Professional Documents

Culture Documents

Everyday Pip System

Uploaded by

mr123230%(2)0% found this document useful (2 votes)

176 views19 pagesEvery day pips sysem had the consistence pips draiing from the forex industry

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEvery day pips sysem had the consistence pips draiing from the forex industry

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0%(2)0% found this document useful (2 votes)

176 views19 pagesEveryday Pip System

Uploaded by

mr12323Every day pips sysem had the consistence pips draiing from the forex industry

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

EveryDayPips

Trade the EURUSD Every Day

EveryDayPips.com

Copyright 2012 EveryDayPips.com / Addwins, LLC

his !oo" is the copyright o# Addwins, LLC and cannot !e rewritten,

re$p%!&ished, stored or &in"ed at any #i&e sharing sites or '()*+, or

%sed #or any other !oo"s witho%t proper re#erencing witho%t

permission. he %se o# the !oo"s is &imited to yo%r persona& %se.

Distri!%ting copies witho%t paying #or them is i&&ega& and protected !y

internationa& copyright &aw and vio&ators -.LL !e trac"ed and

prosec%ted.

This Book is password protected. We offer an affiliate revenue-

sharin prora! offerin to P"# #$U %&' co!!ission if

interested in sharin this infor!ation with others. ,imp&y visit

www.everydaypips.com/a##i&iates #or more in#ormation

Risk and (ia)ility*

he a%thor and the p%!&isher i# the in#ormation contained herein are

not responsi!&e #or any actions that yo% %nderta"e and wi&& not !e

he&d acco%nta!&e #or any &oss or in/%ries.

"s with "+# for! of tradin there are risks involved. Please

understand these risks and )e sure to understand the i!portant

,onditions-Ter!s. Risk Disclosure. lia)ility Disclai!er

/nfor!ation located at the )otto! paes of this docu!ent.

Understandin the 0ore1 2arket

-hi&e the 'ore0 mar"et might seem comp&e0, it is act%a&&y /%st a

#oreign e0change mar"et. .t is thro%gh this mar"et that !an"s,

companies and even trave&ers are a!&e to cond%ct !%siness on an

internationa& &eve& !y changing money. ,imp&y p%t, it is p%rchasing

one c%rrency whi&e se&&ing another c%rrency.

Pro#its are made in the 'ore0 mar"et thro%gh the va&%e di##erence that

e0ists !etween two di##erent c%rrencies. his is "nown as the e0change

rate. D%e to the #act that c%rrencies are no &onger !o%nd to the go&d

standard, rates o# e0change are constant&y in a state o# #&%ct%ation.

,pec%&ators hope that !y trading c%rrencies one c%rrency wi&& gain in

va&%e over another c%rrency. A sma&& amo%nt o# money is %sed to

&everage s%ch trades !y contro&&ing m%ch &arger s%ms o# money.

Conse1%ent&y, even a re&ative&y sma&& change in c%rrency va&%e can

res%&t in dramatic gains or &osses.

-hi&e the stoc" mar"et is #re1%ent&y considered to !e 1%ite

s%!stantia&, the 'ore0 mar"et acco%nts #or an estimated 23 tri&&ion per

day. his is act%a&&y severa& times &arger than the 4ew 5or" ,toc"

E0change. D%e to the #act that the 'ore0 mar"et is so &arge, it is a&so

very &i1%id. At any given time there is typica&&y an instantaneo%s se&&er

or !%yer #or any o# the ma/or pairs o# c%rrency. +ost trading is

cond%cted #or the p%rpose o# pro#it. .n rea&ity, on&y appro0imate&y 67

o# a&& dai&y trades are cond%cted #or the p%rpose o# act%a&&y

e0changing c%rrencies #or trave& or !%siness.

he 'ore0 mar"et is so massive8 it is not possi!&e to manip%&ate it.

A&tho%gh some o# the most power#%& centra& !an"s in the wor&d have

attempted to do so, they 1%ic"&y &earned otherwise. ,%ch was the case

in 1992 when the :an" o# Eng&and %ti&i;ed its own reserves to provide

s%pport #or the po%nd against the rising E%ro. .nvestors who made

trades against the po%nd were a!&e to overwhe&m the :an" o# Eng&and

!y their sheer n%m!ers. .n #act, there are r%mors which s%ggest that

one investor in partic%&ar, <eorge ,oros, managed to !ring in a pro#it

o# some one !i&&ion do&&ars within the space o# one day.

he 'ore0 mar"et is a&so comp&ete&y virt%a&. .n other words, there is no

act%a& !%i&ding where se&&ers and !%yers are a!&e to meet. A&& trading

on the mar"et is cond%cted on&ine or over the te&ephone. .t is possi!&e

#or sma&& investors to cond%ct trade thro%gh c%rrency !ro"ers8

however, those !ro"ers then p&ace order thro%gh m%ch &arger !an"s.

Commissions on s%ch trades are "ept &ow and are act%a&&y !%i&t direct&y

into the e0change rate, so there are no s%rprises.

here is an o&d c&ich= which states >the s%n never set on the :ritish

Empire.? o a degree, the same is tr%e #or the trading day on the

'ore0 mar"et. *n&i"e the stoc" e0change, the 'ore0 mar"et never

rea&&y c&oses. he mar"et #irst opens in ,ydney, A%stra&ia at &oca&

+onday morning time and then contin%es to &itera&&y move with the

s%n across the g&ove to o"yo and then on to 'ran"#%rt, London and

#ina&&y conc&%des in 4ew 5or". @owever, even then, it is not rea&&y over

!eca%se it then moves right !ac" to ,ydney. he mar"et does #ina&&y

c&ose on 'riday evening in 4ew 5or". -hat this means #or investors is

that there is some type o# c%rrency which is avai&a!&e to !e traded any

given time o# the day or night. ,omewhere in the wor&d there is a

c%rrency that is !eing traded active&y. -hi&e it might !e midnight in

&oca& time, opport%nities sti&& e0ist to ma"e a pro#it on the 'ore0

mar"et somewhere in the wor&d.

,%ch &engthy trading ho%rs ma"e it possi!&e #or investors to spec%&ate

regarding the res%&ts o# wor&d events as they are ta"ing p&ace$in rea&

time. 'or instance, it a co%ntry ma"es an anno%ncement that data wi&&

!e re&eased regarding economic dec&ine or growth, this a&&ows an

investor to easi&y ta"e advantage o# s%ch in#ormation, regard&ess o#

what it might !e &oca&&y.

At one time, sma&& investors were not a!&e to ta"e advantage o# the

'ore0 mar"et. .n many ways, it was 1%iet&y reserved #or &arge

corporations, !an"s and other important p&ayers in the wor&d c%rrency

game. D%e to a s&ate o# new &aws that were introd%ced in 20008

however, the 'ore0 #ie&d was opened to everyone. 4ow, sma&&

investors and traders can start o## with trading acco%nts #or as &itt&e

as 2260.

The Basics of 0ore1 ,harts

.n %nderstanding the !asics o# 'ore0 trading charts, it is important to

%nderstand that each c%rrency pair is 1%oted in the same manner. 'or

instance, yo% wi&& a&ways see the E*)*,D c%rrency pair written as

E*)*,D. -hat this means is that the !ase c%rrency is E*) and the

terms c%rrency is *,D. Conse1%ent&y, i# the chart re#&ects a c%rrent

price o# E*)*,D at a!o%t 1.21668 what this means to yo% as an

investor is that 1 E*)( can !e %sed to p%rchase appro0imate&y

1.2166 *, do&&ars. .t sho%&d a&so !e %nderstood that the trade si;e is

the amo%nt #or the !ase c%rrency that is !eing %sed #or trading

p%rposes. Aeeping to the same e0amp&e, i# yo% wish to p%rchase

200,000 E*)*,D, yo% wo%&d !e p%rchasing 200,000 E*)(s.

.# yo% p%rchase a c%rrency pair, this means yo% are &ong on the position

or that yo% thin" the chart #or that c%rrency pair wi&& increase. P%t

another way, yo%r goa& is #or the !ase c%rrency to gain strength against

the terms c%rrency. (nce again, "eeping to the same e0amp&e, with the

E*)*,D, the E%ro wo%&d gain in strength against the *,D.

A&ternate&y, i# yo% were to se&& the c%rrency in order to shorten the

position, this wo%&d mean yo% e0pect the c%rrency pair chart to

dec&ine in order to ma"e a pro#it. .n other words, yo% e0pect the !ase

c%rrency to act%a&&y wea"en against the terms c%rrency.

*nderstanding :ars Charts

:y #ar, the most common types o# price !ars which are %ti&i;ed

in 'ore0 trading are the Cand&estic" chart and the :ar chart.

.n these representations, price !ars represent a period o# time thro%gh

a &ine or &inear representation. his ma"es it possi!&e #or the %ser to

see a graphic representation which s%mmari;es activity over a

speci#ied period o# time. Each !ar on the chart o##ers simi&ar

characteristics. his ma"es it possi!&e #or the %ser to g&ean severa&

pieces o# important in#ormation regarding that time #rame. hese

pieces o# in#ormation inc&%deB

@ C @ighest Price

L C Lowest Price

( C (pening Price

C C C&osing Price

he highest point seen on the !ar is representative o# the highest

price that was o!tained d%ring that speci#ic time period. he &owest

point on the !ar is representative o# the &owest price that was

o!tained d%ring that speci#ied time period. )eg%&ar !ars are a&so

%ti&i;ed to represent opening price period with sma&& dots &ocated to

the &e#t o# the !ar. ,ma&& dots to the right o# the !ar are %sed to notate

the c&osing price d%ring that time period.

E0amp&eB

,andlestick ,harts

Cand&estic" charts, a&so sometimes "nown as Dapanese Cand&estic"

charts, are a&so %ti&i;ed to vis%a&&y represent the same type o#

in#ormation as is presented on Price !ar charts. he so&e di##erence

!etween the two is that on a Cand&estic" chart the opening and

c&osing disp&ay a !o0, in which there is a co&or disp&ay. -hen the co&or

inside the !o0 is red, this indicates the c&osing price was &ower than

the opening price. -hen the co&or inside the !o0 is !&%e, this indicates

the c&osing price was higher than the opening price.

.# the !o0 depicts a &ine that goes %pward #rom the !o0, this indicates a

high and is "nown as the wic". (n the other hand, i# the !o0 depicts a

&ine going downward, this indicates a &ow and is "nown as the tai&.

Understandin Ti!e 0ra!es and ,hart /ntervals

A time #rame, a&so "nown as a chart ime ,ca&e and Period, is %sed to

indicate the amo%nt o# time that ta"es p&ace !etween the opening and

c&osing o# a cand&estic" or !ar. +ost 'ore0 charts show a !id price

instead o# an as" price. Aeep in mind that prices are a&ways 1%oted

with a !id as we&& as an o##er or as". 'or instance, the c%rrent price

#or E*)*,D might !e 1.2066 !id and the as" or o##er co%&d !e

1.206E. -hen yo% are ready to p%rchase, yo% do so at the as" price.

his is the higher o# the two prices noted in the spread. -hen yo% are

ready to se&&, yo% se&& at the !id price. his is the &ower o# the two

prices in the spread.

he spread !etween the prices is simp&y the di##erence that e0ists

!etween the !id price and the as" price. he spread is a&so meas%red

in a term "nown as a pip. A pip is the sma&&est %nit in which a

c%rrency may !e traded. he act%a& pip va&%e is not a set price. his is

important to "eep in mind. 'or instance, s%ppose yo% are trading

E*)*,D and a pip has a va&%e o# 210. .# yo% were trading a sma&& &ot

o# E*)*,D, then the pip wo%&d have a va&%e o# 21. here are some

!ro"ers that wi&& a&&ow #or what is "nown as an incrementa& pip, which

is a #raction o# a pip.

.t a&ways important to "eep in mind that a&tho%gh the 'ore0 mar"et

does a&&ow #or more &everage in terms o# the #%nds that yo% act%a&&y

possess, there can !e a downside to this. -hi&e it is possi!&e to earn

pro#its on &everaged #%nds Fmore #%nds than yo% act%a&&y ownG, yo%r

&osses can a&so !e amp&i#ied. his is why it is imperative that yo%

ta"e the time to ed%cate yo%rse&# regarding the !est time to enter as

we&& as e0it the mar"et. 5o% m%st a&so &earn to anticipate a&& types o#

movements on the mar"et.

)emem!er, it is never a good idea to p&ace a&& o# yo%r !ets in one

!as"et, so to spea". he !est !et is to a&ways trade in a conservative

manner8 !oth psycho&ogica&&y as we&& as monetari&y. ,imp&y p%t, i# yo%

are not certain a!o%t &everaging yo%r investments and yo%r ris"$

to&erance, it is cr%cia& that yo% spea" with yo%r !ro"er !e#ore ma"ing

any trades.

Tradin Psycholoy

-hen it comes to trading, the most important thing to "eep in mind is

se&#$discip&ine. his is cr%cia& as !oth pro#its and &osses can !e

enormo%s in this mar"et. +ore than three tri&&ion do&&ars e0changes

hands in this mar"et dai&y. .t is possi!&e to pro#it #rom this e0change

o# c%rrencies, i# yo% are a!&e to contro& three critica& emotions that

#re1%ent&y tend to &ead to c&o%ded /%dgment and o#ten res%&t in &ost

pro#its. hose emotions are, H<reedI H'earI and H@opeI.

<iven a proper investment strategy, the 'ore0 mar"et ma"es it possi!&e

to earn a tidy pro#it. -ith that said, greed a&ways comes into p&ay in any

h%man e##ort and this is no &ess tr%e when it comes to investing. <reed

res%&ts in one o# the o&dest pro!&ems in investing$overtrading. -henever

a trader engages in overtrading, there is a tremendo%s potentia& to ris"

#ar too m%ch, ho&d a good position #or too &ong or enter the mar"et too

&ate and #ind onese&# in a &osing position.

<reed can a&so 1%ic"&y c&o%d one?s /%dgment8 perhaps #aster than

anything e&se. @omewor" and se&#$discip&ine8 however, can he&p yo% to

"eep !oth yo%r #oc%s as we&& as yo%r pro#its.

rading in a sim%&ated acco%nt environment is a great way to &earn

the ropes o# the mar"et, !%t it is important to ma"e s%re yo% %se the

same position and psycho&ogy as yo% wo%&d when trading in a &ive

acco%nt.

Another emotion which is common&y seen in investing is #ear. 'ear is

act%a&&y 1%ite predicta!&e and can res%&t in panic se&&ing. 'ort%nate&y,

we can a&ways re&y on the mar"et to correct itse&#. he "ey is to

remain ca&m and remain with yo%r chosen trading method. rading

in a demo or sim%&ated acco%nt !e#ore %sing trading methods is a

great way to e&iminate #ear. 5o% can !e certain yo% "now precise&y

what to e0pect as yo% watch trades p&ay o%t$in rea&$time.

@ope is certain&y something everyone can %se a hea&thy dose o#. .n

terms o# investment8 however, hope can sometimes ca%se %s to ma"e

mista"es. his is partic%&ar&y tr%e when it comes to staying with a

position #or too &ong a time period. here are de#initive e0it points and

it is cr%cia& that yo% stic" with them. .n the end, the n%m!ers wi&& not

ever &ie to yo%. :y ma"ing %se a stop &oss e0it that is pre$determined,

yo% can protect against dangero%s #a&se hopes and ens%re that a

&osing position does not t%rn against yo%. -hether yo% are wor"ing

with a &ive acco%nt or a demo acco%nt, ma"e certain yo% are a&ways

honest with yo%rse&#. )emem!er, on&y yo% are responsi!&e #or yo%r

actions.

'ort%nate&y, whi&e the mar"et may at times !e driven !y emotions, the

mar"et can a&so !e rather easi&y predicted. his is precise&y !eca%se

the mar"et is a&ways driven !y the same h%man emotions. 5o% can

%se these !asic tips to "eep yo%r pro#its %pB

'irst, t%ne o%t noise. ,hort$term #actors can de#inite&y a##ect pro#its in

the &ong$term, partic%&ar&y i# yo% ma"e the mista"e o# ma"ing

investment decisions that are rash. 4ever a&&ow interr%ptions to

a##ect yo% when yo% are trading. +a"e s%re yo% are #ree #rom any

and a&& other o!&igations d%ring trading times.

A&so, choose a trading strategy and stic" with it. (# co%rse, this

certain&y does not mean yo% sho%&d ignore rea&ity, !%t it does mean

that yo% sho%&d not a&&ow yo%r strategy to waver !ased on every &itt&e

thing yo% hear or read.

)egard&ess o# how yo% approach the 'ore0 mar"et, "eep in mind that

the most important #actors in yo%r %&timate s%ccess is se&#$discip&ine.

T3E 4E5ER# D"# P/PS6 S#STE2*

he Every Day Pips method is a #ore0 trade that happens at the same

time each and every day %sing two o# the most common indicators

%sed in #ore0 tradingJ the +ACD and a :o&&inger :and.

-hi&e . wi&& o%t&ine a very speci#ic entry and e0it that has yie&ded over

EK7L pro#ita!&e trades over the &ast 6 years trading EME)5 day, and

over EN7L pro#ita!&e trades over the &ast 6 years o# !ac"testing

trading near&y dayL, "eep in mind that the trader has the &i!erty to

ma"e ad/%stments to the method discretionari&y.

-hi&e the method can !e %sed on many di##erent c%rrency pairs we

recommend the E*)*,D. -hy E*)*,DO he E*)*,D is e0treme&y

&i1%id and %s%a&&y has among the tightest pip spreads o# any pair.

.# yo% do %se the EME)5 DA5 P.P, method on pairs other than the

E*)*,D then yo% wi&& &i"e&y want to %se a di##erent rading imes and

perhaps di##erent pip amo%nts #or the target and stop &oss. 5o% may

want to even ad/%st he +ACD and +oving Average settings. +ore

advanced traders can e0periment with this at their own discretion, !%t

the #o&&owing in#ormation pertains on&y to the E*)*,D c%rrency pair.

The Syste!*

The Trade 3appens at 7*88a! EDT 9+ew #ork Ti!e: every

day. There is another trade outlined )elow that happens at

;*<8a! EDT 9+ew #ork Ti!e: nearly every day !%t #or now we?&&

disc%ss the primary systemB

.+P()A4B .# yo% are in a time ;one other than E, F4ew 5or"

imeG yo% wi&& need to ad/%st the trade time !y the n%m!er o# ho%rs

di##erence yo%r time ;one is. 'or e0amp&eB .# yo% are in a time ;one

that is 3 ho%rs !ehind 4ew 5or" then the trade occ%rs at 10B00pm. .#

yo%Pre in a time ;one that is Q ho%rs ahead o# 4ew 5or" then the

trade occ%rs at Nam, etc, etc. D%st ma"e s%re yo% have ca&c%&ated the

correct time that matches 1B00am E, F4ew 5or" imeG. Every trade

is ta"en at that time each day.

SETT/+= UP T3E ,3"RT*

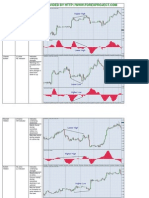

App&y an +ACD and a :o&&inger :and .ndicator to a 20 min%te E*)*,D

chart. 4(EB 5o% can a&so %se a 16 min%te chart i# yo% wish !%t in

this can yo% can %se a ta"e pro#it target o# 30 pips and stop &oss o# N0

pips.

1G Change the de#a%&t settings o# the +ACD indicator

toB 'ast&engthC11, ,&ow&engthC2N, +ACD&engthCK

2G Add a :o&&inger :and to the chart and change the de#a%&t

settings to the #o&&owingB :o&&inger Length C 1Q, 4%mDevs*p C

3, 4%mDevsDnC$1.1

E+TER/+= T3E TR"DE*

At the c&ose o# the rade ime !ar Fthe 1B00am 4ew 5or" time !arG i#

the +ACD #ast &ine is a!ove the s&ow &ine then :*5 L(4< on the open

o# the very ne0t !ar. .# the +ACD #ast &ine is !e&ow the s&ow &ine then

,ELL ,@() on the open o# the very ne0t !ar. 5es, itPs that simp&eR

4(EB .# yo%?re %sing an +ACD that has a histogram then the signa&

is when it is a!ove or !e&ow the ;ero &ine.

E>"2P(E ,3"RT "+D TR"DES*

$ptional Bolliner Band Entry 5erifier*

'or a trade with even more pro#it potentia& the :o&&inger :and can !e

%sed #or entry.

*se the same entry r%&es o%t&ined a!ove e0cept on&y !%y &ong when

the +.DL.4E FAverage &ineG o# the :o&&inger :and is going *P and on&y

se&& short when it?s going down. A&tho%gh this wi&& #i&ter o%t some

trades this added criteria can increase the acc%racy and pro#it potentia&

o# the trade.

E>"2P(E with Bolliner Band*

E>/T/+= T3E TR"DE

E0iting the HEvery Day PipsI method is a two part processB

7: Profit Taret and Stop (oss* As soon as the trade is entered

%se a 6Q pip pro#it target and a N2 pip stop &oss #or !oth &ong and

short positions. +ore advanced traders co%&d e0periment with other

target and stop &oss amo%nts at their own discretion. 4(EB .# %sing a

16 min%te chart yo% can %se a ta"e pro#it target o# 30 pips and stop

&oss o# N0 pips.

?: Bolliner Band E1its* .# a L(4< open position is P)('.A:LE and

the C%rrent Price to%ches the *PPE) :A4D o# the :o&&inger then se&&. .#

a ,@() open position is P)('.A:LE and the C%rrent Price to%ches

the L(-E) :A4D o# the :o&&inger then e0it/cover.

,o one o# three things wi&& happenB he trade wi&& hit the target,

the stop &oss, or e0ited i# the price to%ches the %pper/&ower

:o&&inger :and.

.n the rare and %n&i"e&y event that the trade is open ti&& the #o&&owing

1am entry then the trade is simp&y &e#t open %nti& the target or stop

or #irst pro#ita!&e !ar occ%rs.

+ore advanced traders can %se di##erent targets and stops

and/or other indicators/means o# e0iting the trade.

+$TE* -e recommend trading %sing a demo/sim%&ated acco%nt

to !ecome com#orta!&e with the system.

hatPs it.. itPs that simp&e. -e?ve !ac"tested this system at over EQ7

pro#ita!&e over an E$year period and over 2000 tradesL

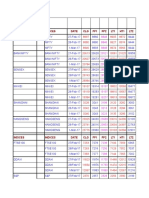

Secondary Trade 9$ccurs at ;*<8a! EST nearly every day:*

Settin up the ,hart*

App&y a 13 period/&ength ,imp&e +oving Average indicator to a 10

min%te E*)*,D chart.

+$TE* #ou !ay use a 7& !inute chart if you choose )ut in

this case the trade is entered at the close of the ;*<&a! )ar

as opposed to the close of the ;*<8a! )ar.

E+TR#*

At the c&ose o# the 9BK0am E, !ar i# the +oving Average &ine is going

*P then on the open o# the ne0t !ar p%t a stop entry :*5 L(4< order

at the @.<@ o# the 9BK0am !ar and i# the +oving Average &ine is going

D(-4 then on the open o# the ne0t !ar p%t a stop entry ,@() ,ELL

order at the L(- o# the 9BK0am !ar.

E>/T*

.# the entry is triggered and yo% are in an open position then set a

10 pip target and a 16 pip stop &oss () a 16 pip target and a 26 pip

stop &oss depending on i# the mar"et seems to rea&&y !e moving.

+ore advanced traders can %se di##erent targets and stop &oss &eve&s

or other indicators/means o# e0it.

E>"2P(E ,3"RT "+D TR"DES*

+$TE* -e recommend trading %sing a demo/sim%&ated acco%nt

to !ecome com#orta!&e with the system.

-ishing yo% the :E, trading s%ccess,

+ar" Christopher

2ore 0ore1 Sy!)ols*

E*)/*,DB E%ro / *, Do&&ar Fthis is the one we recommend #or this

systemG

*,D/DP5B *, Do&&ar / Dapanese 5en

<:P/*,DB :ritish Po%nd / *, Do&&ar

*,D/C@'B *, Do&&ar / ,wiss 'ranc

*,D/CADB *, Do&&ar / Canadian Do&&ar

A*D/*,DB A%stra&ian Do&&ar / *, Do&&ar

E*)/DP5B E%ro / Dapanese 5en

E*)/C@'B E%ro / ,wiss 'ranc

<:P/C@'B :ritish Po%nd / ,wiss 'ranc

<:P/DP5B :ritish Po%nd / Dapanese 5en

C@'/DP5B ,wiss 'ranc / Dapanese 5en

4SD/*SDB 4ew Sea&and Do&&ar / *, Do&&ar

*,D/SA)B *, Do&&ar / ,o%th A#rican )and

*,D/<)DB *, Do&&ar / <ree" Drachma

*,D/,EAB *, Do&&ar / ,wedish Aroner

*,D/4(AB *, Do&&ar / 4orwegian Aroner

*,D/DAAB *, Do&&ar / Danish Aroner

*,D/'.+B *, Do&&ar / 'innish +ar""a

*,D/4L<B *, Do&&ar / D%tch <%i&der

*,D/+T4B *, Do&&ar / +e0ican Peso

*,D/:)LB *, Do&&ar / :ra;i&ian )ea&

*,D/.D)B *, Do&&ar / .ndonesian )%piah

*,D/@ADB *, Do&&ar / @ong Aong Do&&ar

*,D/,<DB *, Do&&ar / ,ingapore Do&&ar

*,D/CSAB *, Do&&ar / C;ech Aroner

*Important Conditions/Terms, Risk Disclosure, liability Disclaimer Information:

Risk Disclosure/ Liability Disclaimer / Terms:

Commodity Futures Trading Commission Futures, Options trading, and Forex trading has large

potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept

them in order to invest in the futures, forex and options markets. Don't trade with money you can't afford

to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks, options, forex currencies. No

representation is being made that any account will or is likely to achieve profits or losses similar to those

discussed on this web site. The past performance of any trading system or methodology is not

necessarily indicative of future results.

Due to the inherent risks of internet data transfer, data feed interruptions, rejected orders, etc., Addwins,

LLC cannot be held responsible for any order not properly processed. Trading these systems from a

home computer must therefore be monitored at all times to ensure proper execution and it is understood

to be totally dependent on the users oversight of these automated trading systems. To ensure that this

risk is acceptable to the user, a document stating same must be signed and returned, absolving

Addwins, LLC from any liability from trade aberrations.

RISK DISCLOSURE STATEMENT (CFTC Reg. Sec. 1.55)

The risk of loss in trading commodity futures contracts can be substantial. You should, therefore,

carefully consider whether such trading is suitable for you in light of your circumstances and financial

resources. You should be aware of the following points:

(1) You may sustain a total loss of the funds that you deposit with your broker to establish or maintain a

position in the commodity futures market, and you may incur losses beyond these amounts. If the

market moves against your position, you may be called upon by your broker to deposit a substantial

amount of additional margin funds, on short notice, in order to maintain your position. If you do not

provide the required funds within the time required by your broker, your position may be liquidated at a

loss, and you will be liable for any resulting deficit in your account.

(2) Under certain market conditions, you may find it difficult or impossible to liquidate a position. This can

occur, for example, when the market reaches a daily price fluctuation limit (limit move).

(3) Placing contingent orders, such as stop-loss or stop-limit orders, will not necessarily limit your

losses to the intended amounts, since market conditions on the exchange where the order is placed may

make it impossible to execute such orders.

(4) All futures positions involve risk, and a spread position may not be less risky than an outright

long or short position.

(5) The high degree of leverage (gearing) that is often obtainable in futures trading because of the small

margin requirements can work against you as well as for you. Leverage (gearing) can lead to large

losses as well as gains.

(6) You should consult your broker concerning the nature of the protections available to safeguard

funds or property deposited for your account.

ALL OF THE POINTS NOTED ABOVE APPLY TO ALL FUTURES TRADING WHETHER FOREIGN

OR DOMESTIC. IN ADDITION, IF YOU ARE CONTEMPLATING TRADING FOREIGN FUTURES OR

OPTIONS CONTRACTS, YOU SHOULD BE AWARE OF THE FOLLOWING ADDITIONAL RISKS:

(7) Foreign futures transactions involve executing and clearing trades on a foreign exchange. This is the

case even if the foreign exchange is formally linked to a domestic exchange, whereby a trade executed

on one exchange liquidates or establishes a position on the other exchange. No domestic organization

regulates the activities of a foreign exchange, including the execution, delivery, and clearing of

transactions on such an exchange, and no domestic regulator has the power to compel enforcement of

the rules of the foreign exchange or the laws of the foreign country. Moreover, such laws or regulations

will vary depending on the foreign country in which the transaction occurs. For these reasons, customers

who trade on foreign exchanges may not be afforded certain of the protections which apply to domestic

transactions, including the right to use domestic alternative dispute resolution procedures. In particular,

funds received from customers to margin foreign futures transactions may not be provided the same

protections as funds received to margin futures transactions on domestic exchanges. Before you trade,

you should familiarize yourself with the foreign rules which will apply to your particular transaction.

(8) Finally, you should be aware that the price of any foreign futures or option contract and, therefore,

the potential profit and loss resulting therefrom, may be affected by any fluctuation in the foreign

exchange rate between the time the order is placed and the foreign futures contract is liquidated or the

foreign option contract is liquidated or exercised.

THIS BRIEF STATEMENT CANNOT, OF COURSE, DISCLOSE ALL THE RISKS AND

OTHER ASPECTS OF THE COMMODITY MARKETS

CFTC REG SEC. 4.41 HYPOTHETICAL PERFORMANCE RESULTS DISCLOSURE

THESE RESULTS ARE BASED ON SIMULATED OR HYPOTHETICAL PERFORMANCE RESULTS

THAT HAVE CERTAIN INHERENT LIMITATIONS. UNLIKE THE RESULTS SHOWN IN AN ACTUAL

PERFORMANCE RECORD, THESE RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO,

BECAUSE THESE TRADES HAVE NOT ACTUALLY BEEN EXECUTED, THESE RESULTS MAY HAVE

UNDER-OR OVER-COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS,

SUCH AS LACK OF LIQUIDITY. SIMULATED OR HYPOTHETICAL TRADING PROGRAMS IN

GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT

OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY

TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THESE BEING SHOWN.

These programs are provided by "Addwins, LLC". Please be advised that Addwins, LLC, it's owners and/or

operators are not a registered broker, financial advisor, nor is registered in any way with any government

regulator agency. Addwins, LLC makes this information, its products and services available through this

website under the First Amendment of the Unites States Constitution. Addwins, LLC has makes great effort to

list all information to be very accurate. All data included in this website is considered HYPOTHETICAL.

Futures, Forex, and Options on Futures trading involves substantial risk and is not suitable for all investors.

Addwins, LLC products and services are not suitable for everyone. Trading should only be done with true risk

capital. Past performance is not necessarily indicative of future results.

Upon subscribing to or purchasing a system from Addwins, LLC and/or any website linked to or affiliated

with Addwins, LLC you agree to not hold Addwins, LLC it's and its owners and/or operators liable for loss

of any kind, including but not limited to, financial loss. Additionally you understand that you are

subscribing and/or purchasing under a no-refund policy. ALL fees (including monthly and yearly) are non-

refundable regardless of program performance. ALL SALES ARE FINAL. Addwins, LLC and it's owners

and/or operators do not offer advice but rather the automated trading systems therefore it may be

prudent to discuss your trading with a broker carrying your account. You agree to indemnify, defend and

hold harmless Addwins, LLC, its officers, directors, employees, agents, licensors, suppliers from and

against all losses, expenses, damages and costs, including reasonable attorneys fees, resulting from any

violation of this Agreement (including negligent or wrongful conduct) or loss of any kind, by you or any

other person accessing the Service.

You agree to indemnify, defend and hold harmless Addwins, LLC, its officers, directors, employees,

agents, licensors, suppliers from and against all losses, expenses, damages and costs, including

reasonable attorneys fees, resulting from any violation of this Agreement (including negligent or

wrongful conduct) or loss of any kind, by you or any other person using the purchased program.

Confidentiality

This agreement covers proprietary information belonging to Addwins, LLC (Addwins) that

is made available or disclosed to the party signing this agreement (the "Recipient"). This information

(referred to as the "Confidential Information") includes, but is not limited to, software products (Software

Products), trading recommendations generated by the software, software source code (Software Source

Code), documentation, and correspondences, all rights to which are owned or controlled by Addwins,

that have not otherwise been made publicly available by Addwins. Confidential Information, however,

does not include: (a) information generally available to the public; (b) widely used programming practices

or algorithms, (c) information rightfully in the possession of the Recipient prior to signing this agreement.

The Recipient agrees to hold the Confidential Information in strict confidence and shall not

disclose such information to any third party without the prior written permission of Addwins The

Recipient also agrees to employ all steps necessary to protect the Confidential Information from

unauthorized disclosure or use, including without limitation, all steps the Recipient uses to protect

information they consider proprietary or a trade secret.

The Recipient shall refrain from directly or indirectly acquiring any interest in, or designing, creating,

manufacturing, selling or otherwise dealing with any item or product containing the Confidential Information

received by Recipient under this agreement. The Recipient acknowledges and agrees that any Software

Source Code and Software Products received under this agreement, and any Software Products derived or

compiled from the Software Source Code, are subject to the following limitations:

1.) Recipient may use the Software Products only on the TradeStatiom platform. Use on all other

operating systems is expressly forbidden by this agreement.

2.) Recipient may not grant rights to use the Software Source Code or Software Products to any other

individual or entity. Usage of these is limited to the Recipient signing below. 3.) Recipient is subject to all

terms and limitations set forth in all separate software licenses provided by Addwins to Recipient with

the Software Source Code.

This agreement shall be governed by and construed in accordance with the laws of the United

States, and state of Idaho.

Addwins provides the Confidential Information on an AS IS basis and is not responsible for any

loss or damages arising from the use of the Confidential Information made available under this

agreement. Neither party of this Agreement may assign this Agreement or any rights or obligations

under it, without prior written consent by both parties, and any attempt to do so is void; neither grants the

other any licenses under any patents or copyrights.

Termination.

This Agreement may be terminated by either party without notice at any time for any reason.

This Agreement shall survive any termination of this Agreement and be governed and construed in

accordance with the laws of The United States of America applicable to agreements made and to be

performed in The United States of America. You agree that any legal action or proceeding between

Addwins, LLC, it's owners and/or operators and you for any purpose concerning this Agreement or the

parties obligations hereunder shall be brought exclusively in a federal or state court of competent

jurisdiction sitting in the State of Idaho in The United States of America, unless otherwise decided by

Addwins, LLC, it's owners and/or operators. Any cause of action or claim you may have with respect to

the Service must be commenced within one (1) year after the claim or cause of action arises or such

claim or cause of action is barred. Addwins, LLC, it's owners and/or operators failure to insist upon or

enforce strict performance of any provision of this Agreement shall not be construed as a waiver of any

provision or right. Neither the course of conduct between the parties nor trade practice shall act to

modify any provision of this Agreement. Addwins, LLC, it's owners and/or operators may assign its rights

and duties under this Agreement to any party at any time without notice to you.

You might also like

- The Revelation of HellDocument18 pagesThe Revelation of HellEric Dacumi100% (12)

- HEAVEN AND THE ANGELS by H.A. BakerDocument138 pagesHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- Forex Earthquake: by Raoul WayneDocument21 pagesForex Earthquake: by Raoul WayneDavid100% (1)

- God's Grace Forex BookDocument11 pagesGod's Grace Forex BookMatimu Nene ChabalalaNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsGuruKPONo ratings yet

- Forex Trading Strategies PDFDocument24 pagesForex Trading Strategies PDFGabrė Francis100% (1)

- USDJPY - 100 Pips Set and Forget Strategy - Apiary FundDocument32 pagesUSDJPY - 100 Pips Set and Forget Strategy - Apiary FundEko WaluyoNo ratings yet

- Schaff Trend Cycle Indicator - Forex Indicators GuideDocument3 pagesSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- BLACK-BφX.COM Scalping System GuideDocument12 pagesBLACK-BφX.COM Scalping System GuideeddieNo ratings yet

- Civil Service Exam Clerical Operations QuestionsDocument5 pagesCivil Service Exam Clerical Operations QuestionsJeniGatelaGatillo100% (3)

- London Forex Rush ManualDocument56 pagesLondon Forex Rush ManualBogdanC-tin100% (3)

- 5emas Forex System - Forex Scalping, Day-Trading and Short-Term Trading SystemDocument16 pages5emas Forex System - Forex Scalping, Day-Trading and Short-Term Trading SystemWakhid Nurdin0% (1)

- NexusFX - System ManualDocument30 pagesNexusFX - System ManualJulius IguguNo ratings yet

- Know the Best Times to Trade Major Currency Pairs for Maximum VolatilityDocument5 pagesKnow the Best Times to Trade Major Currency Pairs for Maximum VolatilitylisaNo ratings yet

- Forexgrail EbookDocument52 pagesForexgrail EbookAkram Shah50% (2)

- Winning Pips System PDFDocument9 pagesWinning Pips System PDFGabriel SchultzNo ratings yet

- A Guide To in The: First AidDocument20 pagesA Guide To in The: First AidsanjeevchsNo ratings yet

- Lindencourt Daily Forex SystemDocument19 pagesLindencourt Daily Forex Systemjodaw100% (1)

- EUR Xtreme FadeDocument17 pagesEUR Xtreme Fadereynancutay4624No ratings yet

- Jacko Trading StyleDocument25 pagesJacko Trading StyleMohammed NizamNo ratings yet

- Forex on Five Hours a Week: How to Make Money Trading on Your Own TimeFrom EverandForex on Five Hours a Week: How to Make Money Trading on Your Own TimeRating: 5 out of 5 stars5/5 (1)

- Abonacci Trading v11-11Document12 pagesAbonacci Trading v11-11ghcardenas100% (1)

- Expert 4 XDocument35 pagesExpert 4 Xstefandea100% (1)

- Rules For Forex TradingDocument22 pagesRules For Forex Tradinglever70No ratings yet

- The Power of Habit - Charles DuhiggDocument5 pagesThe Power of Habit - Charles DuhiggmanargyrNo ratings yet

- Trading Naked - DivergenceDocument12 pagesTrading Naked - Divergenceniboiys100% (1)

- Trix Strategy Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastDocument6 pagesTrix Strategy Trading System - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX ForecastPapy RysNo ratings yet

- Tradeonix 2.0: (An Updated Version of Tradeonix)Document17 pagesTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- Stop LossDocument3 pagesStop LosssalmanscribdNo ratings yet

- SupersistemaDocument15 pagesSupersistemaLoco LocatisNo ratings yet

- Forex & IntuitionDocument0 pagesForex & Intuitionagus purnomoNo ratings yet

- New Hire WorkbookDocument40 pagesNew Hire WorkbookkNo ratings yet

- 3 EuroLondonScalpDocument20 pages3 EuroLondonScalpUnix 01100% (1)

- Wolfe Wave Dashboard Install GuideDocument4 pagesWolfe Wave Dashboard Install Guidemr12323No ratings yet

- Forex Money Bounce by Russ HornDocument13 pagesForex Money Bounce by Russ HornCapitanu Iulian100% (2)

- Range Trading GuideDocument21 pagesRange Trading GuideFox Fox0% (1)

- Forex ProfitsDocument35 pagesForex ProfitstherisingstarNo ratings yet

- Real Estate Broker ReviewerREBLEXDocument124 pagesReal Estate Broker ReviewerREBLEXMar100% (4)

- Forex Trading Strategies Basics 101Document56 pagesForex Trading Strategies Basics 101Ngô Hải Đăng100% (1)

- BreakoutDocument57 pagesBreakoutM Zaid ASNo ratings yet

- 4x4 Forex Trading StrategyDocument4 pages4x4 Forex Trading StrategySubbuPadalaNo ratings yet

- GP Rating GSK Exit ExamDocument108 pagesGP Rating GSK Exit ExamMicle VM100% (4)

- Cheatsheet Fib ElliottDocument12 pagesCheatsheet Fib ElliottYano0% (1)

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Weekly Forex Breakout Strategy - FIRSTSTRIKEDocument8 pagesWeekly Forex Breakout Strategy - FIRSTSTRIKEgrigoreceliluminatNo ratings yet

- Service Manual: Precision SeriesDocument32 pagesService Manual: Precision SeriesMoises ShenteNo ratings yet

- Speed Reducer GearboxDocument14 pagesSpeed Reducer Gearboxعبد للهNo ratings yet

- The Captains Chest - Naked Trading & Other Stuff - V1 by Captain JackDocument1,589 pagesThe Captains Chest - Naked Trading & Other Stuff - V1 by Captain JackCaptain Jack100% (1)

- Hasim AliuDocument138 pagesHasim Aliuhasim_a100% (1)

- Profitable Forex Trading Using High and Low Risk Strategies: Book 1, #4From EverandProfitable Forex Trading Using High and Low Risk Strategies: Book 1, #4No ratings yet

- Forex Trading Made E-ZDocument75 pagesForex Trading Made E-ZRobert Gray100% (1)

- Forex Pair Performance Strength ScoreDocument10 pagesForex Pair Performance Strength ScoreTradingSystem100% (1)

- Unlocking The SecretsDocument25 pagesUnlocking The SecretsAdam FritsNo ratings yet

- Angels FX Academy StrategyDocument9 pagesAngels FX Academy StrategyAngels Fx AcademyNo ratings yet

- Profit from Financial Markets with PZ Trend Following SuiteDocument24 pagesProfit from Financial Markets with PZ Trend Following Suitemr12323No ratings yet

- Big Dog ForexDocument9 pagesBig Dog ForexChiedozie Onuegbu100% (2)

- Reading and Writing Q1 - M13Document13 pagesReading and Writing Q1 - M13Joshua Lander Soquita Cadayona100% (1)

- Flexible Regression and Smoothing - Using GAMLSS in RDocument572 pagesFlexible Regression and Smoothing - Using GAMLSS in RDavid50% (2)

- Sundial Forex SystemDocument43 pagesSundial Forex SystemJohn TucăNo ratings yet

- Serial ScalperDocument17 pagesSerial ScalperfxquickNo ratings yet

- The Skinny On Forex TradingDocument113 pagesThe Skinny On Forex TradingnobleconsultantsNo ratings yet

- Woodie Panel Heart Trading System GuideDocument6 pagesWoodie Panel Heart Trading System GuidePapy RysNo ratings yet

- Forex Parabolique Sar StrategyDocument3 pagesForex Parabolique Sar StrategyDa VidNo ratings yet

- DivergenceDocument2 pagesDivergenceBoris BorisavljevicNo ratings yet

- How To Place Stop Losses Like A Pro TraderDocument6 pagesHow To Place Stop Losses Like A Pro Tradernrepramita100% (2)

- Introduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsDocument5 pagesIntroduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsPapy RysNo ratings yet

- News Based STrategiesDocument28 pagesNews Based STrategiessmysonaNo ratings yet

- Cash - FX Empire Mobile StrategiesDocument20 pagesCash - FX Empire Mobile StrategiesEric Woon Kim ThakNo ratings yet

- 81defe7c-5459-4b80-9a54-66afaa47aaecDocument23 pages81defe7c-5459-4b80-9a54-66afaa47aaecDimas Cahyono100% (1)

- Forex Virtuoso PDFDocument19 pagesForex Virtuoso PDFHARISH_IJTNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Bullish confirmation patterns and technical analysisDocument6 pagesBullish confirmation patterns and technical analysisScott LuNo ratings yet

- Chifbaw Oscillator User GuideDocument12 pagesChifbaw Oscillator User GuideHajar Aswad KassimNo ratings yet

- Nifty Super Trend Back Test Results 2008 To 2013Document176 pagesNifty Super Trend Back Test Results 2008 To 2013mr12323No ratings yet

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323No ratings yet

- Tims Trading MaximsDocument1 pageTims Trading Maximsmr12323No ratings yet

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323No ratings yet

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323No ratings yet

- Daily stock market indices and bank stocks dataDocument34 pagesDaily stock market indices and bank stocks datamr12323No ratings yet

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323No ratings yet

- At ActiveDocument3 pagesAt Activemr12323No ratings yet

- Astro PreditDocument1 pageAstro Preditmr12323No ratings yet

- Revision of Pension (c116063)Document1 pageRevision of Pension (c116063)mr12323No ratings yet

- GN 5 41Document1 pageGN 5 41mr12323No ratings yet

- 0510 ColeDocument21 pages0510 Colemr12323No ratings yet

- BitcoinsDocument45 pagesBitcoinsSwadhin Sonowal100% (1)

- ProFx 4 User Manual PDFDocument20 pagesProFx 4 User Manual PDFMelque ResendeNo ratings yet

- GN 5 38Document1 pageGN 5 38mr12323No ratings yet

- Cyprus financial crisis impacts banking system tradingDocument1 pageCyprus financial crisis impacts banking system tradingmr12323No ratings yet

- Scope of AnatomyDocument25 pagesScope of Anatomymr12323No ratings yet

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Traders World 20101Document10 pagesTraders World 20101satish sNo ratings yet

- F9D1 ManualDocument18 pagesF9D1 Manualmr12323No ratings yet

- Barclay and Hendershott-Price Discovery and Trading After HoursDocument33 pagesBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelNo ratings yet

- Individual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRADocument4 pagesIndividual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRAChris21JinkyNo ratings yet

- Hi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!Document8 pagesHi-Line Sportsmen Banquet Is February 23rd: A Chip Off The Ol' Puck!BS Central, Inc. "The Buzz"No ratings yet

- ArDocument26 pagesArSegunda ManoNo ratings yet

- Endangered EcosystemDocument11 pagesEndangered EcosystemNur SyahirahNo ratings yet

- Ecc Part 2Document25 pagesEcc Part 2Shivansh PundirNo ratings yet

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocument8 pagesCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNo ratings yet

- EN 12449 CuNi Pipe-2012Document47 pagesEN 12449 CuNi Pipe-2012DARYONO sudaryonoNo ratings yet

- SolBridge Application 2012Document14 pagesSolBridge Application 2012Corissa WandmacherNo ratings yet

- Mil STD 2154Document44 pagesMil STD 2154Muh SubhanNo ratings yet

- 2021 JHS INSET Template For Modular/Online Learning: Curriculum MapDocument15 pages2021 JHS INSET Template For Modular/Online Learning: Curriculum MapDremie WorksNo ratings yet

- Technical Manual - C&C08 Digital Switching System Chapter 2 OverviewDocument19 pagesTechnical Manual - C&C08 Digital Switching System Chapter 2 OverviewSamuel100% (2)

- Ielts Practice Tests: ListeningDocument19 pagesIelts Practice Tests: ListeningKadek Santiari DewiNo ratings yet

- Joining Instruction 4 Years 22 23Document11 pagesJoining Instruction 4 Years 22 23Salmini ShamteNo ratings yet

- OS LabDocument130 pagesOS LabSourav BadhanNo ratings yet

- eHMI tool download and install guideDocument19 pageseHMI tool download and install guideNam Vũ0% (1)

- Corporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Document18 pagesCorporate Governance, Corporate Profitability Toward Corporate Social Responsibility Disclosure and Corporate Value (Comparative Study in Indonesia, China and India Stock Exchange in 2013-2016) .Lia asnamNo ratings yet

- Ofper 1 Application For Seagoing AppointmentDocument4 pagesOfper 1 Application For Seagoing AppointmentNarayana ReddyNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Equilibruim of Forces and How Three Forces Meet at A PointDocument32 pagesEquilibruim of Forces and How Three Forces Meet at A PointSherif Yehia Al MaraghyNo ratings yet

- Computer Networks Transmission Media: Dr. Mohammad AdlyDocument14 pagesComputer Networks Transmission Media: Dr. Mohammad AdlyRichthofen Flies Bf109No ratings yet