Professional Documents

Culture Documents

Webcast On Amendments in Indirect Taxes

Uploaded by

Anu Yashpal KapoorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Webcast On Amendments in Indirect Taxes

Uploaded by

Anu Yashpal KapoorCopyright:

Available Formats

CA Final Course Paper 8: Indirect Tax Laws

Bimal J ain

FCA, FCS, LLB, B.Com (Hons)

1

2

120

When I took over in August, 2012, I made a statement that clarity in tax

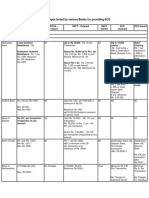

laws, a stable tax regime, a non-adversarial tax administration, a fair

mechanism for dispute resolution, and an independent judiciary will provide

great assurance. That statement is the underlying theme of my tax

proposals, both on the direct taxes side and on the indirect taxes side.

121

An emerging economy must have a tax system that reflects best global

practices. I propose to set up a Tax Administration Reform Commission to

review the application of tax policies and tax laws and submit periodic

reports that can be implemented to strengthen the capacity of our tax

system.

3

4

5

agricultural operations directly related to production of any

agricultural produce including cultivation, harvesting, threshing, plant

protection or seed testing;

S. 66D(d)(i) modified by deleting the word Seed All

testing w.r.t to agriculture or agricultural produce under

Negative List

means any produce of agriculture on which either no further

processing is done or such processing is done as is usually done by

a cultivator or producer which does not alter its essential

characteristics but makes it marketable for primary market

S. 65B(5): Agricultural produce"

Comment: What happen for past period/ Whether Wheat, Rice, etc. covered

under Agricultural Produce

6

Process amounting to manufacture or production of goods" means a

process on which duties of excise are leviable under section 3 of the

Central Excise Act, 1944 or the Medicinal and Toilet Preparations

(Excise Duties) Act, 1955 or any process amounting to manufacture

of alcoholic liquors for human consumption, opium, Indian hemp and

other narcotic drugs and narcotics on which duties of excise are

leviable under any State Act for the time being in force

Definition of Process amounting to manufacture or

production of goods in S. 65B(40) expanded

Comment: Amendment is not made retrospective

7

a course run by an industrial training institute or an industrial training

centre affiliated to the National Council for Vocational Training or

State Council for Vocational Training offering courses in

designated trades notified under the Apprentices Act, 1961; or

a Modular Employable Skill Course, approved by the National

Council of Vocational Training, run by a person registered with the

Directorate General of Employment and Training, Union Ministry of

Labour and Employment; or

a course run by an institute affiliated to the National Skill

Development Corporation set up by the Government of India;

S. 66D(l) - Pre-School & Higher Secondary/ Certified courses

recognized by Law/ Approved Vocational course - S. 65B (11)

Comment: Courses run by State Council for vocational training not taxable/ No

benefits for past period i.e. prior to 10-5-2013

8

S. 66BA introduced to refer to S. 66 as S. 66B

with effect from 01.07.2012

S. 66B There shall be levied a tax at the

rate of 12% on the value of all services, other

than those services specified in the negative

list, provided or agreed to be provided in the

taxable territory by one person to another and

collected in such manner as may be

prescribed

9

Where SCN issued invoking extended period of limitation

By alleging i.e. Fraud/ Collusion/ Willful misstatement/ Suppression

of Facts/ Contravention of any of the provisions of Chapter V of the

Finance Act or rules made thereunder.

Vacated by the Appellate Authorities/ Tribunal/ Court

S. 73(2A) Central Excise Officers allowed to determine the

demand for the Shorter period of 18 months 1/4/2013

Comments:

Reduce litigation to certain extent/ SCN holds good for 18 months.

Similar provisions already exist in Excise Law under Section 11A(9) of the

Central Excise Act, 1944.

10

Earlier provisions: Higher of Rs. 200/- Per day or Rs. 10,000/-

Comment:

Welcome Relief to Assessee having long period of defaults but what

about for past period??

Section 77(1)(a) Penalty 1/4/2013

Any person who is liable to pay service tax, or required to take

registration, fails to take registration in accordance with the

provisions of section 69 or rules made under this Chapter shall be

liable to pay a penalty which may extend to ten thousand rupees or

Rs. 200/- for every day during which such failure continues,

whichever is higher, starting with the first day after the due date, till

the date of actual compliance;

11

Introduced to impose penalty which may extend to Rs. 1 lakh on :

Directors, Manager, Secretary and other officials of the

Company, who was in charge of and was responsible to the

Company for the conduct of business of such company and

was knowingly concerned with such contravention, for

specified offences:-

Evasion of Service Tax

Issuance of Invoice/ Bill/ Challan without provision of Service/

Violation of Rules

Availment and utilisation of Credit of taxes and duty without

actual receipt of Taxable services or excisable goods/

Violation of Rules

Failure to pay beyond 6 months of Service Tax already

collected

New S. 78A Penalty for Offences by director, etc., of Company -1

st

April, 2013

Comments: Bailable or Non-Bailable Offence

12

(5) The Appellate Tribunal may admit an appeal or permit the

filing of a memorandum of cross-objections after the expiry of

the relevant period referred to in sub-section (3) sub section (1)

or sub section (3) or sub-section (4) if it is satisfied that there

was sufficient cause for not presenting it within that period.

(1) Any assessee aggrieved by an order passed by a

Commissioner of Central Excise under section 73 or section

83A, or an order passed by a Commissioner of Central Excise

(Appeals) under section 85, may appeal to the Appellate Tribunal

against such order within three months of the date of receipt of

the order.

S. 86 - Appeals to Appellate Tribunal: Condonation of Delay -1/4/2013

Comments: Welcome Change to condone the delay wherever

sufficient cause exists

13

S. 89(1) Offences and Penalties - Whoever commits any of the following offences:-

(a) Evasion of

Service Tax

(b) Availment and

utilisation of Credit

without actual

receipt of Taxable

services or

excisable goods/

Violation of Rules

(c) Maintains false

books of Accounts or

fails to supply

information/ supply

false information

(d) Fails to pay

beyond 6 months,

ST already

collected

(i) Where amount exceeds Rs. 50 Lakhs Imprisonment

up to 3 Years Reasonable cause: 6 Months

(ii) Where amount

exceeds Rs. 50

Lakhs

Imprisonment

up to 7 Years

Reasonable

cause: 6 Months

(iii) For any other offences (<Rs. 50 Lakhs) Imprisonment up to 1 Year

14

S. 89 (2): Subsequent Offences and Penalties If any person

convicted of offence punishable 1/4/2013

Under (i) 3 Yrs/ 6 Months or (iii) 1 Yr then he shall be punished for every

subsequent offence with imprisonment for a term up to 3 Yrs.

Under (ii) 7 Yrs/ 6 Months then he shall be punished for every subsequent

offence with imprisonment for a term up to 7 Yrs.

Comments:

More Stringent provisions when Fails to pay beyond 6 Months, Service

Tax already collected

15

S. 90(1)

(inserted)

Offence of Failure to pay beyond 6 months - Service Tax

already collected Cognizable/ Non Bailable

S. 90(2)

Notwithstanding anything contained in the Code of Criminal

Procedure, 1973, all other offences, shall be non-cognizable

and Bailable.

Comments: Override Om Prakash vs. UOI [2011 (272) ELT 321 (SC)] wherein it

was held that all offences in central excise or customs are Bailable offences.

16

Under S. 89(1)(i) - Evasion of Service Tax/ Availment and

utilisation of Credit without actual receipt of Taxable services

or excisable goods/ Maintains false books of Accounts or fails

to supply information or

Under S.89(1)(ii) - Fails to pay beyond 6 months, ST already

collected

S. 91(1): If Commissioner (CE) has reason to believe that any

person has committed specified offence: (1/4/2013)

Then he may by general or special order, authorise any officer of

CE, not below the rank of Superintendent of Central Excise, to arrest

such person.

17

To inform such person of the grounds of arrest and produce

him before a magistrate within 24 hours

S. 91(2) In case of Arrest for any Cognizable or Non-Bailable offence

AC or DC, as the case may be, shall, for the purpose of

releasing an arrested person on bail or otherwise, have the

same powers and be subject to the same provisions as an

officer in charge of a police station has, and is subject to,

under section 436 of the Code of Criminal Procedure,

1973.

S. 91(3) In case of a Non-Cognizable or Bailable offence

All arrests under this section shall be carried out in

accordance with the provisions of the Code of Criminal

Procedure, 1973 relating to arrests

S. 91(4)

18

No service tax shall be levied or collected/ No

refund shall be made of service tax paid, in

respect of taxable services provided by the Indian

Railways during the period prior to October 2012

19

Non Filers/ Stop Filers

Any person in respect of which no notice or an

order of determination under Section 72 or

Section 73 or Section 73A of the Chapter has

been issued or made before the 1

st

day of

March, 2013

Eligible Person who may availed VCES

20

Filed Truthful Return but not deposited ST

an inquiry or investigation has been in respect of a service tax

not levied or not paid or short-levied or short-paid initiated by way

of

Search of premises under section 82 of the Chapter; or

Issuance of summons under section 14 of the Central Excise Act,

1944, as made applicable to the Chapter under section 83

thereof; or

Requiring production of accounts, documents or other evidence

under the Chapter or the 40 rules made thereunder;

an audit has been initiated,

Ineligible Person

and such inquiry, investigation or audit is pending as on the 1st day

of March, 2013

21

Period for

Declaration

Defaulter require

to make a truthful

declaration of all

his pending tax

dues from

October 1, 2007

to December 31,

2012 on or before

31-12-2013

Pay at least half

of that dues

before December

31, 2013 and

remaining half to

be paid by:

J une 30, 2014 without

interest; or

By December 31,

2014 with interest

from J uly 1, 2014

onwards;

No Refund of

payment made

under VCES

Fails to pay

declared Amount:

To be recovered as

an arrear of land

revenue u/s 87

Can be recovered by

attaching the movable

and immovable

properties of the

declarant

22

Immunity from Interest/

Penalty/ other

Proceedings

On compliance with all the

requirements the person will

have complete immunity

Pay Normal liability from

January, 2013 as normally

being paid under the

present law

Failure to make true

declaration

Where CCE has reasons to

believe that declaration

made by a declarant was

substantially false, he may,

for reasons to be recorded

in writing, serve notice within

one yr from the date of

declaration on declarant

requiring him to show

cause why he should not

pay the tax dues not paid

or short-paid.

23

Notification No.

Description

2/2013 Service Tax

Amend Abatement Notification No. 26/2012- Service

Tax, dated 20th J une, 2012

Effective from: 1-3-2013

3/2013 Service Tax

Amend Mega Exemption Notification No. 25/2012-

Service Tax, dated 20th J une, 2012

Effective from 1-4-2013

4/2013 Service Tax

Has Notified the resident public limited company as a

class of persons under sub-clause (iii) of clause (b) of

section 96A of the Finance Act, 1994.

Effective from 1-3-2013

24

25

CONSTRUCTION SERVICE

COMMERCIAL UNITS

70% OF GROSS

AMOUNT CHARGED

RESIDENTIAL UNITS

Abatement available to developers/ builders of complex, building or

civil structure is reduced from existing 75% to 70% in following cases:-

26

Comments: Further the same is amended vide Notification No.9/2013-ST

dated 8-05-2013

Abatement in case of Residential Unit

Is the carpet area

<2000 sq. ft. and

the amount

charged <1 Crore

Abatement is 70%

of the gross amount

charged

No

Yes

Abatement is 75% of the gross amount charged

27

Abatement available to developers/ builders of complex,

building or civil structure is reduced from existing 75% to

70% in following cases:-

Residential properties having a carpet area > 2000 sq ft and where

amount charged is > Rs. 1 crore,

Commercial properties.

No Credit of Inputs + Value of Land included

Rule 2A Original Works/ Other than Original Works/ R&M Services

40%/ 60%/ 70%

Comments: Further the same is amended vide Notification

No.9/2013-ST dated 8-05-2013

28

29

Under S. no. 9 - Exemption by way of auxiliary educational services and

renting of immovable property provided by specified educational institutes will

not be available

Services provided to or by an educational institution in respect of education

exempted from service tax, by way of,-

(a) auxiliary educational services; or

(b) renting of immovable property;

auxiliary educational services means any services relating to imparting any skill,

knowledge, education or development of course content or any other knowledge

enhancement activity, whether for the students or the faculty, or any other services which

educational institutions ordinarily carry out themselves but may obtain as outsourced

services from any other person, including services relating to admission to such

institution, conduct of examination, catering for the students under any mid-day meals

scheme sponsored by Government, or transportation of students, faculty or staff of such

institution;

Comment: Specified education still exempted from Service Tax

[Section 66D(l)]

30

Under S. No. 15 - Benefit of exemption in relation to

copyrights for cinematograph films will now be available

only to films exhibited in a cinema hall or theatre

Temporary transfer or permitting the use or enjoyment of a copyright:

covered under clauses (a) or (b) of sub-section (1) of section 13 of the Indian Copyright

Act, 1957 (14 of 1957), relating to original literary, dramatic, musical, artistic works or

of cinematograph films for exhibition in a cinema hall or cinema theatre;

Comment:

Cinematographic films exhibited on TV, Internet, etc. not exempt

31

Under S. No 19 - Exemption will now be available only to non-air-

conditioned or non-centrally air-heated restaurants; the dual requirement

earlier that it should have air-conditioner and license to serve alcohol is

being done away with; - Rule 2C - 40% (No Cenvat on Input)

CERTAIN CLARIFICATIONS -CIRCULAR NO. 173/8/2013-ST DT.07-

10-2013:

Ques In a complex where air conditioned as well as non-air

conditioned restaurants are operational but food is sourced from

the common kitchen, will service tax arise in the non-air

conditioned restaurant?

Reply If restaurants clearly demarcated and separately named.

No ST -- on Service provided in a non air-conditioned or non

centrally air- heated restaurant. Treat it as exempted service.

32

CERTAIN CLARIFICATIONS -CIRCULAR NO. 173/8/2013-ST Dated

07-10-2013 (continued):

Ques In a hotel, if services are provided by a specified restaurant in other

areas e.g. swimming pool or an open area attached to the restaurant,

will service tax arise?

Reply Service Tax Applicable.

Ques Is Service Tax leviable on goods sold on MRP basis across the

counter as part of the Bill/ invoice

Reply No Service Tax Applicable, if goods sold on MRP basis (fixed under

the Legal Metrology Act).

,.

33

Under S. No. 20 Earlier exemptions withdrawn of Services by way

of transportation by rail or a vessel from one place in India to

another of the following goods -

(a) petroleum and petroleum products falling under Chapter heading 2710

and 2711 of the First Schedule to the Central Excise Tariff Act, 1985 (5

of 1986);

(b) relief materials meant for victims of natural or man-made disasters,

calamities, accidents or mishap;

(c) defence or military equipments;

(d) postal mail or mail bags;

(e) household effects;

(f) newspaper or magazines registered with the Registrar of Newspapers;

(g) railway equipments or materials;

(h) agricultural produce;

(i) foodstuff including flours, tea, coffee, jaggery, sugar, milk products, salt

and edible oil, excluding alcoholic beverages; or

(j) chemical fertilizer and oilcakes

34

Under S. No. 21 - Services provided by GTA - Enlarged

(a) agricultural produce; (b) goods, where gross amount charged for the

transportation of goods on a consignment transported in a single

carriage does not exceed one thousand five hundred rupees; (c) goods,

where gross amount charged for transportation of all such goods for a

single consignee does not exceed rupees seven hundred fifty; (d)

foodstuff including flours, tea, coffee, jaggery, sugar, milk products, salt and

edible oil, excluding alcoholic beverages; (e) chemical fertilizer and oilcakes;

(f) newspaper or magazines registered with the Registrar of

Newspapers; (g) relief materials meant for victims of natural or man-made

disasters, calamities, accidents or mishap; or (h) defence or military

equipments;

Earlier: (a) fruits, vegetables, eggs, milk, food grains or pulses in a goods

carriage; Clause (b) and (c) above

35

Under S. No. 24 - Exemptions for vehicle parking to general public are being

withdrawn

Under S. No 25 - Exemption for repair or maintenance service provided to

Government, Local authority or Governmental authority of aircrafts are being

withdrawn but for vessel, exemption will continue

The definition of charitable activities is being changed by deleting the portion

listed in sub-clause (v) of clause (k). Thus the benefit to charities providing

services for advancement of any other object of general public utility up to Rs.

25 Lakh will not be available. However the threshold exemption will continue to

be available up to Rs 10 lakh.

W.e.f. 1.03.2013 - Benefit of Advance Ruling Authority is being

extended to Resident public limited companies under Section 96A

(b)(iii) of the Finance Act

Public company as defined in section 3(1)(iv) of the Companies Act

1956 and Resident as defined in section 2(42) of the Income Tax

Act,1961

36

37

Notification No.

Description

5/2013-ST dt.

10-04-2013

W.e.f. 1.06.2013, Form of appeal or Memorandum of Cross-

Objections to the Appellate Tribunal has been revised under

Service Tax.

Similarly, vide Notification No. 6/2013-C.E. (N.T.), and Notification

No. 37/2013-Cus. (N.T.) both dt.10-4-2013 Forms have been

revised under Central Excise and Customs respectively, which are

also effective from 1.06.2013.

6/2013-ST / 7/2013- ST

dt. 18-04-2013

Regarding exemption under Focus Market Scheme. Notification

shall be applicable to the Focus Market Scheme duty credit scrip

issued to an exporter by the Regional Authority in accordance with

paragraph 3.14/ 3.15 of the Foreign Trade Policy.

8/2013 ST

dt.18-04-2013

Regarding Exemption under Vishesh Krishi and Gram Udyog

Yojana (VKGUY)

38

Notification No.

Description

9/2013-ST dt.

8-05-2013

Amends Notification No.26/2012-Service Tax, dated the 20

th

J une,

2012.

10/2013-ST dt.

13-05-2013

Service Tax Voluntary Compliance Encouragement Rules, 2013 were

provided to facilitate successful implementation of VCES

11/2013-ST dt.

13-06-2013

Amendments in the Notification No.6/2013-ST dt. 18-4-2013

12/2013-ST dt.

1-07-2013

Specified Services provided to a unit located in a SEZ or Developer of

SEZ and used for the authorised operation exempt either ab-initio or

by way of refund

39

40

Sr. No. 9A. Any services provided by-

(i) the NSDC set up by the GOI;

(ii) a Sector Skill Council approved by the NSDC;

(iii) an assessment agency approved by the Sector Skill Council or the

NSDC;

(iv) a training partner approved by the NSDC or the Sector Skill Council

in relation to (a) the National Skill Development Programme implemented

by the NSDC; or (b) a vocational skill development course under the

National Skill Certification and Monetary Reward Scheme; or (c) any other

Scheme implemented by the NSDC

Where NSDC stands for National Skill Development Corporation

41

42

19A. Services provided in relation to serving of food

or beverages by a canteen maintained in a factory

covered under the Factories Act, 1948 (63 of 1948),

having the facility of air-conditioning or central air-

heating at any time during the year.

43

Circular No

Description

168/3/2013-ST dt. 15-04-2013

Tax on service provided by way of erection of pandal or

shamiana

169/4/2013-ST dt. 13-05-2013 and

170/5/2013-ST dt. 8-08-2013

Clarification Regarding VCES

171/6/2013-ST dt. 7-09-2013

Guidelines for arrest and bail in relation to offences

punishable under the Finance Act, 1994

172/7/2013-ST dt.19-09-2013

Clarification Regarding Education services (Auxiliary

Educational Services is explicitly defined )

173/8/2013-ST dt. 07/10/2013 Clarification Regarding Restaurant Service

44

Service includes a declared service [S-65B (44) of the Finance

Act, 1994]

Activity by way of erection of pandal or shamiana is a declared

service, u/s 66E.

For a transaction to be regarded as transfer of right to use

goods, the transfer has to be coupled with possession

Does not fulfill the attributes to qualify as transfer of right to

use goods, as held in BSNL Vs. UOI [2006] 3 STT 245 Honble

Supreme Court.

Whether erection of pandal or shamiana amounts to

transaction involving transfer of right to use goods and hence

deemed sale NO

45

46

Threshold limit for punishment up to 7 years in an offence relating

to evasion of duty

Has been increased from Rs. 30 Lakh to Rs. 50 lakh

Comment: This limit was raised from 1 Lakh to 30 Lakh w.e.f. 01.04.12

47

All offences in Section 9 non-cognizable i.e. Bailable

Only following offences are cognizable/ Non-Bailable:

if duty liability exceeds Rs. 50 Lakhs, and

Offence of the person is that he:

Evades the payment of any duty payable under this Act

Contravenes any of the provision of this Act or the Rules made

there under in relation to credit of any duty allowed to be utilized

towards payment of excise duty on final products.

Comments: This amendment partially overcomes the Supreme Court

judgment in Om Prakash v UOI 2011 (272) ELT 321 (SC) which held

that all offences in Central Excise are non cognizable

48

Comments:

- These powers existed in income tax and in service tax [S. 87(b)].

- Similar provision have been introduced in Customs under S -142(1) (d)

S. 11 is amended to provide:

for recovery of money due to the Central Government from any other

person who owes money to such person other than the defaulter after

giving such other person a notice in writing,

the person to whom such notice has been issued shall be bound to

comply, and

if the person to whom the notice is issued fails to comply, he shall be

deemed to be a defaulter in respect of the amount specified in the

notice.

49

Comments :

This provision is already there in service tax

In case of continuing issues, CE Dept. not required to issue a

SCN each time

A statement containing the details of duty not paid, short levied or

erroneously refunded shall deemed to be service of SCN if any notice

or notices are already being issued under S. 11A (1) or (3) or (4) or (5).

50

Comments:

in case of collusion/ wilful statement/suppression of facts

SCN issued under section 11A(4)

Section 11A amended w.e.f. 8.4.2011 and extended period put

into sub section (4). Earlier it was under sub section (1)

Section 11DDA(1) was not amended to take care of this change

Now, property can be provisionally attached of the persons to whom

notice has been served u/s 11A(4) i.e. fraud, collusion, Suppression,

Wilful etc.

51

Comments:

This seems to be clarificatory

This is so because Advance ruling as presently defined 23A(b)

advance ruling" means the determination, by the Authority, of a

question of law or fact specified in the application regarding the

liability to pay duty in relation to an activity which is proposed to

be undertaken, by the applicant;

Definition of Activity means production or manufacture

of goods and includes any new business of production

or manufacture proposed to be undertaken by the

existing producer or manufacturer, as the case may be.

Comment: Earlier only cenvat credit of excise duty paid or deemed to

have paid on the goods used in or in relation to the manufacture of the

excisable goods was admissible.

52

S.23C(2)(e) admissibility of credit of service tax paid or deemed to have

been paid on input service or excise duty paid or deemed to have paid on

the goods used in or in relation to the manufacture of the excisable goods.

53

Comments: The same change has been brought in Service

tax S 86(7) and Customs Third Proviso to Section 129B(2A)

New proviso is inserted after 2nd proviso of section 35C (2A).

Provided also that where such appeal is not disposed of within the period

specified in the first proviso, the Appellate Tribunal may, on an application made

in this behalf by a party and on being satisfied that the delay in disposing of the

appeal is not attributable to such party, extend the period of stay to such further

period, as it thinks fit, not exceeding 185 days, and in case the appeal is not so

disposed of within the total period of 365 days from the date of order referred to

in the first proviso, the stay order shall, on the expiry of the said period, stand

vacated.

54

Comments:

Similar amendment also made in Customs u/s 129C(4)(c)

Service tax appeal section borrow the powers / procedure from

central excise.

Hence this change also applicable for service tax

S. 35D(3)(b) is being amended to enhance the monetary

limit of the Single Bench of the Tribunal to hear and

dispose of appeals from Rs.10 lakh to Rs.50 lakh.

55

Speed

Post with Proof

of delivery or

courier

approved by

CBEC

Registered post

with

acknowledgment

due

Tendering

(Physical

delivery)

Added by the Finance Act, 2013

Modes of service of decisions/ orders/summons/notices u/s 37(1)(a)

56

Notification No

Description

1/2013 CE (N.T)

dt.1.03.2013

Seeks to amend notification No. 49/2008- CE (N.T.), dt. 24-12-2008, so

as to prescribe MRP based assessment with 35% abatement thereon,

for branded medicaments used in Ayurvedic, Unani, Sidha,

Homeopathic or Bio- Chemic systems and to align the tariff lines relating

to Pressure Cooker with HS 2012 .

2/2013 CE (N.T)

dt.1.03.2013

Seeks to further amend Notification No. 4/2002-CE (N.T.), dt. 1.03.2002

so as to make provision for interest on refund, subject to sub-rule (6),

arising out of an order of final assessment under sub-rule (3) of rule 7 of

the Central Excise Rules, 2002. (Supra)

3/2013 CE (N.T.)

dt.1.03.2013

Seeks to amend Notification No. 23/2004-CE (N.T.), dt.10.9.2004, so as

to provide a mode of recovery of CENVAT credit wrongly taken, under

the CENVAT Credit Rules, 2004.

4/2013 CE (N.T.)

dt.1.03.2013

Seeks to notify the resident public limited company as a class of

persons under the sub-clause (iii) of clause (c) of section 23A of Central

Excise Act, 1944.

57

Rule 7(5) of Central Excise Rules, 2002 has been

amended to provide be interest on refund arising out

of finalization of provisional assessment will be

computed in terms of S 11BB of the Excise Act,1944

i.e., from the date immediately after the expiry of 3

months from the date of receipt of refund application

till the date of refund of such duty.

58

Proviso inserted to sub-rule 5B of Rule 3 of Cenvat Credit Rules, if

the manufacturer of goods or the provider of output service fails to pay

the amount payable

Under sub-rules (5) i.e. inputs or capital goods removed as such,

under sub-rules (5A) i.e. the capital goods are removed after

being used, whether as capital goods or as scrap or waste, and

under sub rules (5B) i.e. input, or capital goods before being put

to use is written off fully or partially,

Then, it shall be recovered, in the manner as provided in Rule 14, for

recovery of CENVAT credit wrongly taken.

59

Notification No

Description

5/2013 CE (N.T)

dt.6.03.2013

Seeks to further amendment in the notification of the Government of

India in the Ministry of Finance (Department of Revenue) number

14/2002-Central Excise (N.T.), dated the 8th March, 2002 .

6/2013 CE (N.T)

dt.10.04.2013

Amends forms for filing appeal in the CESTAT (E.A.-3, E.A.-4, E.A.-5).

7/2013, 8/2013 and

9/2013 CE (N.T.)

dt.23.05.2013

Seeks to allow duty free sale of goods manufactured in India to the

International passengers or members of crew at the DFSs located at

the arrival / departure hall of International Airports and specify the

procedures relating thereto.

10/2013 CE (N.T.)

dt. 2.08.2013

Regarding exemption of Excise duty leviable on the specified goods

affixed with brand name or trade name of another person

60

Notification No .

Description

11/2013 CE (N.T)

dt.2.08.2013

Provides for exemption from registration of premises for affixing lower

ceiling prices on pharmaceutical products to comply with the

notifications issued by the National Pharmaceutical Pricing Authority

under Drugs (Prices Control) Order, 2013

Central Excise - CE

(NT) - F. No.

209/08/2011-CX.6 -

13-08-2013

Corrigendum - Notification No. 08/2013-Central Excise (N.T.), dt.

23.05.2013.

Central Excise - CE

(NT) -

F.No.209/08/2011-

CX.6 - 13-08-2013

Corrigendum - Notification No. 09/2013- Central Excise (N.T.), dt.

23.05.2013.

12/2013 CE (N.T)

dt.27.09.2013

Amendment in Cenvat Credit Rules, 2004

13/2013 CE (N.T)

dt.25.10.2013

Amendment in the Notification No. 20/2006-Central Excise (N.T.)

61

Notification No .

Description

13/2013 CE-dt.

25-03-2013

Seeks to amend the notification No. 64/95 - CE dated 16th March, 1995

to provide exemption to project ASTRAs

14/2013 CE-dt.

18-04-2013

Regarding Exemption under Post Export EPCG Duty Credit Scrip.

15/2013 CE-dt.

8-05-2013

Amends Notifications No. 34/2006-Cx,31/2012-Cx and 33/2012-Cx.

16/2013 CE-dt.

8-05-2013

Seeks to amend notification Nos. 1/2011-Central Excise and 2/2011-

Central Excise both dated the 1st March, 2011 and 12/2012-Central

Excise, dated 17th March, 2012

17/2013 CE-dt.

16-05-2013

Seeks to amends Notifications No. 34/2006-CE, 29/2012-CE, 30/2012-

CE,32/2012-CE and 33/2012-CE.

62

Notification No

Description

18/2013 and

19/2013 CE

dt.23.05.2013

Seeks to allow duty free sale of goods manufactured in India to the

International passengers or members of crew at the DFSs located at the

arrival / departure hall of International Airports and specify the

procedures relating thereto.

20/2013 CE

dt.05.06.2013

Amends Notification No. 12/2012-Central Excise, dated the 17th March,

2012

21/2013 CE-dt.

13-06-2013

Amends Notification No. 30/2012-Central Excise dated the 9th J uly,

2012

22/2013 CE-dt.

29-07-2013

Seeks to exempt central excise duty on the scheduled formulations as

defined under the Drugs Price Control Order (DPCO), 2013 and which

are subjected to re-printing, re-labeling, re-packing or stickering, in

pursuance of the provisions contained in the said Order, in a premises

which is not registered under the Central Excise Act, 1944 or the rules

made thereunder

23/2013 CE-dt.

31-07-2013

Amendment in Notification Nos. 1/2011-Central Excise, dated the 1st

March, 2011 and 12/2012-Central Excise, dated the 17th March, 2012

63

Notification No

Description

24/2013 CE

dt.2.08.2013

Seeks to amends Notifications No.12/2012-Central Excise, dated the

17th March, 2012

25/2013 CE

dt.13.08.2013

Seeks to amends Notifications No.12/2012-Central Excise, dated the

17th March, 2012

26/2013 CE-dt.

30-08-2013

Amends Notification No. 64/95-CE

27/2013 CE-dt.

30-08-2013

Amends in the notification of the Government of India, in the Ministry of

Finance (Department of Revenue), No. 12/2012-Central Excise, dated

the 17th March, 2012

28/2013 CE-dt.

30-08-2013

Seeks to amend Notification No 10/1997 - CE, dated 01.03.1997

64

Circular No

Description

968/02/2013-CX - 01-04-2013

Clarification regarding admissibility of exemption under

area-based Notifications No. 49/2003-Central Excise and

50/2003-Central Excise, both dated 10.06.2003 reg.

969/03/2013-CX - 11-04-2013 Amendment to CESTAT Appeal Forms

970/04/2013-CX - 23-05-2013

Procedure governing the movement of excisable

indigenous goods to the Warehouses or retail outlets of

Duty Free Shops appointed or licensed under the

Customs Act, 1962 Regarding

971/05/2013-CX - 29-05-2013

Regarding writing off of arrears of Central Excise duty,

Customs duty and Service Tax - Constitution of

Committees to advise the authority for writing off of

arrears

65

Circular No

Description

F.No.390/Misc./163/2010-J C

- 03-06-2013

Reduction of Government litigation - providing monetary

limits for filing appeals by the Department before

CESTAT/High Courts and Supreme court Regarding

972/06/2013.CX - 24-07-2013

Applicable excise duty on Sedan cars like Maruti SX4,

Honda Civic, Toyota Corolla Altis under notification No.

12/2013-CE dated 1st March, 2013 - regarding

973/07/2013-CX - 04-09-2013

Regarding reversal of amount under Rule 6(3) the CCR,

2004 on domestic clearances under Notification

Nos.29/2012-CE, 30/2012-CE, 31/2012-CE, 32/2012-CE

and 33/2012-CE all dated 9th J uly, 2012

974/08/2013-CX - 17-09-2013 Regarding Arrest and Bail under Central Excise Act, 1944

66

67

Therefore, Central Government is empowered to prohibit importation or

exportation of goods for protection designs and geographical indications

S-11(1) empowers Central Government to prohibit either absolutely or

conditionally, import or export of specified goods for any purpose

enumerated in S-11(2)

Clause (n) of S-11(2) has been amended to include designs and

geographical indications also.

S. 11(2)(n) the protection of patents, trade marks copyrights, designs and

geographical indications;

No Refund And Recovery If the Amount of Customs

Duty, is < Rs. 100/-

68

Prior to 10.05.2013

No minimum limit for refund

of customs duty exist

On or After 10.05.2013

Third Proviso to S-27(1)

inserted

REFUND

Prior to 10.05.2013

No minimum limit for

recovery of customs duty

exist

On or After 10.05.2013

Third Proviso to S-28(1)

inserted

RECOVERY

Provisional attachment of property may be ordered in case of non

payment of duty on account of fraud, suppression of facts etc. as

well.

Section 28 BA(1) Where, during the pendency of any

proceeding under section 28 or section 28AAA or section 28B,

the proper officer is of the opinion that for the purpose of

protecting the interests of revenue, it is necessary so to do, he

may, with the previous approval of the Commissioner of

Customs, by order in writing, attach provisionally any property

belonging to the person on whom notice is served under sub-

section (1) or sub-section (4) of section 28 or sub-section (3) of

section 28AAA or sub-section (2) of section 28B, as the case

may be, in accordance with the rules made in this behalf under

section 142.

69

Scope of Advance Ruling widened

Section 28E(1)(a) activity means import or export and includes any new

business of import or export proposed to be undertaken by the existing

importer or exporter, as the case may be

CBEC to be empowered to permit the landing of vessels and aircrafts at any

place other than customs port or customs airport.

Section 29(1)The person-in-charge of a vessel or an aircraft entering India

from any place outside India shall not cause or permit the vessel or aircraft

to call or land -

a) for the first time after arrival in India; or

b) at any time while it is carrying passengers or cargo brought in that

vessel or aircraft;

at any place other than a customs port or a customs airport, as the case may

be unless permitted by the Board

70

Duty free allowance in respect of jewellery for an Indian passenger who has been

residing abroad for over one year or a person who is transferring his residence to

India raised from Rs.10,000 to Rs.50,000 in case of a gentleman passenger and from

Rs.20,000 to Rs.1,00,000 in case of a lady passenger.

Import/export general manifest to be filed electronically. However, Commissioner of

Customs may, in cases where it is not feasible to electronically present the same,

allow the same to be delivered in any other manner. [S-30(1) and 41(1)]

Interest free period for payment of import duty is reduced from five days to two

days.[S- 47(2)]

Thirty days time period for storage of imported goods, pending clearance, in a public

or private warehouse has been introduced. However, Commissioner of Customs may

extend the period of storage for further period not exceeding thirty days at a time. [S-

49]

71

72

Offences under the Customs Act, 1962

Non- Bailable Offences

Prohibited Goods

Evasion/ attempted evasion of duty > 50

Lakhs

Import/ Export of any goods improperly declared and the market price

> Rs. 1 Crore

Fraudulently availing of drawback or any exemption from duty, if amount

of drawback/ exemption fom duty exceed ` 50 Lakhs

Bailable Offences

All other offences under the

Customs Act

Any warehoused goods may be

exported to a place outside India

without payment of import duty if a

shipping bill or a bill of export in

prescribed form or label or declaration

accompanying the goods as referred to

in section 82 (postal export documents)

has been presented in respect of such

goods. [S 69(1)(a)]

The threshold limit for punishment in an

offence relating to evasion of duty or

fraudulent availment of drawback or

exemption from duty in connection with

export of goods is increased from Rs.30

lakhs to Rs.50 lakhs. [S 135(1)(i)]

Provision of S-143A providing option for

duty deferment for adjustment of duty

payable against the drawback has been

omitted.

Proper officer may, on the entry or

clearance of any goods or at any time

while such goods are being passed

through the customs area, take samples

of such goods for examination or

testing, or for ascertaining the value. No

duty shall be chargeable such sample.

[4-144]

73

Customs house agents to be

known as customs brokers.

Person who has committed

offence under Finance Act is

also disqualified to act as

authorized representative [S-

146A (4)(b)]

S-146A of the Customs Act has

been amended to include

competent authority under

Finance Act to determine

eligibility of a person to be

authorised representative on the

basis of his solvency status.

S-147(3) of the Customs Act has

been amended to enhance the

liability of agents of the owner,

importer or exporter of any

goods.

74

75

Consensus emerging between Central & State Govts

Place Constitutional Amendment Bill before Parliament during

Budget session

Allocated Rs. 9,000 Cr towards CST compensation to States

Work upon GST Rules & Legislation

No clarity on date of GST implementation

76

Follow your passion,

be prepared to work hard, sacrifice

and above all,

don't let anyone limit your dreams

Donovan Bailey

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Fema PMDocument37 pagesFema PMAnu Yashpal KapoorNo ratings yet

- Salary Deduction and Salary ExemptionsDocument2 pagesSalary Deduction and Salary ExemptionsAnu Yashpal KapoorNo ratings yet

- 16th Feb 13 Accounting TheoryDocument26 pages16th Feb 13 Accounting TheoryAnu Yashpal KapoorNo ratings yet

- Law 2013 Amendments - MemorendumsDocument18 pagesLaw 2013 Amendments - MemorendumsAnu Yashpal KapoorNo ratings yet

- DTLCase Laws RTPof ICAIDocument25 pagesDTLCase Laws RTPof ICAIAnu Yashpal KapoorNo ratings yet

- Sebi PMDocument42 pagesSebi PMAnu Yashpal KapoorNo ratings yet

- DT Case Laws For Nov 2012 FinalDocument0 pagesDT Case Laws For Nov 2012 FinalAnu Yashpal KapoorNo ratings yet

- Report On Synthetic FiberDocument4 pagesReport On Synthetic FiberAnu Yashpal KapoorNo ratings yet

- 30784rtpfinalnov2013 5Document0 pages30784rtpfinalnov2013 5kamlesh1714No ratings yet

- DT Case Laws For Nov 2012 FinalDocument0 pagesDT Case Laws For Nov 2012 FinalAnu Yashpal KapoorNo ratings yet

- 1.4 Planning and Structuring The Cost Audit 1.4.1 Need For Planning An AuditDocument5 pages1.4 Planning and Structuring The Cost Audit 1.4.1 Need For Planning An AuditAnu Yashpal KapoorNo ratings yet

- AmendmentsDocument75 pagesAmendmentsShakti SinghNo ratings yet

- Steps in Responsibility AcingDocument3 pagesSteps in Responsibility AcingAnu Yashpal KapoorNo ratings yet

- Computer EthicsDocument2 pagesComputer EthicsAnu Yashpal KapoorNo ratings yet

- Current Affairs QuestionsDocument67 pagesCurrent Affairs QuestionsAnu Yashpal KapoorNo ratings yet

- Value AnalysisDocument32 pagesValue Analysisbrijkishor2017No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inVivek Jain100% (1)

- History of Indirect TaxDocument5 pagesHistory of Indirect Taxambikaagarwal1934No ratings yet

- Jan2017Document4 pagesJan2017mageshminiNo ratings yet

- Premium Certificate Financial Year 2021-2022 To Whomsoever It May ConcernDocument2 pagesPremium Certificate Financial Year 2021-2022 To Whomsoever It May Concernrajesh nagarajNo ratings yet

- Pune PWD DSR 2016-17Document448 pagesPune PWD DSR 2016-17GaneshZombade96% (95)

- Chennai Telephones: E Kuperan GR Aprts 145-A Omsakthivinayagarklst Peravallore Chennai TN 600082 P O StampDocument3 pagesChennai Telephones: E Kuperan GR Aprts 145-A Omsakthivinayagarklst Peravallore Chennai TN 600082 P O StampGhanesh RSNo ratings yet

- TelephoneBill 8253069363Document3 pagesTelephoneBill 8253069363sourajpatelNo ratings yet

- Love 07Document11 pagesLove 07Diwaker PandeyNo ratings yet

- Terrace WaterproofingDocument30 pagesTerrace WaterproofingAarif Tanwar0% (1)

- ECS ChargesDocument14 pagesECS ChargesgnanaNo ratings yet

- MMIP 7payDocument6 pagesMMIP 7paykarthikrajan123No ratings yet

- GST - Final Presentation On Mutual Funds Sector - FINALDocument44 pagesGST - Final Presentation On Mutual Funds Sector - FINALSulochana ChoudhuryNo ratings yet

- Government of India Office of The Assistant Commissioner of Service Tax: Division - IDocument10 pagesGovernment of India Office of The Assistant Commissioner of Service Tax: Division - IadhipdcNo ratings yet

- ThanjavurDocument232 pagesThanjavurAnonymous eKt1FCDNo ratings yet

- EF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Document44 pagesEF2A2 HDT Budget Indirect Taxes GST PCB7 1661016598246Sikha SharmaNo ratings yet

- ICICI Lombard Health Care Policy Number: 4034i/FPP/04812914/00/000Document3 pagesICICI Lombard Health Care Policy Number: 4034i/FPP/04812914/00/000Punitha RadjaneNo ratings yet

- TallyDocument25 pagesTallyBackiyalakshmi VenkatramanNo ratings yet

- Service TaxDocument2 pagesService TaxpremsuwaatiiNo ratings yet

- Model GST Law: Empowered Committee of State Finance Ministers June, 2016Document190 pagesModel GST Law: Empowered Committee of State Finance Ministers June, 2016AnikBhilwarNo ratings yet

- Exide OctoberDocument1 pageExide OctoberSasidharKalidindiNo ratings yet

- Sales Tax and Service TaxDocument13 pagesSales Tax and Service TaxRaudhatun Nisa'No ratings yet

- Registration Under GSTDocument13 pagesRegistration Under GSTsuyash dugarNo ratings yet

- A537 - 0500 - 1 - ENQ - REV0Power TransformerDocument155 pagesA537 - 0500 - 1 - ENQ - REV0Power TransformerRitaban R. BanerjeeNo ratings yet

- Order No: Date: Ordered From:: #1048816592 1/1/2016 Sri KanyaDocument2 pagesOrder No: Date: Ordered From:: #1048816592 1/1/2016 Sri KanyaVenkat KarthikeyaNo ratings yet

- Microinsurance ProjectDocument59 pagesMicroinsurance Projectmayur9664501232No ratings yet

- Personal Hearing - Written Representation To Central ExciseDocument10 pagesPersonal Hearing - Written Representation To Central ExciseStephen Hale100% (7)

- Notice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)Document9 pagesNotice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)amitjustamitNo ratings yet

- Central Value Added Tax PPT at Bec Doms Bagalkot MbaDocument16 pagesCentral Value Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)No ratings yet

- Indoasian pk89 - DocxDocument50 pagesIndoasian pk89 - DocxPooja KukrejaNo ratings yet