Professional Documents

Culture Documents

Bumper Q1 For M

Uploaded by

Theng Roger0 ratings0% found this document useful (0 votes)

2 views2 pagesM&A

Original Title

Bumper Q1 for M

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentM&A

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesBumper Q1 For M

Uploaded by

Theng RogerM&A

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

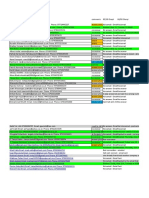

Bumper Q1 for M&A in Singapore

Bankers credit privatisations in property sector

By

Jamie Lee

It has been a busy first quarter for bankers, here and in other parts of Asia, with a slew of

acquisitions and privatisation deals - PHOTO: REUTERS

[SINGAPORE] It has been a busy first quarter for bankers, here and in other parts of Asia,

with a slew of acquisitions and privatisation deals.

Bankers say that it has been a bumper quarter, lifted mainly by privatisations in the property

sector, and that they see many more deals in the pipeline.

But some are also watching if greater public dissent by minority shareholders and activists

could put a damper on the mergers and acquisitions (M&A) process, including that of pricing.

CapitaLand last Friday sweetened its privatisation offer for CapitaMalls Asia (CMA), of

which it already owns about 70 per cent, following concerns that CMA had been

undervalued, a point hammered home in a published commentary by former senior managing

director at Temasek Holdings, Michael Dee.

Shareholder activism is here to stay, say market insiders.

"There is greater activism around these transactions," Axel Granger, head of M&A for South-

east Asia at Bank of America Merrill Lynch, told The Business Times. "Investment bankers

will have to pay more attention to the opinion makers. It is a natural evolution. It is

something we have seen in the United States, and it is moving to Asia."

But Willard McLane, head of Asean corporate and investment banking at Citi, noted that the

current level of activism in this region is still relatively modest.

"I don't see much shareholder activism in Singapore in the way we see it in the US, for

example. We haven't seen a lot of cases where shareholders are publicly promoting agendas

or blocking deals," he said.

But not all calls for higher offers are successful.

United Industrial Corp stuck to its takeover offer price for subsidiary Singapore Land

(SingLand), though the share price movement of SingLand - as it traded above the offer price

- suggested that shareholders were looking for more.

But in other cases, more money was put on the table. Besides CapitaLand, the consortium led

by tycoon Ong Beng Seng and Wheelock Properties also boosted its offer for shares in Hotel

Properties.

There are several factors fanning this wave of privatisations. Bankers note that many deals

were prompted by cheap financing, and the lacklustre market which often "undervalues"

stocks.

The equity markets have valued real estate companies at "a significant discount to their

underlying values", noted Galen Lee, UBS' South-east Asia head of real estate.

"We are seeing some real estate companies undertake privatisations of their subsidiaries to

streamline and re-align the groups' businesses and portfolios," he said.

In Singapore, the privatisation trend may also be driven by the cooling measures affecting

listed real estate developers, Mr Lee added. This has significantly depressed many property

stocks.

Despite the public protestations, Mr Granger noted that the average premium - which has

historically been about 25-30 per cent - has stayed stable in Singapore over the past few

years.

Meanwhile, M&A activity across Asia continues to buzz.

In the Asia-Pacific (excluding Japan), the total value of deals in the first quarter of the year

stood at US$102 billion, up 36 per cent from the same period a year ago, according to

Mergermarket. This is the strongest first-quarter deal flow on Mergermarket's record, which

began in 2001.

Singapore companies are also starting to get into the pan-Asian M&A party.

Temasek Holdings' US$5.7 billion purchase of a 25 per cent stake in drugstore chain Watsons

was the third-largest deal announced in the period.

Bankers note that Temasek is likely in an investment cycle, and has been fairly active in

snapping up stakes in non-financial companies. It has also "doubled down" on Olam

International, one banker noted.

But Temasek has also not shied away from offloading companies in which it has a significant

stake. STATS ChipPAC, which counts Temasek as its major shareholder, announced last

Friday that it had received a "non-binding expression of interest" from a buyer. The

semiconductor assembly firm has a market cap of just over $1 billion.

As Singapore companies regionalise, more outbound activity will be expected in the quarters

ahead, as opposed to inbound deals, said Mr McLane.

Meanwhile in Singapore, bankers are watching for potential consolidation among locally-

listed mid-sized real estate investment trusts (Reits), though they note that some of these

deals may be complicated in structure.

"In an environment where everyone is expecting interest rates to rise, yield is becoming less

attractive," said Mr Granger, referring to Reits.

There may be some spillover activity in Asia as large multinational corporations (MNCs)

consolidate, observed Mr McLane. There is also likely to be more private-equity transactions

in Singapore, he noted.

You might also like

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- High Level of Iron and Manganese inDocument1 pageHigh Level of Iron and Manganese inTheng RogerNo ratings yet

- Super FoodsDocument16 pagesSuper FoodsTheng Roger100% (1)

- Double Protection Against StrokeDocument4 pagesDouble Protection Against StrokeTheng RogerNo ratings yet

- Singapore's IPO Market Roars Back To Life in H1, More Big ListiDocument2 pagesSingapore's IPO Market Roars Back To Life in H1, More Big ListiTheng RogerNo ratings yet

- Lifestyle Gets Blame For 70Document3 pagesLifestyle Gets Blame For 70Theng RogerNo ratings yet

- The Dangers in Rising Bond YieldsDocument2 pagesThe Dangers in Rising Bond YieldsTheng RogerNo ratings yet

- Growth Hormone Guidance: Editor'S Choice in Molecular BiologyDocument2 pagesGrowth Hormone Guidance: Editor'S Choice in Molecular BiologyTheng RogerNo ratings yet

- Hedge Funds' Oil Shorts Reach Peak For The Year: David SheppardDocument3 pagesHedge Funds' Oil Shorts Reach Peak For The Year: David SheppardTheng RogerNo ratings yet

- Danish Krone Stages Biggest Fall Vs Euro Since 2001Document2 pagesDanish Krone Stages Biggest Fall Vs Euro Since 2001Theng RogerNo ratings yet

- Weak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingDocument3 pagesWeak Oil and Euro Drive Europe's QE-fuelled Rally: Greece Ukraine Quantitative EasingTheng RogerNo ratings yet

- Colon CancerDocument12 pagesColon CancerTheng RogerNo ratings yet

- Good Intentions Paved Way To Market MayhemDocument3 pagesGood Intentions Paved Way To Market MayhemTheng RogerNo ratings yet

- Noble GroupDocument5 pagesNoble GroupTheng Roger100% (1)

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- S Merger Activity Back at The TrillionDocument3 pagesS Merger Activity Back at The TrillionTheng RogerNo ratings yet

- Sellout AgainDocument2 pagesSellout AgainTheng RogerNo ratings yet

- Look Out Below If Gold Fails This Technical TestDocument2 pagesLook Out Below If Gold Fails This Technical TestTheng RogerNo ratings yet

- Fight in Iraq Has Oil Traders Holding Their BreathDocument2 pagesFight in Iraq Has Oil Traders Holding Their BreathTheng RogerNo ratings yet

- Greenspan WorryDocument1 pageGreenspan WorryTheng RogerNo ratings yet

- Globalrisk: Friday, January 17, 2014 6:13 AmDocument2 pagesGlobalrisk: Friday, January 17, 2014 6:13 AmTheng RogerNo ratings yet

- MarketDocument2 pagesMarketTheng RogerNo ratings yet

- 15percent CorrectionDocument2 pages15percent CorrectionTheng RogerNo ratings yet

- Buy OpportunityDocument1 pageBuy OpportunityTheng RogerNo ratings yet

- That Police Officer IsDocument3 pagesThat Police Officer IsTheng RogerNo ratings yet

- HereDocument2 pagesHereTheng RogerNo ratings yet

- Markets Fear UDocument2 pagesMarkets Fear UTheng RogerNo ratings yet

- Credit CrunchDocument2 pagesCredit CrunchTheng RogerNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fammthya 000001Document87 pagesFammthya 000001Mohammad NorouzzadehNo ratings yet

- ADS Chapter 303 Grants and Cooperative Agreements Non USDocument81 pagesADS Chapter 303 Grants and Cooperative Agreements Non USMartin JcNo ratings yet

- Sewing Machins Operations ManualDocument243 pagesSewing Machins Operations ManualjemalNo ratings yet

- Common OPCRF Contents For 2021 2022 FINALE 2Document21 pagesCommon OPCRF Contents For 2021 2022 FINALE 2JENNIFER FONTANILLA100% (30)

- Tekla Structures ToturialsDocument35 pagesTekla Structures ToturialsvfmgNo ratings yet

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDocument3 pagesQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarNo ratings yet

- RWJ Corp Ch19 Dividends and Other PayoutsDocument28 pagesRWJ Corp Ch19 Dividends and Other Payoutsmuhibbuddin noorNo ratings yet

- Business-Model Casual Cleaning ServiceDocument1 pageBusiness-Model Casual Cleaning ServiceRudiny FarabyNo ratings yet

- Carelink Connect: User GuideDocument41 pagesCarelink Connect: User GuideMiha SoicaNo ratings yet

- Safety Inspection Checklist Project: Location: Inspector: DateDocument2 pagesSafety Inspection Checklist Project: Location: Inspector: Dateyono DaryonoNo ratings yet

- Effective Communication LeaderDocument4 pagesEffective Communication LeaderAnggun PraditaNo ratings yet

- Flyer Manuale - CON WATERMARK PAGINE SINGOLEDocument6 pagesFlyer Manuale - CON WATERMARK PAGINE SINGOLEjscmtNo ratings yet

- National Senior Certificate: Grade 12Document13 pagesNational Senior Certificate: Grade 12Marco Carminé SpidalieriNo ratings yet

- MSEA News, Jan-Feb 2014Document20 pagesMSEA News, Jan-Feb 2014Justin HinkleyNo ratings yet

- The Website Design Partnership FranchiseDocument5 pagesThe Website Design Partnership FranchiseCheryl MountainclearNo ratings yet

- Criminal Law I Green Notes PDFDocument105 pagesCriminal Law I Green Notes PDFNewCovenantChurchNo ratings yet

- Salva v. MakalintalDocument2 pagesSalva v. MakalintalGain DeeNo ratings yet

- GSMDocument11 pagesGSMLinduxNo ratings yet

- Two 2 Page Quality ManualDocument2 pagesTwo 2 Page Quality Manualtony sNo ratings yet

- Unit List MUZAFFARPUR - Feb 18 PDFDocument28 pagesUnit List MUZAFFARPUR - Feb 18 PDFPawan Kumar100% (1)

- Modal Case Data Form: GeneralDocument4 pagesModal Case Data Form: GeneralsovannchhoemNo ratings yet

- DevelopersDocument88 pagesDevelopersdiegoesNo ratings yet

- China Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmDocument40 pagesChina Ve01 With Tda93xx An17821 Stv9302a La78040 Ka5q0765-SmAmadou Fall100% (1)

- NCR Minimum WageDocument2 pagesNCR Minimum WageJohnBataraNo ratings yet

- Tajima TME, TMEF User ManualDocument5 pagesTajima TME, TMEF User Manualgeorge000023No ratings yet

- A.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdDocument6 pagesA.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdCharisse SarateNo ratings yet

- MDC PT ChartDocument2 pagesMDC PT ChartKailas NimbalkarNo ratings yet

- Invoice Acs # 18 TDH Dan Rof - Maret - 2021Document101 pagesInvoice Acs # 18 TDH Dan Rof - Maret - 2021Rafi RaziqNo ratings yet

- List of Light Commercial LED CodesDocument8 pagesList of Light Commercial LED CodesRenan GonzalezNo ratings yet

- Government of India Act 1858Document3 pagesGovernment of India Act 1858AlexitoNo ratings yet