Professional Documents

Culture Documents

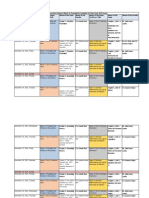

Principles of Accounting, Historical Cost & Current Cost Approaches

Uploaded by

Athirah Roslee0 ratings0% found this document useful (0 votes)

57 views2 pagesaccounting theory

Original Title

Principle Accounting-summary Far600

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting theory

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views2 pagesPrinciples of Accounting, Historical Cost & Current Cost Approaches

Uploaded by

Athirah Rosleeaccounting theory

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

Principle Accounting, & Recognition and Measurement Issues

Historical Cost Accounting

Objective of accounting stewardship

Accounting info took a greater significant as

a source info about firms.

Reasonthe corporate form for a large biz

has caused a separation of biz ownership &

control.

Stewardshipemphasis on the contractual

relation between firm & those who provide

resources to it.

Accountability to equity holdersprimary

function

asic !oncept under "!

PROFIT

Paton & Littleton describe profit#

Accounting exists primarily as a means of computing

a residuum, a balance & the difference between costs

& revenue for individual enterprises. The difference

reflects managerial effectiveness & is particular

significance to those who furnish the capital & take

the ultimate responsibility..

ased on Framework for Preparation and

Presentation of Financial tatement#

$. %ncome is increases in economic benefits during

the accounting period in the form of inflows or

enhancements of assets or decreases of liabilities

that result in increases in equity& other than those

relating to contributions from equity participants.

'. ()penses are decreases in economic benefits

during the accounting period in the form of

outflows or depletions of assets or incurrences of

liabilities that result in decrease in equity.

O!T! ATTA" T"#OR$

!ost of a product can be determined by

counting the attach costs of goods*services

used in the production of the final products.

Supports the view that accounting is not a

process of valuation but of allocation.

+his concept is used as a fundamental in cost

accounting.

FLO% OF O!T!

Accountant must keep track the flow of costs

until it is e)pired to the %S.

,atching concept is important as accountant

need to decide costs to be considered as

Exit Price Accounting

- %s a system of accounting which uses market selling

prices to measure the firm.s financial position &

performance.

- +he values of non-monetary assets are adjusted to

measure changes in market selling prices specific to

those assets.

- !hanges in the general purchasing power of money

are taken into consideration when measuring financial

positions & results of operations.

!upport for e&it price accounting

$. /rovides useful information to decision oriented

shareholders who are 0outsider. to the firm.

'. ()it values reveal the financial condition of the firm& its

ability to adapt to current environment.

1. /rovide relevant & reliable information to all users.

2. /resent market price is superior compared to other

valuation models for decision making.

3. ()it prices are objective because they are market

determine.

4. All the values in the financial statements are additives

as they are referring to one characteristics.

5. +here is no problem concerning allocation of costs.

6. ()it prices and changes in e)it prices indicators of

financial risks.

riticism of e&it price accounting

o 7oes not provide relevance data to match against

revenues to measure the performance of a firm.

o Accounting must measure past events& those that

actually happened rather than those that might

happen.

o %f the firm was actually contemplating liquidation& the

information of e)it price is relevance& but is not for

most firms.

o !urrent cash equivalent are not additive.

o %t does not recognize the ability of the firm to adapt in

terms of combination of assets.

o %nconsistency in the treatment of bonds as assets &

liabilities and treatment of receivables.

'efense of " Accounting

$."! is relevance in making economic

decisions.

'."! is based on actual& not merely possible

transactions.

1.+hrough history& fin.statements based on

historical costs has been found to be useful.

2.+he best understood concept of profit is the

access of selling price over historical cost.

3.Accountants must guard the integrity of their

data against internal modifications

4.!hanges in market prices can be disclosed

as supplementary data.

5. +here is insufficient evidence to justify

rejection of historical cost accounting.

" is rele(ance in ma)ing economic

decision*

,anagers are concern on future commitments& they

need past data to forecast & measure current

performance with past decision.

I+iri present , reasons-

- %t effects the evaluation & selection of decision rules.

- %t provides input for satisficing notion.

- %t imposed on decision makers by their environment.

" is .ased on actual, not merely possi.le

transactions

A record is based on the actual transaction made.

%jiri point out that or current cost or e)it accounting& it

is possible to prepare the balance sheet on the basis

of year-end market price without reference to actual

transactions.

"! provides evidence for determining how effectively

riticism of " Accounting

Objective of Accounting

%nformation for decision making

asis of "istorical cost

,atching

8otions of investor needs

"istorical cost under attack

Current cost Accounting (CCA)

o %s an accounting system in which assets

are valued at current market buying prices

& profits is determined by allocation based

on current costs

o (dwards & ell 9$:4$; proposed a system

of current cost accounting which is based

on the concept of financial capital

maintenance& but illustrated in other

versions of current cost which use physical

capital maintenance.

Rational of current cost accounting

+he choice of capital concept significantly

affects the derive measure of profit.

!!A is an accounting system in which assets

are valued at current market buying prices &

profits is determined by allocation based on

current costs.

%hy used urrent costs/

o ,anagers want to know how they should

allocate the firm.s resources in order to

ma)imize profits.

o ,anagers make decisions regarding the 1

questions based on the e)pectations about

future events.

o +hey need accurate info to compare if the

e)pectations were inaccurate& current events

should be altered for future benefits.

o %f the info includes events for past events mi)ed

oncept of 0usiness Profit

!olding decisionswhether to 0hold. an assets

& liability to dispose<

"perating decisionshow to use & finance the

entity operations<

o ,i)ing holding gains*losses & operating

gain*losses confuses the evaluation of

management decisions & hinders the

allocation of resources in the economy.

o !!A allows the separation of these

components.

o ,anagement decision to hold assets &

liabilities can be evaluated-benefits to the

appropriate managers for proper decision

making.

0enefits on including holding gain1losses in

Income !tatement

$.!an determine if holding activities are

successful.

'.etter prediction of performance of

management.

1.etter prediction of future cash flow.

2.=ives credit when credit is due.

riticism of urrent cost

!ome mainly from ' different camps#

- +hose who subscribe to "! accounting

- +hose who believe in ()it /rice Accounting

Advocates of historical cost

Advocates of e)it price

In support of current cost

>ecognition principle

Purposes of accounting information

under urrent ost Accounting-

(valuation by managers of their past

decisions in order to make best possible

decisions for the future.

(valuation of managers by shareholders&

creditors & others.

2alue3in3use & 2alue3in3e&change 4Adam

!mith5

- An asset can have ' components.

- ()it price ignore value in use.

- An asset that is held rather than sold must be

worth more to its owners than its e)it prices.

- %t is absurb to record a sound of investment as a

loss simply because the asset has no resale

You might also like

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting Theory - Summary Chapter 6Document10 pagesAccounting Theory - Summary Chapter 6Boby Kristanto ChandraNo ratings yet

- Measurement Theory and Cost AllocationDocument17 pagesMeasurement Theory and Cost AllocationYusuf RaharjaNo ratings yet

- Concepts in The Measurement of Income, The Price Level Problem, and Basic Concepts of Management ControlDocument14 pagesConcepts in The Measurement of Income, The Price Level Problem, and Basic Concepts of Management ControljunreymoralesNo ratings yet

- AccountsDocument9 pagesAccountsSivaNo ratings yet

- Jawaban Assigment CH 1Document5 pagesJawaban Assigment CH 1AjiwNo ratings yet

- Conventional AccountingDocument2 pagesConventional AccountingChoi Minri0% (1)

- Far 600Document2 pagesFar 600Nu'ul Qiqi ZaidNo ratings yet

- Business 2 2023Document10 pagesBusiness 2 2023group0840No ratings yet

- THREE MAIN INCOME AND CAPITAL MEASUREMENTDocument5 pagesTHREE MAIN INCOME AND CAPITAL MEASUREMENTnabila IkaNo ratings yet

- Measurement Theory Chapter SummaryThe title provides a concise yet informative summary of the document content. It mentions the key chapter topic of "Measurement TheoryDocument17 pagesMeasurement Theory Chapter SummaryThe title provides a concise yet informative summary of the document content. It mentions the key chapter topic of "Measurement TheoryYusuf Raharja100% (1)

- Normative Theories of AccountingDocument23 pagesNormative Theories of AccountingI Outdoor GuideNo ratings yet

- Unit 5Document15 pagesUnit 5EYOB AHMEDNo ratings yet

- Management Accounting Module - VDocument11 pagesManagement Accounting Module - Vdivya kalyaniNo ratings yet

- Business Accounting and Costing AssignmentDocument19 pagesBusiness Accounting and Costing AssignmentGaurav AnandNo ratings yet

- Chapter 4 - Normative Accounting TheoriesDocument12 pagesChapter 4 - Normative Accounting TheoriesNadia DamayantiNo ratings yet

- Theory Cost and Management AccountingDocument27 pagesTheory Cost and Management AccountingAnkit ShahNo ratings yet

- Chapter 1 Financial Management and Financial ObjectivesDocument11 pagesChapter 1 Financial Management and Financial ObjectivesHarris LuiNo ratings yet

- Section 1: Introduction To Principles of AccountsDocument6 pagesSection 1: Introduction To Principles of AccountsArcherAcsNo ratings yet

- Accounts NotesDocument15 pagesAccounts NotessharadkulloliNo ratings yet

- MMPC-04 2022-23Document8 pagesMMPC-04 2022-23Rajni KumariNo ratings yet

- DBM Employee Sourcing NotesDocument91 pagesDBM Employee Sourcing Notesjxmzeey420No ratings yet

- Accounting Measurement SystemDocument7 pagesAccounting Measurement SystemDionysius Ivan Hertanto100% (1)

- Reliabiliity and AccuracyDocument6 pagesReliabiliity and AccuracyReiner PrayogaNo ratings yet

- Week 2 Questions AnswersDocument2 pagesWeek 2 Questions Answers啵啵贊贊No ratings yet

- SEM II Cost-Accounting Unit 1Document23 pagesSEM II Cost-Accounting Unit 1mahendrabpatelNo ratings yet

- A Framework For Financial Statement AnalysisDocument27 pagesA Framework For Financial Statement AnalysisAndrea Prado CondeNo ratings yet

- Financial Analysis of Wipro LTD PDFDocument25 pagesFinancial Analysis of Wipro LTD PDFMridul sharda100% (2)

- Definition of 'Time Value of Money - TVM'Document4 pagesDefinition of 'Time Value of Money - TVM'Chinmay P KalelkarNo ratings yet

- Enterprise DCF Model: Module-2Document57 pagesEnterprise DCF Model: Module-2DevikaNo ratings yet

- Summary NotesDocument95 pagesSummary NotesLeLe LetzileNo ratings yet

- Historical Costing Is An Important Element of Financial Bookkeeping For A CompanyDocument5 pagesHistorical Costing Is An Important Element of Financial Bookkeeping For A CompanyYolanda FosalaNo ratings yet

- Accounting Concepts and Recording of Financial TransactionsDocument8 pagesAccounting Concepts and Recording of Financial Transactionsjunita bwaliNo ratings yet

- Valuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationDocument15 pagesValuation: The Valuation Principle: The Foundation of Financial Decision Making ValuationWensky RagpalaNo ratings yet

- Financial Modelling Shareholder Value CreationDocument6 pagesFinancial Modelling Shareholder Value Creationshubhagyaldh6253No ratings yet

- Module 1: Introduction (5 Hours) : Financial Reporting, Statements and AnalysisDocument21 pagesModule 1: Introduction (5 Hours) : Financial Reporting, Statements and Analysisshahid sjNo ratings yet

- FINANCIAL REPORTING OBJECTIVESDocument7 pagesFINANCIAL REPORTING OBJECTIVESThakur MangalNo ratings yet

- Distinction Betweeen Cost Accounting and Management AccountingDocument9 pagesDistinction Betweeen Cost Accounting and Management Accountingbhaskaranbalamurali100% (1)

- Accounts Jun 21Document5 pagesAccounts Jun 21Nisha MandaleNo ratings yet

- 6 Historical CostDocument22 pages6 Historical CostAshitaRastogiNo ratings yet

- Chapter One Introdutoin: 1.1. What Is Cost Accounting?Document156 pagesChapter One Introdutoin: 1.1. What Is Cost Accounting?NatnaelNo ratings yet

- Funds Flow StatementDocument101 pagesFunds Flow StatementSakhamuri Ram'sNo ratings yet

- Working Capital in C.L. GUPTADocument106 pagesWorking Capital in C.L. GUPTAprince395No ratings yet

- Accounting:: Information For Decision MakingDocument29 pagesAccounting:: Information For Decision MakingKhursheed Ahmad KhanNo ratings yet

- Replacement Cost AccountingDocument8 pagesReplacement Cost AccountingTosin YusufNo ratings yet

- Examples of Current Assets IncludeDocument4 pagesExamples of Current Assets IncludeMujahidNo ratings yet

- Basic of CostingDocument15 pagesBasic of CostingAmit JaiswatNo ratings yet

- Overview of Cost AccountingDocument21 pagesOverview of Cost AccountingVinayNo ratings yet

- Draft 1Document7 pagesDraft 1John Ray RonaNo ratings yet

- Chapter 7Document15 pagesChapter 7rachel banana hammockNo ratings yet

- Final Exam PreparationDocument4 pagesFinal Exam PreparationHiếu Nguyễn Minh HoàngNo ratings yet

- MA 6e CH01 WebsiteDocument26 pagesMA 6e CH01 WebsiteSewale AbateNo ratings yet

- Jawaban Versi Indo Akm 2Document8 pagesJawaban Versi Indo Akm 2dindaNo ratings yet

- DocDocument4 pagesDocPutri SitohangNo ratings yet

- Chapter 1 AnswerDocument11 pagesChapter 1 Answerelainelxy2508No ratings yet

- Financial Analysis of BART! A!RT"# $"R%!&"$ #TDDocument70 pagesFinancial Analysis of BART! A!RT"# $"R%!&"$ #TDBrandon AndersonNo ratings yet

- SwrfeDocument204 pagesSwrfekmillatNo ratings yet

- Financial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesFrom EverandFinancial Statement Analysis Study Resource for CIMA & ACCA Students: CIMA Study ResourcesNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Androids Report-Solid WasteDocument6 pagesAndroids Report-Solid WasteAthirah RosleeNo ratings yet

- Summary Far600-Standard Setting in MalaysiaDocument1 pageSummary Far600-Standard Setting in MalaysiaAthirah RosleeNo ratings yet

- About Petronas BHDDocument6 pagesAbout Petronas BHDAthirah RosleeNo ratings yet

- 21 Years For Mum Who Recorded DaughterDocument3 pages21 Years For Mum Who Recorded DaughterAthirah RosleeNo ratings yet

- Assignment MKT! Auto Saved)Document17 pagesAssignment MKT! Auto Saved)Athirah RosleeNo ratings yet

- English 2.2 FPT PolytechnicDocument10 pagesEnglish 2.2 FPT PolytechnicKieu Mai Trang (FPL HCM)0% (1)

- Hempathane Topcoat 55219 Base 5521967280 En-UsDocument11 pagesHempathane Topcoat 55219 Base 5521967280 En-UsSantiago Rafael Galarza JacomeNo ratings yet

- Radiant Tube BurnersDocument18 pagesRadiant Tube BurnersRajeshNo ratings yet

- Geomatics Lab 6 (GPS)Document24 pagesGeomatics Lab 6 (GPS)nana100% (1)

- Working Capital Management (2015)Document62 pagesWorking Capital Management (2015)AJNo ratings yet

- On MCH and Maternal Health in BangladeshDocument46 pagesOn MCH and Maternal Health in BangladeshTanni ChowdhuryNo ratings yet

- Iwwusa Final Report IdsDocument216 pagesIwwusa Final Report IdsRituNo ratings yet

- ALT Company Introduction 20170524.1Document51 pagesALT Company Introduction 20170524.1Terence WoonNo ratings yet

- Upper Six 2013 STPM Physics 2 Trial ExamDocument11 pagesUpper Six 2013 STPM Physics 2 Trial ExamOw Yu Zen100% (2)

- Participatory Assessment of Ragay Gulf Resources and SocioeconomicsDocument167 pagesParticipatory Assessment of Ragay Gulf Resources and SocioeconomicsCres Dan Jr. BangoyNo ratings yet

- 1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Document36 pages1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Vasile AlexandraNo ratings yet

- Automorphic Representations and L-Functions For The General Linear Group - Volume 2cDocument210 pagesAutomorphic Representations and L-Functions For The General Linear Group - Volume 2cluisufspaiandreNo ratings yet

- Comparison of AdjectivesDocument2 pagesComparison of AdjectivesmallxNo ratings yet

- EMA Guideline on Calculating Cleaning LimitsDocument4 pagesEMA Guideline on Calculating Cleaning LimitsshivanagiriNo ratings yet

- Chapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsDocument10 pagesChapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsALANKRIT TRIPATHINo ratings yet

- SRT95 Engine Power TakeoffDocument20 pagesSRT95 Engine Power TakeoffoktopusNo ratings yet

- The Teacher and The LearnerDocument23 pagesThe Teacher and The LearnerUnique Alegarbes Labra-SajolNo ratings yet

- Viscosity IA - CHEMDocument4 pagesViscosity IA - CHEMMatthew Cole50% (2)

- IRC-114-2013 Use of Silica Fume in Rigid PavementDocument14 pagesIRC-114-2013 Use of Silica Fume in Rigid PavementZakee MohamedNo ratings yet

- Working Capital Management at Padmavathi Co-operative BankDocument53 pagesWorking Capital Management at Padmavathi Co-operative BankMamidishetty Manasa67% (3)

- Application of Carbon-Polymer Based Composite Electrodes For Microbial Fuel CellsDocument26 pagesApplication of Carbon-Polymer Based Composite Electrodes For Microbial Fuel Cellsavinash jNo ratings yet

- DEWA Electrical Installation Regulations Section 1 OverviewDocument123 pagesDEWA Electrical Installation Regulations Section 1 Overviewsiva_nagesh_280% (5)

- Industrial/Organi Zational Psychology: Alday, Angeli Camille M. - 2P2Document51 pagesIndustrial/Organi Zational Psychology: Alday, Angeli Camille M. - 2P2SteffanyNo ratings yet

- Avance Collection Mixer Grinder SpecsDocument3 pagesAvance Collection Mixer Grinder SpecsfaNo ratings yet

- Caribbean Studies - Lesson 8 - Concept and Indicator of Development PDFDocument37 pagesCaribbean Studies - Lesson 8 - Concept and Indicator of Development PDFDarrion BruceNo ratings yet

- Captive Screws - Cap Head: Hex. SocketDocument5 pagesCaptive Screws - Cap Head: Hex. SocketvikeshmNo ratings yet

- Transactionreceipt Ethereum: Transaction IdentifierDocument1 pageTransactionreceipt Ethereum: Transaction IdentifierVALR INVESTMENTNo ratings yet

- 05 Askeland ChapDocument10 pages05 Askeland ChapWeihanZhang100% (1)

- 1-2-Chemical Indicator of GeopolymerDocument4 pages1-2-Chemical Indicator of GeopolymerYazmin Alejandra Holguin CardonaNo ratings yet

- Rigor Mortis and Lividity in Estimating Time of DeathDocument2 pagesRigor Mortis and Lividity in Estimating Time of DeathfunnyrokstarNo ratings yet