Professional Documents

Culture Documents

Capital Budgeting Examples

Uploaded by

justin_zelin0 ratings0% found this document useful (0 votes)

88 views21 pagescapital budgeting

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcapital budgeting

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views21 pagesCapital Budgeting Examples

Uploaded by

justin_zelincapital budgeting

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 21

Capital Budgeting Examples

Instructions Question 1 Question 5

Question 2 Question 6

Question 3 Question 7

Question 4 Question 8

Copyright 2008 McGraw-Hill/Irwin

Copyright 2004 McGraw-Hill/Irwin

Capital Budgeting Examples

Main Menu

Instructions

Navigating the Workbook Top

CTRL+PAGE DOWN: Moves you to the next sheet in the workbook.

Entering your information Top

For each question, you will see the following lists and boxes:

Student Name:

Course Name:

Student ID:

Course Number:

Enter your information in these cells before submitting your work.

Entering data Top

To enter numbers or text for these questions, click the cell you want, type the data and

press ENTER or TAB. Press ENTER to move down the column or TAB to move across the row.

For cells or columns where you want to enter text, select Format, and then Cells from

Excels main menu at the top of your screen. Select the Number tab and then Text

from the category list.

Printing Top

To print your work, select "File," and then "Print Preview" from Excels main menu at the top

of your screen. The print area for each question has been set, but be sure to review

the look of your print job. If you need to make any changes, select Setup when

you are previewing the document.

Help Top

There are two sources of help throughout these spreadsheet templates. First, you will find comments

in specific cells (highlighted in red) providing tips to what formula or function is needed to complete

the problem. Second, you will find links to Microsoft Office's online help page when an Excel Function

is needed to complete the problem.

keyboard shortcuts:

CTRL+PAGE UP: Moves you to the previous sheet in the workbook.

at the bottom of the screen. Each worksheet in an Excel workbook will have its own

tab. In the spreadsheetsyou will see a separate tab for each problem, along with

the Main Menu, Instructions and Help Topics worksheets.

Another way to move quickly around an Excel workbook is by using the following

You can move quickly around an Excel workbook by selecting the worksheet tab

Navigating the Workbook

Entering your information

Entering data

Printing

Help

These hyperlinks help you move around the workbook quickly.

Copyright 2008 McGraw-Hill/Irwin

Copyright 2008 McGraw-Hill/Irwin

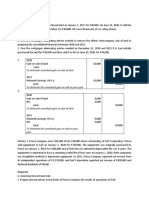

Question 1: Determining the value of a tax shield

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

Assumptions

Installation cost $50,000

Tax rate 35%

Opportunity cost 5%

MACRS percentages Annual Tax

Years Percentages Depreciation Shield

1 20%

2 32%

3 19.2%

4 11.52%

5 11.52%

6 5.76%

Value of tax shield if:

Installations costs expensed year 1

Value of tax shield if:

Capitalized and depreciated FORMULA

Copyright 2008 McGraw-Hill/Irwin

Question 2: Analyze capital projects under different tax scenarios

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

Assumptions

Projected cash flows:

Initial investment ($100,000)

Before-tax cash inflow $26,000

Company B tax rate 35%

Opportunity cost of capital 8%

Year

1 2 3 4 5 6

5-year MACRS Schedule:

Company A: Year

Projected cash flows 1 2 3 4 5 6

Cash in

Tax 0 0 0 0 0 0

Cash flow

Company B: Year

Projected cash flows 1 2 3 4 5 6

Cash in

Depreciation

Taxable income

Tax

Net income

Cash flow

(a) Calculate project NPV for each company.

Company A NPV: FUNCTION

Company B NPV:

(b) What is the IRR of the after-tax cash flows for each company? What does comparison of the

IRRs suggest is the effective corporate tax rate?

IRR for A FORMULA

IRR for B

Effective tax rate 0.0%

Help with Excel's NPV function

Help with Excel's IRR function

Copyright 2008 McGraw-Hill/Irwin

Question 3

Student Name:

Course Name:

Student ID:

Course Number:

Click here to use Tables 7.5 and 7.6 for the answer part a.

Click here to use Tables CBE.1 and CBE.2 for the answers to parts b and c.

c. Continue with the assumed $15 million capital investment and the 11% cost of capital.

What if sales, cost of goods sold, and net working capital are each 10% higher

in every year? Recalculate NPV. Note: Enter the revised sales, cost, and workingcapital

forecasts in the spreadsheet for Table CBE.1.

a. How does the guano projects NPV change if IM&C is forced to use the seven-year

MACRS tax depreciation schedule?

b. New engineering estimates raise the possibility that capital investment will be more

than $10 million, perhaps as much as $15 million. On the other hand, you believe

that the 20% cost of capital is unrealistically high and that the true cost of capital is

about 11%. Is the project still attractive under these alternative assumptions?

Copyright 2008 McGraw-Hill/Irwin

Capital Budgeting Exercises

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

a) Read the notes to the table carefully. Which entries make sense? Which do not? Why or why not?

Consider each of the items listed and type your answer in the text box below. Attach any additional sheets if necessary.

Item

Capital Expenditure

Research and Development

Working Capital

Revenues

Operating Costs

Overhead

Depreciation

Interest

Taxes

Net Cash Flow

b) What additional information would you need to construct a version of TABLE CBE.7 that makes sense?

List the items for which you would like more information below:

1

2

3

4

5

6

7

8

9

10

click here to begin typing

Copyright 2008 McGraw-Hill/Irwin

c) Construct such a table and recalculate NPV. Make additional assumptions as necessary.

Assumptions

1 Enter all figures in thousands of dollars (e.g., $100,000 is entered as 100).

2

3

4

5

6

7

8

9

10

11

12

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

1

2

3

4

5

6

7

8

9

10

11

12

13 Net Cash Flows FORMULA

14 Present value

16 Net present value = FUNCTION Help with Excel's SUM function

Copyright 2008 McGraw-Hill/Irwin

Question 5: Using NPV to evaluate a capital project

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

Assumptions

Initial investment ($000) Enter all figures in thousands of dollars (e.g., $100,000 is entered as 100).

Resale Value year 8

Working Capital Investment

Projected working capital

(% of Sales)

Yearly rental income

Rental Income growth rate

First year sales

Sales growth rate

Manufacturing costs

(% of Sales)

Tax rate

Cost of capital

Year

1 2 3 4 5 6 7 8 9

Sales

Manufacturing Costs

Depreciation

Earnings before tax

Taxes

Net Income

Working Capital

Increase in W.C.

Lost After Tax Rental Income FORMULA

Initial Investment

Sale of Plant

Tax on Sale

Net Cash Flows FORMULA

Present value

Net present value = FUNCTION Help with Excel's SUM function

Copyright 2008 McGraw-Hill/Irwin

Question 6: Evaluating alternative capital asset decisions

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

The net cash flows for each copier have been calculated for you and are shown below.

Select each cell to see the formula used for this calculation.

Parts A through D below have been structured to help you develop the solution.

Assumptions

Current Copier Net Cash Flows: New Copier Projected Net Cash Flows

Net * Net *

Years Cash Flow Years Cash Flow

1 -675 0 -25,000

2 -675 1 600

3 -4,575 2 1,493

4 -4,889 3 880

5 -5,200 4 443

6 -5,200 5 131

6 131

7 131

* After taxes 8 -261

Cost of capital 7%

Income tax rate 35%

A. What is the present value of each copier?

Present value of current copier

Equivalent annual cost $0.00

Present value of new copier

B. If you replace the current copier now, when the book value is $6,248 and

the resale value is $8,000, what will be the present value of the decision?

Present value FORMULA

Equivalent annual cost FORMULA

C. If you replace the copier in 2 years, when the book value is $2,676 and what will be the present value of the decision?

the resale value is $3,500, what will be the present value of the decision?

Present value

Equivalent annual cost $0

D. If you replace the copier in 6 years, what will be the present value of the decision? Assume a zero book and

resale value.

Present value FORMULA

Equivalent annual cost FORMULA

When should the copier be replaced?

Help with Excel's PV function

Copyright 2008 McGraw-Hill/Irwin

Question 7

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

0 1 2 3 4

Cash flows A 40000 10000 10000 10000

PV Cash flows A

Cash flows B 50000 8000 8000 8000 8000

PV Cash flows B

Annuity Factor - 3 years FUNCTION

Annuity Factor - 4 years FUNCTION

Equivalent Annual Cost A

Equivalent Annual Cost B

b. Which machine should Borstal buy?

c. How much would you actually have to charge in each future year if there is steady 8% per year inflation?

Click here for help with Excel's PV function

Copyright 2008 McGraw-Hill/Irwin

Question 8

Student Name:

Course Name:

Student ID:

Course Number:

Select the red highlighted items below for tips and suggestions to complete this problem.

0 1 2 3 4

Cash flows A 40000

PV Cash flows A

Cash flows B 50000

PV Cash flows B

Annuity Factor - 3 years FUNCTION

Annuity Factor - 4 years FUNCTION

Equivalent Annual Cost A

Equivalent Annual Cost B

0

c. How much would you actually have to charge in each future year if there is steady 8% per year inflation?

Click here for help with Excel's PV function

Copyright 2008 McGraw-Hill/Irwin

Period

0 1 2 3 4 5

1. Capital investment 10,000

2. Accumulated depn. 1,583 3,167 4,750 6,333 7,917

3. Year-end book value 10,000 8,417 6,833 5,250 3,667 2,083

4. Working capital 550 1,289 3,261 4,890 3,583

5. Total book value (3 + 4) 8,967 8,122 8,511 8,557 5,666

6. Sales 523 12,887 32,610 48,901 35,834

7. Cost of goods sold 837 7,729 19,552 29,345 21,492

8. Other costs 4,000 2,200 1,210 1,331 1,464 1,611

9. Depreciation 1,583 1,583 1,583 1,583 1,583

10. Pretax profit -4,000 -4,097 2,365 10,144 16,509 11,148

11. Tax -1,400 -1,434 828 3,550 5,778 3,902

12. Profit after tax (10 - 11) -2,600 -2,663 1,537 6,593 10,731 7,246

Notes:

No. of years depreciation 6

Assumed salvage value in depreciation calculation 500

Tax rate (percent) 35

TABLE CBE.1 IM&C's guano project -- projections ($ thousands) reflecting inflation and straight line depreciation

Main Menu

6 7

-1,949

9,500 0

500 0

2,002 0

2,502 0

19,717

11,830

1,772

1,583 0

4,532 1,449

1,586 507

2,946 942

TABLE CBE.1 IM&C's guano project -- projections ($ thousands) reflecting inflation and straight line depreciation

Back to

Question

Period

0 1 2 3 4

1. Sales 0 523 12,887 32,610 48,901

2. Cost of goods sold 0 837 7,729 19,552 29,345

3. Other costs 4,000 2,200 1,210 1,331 1,464

4. Tax -1,400 -1,434 828 3,550 5,778

5. Cash flow from operations (1 - 2 - 3 - 4) -2,600 -1,080 3,120 8,177 12,314

6. Change in working capital -550 -739 -1,972 -1,629

7. Capital investment and disposal -10,000 0 0 0 0

8. Net cash flow (5 + 6 + 7) -12,600 -1,630 2,381 6,205 10,685

9. Present value -12,600 -1,358 1,654 3,591 5,153

Net present value = 3,520

Cost of capital (percent) 20

TABLE CBE.2 IM&C's guano project -- initial cash flow analysis with straight-line depreciation ($ thousands)

Go back to Table 7.1 to change Sales, Cost of goods sold, etc.

Main Menu

5 6 7

35,834 19,717 0

21,492 11,830 0

1,611 1,772 0

3,902 1,586 507

8,829 4,529 -507

1,307 1,581 2,002

0 0 1,949

10,136 6,110 3,444

4,074 2,046 961

TABLE CBE.2 IM&C's guano project -- initial cash flow analysis with straight-line depreciation ($ thousands)

Back to

Question

Recovery-Period Years

Class 1 2 3 4 5 6 7 8

3-year 33.33 44.45 14.81 7.41

5-year 20.00 32.00 19.20 11.52 11.52 5.76

7-year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.45

10-year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55

15-year 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90

20-year 3.75 7.22 6.68 6.18 5.71 5.28 4.89 4.52

TABLE CBE.4 Tax Depreciation Schedules by Recovery-Period Class

Main Menu

9 10 11 12 13 14 15 16 17

6.56 6.55 3.29

5.90 5.90 5.90 5.90 5.91 5.90 5.91 2.99

4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46 4.46

TABLE CBE.4 Tax Depreciation Schedules by Recovery-Period Class Back to

Question

18 19 20 21

4.46 4.46 4.46 2.23

No. of years depreciation (3, 5 or 7 years only) 5

Tax rate (percent) 35

0 1 2

MACRS % 20.0 32.0

Tax depreciation (MACRS % x depreciable investment) 2,000 3,200

1 Sales 0 523 12,887

2 Cost of goods sold 0 837 7,729

3 Other costs 4,000 2,200 1,210

4 Tax depreciation 0 2,000 3,200

5 Pretax profits -4,000 -4,514 748

6 Tax -1,400 -1,580 262

0 1 2

1. Sales 0 523 12,887

2. Cost of goods sold 0 837 7,729

3. Other costs 4,000 2,200 1,210

4. Tax -1,400 -1,580 262

5. Cash flow from operations (1 - 2 - 3 - 4) -2,600 -934 3,686

6. Change in working capital -550 -739

7. Capital investment & disposal -10,000 0 0

8. Net cash flow (5 + 6 + 7) -12,600 -1,484 2,947

9. Present value -12,600 -1,237 2,047

Net present value = 3,802

Cost of capital (percent) 20

TABLE CBE.5 Tax payments on IM&C's guano project ($ thousands)

TABLE CBE.6 IM&C's guano project -- revised cash flow analysis with MACRS depreciation ($ thousands)

Note: Vary depreciable life by changing inputs in these tables. Go back to Tables 7.1 or 7.2 to change sales, cost of goods sold, cost of capital etc.

Main Menu

Period

3 4 5 6 7

19.2 11.5 11.5 5.8 0.0

1,920 1,152 1,152 576 0

32,610 48,901 35,834 19,717 0

19,552 29,345 21,492 11,830 0

1,331 1,464 1,611 1,772 0

1,920 1,152 1,152 576 0

9,807 16,940 11,579 5,539 1,949

3,432 5,929 4,053 1,939 682

Period

3 4 5 6 7

32,610 48,901 35,834 19,717 0

19,552 29,345 21,492 11,830 0

1,331 1,464 1,611 1,772 0

3,432 5,929 4,053 1,939 682

8,295 12,163 8,678 4,176 -682

-1,972 -1,629 1,307 1,581 2,002

0 0 0 0 1,949

6,323 10,534 9,985 5,757 3,269

3,659 5,080 4,013 1,928 912

TABLE CBE.5 Tax payments on IM&C's guano project ($ thousands)

TABLE CBE.6 IM&C's guano project -- revised cash flow analysis with MACRS depreciation ($ thousands)

Note: Vary depreciable life by changing inputs in these tables. Go back to Tables 7.1 or 7.2 to change sales, cost of goods sold, cost of capital etc.

Back to

Question

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Chapter 06 - Risk & ReturnDocument42 pagesChapter 06 - Risk & Returnmnr81No ratings yet

- Mini Case On Risk Return 1-SolutionDocument27 pagesMini Case On Risk Return 1-Solutionjagrutic_09No ratings yet

- LP SensitivityAnalysisDocument47 pagesLP SensitivityAnalysisHarshit MishraNo ratings yet

- Bond Valuation Formulas in ExcelDocument22 pagesBond Valuation Formulas in Excelrameessalam852569No ratings yet

- Excel Solution - Extruder Capital Budgeting Case StudyDocument15 pagesExcel Solution - Extruder Capital Budgeting Case Studyalka murarkaNo ratings yet

- Assignment of Time Value of MoneyDocument3 pagesAssignment of Time Value of MoneyMuxammil IqbalNo ratings yet

- Sensitivity Problems - ExerciseDocument17 pagesSensitivity Problems - Exercisechandel08No ratings yet

- CH 13 SolutionsDocument7 pagesCH 13 SolutionsSyed Mohsin Haider0% (1)

- 01-Problem Set Unit 04Document21 pages01-Problem Set Unit 04Tatiana BuruianaNo ratings yet

- Ch01 Solutions Manual An Overview of FM and The Financial Management and The FinancialDocument4 pagesCh01 Solutions Manual An Overview of FM and The Financial Management and The FinancialAM FMNo ratings yet

- Cost of Capital Excel Temple-Free CH 10Document10 pagesCost of Capital Excel Temple-Free CH 10Mohiuddin AshrafiNo ratings yet

- Relevant Cash Flow HomeworkDocument3 pagesRelevant Cash Flow HomeworkSunil KumarNo ratings yet

- FINC600 - Week4Document12 pagesFINC600 - Week4joeNo ratings yet

- Estimating IRR With Fake Payback Period-L10Document9 pagesEstimating IRR With Fake Payback Period-L10akshit_vij0% (1)

- Chapter10 StudentworksheetDocument45 pagesChapter10 StudentworksheetMohitNo ratings yet

- Ross CH 13Document23 pagesRoss CH 13miftahulamalahNo ratings yet

- Bond Valuation With PluginsDocument23 pagesBond Valuation With PluginsHu-Jean RussellNo ratings yet

- Excel Advanced Skills For Financial ModellingDocument10 pagesExcel Advanced Skills For Financial ModellingChaurasia TanuNo ratings yet

- Hand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadDocument55 pagesHand Notes On Cost of Capital and Capital Structure: Composed By: H. B. HamadHamad Bakar HamadNo ratings yet

- RATIOSDocument136 pagesRATIOSAadiSharmaNo ratings yet

- Cfin4 Integrative Problem Ch04Document3 pagesCfin4 Integrative Problem Ch04Jagatjeet Mohapatra0% (1)

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- HW 1, FIN 604, Sadhana JoshiDocument40 pagesHW 1, FIN 604, Sadhana JoshiSadhana JoshiNo ratings yet

- Capital StructureDocument25 pagesCapital StructureMihael Od SklavinijeNo ratings yet

- AF 325 Homework # 1Document3 pagesAF 325 Homework # 1Kunhong ZhouNo ratings yet

- 2013 S1 Solutions bfc2410Document17 pages2013 S1 Solutions bfc2410Lisa Kang100% (1)

- Sensitivity Analysis or What If Analysis and UncertaintyDocument12 pagesSensitivity Analysis or What If Analysis and Uncertaintysinghalok1980No ratings yet

- © 2010 Financial Management Prepared By: Amyn WahidDocument66 pages© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- FM11 CH 13 Mini-Case Old3Document14 pagesFM11 CH 13 Mini-Case Old3Wu Tian WenNo ratings yet

- ACCA AiD - NPV (Net Present Value) Advantages and DisadvantagesDocument2 pagesACCA AiD - NPV (Net Present Value) Advantages and DisadvantagesStavri Makri SmirilliNo ratings yet

- Excel As A Tool in Financial ModellingDocument5 pagesExcel As A Tool in Financial Modellingnikita bajpaiNo ratings yet

- WACC Capital StructureDocument68 pagesWACC Capital StructuremileticmarkoNo ratings yet

- 01e Sensitivity Analysis and DualityDocument42 pages01e Sensitivity Analysis and DualityNitesh Ranjan100% (2)

- Pricing StrategiesDocument34 pagesPricing StrategiesshwetambarirupeshNo ratings yet

- TMV Solved ProblemDocument27 pagesTMV Solved ProblemIdrisNo ratings yet

- Sensitivity Analysis Using ExcelDocument8 pagesSensitivity Analysis Using ExcelUNsha bee komNo ratings yet

- Cost of CaptialDocument72 pagesCost of CaptialkhyroonNo ratings yet

- 2 - Time Value of MoneyDocument68 pages2 - Time Value of MoneyDharmesh GoyalNo ratings yet

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Document27 pagesBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Capital BudgetingDocument66 pagesCapital BudgetingKhizer Ahmed KhanNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Financial Management 2: UCP-001BDocument3 pagesFinancial Management 2: UCP-001BRobert RamirezNo ratings yet

- Chapter 1 - Macroeconomics Final Exam Compilation - SarahDocument7 pagesChapter 1 - Macroeconomics Final Exam Compilation - SarahSARAH CHRISTINE TAMARIANo ratings yet

- Assignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanDocument6 pagesAssignment 1 Iqra Javaid - 46032 Submitted To Muhammad ZeeshanFAIQ KHALIDNo ratings yet

- Risk and Return - PresentationDocument75 pagesRisk and Return - PresentationMosezandroNo ratings yet

- NPV CF K Initial Investment: CautionDocument36 pagesNPV CF K Initial Investment: CautionKhurram AbbasiNo ratings yet

- Case Study (Portfolio)Document6 pagesCase Study (Portfolio)WinniferTeohNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- Reviewer Financial ManagementDocument39 pagesReviewer Financial ManagementDerek Dale Vizconde NuñezNo ratings yet

- EVA Vs ROIDocument5 pagesEVA Vs ROINikhil KhobragadeNo ratings yet

- Valuation of Bonds and Shares: Problem 1Document29 pagesValuation of Bonds and Shares: Problem 1Sourav Kumar DasNo ratings yet

- Topic 10 Capital BudgetingDocument11 pagesTopic 10 Capital Budgetingsalman hussainNo ratings yet

- CH 12 Cash Flow Estimatision and Risk AnalysisDocument39 pagesCH 12 Cash Flow Estimatision and Risk AnalysisRidhoVerianNo ratings yet

- Fcffsimpleginzu ITCDocument62 pagesFcffsimpleginzu ITCPravin AwalkondeNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- M09 Gitman50803X 14 MF C09Document56 pagesM09 Gitman50803X 14 MF C09dhfbbbbbbbbbbbbbbbbbhNo ratings yet

- Instructions Help Topics: Principles of Corporate Finance, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 10Document6 pagesInstructions Help Topics: Principles of Corporate Finance, 8th Edition Spreadsheet Templates MAIN MENU - Chapter 10joyabyssNo ratings yet

- Financial ModelDocument28 pagesFinancial ModelSlidebooks Consulting100% (5)

- Who Trades On WhatDocument53 pagesWho Trades On Whatjustin_zelinNo ratings yet

- Homework Policy 2015Document1 pageHomework Policy 2015justin_zelinNo ratings yet

- Case 2 - Question 1Document8 pagesCase 2 - Question 1justin_zelin100% (1)

- Compass Math Study GuideDocument30 pagesCompass Math Study GuideneelimakomalNo ratings yet

- A Force More PowerfulDocument21 pagesA Force More PowerfultomlecNo ratings yet

- Unit 2 Capital Budgeting Decisions: IllustrationsDocument4 pagesUnit 2 Capital Budgeting Decisions: IllustrationsJaya SwethaNo ratings yet

- FAR 2&3 Test BankDocument63 pagesFAR 2&3 Test BankRachelle Isuan TusiNo ratings yet

- Hero MotocorpDocument27 pagesHero MotocorpDipesh Mehta0% (1)

- Sample Exam - ACT-113X (2014)Document7 pagesSample Exam - ACT-113X (2014)Jamie ToriagaNo ratings yet

- Canvas Shoes (With Rubber Sole)Document9 pagesCanvas Shoes (With Rubber Sole)PRAKASH SUBRAMANIYANNo ratings yet

- 1st Practice Set On Fabm2 1Document6 pages1st Practice Set On Fabm2 1Kezie GirayNo ratings yet

- Assignment #1 FSET TemplateDocument12 pagesAssignment #1 FSET Templateshaitan singhNo ratings yet

- Technician - QA December 2016Document127 pagesTechnician - QA December 2016Biplob K. SannyasiNo ratings yet

- Let's Check: To Eliminate Unrealized Gain On Sale of LandDocument4 pagesLet's Check: To Eliminate Unrealized Gain On Sale of Landalmira garciaNo ratings yet

- Econ QuestionsDocument22 pagesEcon QuestionsAmzar AizadNo ratings yet

- 1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023Document30 pages1.gnutti Carlo - Tax Audit - 2023 - 27.10.2023ssb.corporateteamNo ratings yet

- AstroDocument256 pagesAstroCheong Chun FeiNo ratings yet

- Revaluation Model, Impairment Loss, and Cash Generating UnitDocument6 pagesRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaNo ratings yet

- Combinepdf PDFDocument25 pagesCombinepdf PDFMika MolinaNo ratings yet

- Problema 11Document8 pagesProblema 11zimbolixNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Myanmar Investment Guide 2018Document52 pagesMyanmar Investment Guide 2018THAN HANNo ratings yet

- Minor Project ReportDocument69 pagesMinor Project ReportrimpaNo ratings yet

- Conceptual Framework Chapter 4 5 6Document22 pagesConceptual Framework Chapter 4 5 6SugaNo ratings yet

- Volume 1 - 50 Pages MN23Document52 pagesVolume 1 - 50 Pages MN23Kajal KanduNo ratings yet

- Ch02 Financial Statements, Taxes, and Cash FlowsDocument34 pagesCh02 Financial Statements, Taxes, and Cash FlowsAndrew BruceNo ratings yet

- SAP TcodesDocument47 pagesSAP Tcodesdushyant mudgalNo ratings yet

- 305 Final Exam Cram Question PackageDocument14 pages305 Final Exam Cram Question PackageGloriana FokNo ratings yet

- Funds and Flow StatementDocument14 pagesFunds and Flow Statement75 SHWETA PATILNo ratings yet

- Savant FrameworkDocument41 pagesSavant FrameworkফেরদৌসআলমNo ratings yet

- Chapter 21Document18 pagesChapter 21Ardilla Noor Paramashanti Wirahadikusuma100% (1)

- Sales Budget Cost of Sales Operating ExpenseDocument5 pagesSales Budget Cost of Sales Operating ExpenseViolen AmeliaNo ratings yet

- Lesson Plan-EEFM - NEW FinalDocument5 pagesLesson Plan-EEFM - NEW FinaltanmayeeNo ratings yet

- Steel Production Galan AbdiDocument37 pagesSteel Production Galan AbdiTesfaye Degefa100% (3)

- Chapter 2Document74 pagesChapter 2farooqNo ratings yet