Professional Documents

Culture Documents

5.16.14 DPOA Objection To PoA

Uploaded by

WDET 101.9 FM0 ratings0% found this document useful (0 votes)

59 views22 pagesThis is the Detroit Police Officers Association Objection to the City's Plan of Adjustment.

Original Title

5.16.14 DPOA Objection to PoA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis is the Detroit Police Officers Association Objection to the City's Plan of Adjustment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

59 views22 pages5.16.14 DPOA Objection To PoA

Uploaded by

WDET 101.9 FMThis is the Detroit Police Officers Association Objection to the City's Plan of Adjustment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 22

1

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

IN RE: Chapter 9

City of Detroit, Michigan, No. 13-53846

Debtor. Hon. Steven W. Rhodes

/

OBJECTIONS TO FOURTH AMENDED PLAN OF ADJUSTMENT

BY DETROIT POLICE OFFICERS ASSOCIATION

The Detroit Police Officers Association (the DPOA), through their counsel, Erman,

Teicher, Zucker & Freedman, P.C., state as follows for their Objections to the Fourth Amended

for the Adjustment of Debts of the City of Detroit (May 5, 2014) (the Objections):

INTRODUCTION

1. As this chapter 9 bankruptcy case proceeds towards the confirmation hearing, the

DPOA, one of the Citys two largest public safety unions, has been unable to reach terms on a

collective bargaining agreement with the City. The DPOA and its members stand squarely on

both sides of the feasibility issue. On the one hand, they strongly support the Citys restructuring

efforts to aid them in their ability to provide the Citys residents, businesses and visitors with

more effective police protection. On the other hand, the DPOAs members are creditors of the

City, who, as a result of the freeze on their accrued pension benefits and the proposed New PFRS

Pension Formula, face additional and significant cuts to their pension benefitsa critical

condition of their employment, since City police officers lack the protection of Social Security

for retirement or disability.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 1 of 19

1CFN.%05'

1353846140516000000000021

Docket #4901 Date Filed: 5/16/2014

2

2. As this Court has recognized, the services provided by all of the Public Safety

Unions, including the DPOA, are at the core of the essential services for which the

Eligibility Opinion found the City was service delivery insolvent. Eligibility Opinion, R.

1945, pg. 114; Nov. 4 Trial Transcript, R. 1605, pg. 32.

3. Having used PA 436 and the timing of the bankruptcy filing to strip the DPOA of

its collective bargaining rights under state law, the City, with the support and approval of the

State, now proposes, through the Plan

1

[Docket No. 4392] and its proposed treatment of the

DPOA members PFRS Pension Claims: (a) to freeze and impair DPOA members

constitutionally protected, accrued pension benefits,

2

4. The Citys cynical treatment of the men and women who provide core and

essential police protection is the punishment the members of the DPOA stand to receive

because they have reached what would otherwise be a readily resolvable impasse with the City

as to economic terms of a collective bargaining agreement. Ironically, the very mechanism that

State public policy provides to address such an impassethe right to arbitrationhas been made

unavailable to them by the effects of PA 436 and the stay in place in these chapter 9 proceedings.

(b) to impose on them, as part of their

PFRS Pension Claim, a pension benefit that, effective J uly 1, 2014, is significantly less generous

than the New PFRS Pension benefit that will be provided to members of public safety unions

who have reached tentative settlements with the City and (c) after imposing this less generous

benefit, to block the DPOA, in direct conflict with State and federal labor law, from the right to

bargain collectively to improve those pension benefits until at least J une of 2023.

1

Unless otherwise indicated, all capitalized terms are as defined by the Plan.

2

The effect of the June 30, 2014 hard freeze on active police officers accrued pension benefits results in greater

cuts to those benefits the further the officer is from retirement.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 2 of 19

3

5. The DPOA recognizes the broad powers the State and City have over the Citys

creditors under Sections 903 and 904 of the Code. However, the City cannot violate either the

plain terms of Bankruptcy Code Sections 1123(a)(4) (imposing a significantly smaller recovery

on DPOA members compared to settling public safety union members) and 943(a)(4) (stripping

their mandatory, State law right to bargain about this mandatory condition of employment until

at least J une of 2023) in order to punish DPOA members for the failure to reach terms on a

tentative collective bargaining agreement.

6. The DPOA is the exclusive bargaining representative of the Citys police officers.

The DPOA, like the Detroit Fire Fighters Association (DFFA)the Citys other large public

safety union-- now finds itself in the eye of a storm of other objecting creditors, many of whom

claim that the treatment of the pension claims is unfairly discriminatory (i.e., too rich) and/or that

the Plan is not feasible for a variety of other reasons. Given the undisputed challenges that

DPOA members face in providing the City with core and essential police protection, it is

imperative that these objections not get lost in the tsunami of financial data and projections that

are also an important component of the Courts feasibility analysis.

7. The actions of the City toward the DPOA (and DFFA) members, as proposed by

the Plan, are illegal and punitive. The Plan cannot be confirmed unless the DPOAs objections

are allowed, and the City consents to modify the Plan.

FACTUAL AND PROCEDURAL BACKGROUND

8. In J uly of 2013, the DPOA joined forces with the Citys three other uniformed

public safety unions and through their leadership, the four public safety unions reached out to the

City in an effort to play a constructive role in the Citys restructuring efforts.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 3 of 19

4

9. Although the City responded to those efforts by thanking the leaders of the four

public safety unions for their strong cooperation, see attached Exhibit 1, DPSU Exhibit 705,

Eligibility Trial, the following day, the City filed its chapter 9 petition for relief [Docket No. 1].

10. On December 5, 2013, this Court found the City eligible for relief under chapter 9

of the Bankruptcy Code. In re City of Detroit, 504 BR 97 (E.D. Mich. Bankr. 2013). The Court

also specifically found that the City had failed to negotiate in good faith with its creditors,

including the DPOA, and found that the Citys conduct bordered on disingenuous in its claims

that it had. Id at 176. On August 20, 2013, the Court ordered each of the Detroit public safety

unions, including the DPOA, and other key creditors of the City into mediation (the Orders for

Mediation) [Docket Nos. 333 and 527].

11. For more than seven months, the DPOA has participated with the other public

safety unions in extensive and exhaustive mediation sessions pursuant to Orders for Mediation.

Those sessions were conducted by Court appointed mediators, the Hon. Victoria Roberts and

Eugene Driker with the active assistance and participation of Chief J udge Gerald Rosen. They

have involved representatives of the City, including the Emergency Manager and the Mayor, and

J ones Day.

12. As a result of those exhaustive efforts, two of the four public safety unions

reached tentative settlements with the City. However, the DFFA and DPOA, the two largest

public safety unions, have not, as of the date of these Objections, been able to reach an

agreement.

13. As this Court recognized in its Eligibility Opinion, the challenges faced by the

members of the DPOA in providing effective police protection to the Citys residents, businesses

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 4 of 19

5

and visitors are enormous and daunting, 504 BR at 120, 169-170. At the time the Petition was

filed, the City had reduced the number of City employees by more than 22% since fiscal year

2010, and had imposed wage and benefit cuts on union employees under expired collective

bargaining agreements. Orr Declaration, R. 11, pg. 14.

14. The Citys Disclosure Statement notes that the number of City police officers has

been reduced by over 40% during the last 10 years and that, until the recent appointment of

current City Police Chief J ames Craig (Chief Craig), its officers had been forced into working

12 hour shifts [Docket No. 4391, p. 133]

15. This Courts Eligibility Opinion recognized that the City could not, . . . reduce its

employee expenses without further endangering public safety, Eligibility Opinion, R. 1945, pg.

30. However, the City, when it filed its petition for relief, sought to do exactly that by seeking to

impair its active police and fire fighters accrued pension rights.

16. At the eligibility trial, Chief Craig addressed the challenges the City and its police

officers faced in their efforts to provide essential police protection. Oct. 25 Trial Transcript, R.

1501, pgs. 177-215. Among those challenges was the very low morale of City public safety

workers. According to Craig, the morale of the Citys police officers . . . was the lowest . . . [he

had] . . . seen of any police department [hed] ever worked, including when . . . [he] . . . worked .

. . [in Detroit] . . . in the 70s. Id., pg. 192. That low morale was caused, in significant part, by

a ten percent pay cut and 12 hour work day schedule forced on them and their lack of voice and

decision making in the department. Id., pg. 193. The chief told the court that the Citys police

department was undermanned, its officers underpaid and their working conditions deplorable,

and that the Citys fire department and its firefighters faced similarly deplorable conditions. Id.,

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 5 of 19

6

pgs. 204-05. Trial testimony established the dangerous and life-threatening work done by City

police officers and fire fighters. Id., pg. 207; pg. 154.

17. The eligibility trial record also established that the Citys police officers and fire

fighters lacked the safety net of Social Security benefits upon retirement or disability, and that

those hired prior to 1986 also lacked the protection afforded by Medicare. Nov. 4 Trial

Transcript, R.1605, pgs. 34-35; Oct. 28 Trial Transcript, R. 1502, pg. 212; Nov. 7 Trial

Transcript, R. 1681, pgs. 165-67, 178.

18. Faced with these challenges, the DPOA and the City have worked exhaustively

for more than seven months to attempt to reach agreement on key issues that would form the

basis of a collective bargaining agreement. To date, they have been unable to do so.

19. As an apparent result of this inability, the Plan subjects the DPOA to (a) significantly

less favorable pension treatment than the other active public safety employees in Class and (b) a

non-consensual, 10 year injunction that bars them from any negotiations on their pension rights

a mandatory subject of bargaining under any applicable labor law.

20. Given DPOA members critical role in the Citys restructuring and their proposed

illegal treatment under the Plan, the DPOA objects to the Plan.

ARGUMENT

The Plan cannot be confirmed as proposed because, contrary to Code Section

1123(a)(4), it imposes less favorable treatment on DPOA members than are

afforded other members of Class 10, and DPOA members have not agreed to

the less favorable treatment.

21. 11 U.S.C. 1123(a)(4) applies to these proceedings pursuant to 11 U.S.C. 901(a).

Section 1123(a)(4) requires that the Plan, provide the same treatment for each claim or interest

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 6 of 19

7

of a particular class, unless a holder of a claim or interest agrees to less favorable treatment of

such particular claim or interest. The Citys Plan turns Section 1123(a)(4) on its head. It

proposes less favorable treatment for the prospective pension benefits of DPOA members

because they have not reached agreement with the City through their exclusive bargaining

representatives.

22. Under the Plan, all active, uniformed public safety employees have Class 10

PFRS Pension Claims. In its current form, the Plan provides substantively different treatment

for active public safety employees whose bargaining units have reached tentative settlements

and those who have not.

The Plan defines the New PFRS Active Pension Formula as follows:

New PFRS Active Pension Plan Formula means an accrual rate for active

employee participants in the PFRS for benefits earned on or after J uly 1, 2014

that equals the product of (a) 2.0% multiplied by (b) an employee's average base

compensation over the employee's final 10 years of service, multiplied by (c)

such employee's years of service after J uly 1, 2014. For purposes of this

definition, base compensation will mean the employee's actual base

compensation and will exclude overtime, longevity or other bonuses, and

unused sick leave, and the New PFRS Active Pension Plan Formula will be part

of a hybrid program that will contain rules to shift funding risk to participants in

the event of underfunding of hybrid pensions, and mandate minimum retirement

ages for unreduced pensions.

See Plan Definitions [Docket No. 4392, p. 23]

23. Article II, Section B.3.q.ii, which provides for the treatment of Class 10 PFRS

Pension Claims, describes the treatment to be afforded to Class 10 pension benefits that accrue

on or after J uly 1, 2014 as consistent with the terms and conditions of the New PFRS Active

Pension Plan Formula and the New PFRS Active Pension Plan. [Docket No. 4392, Art II, Sec

B.3.q.iiE, p. 39].

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 7 of 19

8

24. However, as set forth on Exhibit I.A.191.b to the Plan [Docket No. 4449, pp. 5-

10], the Principal Terms of New PFRS Active Pension Plan are different than the terms of

the New PFRS Active Pension Formula. Specifically, while Exhibit I.A.191.b. provides a

reduced future benefit to all City public safety employees, the benefit for DPOA members is

significantly reduced compared to settling unions members benefits.

25. The significant differences in treatment include a different final average

compensation formula,

3

26. This disparate treatment is illegal, in the absent of the consent of the Holders of

these Class 10 claims under Section 1123(a)(4) because it fails to provide them with the same

treatment as other active members of Class 10.

a COLA of 1% for DPLSA and DPCOA members, and different ages

for eligibility for retirement.

27. Furthermore, precisely because the DPOA is the exclusive bargaining

representative of its members, in the absence of a collective bargaining agreement after J une 30,

2014, there is no mechanism by which the Holders of these claims can agree to this disparate

treatment.

28. Upon information and belief, the assumptions that underlie the Citys Plan (as it

applies to its future pension obligations to public safety) do not require this less favorable and

punitive treatment of DPOA members.

3

Pension benefits are calculated, in part, based upon a look back at an employees historical compensation.

Under the New PFRS Pension Formula, that formula is being made significantly less generous by excluding certain

components of pay, such as accrued sick leave, from the formula. However, for DPLSA and DPCOA members, the

pension received is calculated based upon the last five (5) years of earnings, whereas for DPOA and DFFA

members, it is based upon the last ten (10) years. Because public safety employees income tends to increase with

years of service, the ten year look back provides a significantly less generous formula to DFFA and DPOA

members.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 8 of 19

9

29. Furthermore, this punitive treatment is unwarranted since the City has

consistently maintained that DPOA members remain subject to whatever terms the Emergency

Manager chooses to impose on them under his largely unfettered authority. Under PA 436, the

Emergency Manager act[s] exclusively on the [Citys] behalf in these chapter 9 bankruptcy

proceedings.

4

30. The Sixth Circuit directly addressed the application of Section 1123(a)(4) in

connection with disparate treatment of certain claims which were purported to be paid in full

under the debtors plan of reorganization in that case. In re Dow Corning Corp., 280 F.3

rd

648,

660-61 (6

th

Cir 2002). The Dow Court, in addressing treatment of government providers claims

resulting from personal injuries, found that the plan violated Section 1123(a)(4) because,

although it facially provided for payment in full for Class 15 government payers, who included

the U.S. and Canada, the treatment was not the same because their opportunity to receive full

payment for their claims were materially different. Id. Specifically, the Canadian governments

recovery under the plan was protected by a separate British Columbia Class Action Settlement

Agreement which established procedural protections that helped ensure its payment in full,

which the U.S. Government did not have. Id.

MCL 141.1558 (1). This unnecessary and disparate treatment violates the plain

terms of Section 1123(a)(4) and cannot be permitted.

31. The Dow Court found that, while the treatment purported to be the same, the

additional procedural protections the settlement afforded the Canadian government resulted in a

4

Arguably, the only limitations on the EMs unchecked authority to address wage, pension and other labor issues in

chapter 9 are the limitations imposed by 11 U.S.C. 365 (which were rendered essentially inapplicable by the State

the Citys pre-bankruptcy planning here); any contingencies the Governor chose to put on that authority when the

filing of the Petition was authorized, MCL 141.1558(1) (here, none); that the EM serves at the pleasure of the

governor; MCL 141.1549(3)(d); and, finally, that he is subject to impeachment for corrupt conduct, crimes or

misdemeanors. Id., see also, Mich. Const., Art. XI, Sec. 7. As addressed in Issue I, the Citys Plan, as proposed by

the EM, seeks to wipe out the prospective rights of the DFFA and DPOA to bargain for their members pension

benefits for the 9-year term of the non-consensual (i.e., imposed) injunction that is part of the treatment of Class 10

claims.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 9 of 19

10

substantively different opportunity for recovery which violated Section 1123(a)(4). See also, In

re W. R. Grace & Co., 729 F.3d 311, 327-28 (3

rd

Cit. 2013).

32. The Citys Plan, goes well beyond this. It imposes through J une of 2023 a

significantly reduced pension benefit for active Class 10 members who belong to non-settling

unions, that is substantively different than the benefit for members of settling unions.

33. This disparate treatment is indefensible, given that the City proposed (and indeed

is the only one who could propose) the classification of pension claims; that the City, through the

Emergency Manager, claims full authority to impose any other economic terms it chooses on

DPOA members; and that the stay in place in these bankruptcy proceedings deprives the DPOA

of the very mechanism binding arbitrationthat, outside of bankruptcy, would have allowed it

to efficiently and peacefully resolve impasse that is the apparent cause of this disparate

treatment.

34. Although PA 436 temporarily suspends the Citys obligation to bargain, it

remains the public policy of the State that, in police and fire departments, where the right of

employees to strike is by law prohibited, . . . requisite to the high morale of such employees and

the efficient operation of such departments . . . , a mechanismcompulsory, binding

arbitrationis available to resolve such disputes. See PA 312, MCL 423.231(1). Under that

mechanism, in resolving such disputes, the panel must give the financial ability of the unit of

government to pay the most significance. MCL 423.239(2).

35. The City has articulated a desire to reach collective bargaining agreements with

all of its public safety unions, but reached an impasse with the DPOA. The City is certainly

entitled to present DPOA with a last best offer in order to reach an agreement with them, and

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 10 of 19

11

where an agreement cannot be reached, to exercise its claimed right to impose terms the

Emergency Manager deems appropriate.

36. What the City cannot do is to punish DPOA members with a significantly less

generous pension benefit than those benefits received by others in their class because they were

unable to reach agreement.

37. This indefensibly punitive action is particularly egregious in light of the Citys

proofs in the eligibility trial, which established the extremely low morale, poor working

conditions, and underpaid status of DPOA members. The DPOA objects to this punitive and

disparate treatment, as it violates the plain requirements of Section 1123(a)(4).

The Plan cannot be confirmed because it proposes to enjoin the DPOA from

bargaining for improved pension benefits until at least June of 2023, in violation of

applicable law.

38. Under Bankruptcy Code Section 943(b)(4), the Plan cannot propose any action

prohibited by law. The National Labor Relations Act (NLRA), 29 U.S.C. 151 et seq. governs

private sector labor relations and collective bargaining. The Public Employees Relations Act

(PERA) governs public sector labor relations and collective bargaining in Michigan. MCL

423.215. et seq. Under PA 436, PERAs duty to bargain obligation is temporarily suspended

once an Emergency Manager is appointed. MCL 141.1567(3).

39. For many years, under either the NLRA or PERA, (29 U.S.C. 159(d); M.C.L.

423.215(1)), pension plans have been recognized as a mandatory subject of bargaining. Allied

Chemical and Alkali Workers of Am., Local Union No. 1 v. Pittsburgh Plate Glass Co., Chem.

Div., 404 U.S. 157, 160 (1971) (Under the [NLRA], as amended, mandatory subjects of

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 11 of 19

12

collective bargaining include pensionfor active employees.); Detroit Police Officers Assn

v. City of Detroit, 212 Mich. App. 383 (1995) (We again hold that pensions and the significant

provisions of a pension plan are mandatory subjects of collective bargaining.).

40. Here, the Plan not only proposes a less generous pension benefit for DPOA

members than is proposed to other active members of Class 10, it proposes to freeze that benefit

and block the DPOA from any further bargaining about it until at least J une of 2023. As stated

in the Plan:

Except as may be required to maintain the tax-qualified status of the PFRS, the

City, the trustees of the PFRS and all other persons or entities shall be enjoined

from and against the subsequent amendment of the terms, conditions and rules of

operation of the PFRS, or any successor plan or trust, that govern the calculation

of pension benefits (including the PFRS Adjusted Pension Amount, accrual of

additional benefits, the DIA Proceeds Default Amount, the Prior PFRS Pension

Plan, the PFRS Restoration Payment, the New PFRS Active Pension Plan

Formula and the terms of the New PFRS Active Pension Plan) or against any

action that governs the selection of the investment return assumption described

in Section I.B.3.q.ii.B, the contribution to the PFRS or the calculation or amount

of PFRS pension benefits for the period ending J une 30, 2023, notwithstanding

whether that subsequent amendment or act is created or undertaken by contract,

agreement (including collective bargaining agreement), statute, rule, regulation,

ordinance, charter, resolution or otherwise by operation of law.

See Plan, Art. II., Section B.3.q.ii.G, [Docket No. 4392, p. 40].

41. This Court cannot confirm the Plan unless it complies with applicable law. See In

re Sanitary & Improvement Dist. #7, 98 BR 970 (D. Neb. Bankr. 1989). See also U.S. v. Bekins,

304 U.S. 27, 49 (1938), noting that an analogous provision in the municipal bankruptcy code at

that time manifestly refers to the law of the State. See also, In re Fracella Enterprises, 360

B.R. 435, 445-446 (E.D. Pa. 2007); In re Rent Rite Super Kegs West Ltd, 484 BR 799(Bankr.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 12 of 19

13

D.Colo. 2012), (applying the analogous chapter 11 provision under Section 1129(a)(3) that plan

cannot be proposed by any means forbidden by law).

42. As set forth more fully in the separately filed DFFA Plan objections, the terms of

this proposed injunction, to which the DPOA and its members have not agreed, violate both State

and federal labor law, and, as such do not comply with Section 943(b)(4). The Plan improperly

enjoins any change in the New PFRS Active Pension Plan through J une of 2023. In doing so,

without the DPOAs consent, it illegally deprives the DPOA of its right to bargain on a

mandatory subject of bargaining.

43. There is no legal authority for the City to prospectively and non-consensually

abrogate this right for a longer period than authorized by Sec. 27(3) of PA 436, and unless the

DPOAs consent is obtained, the DPOA must be carved out of this injunction for the Plan to be

confirmed. In asserting this objection, the DPOA also joins in the DFFAs objection on this

issue.

The DPOAs Objections to the treatment of its members PFRS Pension Claims must

be allowed for the Plan to be feasible.

44. In determining whether the Plan is feasible under Section 943(b)(7), the Court

must independently determine that the City can provide essential government services. See, e.g.,

In re Mount Carbon Metropolitan District, 242 BR 18, 34-35 (D. Colo. 1999).

45. As this Court recognized when it adopted Chief Craigs testimony at the

eligibility trial, the City has struggled to provide police protection, in part, because the Citys

police officers were underpaid, undermanned and their morale was extremely low. This Court

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 13 of 19

14

found the City service delivery insolvent, including its ability to provide an essential police

and fire protection for its residents, businesses and visitors. 504 BR at 170.

46. Among the eligibility trial evidence that supports this Courts finding of service

delivery insolvency was an arbitration award received by the DPOA on March 25, 2013. See

Docket No. 512-2 (also, Elig. Tr. Exhibit 706) (the Arbitration Award). Consistent with Chief

Craigs testimony that City police officers were underpaid, the Arbitration Award specifically

found that City police officers were paid significantly less than similarly situated officers in the

City of Flint another city decimated by the recession, loss of jobs and State funding, and under

the control of an emergency manager at the time of the award.

47. In making findings about comparable pay of City police officers in similarly

distressed urban areas, the arbitrator noted the wide discrepancy between pay in Detroit by

comparison to Flint (also under an emergency financial manager) and Saginaw (financially

distressed). As the Arbitration Award found:

". . . in each of those cities, the police officers are paid more than Detroits

current $47,914 based on an annual base wage at 2,080 straight time hours for a

five year Officer, the top pay in Detroit.

See Arb. Award at p 104, Docket No. 512-4, p 15.

48. The arbitrator included in his findings a chart comparing the base wage and total

compensation between Detroit at the current $47,916 top rate. Id. That chart showed:

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 14 of 19

15

Five (5) Year Officer Annual Base Annual Total

Compensation

Detroit $47,916 $51,828

Flint $51,336 $60,888

Saginaw $53,700 $63,396

Ten (10) Year Officer Annual Base Annual Total

Compensation

Detroit $47,916 $51,828

Flint $51,336 $62,028

Saginaw $53,700 $66,048

Fifteen (15) Year Officer Annual Base Annual Total

Compensation

Detroit $47,916 $51,828

Flint $52,176 $64,272

Saginaw $53,700 $67,344

Twenty (20) Year Officer Annual Base Annual Total

Compensation

Detroit $47,916 $51,828

Flint $53,148 $66,000

Saginaw $53,700 $68,628

Id.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 15 of 19

16

49. These numbers include the 10% pay cut imposed on DPOA members before the

Citys petition was filed. The DPOA acknowledges (and indeed, on a daily basis, its members

live and work in) the Citys service delivery insolvency. They do not include this chart in

seeking the same rate of pay as Flint or Saginaw police officers, although certainly the work

they do is no less and probably more daunting and dangerous.

50. Rather, the chart is included because it demonstrates (a) an objective reason for

their low morale and (b) how well the binding arbitration requirement of Act 312 has worked to

hold down salaries to well below levels in other Michigan cities. Yet, in this case, rather than

use the tool of binding arbitration, the City has chosen to further punish DPOA members for

declining to reach agreement, without the benefit of its usual tool to do so.

51. It is not without irony that, as creditors work to reach binding agreements that will

inevitably aid the confirmation process, the loss of this very tool - binding arbitration - that, for

more than forty years, has allowed the City and the DPOA to resolve their differences, deprives

both parties of the ability to resolve their impasse. The City is wise to want collective bargaining

agreements with its employees.

52. The evidence at the eligibility trial suggests that the City well recognizes the

importance of that good will and the significant problem it faces with police morale. However,

rather than resort to a readily available tool that could efficiently solve the problems, the City

chooses to impose a Plan that further impairs DPOA members.

53. The DPOA respectfully suggests that these actions not only fail to comply with

the Bankruptcy Code, they will inevitably hurt rather than help the Citys ability to deliver core

and essential public safety services.

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 16 of 19

17

MISCELLANEOUS OBJECTIONS

54. The DPOA objects to the Plan to the extent that pending State legislation would

undo or materially alter the terms of the Plan and/or the rights and benefits of the DPOA, as set

forth in the Plan and Disclosure Statement, in violation of Bankruptcy Code Section 942.

55. The DPOA further objects to the Plan to the extent that, if these objections are not

allowed, any of the releases or injunctions set forth in the Plan, including but not limited to the

injunction set forth in Art. II, Section B.3.q.ii. G of the Plan or any proposed third party releases,

can improperly be construed to release the prospective rights of the DPOA or its members in

violation of applicable bankruptcy law, applicable labor laws and/or the Michigan Constitution.

RESERVATION OF RIGHTS

56. The DPOA hereby reserves and preserves all of its rights and remedies that are in

any way related to this Objection, including but not limited to its right, as set forth herein, to

assert any potential legal challenges to any enabling or other legislation enacted for the

purported purpose of implementing, effectuating or undoing the effect of the Plan; objections

to the scope of the Plan releases and Plan Injunction(s), including but not limited to the

proposed scope of the injunction governing pension terms; objections to any effort by the

City to use the Plan releases and/or Plan Injunction to avoid, release or discharge the City for

(a) its ordinary course labor obligation to the DPOA and/or its current or former members,

(b) any obligations of the City, the State and/or its Related Entities obligations to the DPOA

and its current and/or former members for indemnification and/or grievance claims, (c) any

of the City and its Related Entities post-petition obligations to the DPOA and its current

and/or former members under applicable State labor laws, the City Charter or any other

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 17 of 19

18

applicable term of employment; and to object to any modification of the Plan that occur after

this Objection is filed.

57. The DPOA reserves its rights to amend, supplement or make any other applicable

arguments as a result of information learned through discovery in this matter. The DPOA

also reserves its rights to make and/or join in any objections or arguments in support thereof

made by any other objecting party in these proceedings with respect to the Plan, including its

joinder and concurrence in the objections of the DFFA as to be more fully set forth in the

DFFAs Plan objections.

WHEREFORE, the Detroit Police Officers Association (the DPOA) respectfully

requests, for all the reasons contained herein, that this Honorable Court allow its objections

and deny confirmation of the Plan in its present form.

Respectfully submitted,

ERMAN, TEICHER, ZUCKER & FREEDMAN, P.C.

By: /s/ Barbara A. Patek

Barbara A. Patek (P34666)

Earle I. Erman (P24296)

Counsel for the Detroit Police Officers

Association

400 Galleria Officentre, Suite 444

Southfield, MI 48034

Telephone: (248) 827-4100

Facsimile: (248) 827-4106

E-mail: bpatek@ermanteicher.com

DATED: May 16, 2014

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 18 of 19

UNITED STATES BANKRUPTCY COURT

EASTERN DISTRICT OF MICHIGAN

SOUTHERN DIVISION

IN RE: Chapter 9

City of Detroit, Michigan, No. 13-53846

Debtor. Hon. Steven W. Rhodes

/

CERTIFICATE OF SERVICE

The undersigned certifies that on May 16, 2014, the Objections to Fourth Amended Plan

of Adjustment by Detroit Police Officers Association and Certificate of Service were

electronically filed with the Clerk of the Court for the United States Bankruptcy Court, Eastern

District of Michigan, Southern Division using the CM/ECF System, which will send notification

of such filing to all attorneys and parties of record registered electronically.

ERMAN, TEICHER, ZUCKER & FREEDMAN, P.C.

By: /s/ Barbara A. Patek

Barbara A. Patek (P34666)

Earle I. Erman (P24296)

Counsel for the Detroit Police Officers

Association

400 Galleria Officentre, Suite 444

Southfield, MI 48034

Telephone: (248) 827-4100

Facsimile: (248) 827-4106

E-mail: bpatek@ermanteicher.com

DATED: May 16, 2014

13-53846-swr Doc 4901 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 19 of 19

13-53846-swr Doc 4901-1 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 1 of 3

13-53846-swr Doc 4901-1 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 2 of 3

13-53846-swr Doc 4901-1 Filed 05/16/14 Entered 05/16/14 17:15:21 Page 3 of 3

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Did The Past Economic Recovery Result in Shared Prosperity?Document33 pagesDid The Past Economic Recovery Result in Shared Prosperity?WDET 101.9 FMNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- Bell Pepeprs RecipeDocument2 pagesBell Pepeprs RecipeWDET 101.9 FMNo ratings yet

- 2019 Combined BracketsDocument2 pages2019 Combined BracketsWDET 101.9 FMNo ratings yet

- Algae Bloom Forecast 5/23/19Document1 pageAlgae Bloom Forecast 5/23/19WDET 101.9 FMNo ratings yet

- Lake Erie Bill of RightsDocument3 pagesLake Erie Bill of RightsWDET 101.9 FMNo ratings yet

- Lake Erie Harmful Algal Bloom Early ProjectionDocument1 pageLake Erie Harmful Algal Bloom Early ProjectionWDET 101.9 FMNo ratings yet

- Mental Health Across The Criminal Legal ContinuumDocument24 pagesMental Health Across The Criminal Legal ContinuumWDET 101.9 FMNo ratings yet

- Asian Carp Control MeasuresDocument2 pagesAsian Carp Control MeasuresWDET 101.9 FMNo ratings yet

- 2019 Wayne County Road ScheduleDocument7 pages2019 Wayne County Road ScheduleWDET 101.9 FMNo ratings yet

- Marathon Application and Variance RequestDocument43 pagesMarathon Application and Variance RequestWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

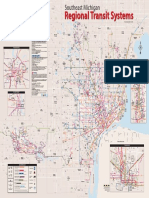

- 2014 Regional System MapDocument1 page2014 Regional System MapWDET 101.9 FMNo ratings yet

- NTSB Preliminary Report On Arizona FatalityDocument4 pagesNTSB Preliminary Report On Arizona FatalityWDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- Winter 2018-19 OutlookDocument6 pagesWinter 2018-19 OutlookWDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- Abdul El-Sayed DJC Interview TranscriptDocument18 pagesAbdul El-Sayed DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Pickled Summer SquashDocument2 pagesPickled Summer SquashWDET 101.9 FMNo ratings yet

- Jim Hines DJC Interview TranscriptDocument15 pagesJim Hines DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Voters Not Politicians ProposalDocument8 pagesVoters Not Politicians ProposalWDET 101.9 FMNo ratings yet

- What's Fresh: Sweet Corn SoupDocument2 pagesWhat's Fresh: Sweet Corn SoupWDET 101.9 FMNo ratings yet

- Shri Thanedar DJC Interview TranscriptDocument12 pagesShri Thanedar DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Patrick Colbeck DJC Interview TranscriptDocument14 pagesPatrick Colbeck DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- Brian Calley DJC Interview TranscriptDocument14 pagesBrian Calley DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Promoting IP rights in local governanceDocument5 pagesPromoting IP rights in local governanceBenjamin Jovan SisonNo ratings yet

- Microsoft Collaborate Terms of UseDocument6 pagesMicrosoft Collaborate Terms of UseZeeshan OpelNo ratings yet

- Road To Independence: Discuss Any Five Social Developments in Ghana From 1957-1966 (Submission 28 June, 2022)Document163 pagesRoad To Independence: Discuss Any Five Social Developments in Ghana From 1957-1966 (Submission 28 June, 2022)Mary DonnaNo ratings yet

- Accuracy Obligation GuideDocument4 pagesAccuracy Obligation GuideClement ChanNo ratings yet

- Extrajudicial Settlement of The Estate GurionDocument2 pagesExtrajudicial Settlement of The Estate GurionJheyps VillarosaNo ratings yet

- Revenue vs Capital Expenditure and Capital AllowancesDocument4 pagesRevenue vs Capital Expenditure and Capital AllowancesLidia PetroviciNo ratings yet

- Rivera Family Property Dispute ResolvedDocument1 pageRivera Family Property Dispute ResolvedMalen Crisostomo Arquillo-SantosNo ratings yet

- Attack The Debt CollectorDocument3 pagesAttack The Debt CollectorGabe Perazzo100% (1)

- G R - No - 157547Document1 pageG R - No - 157547Noel Christopher G. BellezaNo ratings yet

- Bhutto & Zardari's Corruption Highlighted in Raymond Baker's Book On Dirty Money - Teeth MaestroDocument6 pagesBhutto & Zardari's Corruption Highlighted in Raymond Baker's Book On Dirty Money - Teeth Maestroسید ہارون حیدر گیلانیNo ratings yet

- Final ObliconDocument4 pagesFinal ObliconPortgas D. AceNo ratings yet

- Nab McqsDocument23 pagesNab McqsIzzat FatimaNo ratings yet

- Bombay Tenancy and Agricultural Lands Act 1948Document4 pagesBombay Tenancy and Agricultural Lands Act 1948Keith10w0% (1)

- 2019 Train Tax Tables and Bir Income Tax RatesDocument2 pages2019 Train Tax Tables and Bir Income Tax RatesAljohn SebucNo ratings yet

- Answering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefDocument171 pagesAnswering Brief of Defendants-Appellees: Ronald Pierce et al vs. Chief Justice Tani Cantil-Sakauye Judicial Council Chair and Steven Jahr Judicial Council Administrative Director - Federal Class Action Lawsuit for Alleged Illegal Use of California Vexatious Litigant Law by Family Court Judges in Child Custody Disputes - Ventura County - Tulare County - Sacramento County - San Mateo County - Santa Clara County - Riverside County - San Francisco County - US District Court for the Northern District of California Judge Jeffrey S. White - US Courts for the Ninth Circuit - 9th Circuit Court of Appeal Class Action for Injunctive and Declaratory ReliefCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (1)

- Netaji-Life & ThoughtsDocument42 pagesNetaji-Life & ThoughtsVeeresh Gahlot100% (2)

- Government of The Virgin Islands v. Eurie Joseph, 964 F.2d 1380, 3rd Cir. (1992)Document18 pagesGovernment of The Virgin Islands v. Eurie Joseph, 964 F.2d 1380, 3rd Cir. (1992)Scribd Government DocsNo ratings yet

- United States v. Franco Anthony Smith, 166 F.3d 1223, 10th Cir. (1999)Document3 pagesUnited States v. Franco Anthony Smith, 166 F.3d 1223, 10th Cir. (1999)Scribd Government DocsNo ratings yet

- Sample QuestionDocument2 pagesSample QuestionMel ManatadNo ratings yet

- Constantino V CuisiaDocument2 pagesConstantino V Cuisiaatoydequit100% (1)

- Law124 1stsem 12 13outlinerevisedDocument5 pagesLaw124 1stsem 12 13outlinerevisedClaudineNo ratings yet

- Comparative Study Analysis - An Argumentative PaperDocument3 pagesComparative Study Analysis - An Argumentative PaperChloie Marie RosalejosNo ratings yet

- RELIGION - (ICCPR) A.18 - Freedom of Thought, Conscience, Religion-Subject To Public Safety, OrderDocument6 pagesRELIGION - (ICCPR) A.18 - Freedom of Thought, Conscience, Religion-Subject To Public Safety, OrdermanikaNo ratings yet

- Central: EducationalDocument2 pagesCentral: EducationalBhaskar BethiNo ratings yet

- 1 Introduction To Law and Society and Reasons For LawsDocument19 pages1 Introduction To Law and Society and Reasons For Lawsapi-88846630100% (2)

- NCSBE 2023 Order Implementation Funding Letter - 2023-05-12Document3 pagesNCSBE 2023 Order Implementation Funding Letter - 2023-05-12Daniel WaltonNo ratings yet

- York County Court Schedule For March 24, 2016Document5 pagesYork County Court Schedule For March 24, 2016HafizRashidNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument52 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- 5.4 Arrests Press ReleasesDocument4 pages5.4 Arrests Press Releasesnpdfacebook7299No ratings yet

- Sensa Verogna v. Twitter, Inc., Docket 9 - Defendant Motion Pro Hac ViceDocument4 pagesSensa Verogna v. Twitter, Inc., Docket 9 - Defendant Motion Pro Hac ViceSensa VerognaNo ratings yet