Questions For ConsiderationFarrah ZhaoNo ratings yet

- Tuckefeller - Discussion Materials On Pinkerton - VfinalDocument27 pagesTuckefeller - Discussion Materials On Pinkerton - VfinalBo Wang100% (1)

- UGBA 103 F17 Case 3Document4 pagesUGBA 103 F17 Case 3juan0% (1)

- Sampa Video CaseDocument6 pagesSampa Video CaseRahul BhatnagarNo ratings yet

- Analysis Butler Lumber CompanyDocument3 pagesAnalysis Butler Lumber CompanyRoberto LlerenaNo ratings yet

- ClarksonDocument22 pagesClarksonfrankstandaert8714No ratings yet

- Report On Marvel's Restructuring Dilemma: Financial ManagementDocument19 pagesReport On Marvel's Restructuring Dilemma: Financial Managementebi ayatNo ratings yet

- Warren BuffeDocument4 pagesWarren BuffeastrdppNo ratings yet

- RJR Nabisco Pre-Bid Valuation AnalysisDocument13 pagesRJR Nabisco Pre-Bid Valuation AnalysisMohit Khandelwal100% (1)

- Apache Corporation's Acquisition of MW Petroleum Corp DCF ValuationDocument20 pagesApache Corporation's Acquisition of MW Petroleum Corp DCF ValuationasmaNo ratings yet

- Analyse The Structure of The Personal Computer Industry Over The Last 15 YearsDocument7 pagesAnalyse The Structure of The Personal Computer Industry Over The Last 15 Yearsdbleyzer100% (1)

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDocument2 pagesM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현No ratings yet

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyNo ratings yet

- Netscape Valuation For IPO... PV of FCFsDocument1 pageNetscape Valuation For IPO... PV of FCFsJunaid EliasNo ratings yet

- MAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDocument5 pagesMAS Handout - Risk and Returns, Cost of Capital, Capital Structure and Leverage PDFDivine VictoriaNo ratings yet

- Chapter Test 2Document2 pagesChapter Test 2Charmaine MagyayaNo ratings yet

- CF AGE SM Ch17Document10 pagesCF AGE SM Ch17SK (아얀)No ratings yet

- Midterm Exam - FA2 (Current and Non - Current) With QuestionsDocument5 pagesMidterm Exam - FA2 (Current and Non - Current) With Questionsjanus lopezNo ratings yet

- Capital Structure Limits to DebtDocument9 pagesCapital Structure Limits to DebtArini FalahiyahNo ratings yet

- Pre Market Analysis: Important Price Levels for Today's TradingDocument12 pagesPre Market Analysis: Important Price Levels for Today's TradingVarun VasurendranNo ratings yet

- Finance - WS2Document2 pagesFinance - WS2ElenaNo ratings yet

- Project Selection and Portfolio ManagementDocument28 pagesProject Selection and Portfolio Management胡莉沙No ratings yet

- The Investment Environment - Topic OneDocument39 pagesThe Investment Environment - Topic OneRita NyairoNo ratings yet

- UntitledDocument102 pagesUntitledPrima AditNo ratings yet

- Options, Futures, and Other Derivatives, 8th Edition, 1Document25 pagesOptions, Futures, and Other Derivatives, 8th Edition, 1Anissa Nurlia KusumaningtyasNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Level I of CFA Program 2 Mock Exam June 2020 Revision 1Document40 pagesLevel I of CFA Program 2 Mock Exam June 2020 Revision 1JasonNo ratings yet

- September 08 - Chapter 6-Capital Gains Taxation (Assignment)Document3 pagesSeptember 08 - Chapter 6-Capital Gains Taxation (Assignment)anitaNo ratings yet

- All Practice Set SolutionsDocument22 pagesAll Practice Set SolutionsJohn TomNo ratings yet

- Evaluating Project Risks & Capital RationingDocument53 pagesEvaluating Project Risks & Capital RationingShoniqua JohnsonNo ratings yet

- Fin - 444 - Chapter - 6 - GOVT. INFLUENCE ON EXCHANGE RATESDocument45 pagesFin - 444 - Chapter - 6 - GOVT. INFLUENCE ON EXCHANGE RATESFahimHossainNitolNo ratings yet

- Asset Management RatiosDocument5 pagesAsset Management RatiosJhon Ray RabaraNo ratings yet

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementDocument45 pagesStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshNo ratings yet

- Assessment Year 2022-23 Income Tax Return Filing SchedulesDocument141 pagesAssessment Year 2022-23 Income Tax Return Filing SchedulesMaitri SaraswatNo ratings yet

- Department of Business and Industrial Management G.H. Bhakta Management Academy MBADocument11 pagesDepartment of Business and Industrial Management G.H. Bhakta Management Academy MBAMonalisa BagdeNo ratings yet

- Capital Structure Theories AssumptionsDocument1 pageCapital Structure Theories AssumptionsKamala Kris100% (1)

- ASX Selects DLT To Replace CHESS - Media Release 7 December 2017Document2 pagesASX Selects DLT To Replace CHESS - Media Release 7 December 2017lfsequeiraNo ratings yet

- Mastering Options Trading: by Mentor - Ravi ChandiramaniDocument120 pagesMastering Options Trading: by Mentor - Ravi ChandiramanivivekNo ratings yet

- Exam 3 MBA 631 Spring 22Document8 pagesExam 3 MBA 631 Spring 22Rakesh PatelNo ratings yet

- Sample - Thermax Financial Statement AnalysisDocument25 pagesSample - Thermax Financial Statement Analysispavan79No ratings yet

- Working Capital ManagementDissertation PDFDocument62 pagesWorking Capital ManagementDissertation PDFsame6same100% (2)

- Negotiation and Selling SkillsDocument18 pagesNegotiation and Selling SkillsTanvi JuikarNo ratings yet