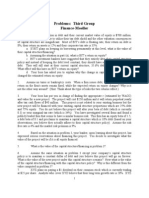

Professional Documents

Culture Documents

Chap 013

Uploaded by

saud1411Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 013

Uploaded by

saud1411Copyright:

Available Formats

Chapter 13 - Equity Valuation

Chapter 13

Equity Valuation

Multiple Choice Questions

1. The accounting measure of a firm's equity value generated by applying accounting

principles to asset and liability acquisitions is called .

!. boo" value

#. mar"et value

C. liquidation value

$. Tobin's q

%. The price-to-sales ratio is probably most useful for firms in &hich phase of the industry life

cycle'

!. (tart up phase

#. Consolidation

C. )aturity

$. *elative decline

3. +f a firm increases its plo&bac" ratio this &ill probably result in a,n- ./E ratio.

!. higher

#. lo&er

C. unchanged

$. unable to determine

0. The value of internet companies is based primarily on .

!. current profits

#. Tobin's q

C. gro&th opportunities

$. replacement cost

13-1

Chapter 13 - Equity Valuation

1. 2e&-economy companies generally have higher than old-economy companies.

!. boo" value per share

#. ./E multiples

C. profits

$. asset values

3. ./E ratios tend to be &hen inflation is .

!. higher4 higher

#. lo&er4 lo&er

C. higher4 lo&er

$. they are unrelated

5. 6hich one of the follo&ing statements about mar"et and boo" value is correct'

!. !ll firms sell at a mar"et to boo" ratio above 1.

#. !ll firms sell at a mar"et to boo" ratio greater than or equal to 1.

C. !ll firms sell at a mar"et to boo" ratio belo& 1.

$. )ost firms have a mar"et to boo" ratio above 17 but not all.

8. Earnings yields tend to &hen Treasury yields fall.

!. fall

#. rise

C. remain unchanged

$. fluctuate &ildly

9. 6hich one of the follo&ing is a common term for the mar"et consensus value of the

required return on a stoc"'

!. $ividend payout ratio

#. +ntrinsic value

C. )ar"et capitali:ation rate

$. .lo&bac" ratio

13-%

Chapter 13 - Equity Valuation

1;. 6hich one of the follo&ing is equal to the ratio of common shareholders' equity to

common shares outstanding'

!. #oo" value per share

#. <iquidation value per share

C. )ar"et value per share

$. Tobin's =

11. ! firm has current assets &hich could be sold for their boo" value of >1; million. The

boo" value of its fi?ed assets is >3; million but they could be sold for >91 million today. The

firm has total debt at a boo" value of >0; million but interest rate changes have increased the

value of the debt to a current mar"et value of >1; million. This firm's mar"et to boo" ratio is

.

!. 1.83

#. 1.1;

C. 1.31

$. 1.03

1%. +f a stoc" is correctly priced then you "no& that .

!. the dividend payout ratio is optimal

#. the stoc"'s required return is equal to the gro&th rate in earnings and dividends

C. the sum of the stoc"'s e?pected capital gain and dividend yield is equal to the stoc"'s

required rate of return

$. the present value of gro&th opportunities is equal to the value of assets in place

13. ! stoc" has an intrinsic value of >11 and an actual stoc" price of >13.1;. @ou "no& that

this stoc" .

!. has a Tobin's = value A 1

#. &ill generate a positive alpha

C. has an e?pected return less than its required return

$. has a beta B 1

13-3

Chapter 13 - Equity Valuation

10. #ill7 Cim and (helly are all loo"ing to buy the same stoc" that pays dividends. #ill plans

on holding the stoc" for one year. Cim plans on holding the stoc" for three years. (helly plans

on holding the stoc" until she retires in 1; years. 6hich one of the follo&ing statements is

correct'

!. #ill &ill be &illing to pay the most for the stoc" because he &ill get his money bac" in one

year &hen he sells.

#. Cim should be &illing to pay three times as much for the stoc" as #ill because his e?pected

holding period is three times as long as #ill's.

C. (helly should be &illing to pay the most for the stoc" because she &ill hold it the longest

and hence she &ill get the most dividends.

$. !ll three should be &illing to pay the same amount for the stoc" regardless of their holding

period.

11. ! firm that has an *DE of 1%E is considering cutting its dividend payout. The

stoc"holders of the firm desire a dividend yield of 0E and a capital gain yield of 9E. Fiven

this information &hich of the follo&ing statement,s- is/are correct'

+. !ll else equal the firm's gro&th rate &ill accelerate after the payout change

++. !ll else equal the firm's stoc" price &ill go up after the payout change

+++. !ll else equal the firm's ./E ratio &ill increase after the payout change

!. + only

#. + and ++ only

C. ++ and +++ only

$. +7 ++ and +++

13. ! firm cuts its dividend payout ratio. !s a result you "no& that the firm's .

!. return on assets &ill increase

#. earnings retention ratio &ill increase

C. earnings gro&th rate &ill fall

$. stoc" price &ill fall

13-0

Chapter 13 - Equity Valuation

15. is the amount of money per common share that could be reali:ed by brea"ing

up the firm7 selling its assets7 repaying its debt7 and distributing the remainder to

shareholders.

!. #oo" value per share

#. <iquidation value per share

C. )ar"et value per share

$. Tobin's =

18. !n underpriced stoc" provides an e?pected return &hich is the required

return based on the capital asset pricing model ,C!.)-.

!. less than

#. equal to

C. greater than

$. greater than or equal to

19. (toc"holders of $og's * Gs .et (upply e?pect a 1%E rate of return on their stoc".

)anagement has consistently been generating a *DE of 11E over the last 1 years but no&

believes that *DE &ill be 1%E for the ne?t five years. Fiven this the firm's optimal dividend

payout ratio is no& .

!. ;E

#. 1;;E

C. bet&een ;E and 1;E

$. bet&een 1;E and 1;;E

%;. The constant gro&th dividend discount model ,$$)- can be used only &hen the

.

!. gro&th rate is less than or equal to the required return

#. gro&th rate is greater than or equal to the required return

C. gro&th rate is less than the required return

$. gro&th rate is greater than the required return

13-1

Chapter 13 - Equity Valuation

%1. (uppose that in %;;9 the e?pected dividends of the stoc"s in a broad mar"et inde? equaled

>%0; million &hen the discount rate &as 8E and the e?pected gro&th rate of the dividends

equaled 3E. Gsing the constant gro&th formula for valuation7 if interest rates increase to 9E

the value of the mar"et &ill change by .

!. -1;E

#. -%;E

C. -%1E

$. -33E

%%. @ou &ish to earn a return of 1;E on each of t&o stoc"s7 ! and #. Each of the stoc"s is

e?pected to pay a dividend of >0 in the upcoming year. The e?pected gro&th rate of dividends

is 3E for stoc" ! and 1E for stoc" #. Gsing the constant gro&th $$)7 the intrinsic value of

stoc" ! .

!. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

%3. Each of t&o stoc"s7 ! and #7 are e?pected to pay a dividend of >5 in the upcoming year.

The e?pected gro&th rate of dividends is 3E for both stoc"s. @ou require a return of 1;E on

stoc" ! and a return of 1%E on stoc" #. Gsing the constant gro&th $$)7 the intrinsic value

of stoc" ! .

!. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

%0. @ou &ish to earn a return of 11E on each of t&o stoc"s7 ! and #. (toc" ! is e?pected to

pay a dividend of >3 in the upcoming year &hile stoc" # is e?pected to pay a dividend of >%

in the upcoming year. The e?pected gro&th rate of dividends for both stoc"s is 0E. Gsing the

constant gro&th $$)7 the intrinsic value of stoc" ! .

!. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

13-3

Chapter 13 - Equity Valuation

%1. @ou are considering acquiring a common share of (ahali (hopping Center Corporation

that you &ould li"e to hold for one year. @ou e?pect to receive both >1.%1 in dividends and

>31 from the sale of the share at the end of the year. The ma?imum price you &ould pay for a

share today is if you &anted to earn a 1%E return.

!. >31.%1

#. >3%.35

C. >38.05

$. >01.3%

%3. The mar"et capitali:ation rate on the stoc" of !berdeen 6holesale Company is 1;E. +ts

e?pected *DE is 1%E and its e?pected E.( is >1.;;. +f the firm's plo&-bac" ratio is 1;E7 its

./E ratio &ill be .

!. 8.33

#. 1%.1;

C. 19.%3

$. %0.11

%5. The mar"et capitali:ation rate on the stoc" of !berdeen 6holesale Company is 1;E. +ts

e?pected *DE is 1%E and its e?pected E.( is >1.;;. +f the firm's plo&-bac" ratio is 3;E7 its

./E ratio &ill be .

!. 5.10

#. 10.%9

C. 13.35

$. %%.%%

%8. 6eyerhaeuser +ncorporated has a balance sheet &hich lists >5; million in assets7 >01

million in liabilities and >%1 million in common shareholders' equity. +t has 17;;;7;;;

common shares outstanding. The replacement cost of its assets is >81 million. +ts share price

in the mar"et is >09. +ts boo" value per share is .

!. >13.35

#. >%1.;;

C. >35.1;

$. >0;.83

13-5

Chapter 13 - Equity Valuation

%9. Eagle #rand !rro&heads has e?pected earnings of >1.%1 per share and a mar"et

capitali:ation rate of 1%E. Earnings are e?pected to gro& at 1E per year indefinitely. The

firm has a 0;E plo&bac" ratio. #y ho& much does the firm's *DE e?ceed the mar"et

capitali:ation rate'

!. ;.1E

#. 1.;E

C. 1.1E

$. %.;E

3;. Fagliardi 6ay Corporation has an e?pected *DE of 11E. +f it pays out 3;E of it earnings

as dividends7 its dividend gro&th rate &ill be .

!. 0.1E

#. 1;.1E

C. 11.;E

$. 3;.;E

31. ! preferred share of Coquihalla Corporation &ill pay a dividend of >8.;; in the upcoming

year7 and every year thereafter7 i.e.7 dividends are not e?pected to gro&. @ou require a return

of 5E on this stoc". Gsing the constant gro&th $$) to calculate the intrinsic value7 a

preferred share of Coquihalla Corporation is &orth .

!. >13.1;

#. >01.1;

C. >91.;;

$. >110.%9

3%. #revi" #uilders has an e?pected *DE of %1E. +ts dividend gro&th rate &ill be

if it follo&s a policy of paying 3;E of earning in the form of dividends.

!. 1.;E

#. 11.;E

C. 15.1E

$. 01.;E

13-8

Chapter 13 - Equity Valuation

33. ! firm is planning on paying its first dividend of >% after t&o years. Then dividends are

e?pected to gro& at 3E per year indefinitely. The stoc"'s required return is 10E. 6hat is the

intrinsic value of a share today'

!. >%1.;;

#. >13.85

C. >19.%0

$. >%;.99

30. *ose Hill Trading Company is e?pected to have E.( in the upcoming year of >8.;;. The

e?pected *DE is 18.;E. !n appropriate required return on the stoc" is 10E. +f the firm has a

plo&bac" ratio of 5;E7 its dividend in the upcoming year should be .

!. >1.1%

#. >1.00

C. >%.0;

$. >1.3;

31. *ose Hill Trading Company is e?pected to have E.( in the upcoming year of >3.;;. The

e?pected *DE is 18.;E. !n appropriate required return on the stoc" is 10E. +f the firm has a

plo&bac" ratio of 5;E7 its intrinsic value should be .

!. >%;.93

#. >39.55

C. >1%8.15

$. >11;.;;

33. Cache Cree" )anufacturing Company is e?pected to pay a dividend of >3.33 in the

upcoming year. $ividends are e?pected to gro& at 8E per year. The ris"free rate of return is

0E and the e?pected return on the mar"et portfolio is 10E. +nvestors use the C!.) to

compute the mar"et capitali:ation rate7 and the constant gro&th $$) to determine the value

of the stoc". The stoc"'s current price is >80.;;. Gsing the constant gro&th $$)7 the mar"et

capitali:ation rate is .

!. 9E

#. 1%E

C. 10E

$. 18E

13-9

Chapter 13 - Equity Valuation

35. Frott and .errin7 +nc. has e?pected earnings of >3 per share for ne?t year. The firm's *DE

is %;E and its earnings retention ratio is 5;E. +f the firm's mar"et capitali:ation rate is 11E7

&hat is the present value of its gro&th opportunities'

!. >%;

#. >5;

C. >9;

$. >111

38. !ce Ventura7 +nc. has e?pected earnings of >1 per share for ne?t year. The firm's *DE is

11E and its earnings retention ratio is 0;E. +f the firm's mar"et capitali:ation rate is 1;E7

&hat is the present value of its gro&th opportunities'

!. >%1

#. >1;

C. >51

$. >1;;

39. !nnie's $onut (hops7 +nc. has e?pected earnings of >3.;; per share for ne?t year. The

firm's *DE is 18E and its earnings retention ratio is 3;E. +f the firm's mar"et capitali:ation

rate is 1%E7 &hat is the value of the firm e?cluding any gro&th opportunities'

!. >%1.;;

#. >1;.;;

C. >83.33

$. >%;8

0;. Ilanders7 +nc. has e?pected earnings of >0 per share for ne?t year. The firm's *DE is 8E

and its earnings retention ratio is 0;E. +f the firm's mar"et capitali:ation rate is 11E7 &hat is

the present value of its gro&th opportunities'

!. ->3.33

#. >;

C. >%;.30

$. >%3.35

13-1;

Chapter 13 - Equity Valuation

01. Iirm ! is high ris" and Iirm # is lo& ris". Everything else equal7 &hich firm &ould you

e?pect to have a higher ./E ratio'

!. Iirm !

#. Iirm #

C. #oth &ould have the same ./E if they &ere in the same industry

$. There is not any necessary lin"age bet&een ris" and ./E ratios

0%. Iirms &ith higher e?pected gro&th rates tend to have ./E ratios that are the

./E ratios of firms &ith lo&er e?pected gro&th rates.

!. higher than

#. equal to

C. lo&er than

$. There is not necessarily any lin"age bet&een ris" and ./E ratios

03. Value stoc"s are more li"ely to have a .EF ratio .

!. less than one

#. equal to one

C. greater than one

$. less than :ero

00. Fenerally spea"ing7 as the firm progresses through the industry life cycle you &ould

e?pect the .VFD to as a percent of share price.

!. increase

#. decrease

C. stay the same

$. no typical pattern can be e?pected

13-11

Chapter 13 - Equity Valuation

01. Cache Cree" )anufacturing Company is e?pected to pay a dividend of >0.%; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"free rate of

return is 0E and the e?pected return on the mar"et portfolio is 10E. +nvestors use the C!.)

to compute the mar"et capitali:ation rate on the stoc"7 and the constant gro&th $$) to

determine the intrinsic value of the stoc". The stoc" is trading in the mar"et today at >80.;;.

Gsing the constant gro&th $$) and the C!.)7 the beta of the stoc" is .

!. 1.0

#. ;.9

C. ;.8

$. ;.1

03. 6estsyde Tool Company is e?pected to pay a dividend of >1.1; in the upcoming year.

The ris"-free rate of return is 3E and the e?pected return on the mar"et portfolio is 10E.

!nalysts e?pect the price of 6estsyde Tool Company shares to be >%9 a year from no&. The

beta of 6estsyde Tool Company's stoc" is 1.%;. Gsing the C!.)7 an appropriate required

return on 6estsyde Tool Company's stoc" is .

!. 8.;E

#. 1;.8E

C. 11.3E

$. 13.8E

05. 6estsyde Tool Company is e?pected to pay a dividend of >%.;; in the upcoming year.

The ris"-free rate of return is 3E and the e?pected return on the mar"et portfolio is 1%E.

!nalysts e?pect the price of 6estsyde Tool Company shares to be >%9 a year from no&. The

beta of 6estsyde Tool Company's stoc" is 1.%;. Gsing a one-period valuation model7 the

intrinsic value of 6estsyde Tool Company stoc" today is .

!. >%0.%9

#. >%5.39

C. >31.13

$. >30.1%

13-1%

Chapter 13 - Equity Valuation

08. Todd )ountain development Corporation is e?pected to pay a dividend of >%.1; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"-free rate

of return is 1E and the e?pected return on the mar"et portfolio is 1%E. The stoc" of Todd

)ountain $evelopment Corporation has a beta of ;.51. Gsing the C!.)7 the return you

should require on the stoc" is .

!. 5.%1E

#. 1;.%1E

C. 10.51E

$. %1.;;E

09. Todd )ountain $evelopment Corporation is e?pected to pay a dividend of >3.;; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"-free rate

of return is 1E and the e?pected return on the mar"et portfolio is 15E. The stoc" of Todd

)ountain $evelopment Corporation has a beta of ;.51. Gsing the constant gro&th $$)7 the

intrinsic value of the stoc" is .

!. 0.;;

#. 15.31

C. 35.1;

$. 1;.;;

1;. Fenerally spea"ing the higher a firm's *D! the the dividend payout ratio and

the the firm's gro&th rate of earnings.

!. higher4 lo&er

#. higher4 higher

C. lo&er4 lo&er

$. lo&er4 higher

11. +nterior !irline is e?pected to pay a dividend of >3 in the upcoming year. $ividends are

e?pected to gro& at the rate of 1;E per year. The ris"-free rate of return is 0E and the

e?pected return on the mar"et portfolio is 13E. The stoc" of +nterior !irline has a beta of

0.;;. Gsing the constant gro&th $$)7 the intrinsic value of the stoc" is .

!. >1;.;;

#. >%%.53

C. >%5.58

$. >01.35

13-13

Chapter 13 - Equity Valuation

1%. Caribou Fold )ining Corporation is e?pected to pay a dividend of >0 in the upcoming

year. $ividends are e?pected to decline at the rate of 3E per year. The ris"-free rate of return

is 1E and the e?pected return on the mar"et portfolio is 13E. The stoc" of Caribou Fold

)ining Corporation has a beta of -;.1;. Gsing the C!.)7 the return you should require on

the stoc" is .

!. %E

#. 1E

C. 8E

$. 9E

13. Caribou Fold )ining Corporation is e?pected to pay a dividend of >3 in the upcoming

year. $ividends are e?pected to decline at the rate of 3E per year. The ris"-free rate of return

is 1E and the e?pected return on the mar"et portfolio is 13E. The stoc" of Caribou Fold

)ining Corporation has a beta of -;.1;. Gsing the constant gro&th $$)7 the intrinsic value

of the stoc" is .

!. >1;.;;

#. >1;;.;;

C. >11;.;;

$. >%;;.;;

10. <ifecycle )otorcycle Company is e?pected to pay a dividend in year 1 of >%.;;7 a

dividend in year % of >3.;;7 and a dividend in year 3 of >0.;;. !fter year 37 dividends are

e?pected to gro& at the rate of 5E per year. !n appropriate required return for the stoc" is

1%E. Gsing the multistage $$)7 the stoc" should be &orth today.

!. >33.8;

#. >31.13

C. >35.91

$. >81.3;

13-10

Chapter 13 - Equity Valuation

11. !ce Irisbee Corporation produces a good that is very mature in their product life cycles.

!ce Irisbee Corporation is e?pected to pay a dividend in year 1 of >3.;;7 a dividend in year %

of >%.;;7 and a dividend in year 3 of >1.;;. !fter year 37 dividends are e?pected to decline at

the rate of %E per year. !n appropriate required return for the stoc" is 8E. Gsing the

multistage $$)7 the stoc" should be &orth today.

!. >13.;5

#. >13.18

C. >18.%1

$. >18.58

13. ! firm's earnings per share increased from >1; to >1%7 its dividends increased from >0.;;

to >0.0;7 and its share price increased from >8; to >1;;. Fiven this information7 it follo&s

that .

!. the stoc" e?perienced a drop in its ./E ratio

#. the company had a decrease in its dividend payout ratio

C. both earnings and share price increased by %;E

$. the required rate of return increased

15. !ssuming all other factors remain unchanged7 &ould increase a firm's

price/earnings ratio.

!. an increase in the dividend payout ratio

#. a reduction in investor ris" aversion

C. an e?pected increase in the level of inflation

$. an increase in the yield on treasury bills

18. ! company &ith an e?pected earnings gro&th rate &hich is greater than that of the typical

company in the same industry7 most li"ely has .

!. a dividend yield &hich is greater than that of the typical company

#. a dividend yield &hich is less than that of the typical company

C. less ris" than the typical company

$. less sensitivity to mar"et trends than the typical company

13-11

Chapter 13 - Equity Valuation

19. Everything equal7 &hich variable is negatively related to intrinsic value of a company'

!. $

1

#. $

;

C. g

$. "

3;. (anders7 +nc.7 paid a >0.;; dividend per share last year and is e?pected to continue to pay

out 3;E of its earnings as dividends for the foreseeable future. +f the firm is e?pected to

generate a 13E return on equity in the future7 and if you require a 11E return on the stoc"7 the

value of the stoc" is .

!. >%3.35

#. >31.19

C. >0%.90

$. >19.89

31. ! firm has .VFD of ; and a mar"et capitali:ation rate of 1%E. 6hat is the firm's ./E

ratio'

!. 1%.;;

#. 8.33

C. 1;.%1

$. 18.11

3%. ! firm has an earnings retention ratio of 0;E. The stoc" has a mar"et capitali:ation rate

of 11E and an *DE of 18E. 6hat is the stoc"'s ./E ratio'

!. 1%.8%

#. 5.39

C. 8.33

$. 9.03

13-13

Chapter 13 - Equity Valuation

33. ! common stoc" pays an annual dividend per share of >1.8;. The ris"-free rate is 1

percent and the ris" premium for this stoc" is 0 percent. +f the annual dividend is e?pected to

remain at >1.8; per share7 &hat is the value of the stoc"'

!. >15.58

#. >%;.;;

C. >0;.;;

$. 2one of the above

30. Transportation stoc"s currently provide an e?pected rate of return of 11E. TTT7 a large

transportation company7 &ill pay a year-end dividend of >3 per share. +f the stoc" is selling at

>3; per share7 &hat must be the mar"et's e?pectation of the constant gro&th rate of TTT

dividends'

!. 1E

#. 1;E

C. %;E

$. 2one of the above

31. ! stoc" is priced at >01 per share. The stoc" has earnings per share of >3.;; and a mar"et

capitali:ation rate of 10E. 6hat is the stoc"'s .VFD'

!. >%3.15

#. >11.;;

C. >19.58

$. >%1.30

33. ! firm increases its dividend plo&bac" ratio. !ll else equal you "no& that

.

!. earnings gro&th &ill increase and the stoc"'s ./E &ill increase

#. earnings gro&th &ill decrease and the stoc"'s ./E &ill increase

C. earnings gro&th &ill increase and the stoc"'s ./E &ill decrease

$. earnings gro&th &ill increase and the stoc"'s ./E may or may not increase

13-15

Chapter 13 - Equity Valuation

35. ! firm has a stoc" price of >10.51 per share. The firm's earnings are >51 million and the

firm has %; million shares outstanding. The firm has an *DE of 11E and a plo&bac" of 31E.

6hat is the firm's .EF ratio'

!. 1.1;

#. 1.%1

C. 1.1;

$. 1.;;

!*T has come out &ith a ne& and improved product. !s a result7 the firm proJects an *DE

of %1E7 and it &ill maintain a plo&bac" ratio of ;.%;. +ts earnings this year &ill be >3 per

share. +nvestors e?pect a 1%E rate of return on the stoc".

38. !t &hat price &ould you e?pect !*T to sell'

!. >%1.;;

#. >30.%9

C. >0%.83

$. >01.35

39. !t &hat ./E ratio &ould you e?pect !*T to sell'

!. 8.33

#. 11.03

C. 10.%9

$. 11.%1

5;. 6hat is the present value of gro&th opportunities for !*T'

!. >8.15

#. >9.%9

C. >10.%9

$. >13.%9

13-18

Chapter 13 - Equity Valuation

51. 6hat price do you e?pect !*T shares to sell for in 0 years'

!. >13.93

#. >00.91

C. >01.38

$. >39.53

5%. The E#+T of a firm is >3;;7 the ta? rate is 31E7 the depreciation is >%;7 capital

e?penditures are >3; and the increase in net &or"ing capital is >3;. 6hat is the free cash flo&

to the firm'

!. >81

#. >1%1

C. >181

$. >3;1

53. ! firm reports E#+T of >1;; million. The income statement sho&s depreciation of >%;

millions. +f the ta? rate is 31E and total capital e?penditures and increases in &or"ing capital

total >1; million7 &hat is the free cash flo& to the firm'

!. >15

#. >31

C. >51

$. >91

50. The free cash flo& to the firm is >3;; million in perpetuity7 the cost of equity equals 10E

and the 6!CC is 1;E. +f the mar"et value of the debt is >1.; billion7 &hat is the value of the

equity using the free cash flo& valuation approach'

!. >1 billion

#. >% billion

C. >3 billion

$. >0 billion

13-19

Chapter 13 - Equity Valuation

51. +f a firm has a free cash flo& equal to >1; million and that cash flo& is e?pected to gro&

at 3E forever7 &hat is the total firm value given a 6!CC of 9.1E'

!. >359 million

#. >511 million

C. >539 million

$. >8;3 million

53. The free cash flo& to the firm is reported as >0;1 million. The interest e?pense to the firm

is >53 million. +f the ta? rate is 31E and the net debt of the firm increased by >1;7 &hat is the

free cash flo& to the equity holders of the firm'

!. >0;3 million

#. >010 million

C. >1;1 million

$. >113 million

55. The free cash flo& to the firm is reported as >%51 million. The interest e?pense to the firm

is >3; million. +f the ta? rate is 31E and the net debt of the firm increased by >337 &hat is the

free cash flo& to the equity holders of the firm'

!. >%39 million

#. >%93 million

C. >3;1 million

$. >3%5 million

58. The free cash flo& to the firm is reported as >%;1 million. The interest e?pense to the firm

is >%% million. +f the ta? rate is 31E and the net debt of the firm increased by >%17 &hat is the

mar"et value of the firm if the ICIE gro&s at %E and the cost of equity is 11E'

!. >%7138 billion

#. >%7395 billion

C. >%7131 billion

$. >%7998 billion

13-%;

Chapter 13 - Equity Valuation

59. The free cash flo& to the firm is reported as >198 million. The interest e?pense to the firm

is >11 million. +f the ta? rate is 31E and the net debt of the firm increased by >%; million7

&hat is the mar"et value of the firm if the ICIE gro&s at 3E and the cost of equity is 10E'

!. >17893 billion

#. >%7095 billion

C. >%7181 billion

$. >37;98 billion

8;. Iirm ! has a stoc" price of >31 and 3;E of the value of the stoc" is in the form of .VFD.

Iirm # also has a stoc" price of >31 but only %;E of the value of (toc" # is in the form of

.VFD. 6e "no& that .

+. (toc" ! &ill give us a higher return than (toc" #

++. an investment in (toc" ! is probably ris"ier than an investment in (toc" #

+++. (toc" ! has higher forecast earnings gro&th than (toc" #

!. + only

#. + and ++ only

C. ++ and +++ only

$. +7 ++ and +++

81. ! firm is e?pected to produce earnings ne?t year of >3.;; per share. +t plans to reinvest

%1E of its earnings at %;E. +f the cost of equity if 11E7 &hat should be the value of the

stoc"'

!. >%5.%5

#. >1;.;;

C. >33.35

$. >5;.;;

8%. 2e?t year's earnings are estimated to be >1.;;. The company plans to reinvest %;E of its

earnings at 11E. +f the cost of equity is 9E7 &hat is the present value of gro&th

opportunities'

!. >9.;9

#. >1;.1;

C. >11.11

$. >1%.%1

13-%1

Chapter 13 - Equity Valuation

83. 2e?t year's earnings are estimated to be >3.;;. The company plans to reinvest 33E of its

earnings at 1%E. +f the cost of equity is 8E7 &hat is the present value of gro&th

opportunities'

!. >3.;;

#. >%1.;;

C. >00.00

$. >51.;;

80. 6hen Foogle's share price reached >051 per share Foogle had a ./E ratio of about 38 and

an estimated mar"et capitali:ation rate of 11.1E. Foogle pays no dividends. 6hat percentage

of Foogle's stoc" price &as represented by .VFD'

!. 9%E

#. 85E

C. 55E

$. 30E

81. ! firm has a stoc" price of >11 per share and a ./E ratio of 51. +f you buy the stoc" at this

./E and earnings fail to gro& at all7 ho& long should you e?pect it to ta"e to Just recover the

cost of your investment'

!. %5 years

#. 35 years

C. 11 years

$. 51 years

83. +n &hat industry are investors li"ely to use the dividend discount model and arrive at a

price close to the observed mar"et price'

!. +mport/e?port trade

#. (oft&are

C. Telecommunications

$. Gtility

13-%%

Chapter 13 - Equity Valuation

85. Estimates of a stoc"'s intrinsic value calculated &ith the free cash flo& methodology

depends most critically on .

!. the terminal value used

#. &hether one uses ICII or ICIE

C. the time period used to estimate the cash flo&s

$. &hether the firm is currently paying dividends

88. The greatest value to an analyst from calculating a stoc"'s intrinsic value is .

!. ho& easy it is to come up &ith accurate model inputs

#. the precision of the value estimate

C. ho& the process forces analysts to understand the critical variables that have the greatest

impact on value

$. ho& all the different models typically yield identical value results

89. 6hich of the follo&ing valuation measures is often used to compare firms &hich have no

earnings'

!. .rice-to-boo" ratio

#. ./E ratio

C. .rice-to-cash flo& ratio

$. .rice-to-sales ratio

Chapter 13 Equity Valuation !ns&er Key

Multiple Choice Questions

13-%3

Chapter 13 - Equity Valuation

1. The accounting measure of a firm's equity value generated by applying accounting

principles to asset and liability acquisitions is called .

A. boo" value

#. mar"et value

C. liquidation value

$. Tobin's q

Difficulty: Easy

%. The price-to-sales ratio is probably most useful for firms in &hich phase of the industry life

cycle'

A. (tart up phase

#. Consolidation

C. )aturity

$. *elative decline

Difficulty: Easy

3. +f a firm increases its plo&bac" ratio this &ill probably result in a,n- ./E ratio.

!. higher

#. lo&er

C. unchanged

D. unable to determine

Difficulty: Medium

0. The value of internet companies is based primarily on .

!. current profits

#. Tobin's q

C. gro&th opportunities

$. replacement cost

Difficulty: Medium

13-%0

Chapter 13 - Equity Valuation

1. 2e&-economy companies generally have higher than old-economy companies.

!. boo" value per share

B. ./E multiples

C. profits

$. asset values

Difficulty: Medium

3. ./E ratios tend to be &hen inflation is .

!. higher4 higher

#. lo&er4 lo&er

C. higher4 lo&er

$. they are unrelated

Difficulty: Medium

5. 6hich one of the follo&ing statements about mar"et and boo" value is correct'

!. !ll firms sell at a mar"et to boo" ratio above 1.

#. !ll firms sell at a mar"et to boo" ratio greater than or equal to 1.

C. !ll firms sell at a mar"et to boo" ratio belo& 1.

D. )ost firms have a mar"et to boo" ratio above 17 but not all.

Difficulty: Easy

8. Earnings yields tend to &hen Treasury yields fall.

A. fall

#. rise

C. remain unchanged

$. fluctuate &ildly

Difficulty: Medium

13-%1

Chapter 13 - Equity Valuation

9. 6hich one of the follo&ing is a common term for the mar"et consensus value of the

required return on a stoc"'

!. $ividend payout ratio

#. +ntrinsic value

C. )ar"et capitali:ation rate

$. .lo&bac" ratio

Difficulty: Easy

1;. 6hich one of the follo&ing is equal to the ratio of common shareholders' equity to

common shares outstanding'

A. #oo" value per share

#. <iquidation value per share

C. )ar"et value per share

$. Tobin's =

Difficulty: Easy

11. ! firm has current assets &hich could be sold for their boo" value of >1; million. The

boo" value of its fi?ed assets is >3; million but they could be sold for >91 million today. The

firm has total debt at a boo" value of >0; million but interest rate changes have increased the

value of the debt to a current mar"et value of >1; million. This firm's mar"et to boo" ratio is

.

A. 1.83

#. 1.1;

C. 1.31

$. 1.03

Difficulty: Medium

13-%3

Chapter 13 - Equity Valuation

1%. +f a stoc" is correctly priced then you "no& that .

!. the dividend payout ratio is optimal

#. the stoc"'s required return is equal to the gro&th rate in earnings and dividends

C. the sum of the stoc"'s e?pected capital gain and dividend yield is equal to the stoc"'s

required rate of return

$. the present value of gro&th opportunities is equal to the value of assets in place

Difficulty: Medium

13. ! stoc" has an intrinsic value of >11 and an actual stoc" price of >13.1;. @ou "no& that

this stoc" .

!. has a Tobin's = value A 1

B. &ill generate a positive alpha

C. has an e?pected return less than its required return

$. has a beta B 1

Difficulty: Medium

10. #ill7 Cim and (helly are all loo"ing to buy the same stoc" that pays dividends. #ill plans

on holding the stoc" for one year. Cim plans on holding the stoc" for three years. (helly plans

on holding the stoc" until she retires in 1; years. 6hich one of the follo&ing statements is

correct'

!. #ill &ill be &illing to pay the most for the stoc" because he &ill get his money bac" in one

year &hen he sells.

#. Cim should be &illing to pay three times as much for the stoc" as #ill because his e?pected

holding period is three times as long as #ill's.

C. (helly should be &illing to pay the most for the stoc" because she &ill hold it the longest

and hence she &ill get the most dividends.

D. !ll three should be &illing to pay the same amount for the stoc" regardless of their holding

period.

Difficulty: Medium

13-%5

Chapter 13 - Equity Valuation

11. ! firm that has an *DE of 1%E is considering cutting its dividend payout. The

stoc"holders of the firm desire a dividend yield of 0E and a capital gain yield of 9E. Fiven

this information &hich of the follo&ing statement,s- is/are correct'

+. !ll else equal the firm's gro&th rate &ill accelerate after the payout change

++. !ll else equal the firm's stoc" price &ill go up after the payout change

+++. !ll else equal the firm's ./E ratio &ill increase after the payout change

A. + only

#. + and ++ only

C. ++ and +++ only

$. +7 ++ and +++

Difficulty: Medium

13. ! firm cuts its dividend payout ratio. !s a result you "no& that the firm's .

!. return on assets &ill increase

B. earnings retention ratio &ill increase

C. earnings gro&th rate &ill fall

$. stoc" price &ill fall

Difficulty: Easy

15. is the amount of money per common share that could be reali:ed by brea"ing

up the firm7 selling its assets7 repaying its debt7 and distributing the remainder to

shareholders.

!. #oo" value per share

B. <iquidation value per share

C. )ar"et value per share

$. Tobin's =

Difficulty: Easy

13-%8

Chapter 13 - Equity Valuation

18. !n underpriced stoc" provides an e?pected return &hich is the required

return based on the capital asset pricing model ,C!.)-.

!. less than

#. equal to

C. greater than

$. greater than or equal to

Difficulty: Easy

19. (toc"holders of $og's * Gs .et (upply e?pect a 1%E rate of return on their stoc".

)anagement has consistently been generating a *DE of 11E over the last 1 years but no&

believes that *DE &ill be 1%E for the ne?t five years. Fiven this the firm's optimal dividend

payout ratio is no& .

!. ;E

B. 1;;E

C. bet&een ;E and 1;E

$. bet&een 1;E and 1;;E

Difficulty: Easy

%;. The constant gro&th dividend discount model ,$$)- can be used only &hen the

.

!. gro&th rate is less than or equal to the required return

#. gro&th rate is greater than or equal to the required return

C. gro&th rate is less than the required return

$. gro&th rate is greater than the required return

Difficulty: Easy

13-%9

Chapter 13 - Equity Valuation

%1. (uppose that in %;;9 the e?pected dividends of the stoc"s in a broad mar"et inde? equaled

>%0; million &hen the discount rate &as 8E and the e?pected gro&th rate of the dividends

equaled 3E. Gsing the constant gro&th formula for valuation7 if interest rates increase to 9E

the value of the mar"et &ill change by .

!. -1;E

#. -%;E

C. -%1E

D. -33E

Difficulty: Hard

%%. @ou &ish to earn a return of 1;E on each of t&o stoc"s7 ! and #. Each of the stoc"s is

e?pected to pay a dividend of >0 in the upcoming year. The e?pected gro&th rate of dividends

is 3E for stoc" ! and 1E for stoc" #. Gsing the constant gro&th $$)7 the intrinsic value of

stoc" ! .

A. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

Difficulty: Medium

13-3;

Chapter 13 - Equity Valuation

%3. Each of t&o stoc"s7 ! and #7 are e?pected to pay a dividend of >5 in the upcoming year.

The e?pected gro&th rate of dividends is 3E for both stoc"s. @ou require a return of 1;E on

stoc" ! and a return of 1%E on stoc" #. Gsing the constant gro&th $$)7 the intrinsic value

of stoc" ! .

A. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

Difficulty: Medium

%0. @ou &ish to earn a return of 11E on each of t&o stoc"s7 ! and #. (toc" ! is e?pected to

pay a dividend of >3 in the upcoming year &hile stoc" # is e?pected to pay a dividend of >%

in the upcoming year. The e?pected gro&th rate of dividends for both stoc"s is 0E. Gsing the

constant gro&th $$)7 the intrinsic value of stoc" ! .

A. &ill be higher than the intrinsic value of stoc" #

#. &ill be the same as the intrinsic value of stoc" #

C. &ill be less than the intrinsic value of stoc" #

$. more information is necessary to ans&er this question

Difficulty: Medium

%1. @ou are considering acquiring a common share of (ahali (hopping Center Corporation

that you &ould li"e to hold for one year. @ou e?pect to receive both >1.%1 in dividends and

>31 from the sale of the share at the end of the year. The ma?imum price you &ould pay for a

share today is if you &anted to earn a 1%E return.

!. >31.%1

B. >3%.35

C. >38.05

$. >01.3%

Difficulty: Medium

13-31

Chapter 13 - Equity Valuation

%3. The mar"et capitali:ation rate on the stoc" of !berdeen 6holesale Company is 1;E. +ts

e?pected *DE is 1%E and its e?pected E.( is >1.;;. +f the firm's plo&-bac" ratio is 1;E7 its

./E ratio &ill be .

!. 8.33

B. 1%.1;

C. 19.%3

$. %0.11

Difficulty: Medium

%5. The mar"et capitali:ation rate on the stoc" of !berdeen 6holesale Company is 1;E. +ts

e?pected *DE is 1%E and its e?pected E.( is >1.;;. +f the firm's plo&-bac" ratio is 3;E7 its

./E ratio &ill be .

!. 5.10

B. 10.%9

C. 13.35

$. %%.%%

Difficulty: Medium

13-3%

Chapter 13 - Equity Valuation

%8. 6eyerhaeuser +ncorporated has a balance sheet &hich lists >5; million in assets7 >01

million in liabilities and >%1 million in common shareholders' equity. +t has 17;;;7;;;

common shares outstanding. The replacement cost of its assets is >81 million. +ts share price

in the mar"et is >09. +ts boo" value per share is .

!. >13.35

B. >%1.;;

C. >35.1;

$. >0;.83

Difficulty: Medium

%9. Eagle #rand !rro&heads has e?pected earnings of >1.%1 per share and a mar"et

capitali:ation rate of 1%E. Earnings are e?pected to gro& at 1E per year indefinitely. The

firm has a 0;E plo&bac" ratio. #y ho& much does the firm's *DE e?ceed the mar"et

capitali:ation rate'

A. ;.1E

#. 1.;E

C. 1.1E

$. %.;E

*DE L g/b L ;.;1/;.0 L 1%.1E4 " is given as 1%E so *DE - " L ;.1E

Difficulty: Medium

13-33

Chapter 13 - Equity Valuation

3;. Fagliardi 6ay Corporation has an e?pected *DE of 11E. +f it pays out 3;E of it earnings

as dividends7 its dividend gro&th rate &ill be .

!. 0.1E

B. 1;.1E

C. 11.;E

$. 3;.;E

Difficulty: Medium

31. ! preferred share of Coquihalla Corporation &ill pay a dividend of >8.;; in the upcoming

year7 and every year thereafter7 i.e.7 dividends are not e?pected to gro&. @ou require a return

of 5E on this stoc". Gsing the constant gro&th $$) to calculate the intrinsic value7 a

preferred share of Coquihalla Corporation is &orth .

!. >13.1;

#. >01.1;

C. >91.;;

D. >110.%9

Difficulty: Medium

3%. #revi" #uilders has an e?pected *DE of %1E. +ts dividend gro&th rate &ill be

if it follo&s a policy of paying 3;E of earning in the form of dividends.

!. 1.;E

#. 11.;E

C. 15.1E

$. 01.;E

Difficulty: Medium

13-30

Chapter 13 - Equity Valuation

33. ! firm is planning on paying its first dividend of >% after t&o years. Then dividends are

e?pected to gro& at 3E per year indefinitely. The stoc"'s required return is 10E. 6hat is the

intrinsic value of a share today'

!. >%1.;;

#. >13.85

C. >19.%0

$. >%;.99

Difficulty: Medium

30. *ose Hill Trading Company is e?pected to have E.( in the upcoming year of >8.;;. The

e?pected *DE is 18.;E. !n appropriate required return on the stoc" is 10E. +f the firm has a

plo&bac" ratio of 5;E7 its dividend in the upcoming year should be .

!. >1.1%

#. >1.00

C. >%.0;

$. >1.3;

Difficulty: Medium

13-31

Chapter 13 - Equity Valuation

31. *ose Hill Trading Company is e?pected to have E.( in the upcoming year of >3.;;. The

e?pected *DE is 18.;E. !n appropriate required return on the stoc" is 10E. +f the firm has a

plo&bac" ratio of 5;E7 its intrinsic value should be .

!. >%;.93

#. >39.55

C. >1%8.15

$. >11;.;;

Difficulty: Hard

33. Cache Cree" )anufacturing Company is e?pected to pay a dividend of >3.33 in the

upcoming year. $ividends are e?pected to gro& at 8E per year. The ris"free rate of return is

0E and the e?pected return on the mar"et portfolio is 10E. +nvestors use the C!.) to

compute the mar"et capitali:ation rate7 and the constant gro&th $$) to determine the value

of the stoc". The stoc"'s current price is >80.;;. Gsing the constant gro&th $$)7 the mar"et

capitali:ation rate is .

!. 9E

B. 1%E

C. 10E

$. 18E

Difficulty: Medium

13-33

Chapter 13 - Equity Valuation

35. Frott and .errin7 +nc. has e?pected earnings of >3 per share for ne?t year. The firm's *DE

is %;E and its earnings retention ratio is 5;E. +f the firm's mar"et capitali:ation rate is 11E7

&hat is the present value of its gro&th opportunities'

!. >%;

B. >5;

C. >9;

$. >111

Difficulty: Medium

38. !ce Ventura7 +nc. has e?pected earnings of >1 per share for ne?t year. The firm's *DE is

11E and its earnings retention ratio is 0;E. +f the firm's mar"et capitali:ation rate is 1;E7

&hat is the present value of its gro&th opportunities'

A. >%1

#. >1;

C. >51

$. >1;;

Difficulty: Medium

13-35

Chapter 13 - Equity Valuation

39. !nnie's $onut (hops7 +nc. has e?pected earnings of >3.;; per share for ne?t year. The

firm's *DE is 18E and its earnings retention ratio is 3;E. +f the firm's mar"et capitali:ation

rate is 1%E7 &hat is the value of the firm e?cluding any gro&th opportunities'

A. >%1.;;

#. >1;.;;

C. >83.33

$. >%;8

Difficulty: Medium

0;. Ilanders7 +nc. has e?pected earnings of >0 per share for ne?t year. The firm's *DE is 8E

and its earnings retention ratio is 0;E. +f the firm's mar"et capitali:ation rate is 11E7 &hat is

the present value of its gro&th opportunities'

A. ->3.33

#. >;

C. >%;.30

$. >%3.35

Difficulty: Medium

01. Iirm ! is high ris" and Iirm # is lo& ris". Everything else equal7 &hich firm &ould you

e?pect to have a higher ./E ratio'

!. Iirm !

#. Iirm #

C. #oth &ould have the same ./E if they &ere in the same industry

$. There is not any necessary lin"age bet&een ris" and ./E ratios

Difficulty: Easy

13-38

Chapter 13 - Equity Valuation

0%. Iirms &ith higher e?pected gro&th rates tend to have ./E ratios that are the

./E ratios of firms &ith lo&er e?pected gro&th rates.

A. higher than

#. equal to

C. lo&er than

$. There is not necessarily any lin"age bet&een ris" and ./E ratios

Difficulty: Easy

03. Value stoc"s are more li"ely to have a .EF ratio .

A. less than one

#. equal to one

C. greater than one

$. less than :ero

Difficulty: Medium

00. Fenerally spea"ing7 as the firm progresses through the industry life cycle you &ould

e?pect the .VFD to as a percent of share price.

!. increase

B. decrease

C. stay the same

$. no typical pattern can be e?pected

Difficulty: Medium

13-39

Chapter 13 - Equity Valuation

01. Cache Cree" )anufacturing Company is e?pected to pay a dividend of >0.%; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"free rate of

return is 0E and the e?pected return on the mar"et portfolio is 10E. +nvestors use the C!.)

to compute the mar"et capitali:ation rate on the stoc"7 and the constant gro&th $$) to

determine the intrinsic value of the stoc". The stoc" is trading in the mar"et today at >80.;;.

Gsing the constant gro&th $$) and the C!.)7 the beta of the stoc" is .

!. 1.0

B. ;.9

C. ;.8

$. ;.1

Difficulty: Hard

03. 6estsyde Tool Company is e?pected to pay a dividend of >1.1; in the upcoming year.

The ris"-free rate of return is 3E and the e?pected return on the mar"et portfolio is 10E.

!nalysts e?pect the price of 6estsyde Tool Company shares to be >%9 a year from no&. The

beta of 6estsyde Tool Company's stoc" is 1.%;. Gsing the C!.)7 an appropriate required

return on 6estsyde Tool Company's stoc" is .

!. 8.;E

#. 1;.8E

C. 11.3E

$. 13.8E

Difficulty: Medium

13-0;

Chapter 13 - Equity Valuation

05. 6estsyde Tool Company is e?pected to pay a dividend of >%.;; in the upcoming year.

The ris"-free rate of return is 3E and the e?pected return on the mar"et portfolio is 1%E.

!nalysts e?pect the price of 6estsyde Tool Company shares to be >%9 a year from no&. The

beta of 6estsyde Tool Company's stoc" is 1.%;. Gsing a one-period valuation model7 the

intrinsic value of 6estsyde Tool Company stoc" today is .

!. >%0.%9

B. >%5.39

C. >31.13

$. >30.1%

" L ;.;3 M 1.%,;.1% - ;.;3- L ;.13%

Difficulty: Hard

08. Todd )ountain development Corporation is e?pected to pay a dividend of >%.1; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"-free rate

of return is 1E and the e?pected return on the mar"et portfolio is 1%E. The stoc" of Todd

)ountain $evelopment Corporation has a beta of ;.51. Gsing the C!.)7 the return you

should require on the stoc" is .

!. 5.%1E

B. 1;.%1E

C. 10.51E

$. %1.;;E

Difficulty: Medium

13-01

Chapter 13 - Equity Valuation

09. Todd )ountain $evelopment Corporation is e?pected to pay a dividend of >3.;; in the

upcoming year. $ividends are e?pected to gro& at the rate of 8E per year. The ris"-free rate

of return is 1E and the e?pected return on the mar"et portfolio is 15E. The stoc" of Todd

)ountain $evelopment Corporation has a beta of ;.51. Gsing the constant gro&th $$)7 the

intrinsic value of the stoc" is .

!. 0.;;

#. 15.31

C. 35.1;

D. 1;.;;

Difficulty: Hard

1;. Fenerally spea"ing the higher a firm's *D! the the dividend payout ratio and

the the firm's gro&th rate of earnings.

!. higher4 lo&er

#. higher4 higher

C. lo&er4 lo&er

D. lo&er4 higher

Difficulty: Medium

13-0%

Chapter 13 - Equity Valuation

11. +nterior !irline is e?pected to pay a dividend of >3 in the upcoming year. $ividends are

e?pected to gro& at the rate of 1;E per year. The ris"-free rate of return is 0E and the

e?pected return on the mar"et portfolio is 13E. The stoc" of +nterior !irline has a beta of

0.;;. Gsing the constant gro&th $$)7 the intrinsic value of the stoc" is .

A. >1;.;;

#. >%%.53

C. >%5.58

$. >01.35

Difficulty: Medium

1%. Caribou Fold )ining Corporation is e?pected to pay a dividend of >0 in the upcoming

year. $ividends are e?pected to decline at the rate of 3E per year. The ris"-free rate of return

is 1E and the e?pected return on the mar"et portfolio is 13E. The stoc" of Caribou Fold

)ining Corporation has a beta of -;.1;. Gsing the C!.)7 the return you should require on

the stoc" is .

!. %E

#. 1E

C. 8E

D. 9E

Difficulty: Medium

13-03

Chapter 13 - Equity Valuation

13. Caribou Fold )ining Corporation is e?pected to pay a dividend of >3 in the upcoming

year. $ividends are e?pected to decline at the rate of 3E per year. The ris"-free rate of return

is 1E and the e?pected return on the mar"et portfolio is 13E. The stoc" of Caribou Fold

)ining Corporation has a beta of -;.1;. Gsing the constant gro&th $$)7 the intrinsic value

of the stoc" is .

A. >1;.;;

#. >1;;.;;

C. >11;.;;

$. >%;;.;;

Difficulty: Hard

10. <ifecycle )otorcycle Company is e?pected to pay a dividend in year 1 of >%.;;7 a

dividend in year % of >3.;;7 and a dividend in year 3 of >0.;;. !fter year 37 dividends are

e?pected to gro& at the rate of 5E per year. !n appropriate required return for the stoc" is

1%E. Gsing the multistage $$)7 the stoc" should be &orth today.

!. >33.8;

#. >31.13

C. >35.91

$. >81.3;

Difficulty: Hard

13-00

Chapter 13 - Equity Valuation

11. !ce Irisbee Corporation produces a good that is very mature in their product life cycles.

!ce Irisbee Corporation is e?pected to pay a dividend in year 1 of >3.;;7 a dividend in year %

of >%.;;7 and a dividend in year 3 of >1.;;. !fter year 37 dividends are e?pected to decline at

the rate of %E per year. !n appropriate required return for the stoc" is 8E. Gsing the

multistage $$)7 the stoc" should be &orth today.

A. >13.;5

#. >13.18

C. >18.%1

$. >18.58

Difficulty: Hard

13. ! firm's earnings per share increased from >1; to >1%7 its dividends increased from >0.;;

to >0.0;7 and its share price increased from >8; to >1;;. Fiven this information7 it follo&s

that .

!. the stoc" e?perienced a drop in its ./E ratio

B. the company had a decrease in its dividend payout ratio

C. both earnings and share price increased by %;E

$. the required rate of return increased

Difficulty: Medium

15. !ssuming all other factors remain unchanged7 &ould increase a firm's

price/earnings ratio.

!. an increase in the dividend payout ratio

B. a reduction in investor ris" aversion

C. an e?pected increase in the level of inflation

$. an increase in the yield on treasury bills

Difficulty: Medium

13-01

Chapter 13 - Equity Valuation

18. ! company &ith an e?pected earnings gro&th rate &hich is greater than that of the typical

company in the same industry7 most li"ely has .

!. a dividend yield &hich is greater than that of the typical company

B. a dividend yield &hich is less than that of the typical company

C. less ris" than the typical company

$. less sensitivity to mar"et trends than the typical company

Difficulty: Medium

19. Everything equal7 &hich variable is negatively related to intrinsic value of a company'

!. $

1

#. $

;

C. g

D. "

Difficulty: Medium

3;. (anders7 +nc.7 paid a >0.;; dividend per share last year and is e?pected to continue to pay

out 3;E of its earnings as dividends for the foreseeable future. +f the firm is e?pected to

generate a 13E return on equity in the future7 and if you require a 11E return on the stoc"7 the

value of the stoc" is .

!. >%3.35

#. >31.19

C. >0%.90

$. >19.89

Difficulty: Hard

13-03

Chapter 13 - Equity Valuation

31. ! firm has .VFD of ; and a mar"et capitali:ation rate of 1%E. 6hat is the firm's ./E

ratio'

!. 1%.;;

B. 8.33

C. 1;.%1

$. 18.11

. L E/" M ;4 ./E L 1/;.1% L 8.33

Difficulty: Medium

3%. ! firm has an earnings retention ratio of 0;E. The stoc" has a mar"et capitali:ation rate

of 11E and an *DE of 18E. 6hat is the stoc"'s ./E ratio'

!. 1%.8%

B. 5.39

C. 8.33

$. 9.03

Difficulty: Medium

33. ! common stoc" pays an annual dividend per share of >1.8;. The ris"-free rate is 1

percent and the ris" premium for this stoc" is 0 percent. +f the annual dividend is e?pected to

remain at >1.8; per share7 &hat is the value of the stoc"'

!. >15.58

B. >%;.;;

C. >0;.;;

$. 2one of the above

. L 1.8;/.;9 L %;

Difficulty: Medium

13-05

Chapter 13 - Equity Valuation

30. Transportation stoc"s currently provide an e?pected rate of return of 11E. TTT7 a large

transportation company7 &ill pay a year-end dividend of >3 per share. +f the stoc" is selling at

>3; per share7 &hat must be the mar"et's e?pectation of the constant gro&th rate of TTT

dividends'

!. 1E

B. 1;E

C. %;E

$. 2one of the above

" L $

1

/.

;

M g

.11 L 3/3; M g

g L .1;

Difficulty: Medium

31. ! stoc" is priced at >01 per share. The stoc" has earnings per share of >3.;; and a mar"et

capitali:ation rate of 10E. 6hat is the stoc"'s .VFD'

A. >%3.15

#. >11.;;

C. >19.58

$. >%1.30

Difficulty: Medium

33. ! firm increases its dividend plo&bac" ratio. !ll else equal you "no& that

.

!. earnings gro&th &ill increase and the stoc"'s ./E &ill increase

#. earnings gro&th &ill decrease and the stoc"'s ./E &ill increase

C. earnings gro&th &ill increase and the stoc"'s ./E &ill decrease

D. earnings gro&th &ill increase and the stoc"'s ./E may or may not increase

Difficulty: Medium

13-08

Chapter 13 - Equity Valuation

35. ! firm has a stoc" price of >10.51 per share. The firm's earnings are >51 million and the

firm has %; million shares outstanding. The firm has an *DE of 11E and a plo&bac" of 31E.

6hat is the firm's .EF ratio'

A. 1.1;

#. 1.%1

C. 1.1;

$. 1.;;

Difficulty: Hard

!*T has come out &ith a ne& and improved product. !s a result7 the firm proJects an *DE

of %1E7 and it &ill maintain a plo&bac" ratio of ;.%;. +ts earnings this year &ill be >3 per

share. +nvestors e?pect a 1%E rate of return on the stoc".

38. !t &hat price &ould you e?pect !*T to sell'

!. >%1.;;

B. >30.%9

C. >0%.83

$. >01.35

Difficulty: Medium

13-09

Chapter 13 - Equity Valuation

39. !t &hat ./E ratio &ould you e?pect !*T to sell'

!. 8.33

B. 11.03

C. 10.%9

$. 11.%1

./E L 30.%9/3 L 11.03

Difficulty: Medium

5;. 6hat is the present value of gro&th opportunities for !*T'

!. >8.15

B. >9.%9

C. >10.%9

$. >13.%9

.VFD L .

;

- ,E.(

;

/"- L 30.%9 - ,3/.1%- L >9.%9

Difficulty: Medium

51. 6hat price do you e?pect !*T shares to sell for in 0 years'

!. >13.93

#. >00.91

C. >01.38

$. >39.53

.

3

L .

;

,1 M g-

0

L 30.%9 ,1.;1-

0

L 01.38

Difficulty: Medium

13-1;

Chapter 13 - Equity Valuation

5%. The E#+T of a firm is >3;;7 the ta? rate is 31E7 the depreciation is >%;7 capital

e?penditures are >3; and the increase in net &or"ing capital is >3;. 6hat is the free cash flo&

to the firm'

!. >81

B. >1%1

C. >181

$. >3;1

ICII L 3;;,1 - .31- M %; - 3; - 3; L >1%1 million

Difficulty: Medium

53. ! firm reports E#+T of >1;; million. The income statement sho&s depreciation of >%;

millions. +f the ta? rate is 31E and total capital e?penditures and increases in &or"ing capital

total >1; million7 &hat is the free cash flo& to the firm'

!. >15

#. >31

C. >51

$. >91

ICII L 1;;,1 - .31- M %; - 1; L >51 million

Difficulty: Medium

50. The free cash flo& to the firm is >3;; million in perpetuity7 the cost of equity equals 10E

and the 6!CC is 1;E. +f the mar"et value of the debt is >1.; billion7 &hat is the value of the

equity using the free cash flo& valuation approach'

!. >1 billion

B. >% billion

C. >3 billion

$. >0 billion

Total value L 3;;/.1; L >3 billion. Equity value L >3 bil - 1 bil L >% billion

Difficulty: Medium

13-11

Chapter 13 - Equity Valuation

51. +f a firm has a free cash flo& equal to >1; million and that cash flo& is e?pected to gro&

at 3E forever7 &hat is the total firm value given a 6!CC of 9.1E'

!. >359 million

#. >511 million

C. >539 million

$. >8;3 million

Total value L 1;/,.;91 - .;3- L 539.%3

Difficulty: Medium

53. The free cash flo& to the firm is reported as >0;1 million. The interest e?pense to the firm

is >53 million. +f the ta? rate is 31E and the net debt of the firm increased by >1;7 &hat is the

free cash flo& to the equity holders of the firm'

A. >0;3 million

#. >010 million

C. >1;1 million

$. >113 million

ICIE L 0;1 - 53,1 - .31- M 1; L 0;1.3;

Difficulty: Medium

55. The free cash flo& to the firm is reported as >%51 million. The interest e?pense to the firm

is >3; million. +f the ta? rate is 31E and the net debt of the firm increased by >337 &hat is the

free cash flo& to the equity holders of the firm'

A. >%39 million

#. >%93 million

C. >3;1 million

$. >3%5 million

ICIE L %51 - 3;,1 - .31- M 33 L %39

Difficulty: Medium

13-1%

Chapter 13 - Equity Valuation

58. The free cash flo& to the firm is reported as >%;1 million. The interest e?pense to the firm

is >%% million. +f the ta? rate is 31E and the net debt of the firm increased by >%17 &hat is the

mar"et value of the firm if the ICIE gro&s at %E and the cost of equity is 11E'

!. >%7138 billion

B. >%7395 billion

C. >%7131 billion

$. >%7998 billion

ICIE L %;1 - %%,1 - .31- M %1 L %11.5;. Value L %11.5/,.11 - .;%- L %395.

Difficulty: Hard

59. The free cash flo& to the firm is reported as >198 million. The interest e?pense to the firm

is >11 million. +f the ta? rate is 31E and the net debt of the firm increased by >%; million7

&hat is the mar"et value of the firm if the ICIE gro&s at 3E and the cost of equity is 10E'

A. >17893 billion

#. >%7095 billion

C. >%7181 billion

$. >37;98 billion

ICIE L 198 - 11,1 - .31- M %; L %;8.%1. Value L %;8.%1/,.10 - .;3- L 1893.

Difficulty: Hard

8;. Iirm ! has a stoc" price of >31 and 3;E of the value of the stoc" is in the form of .VFD.

Iirm # also has a stoc" price of >31 but only %;E of the value of (toc" # is in the form of

.VFD. 6e "no& that .

+. (toc" ! &ill give us a higher return than (toc" #

++. an investment in (toc" ! is probably ris"ier than an investment in (toc" #

+++. (toc" ! has higher forecast earnings gro&th than (toc" #

!. + only

#. + and ++ only

C. ++ and +++ only

$. +7 ++ and +++

Difficulty: Medium

13-13

Chapter 13 - Equity Valuation

81. ! firm is e?pected to produce earnings ne?t year of >3.;; per share. +t plans to reinvest

%1E of its earnings at %;E. +f the cost of equity if 11E7 &hat should be the value of the

stoc"'

!. >%5.%5

B. >1;.;;

C. >33.35

$. >5;.;;

g L .%1 ? .%; L .;14 . L 3.;/,.11 - .;1- L 1;.;;

Difficulty: Medium

8%. 2e?t year's earnings are estimated to be >1.;;. The company plans to reinvest %;E of its

earnings at 11E. +f the cost of equity is 9E7 &hat is the present value of gro&th

opportunities'

!. >9.;9

#. >1;.1;

C. >11.11

$. >1%.%1

g L .%; ? .11 L .;34 . L 0.;/,.;9 - .;3- L 33.354 .VFD L 33.35 - ,1/.;9- L 11.11

Difficulty: Hard

83. 2e?t year's earnings are estimated to be >3.;;. The company plans to reinvest 33E of its

earnings at 1%E. +f the cost of equity is 8E7 &hat is the present value of gro&th

opportunities'

!. >3.;;

B. >%1.;;

C. >00.00

$. >51.;;

g L .33 ? .1% L .;04 . L 0.;/,.;8 - .;0- L 1;;.;;4 .VFD L 1;;.;; - ,3/.;8- L %1.;;

Difficulty: Hard

13-10

Chapter 13 - Equity Valuation

80. 6hen Foogle's share price reached >051 per share Foogle had a ./E ratio of about 38 and

an estimated mar"et capitali:ation rate of 11.1E. Foogle pays no dividends. 6hat percentage

of Foogle's stoc" price &as represented by .VFD'

!. 9%E

B. 85E

C. 55E

$. 30E

Difficulty: Hard

81. ! firm has a stoc" price of >11 per share and a ./E ratio of 51. +f you buy the stoc" at this

./E and earnings fail to gro& at all7 ho& long should you e?pect it to ta"e to Just recover the

cost of your investment'

!. %5 years

#. 35 years

C. 11 years

D. 51 years

Difficulty: Easy

83. +n &hat industry are investors li"ely to use the dividend discount model and arrive at a

price close to the observed mar"et price'

!. +mport/e?port trade

#. (oft&are

C. Telecommunications

D. Gtility

Difficulty: Easy

13-11

Chapter 13 - Equity Valuation

85. Estimates of a stoc"'s intrinsic value calculated &ith the free cash flo& methodology

depends most critically on .

A. the terminal value used

#. &hether one uses ICII or ICIE

C. the time period used to estimate the cash flo&s

$. &hether the firm is currently paying dividends

Difficulty: Easy

88. The greatest value to an analyst from calculating a stoc"'s intrinsic value is .

!. ho& easy it is to come up &ith accurate model inputs

#. the precision of the value estimate

C. ho& the process forces analysts to understand the critical variables that have the greatest

impact on value

$. ho& all the different models typically yield identical value results

Difficulty: Easy

89. 6hich of the follo&ing valuation measures is often used to compare firms &hich have no

earnings'

!. .rice-to-boo" ratio

#. ./E ratio

C. .rice-to-cash flo& ratio

D. .rice-to-sales ratio

Difficulty: Easy

13-13

You might also like

- Chap 012Document77 pagesChap 012limed1100% (1)

- Chap 014Document87 pagesChap 014limed1100% (1)

- Chap 016Document77 pagesChap 016limed1100% (1)

- Chap 012Document46 pagesChap 012saud1411100% (5)

- Chap 021Document41 pagesChap 021saud1411No ratings yet

- Chap 017Document45 pagesChap 017saud1411No ratings yet

- Chap 011Document48 pagesChap 011saud1411100% (3)

- Chap 008Document43 pagesChap 008saud1411100% (6)

- Chap 007Document50 pagesChap 007saud1411100% (7)

- HW 2Document4 pagesHW 2milay2002No ratings yet

- Chap 023Document7 pagesChap 023Veins Of-ice Shanchang100% (1)

- Chap 018Document53 pagesChap 018saud1411100% (2)

- Chap 017Document88 pagesChap 017limed1No ratings yet

- Chap002 Text Bank (1) SolutionDocument18 pagesChap002 Text Bank (1) Solutionjl3542No ratings yet

- Chap 015Document50 pagesChap 015saud1411100% (3)

- Chap 020Document36 pagesChap 020saud1411100% (1)

- Chap 013Document102 pagesChap 013limed1No ratings yet

- Chap 001Document36 pagesChap 001saud1411100% (6)

- CH 1 HW Answer KeyDocument9 pagesCH 1 HW Answer KeyTarek Hoteit100% (1)

- Lecture 3 Answers 1Document5 pagesLecture 3 Answers 1Thắng ThôngNo ratings yet

- Chap 019Document41 pagesChap 019saud1411No ratings yet

- 5 AGibson 13E Ch08 (Topic 5) ProfitabilityDocument28 pages5 AGibson 13E Ch08 (Topic 5) ProfitabilityFatihahZainalLimNo ratings yet

- Fins2624 Online Question Bank CH 15Document28 pagesFins2624 Online Question Bank CH 15AllenRuan100% (3)

- Chap 009Document127 pagesChap 009limed1100% (1)

- Ch20 SolutionsDocument19 pagesCh20 SolutionsAlexir Thatayaone NdovieNo ratings yet

- Chap 004Document17 pagesChap 004saud1411100% (1)

- Chapter 3 MishkinDocument22 pagesChapter 3 MishkinLejla HodzicNo ratings yet

- Financial Statement Analysis: Charles H. GibsonDocument30 pagesFinancial Statement Analysis: Charles H. GibsonAmutha RamasamyNo ratings yet

- FNCE 30001 Week 12 Portfolio Performance EvaluationDocument83 pagesFNCE 30001 Week 12 Portfolio Performance EvaluationVrtpy Ciurban100% (1)

- Multiple Investment Rules and Concepts ExplainedDocument49 pagesMultiple Investment Rules and Concepts ExplainedAurash KazeminiNo ratings yet

- How Government Policies Impact National Saving RatesDocument23 pagesHow Government Policies Impact National Saving RatesLejla HodzicNo ratings yet

- Arbitrage Pricing TheoryDocument4 pagesArbitrage Pricing TheoryShabbir NadafNo ratings yet

- Cost of Capital Questions AnsweredDocument7 pagesCost of Capital Questions Answeredsmoky 22No ratings yet

- Index Models MCQsDocument26 pagesIndex Models MCQsKen WhiteNo ratings yet

- Chapter 06 Efficient DiversificationDocument50 pagesChapter 06 Efficient Diversificationsaud141192% (12)

- Chap021 Text Bank (1) SolutionDocument50 pagesChap021 Text Bank (1) Solutionandlesmason50% (2)

- Jawaban Chapter 18 Performance EvaluationDocument3 pagesJawaban Chapter 18 Performance EvaluationfauziyahNo ratings yet

- Making Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelDocument3 pagesMaking Capital Investment Decisions for Goodtime Rubber Co's New Tire ModelMuhammad abdul azizNo ratings yet

- Capital Budgeting Narain NotesDocument35 pagesCapital Budgeting Narain NoteskrishanptfmsNo ratings yet

- Single Index ModelDocument3 pagesSingle Index ModelPinkyChoudhary100% (1)

- Interest Rates and Bond ValuationDocument39 pagesInterest Rates and Bond ValuationMuhammad BaihaqiNo ratings yet

- Financial Planning: Short Term and Long Term: True-False QuestionsDocument8 pagesFinancial Planning: Short Term and Long Term: True-False Questionsbia070386No ratings yet

- Chap 006Document133 pagesChap 006limed1No ratings yet

- Chapter 8 MishkinDocument20 pagesChapter 8 MishkinLejla HodzicNo ratings yet

- MC Chapter 9Document3 pagesMC Chapter 9Venz LacreNo ratings yet

- Types and Costs of Financial Capital: True-False QuestionsDocument8 pagesTypes and Costs of Financial Capital: True-False Questionsbia070386No ratings yet

- Chap 019Document36 pagesChap 019skuad_024216No ratings yet

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- Chap 007Document113 pagesChap 007limed1100% (1)

- Chapter 1: The Investment Environment: Problem SetsDocument6 pagesChapter 1: The Investment Environment: Problem SetsMehrab Jami Aumit 1812818630No ratings yet

- Chapter 8. Stock Valuation: Multiple Choice QuestionsDocument10 pagesChapter 8. Stock Valuation: Multiple Choice QuestionsQuang Minh NguyễnNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Leach TB Chap12 Ed3Document7 pagesLeach TB Chap12 Ed3bia070386No ratings yet

- Making Investment Decisions With The Net Present Value RuleDocument60 pagesMaking Investment Decisions With The Net Present Value Rulecynthiaaa sNo ratings yet

- Chapter 14 Capital Structure and Financial RatiosDocument12 pagesChapter 14 Capital Structure and Financial Ratiossamuel_dwumfourNo ratings yet

- Leverage and Capital Structure AnalysisDocument6 pagesLeverage and Capital Structure AnalysisPamela-Jo RefuerzoNo ratings yet

- Suggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisDocument20 pagesSuggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisQueasy PrintNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDocument5 pages2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraNo ratings yet

- MBA711 - Answers To Book - Chapter 3Document17 pagesMBA711 - Answers To Book - Chapter 3noisomeNo ratings yet

- Chap 018Document53 pagesChap 018saud1411100% (2)

- Chapter 06 Efficient DiversificationDocument50 pagesChapter 06 Efficient Diversificationsaud141192% (12)

- Chapter 05 Risk and Return: Past and PrologueDocument30 pagesChapter 05 Risk and Return: Past and Prologuesaud141192% (13)

- Chap 004Document17 pagesChap 004saud1411100% (1)

- Chap 020Document36 pagesChap 020saud1411100% (1)

- Chap 019Document41 pagesChap 019saud1411No ratings yet

- Chapter 03 - Securities Markets Multiple Choice QuestionsDocument48 pagesChapter 03 - Securities Markets Multiple Choice QuestionsNoni AlhussainNo ratings yet

- Chap 001Document36 pagesChap 001saud1411100% (6)

- Chap 015Document50 pagesChap 015saud1411100% (3)

- Chap 002Document43 pagesChap 002Jose MartinezNo ratings yet

- Chap 022Document44 pagesChap 022jmsmartinsNo ratings yet

- Chap 017Document45 pagesChap 017saud1411No ratings yet

- Fin 3013 Chapter 10Document56 pagesFin 3013 Chapter 10spectrum_48No ratings yet

- Chap 011Document48 pagesChap 011saud1411100% (3)

- Chap 008Document43 pagesChap 008saud1411100% (6)

- Chap 007Document50 pagesChap 007saud1411100% (7)

- Bridgeloyalty Company Profile - 2019Document20 pagesBridgeloyalty Company Profile - 2019Rohit KrishnaNo ratings yet

- Accounting For Inventories Part 2 Gross and Retail MethodDocument5 pagesAccounting For Inventories Part 2 Gross and Retail MethodDarius JuniorNo ratings yet

- Mis Group 5 Deliverable 4 Final SubmissionDocument72 pagesMis Group 5 Deliverable 4 Final SubmissionMinh Thư NguyễnNo ratings yet

- Fasih Ur Rehman CVDocument3 pagesFasih Ur Rehman CVAnonymous a2NRDXNo ratings yet

- Understanding Financial Statements (Suman)Document77 pagesUnderstanding Financial Statements (Suman)Suman ChaudhuriNo ratings yet

- Ajmal CV NewDocument2 pagesAjmal CV NewAfzalkhan PathanNo ratings yet

- DCF Valuation ExerciseDocument18 pagesDCF Valuation ExerciseAkram MohiddinNo ratings yet

- Printable Flashcard On Accounting Final Exam Review - Free Flash CardsDocument16 pagesPrintable Flashcard On Accounting Final Exam Review - Free Flash CardsSureshArigelaNo ratings yet

- 1 Sem Bcom - Financial AccountingDocument50 pages1 Sem Bcom - Financial AccountingMahantesh Mahantesh100% (2)

- Protection Technology v. SOLEDocument4 pagesProtection Technology v. SOLECristelle Elaine ColleraNo ratings yet

- Practice Set 1 Intro BS ISDocument19 pagesPractice Set 1 Intro BS ISAtul DarganNo ratings yet

- FA Assignment - 5 (Group 5)Document3 pagesFA Assignment - 5 (Group 5)Muskan ValbaniNo ratings yet

- CH 06Document40 pagesCH 06lalala010899No ratings yet

- 3is GROUP 3 MARVIDA 1 3Document13 pages3is GROUP 3 MARVIDA 1 3AnonymousNo ratings yet

- UTS - English Management - Andi - MN5BDocument5 pagesUTS - English Management - Andi - MN5BFebi FebrianisNo ratings yet

- Stratcosman CompilationDocument22 pagesStratcosman CompilationAl Francis GuillermoNo ratings yet

- CHAPTER 2 Introduction To AuditingDocument15 pagesCHAPTER 2 Introduction To AuditingChristine Mae ManliguezNo ratings yet

- mgt101 MCQS FileDocument61 pagesmgt101 MCQS FileAzhar Nadeem100% (1)

- The Effects of Audit Committee AttributesDocument9 pagesThe Effects of Audit Committee AttributesYehezkiel OktavianusNo ratings yet

- Id Fas Brochure Noexp PDFDocument24 pagesId Fas Brochure Noexp PDFDaniel PandapotanNo ratings yet

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Far Dec 11Document12 pagesFar Dec 11Trisha Kaira RodriguezNo ratings yet

- Ratio Formula Calculation Industry Average CommentDocument2 pagesRatio Formula Calculation Industry Average Commentjay balmesNo ratings yet

- Cloud-Based App and Impact On AccountingDocument27 pagesCloud-Based App and Impact On AccountingChidozie FarsightNo ratings yet

- Bank Audit-1.Document7 pagesBank Audit-1.Venkatraman ThiyagarajanNo ratings yet

- Chapter - 2: FinancialDocument21 pagesChapter - 2: FinancialYasir Saeed AfridiNo ratings yet

- Accounting For InventoriesDocument15 pagesAccounting For Inventoriesrichardchan001No ratings yet

- Finance ManagerDocument4 pagesFinance Managerknowledge musendekwaNo ratings yet

- FICO STD ReportsDocument12 pagesFICO STD Reportsshekar8876100% (1)

- INTERNAL AUDIT PROGRAMMEDocument14 pagesINTERNAL AUDIT PROGRAMMERiya XavierNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)