Professional Documents

Culture Documents

Fsap Template in English

Uploaded by

Do Hoang HungCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fsap Template in English

Uploaded by

Do Hoang HungCopyright:

Available Formats

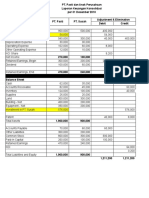

Financial Statement Analysis Package (FSAP): Version 7.

0

Financial Reporting, Financial Statement Analysis, and Valuation: A Strategic Perspective, 7th Edition

By James Wahlen, Steve Baginski and Mark Bradshaw

The FSAP User Guides appear in column I to the right.

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name:

Year (Most recent in far right column.) 2003 2004 2005 2006 2007 2008

BALANCE SHEET DATA

Assets:

Cash and cash equivalents

Marketable securities

Accounts receivable - net

Inventories

Prepaid expenses and other current assets

Deferred tax assets - current

Other current assets (1)

Other current assets (2)

Current Assets 0 0 0 0 0 0

Long term investments

Property, plant, and equipment - at cost

<Accumulated depreciation>

Amortizable intangible assets (net)

Goodwill and nonamortizable intangibles

Deferred tax assets - noncurrent

Other noncurrent assets (1)

Other noncurrent assets (2)

Total Assets 0 0 0 0 0 0

Liabilities and Equities:

Accounts payable - trade

Current accrued liabilities

Notes payable and short-term debt

Current maturities of long-term debt

Deferred tax liabilities - current

Income taxes payable

Other current liabilities (1)

Other current liabilities (2)

Current Liabilities 0 0 0 0 0 0

Long-term debt

Long-term accrued liabilities

Deferred tax liabilities - noncurrent

Other noncurrent liabilities (1)

Other noncurrent liabilities (2)

Total Liabilities 0 0 0 0 0 0

Minority interest

Preferred stock

Common stock + Additional paid in capital

Retained earnings <deficit>

Accum. other comprehensive income <loss>

Other equity adjustments

<Treasury stock>

Common Shareholders' Equity 0 0 0 0 0 0

Total Liabilities and Equities 0 0 0 0 0 0

INCOME STATEMENT DATA 2003 2004 2005 2006 2007 2008

Revenues

<Cost of goods sold>

Gross Profit 0 0 0 0 0 0

<Selling, general and administrative expenses>

<Research and development expenses>

<Amortization of intangible assets>

<Other operating expenses (1)>

<Other operating expenses (2)>

Other operating income (1)

Other operating income (2)

Non-recurring operating gains

<Non-recurring operating losses>

Operating Profit 0 0 0 0 0 0

Interest income

<Interest expense>

Income <Loss> from equity affiliates

Other income or gains

<Other expenses or losses>

Income before Tax 0 0 0 0 0 0

<Income tax expense>

<Minority interest in earnings>

Income <Loss> from discontinued operations

Extraordinary gains <losses>

Changes in accounting principles

Net Income (computed) 0 0 0 0 0 0

Net Income (enter reported amount as a check)

Other comprehensive income items

Comprehensive Income 0 0 0 0 0 0

STATEMENT OF CASH FLOWS DATA 2003 2004 2005 2006 2007 2008

Net Income 0 0 0 0 0 0

Add back depreciation and amortization expenses

Add back stock-based compensation expense

Deferred income taxes

<Income from equity affiliates, net of dividends>

<Increase> Decrease in accounts receivable

<Increase> Decrease in inventories

<Increase> Decrease in prepaid expenses

<Increase> Decrease in other current assets (1)

<Increase> Decrease in other current assets (2)

Increase <Decrease> in accounts payable

Increase <Decrease> in other current liabilities (1)

Increase <Decrease> in other current liabilities (2)

Increase <Decrease> in other noncurrent liabilities (1)

Increase <Decrease> in other noncurrent liabilities (2)

Other addbacks to net income

<Other subtractions from net income>

Other operating cash flows

Net CF from Operations 0 0 0 0 0 0

Proceeds from sales of property, plant, and equipment

<Property, plant, and equipment acquired>

<Increase> Decrease in marketable securities

Investments sold

<Investments acquired>

Other investment transactions (1)

Other investment transactions (2)

Net CF from Investing Activities 0 0 0 0 0 0

Increase in short-term borrowing

<Decrease in short-term borrowing>

Increase in long-term borrowing

<Decrease in long-term borrowing>

Issue of capital stock

Proceeds from stock option exercises

<Share repurchases - treasury stock>

<Dividend payments>

Other financing transactions (1)

Other financing transactions (2)

Net CF from Financing Activities 0 0 0 0 0 0

Effects of exchange rate changes on cash

Net Change in Cash 0 0 0 0 0 0

Cash and cash equivalents, beginning of year 0 0 0 0 0

Cash and cash equivalents, end of year 0 0 0 0 0

SUPPLEMENTAL DATA 2003 2004 2005 2006 2007 2008

Statutory tax rate

Average tax rate implied from income statement data #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

After-tax effects of nonrecurring and unusual items on

net income 0 0 0 0 0 0

Total deferred tax assets (from above) 0 0 0 0 0 0

Deferred tax asset valuation allowance

Allowance for uncollectible accounts receivable

Depreciation expense

Preferred stock dividends (total, if any)

Common shares outstanding

Earnings per share (basic)

Common dividends per share #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Market price per share at fiscal year end

FINANCIAL DATA CHECKS

Assets - Liabilities - Equities 0 0 0 0 0 0

Net Income (computed) - Net Income (reported) 0 0 0 0 0 0

Cash Changes 0 0 0 0 0

Financial Statement Analysis Package (FSAP): Version 7.0

Financial Reporting, Financial Statement Analysis, and Valuation: A Strategic Perspective, 7th Edition

By James Wahlen, Steve Baginski and Mark Bradshaw

The FSAP User Guides appear in column J to the right.

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

DATA CHECKS

Assets - Liabilities - Equities 0 0 0 0 0

Net Income (computed) - Net Income (reported) 0 0 0 0 0

Cash Changes 0 0 0 0

In the computations below, a #DIV/0! message indicates that a ratio denominator is zero.

PROFITABILITY FACTORS:

Year 2004 2005 2006 2007 2008

RETURN ON ASSETS (based on reported amounts):

Profit Margin for ROA

x Asset Turnover

= Return on Assets

RETURN ON ASSETS (excluding the effects of nonrecurring items):

Profit Margin for ROA

x Asset Turnover

= Return on Assets

RETURN ON COMMON EQUITY (based on reported amounts):

Profit Margin for ROCE

x Asset Turnover

x Capital Structure Leverage

= Return on Common Equity

RETURN ON COMMON EQUITY (excluding the effects of nonrecurring items):

Profit Margin for ROCE

x Asset Turnover

x Capital Structure Leverage

= Return on Common Equity

OPERATING PERFORMANCE:

Gross Profit / Revenues

Operating Profit / Revenues

Net Income / Revenues

Comprehensive Income / Revenues

PERSISTENT OPERATING PERFORMANCE (excluding the effects of nonrecurring items):

Persistent Operating Profit / Revenues

Persistent Net Income / Revenues

GROWTH:

Revenue Growth

Net Income Growth

Persistent Net Income Growth

OPERATING CONTROL:

Gross Profit Control Index

Operating Profit Contol Index

Profit Margin Decomposition:

Gross Profit Margin

Operating Profit Index

Leverage Index

Tax Index

Net Profit Margin

Comprehensive Income Performance:

Comprehensive Income Index

Comprehensive Income Margin

RISK FACTORS:

Year 2004 2005 2006 2007 2008

LIQUIDITY:

Current Ratio

Quick Ratio

Operating Cash Flow to Current Liabilities

ASSET TURNOVER:

Accounts Receivable Turnover

Days Receivables Held

Inventory Turnover

Days Inventory Held

Accounts Payable Turnover

Days Payables Held

Net Working Capital Days

Revenues / Average Net Fixed Assets

Cash Turnover

Days Sales Held in Cash

SOLVENCY:

Total Liabilities / Total Assets

Total Liabilities / Shareholders' Equity

LT Debt / LT Capital

LT Debt / Shareholders' Equity

Operating Cash Flow to Total Liabilities

Interest Coverage Ratio (reported amounts)

Interest Coverage ratio (recurring amounts)

RISK FACTORS:

Bankruptcy Predictors:

Altman Z Score

Bankruptcy Probability

Earnings Manipulation Predictors:

Beneish Earnings Manipulation Score

Earnings Manipulation Probability

STOCK MARKET-BASED RATIOS:

Stock Returns

Price-Earnings Ratio (reported amounts)

Price-Earnings Ratio (recurring amounts)

Market Value to Book Value Ratio

INCOME STATEMENT ITEMS AS A PERCENT OF REVENUES:

Year 2004 2005 2006 2007 2008

Revenues

<Cost of goods sold>

Gross Profit

<Selling, general and administrative expenses>

<Research and development expenses>

<Amortization of intangible assets>

<Other operating expenses (1)>

<Other operating expenses (2)>

Other operating income (1)

Other operating income (2)

Non-recurring operating gains

<Non-recurring operating losses>

Operating Profit

Interest income

<Interest expense>

Income <Loss> from equity affiliates

Other income or gains

<Other expenses or losses>

Income before Tax

<Income tax expense>

<Minority interest in earnings>

Income <Loss> from discontinued operations

Extraordinary gains <losses>

Changes in accounting principles

Net Income (computed)

Other comprehensive income items

Comprehensive Income

INCOME STATEMENT ITEMS: GROWTH RATES

Year 2004 2005 2006 2007 2008

COMPOUND

GROWTH

YEAR TO YEAR GROWTH RATES: RATE

Revenues

<Cost of goods sold>

Gross Profit

<Selling, general and administrative expenses>

<Research and development expenses>

<Amortization of intangible assets>

<Other operating expenses (1)>

<Other operating expenses (2)>

Other operating income (1)

Other operating income (2)

Non-recurring operating gains

<Non-recurring operating losses>

Operating Profit

Interest income

<Interest expense>

Income <Loss> from equity affiliates

Other income or gains

<Other expenses or losses>

Income before Tax

<Income tax expense>

<Minority interest in earnings>

Income <Loss> from discontinued operations

Extraordinary gains <losses>

Changes in accounting principles

Net Income (computed)

Other comprehensive income items

Comprehensive Income

COMMON SIZE BALANCE SHEET - AS A PERCENT OF TOTAL ASSETS

Year 2004 2005 2006 2007 2008

Assets:

Cash and cash equivalents

Marketable securities

Accounts receivable - net

Inventories

Prepaid expenses and other current assets

Deferred tax assets - current

Other current assets (1)

Other current assets (2)

Current Assets

Long term investments

Property, plant, and equipment - at cost

<Accumulated depreciation>

Amortizable intangible assets (net)

Goodwill and nonamortizable intangibles

Deferred tax assets - noncurrent

Other noncurrent assets (1)

Other noncurrent assets (2)

Total Assets

Liabilities and Equities:

Accounts payable - trade

Current accrued liabilities

Notes payable and short-term debt

Current maturities of long-term debt

Deferred tax liabilities - current

Income taxes payable

Other current liabilities (1)

Other current liabilities (2)

Current Liabilities

Long-term debt

Long-term accrued liabilities

Deferred tax liabilities - noncurrent

Other noncurrent liabilities (1)

Other noncurrent liabilities (2)

Total Liabilities

Minority interest

Preferred stock

Common stock + Additional paid in capital

Retained earnings <deficit>

Accum. other comprehensive income <loss>

Other equity adjustments

<Treasury stock>

Common Shareholders' Equity

Total Liabilities and Equities

BALANCE SHEET ITEMS: GROWTH RATES

Year 2004 2005 2006 2007 2008

COMPOUND

GROWTH

Assets: YEAR TO YEAR GROWTH RATES: RATE

Cash and cash equivalents

Marketable securities

Accounts receivable - net

Inventories

Prepaid expenses and other current assets

Deferred tax assets - current

Other current assets (1)

Other current assets (2)

Current Assets

Long term investments

Property, plant, and equipment - at cost

<Accumulated depreciation>

Amortizable intangible assets (net)

Goodwill and nonamortizable intangibles

Deferred tax assets - noncurrent

Other noncurrent assets (1)

Other noncurrent assets (2)

Total Assets

Liabilities and Equities:

Accounts payable - trade

Current accrued liabilities

Notes payable and short-term debt

Current maturities of long-term debt

Deferred tax liabilities - current

Income taxes payable

Other current liabilities (1)

Other current liabilities (2)

Current Liabilities

Long-term debt

Long-term accrued liabilities

Deferred tax liabilities - noncurrent

Other noncurrent liabilities (1)

Other noncurrent liabilities (2)

Total Liabilities

Minority interest

Preferred stock

Common stock + Additional paid in capital

Retained earnings <deficit>

Accum. other comprehensive income <loss>

Other equity adjustments

<Treasury stock>

Common Shareholders' Equity

Total Liabilities and Equities

RETURN ON ASSETS ANALYSIS (excluding the effects of non-recurring items)

Level 1 RETURN ON ASSETS

2006 2007 2008

Level 2 PROFIT MARGIN FOR ROA ASSET TURNOVER

2006 2007 2008 2006 2007 2008

Level 3 2006 2007 2008 2006 2007 2008 Turnovers:

Revenues Receivables

<Cost of goods sold> Inventory

Gross Profit Fixed Assets

<Selling, general and administrative expenses>

Operating Profit

Income before Tax

<Income tax expense>

Profit Margin for ROA

*

*

Amounts do not sum.

RETURN ON COMMON SHAREHOLDERS' EQUITY ANALYSIS (excluding the effects of non-recurring items)

RETURN ON COMMON SHAREHOLDERS' EQUITY

2006 2007 2008

2006 2007 2008

PROFIT MARGIN FOR ROCE

ASSET TURNOVER

CAPITAL STRUCTURE LEVERAGE

STATEMENT OF CASH FLOWS: SUMMARY

Year 2004 2005 2006 2007 2008

Operating Activities:

Net Income 0 0 0 0 0

Add back depreciation and amortization expenses 0 0 0 0 0

Net cash flows for working capital 0 0 0 0 0

Other net addbacks/subtractions 0 0 0 0 0

Net CF from Operations 0 0 0 0 0

Investing Activities:

Capital expenditures (net) 0 0 0 0 0

Investments 0 0 0 0 0

Other investing transactions 0 0 0 0 0

Net CF from Investing Activities 0 0 0 0 0

Financing Activities:

Net proceeds from short-term borrowing 0 0 0 0 0

Net proceeds from long-term borrowing 0 0 0 0 0

Net proceeds from share issues and repurchases 0 0 0 0 0

Dividends 0 0 0 0 0

Other financing transactions 0 0 0 0 0

Net CF from Financing Activities 0 0 0 0 0

Effects of exchange rate changes on cash 0 0 0 0 0

Net Change in Cash 0 0 0 0 0

Financial Statement Analysis Package (FSAP): Version 7.0

Financial Reporting, Financial Statement Analysis, and Valuation: A Strategic Perspective, 7th Edition

By James Wahlen, Steve Baginski, and Mark Bradshaw

The FSAP User Guides appear in column L to the right.

FSAP OUTPUT: FINANCIAL STATEMENT FORECASTS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Row Format: Row Format:

Actual Amounts Forecast Amounts Year +6 and beyond:

Common Size Percentage Forecast assumption Long-Run Growth Rate: 3.0%

Rate of Change Percentage Forecast assumption explanation Long-Run Growth Factor: 103.0%

Actuals Forecasts

Year 2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

INCOME STATEMENT

Revenues 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

rate of change #DIV/0! #DIV/0! See Forecast Development worksheet for details of revenues forecasts.

<Cost of goods sold> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume slowly increasing cost of goods sold as a percent of sales.

Gross Profit 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

<Selling, general and administrative expenses> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady SG&A expense as a percent of sales.

<Research and development expenses> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Explain assumptions.

<Amortization of intangible assets> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Amounts based on PepsiCo disclosures in Note 4.

<Other operating expenses (1)> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Explain assumptions.

<Other operating expenses (2)> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Explain assumptions.

Other operating income (1) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Explain assumptions.

Other operating income (2) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Explain assumptions.

Non-recurring operating gains 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

<Non-recurring operating losses> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Operating Profit 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Interest income 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Interest rate earned on average balance in cash and marketable securities.

<Interest expense> 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Interest rate paid on average balance in financial liabilities.

Income <Loss> from equity affiliates 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume expected return of 12% on investments in noncontrolled affilates.

Other income or gains 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

<Other expenses or losses> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Income before Tax 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

<Income tax expense> 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Effective income tax rate assumptions.

<Minority interest in earnings> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Income <Loss> from discontinued operations 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Extraordinary gains <losses> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Changes in accounting principles 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Explain assumptions

Net Income (computed) 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Other comprehensive income items 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume random walk.

Comprehensive Income 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

FSAP OUTPUT: FINANCIAL STATEMENT FORECASTS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Row Format: Row Format:

Actual Amounts Forecast Amounts Year +6 and beyond:

Common Size Percent Forecast assumption Long-Run Growth Rate: 3.0%

Rate of Change Percent Forecast assumption explanation Long-Run Growth Factor: 103.0%

Actuals Forecasts

2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

BALANCE SHEET

ASSETS:

Cash and cash equivalents 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume ending cash balances equal to 12 days sales.

Marketable securities 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume ending balances equal to 8 days sales.

Accounts receivable - net 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume 38 days to collect sales in accounts receivable.

Inventories 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume average inventory turnover of roughly 8.5 times per year.

Prepaid expenses and other current assets 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

rate of change #DIV/0! #DIV/0! Assume growth with sales.

Deferred tax assets - current 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0% 0% 0% 0%

rate of change #DIV/0! #DIV/0! Assume steady growth.

Other current assets (1) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0% 0% 0% 0% 0%

rate of change #DIV/0! #DIV/0! Assume steady growth.

Other current assets (2) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0% 0% 0% 0% 0%

rate of change #DIV/0! #DIV/0! Assume steady growth.

Current Assets 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Long term investments 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0% 0% 0% 0%

rate of change #DIV/0! #DIV/0! Assume steady growth.

Property, plant, and equipment - at cost 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! PP&E assumptions - see schedule in forecast development

<Accumulated depreciation> 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! See depreciation schedule in forecast development worksheet.

Amortizable intangible assets (net) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume amortization per PepsiCo disclosures in Note 4; assume no new investments.

Goodwill and nonamortizable intangibles 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

rate of change #DIV/0! #DIV/0! Assume growth with sales.

Deferred tax assets - noncurrent 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Other noncurrent assets (1) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady growth.

Other noncurrent assets (2) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Total Assets 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

LIABILITIES:

Accounts payable - trade 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Assume a steady payment period consistent with recent years.

Current accrued liabilities 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

rate of change #DIV/0! #DIV/0! Assume growth with SG&A expenses, which grow with sales.

Notes payable and short-term debt 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume 1.0 percent of total assets.

Current maturities of long-term debt 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Current maturities of long-term debt per long-term debt note.

Deferred tax liabilities - current 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Income taxes payable 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume a steady percentage of total assets.

Other current liabilities (1) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Other current liabilities (2) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Current Liabilities 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Long-term debt 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume steady percent of total assets.

Long-term accrued liabilities 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

rate of change #DIV/0! #DIV/0! Assume growth with SG&A expenses, which grow with sales.

Deferred tax liabilities - noncurrent 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume steady percent of total assets.

Other noncurrent liabilities (1) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Other noncurrent liabilities (2) 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0% 0.0% 0.0% 0.0% 0.0%

rate of change #DIV/0! #DIV/0! Assume steady state growth.

Total Liabilities 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

SHAREHOLDERS' EQUITY

Minority interest 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Minority interest assumptions

Preferred stock 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Preferred stock assumptions

Common stock + Additional paid in capital 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Assume steady percent of total assets.

Retained earnings <deficit> 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Add net income and subtract dividends; see dividends forecast box below.

Accum. other comprehensive income <loss> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Add accumulated other comprehensive income items from income statement

Other equity adjustments 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0! 0.0 0.0 0.0 0.0 0.0

rate of change #DIV/0! #DIV/0! Other equity adjustments assumptions

<Treasury stock> 0 0 0 0 0 0 0 0 0

common size #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! Treasury stock repurchases, net of treasury stock reissues.

Common Shareholders' Equity 0 0 0.0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total Liabilities and Equities 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

common size #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

rate of change #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Check figures: Balance Sheet A=L+OE? 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Initial adjustment needed to balance the balance sheet:

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Account adjusted: Dividends

Dividends forecasts:

Common dividends: 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

50.0% 50.0% 50.0% 50.0% 50.0%

Assume dividend payout of lagged net income from continuing operations.

Preferred dividends: 0 0 0 0 0 0

0.0 0.0 0.0 0.0 0.0

Enter preferred stock dividend payments, if any.

Implied dividends: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Implied dividend amount to balance the balance sheet.

Total dividends: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total dividend forecast amounts.

FSAP OUTPUT: FINANCIAL STATEMENT FORECASTS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Actuals Forecasts

IMPLIED STATEMENT OF CASH FLOWS 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Net Income 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Add back depreciation expense (net) 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Add back amortization expense (net) 0 0 0 0 0 0 0 0

<Increase> Decrease in receivables - net 0 0 0 0 0 0 0 0

<Increase> Decrease in inventories 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

<Increase> Decrease in prepaid expenses 0 0 0 0 0 0 0 0

<Increase> Decrease in other current assets (1) 0 0 0 0 0 0 0 0

<Increase> Decrease in other current assets (2) 0 0 0 0 0 0 0 0

Increase <Decrease> in accounts payable - trade 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in current accrued liabilities 0 0 0 0 0 0 0 0

Increase <Decrease> in income taxes payable 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in other current liabilities (1) 0 0 0 0 0 0 0 0

Increase <Decrease> in other current liabilities (2) 0 0 0 0 0 0 0 0

Net change in deferred tax assets and liabilities 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in long-term accrued liabilities 0 0 0 0 0 0 0 0

Increase <Decrease> in other noncurrent liabilities (1) 0 0 0 0 0 0 0 0

Increase <Decrease> in other noncurrent liabilities (2) 0 0 0 0 0 0 0 0

Net Cash Flows from Operations 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

<Increase> Decrease in property, plant, & equip. at cost 0 0 0 0 0 0 0 0

<Increase> Decrease in marketable securities 0 0 0 0 0 0 0 0

<Increase> Decrease in investment securities 0 0 0 0 0 0 0 0

<Increase> Decrease in amortizable intangible assets (net) 0 0 0 0 0 0 0 0

<Increase> Decrease in goodwill and nonamort. intangibles 0 0 0 0 0 0 0 0

<Increase> Decrease in other noncurrent assets (1) 0 0 0 0 0 0 0 0

<Increase> Decrease in other noncurrent assets (2) 0 0 0 0 0 0 0 0

Net Cash Flows from Investing Activities 0 0 0 0 0 0 0 0

Increase <Decrease> in short-term debt 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in long-term debt 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in minority interest and preferred stock 0 0 0 0 0 0 0 0

Increase <Decrease> in common stock + paid in capital 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Increase <Decrease> in accum. OCI and other equity adjs. 0 0 0 0 0 0 0 0

Increase <Decrease> in treasury stock 0 0 0 0 0 0 0 0

Dividends 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net Cash Flows from Financing Activities 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net Change in Cash 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Check Figure:

Net change in cash - Change in cash balance 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

FSAP OUTPUT: FINANCIAL STATEMENT FORECASTS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Actuals Forecasts

2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

FORECAST VALIDITY CHECK DATA:

GROWTH

Revenue Growth Rates: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net Income Growth Rates: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total Asset Growth Rates #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

RETURN ON ASSETS (based on reported amounts):

Profit Margin for ROA #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Asset Turnover #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

= Return on Assets #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

RETURN ON ASSETS (excluding the effects of nonrecurring items):

Profit Margin for ROA #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Asset Turnover #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

= Return on Assets #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

RETURN ON COMMON EQUITY (based on reported amounts):

Profit Margin for ROCE #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Asset Turnover #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Capital Structure Leverage #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

= Return on Common Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

RETURN ON COMMON EQUITY (excluding the effects of nonrecurring items):

Profit Margin for ROCE #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Asset Turnover #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

x Capital Structure Leverage #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

= Return on Common Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

OPERATING PERFORMANCE:

Gross Profit / Revenues #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Operating Profit Before Taxes / Revenues #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

ASSET TURNOVER:

Revenues / Avg. Accounts Receivable #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

COGS / Average Inventory #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Revenues / Average Fixed Assets #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

LIQUIDITY:

Current Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Quick Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

SOLVENCY:

Total Liabilities / Total Assets #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Total Liabilities / Total Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Interest Coverage Ratio #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Financial Statement Analysis Package (FSAP): Version 7.0

Financial Reporting, Financial Statement Analysis, and Valuation: A Strategic Perspective, 7th Edition

By James Wahlen, Steve Baginski and Mark Bradshaw

The FSAP User Guides appear in column K to the right.

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Sales Revenue Forecast Development

Actuals Forecasts

Year 2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5

Revenues - - - - - - - -

rate of change #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

#DIV/0! Sales growth rate assumptions.

Sales Forecasts Combined by Segments:

Forecast Development: Capital Expenditures, Property, Plant and Equipment, and Depreciation

Capital Expenditures: CAPEX Forecasts:

2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5

CAPEX:

PP&E Acquired 0 0 0

PP&E Sold 0 0 0

Net CAPEX 0 0 0 0 0 0 0 0

Net CAPEX as a percent of:

Gross PP&E #DIV/0! #DIV/0! #DIV/0!

Revenues #DIV/0! #DIV/0! #DIV/0! 1.0% 1.0% 1.0% 1.0% 1.0%

#DIV/0!

Property, Plant and Equipment and Depreciation Property, Plant and Equipment and Depreciation Forecasts:

PP&E at cost: 2006 2007 2008 Year +1 Year +2 Year +3 Year +4 Year +5

Beg. balance at cost: 0 0 0 0 0

Add: CAPEX forecasts from above: 0 0 0 0 0

End balance at cost: 0 0 0 0 0 0 0 0

Accumulated Depreciation:

Beg. Balance: 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Subtract: Depreciation expense forecasts from below: #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

End Balance: 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

PP&E - net 0 0 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Depreciation Expense Forecast Development: Depreciation expense forecast on existing PP&E:

Existing PP&E at cost: 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Remaining balance to be depreciated. 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

PP&E Purchases: Depreciation expense forecasts on new PP&E:

Capex Year +1 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Capex Year +2 0 #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Capex Year +3 0 #DIV/0! #DIV/0! #DIV/0!

Capex Year +4 0 #DIV/0! #DIV/0!

Capex Year +5 0 #DIV/0!

Total Depreciation Expense #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Depreciation methods: 2006 2007 2008

PPE at Cost 0 0 0

Avg Depreciable PPE 0 0

Depreciation Expense 0 0 0

Implied Avg. Useful Life in Years #DIV/0! #DIV/0!

Useful Life Forecast Assumption: #DIV/0!

(in years)

Financial Statement Analysis Package (FSAP): Version 7.0

Financial Reporting, Financial Statement Analysis, and Valuation: A Strategic Perspective, 7th Edition

By James Wahlen, Steve Baginski and Mark Bradshaw

The FSAP User Guides appear in column L to the right.

DATA CHECKS - Estimated Value per Share

Dividend Based Valuation #DIV/0!

Free Cash Flow Valuation #DIV/0!

Residual Income Valuation #DIV/0!

Residual Income Market-to-Book Valuation #DIV/0!

Free Cash Flow for All Debt and Equity Valuation #DIV/0!

Check: All Estimated Value per Share amounts should be the same, with the possible exception of the share value from the

Free Cash Flow for All Debt and Equity model. See additional comments in cell L266.

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

VALUATION PARAMETER ASSUMPTIONS

Current share price - $

Number of shares outstanding 0.0

Current market value - $

Long-run growth assumption used in forecasts 3.0%

Long-run growth assumption used in valuation. 3.0%

(Both long-run growth assumptions should be the same.)

COST OF EQUITY CAPITAL:

Equity risk factor (market beta) 0.75

Risk free rate 4.0%

Market risk premium 6.0%

Required rate of return on common equity: 8.50%

COST OF DEBT CAPITAL

Debt capital - $

Cost of debt capital, before tax 0.0%

Effective tax rate 0.0%

After-tax cost of debt capital 0.00%

COST OF PREFERRED STOCK

Preferred stock capital - $

Preferred dividends - $

Implied yield 0.00%

WEIGHTED AVERAGE COST OF CAPITAL

Weight of equity in capital structure #DIV/0!

Weight of debt in capital structure #DIV/0!

Weight of preferred in capital structure #DIV/0!

Weighted average cost of capital #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Continuing

1 2 3 4 5 Value

Dividends-Based Valuation Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Dividends Paid to Common Shareholders #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Less: Common Stock Issues #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Plus: Common Stock Repurchases 0.0 0.0 0.0 0.0 0.0

Dividends to Common Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Factors 0.922 0.849 0.783 0.722 0.665

Present Value Net Dividends #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sum of Present Value Net Dividends #DIV/0!

Present Value of Continuing Value #DIV/0!

Total #DIV/0!

Adjust to midyear discounting 1.043

Total Present Value Dividends #DIV/0!

Shares Outstanding 0.0

Estimated Value per Share #DIV/0!

Current share price - $

Percent difference #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Continuing

1 2 3 4 5 Value

Free Cash Flows for Common Equity Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Net Cash Flow from Operations #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Decrease (Increase) in Cash Required for Operations #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net Cash Flow from Investing 0.0 0.0 0.0 0.0 0.0 0.0

Net CFs from Debt Financing #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net CFs into Financial Assets 0.0 0.0 0.0 0.0 0.0 0.0

Net CFs - Pref. Stock and Minority Int. 0.0 0.0 0.0 0.0 0.0 0.0

Free Cash Flow for Common Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Factors 0.922 0.849 0.783 0.722 0.665

Present Value Free Cash Flows #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sum of Present Value Free Cash Flows #DIV/0!

Present Value of Continuing Value #DIV/0!

Total #DIV/0!

Adjust to midyear discounting 1.043

Total Present Value Free Cash Flows to Equity #DIV/0!

Shares Outstanding 0.0

Estimated Value per Share #DIV/0!

Current share price - $

Percent difference #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Free Cash Flow Valuation Sensitivity Analysis:

Long-Run Growth Assumptions

#DIV/0! 0% 2% 3% 4% 5% 6% 8% 10%

Discount 5% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Rates: 6% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

7% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

8.50% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

9% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

11% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

12% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

13% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

14% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

15% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

16% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

18% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

20% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Continuing

1 2 3 4 5 Value

RESIDUAL INCOME VALUATION Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Comprehensive Income Available

for Common Shareholders #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Lagged Book Value of Common

Shareholders' Equity (at t-1) 0.0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Required Earnings 0.0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Residual Income #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Factors 0.922 0.849 0.783 0.722 0.665

Present Value Residual Income #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sum of Present Value Residual Income #DIV/0!

Present Value of Continuing Value #DIV/0!

Total #DIV/0!

Add: Beginning Book Value of Equity 0.0

Present Value of Equity #DIV/0!

Adjust to midyear discounting 1.043

Total Present Value of Equity #DIV/0!

Shares Outstanding 0.0

Estimated Value per Share #DIV/0!

Current share price - $

Percent difference #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

RESIDUAL INCOME VALUATION SENSITIVITY ANALYSIS:

Long-Run Growth Assumptions

#DIV/0! 0% 2% 3% 4% 5% 6% 8% 10%

Discount 5% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Rates: 6% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

7% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

8.50% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

9% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

10% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

11% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

12% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

13% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

14% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

15% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

16% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

18% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

20% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Continuing

RESIDUAL INCOME VALUATION 1 2 3 4 5 Value

Market-to-Book Approach Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Comprehensive Income Available

for Common Shareholders #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Book Value of Common

Shareholders' Equity (at t-1) 0.0 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Implied ROCE #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Residual ROCE #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Cumulative growth factor in common equity as of t-1 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Residual ROCE times cumulative growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Factors 0.922 0.849 0.783 0.722 0.665

Present Value Residual ROCE times growth #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sum of Present Value Residual ROCE times growth #DIV/0!

Present Value of Continuing Value #DIV/0!

Total Present Value Residual ROCE #DIV/0!

Add one for book value of equity at t-1 1.0

Sum #DIV/0!

Adjust to mid-year discounting 1.043

Implied Market-to-Book Ratio #DIV/0!

Times Beginning Book Value of Equity 0.0

Total Present Value of Equity #DIV/0!

Shares Outstanding 0.0

Estimated Value per Share #DIV/0!

Current share price - $

Percent difference #DIV/0!

Sensitivity analysis for the market-to-book approach should be identical to that of the residual income approach.

FSAP OUTPUT: VALUATION MODELS

Analyst Name: Wahlen, Baginski & Bradshaw

Company Name: 0

Continuing

1 2 3 4 5 Value

Free Cash Flows for All Debt and Equity Year +1 Year +2 Year +3 Year +4 Year +5 Year +6

Net Cash Flow from Operations #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Add back: Interest Expense after tax #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Subtract: Interest Income after tax 0.0 0.0 0.0 0.0 0.0 0.0

Decrease (Increase) in Cash Required for Operations #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Free Cash Flow from Operations #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Net Cash Flow from Investing 0.0 0.0 0.0 0.0 0.0 0.0

Add back: Net CFs into Financial Assets 0.0 0.0 0.0 0.0 0.0 0.0

Free Cash Flows - All Debt and Equity #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Factors #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Present Value Free Cash Flows #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Sum of Present Value Free Cash Flows #DIV/0!

Present Value of Continuing Value #DIV/0!

Total Present Value Free Cash Flows to Equity and Debt #DIV/0!

Less: Value of Outstanding Debt 0.0

Less: Value of Preferred Stock 0.0

Plus: Value of Financial Assets 0.0

Present Value of Equity #DIV/0!

Adjust to midyear discounting #DIV/0!

Total Present Value of Equity #DIV/0!

Shares Outstanding 0.0

Estimated Value per Share #DIV/0!

Current share price - $

Percent difference #DIV/0!

You might also like

- CH 2 Financial Statements, Cash Flow, and TaxesDocument28 pagesCH 2 Financial Statements, Cash Flow, and TaxesKhumairatul AdawiyahNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình MinhNo ratings yet

- Yahoo, Microsoft and Google Financial AnalysisDocument62 pagesYahoo, Microsoft and Google Financial AnalysisAnjana GummadivalliNo ratings yet

- Balance Sheet AnalysisDocument42 pagesBalance Sheet Analysismusadhiq_yavarNo ratings yet

- Five Year Record: Shareholder InformationDocument4 pagesFive Year Record: Shareholder InformationSalim Abdulrahim BafadhilNo ratings yet

- Reformulating Financial StatementsDocument17 pagesReformulating Financial Statementsteguh100% (1)

- Financial Statements, Cash Flows, and TaxesDocument31 pagesFinancial Statements, Cash Flows, and Taxesjoanabud100% (1)

- BS & Income Statement ReformulationDocument30 pagesBS & Income Statement ReformulationAbhishek Singh RanaNo ratings yet

- Consolidated Statement of Earnings (Usd $)Document68 pagesConsolidated Statement of Earnings (Usd $)fivehoursNo ratings yet

- Statement of Comprehensive Income (Income Statement)Document29 pagesStatement of Comprehensive Income (Income Statement)Alphan SofyanNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Cash Flow Statement Review SheetDocument3 pagesCash Flow Statement Review SheetSarah WinzenriedNo ratings yet

- Financial or Accounting Statements Are Used For Reporting Corporate ActivityDocument17 pagesFinancial or Accounting Statements Are Used For Reporting Corporate Activityaaashu77No ratings yet

- C4A Income StatementDocument6 pagesC4A Income StatementSteeeeeeeephNo ratings yet

- Business Activities and Financial StatementsDocument23 pagesBusiness Activities and Financial StatementsUsha RadhakrishnanNo ratings yet

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- CH 2 Financial Statements, Cash Flow, and TaxesDocument24 pagesCH 2 Financial Statements, Cash Flow, and TaxesHarriz JatiNo ratings yet

- Particulars: Form II Operating StatementDocument26 pagesParticulars: Form II Operating StatementvineshjainNo ratings yet

- Analysis of Financial StatementDocument9 pagesAnalysis of Financial StatementSums Zubair MoushumNo ratings yet

- Corfin Tutorial Cfa Research Preparation 1Document14 pagesCorfin Tutorial Cfa Research Preparation 1Felia RizkitaNo ratings yet

- Apple Inc.: Form 10-QDocument55 pagesApple Inc.: Form 10-QdsafoijoafjoasdNo ratings yet

- Accounting Study GuideDocument4 pagesAccounting Study GuideCPALawyer012No ratings yet

- CH 04 Income StatementDocument6 pagesCH 04 Income Statementnreid2701No ratings yet

- IPTC CMA Bank FormatDocument12 pagesIPTC CMA Bank FormatRadhesh BhootNo ratings yet

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocument40 pagesAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraNo ratings yet

- Apple 10QDocument57 pagesApple 10QadsadasMNo ratings yet

- Financial ReportDocument35 pagesFinancial ReportDaniela Denisse Anthawer LunaNo ratings yet

- Glosario de FinanzasDocument9 pagesGlosario de FinanzasRaúl VargasNo ratings yet

- Apple Inc. - Dupont Analysis For Class-1 - Group - 11Document24 pagesApple Inc. - Dupont Analysis For Class-1 - Group - 11Anurag SharmaNo ratings yet

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- ACM 31 Lec2Document18 pagesACM 31 Lec2Vishal AmbadNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- Cash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesDocument6 pagesCash Flow Statements (FRS 1) : A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesCross MatricNo ratings yet

- Balance Sheet & Income StatementDocument12 pagesBalance Sheet & Income StatementPahile Bajirao PeshaveNo ratings yet

- Statement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesDocument5 pagesStatement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesVasantha ShetkarNo ratings yet

- Apple Inc Assignment, Financial ModuleDocument15 pagesApple Inc Assignment, Financial ModuleRahmati RahmatullahNo ratings yet

- Cash Flow Analysis and Value Added MeasuresDocument19 pagesCash Flow Analysis and Value Added MeasuresShruti MaindolaNo ratings yet

- Chapter 2 Buiness FinanxceDocument38 pagesChapter 2 Buiness FinanxceShajeer HamNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Investment VI FINC 404 Company ValuationDocument52 pagesInvestment VI FINC 404 Company ValuationMohamed MadyNo ratings yet

- The Red Marks Contain Instructions. To View The Tips, Place Cursor in That CellDocument15 pagesThe Red Marks Contain Instructions. To View The Tips, Place Cursor in That Cellsiddharthzala0% (1)

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Statement of Cash FLowsDocument44 pagesStatement of Cash FLowsNeerunjun HurlollNo ratings yet

- Accounting Income and Assets: The Accrual ConceptDocument40 pagesAccounting Income and Assets: The Accrual ConceptMd TowkikNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- Understanding Financial StatementsDocument60 pagesUnderstanding Financial StatementsAnonymous nD4Kwh100% (1)

- Introduction To Financial Statements: Income Statement: Topic 4bDocument31 pagesIntroduction To Financial Statements: Income Statement: Topic 4bsarahNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Lecture 5Document4 pagesLecture 5zehratmuzaffarNo ratings yet

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyNo ratings yet

- Opening Day Balance SheetDocument4 pagesOpening Day Balance SheetniranjanusmsNo ratings yet

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- Chapter 4 AnswersDocument4 pagesChapter 4 Answerscialee100% (2)

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument105 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinVKrishna Kilaru100% (2)

- FIRE654 Oct 3 Mid-Term ReviewDocument41 pagesFIRE654 Oct 3 Mid-Term ReviewloveofprofitNo ratings yet

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1No ratings yet

- Lecture 1 CHP 1 No SolutionsDocument20 pagesLecture 1 CHP 1 No SolutionsHarry2140No ratings yet

- Wiley - Chapter 4: Income Statement and Related InformationDocument42 pagesWiley - Chapter 4: Income Statement and Related InformationIvan Bliminse86% (7)

- 4 Sem Bcom - Advanced Corporate AccountingDocument56 pages4 Sem Bcom - Advanced Corporate AccountingDipak Mahalik50% (6)

- Assignment 2 - With Answer2022Document6 pagesAssignment 2 - With Answer2022Wai Lam HsuNo ratings yet

- BRAUDocument3 pagesBRAUKrisNo ratings yet

- Business Studies Revision-BookletDocument183 pagesBusiness Studies Revision-BookletHillary DzudaNo ratings yet

- What Are Exchange Rates?Document17 pagesWhat Are Exchange Rates?Ahmad MalikNo ratings yet

- Interest Rate SwapsDocument19 pagesInterest Rate SwapsSubodh MayekarNo ratings yet

- B009 Dhruvil Shah Wealth Management WGz0kGfcZbDocument5 pagesB009 Dhruvil Shah Wealth Management WGz0kGfcZbDhruvil ShahNo ratings yet

- Duration Ratio As A Risk Management ToolDocument9 pagesDuration Ratio As A Risk Management ToolSanath FernandoNo ratings yet

- Steven Shreve. Lectures On Stochastic Calculus and FinanceDocument365 pagesSteven Shreve. Lectures On Stochastic Calculus and FinanceSee Keong LeeNo ratings yet

- Fixed Income - Part II SolutionsDocument50 pagesFixed Income - Part II SolutionsJohnNo ratings yet

- Chapter 20 - EntrepreneurshipDocument28 pagesChapter 20 - EntrepreneurshipMaryjanedbn Dlamini100% (1)

- Chapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Document26 pagesChapter 3: Group Reporting II: Application of The Acquisition Method Under IFRS 3Phạm Ngọc ÁnhNo ratings yet

- MF ISIN CodeDocument49 pagesMF ISIN CodeshriramNo ratings yet

- Corporate Finance Problem Set 5Document2 pagesCorporate Finance Problem Set 5MANo ratings yet

- CH 14Document42 pagesCH 14Mohamed AdelNo ratings yet

- 0809 KarlsenDocument5 pages0809 KarlsenprateekbaldwaNo ratings yet

- Global Investors Target Latin American Fintech LendIt Finnovista PDFDocument18 pagesGlobal Investors Target Latin American Fintech LendIt Finnovista PDFcristiansearNo ratings yet

- PV Vs NPV (Present Value Vs Net Present Value) Difference Between PV and NPVDocument5 pagesPV Vs NPV (Present Value Vs Net Present Value) Difference Between PV and NPVTS OrigamiNo ratings yet

- MBA - AFM - Inflation AccountingDocument20 pagesMBA - AFM - Inflation AccountingVijayaraj JeyabalanNo ratings yet

- Shiller 2003Document36 pagesShiller 2003JanitscharenNo ratings yet

- Dispersion - A Guide For The CluelessDocument6 pagesDispersion - A Guide For The CluelessCreditTraderNo ratings yet

- Intermediate Accounting I: Financial AssetsDocument20 pagesIntermediate Accounting I: Financial AssetsdeeznutsNo ratings yet

- Financial Closing Process Checklist by Said IslamDocument8 pagesFinancial Closing Process Checklist by Said IslamAndi Tri JatiNo ratings yet

- Principles of Marketing: Engaging Consumers and Communicating Customer Value: Integrated Marketing Communication StrategyDocument32 pagesPrinciples of Marketing: Engaging Consumers and Communicating Customer Value: Integrated Marketing Communication StrategyTehreem KhizraNo ratings yet

- P1 6aDocument2 pagesP1 6aGurleen Singh RuprahNo ratings yet

- Final Group 2Document17 pagesFinal Group 2Asnia Fuentabella ImamNo ratings yet

- Meezan Rozana Amdani FundDocument2 pagesMeezan Rozana Amdani FundAbdur rehmanNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Wema-Bank-Financial Statement-2020Document24 pagesWema-Bank-Financial Statement-2020john stonesNo ratings yet

- Commercial PropertyDocument14 pagesCommercial PropertyMITHILESHBHARATINo ratings yet