Professional Documents

Culture Documents

5-Highlights Budget 2013-14 English

Uploaded by

softdev110 ratings0% found this document useful (0 votes)

8 views4 pagesTotal tax revenue receipts in 2013-14 are estimated to be Rs. 11007. Crore as against B.E of Rs. 9368. Crore in 2012-13, showing an increase of 17.50%.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTotal tax revenue receipts in 2013-14 are estimated to be Rs. 11007. Crore as against B.E of Rs. 9368. Crore in 2012-13, showing an increase of 17.50%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views4 pages5-Highlights Budget 2013-14 English

Uploaded by

softdev11Total tax revenue receipts in 2013-14 are estimated to be Rs. 11007. Crore as against B.E of Rs. 9368. Crore in 2012-13, showing an increase of 17.50%.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

1

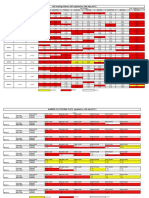

Highlights of Budget 2013-14

1- Receipts

Rs.18955.72 crore revenue receipts are estimated in 2013-14 as

against the B.E of Rs. 16158.95 crore in 2012-13 showing an increase

of 17.31%.

Total tax revenue receipts in 2013-14 are estimated to be Rs.

11007.81 crore as against B.E of Rs. 9368.71 crore in 2012-13,

showing an increase of 17.50%.

Capital receipts of Rs. 5984.59 crore is estimated in 2013-14 as

against B.E of Rs. 4884.10 crore in 2012-13 which shows an increase

of 22.53%. Against capital receipts, Rs. 5300 crore is estimated under

loan receipts showing an increase of 11.20% with respect to loan

receipts of Rs. 4766 crore in 2012-13.

Total receipts in 2013-14 are estimated to be Rs. 24940.32 crore as

against Rs. 21043.05 crore in 2012-13, showing an increase of

18.52%.

2- Expenditure

Total expenditure in 2013-14 is estimated to be Rs. 25329.84 crore as

against Rs. 21931.77 crore in 2012-13, showing an increase of

15.49%.

Non-Plan expenditure in 2013-14 is estimated to be Rs. 16619.46

crore, which is 65.61% of total expenditure. This shows an increase of

11.67% against B.E. of Rs. 14882.81 crore in 2012-13.

Plan expenditure is estimated to be Rs.8710.38 crore in 2013-14 as

against B.E of Rs. 7048.97 crore in 2012-13, showing an increase of

23.57%.

Capital expenditure is estimated to be Rs. 7275.64 crore in 2013-14 as

against B.E of Rs. 6214.66 crore in 2012-13, showing an increase of

17.07%.

2

Interest payment during 2013-14 is estimated to be Rs. 2540.85 crore

as against Rs. 2025 crore in 2012-13, showing an increase of 25.47%.

Pension expenditure is estimated to be Rs. 1989.55 crore in 2013-14

as against Rs. 1439.80 crore in 2012-13, showing an increase of

38.18%.

Loan repayment has been estimated at Rs. 2152.79 crore in 2013-14

as against Rs. 2297.13 crore in 2012-13 showing a decrease of 6.28%.

Salary expenditure in 2013-14 has been estimated at Rs. 7846.95 crore

as against Rs. 6913.50 crore in 2012-13. This shows an increase of

13.50%.

3-Fiscal Indicators

Revenue surplus budget of Rs. 901.52 crore has been estimated which

is in conformity of FRBM Act targets. This means total revenue

expenditure of the State Government is estimated to be less than the

estimated revenue receipts.

Fiscal deficit has been estimated to the turn of Rs. 3536.74 crore,

which is 2.92% of GSDP. This is well within the FRBM target of 3%.

4-Tax concessions

Colours of Holi and Pichkaries will be exempted from VAT.

To empower women in property matters, stamp duty exemption of

25% will be given upto Rs. 30 lakhs (an increase from the earlier

amount of R. 20 lakhs).

Stamp duty is proposed to be reduced from present 2% to 1% in cases

of gift deeds in favour of family members.

3

Stamp duty exemption of 25% in case of property transfers to disabled

persons will be enhanced from 5 lakhs to 10 lakhs.

VAT rate of wire crates used for disaster prevention and flood

protection works is proposed to be reduced from 13.5% to 5%.

To encourage I.T related industries tax concession against form "C"

will be extended till 31

st

March 2015 or implementation of GST.

To encourage tourism in the State, Luxury tax will not be imposed on

"Spa" activities.

To give facility to hotel industry, assessment related to luxury tax will

be done annually instead of half-yearly.

To give facility to trade and industry it is proposed that form "C", and

"H" will be downloaded from the departmental web site, for which no

fees is to be paid.

For the facility of industry, the monetary limit of Rs. 5 lakh on form

"XI" under VAT rules is proposed to be abolished.

To encourage fruit producers, VAT on fruit wine will be reduced from

32.5% to 5%.

5-Other Highlights

"Gender Budgeting" is being done in Uttarakhand to ensure sufficient

focus on women centric scheme, with the ultimate objective of

"women's empowerment". "Gender Budget" for 2013-14 has a

provision of Rs. 3262 crores, which is 46% higher than F.Y. 2012-13.

4

To ensure security of women and speedy police action, "State

Women's Security Cell" is being set up at state level and Women's

Security Cells in every district

For development of infrastructure facilities in SC majority areas a

provision of Rs. 50 crore has been included which is in addition to the

other specific departmental schemes. A total provision of Rs. 946.69

crore has been included under SC sub plan in 2013-14 as against the

B.E of 794.50 crore in 2012-13, showing an increase of 19.69%.

For the welfare of minorities, Rs. 75 crore has been provided in the

budget 2013-14, an increase of 127% against FY 2012-13.

Provision of Rs. 40 crore has been made under National Fruits

Processing Mission to increase fruits processing schemes in the State.

Despite fiscal stress, the State government has increased provision in

major departments for public good:

o Education - From Rs. 4321 crore in 2012-13 to Rs. 4875 crore

o Health- From Rs. 996 crore in 2012-13 to Rs. 1209 crore

o Roads- From Rs. 1167 crore in 2012-13 to Rs. 1314 crore

o Drinking Water- From Rs. 429 crore in 2012-13 to Rs. 588

crore

o Welfare schemes- From Rs. 1000 crore in 2012-13 to Rs. 1237

crore

o Agriculture and allied- About 3400 crore

You might also like

- Union Budget 2013-14: Key Takeout's From The BudgetDocument4 pagesUnion Budget 2013-14: Key Takeout's From The BudgetFeedback Business Consulting Services Pvt. Ltd.No ratings yet

- Union Budget Analysis 2023 24Document8 pagesUnion Budget Analysis 2023 24minakshi malviyaNo ratings yet

- Budget 2012 13 HighlightsDocument66 pagesBudget 2012 13 HighlightsvickyvikashsinhaNo ratings yet

- Budget AnalysisDocument9 pagesBudget AnalysisAdeel AshrafNo ratings yet

- Interim Budget 2024-2025Document13 pagesInterim Budget 2024-2025anushkajain1710No ratings yet

- Budget 2012 Highlights SummaryDocument11 pagesBudget 2012 Highlights SummaryMilan MeeraNo ratings yet

- Union Budget 2023Document5 pagesUnion Budget 2023Datta CreationsNo ratings yet

- Highlights of Union Budget 2012Document7 pagesHighlights of Union Budget 2012Debarun ChatterjeeNo ratings yet

- Budget 2012 Highlights Raises Income Tax Exemption LimitDocument5 pagesBudget 2012 Highlights Raises Income Tax Exemption LimitAswathy PkNo ratings yet

- Budget 2013 - 14Document3 pagesBudget 2013 - 14Jagdeep PabbaNo ratings yet

- New Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearDocument3 pagesNew Delhi: Finance Minister Pranab Mukherjee Presented The Union Budget For The YearTapas KumarNo ratings yet

- Union Budget 2019-20Document15 pagesUnion Budget 2019-20Smitha MohanNo ratings yet

- Cpfga 15645 BHDocument3 pagesCpfga 15645 BHShanthan ChippaNo ratings yet

- Impact of Budget 2014-15 on key sectorsDocument4 pagesImpact of Budget 2014-15 on key sectorsRaj AraNo ratings yet

- Union Budget Analysis - 2022-23Document8 pagesUnion Budget Analysis - 2022-23PRIYA PAULNo ratings yet

- Budget 2013Document5 pagesBudget 2013@nshu_theachieverNo ratings yet

- Union Budget 2013-14 - Highlights and AnalysisDocument28 pagesUnion Budget 2013-14 - Highlights and AnalysisNaureen FatimaNo ratings yet

- Project Report On BUDGET (2022-23) : Computer Applications in BusinessDocument15 pagesProject Report On BUDGET (2022-23) : Computer Applications in BusinessDeepu yadavNo ratings yet

- Highlights of Union Budget 2013Document10 pagesHighlights of Union Budget 2013sapphire1988No ratings yet

- Union Budget 2012Document3 pagesUnion Budget 2012anyashikaNo ratings yet

- Maharashtra Budget Analysis 1Document11 pagesMaharashtra Budget Analysis 1asdfjkNo ratings yet

- Union - Budget 2023-24Document8 pagesUnion - Budget 2023-24Priya UpscNo ratings yet

- J&K Budget 2014-15 Highlights SummaryDocument4 pagesJ&K Budget 2014-15 Highlights SummaryVarun KundalNo ratings yet

- O o o o o o o o o o o o o oDocument5 pagesO o o o o o o o o o o o o oAneesha KasimNo ratings yet

- Edristi English edition preface highlights priorities of authenticity and reader feedbackDocument148 pagesEdristi English edition preface highlights priorities of authenticity and reader feedbackmadhukar tiwariNo ratings yet

- Union Budget 2012Document4 pagesUnion Budget 2012Siddhant SekharNo ratings yet

- Union Budget 2012Document11 pagesUnion Budget 2012vivek1245No ratings yet

- Analysis of BudgetDocument5 pagesAnalysis of BudgetSargun KaurNo ratings yet

- Budget 2012Document6 pagesBudget 2012Divya HdsNo ratings yet

- Current Affairs March 1Document19 pagesCurrent Affairs March 1Puneet_TryLoNo ratings yet

- Telecom Industry: Group Member: Sunil Soni Shashank Chaturvedi Mukesh Saurabh KumarDocument17 pagesTelecom Industry: Group Member: Sunil Soni Shashank Chaturvedi Mukesh Saurabh Kumarmukesh04No ratings yet

- Budget Plan Financial GuidelineDocument12 pagesBudget Plan Financial GuidelineRahul DubeyNo ratings yet

- Budget 2014-15 Analysis - Vedantam GuptaDocument3 pagesBudget 2014-15 Analysis - Vedantam GuptaVedantam GuptaNo ratings yet

- Budget 2013 Highlights: Tax Relief, Duty Hikes, Funds For WomenDocument15 pagesBudget 2013 Highlights: Tax Relief, Duty Hikes, Funds For WomenSanjana BhattNo ratings yet

- February 2013 Monthly Policy Review Highlights Key DevelopmentsDocument12 pagesFebruary 2013 Monthly Policy Review Highlights Key DevelopmentsAbhishek Mani TripathiNo ratings yet

- union budget 2024Document68 pagesunion budget 2024Scribd007No ratings yet

- Budget 2015-16: Net Revenue ReceiptDocument7 pagesBudget 2015-16: Net Revenue ReceiptDani RajaNo ratings yet

- F - 413 - SamirDocument5 pagesF - 413 - SamirSamir Paul PrantoNo ratings yet

- Aakash GD3 BudgetanalysisDocument7 pagesAakash GD3 BudgetanalysisMen AtworkNo ratings yet

- Compare Budget 2023 With 2022Document8 pagesCompare Budget 2023 With 2022Vartika VNo ratings yet

- 1 Doc 202421304501Document5 pages1 Doc 202421304501Brian DixieNo ratings yet

- Click Here For Pakistan Budget 2011-12 DetailsDocument6 pagesClick Here For Pakistan Budget 2011-12 DetailsSaim AhamdNo ratings yet

- Pakistan Federal Budget 2007-08 AnalysisDocument18 pagesPakistan Federal Budget 2007-08 Analysisclimax manoNo ratings yet

- Budget AuroDocument38 pagesBudget AuroSrihari PatelNo ratings yet

- A Gist of Union Budget 2012Document4 pagesA Gist of Union Budget 2012Robin GandhiNo ratings yet

- Critical Review of Bangladesh's FY2019-20 National BudgetDocument6 pagesCritical Review of Bangladesh's FY2019-20 National Budgetrakibul hasanNo ratings yet

- Highlights of Union Budget For 2013-14 Personal TaxDocument13 pagesHighlights of Union Budget For 2013-14 Personal Taxindia1965No ratings yet

- Despite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyDocument8 pagesDespite This Slowdown in FY 2012, in Cross Country Comparison, India Still Remains Amongst The Highest Grown EconomyGurunam Singh DeoNo ratings yet

- Monthly Policy Review - Key Highlights of July 2014Document15 pagesMonthly Policy Review - Key Highlights of July 2014fandyanu1No ratings yet

- Finance Minister Budget Highlights: Fiscal Deficit, CAD, Excise Duty CutsDocument7 pagesFinance Minister Budget Highlights: Fiscal Deficit, CAD, Excise Duty CutskaifiahmedNo ratings yet

- Budget 2012-13Document10 pagesBudget 2012-13Ravi SharmaNo ratings yet

- Expected Budget 2023 Continued by Akshat SharmaDocument2 pagesExpected Budget 2023 Continued by Akshat SharmaAkshat Sharma Roll no 21No ratings yet

- Budget 2012-13by Sachin KakdeDocument19 pagesBudget 2012-13by Sachin Kakdesachinkakde99No ratings yet

- Highlights of The Union Budget 2022 Partt 222Document33 pagesHighlights of The Union Budget 2022 Partt 222KUSUMA ANo ratings yet

- BUDGET 2012: HighlightsDocument22 pagesBUDGET 2012: HighlightsSamridhi TrikhaNo ratings yet

- Ventura - Budget 2013Document47 pagesVentura - Budget 2013Manish SachdevNo ratings yet

- Sop-G 8 PresentsDocument24 pagesSop-G 8 PresentsHimesh V NairNo ratings yet

- Union Budget 2012-13 Key HighlightsDocument14 pagesUnion Budget 2012-13 Key Highlightssandeep25011990No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Four Level Basement in IT UnitsDocument1 pageFour Level Basement in IT Unitssoftdev11No ratings yet

- BP - OC Approval To Linked To Renewal of Licence 28.3.11Document1 pageBP - OC Approval To Linked To Renewal of Licence 28.3.11softdev11No ratings yet

- Area Norm BP OC 27.9.2017Document1 pageArea Norm BP OC 27.9.2017softdev11No ratings yet

- Amended Composition Policy 30.5.11Document2 pagesAmended Composition Policy 30.5.11Abhimanyu BhatiaNo ratings yet

- Office Order ZP-180 BPACDocument1 pageOffice Order ZP-180 BPACsoftdev11No ratings yet

- Composition PolicyDocument8 pagesComposition Policysoftdev11No ratings yet

- Composition Rates Norms 28.8.2007Document1 pageComposition Rates Norms 28.8.2007softdev11No ratings yet

- Min Far For BP - Oc 6.4.11Document1 pageMin Far For BP - Oc 6.4.11softdev11No ratings yet

- Combined Zoning Plan Policy 17.5.2011Document1 pageCombined Zoning Plan Policy 17.5.2011softdev11No ratings yet

- Composition BPAC 21.7.2017Document1 pageComposition BPAC 21.7.2017softdev11No ratings yet

- Amendment AHP Policy 10.10.2017Document1 pageAmendment AHP Policy 10.10.2017softdev11No ratings yet

- BPAC Adding Fire Officer STP E MDocument1 pageBPAC Adding Fire Officer STP E Msoftdev11No ratings yet

- Depress Front Boudary For OC 3.3.05Document1 pageDepress Front Boudary For OC 3.3.05softdev11No ratings yet

- Composition Rates Norms 15.1.2008Document1 pageComposition Rates Norms 15.1.2008softdev11No ratings yet

- Composition Rates Norms 29.1.2007Document1 pageComposition Rates Norms 29.1.2007softdev11No ratings yet

- Status of licence applications under affordable housing policyDocument13 pagesStatus of licence applications under affordable housing policysoftdev11No ratings yet

- HIG Housing Scheme-ISBT (Updated On 14th Sept, 2017) : Reserved BookedDocument2 pagesHIG Housing Scheme-ISBT (Updated On 14th Sept, 2017) : Reserved Bookedsoftdev11No ratings yet

- Somany Tiles PricelistDocument9 pagesSomany Tiles Pricelistanirbanpwd76100% (1)

- JsonDocument71 pagesJsonAngshusmita Baruah Segra100% (1)

- LLMDocument1 pageLLMsoftdev11No ratings yet

- Final Menu With Revised PriceDocument14 pagesFinal Menu With Revised Pricesoftdev11No ratings yet

- Must Do HR ChecklistDocument5 pagesMust Do HR Checklistsoftdev11No ratings yet

- LLMDocument1 pageLLMsoftdev11No ratings yet

- Employee Handbook: HR Guidelines Applicable For All Permanent Employees of ABC Corp. Services Private LimitedDocument15 pagesEmployee Handbook: HR Guidelines Applicable For All Permanent Employees of ABC Corp. Services Private LimitedpreaNo ratings yet

- Quick Guides - Manufacturing Foundation - ClassicDocument29 pagesQuick Guides - Manufacturing Foundation - Classicsoftdev11No ratings yet

- ReadmeDocument1 pageReadmesoftdev11No ratings yet

- Gym SoftwareDocument2 pagesGym Softwaresoftdev11No ratings yet

- Quick Guides - Manufacturing Foundation - ClassicDocument29 pagesQuick Guides - Manufacturing Foundation - Classicsoftdev11No ratings yet

- Final Menu With Revised PriceDocument27 pagesFinal Menu With Revised Pricesoftdev11No ratings yet

- 5 LakesDocument7 pages5 Lakessoftdev11No ratings yet

- ATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditDocument4 pagesATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditTanmoy HasanNo ratings yet

- The Statement of Comprehensive Income of A Merchandising BusinessDocument6 pagesThe Statement of Comprehensive Income of A Merchandising BusinessMichael MangahasNo ratings yet

- 2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFDocument1 page2020 07 21 14 18 51 966 - 1595321331966 - XXXPA5493X - Acknowledgement PDFVasanth Kumar AllaNo ratings yet

- Tip 21a01-05Document3 pagesTip 21a01-05Melissa R.No ratings yet

- Stop Coddling the Super-RichDocument3 pagesStop Coddling the Super-RichSanyu LakhaniNo ratings yet

- GST Book by Rahul PDFDocument271 pagesGST Book by Rahul PDFharishNo ratings yet

- BAR Test Cases ManualDocument20 pagesBAR Test Cases ManualMaida MarcanoNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-354477702No ratings yet

- Assessing Paymaya as Payment for STI StudentsDocument8 pagesAssessing Paymaya as Payment for STI StudentsAlyssa DenneseNo ratings yet

- Form 8960 InstructionsDocument20 pagesForm 8960 InstructionsforbesadminNo ratings yet

- Consider The Following Highly Simplified Description of The U S WageDocument1 pageConsider The Following Highly Simplified Description of The U S Wagetrilocksp SinghNo ratings yet

- H16 Preferential Taxation PDFDocument7 pagesH16 Preferential Taxation PDFJoshlyne MijaresNo ratings yet

- PCEC - FLUENCE TSP - Billing Form - JMC - Feb 15Document1 pagePCEC - FLUENCE TSP - Billing Form - JMC - Feb 15GREGORIO RAMBAYONNo ratings yet

- Running Head: Apple Pay and Paypal 1Document3 pagesRunning Head: Apple Pay and Paypal 1Ayesha IftikharNo ratings yet

- Att Usa New Edited 1 PGDocument1 pageAtt Usa New Edited 1 PGKenneth GonzalesNo ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFAvijitSinharoyNo ratings yet

- SBI CSP Commission NewDocument2 pagesSBI CSP Commission Newsai krishnaNo ratings yet

- House Property IncomeDocument4 pagesHouse Property IncomeOnkar BandichhodeNo ratings yet

- Negotiable Instruments Act, 1881Document33 pagesNegotiable Instruments Act, 1881Vinayak Khemani100% (1)

- Taxation Principles and Allowable Deductions QuizDocument4 pagesTaxation Principles and Allowable Deductions Quizwind snip3r reojaNo ratings yet

- Passenger Detail: Rajasthan State Road Transport CorporationDocument2 pagesPassenger Detail: Rajasthan State Road Transport CorporationDheeraj Jha0% (1)

- Sample of Contract With Direct Sellers PDFDocument2 pagesSample of Contract With Direct Sellers PDFPankaj PandeyNo ratings yet

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndNo ratings yet

- 41Document5 pages41Malkeet SinghNo ratings yet

- Fast Services Payroll SlipDocument1 pageFast Services Payroll SlipLeidegay AnicoyNo ratings yet

- OnlineStatement (JanDocument3 pagesOnlineStatement (JanCarrie DuboisNo ratings yet

- Republic v. Limaco & de GuzmanDocument10 pagesRepublic v. Limaco & de GuzmanMitch BarandonNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of Indiasaikumar yellankiNo ratings yet

- Tax Invoice: Payment DetailsDocument2 pagesTax Invoice: Payment DetailsYashNo ratings yet

- Suffolk County Democratic Committee - 11-Day Pre-GeneralDocument47 pagesSuffolk County Democratic Committee - 11-Day Pre-GeneralRiverheadLOCALNo ratings yet