Professional Documents

Culture Documents

Androids Report-Solid Waste

Uploaded by

Athirah RosleeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Androids Report-Solid Waste

Uploaded by

Athirah RosleeCopyright:

Available Formats

Weaknesses - Solid Waste

Solid Waste had been a case that leaves quite a big impact on Androids. As we can see, there

are too many weaknesses arise from this case. Androids had been acting recklessly as based

on what we can see from this case. Security Exchange ommission !SE" found Androids been

guilty of issuing materially false and misleading audit reports on Solid Waste financial statement

for the period #$$% through #$$&. Androids' audit engagement team recogni(ed that Solid

Waste employed )aggressive* accounting practice yet they still allowed management of Solid

Waste to use improper accounting to inflate its operating income and other measures to

success, primarily by deferring the recognition of current period operating expenses into the

future and by netting one+time gains against current and prior period misstatements and current

period operating expenses. Solid Waste capped Androids' corporate audit fees at the prior

year's level but allowed Androids to earn additional fees for tax, attest work unrelated to

financial statement audits or reviews, regulatory issues and consulting services. ,ost

accounting practice that are applied by Solid Waste were violating with -AA.. /hus, Androids

approved the issuance of an unqualified audit report on the financial statement each year

regardless of its reality and six of its partners are found to be involved.

Question Solid Waste

0ased on auditors opinion that we had compile, Androids had been at fault in many aspect.

1irstly we are about to discuss about how they violate the ,2A+by+3aw. /hey violate

,2A+by+3aw in terms of integrity, ob4ectivity, professional behavior and independence. Section

110 of by-Laws on professional ethics states that principle of integrity imposes an obligation on

all professional accountants to be straightforward and honest in all professional and business

relationships. 2ntegrity also implies fair dealing and truthfulness. A professional accountant shall

not knowingly be associated with reports, returns, communications or other information where

the professional accountant believes that the information to contains a materially false or

misleading statement, to contains statements or information furnished recklessly or to omits or

obscures information required to be included where such omission or obscurity would be

misleading. When a professional accountant becomes aware that the accountant has been

associated with such information, the accountant shall take steps to be disassociated from that

information. 2n this Solid Waste case, Androids' engagement team had been not acting truthful

enough as they end up allowed Solid Waste to continue employed )aggressive* accounting

which result in increasing operating income and understating operating expenses. Androids had

failed to totally apply integrity in carrying out their duty as an auditor. Section 120 of by-Laws on

professional ethics states that principle of objectivity imposes an obligation on all professional

accountants not to compromise their professional or business 4udgment because of bias, conflict

of interest or the undue influence of others. A professional accountant may be exposed to

situations that may impair ob4ectivity. 2t is impracticable to define and prescribe all such

situations. A professional accountant shall not perform a professional service if a circumstance

or relationship biases or unduly influences the accountant's professional 4udgment with respect

to that service. Androids had failed to act ob4ectively when carrying their duty as many conflicts

of interest arise. Androids gain additional fees from Solid Waste, as what Solid Waste want is

for Androids to cooperate with them to cover up their )aggressive* accounting practice that they

had been applying all along. Androids make 4udgment that are biased and recklessly issued

unqualified audit reports. Section 150 of by-Laws on professional ethics states that professional

behavior is about obligation on professional accountants to comply with relevant laws and

regulations in addition to these 0y+3aws and avoid any action that the professional accountant

knows or should know may discredit the profession. /his includes actions that a reasonable and

informed third party, weighing all the specific facts and circumstances available to the

professional accountant at that time, would be likely to conclude adversely affects the good

reputation of the profession. Androids clearly violate this 0y+3aw when they did not reveal all the

findings that they get regarding the improper accounting practice that had been applied by Solid

Waste. /hey 4ust simply identify them as )continuing audit issues*. Section 290 of by-Laws on

professional ethics divides independence into independence of mind and independence in

appearance. 2ndependence of mind is the state of mind that permits the expression of a

conclusion without being affected by influences that compromise professional 4udgment, thereby

allowing an individual to act with integrity, and exercise ob4ectivity and professional skepticism.

2ndependence in appearance mean that the avoidance of facts and circumstances that are so

significant that a reasonable and informed third party, would be likely to conclude, weighing all

the specific facts and circumstances, that a firm's, or a member of the audit team's, integrity,

ob4ectivity or professional skepticism has been compromised. Androids failed to act both

independence of mind and independence in appearance as they end up compromising with

Solid Waste to cover up Solid Waste materially misstatement that exist in their accounting

practice.

Secondly, we brainstorm issue regarding creative accounting. 2t is an accounting

practice that follows required laws and regulations, but deviate from what those standards

intends to accomplish. reative accounting capitali(es on loopholes in the accounting standards

to falsely portray a better image of the company. Although creative accounting practices are

legal, the loopholes they exploit are often reformed to prevent such behaviors. 0ased on

auditors, creative accounting should not be applicable and must be avoided as far as we can.

Androids' engagement team discovered Solid Waste's accounting practices that gave rise to

misstatements involving understatements of operating income and they suggest Solid Waste to

record those 4ournal entries or correct the accounting practices but Solid Waste refuse to do so.

Androids' partner relented and instructed the engagement team to identify these as )continuing

audit issues*, as they are aware that it is considered as creative accounting. /hus this will allow

them to issue unqualified audit report on Solid Waste.

3astly is the issue regarding Androids provides both audit services and non+audit

services to Solid Waste. 0ased on auditors opinion that we gather, audit firm are permitted to

provide )permissible non+audit services* to their audit client. Ethical code forbids auditors to

provide non+audit services to audit clients if that would present a threat to independence for

which no adequate safeguards are available. 2n such circumstances, the firm must either resign

as auditor or refuse to supply the non+audit services. /he code includes specific activities where

no acceptable safeguards are available. 5nder corporate governance point of view, the audit

committee, as representative of the shareholders, is required to oversee the relationship with

the auditors and keep the nature and extent of non+audit services under review. /he audit

committee must satisfy itself that the independence and ob4ectivity of the auditor are not

compromised. /his important task specifically require that, for listed companies, audit

engagement partners in the firm who are responsible for a company6s audit must able to

disclose in writing to the audit committee all relationships between the audit firm and the client

that may reasonably be thought to bear on the firm6s independence and the ob4ectivity of the

audit engagement partner and staff !including arrangements for ensuring that independence

remains when non+audit services are commissioned" and the related safeguards that are in

place and confirm that, in their professional 4udgment, the firm is independent and the ob4ectivity

of the audit engagement partner and audit staff is not impaired. /herefore, auditors are allowed

to provide permissible non+audit services to audit client as long as it does not affect their

independence and ob4ectivity. 0ased on this case, Androids did follow the guidelines of non+

audit services that they are permitted to provide to Solid Waste. 0ut the issue arise when Solid

Waste ask for their non+audit services purposely due to their intention of influencing Androids to

compromise with them to cover up their )aggressive* accounting practices. /his is now causing

Androids to no longer able to provide their services with integrity and ob4ectivity.

Recommendation Solid Waste

.rofessional skepticism is an attitude that is very familiar with an auditor. Every auditor should

be able to act with professional skepticism in order for them to produce audit reports which is

reliable. Auditing and Assurance Standard !ASA" did provide a clear picture of auditing and

assurance related matter. 5nder ASA 788, it is clearly stated that an auditor must plan and

perform audit with professional skepticism as they need to consider the possibility of financial

statement to be materially misstated. 1raud may arise at any point of audit, so an auditor should

be able to identify the areas that contain high risk. .rofessional skepticism is about questioning

mind and critical assessment of audit evidence. /hus, an auditor should maintain attitude of

professional skepticism through the audit, recogni(e and consider the possibility of materially

misstatement due to fraud that could arise regardless of their past experience with the same

entity which provides them with honesty and integrity management. Androids should stress out

this point of attitude that able to help them converting to become a good auditor 4ust like what

their founder used to do.

9ext is about how auditor response to the risk of materially misstatement due to fraud.

An auditor should able to determine the overall response to assess the risk of materially

misstatement due to fraud at the financial report level and shall design and perform further audit

procedures whose nature, timing and extent are responsive to the assessed risks at the

assertion level. ASA %%8 states that the auditor needs to perform substantive procedures that

are specifically responsive to risks that are assessed as significant risks. 5nder paragraph :8 of

Auditing Standard, the auditor needs to consider management's selection and application of

significant accounting policies, particularly those related to sub4ective measurement and

complex transaction. Androids' engagement team should be well aware that every risk have it

related response which will help them to determine the materially misstatement better. 2f any

materially misstatement arises due to fraud, they should response well to the problem and they

cannot simply hide it or use creative accounting to cover it up.

1rom this case, we know that Androids are well aware of the manipulation of data by

Solid Waste regarding 4ournal entry and their accounting practice, yet they still did not take

appropriate action. /his is where management representation is vital. According to paragraph

$& of Auditing Standard, auditor should try all his best to obtain written representation from

management confirming that it acknowledges its responsibility for the design and

implementation of internal control to prevent and detect fraud, it has disclosed to the auditor the

results of its assessment of the risk that the financial report may be materially misstated as a

result of fraud and it has disclosed to the auditor its knowledge of actual, suspected or alleged

fraud affecting the entity. ASA ;<8 related to ,anagement =epresentation had provided

guidance on obtaining appropriate representations from management in the audit. 2n addition to

acknowledging its responsibility for financial report, it is important that, irrespective of the si(e of

entity, management acknowledges its responsibility for internal control designed and

implemented to prevent and detect fraud. 0ased on Solid Waste case, Androids had discovered

material misstatement, yet Solid Waste still refuse to alter and take corrective action. /hey had

act not in accordance with the standard. Androids should have been communicated with their

top management regarding this matter, but as in this case, their top management asks them to

apply creative accounting in their report so they should find other alternative. /hey cannot

blindly follow what their top management asks them to do when they are well aware that it is not

right to do so. 2t is stated in the paragraph $$ of Auditing Standard that an auditor need to report

any identified fraud or information related to the existence of fraud to appropriate level of

management. 2f auditor has identified fraud involving management, employees who have

significant roles in internal control or others where the fraud results in material misstatement in

the financial report, they shall communicate these matters to those charged with governance as

soon as possible. Androids' engagement team should have report to the governance as to when

they obtain their findings regarding this matter. 2t is the correct action that should be taken by

them on that moment.

=eference

http>??www.investopedia.com?terms?c?creative+accounting.asp

https>??www.icaew.com?en?technical?ethics?auditor+independence?provision+of+non+audit+

services+to+audit+clients

http>??www.ey.com?.ublication?vw35Assets?.oint@of@view@+@AandA@on@non+audit@services?

B123E?.oint@of@view@Cur@perspective@on@issues@of@concern.pdf

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Advance Security by AguirreDocument17 pagesAdvance Security by AguirreAsiol RecilabmocNo ratings yet

- Final Corrected Abhishek ProtocDocument30 pagesFinal Corrected Abhishek Protocsidhant pundhirNo ratings yet

- ISMS Statement of ApplicabilityDocument20 pagesISMS Statement of ApplicabilityROBERTO DA SILVA ALMEIDA100% (2)

- Ar VW FS Ag 2017Document150 pagesAr VW FS Ag 2017Tangirala AshwiniNo ratings yet

- Basics of Commercial Banking Group 6 Handout 2Document12 pagesBasics of Commercial Banking Group 6 Handout 2Daniela Kian AyalaNo ratings yet

- Lecture 9 Decision Recognizing RiskDocument21 pagesLecture 9 Decision Recognizing RiskCol. Jerome Carlo Magmanlac, ACPNo ratings yet

- CommRev CasesDocument30 pagesCommRev CasesanjisyNo ratings yet

- Fire Risk Analysis of The Airport TerminalsDocument5 pagesFire Risk Analysis of The Airport TerminalsKristaps Puļķis0% (1)

- Back To Back ContractsDocument4 pagesBack To Back ContractshumaidjafriNo ratings yet

- Business Studies Project Class 11-CompressedDocument23 pagesBusiness Studies Project Class 11-CompressedRidhima MungekarNo ratings yet

- Retail Banking and Wealth ManagementDocument36 pagesRetail Banking and Wealth ManagementSAMBITPRIYADARSHINo ratings yet

- CHAPTER 2 Bank RegulationDocument55 pagesCHAPTER 2 Bank RegulationBaby Khor0% (1)

- 2023-03-16 Audit Report - StreamSwapv1.1Document21 pages2023-03-16 Audit Report - StreamSwapv1.1abhishek kumarNo ratings yet

- Logical Thinking: The Categories of Legitimate ReservationDocument4 pagesLogical Thinking: The Categories of Legitimate ReservationEduardJoHoNo ratings yet

- Enterprise - Risk - Management - Cima PDFDocument17 pagesEnterprise - Risk - Management - Cima PDFKarlina PuspitasariNo ratings yet

- PE 4 DISCUSSION HandoutsDocument3 pagesPE 4 DISCUSSION Handoutsjmo32309No ratings yet

- Qrmo Qrma QRMP Qcro QRGP: BulletinDocument4 pagesQrmo Qrma QRMP Qcro QRGP: BulletinIlham Ahmad RosyadiNo ratings yet

- YWCHSB Sample Form Workplace Risk Assessment YWCHSB LIB0266 v1Document3 pagesYWCHSB Sample Form Workplace Risk Assessment YWCHSB LIB0266 v1Hasan WaqarNo ratings yet

- Invitational 2020 2ndDocument36 pagesInvitational 2020 2ndÁnh Thiện TriệuNo ratings yet

- Unit 7-Develop and Implement Reactive Monitoring Systems For Health and Safety RGDocument15 pagesUnit 7-Develop and Implement Reactive Monitoring Systems For Health and Safety RGAshraf EL WardajiNo ratings yet

- Mitul Chawda: Management SkillsDocument5 pagesMitul Chawda: Management Skillsanon_907856858No ratings yet

- GLOBA EssayDocument2 pagesGLOBA EssayJames Vidad100% (1)

- Project Management HomeworkDocument6 pagesProject Management HomeworkHagen OszarwinNo ratings yet

- Okun - FINC - GB.3173.W1 - Venture Capital FinancingDocument7 pagesOkun - FINC - GB.3173.W1 - Venture Capital FinancingaakashchandraNo ratings yet

- Cost of Capital 2010Document105 pagesCost of Capital 2010Amit PandeyNo ratings yet

- Practices That Promote Comprehensive School Safety: ArticleDocument10 pagesPractices That Promote Comprehensive School Safety: ArticleOyam MendozaNo ratings yet

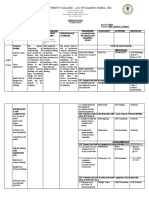

- Curriculum Map TLE8Document11 pagesCurriculum Map TLE8Leonisa GurreaNo ratings yet

- Engineering As Social ExperimentationDocument18 pagesEngineering As Social ExperimentationHarshan ArumugamNo ratings yet

- Risk Taking WorksheetDocument1 pageRisk Taking WorksheetTina EvansNo ratings yet

- MIT College of Management (MITCOM), Pune: A Project Report ONDocument15 pagesMIT College of Management (MITCOM), Pune: A Project Report ONVineet MahajanNo ratings yet