Professional Documents

Culture Documents

Income Tax

Uploaded by

Vineet GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax

Uploaded by

Vineet GuptaCopyright:

Available Formats

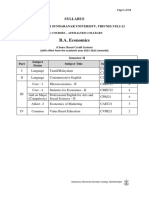

CONTENTS AND WEIGHTAGE IN PREVIOUS EXAMS

CHP.NO TOPICS

May 2007 Nov

2007

May

2008

Nov

2008

1 INTRODUCTION AND BASIC CONCEPTS OF TAX. 0 0 0

2 RESIDENTIA! STATUS AND TAX INCIDENCE 1" 0 0 2

# CONCEPT AND CA!CU!ATION OF TAX $ 0 0

INCOME UNDER THE HEAD SA!AR% 0 # 1" "

& FBT AND NEW PER'UISITES 0 0 0 0

" INCOME UNDER THE HEAD HOUSE PROPERT% 0 0 8 $

7

INCOME UNDER THE HEAD BUSINESS AND

PROFESSION

10 27 0 8

8 INCOME UNDER THE HEAD CAPITA! GAINS 0 10 10 "

$ INCOME UNDER THE HEAD OF OTHER SOURCES 0 0 0 0

10 C!UBBING OF INCOMES # 1# 0

11 SET OFF AND CARR% FORWARD OF !OSSES 10 # $ "

12 AGRICU!TURE INCOME AND ITS TAXABI!IT% 0 0 0 0

1# DEDUCTION FROM GROSS TOTA! INCOME 2 10 2

1 EXEMPTED INCOMES 0 2 0 2

1& ASSESSMENT PROCEDURE 8 # " "

1" ADVANCE PA%MENT OF INCOME TAX 0 # 8 0

17 TAX DEDUCTED AT SOURCE # 2 0

18 CHARITAB!E AND RE!IGIOUS TRUST 2 0 2 0

1$ SERVICE TAX 2" 17 20 22

20 VA!UE ADDED TAX 1# 10 8

21 ASSESSMENT OF INDIVIDUA!S 20 20 0 20

22 ASSESSMENT OF HUF( 0 0 20 8

SUMMAR% OF 1

ST

CHAPTER

BASIC CONCEPTS AND DEFINATIONS

1. The Income-tax Act, 1961 came into force with effect from 1/4/1962. It has XXIII chapters and 298 sections in a.

2. I)*+a, S-./+o) 202&A1 India means the territor! of India as referred to in Artice 1 of the "onstit#tion, its territoria waters, sea$ed and s#$soi

#nder!in% s#ch waters, continenta shef, exc#si&e economic 'one or an! other maritime 'one as referred to in the Territoria (aters, "ontinenta

)hef, *xc#si&e *conomic +one and other maritime +ones Act, 19,6 and the air space a$o&e its territor! and territoria waters.

-. P-2(o), S-./+o) 20#11 inc#des se&en t!pes of persons name! an indi&id#a, a .ind# #ndi&ided fami! /.012, A compan!, A firm, An association

of persons /A342 or a $od! of indi&id#as /53I2, A oca a#thorit!, *&er! artificia 6#ridica person not fain% within an! of the precedin% s#$

ca#ses.

4. The 2 $asic differences $etween AOP a)* BOI are7

a1 In 53I there are on! indi&id#as $#t in A34 there can $e an! t!pe of persons.

31 53I is creation of aw whereas A34 can $e created $! different persons comin% to%ether for doin% some income prod#cin% acti&it! on the

&o#ntar! $asis.

8. A((-((--, S-./+o) 2071 means an! person $! whom tax, interest or penat! is pa!a$e #nder an! pro&ision of this act and inc#des7

1. deemed assessee

2. assessee in defa#t

-. 4erson a%ainst whom an! income tax proceedin%s ha&e $een started for the assessment of his income or oss or the income of some other

person or the oss for whom he is ia$e.

6. A((-((4-)/ y-a2, S-./+o) 20$1 means the period of 12 months startin% from 1

st

Apri e&er! !ear and endin% on -1

st

march of the s#cceedin% !ear.

,. P2-v+o5( y-a2, S-./+o) 20#1 means the !ear immediate! preceedin% to assessment !ear. Income for the pre&io#s !ear is awa!s taxed in the

assessment !ear. The foowin% are the exceptions to the %enera r#e that income of e&er! pre&io#s !ear is char%ea$e to tax in the ree&ant

assessment !ear.

)ection 1,27 )hippin% $#siness of a non-resident9

)ection 1,47 4erson ea&in% India9

)ection 1,4A7 An A34 formed for the p#rpose of a partic#ar e&ent.

)ection 1,87 4ersons i:e! to transfer propert! to a&oid tax9

)ection 1,67 ;iscontin#ed $#siness or profession

8. I).o4- +).65*-( /7- 8+9/( recei&ed in excess of <s.8====. If an!one has recei&ed %ift in cash exceedin% <s.8==== from a non-reati&e then whoe of

s#ch amo#nt recei&ed sha $e considered his income.

9. .owe&er %ifts recei&ed from reati&es sha not $e co&ered in the said 82 point a$o&e.

1=. S-./+o) 1, >ross tota income is the a%%re%ate of income from a fi&e heads of Income, name!

Income #nder the head saar!

Income #nder the head ho#se propert!

Income #nder the head $#siness and profession

Income #nder the head capita %ains

Income #nder the head other so#rces

11. S-./+o) 1A, whie comp#tin% tota income no ded#ction sha $e aowed for that expendit#re which has $een inc#rred to earn exempted income.

12. S-./+o) 20&1, Tota income is income after red#cin% the ded#ction #nder chapter ?I-A from the %ross tota income. This income is aso caed

taxa$e income on which tax has to $e imposed.

1-. S-./+o) 288A, The tota income sha $e ro#nded off in the m#tipes of <s. 1=.

14. APP!ICATION OF INCOME V:S DIVERSION OF INCOME, Appication of income means spendin% the mone! after it has $een earned $! the

assessee. )#ch an amo#nt is awa!s inc#ded whie comp#tin% taxa$e income in the hands of assessee. In other words once an income has $een

earned it co#d not $e exc#ded on the %ro#nds that it has $een appied for some p#rpose. 3n the other hand di&ersion of income is the process of

di&ertin% the income $efore it is earned $! the assessee.

FOR EXAMP!E, @ Atd ses a #nit of a prod#ct at <s.1== with &er! cear messa%e to c#stomer that o#t of <s.1== <s.8 wi %o to the charita$e instit#tion.

Bow on! <s.98 sha $e re%arded as the income in the hands of compan! and <s.8 wi $e :nown as di&ersion of income.

FOR EXAMP!E, Cr. @ inherited propert! from his father $#t s#$6ect to the ri%ht of residence in fa&o#r of mother of Cr. @. This means that Cr. @ has the

ri%ht o&er the ownership of the propert! $#t mother has ri%ht o&er residence in the ho#se. If the ho#se is to $e sod then for the effecti&e sae of ho#se $oth

sho#d transfer their ri%hts in ho#se. 1rom the tota saes consideration Cr. @ can not $e hed ia$e for the tax on that portion which represents the ri%ht of his

mother.

18. REVENUE VS CAPITA!, An! receipt of mone! can either $e cate%ori'ed as re&en#e or capita. <e&en#e receipts are awa!s f#! taxa$e #ness

specific exemption has $een pro&ided for that. "apita receipts are ne&er taxa$e. ThatDs wh! amo#nt recei&ed from ins#rance compan! at the time of

mat#rit! is not taxed #/s 1=/1=;2. )imiar! oan ta:en is aso not taxed. .owe&er, some of the capita receipts are taxa$e since the! ha&e $een

specifica! pro&ided in the definition of Income s#ch as tax on "apita %ains on sae of "apita asset.

DIFFERENCE BETWEEN CAPITA! RECEIPT AND REVENUE RECEIPT

Ca;+/a6 R-.-+;/ R-v-)5- R-.-+;/(

"apita receipt is %enera! refera$e to fixed

capita. 1or e%. )ae price on the sae of assets,

which assessee #ses as a fixed asset in his $#siness

is a capita receipt

<e&en#e receipt refers to circ#atin% capita. 1or

e%. )ae price of the stoc: in trade is a re&en#e

receipt

4a!ment recei&ed towards the compensation for

the extinction of a profit earnin% so#rce is a capita

receipt

4a!ment recei&ed to compensate oss of earnin%s

is a re&en#e receipt

A receipt in ie# of so#rce of income is a capita

receipt. 1or e%. "ompensation for the oss of

empo!ment is a capita receipt.

A receipt in ie# of income is a re&en#e receipt

"apita receipts are exempt from tax #ness the!

are expressi&e! taxa$e i:e in the case of capita

%ains

<e&en#e receipts are awa!s taxa$e #ness

express! exempt from tax #nder section 1=

16. 1or the p#rposes of Income Tax Act "ompan! has &er! wide meanin% as compared to what has $een defined #nder the compan! aw. The term

compan! has $een defined #nder section 2/1,2 and it has $een f#rther cassified into7

1. ;omestic compan! 7 )ection 2/22A2

2. 1orei%n compan! 7 )ection 2/2-A2

-. Indian compan! 7 )ection 2/262

4. A "ompan! in which p#$ic is s#$stantia! interested 7 )ection 2/182

SUMMAR% OF 2

ND

CHAPTER

RESIDENTIA! STATUS

1. S-./+o) "011, An Indi&id#a can $e resident or a non resident in India. To $e a resident he has to satisf! one of the foowin% conditions7

1. )ta! in India E/F 182 da!s in a 4G 3<

2. )ta! in India E/F 6= da!s in a 4G and )ta! in India E/F -68 da!s in preceedin% 4 4Gs.

2. 1or the $2 condition a$o&e, we ha&e - exceptiona cases. In a these - cases 6= da!s sha $e ta:en as 182 da!s7

1. A citi'en of India who ea&es India for the empo!ment p#rposes.

2. A citi'en of India who ea&es India as a mem$er of crew of Indian ship.

-. An Indi&id#a who is a citi'en of India 3< is a person of Indian ori%in who comes to India on a &isit.

-. S-./+o) "0"10a1, A <esident indi&id#a can $e <3< or B3<. <3< is one who satisfies $oth of the foowin% conditions

1. <esident in 2/1= preceedin% 4Gs.

2. )ta! in India E/F ,-= da!s in a , precedin% 4Gs.

4. 1or an indi&id#a, residentia stat#s is determined $ased on the period of sta! in India. .owe&er, for .01, 1irm, A34 and other non-corporate entities the contro and mana%ement

is critica in determinin% residentia stat#s.

8. (hie determinin% residentia stat#s of .01 period of sta! of :arta is not at a ree&ant. (hat is important is whether contro and mana%ement of s#ch .01 is sit#ated in India or

not. 1#rther to chec: whether .01 is <3< or B3< residentia stat#s of :arta as an indi&id#a $ecomes ree&ant.

6. An Indian compan! is awa!s re%arded as a ;omestic "ompan!. A compan! incorporated o#tside India ma! aso $e treated as a domestic compan! if certain conditions are

f#fied.

,. An Indian compan! is awa!s a resident. A "ompan! incorporated o#tside India is treated as HresidentD on! if contro and mana%ement is who! in India.

8. <esident and ordinari! resident is taxed on his %o$a income.

9. Bot ordinari! resident is taxed in respect of Indian Income. In respect of forei%n income he is taxed on! if it is from $#siness controed in India or profession set #p in India.

1=. Bon resident is taxed in respect of Indian Incomes on!.

11. <emittance in India is ne&er taxed in India, since it is the second receipt.

12. A%ric#t#re income from a and in India is awa!s exempt from tax. .owe&er, if and is not in India then a%ric#t#re income wi $e taxed in India.

1-. ;i&idend from ;omestic "ompan! is not taxed $#t from forei%n compan! it is f#! char%ea$e to tax. ;i&idends from cooperati&e societies are f#! taxa$e.

SUMMAR% OF #

RD

CHAPTER

CA!CU!ATION OF INCOME TAX

1. Income of e&er! person is char%ea$e to tax at the rates prescri$ed in the 1inance Act s#ch as sa$ rates. .owe&er some of the income tax rates are not mentioned in 1inance Act

$#t the! ha&e $een mentioned in Act itsef, s#ch as Tax on otter! income is -=I as per section 11855 and tax on on%-term capita %ains is 2=I as per section 112 and if eJ#it!

shares are sod after 1/1=/2==4 the )T"> are taxa$e at 18I as per section 111A.

2. Indi&id#as, .01, A34, 53I and e&er! artificia 6#ridica person %et their income taxa$e on the $asis of sa$ rate.

-. )#rchar%e K 1=I is e&ia$e on the tax ia$iit! in the case of indi&id#a and .01 where their taxa$e income exceeds <s. 1= a:hs and <s. 1== Aa:hs in case of firms and

companies for the AG 2==9-2=1=.

4. 1irms L domestic companies are char%ea$e at a fat rate of -=I.

8. )#rchar%e e&ia$e for the AG 2==9-2=1= has $een 1=I except in case of forei%n companies where it is 2.8I.

6. Bo s#rchar%e is imposed on oca a#thorit! and co-operati&e societies.

,. *&er! person whose tota income of the assessment !ear exceeds the maxim#m amo#nt not char%ea$e to tax sha pa! the tax as per the rates mentioned in the finance act, in the

pre&io#s !ear itsef. )#ch tota income is to $e cac#ated on the $asis of the residentia stat#s of a person.

8. *d#cation cess for the AG 2==9-2=1= is 2I for primar! ed#cation and 1I for hi%her and secondar! ed#cation. (e sho#d not cac#ate and char%e ed#cation cess at -I, it wo#d

$e principa! wron%.

SUMMAR% OF THE

TH

CHAPTER

INCOME UNDER THE HEAD SA!AR%

1. E4;6oy-2 < E4;6oy-- 2-6a/+o)(7+;, Income is taxa$e as income from saar! if there is an empo!er - empo!ee reationship $etween 2 persons. 4artners are not empo!ees of

partnership firm and thatDs wh! saar! recei&ed from the firm is not taxa$e as saar! income $#t it is taxa$e as income from $#siness and profession. )imiar! mem$ers of

pariament ha&e no empo!er and therefore sittin% fees recei&ed $! them for attendin% pariament session sha $e taxa$e as income from other so#rces.

2. Co)/2a./ o9 (-2v+.- v( Co)/2a./ 9o2 (-2v+.-, (here&er there exists empo!er-empo!ee reationship there is a =.o)/2a./ o9 (-2v+.->. In this

empo!er can contro and direct the wor: to $e performed $! empo!ee. In this case income recei&ed $! a person sha $e re%arded as saar!. (here

there is )o -4;6oy-2?-4;6oy-- 2-6a/+o)(7+; then two peope en6o! the reationship of =.o)/2a./ 9o2 (-2v+.->. In this the contractee can on! $e tod

what is to $e done. There can $e no specific instr#ctions a$o#t how it is to $e done. In this case income sha $e taxa$e as income of $#siness and

profession or income of other so#rces.

-. @"ontract of )er&iceD creates empo!er M empo!ee reationship whereas Hcontract for ser&iceD doesnDt res#t in s#ch a reationship. Therefore an! Income from s#ch reation is not

to $e taxed #nder this head of Income.

4. TDS o) (a6a2y v( TaA 92-- (a6a2y, 0nder the concept of T;) empo!er wi cac#ate and ded#ct tax on the month! $asis $efore handin% o&er saar! to empo!ee. 5#t in case of

tax free saar! empo!er wi pa! tax on the saar! income of empo!ee o#t of his own poc:et and therefore s#ch amo#nt of tax is added in the saar! of the empo!ee.

8. A*va).- (a6a2y v( a*va).- a8a+)(/ (a6a2y, 0nder the concept of ad&ance saar! empo!ee %ets saar! from the empo!er $efore saar! %ets d#e to him. 5#t in case of ad&ance

a%ainst saar! empo!er %i&er oan to empo!ee on a condition that instament of s#ch oan wo#d $e ded#cted from the month! saar! of empo!ee.

111111111111111111111111111111111111111111111111111111111111111111111111111111111111

6. S-./+o) 1&, )aar! income is taxa$e on d#e or receipt $asis whiche&er is earier. 5#t if it is taxed on d#e $asis it wi not $e a%ain taxed when it is recei&ed.

,. S-./+o) $011, )aar! is awa!s accr#ed at a pace where the ser&ices are rendered. .owe&er in case of %o&ernment empo!ee who is wor:in% o#tside India, his saar! sha awa!s

$e accr#ed in India.

8. S522-)*-2 a)* 9o28o+)8 o9 (a6a2y, Is saar! is s#rrendered in fa&or of the %o&ernment then s#ch saar! is not taxed. .owe&er if empo!ee for%oes his saar! in fa&or of some

other empo!ee then s#ch saar! is taxa$e in hands of empo!ee.

9. Sa6a2y 92o4 4o2- /7a) 1 -4;6oy-2, If saar! is recei&ed from more than 1 empo!er then a%%re%ate of saar! from a empo!ers sha $e taxed.

1=. P2o9+/( +) 6+-5 o9 (a6a2y, Amo#nt of compensation from an! person $efore assessee 6oinin% an! empo!ment with that person or after cessation of his empo!ment with that person

is profit in ie# of saar! and taxa$e #/s 1,/-2.

11. TaA ;a+* 3y -4;6oy-2 o) /7- ;-2B5+(+/- va65- o9 )o)?4o)-/a2y ;-2B5+(+/-(, If empo!er pa!s tax on $ehaf of empo!ee then saar! paid to empo!ee wi :now as tax free

saar!. )#ch amo#nt of tax paid $! empo!er on $ehaf of empo!ee sha $e empo!eeDs income and wi $e added to his %ross saar!. .owe&er if empo!er pa!s s#ch amo#nt of

tax on non monetar! perJ#isites then so m#ch of tax sha B3T $e inc#ded in %ross saar! of empo!ee---)ection 1=/1=""2.

12. E)/-2/a+)4-)/ a66oCa).- is %i&en a ded#ction on! to %o&ernment empo!ees. >o&ernment empo!ees mean empo!ees of "entra >o&ernment and )tate >o&ernment---)ection

16/ii2.

1-. P2o9-((+o)a6 /aA is imposed $! the )tate >o&ernment and ne&er $! "entra >o&ernment. 4rofessiona Tax is aowed as ded#ction #/s 16/iii2 on the pa!ment $asis and not on

accr#a $asis. 4rofessiona Tax is %i&en a ded#ction e&en if amo#nt has $een paid $! empo!ers atho#%h it wi $e first inc#ded in the %ross saar!.

14. G2a/5+/yDS-./+o) 100101 1or %o&ernment empo!ees, %rat#it! is f#! exempt from tax at the time of retirement. >o&ernment empo!ees mean empo!ees of "entra

>o&ernment, )tate >o&ernment, Aoca A#thorit!. 1or other maxim#m exemption for the ife time is <s.-8====. >rat#it! recei&ed an!time $efore retirement sha $e f#! taxa$e

and %rat#it! at death is exempt from tax.

18. Co445/-* P-)(+o)DS-. 10010A1, 1or %o&ernment empo!ees or non %o&ernment empo!ees #ncomm#ted pension is awa!s f#! taxa$e. 4ension is aowed to $e comm#ted

to the maxim#m of 4=I of the f#t#re 1== months. "omm#ted pension is awa!s f#! exempt from tax for %o&ernment empo!ees $#t for non %o&ernment empo!ees its exemption

depends on whether assessee has recei&ed %rat#it! or not at retirement. >o&ernment empo!ees mean empo!ees of "entra >o&ernment, )tate >o&ernment, Aoca A#thorit! and

)tat#tor! "orporation.

16. Fa4+6y ;-)(+o), After the death of the empo!ee pension sha $e paid to his fami! mem$ers and s#ch pension is caed fami! pension. After death of mem$er of armed forces

who was winner of %aantr! award pension %i&en to his fami! mem$ers sha $e f#! exempt from tax #nder section 1=/182. If mem$er of armed forces die d#rin% com$at d#ties

then pension %i&en to his fami! mem$ers sha $e f#! exempt from tax #nder section 1=/192. In a other cases fami! pension is re%arded as income from other so#rces and is

exempt from tax #nder section 8, to the ower of7

1. 1/- of fami! pension recei&ed.

2. Caxim#m imit of <s. 18===/

1,. !-av- (a6a2y??S-.10010AA1, *ncashment of ea&e d#rin% ten#re of 6o$ is awa!s f#! taxa$e for a :inds of empo!ees whether %o&ernment or non %o&ernment. *ncashment of

ea&e at retirement is exempt for maxim#m of <s.-=====. >o&ernment empo!ee means empo!ee of "entra >o&ernment and )tate >o&ernment. Aea&e encashment %i&en to

fami! mem$ers after the death of the empo!ee sha $e f#! exempt from tax.

18. P2ov+*-)/ F5)*, "ontri$#tion of empo!er to )41 is f#! exempt from tax. 1#rther interest accr#ed on )41 is aso f#! exempt from tax #nder section 1=/112. "ontri$#tion of

empo!er to <41 acco#nt of empo!ee is exempt #p to 12I of saar! and interest thereon is exempt #p to 9.8I of tota contri$#tion. "ontri$#tion to 0<41 and interest thereon is

f#! taxa$e at the time of retirement or withdrawa.

19. !TC, *xemption #/s. 1=/82 in respect of ea&e tra&e concession or aowance is with reference to 2 trips in a $oc: of 4 caendar !ears.

2=. Fo2-+8) a66oCa).-( a)* ;-2B5+(+/-(, An! aowances or perJ#isite %i&en to empo!ee of %o&ernment o#tside India sha $e f#! exempt from tax #nder section 1=/,2. )#ch an

aowance is aso :nown as forei%n aowance.

21. ESOP( are not taxa$e as perJ#isite if iss#ed in accordance with the %#ideines specified $! the "entra >o&ernment.

22. The foowin% is the tax treatment for &ario#s aowances7

A1 HRA 5:( 1001#A1 RWR 2AD*xempt #p to the east of

1. Act#a .<A recei&ed.

2. <ent paid in excess of 1=I of saar! i.e. rent paid M1=I of saar!.

-. 8=I of the saar! in metros and 4=I in other paces.

)aar! wo#d mean 5)N;A/<2Ncommission on fixed I $asis of saes.

52 3fficia aowances #/s 1=/1427 a66 /7-(- a66oCa).-( a2- -A-4;/ 5; /o /7- 6oC-2 o9,

a2 a4o5)/ 2-.-+v-* o2

$2 A./5a6 a4o5)/ (;-)/ 9o2 /7- o99+.+a6 ;52;o(-(

Co)v-ya).- A66oCa).-E A.a*-4+. A66oCa).-E T2av-6+)8 A66oCa).-E H-6;-2 A66oCa).-E U)+9o24 A66oCa).-E Da+6y A66oCa).-

C1 A66oCa).-( C7+.7 a2- -A-4;/ /o /7- 6oC-2 o9 a4o5)/ 2-.-+v-* a)* 6+4+/ (-/ 3y 6aC.

i. .oste *xpendit#re Aowance7 exempt #p to <s.-== p.m. per chid #p to a maxim#m of two chidren. "hidren wi inc#de adopted and step chidren $#t sha not inc#de %rand-

chidren. That means aowance for %rand-chidren sha $e f#! taxa$e.

ii. 0nder%ro#nd Aowance7 exempt #p to <s.8== 4er month.

iii. Tri$a Area Aowance7 It is exempt #p to <s.2== per month.

i&. "hidren *d#cation Aowance7 It is exempt #p to <s.1== p.m. per chid for maxim#m of 2 chidren. "hidren ma! inc#de adopted or step chidren $#t sha not inc#de

%randchidren. "hidren can $e an! 2 chidren.

&. "o#nter Ins#r%enc! aowances7 *xempt #p to <s.-9== pm.

&i. Transport Aowance7 *xempt to the extent of <s.8== p.m. $#t if the empo!ee is ph!sica! handicapped then the amo#nt exempt is <s.16== pm.

&ii. 3#tstation aowance7 The amo#nt of exemption sha $e7 /a2 ,=I of s#ch aowance or /$2 <s.6 === p.m. (hiche&er is ess.

D1 A66oCa).-( C7+.7 a2- 9566y /aAa36- a2-

;earness aowances /;A2, 3&ertime aowance, "it! compensator! aowance /""A2, )er&ant aowance/ warden aowance, A#nch aowance/Tiffin

aowance, 1ami! aowance, Cedica aowance is awa!s f#! taxa$e irrespecti&e of an! amo#nt spent on medica treatment, *ntertainment aowance,

;ep#tation aowance, )pit d#t! aowance, datin% aowance etc.

2#1 T7- 9o66oC+)8 a2- -A-4;/ ;-2B5+(+/-(,

i. Interest free oan in respect of medica treatment for specified aiments.

ii. .oida! home .eath c#$ sports and simiar faciities made #niform! a&aia$e to a empo!ees.

iii. .ote accommodation #p to 18 da!s on transfer.

i&. Cotorcar and "on&e!ance faciit!.

&. Cedica faciit! in own hospita9 p#$ic hospita9 >o&ernment hospita or appro&ed hospita.

&i. "ar credit card and c#$ faciit!.

&ii. 0se of comp#ters and aptop.

&iii. *xpenses on phones inc#din% mo$ie phones i.e. teephone faciit!.

ix. Bewspapers and periodicas.

x. Ceas Tea coffee snac:s etc pro&ided.

xi. Amo#nt spent on the trainin% of empo!ee or on refreshment co#rse.

xii. An! :ind of %ood of which empo!er is a prod#cer and is s#ppied $! him to his empo!ee at concessiona rate.

xiii. <ecreationa faciit! pro&ided $! empo!er to empo!ee.

xi&. 4erJ#isites o#tside India to citi'en of India who is %o&ernment empo!ee.

x&. 4a!ment of the premi#m on the accidenta poic! of empo!ee.

x&i. <1A pro&ided to 6#d%es of ." or )" or officia of pariament or #nion minister or eader of opposition in pariament.

x&ii. "on&e!ance pro&ided to 6#d%es of ." or )".

21 T7- 9o66oC+)8 ;-2B5+(+/-( a2- -A-4;/ +9 /7- va65- *o-( )o/ -A.--* /7- ;2-(.2+3-* 6+4+/.

1. Interest on pett! oans not exceedin% <s. 2==== in a%%re%ate

2. *d#cationa $enefit not exceedin% <s. 1=== per chid per month.

-. Cedica reim$#rsement #p to <s. 18=== in a !ear.

2&1 P-2B5+(+/-( /aAa36- o)6y 9o2 (;-.+9+-* -4;6oy--(?????(-./+o) 17021 0+++1

1. >ardner, watchman, sweeper or an! other persona attendant--------<#e -/-2.

2. >as, eectricit!, water faciit!---------<#e -/42.

-. *d#cationa faciit!---------------------<#e -/82.

2"1 E4;6oy-- +( (;-.+9+-* -4;6oy-- +9 7- 9a66( 5)*-2 a)y 1 o9 /7- 9o66oC+)8 # .a/-8o2+-(,

1. .e is an! director of the compan! and is aso empo!ee of compan!.

2. .e is the empo!ee with the s#$stantia interest in the compan! i.e. he hods 2=I or more of the &otin% power.

-. .is income #nder the head OsaariesP exc#din% non monetar! perJ#isites exceeds <s.8====.

271 P-2B5+(+/-( /aAa36- 9o2 a66 F+)*( o9 -4;6oy--(,

1. <1A----------------------------------------------------)ection 1,/22/i2 <(< -/12.

2. Accommodation at concessiona rate --------)ection 1,/22/ii2 <(< -/12.

-. *mpo!eeDs o$i%ation met $! empo!er-----------------)ection 1,/22/i&2

4. Amo#nt of premi#m paid $! empo!er on $ehaf of empo!ee--------)ection 1,/22/&2

8. 1rin%e $enefits---------)ection 1,/22/&i2 <(< -/,2

1. Interest free or concessiona oan

2. 0se of mo&a$e asset $eon%in% to empo!er

-. Transfer of a mo&a$e asset $! empo!er to empo!ee.

SUMMAR% OF THE &

TH

CHAPTER

FRINGE BENEFIT AND NEW PER'UISITES

1. This chapter reates to the frin%e $enefits pro&ided $! empo!er to empo!ee and #p on which empo!er wi $e ia$e to pa! tax.

2. A compan!, partnership firm, A34, 53I, oca a#thorit! and artificia 6#dicia person arte re%arded as empo!ers and 15T is e&ied on them.

-. An indi&id#a, a .01, centra %o&ernment, state %o&ernment, a poitica part! and tr#sts sha not $e re%arded as empo!er and no 15T is

e&ied on them..

4. *&er! empo!er sha $e ia$e to pa! 15T of -=I on the &a#e of frin%e $enefits pro&ided to empo!ee or deemed to ha&e $een pro&ided to

empo!ee d#rin% the 4G. 1#rther s#rchar%e sha $e appica$e if the &a#e of frin%e $enefits exceeds <s. 1== a:hs and ed#cation cess sha

aso $e appica$e.

8. )ection 118(5 /12 and /22 defines the nat#re of frin%e $enefits and section 118(" defines the &a#e of frin%e $enefits.

6. (*1 AG 2==8-2==9, the concept of ad&ance tax has $een made appica$e to 15T aso. The amo#nt of 15T sha $e paid in instaments in

the pre&io#s !ear itsef #nder section 118(@/22.

,. If ad&ance tax of 15T is not paid then assessee sha $e char%ed simpe interest of 1I pm for the dea! in the pa!ment of 15T #nder section

118(@ /-2, /42 and /82.

8. The perJ#isite of car sha $e taxa$e for empo!ee if empo!er is not ia$e for 15T.

9. The perJ#isite &a#e of car taxa$e for empo!ee wi depend on the ownership of car and who has inc#rred expenses for the r#nnin% and

maintaince of car.

1=. If car is #sed exc#si&e! for the officia p#rposes then perJ#isite &a#e of car sha $e Bi and nothin% sha $e taxa$e for empo!ee $#t for

this few doc#ments ha&e to $e maintained.

11. If empo!er has pro&ided more than 1 car to empo!ee and a cars are #sed part! for officia and part! for persona p#rposes then one car

sha $e taxa$e as per the r#es of 4344 p#rposes and a other cars sha $e taxa$e as per the r#es of car #sed for persona p#rposes.

12. 4ic: and drop faciit! pro&ided $! the empo!er to empo!ee sha $e f#! exempt from tax for empo!ee.

1-. 1aciit! of tra&ein%, to#rin% and accommodation sha $e taxa$e for empo!ee and for this 4? sha $e the &a#e at which these faciities are

a&aia$e to %enera p#$ic.

14. 4? of the meas pro&ided sha $e the act#a expendit#re inc#rred $! the empo!er $#t <s. 8= per mea sha $e exempt from tax.

18. 4? of tea and snac:s pro&ided $! the empo!er d#rin% office ho#rs sha $e f#! exempt from tax $#t which are pro&ided after office ho#rs

sha $e f#! taxa$e.

16. >ifts recei&ed from empo!er $! the empo!ee in :ind are exempt #p to <s. 8=== pa. 5#t %ift is cash or in con&erti$e in cash sha $e f#!

taxa$e.

1,. 4erJ#isite &a#e of credit card and c#$ sha $e f#! exempt from tax for empo!ee if #se of card or c#$ is for exc#si&e for officia

p#rposes. 5#t is #se is persona or part! officia and part! persona then it sha $e f#! taxa$e.

18. The car is taxa$e for the empo!ee is empo!er is ia$e for 15T and empo!ee is a s specified empo!ee. The detaied taxa$iit! of motor car

pro&ided to the empo!ee is as foows

1. IF THE CAR IS OWNED:HIRED B% EMP!O%ER AND IS USED B% EMP!O%EE

1. CAR IF USED ON!% FOR THE OFFICIA! PURPOSES7 Its 4? sha $e BIA pro&ided some specified doc#ments ha&e $een maintained.

2. CAR IS USED ON!% FOR THE PRIVATE PURPOSES, Its 4? sha $e a%%re%ate of foowin%7

Act#a r#nnin% and maintaince char%es

A;; Act#a cha#ffer char%es /dri&erDs saar!2

A;; (ear and tear char%es, which sha $e 1=I of the historica cost of car.

1.# CAR IS USED PART!% FOR OFFICIA! AND PART!% FOR PERSONA! PURPOSES, Its 4? &a#e sha

$e cac#ated as foows7

1. IF RUNNING AND MAINTAINCE CHARGES ARE MET B% EMP!O%ER THEN,

i. If carDs en%ine capacit! is of 16== cc or ess7 <s. 12== pm.

ii. If carDs en%ine capacit! is of more than 16== ccQ<s.16== pm.

2. IF RUNNING AND MAINTAINCE CHARGES ARE MET B% EMP!O%EE THEN,

i. If carDs en%ine capacit! is of 16== cc or ess-----<s. 4== pm

ii. If carDs en%ine capacit! is of more than 16== ccQ<s.6== pm

NOTES,

1. If aon% with car cha#ffer is aso pro&ided then 6== pm has to $e added in $oth of the a$o&e cases.

2. 4ower of car can $e defined in terms of cc /c#$ic capacit!2 or in terms of iters. Therefore 16== cc ma! $e said as 1.6 iters of en%ine capacit!.

2. IF EMP!O%EE OWNS CAR AND IS USED B% EMP!O%EE HIMSE!F AND EXPENSES ARE MET B% EMP!O%ER OR REIMBURSED

B% HIM

2.1 CAR IF USED ON!% FOR THE OFFICIA! PURPOSES, Its 4? sha $e BIA pro&ided some specified doc#ments ha&e $een maintained.

2.2 CAR IS USED ON!% FOR THE PRIVATE PURPOSES, Its 4? sha $e taxed #nder section 1,/22/i&2 i.e. it sha $e f#! taxa$e for $oth

specified as we as non specified empo!ees.

2.# CAR IS USED PART!% FOR OFFICIA! AND PART!% FOR PERSONA! PURPOSES, Its 4? &a#e sha $e cac#ated as foows7

Act#a expendit#re done $! empo!er

A*)) 12== pm 3< 16== pm as the case ma! $e dependin% #pon c#$ic capacit! of car

A*)) 6== pm for cha#ffer

NOTES

1. F2a./+o) o9 4o)/7, 1or comp#tin% the 4? of a car the fraction of the month sha $e exc#ded.

2. M-a)+)8 o9 4o)/7, Conth has to $e rec:oned in respect to the 5ritish caendar. 1or this p#rpose month sha

$e #nderstood in this manner7 18/8/2==9 to 14/6/2==9 or 19/8/2==9 to 18/9/2==9 or 2/1=/2==9 to 1/11/2==9 and

i:ewise.

-. A4o5)/ 2-.ov-2-* 3y -4;6oy-2 92o4 -4;6oy--, If an empo!ee has paid an! amo#nt $ac: to the empo!er then it sha not $e red#ced from the

4? of car, if the car has $een #sed for 4344 p#rposes. 5#t if the car has $een #sed for the persona p#rposes then the amo#nt ret#rned $! empo!ee

to empo!er sha $e red#ced to cac#ate the 4?.

4. Poo6 o9 .a2(, If the empo!er has pro&ided more than 1 car for part! officia and part! persona p#rposes then it wi $e a case of 4oos of "ar. In

s#ch a case an! one car wi $e taxed as per the r#es of 4344 and remainin% car/s2 wi $e taxed as per the r#es of persona #se.

8. V-7+.6- o/7-2 /7a) .a2, If empo!er has pro&ided an! other &ehice other than car then its 4? sha $e 6== pm.

6. P+.F a)* *2o; 9a.+6+/y, If empo!er has pro&ided pic: and drop faciit! then its 4? sha $e exempt from tax.

7. S;-.+9+-* *o.54-)/( 4-a)(,

1. A Ao%$oo:, which contains compete detais of 6o#rne! #nderta:en for the officia p#rpose, which ma! inc#de date of 6o#rne!, destination,

miea%e and the amo#nt of expendit#re, inc#rred thereon.

2. The empo!er %i&es a certificate that the expendit#re was inc#rred who! and exc#si&e! for the officia p#rposes.

8. 4ersona p#rposes inc#de the $enefit to mem$ers of ho#sehod of empo!ee. Cem$ers of ho#sehod mean spo#se, chidren, spo#se/s2 of chidren,

parents, ser&ants and dependents

SUMMAR% OF THE "

TH

CHAPTER

INCOME FROM HOUSE PROPERT%

1. .o#se propert! m#st comprise of $#idin% 3< ands attached to s#ch $#idin% to attract taxa$iit! #nder this head of income.

2. This is the on! head of income where income ma! %et comp#ted on notiona $asis and taxed.

-. Taxa$iit! arises in the hands of the owner or deemed owner as defined #nder section 2,.

4. BA? is comp#ted #/s 2- and for this p#rposes the foowin% steps are foowed7

1. )tep 17 .i%her of C#nicipa &a#e and 1air <ent.

2. )tep 27 Aower of )tandard rent and &a#e at step 2.

-. )tep -7 ?a#e of step 2 ess Aoss of rent d#e to &acanc! of propert!.

4. )tep 47 .i%her of &a#e at step - and act#a rent recei&ed is >A?.

8. )tep 87 1rom >A? cac#ated at step 4 we red#ce m#nicipa taxes paid $! andord on or $efore -1/-/4G

8. C#nicipa taxes are ded#cted on pa!ment $asis and not on the accr#a $asis. 1#rther taxes which are paid $! andord are to $e red#ced and not which

ha&e $een paid $! tenant.

6. )ection 24/a2 aows -=I fat ded#ction on BA? and section 24/$2 aows interest on capita $orrowed.

,. In case of one sef occ#pied propert!, net ann#a &a#e is ni $#t interest on $orrowed capita #/s 24/$2 is aowed as a ded#ction #p to <s. -=,===, if oan

was ta:en $efore 1/4/99.

8. If oan is ta:en on or after 1/4/99 and p#rchase or constr#ction of ho#se is competed within - !ears from the end of the financia !ear of o$tainin% the

oan, then the imit of <s. -==== is s#$stit#ted $! <s. 1,8=,===.

9. Interest on oan $orrowed which is pa!a$e o#tside India sha $e aowed as ded#ction on! if tax is ded#cted or paid at so#rce.

1=. In case of ho#se propert! which is &acant, m#nicipa taxes are aowed to $e red#ced and th#s we can ha&e ne%ati&e BA?.

11. 0nreai'ed rent does not form part of act#a rent if a the conditions of <#e 4 are satisfied.

12. If s#$seJ#ent! #nreai'ed rent is recei&ed it is taxed #/s. 28AA in the !ear of receipt witho#t an! ded#ction #/s. 24.

1-. Arrears of rent recei&ed from a tenant sha $e taxed #/s. 285 $#t s#$6ect to -=I ded#ction of s#ch arrear.

14. "o-ownerDs share of income from propert! is inc#ded in each co-owners indi&id#a assessment and is not assessa$e as on A34.

18. In case where the propert! is part! sef occ#pied and part! et o#t on the $asis of area then C?, 1<, )<,CT paid and Interest on $orrowed capita has

to $e $if#rcated on the $asis of area. .owe&er, if propert! is 4A3/4)3 on the $asis of time period then nothin% has to $e $if#rcated.

16. Bet ann#a &a#e of a propert! can $e ne%ati&e pro&ided m#nicipa taxes paid are hi%her than the amo#nt of >A?.

1,. If assessee has the main $#siness of ettin% o#t propert! or deain% in propert! e&en then the renta income is to $e taxed #nder this head of income and

not #nder the head of 4>54.

18. In case assessee recei&ed composite rent for ettin% o#t the propert! as we as faciities aon% with s#ch propert! then it has the foowin% tax treatment7

1. If ettin% o#t of $#idin% and faciities is separa$e then rent of the propert! is to $e taxed #nder the head of .4 and rent of faciities #nder the head 4>54 or 3) as the case ma! $e.

2. If ettin% o#t of $#idin% and faciities is not separa$e then rent of the propert! as we as rent of faciities is to $e taxed #nder the head 4>54 or 3) as the case ma! $e.

1. 1oowin% .4 are not char%ea$e to tax #nder the head of .47

1. Income from a farmho#se.

2. 4ropert! hed $! a charita$e tr#st

-. 4ropert! #sed for own $#siness or profession.

4. A )3 or a &acant ho#se.

8. A paace of ex r#er.

2=. Ad&ance rent recei&ed $! the assessee sha $e taxa$e in the !ear to which it reates.

21. In the case of ho#se propert! which is &acant, m#nicipa taxes are aowed to $e red#ced.

SUMMAR% OF THE 7

TH

CHAPTER

INCOME FROM BUSINESS G PROFESSION

1. S-./+o) 1&, 4rofits and %ains of 5#siness or 4rofession sha $e comp#ted either on cash $asis or mercantie $asis of acco#ntin%.

2. )pec#ation 5#siness income sho#d to $e comp#ted separate! as oss from s#ch $#siness cannot $e set off a%ainst an! other $#siness income.

-. <e&en#e oss or expendit#re incidenta to $#siness is exc#da$e in the comp#tation e&en tho#%h there is no specification pro&ision. 1or exampe

expendit#re on stationer! is ded#cti$e e&en tho#%h there is no specific section for this.

4. A the assets #se for $#siness can $e cassified as #nder7

Ta)8+36-, /a2 Aand M it is not ei%i$e for depreciation.

/$2 5#idin%, machiner!, pant and f#rnit#re are ei%i$e for depreciation.

I)/a)8+36-, Rnow-how, patents, cop!ri%hts, trademar:s, icenses, franchises are ei%i$e for depreciation.

1. <e&en#e expenses inc#rred in reation to the assets mentioned in point 42 sho#d $e considered for ded#ction #/s. -=, -1 and -,/12. "apita expendit#re

not J#aif!in% #nder these pro&isions ma! $e capitai'ed and depreciation #/s. -2 can $e caimed if ei%i$e.

2. 3n! in the case of #nderta:in%s en%a%ed in the $#siness of %eneration or %eneration and distri$#tion of power, there is an option to a&ai depreciation

on strai%ht-ine method. This option is for on! those assets, which ha&e $een p#rchased after -1/-/98. In a other cases depreciation is ded#cti$e on!

on written down &a#e method. The option has to $e exercised in the $e%innin% and sha app! to a the s#$seJ#ent assessment !ears.

-. If depreciation has $een char%ed as per )AC $asis as mentioned in 62 a$o&e and then $oc: of asset has $een sod7

1. 1or the &a#e ess than the &a#e of $oc: then we %et termina depreciation, which can $e de$ited, to 4A acco#nt.

2. 1or the &a#e more than the &a#e of $oc: then #p to the amo#nt of depreciation de$ited to the da! is treated as

4>54 income and $aance if an! is treated as )T">.et destro!ed

4. Interest on oan $orrowed for acJ#irin% on asset #sed in the $#siness has to $e treated as #nder7

1. 5efore the commencement of prod#ction/5#siness has to $e capitai'ed.

2. Interest reatin% to the period after the asset is first p#t to #se sha ne&er form part of the cost of the asset. As per )ec. 4-/12 it sha $e aowed as re&en#e expendit#re.

9. 0na$sor$ed depreciation is treated as part of c#rrent !ear depreciation and therefore, can $e set off a%ainst income #nder other heads of income as we

/except income of saar! and cas#a incomes2. It can $e carried forward indefinite! e&en if the $#siness is discontin#ed.

1=. As per section 8= there sha $e awa!s )T"> on sae of a deprecia$e asset.

11. In case of asset $ein% destro!ed and ins#rance compan! %i&es a simiar asset to assessee then the &a#e of s#ch asset destro!ed sha not $e red#ced from

the $oc: as per the )" case of CIT v( Ha(/52+ a)* So)( !/*.

12. The ded#ction of scientific research expendit#re #/s. -8 sha $e as foows7

4artic#ars ;ed#ction permissi$e.

1

*xpendit#re inc#rred for own $#siness7

- 0/s. -8/2A52 M specia acti&ities s#ch as pharmace#ticas, $io-technoo%!,

comp#ters etc.

- 0/s. -8 M 3ther cases

(ei%hted ded#ction of 18=I

;ed#ction of 1==I

2 "ontri$#tion to >o&ernmentDs, appro&ed #ni&ersit!Ds, coe%e or instit#tionDs

a$orator!

(ei%hted ded#ction of 128I

1#1 >enera!, re&en#e expendit#re is ded#cti$e in the !ear when expendit#re has $een inc#rred and capita expendit#re is capitai'ed. The concept of deferred re&en#e expendit#re is

not pre&aent in Indian income tax str#ct#re. .owe&er, s#ch principe is made appica$e #nder the foowin% sections7

A1 S-./+o) #&D M Amorti'ation of preiminar! expendit#re M write it off o&er 8 !ears. S#aif!in% amo#nt sha $e foows7

1. 1or non-corporate assessee it cannot exceed 8I of cost of pro6ect

2. 1or a "ompan! it cannot exceed 8I of cost of pro6ect 3< 8I capita empo!ed which e&er is hi%her.

B1 S-./+o) #&DD M *xpenses inc#rred for ama%amation and demer%er M write off o&er 8 !ears.

C1 S-./+o) #&DDA M ?o#ntar! <etirement )er&ice compensation M write off o&er 8 !ears.

D1 S-./+o) #7011 M ;isco#nt/ premi#m on redeema$e preference shares or $onds or de$ent#res can $e spread o&er the ife of the instr#ment < Ma*2a(

I)*5(/2+a6 I)v-(/4-)/ Co2;o2a/+o) !/*.

14. The $ad de$ts written off d#rin% precedin% pre&io#s !ears and which are reco&ered d#rin% the pre&io#s !ear then reco&er! is f#! taxa$e in the !ear of reco&er! pro&ided

it is reco&ered $! the same assessee who has inc#rred s#ch $ad de$t as was decided $! SC +) /7- .a(- o9 P.H.Ha+4a6.

18. *xpendit#re on ad&ertisement in so#&enir, $roch#re, pamphet etc. p#$ished $! a poitica part! is not aowed as ded#ction. .owe&er a ded#ction for the same or/and

simiar expendit#re is aowed as ded#ction #nder section 8=>>5 and 8= >>".

16. *xpenses not ded#cti$e are as foows7

1. S-.. 00a1 MAn! pa!ment o#tside India on which no T;) has $een done or has $een paid.

2. S-.. 0A021 M *xcessi&e and #nreasona$e expendit#re where a reati&e and s#$stantia interest hodin%

is in&o&ed.

-. S-.. 0A0#1 M *xpendit#re paid in excess of <s.2==== otherwise than $! acco#nt pa!ee cheJ#e or $an:

draft s#$6ect to r#e 6;;.

4. S-.. 0A071 M 4ro&ision for %rat#it!.

8. S-.. 0A0$1 M "ontri$#tion to #nappro&ed f#nds.

6. S-.. #B M "ertain expenses not paid within the stip#ated time imit. This appies irrespecti&e of

method of acco#ntin%.

14. (here the partnership deed stip#ates terms of interest and saar! to partners, the amo#nt a#thori'ed $! the deed or the imit prescri$ed $! )ec. 4=/$2, whiche&er is ower,

sha $e aowed as ded#ction. This imit is as foows7

BOOH PROFITS OF PROFESSIONA!

FIRMS

BOOH PROFITS OF

OTHER FIRMS

REMUNERATION AS I OF BOOH

PROFITS

3n first <s.1===== or

in case of Aoss

3n first <s.,8=== or

in case of Aoss

<s.8==== or 9=I of $oo: profits which

e&er is hi%her

3n next 1===== 3n next ,8=== 6=I

3n 5aance 3n 5aance 4=I

181 U:(. AA the assessee needs to maintain $oo:s of acco#nt in the foowin% cases7

1. Botified professions M >ross receipts exceed <s. 1.8 a:hs.

2. 3ther professions/$#sinessM Income exceeds <s. 12 a:hs or t#rno&er exceeds <s. 1= a:hs.

1$1 U:(.AB A#dit is mandator! if

1. 4rofession %ross receipts exceed <s. 1= a:hs.

2. 4res#mpti&e cases co&ered $! 44A;9 44A* L 44A1. 4455 and 44555, where the income is ess than prescri$ed imit.

2=. 4res#mpti&e $#siness income pro&isions are as foows7

P2ov+(+o) S-..AD S-..AE S-..AF

Bat#re L

*i%i$iit!

"i&i constr#ction $#siness ha&in%

T#rno&er 4= a:hs.

Transport $#siness-ha&in% no. of &ehices

1=

<etai Traders ha&in%

T#rno&er 4= a:hs.

;eemed

Income

8I or more of t#rno&er. .ea&! &ehice M <s. -,8== or more. 3thers

<s. -,18= or more /p.m. or part of the

month2

8I or more of T#rno&er.

SUMMAR% OF THE 8

TH

CHAPTER

INCOME FROM CAPITA! GAINS

1. In order to attract taxa$iit! #nder this head of income there m#st $e Hcapita assetD and it m#st $e co&ered #nder the term of HtransferD.

2. As per section 2/142 stoc: in trade, persona effects and a%ric#t#ra and in r#ra area are not considered as capita asset and hence there sha $e no capita %ains on their

transfer.

-. Transactions constit#tin% HtransferD are i#strated #/s. 2/4,2 some of which are as foows7

1. )ae, exchan%e or reinJ#ishment of a capita asset.

2. *xtin%#ishments of an! ri%ht in asset.

-. "omp#sor! acJ#isition $! of capita asset $! %o&ernment

4. "on&ersion of capita asset into stoc: in trade.

8. An! transaction as referred as to in )ection 8-A of Transfer 3f 4ropert! Act 1882.

4. These transactions are not re%arded as HtransferD #/s. 4,, therefore no capita %ains sha $e char%ed

i. Transfer #nder %ift or wi

ii. ;istri$#tion of assets on partition of .01

iii. Transfer of the artistic, scientific wor: etc. to the %o&ernment, #ni&ersit!, m#se#m etc.

i&. "on&ersion of the $onds, de$ent#res, deposits etc into shares or the de$ent#res of that compan!.

&. Transfer of shares hed $! sharehoders #nder the ama%amation if7

1. Ama%amated compan! is an Indian compan!.

2. Transfer is made in consideration of aotment to him of the shares in the ama%amated compan!.

8. A capita asset is treated as on%-term capita asset on the $asis of period of hodin% as foows7

0a1 )hares, isted sec#rities, 0nits of 0TI and m#t#a f#nds reco%ni'ed #/s. 1=/2-;2 M 12 months or more.

031 A other capita assetsM-6 months or more /;eprecia$e assets are awa!s treated as )T"A2

1. In case of AT"A, "3A is to $e indexed with the factor for that !ear in which the asset was for the first time acJ#ired $! the assessee.

2. )ection 48Ds pro&isos7

1. 1st 4ro&iso appies to non residents on transfer of shares and de$ent#res on!.

2. 2nd pro&iso appies to a :inds of AT"A.

-. -rd pro&iso appies to $onds and de$ent#res and indexation is not done.

1. 5enefit of indexation is not a&aia$e in case of7

1. )hort term capita assets9

2. 5onds and de$ent#res since -

rd

pro&iso to section 48 is appica$e.

-. )#mp sae #/s. 8=5

9. There are 8 sef %enerated assets in respect of which the .o(/ o9 a.B5+(+/+o) sha $e adopted as )+6 in case an assessee has not inc#rred an! cost for acJ#isition them.

These assets are sef %enerated %oodwi9 tenanc! ri%ht9 ro#te permit9 Aoom ho#rs9 <i%ht to man#fact#re, prod#ce or process an! artice or thin%9 5on#s shares acJ#ired

after 1/4/819 <i%ht to s#$scri$e to shares 9 trademar: or $rand name.

1=. In the case of $on#s shares acJ#ired $efore 1/4/1981, it is possi$e to a&ai fair mar:et &a#e as on 1/4/1981 as the cost of acJ#isition. In fact, it is the on! asset9 amon%

the 8 assets referred to a$o&e for which fair mar:et &a#e as on 1/4/1981 can $e a&aied if the $on#s shares ha&e $een acJ#ired prior to that date. I) /7- .a(- o9 /7- o/7-2

a((-/(E -v-) +9 /7-y a2- a.B5+2-* ;2+o2 /o 1::1$81E .o(/ C+66 3- /aF-) a( )+6.

11. In case of %ift or wi or inheritance cost of acJ#isition sha $e the cost at which the pre&io#s owner acJ#ired the asset. 1#rther in whie cac#atin% the period of hodin%

the period for which the asset was hed $! pre&io#s owner and c#rrent owner sha $e added to%ether.

12. The differentia treatment $etween on% term and short term capita assets sha $e as foows7-

Pa2/+.56a2( !o)8 T-24 S7o2/ T-24

Indexation $enefit A&aia$e Bot a&aia$e

*xemption #/s 84, 84*",841 L 84>

*xemption #/s 845, 84;, 84> L 84>A

A&aia$e

A&aia$e

Bot a&aia$e

A&aia$e

"oncessiona tax rate #/s. 112 A&aia$e in case of sec#rities Bot a&aia$e

5asic exemption imit

/Indi&id#a L .012

A&aia$e to residents if

incomes except AT"> are

ess than $asic exempt imit

A&aia$e

;ed#ctions of section 8=" to 8=0 Bot a&aia$e A&aia$e

1. S-./+o) &01A1, "apita %ains tax norma! arises in the !ear of transfer except in the case of ins#rance compensation where it is taxed in the !ear of receipts.

2. S-./+o) &021, "on&ersion of capita asset into stoc:-in-trade is taxed in the !ear of sae of s#ch stoc:-in-trade $#t whie indexin% the cost of acJ#isition sha ta:en for

the !ear in which con&ersion too: pace.

-. S-./+o) &0&1, In case of comp#sor! acJ#isition capita %ain is taxed in the !ear of receipt of compensation or part of the compensation. In case of enhanced

compensation "> sha ha&e the same nat#re as that of ori%ina compensation. In case of red#ction of compensation, the tax on ori%ina compensation or enhanced

compensation sha $e re&ised.

4. ?a#es to $e considered for the adoption for comp#tation of capita %ains are as7

1. S-./+o) &021 "on&ersion of capita asset into stoc: M 1air mar:et &a#e on date of con&ersion.

2. S-./+o) &0#1 4artner or mem$er introd#cin% asset to firm or A34 M 5oo: &a#e recorded in firm.

-. S-./+o) &01 ;isso#tion of firm and distri$#tion of assets M 1air mar:et &a#e on the date of distri$#tion. In other cases, act#a consideration to $e adopted.

1. "omp#tation of capita %ains in case of non-deprecia$e assets sha $e cac#ated #/s. 48 and in the case of deprecia$e assets it sha $e as #nder7

i. S-./+o) &0, In case of deprecia$e assets #sed for the $#siness and professiona p#rposes.

ii. S-./+o). &0A, where strai%ht-ine method is adopted $! power sector #nderta:in%.

iii. S-./+o). &0B, where s#mp sae is affected.

18. S-./+o). &0C of &a#ation for the )tamp ;#t! Act we ha&e to ta:e hi%her of7

a1 )ae consideration

31 ?a#e as fixed #nder that act.

19. 5enefit of indexation is not a&aia$e in case of7

1. )hort term capita assets9

2. 5onds and de$ent#res since -

rd

pro&iso to section 48 is appica$e.

-. )#mp sae #/s. 8=5

201 EA-4;/+o)( o9 .a;+/a6 8a+)( ava+6a36- o)6y /o +)*+v+*5a6 a)*:o2 HUF a((-((--(, S-./+o) &E &B a)* &F

P2ov+(+o)(

Ca;+/a6 8a+)( o) (a6-

o9 2-(+*-)/+a6

;2o;-2/y 5(-* 9o2

2-(+*-)/+a6 ;2o;-2/y,

S-./+o) &

Ca;+/a6 8a+)( o) (a6- o9

523a) a82+.56/52a6

6a)* a)* 5(-* 9o2

a)o/7-2 a82+.56/52-

6a)*

S-./+o) &B

Ca;+/a6 8a+) o) (a6- o9

!TCA )o/ /o 3-

.7a28-* +) .a(- o9

+)v-(/4-)/ +)

2-(+*-)/+a6 7o5(-,

S-./+o) &F

1. A((-((-- Indi&id#a/.01 Indi&id#a Indi&id#a/.01

2. A((-/ /2a)(9-22-* <esidentia ho#se

propert! $ein%

$#idin%s or ands

app#rtenant thereto.

A%ric#t#ra and #sed

$! indi&id#a or his

parent for a%ric#t#ra

p#rposes d#rin% 2 !ears

precedin% date of

transfer

An! capita asset not

$ein% residentia ho#se

propert!. *xemption is

not a&aia$e if assessee

owns more than 2

residentia ho#ses

inc#din% a new ho#se.

#. Na/52- o9 A((-/ AT"A AT"A / )T"A AT"A

. N-C A((-/ /o 3-

;52.7a(-*:.o)(/25./-*

<esidentia ho#se

propert! i.e. $#idin%s

or ands app#rtenant

thereto

A%ric#t#ra and /in

#r$an or r#ra area2

<esidentia ho#se

propert! i.e. $#idin%s or

ands app#rtenant

thereto

&. T+4-?6+4+/ 9o2

;52.7a(-:.o)(/25./+o)

4#rchase7 (ithin 1

!ear $efore or 2 !ears

after the date of

transfer.

"onstr#ction7

compete constr#ction

within - !ears !ear

from date of transfer

4#rchase within 2 !ears

from the date of transfer

4#rchase7 (ithin 1 !ear

$efore or 2 !ears after

date of transfer9 and

"onstr#ction7 "ompete

constr#ction within -

!ear from date of

transfer

". D-;o(+/ (.7-4-

0D+(.5((-* 6a/-21

Appica$e Appica$e Appica$e

7. A4o5)/ o9 EA-4;/+o) Aower of M "apita

%ains or in&estment in

new asset

Aower of M capita %ains

or cost of new asset

"ost of new ho#se x

"apita >ains T Bet

consideration $ein% 1#

?a#e of consideration

ess *xpenses on transfer

8. W+/7*2aCa6 o9

EA-4;/+o) o)

If transfer of the new

asset within - !ears

from its p#rchase/

constr#ction

If transfer of the new

asset within - !ears

from its p#rchase

/a2 if assessee p#rchases

within 2 !ears or

constr#cts within - !ears

from date of transfer of

ori%ina asset, a

residentia ho#se other

than new ho#se9 or

/$2 transfer new asset

within - !ears from date

of its p#rchase/

constr#ction

$. TaAa3+6+/y o) W+/7*2aCa6 Amo#nt of exemption

caimed earier sha

$e red#ced from the

cost of acJ#isition of

new asset.

*xemption caimed

earier sha $e red#ced

from cost of acJ#isition

of new asset.

Amo#nt exempted

earier sha $e taxa$e

as on%-term capita

%ains in pre&io#s !ear in

which M /a2 another

residentia ho#se is

p#rchased or

constr#cted, or /$2 the

new asset is transferred.

211 EA-4;/+o)( +) 2-(;-./ o9 .a;+/a6 8a+)( ava+6a36- /o a66 a((-((--(, S-./+o) &DE &ECE &G a)* &GA

P2ov+(+o)(

Co4;56(o2y

a.B5+(+/+o) o9 6a)*

G 35+6*+)8(

S-./+o) &D

I)v-(/4-)/ +) .-2/a+)

3o)*(,

S-./+o) &EC

S7+9/+)8 o9

5)*-2/aF+)8 /o

252a6 a2-a,

S-./+o) &G

S7+9/+)8 o9 5)*-2/aF+)8

/o SEJ,

S-./+o) &GA

1. A((-((-- An! person An! person An! person An! person

2. A((-/

/2a)(9-22-*

"omp#sor!

acJ#isition of and

or $#idin% which

was #sed in the

$#siness of

ind#stria

#nderta:in% d#rin%

2 !ears prior to date

of transfer.

An! on% term capita

asset

Transfer of pant,

machiner! or and

or $#idin% for

shiftin% ind#stria

#nderta:in% from

#r$an area to r#ra

area

Transfer of pant,

machiner! or and or

$#idin% for shiftin%

ind#stria #nderta:in%

from #r$an area to

)pecia *conomic +one

#. Na/52- o9

A((-/

)hort term/ Aon%

term

Aon% term )hort term/ Aon%

term

)hort term/ Aon% term

. N-C A((-/

/o 3-

;52.7a(-*:

.o)(/25./-*

Bew and or

$#idin%s for the

ind#stria

#nderta:in%.

5onds, redeema$e after

- !ears iss#ed M

/a2 $! Bationa .i%hwa!

A#thorit! of India9 or

/$2 $! <#ra

*ectrification

"orporation, maxim#m

exemption imit $ein%

<s. 8= a:hs /Amended

$! 1A, 2==, w.e.f. 1-4-

=82

/a2 4#rchase/

"onstr#ction of

pant, machiner!,

and or $#idin% in

s#ch r#ra area or,

/$2 )hiftin% ori%ina

assets to that area

or, /c2 Inc#rrin%

notified expenses

/a2 4#rchase/

"onstr#cted of pant,

machiner!, and or

$#idin% in s#ch )*+ or,

/$2 )hiftin% the ori%ina

assets to )*+ or, /c2

Inc#rrin% notified

expenses.

&. T+4-?6+4+/

9o2

;52.7a(-:

.o)(/25./+o

) o9 )-C

a((-/.

(ithin - !ears from

date of receipt of

initia

compensation.

(ithin 6 months from

the date of transfer of

ori%ina asset.

(ithin 1 !ear

$efore or - !ears

after the date of

transfer.

(ithin 1 !ear $efore or

- !ears after the date of

transfer.

". D-;o(+/ Appica$e - Appica$e Appica$e

(.7-4-

7. a4o5)/ o9

EA-4;/+o)

Aower of M capita

%ains or in&estment

in new asset.

Aower of M capita %ains

or in&estment in new

asset

Aower of M "apita

%ains, or "ost

inc#rred for /a2 to

/c2 of point 4.

Aower of "apita %ains,

or "ost inc#rred for /a2

to /c2 of point 4.

8. W+/7*2aCa6

-A-4;/+o)

Transfer of new

asset within a period

of - !ears from the

date of its

acJ#isition or

constr#ction.

Transfer of new asset,

con&ersion thereof in

mone! of ta:in% oan or

ad&ance on its sec#rit!

within - !ears from date

of its acJ#isition

Transfer of new or

shifted asset within

a period of - !ears

from the date of its

acJ#isition or

constr#ction or

shiftin%

Transfer of new or

shifted asset within a

period of - !ears from

the date of its

acJ#isition or

constr#ction or shiftin%

$. TaAa3+6+/y

o)

W+/7*2aCa6

o9

EA-4;/+o)

Amo#nt of

exemption caimed

earier sha $e

red#ced from the

cost of acJ#isition

of new asset.

*xempted capita %ain

wi taxa$e as on%-term

capita %ains in pre&io#s

!ear in which s#ch

transfer/con&ersion ta:es

pace.

Amo#nt of

exemption caimed

earier sha $e

red#ced from the

cost of acJ#isition

of new or shifted

asset.

Amo#nt of exemption

caimed earier sha $e

red#ced from the cost of

acJ#isition of new or

shifted asset.

No/-, If exemption has $een caimed #/s 84*" in respect of in&estment in a new asset, no ded#ction sha $e aowed

#/s 8=" with reference to the amo#nt of in&estment for which exemption has $een caimed.

221 Indexation factors to $e #sed for indexation of AT"A are7

P2-v+o5( %-a2

I)*-Aa/+o)

9a./o2

P2-v+o5( %-a2

I)*-Aa/+o)

9a./o2

P2-v+o5( %-a2

I)*-Aa/+o)

9a./o2

1981-1982 1== 1991-1992 199 2==1-2==2 426

1982-198- 1=9 1992-199- 22- 2==2-2==- 44,

198--1984 116 199--1994 244 2==--2==4 46-

1984-1988 128 1994-1998 289 2==4-2==8 48=

1988-1986 1-- 1998-1996 281 2==8-2==6 49,

1986-198, 14= 1996-199, -=8 2==6-2==, 819

198,-1988 18= 199,-1998 --1 2==,-2==8 881

1988-1989 161 1998-1999 -81 2==8-2==9 882

1989-199= 1,2 1999-2=== -89

199=-1991 182 2===-2==1 4=6

SUMMAR% OF THE $

TH

CHAPTER

INCOME FROM OTHER SOURCES

1. The foowin% incomes are awa!s taxa$e as income from other so#rces7

1. ;i&idend income from forei%n compan!.

2. "as#a income s#ch as winin% from otter!, crossword p#''es, %am$in%, card %ames, winnin% from horse races etc.

-. "ontri$#tion of 41 recei&ed $! the empo!ee and not deposited with the 41.

4. Interest on sec#rities.

8. <ent from ettin% of pant and machiner! aon% with $#idin%.

6. )#m recei&ed $! :e!man from :e!man ins#rance poic! if empo!er and empo!ee reation is a$sent.

,. Income from s#$ettin% of ho#se propert!.

8. >ifts in cash recei&ed exceedin% <s. 8==== from non reati&es. 5#t %ifts on the occasion of marria%e are not taxa$e. )imiar! %ifts %i&en in anticipation of death sha not $e

taxa$e.

2. S-./+o) 1&, Income #nder the head of other so#rces sha $e cac#ated on the cash $asis or accr#a $asis of acco#ntin% whiche&er is foowed $! the assessee.

-. 1oowin% are some of the incomes which are taxa$e #nder the head of other so#rces7

1. ;irectorDs fee.

2. A%ric#t#re income from o#tside India.

-. <ent of open pot of and.

4. )aar! pa!a$e to mem$ers of pariament.

8. 1ami! pension recei&ed $! fami! mem$ers of deceased empo!ee is taxa$e as income from other so#rces. 5#t an exemption of 18=== or 1/- of s#ch income sha $e aowed as

per section 8,.

6. Interest on empo!eeDs own contri$#tion in 0<41 when he %ets retired.

,. An! income from #ndiscosed so#rces.

8. An! other cas#a income.

9. Income from ro!at!.

1=. >ro#nd rent.

11. *xamination fees recei&ed $! a teacher from a person other than his empo!er.

4. ;i&idends recei&ed $! sharehoders from a domestic compan! other than those co&ered $! section 2/222/e2 is exempt from tax #/s. 1=/-42 for sharehoder since compan! has to

pa! ";T.

8. Income from 3ther )o#rces is a resid#ar! head of income, which inc#des a income which is not co&ered $! other heads of income and which are not exempt from tax.

6. (hie income from $#idin% propert! and and app#rtenant thereto is taxa$e #nder the head HIncome from ho#se propert!D, if &acant and is et o#t, the rent is assessa$e #nder the

head HIncome from other so#rcesD.

,. Income from a%ric#t#ra acti&ities is exempt from tax #/s 1=/12, if a%ric#t#re and is sit#ated in India $#t if and is o#tside India then income sha not $e exempt $#t it wi $e

taxa$e as the income from other so#rces.

8. Apart from the specific ded#ctions permissi$e #/s. 8,, an! expendit#re who! and exc#si&e! inc#rred for the p#rpose of earnin% an! income assessa$e #nder this head is aso

aowa$e and ded#ction.

9. If the assessee recei&es pension after retirement, the same is assessa$e #nder the head H)aariesD. (hereas, if fami! pension is recei&ed $! the e%a heir of the deceased empo!ee,

it is taxa$e #nder this head s#$6ect to 1/- of fami! pension or <s. 18,=== whiche&er is ess.

1=. (innin%s from otter!, crossword p#''es, races, etc. sha $e taxed at the rate of -=I /p#s s#rchar%e and ed#cation cess2 #/s. 11855.

11. 1rom the cas#a incomes no :ind of expenses are aowed to $e ded#cted and %ross amo#nt is taxa$e.

SUMMAR% OF THE 10

TH

CHAPTER

C!UBBING OF INCOMES

1. S-./+o) "0, If income is transferred witho#t transfer of the asset then s#ch income sha $e taxa$e for the transferred and not for the transferee.

2. S-./+o) "1, In the case of re&oca$e transfer, income from the asset sha $e taxa$e for the transfer and not for the transferee $#t if the transfer is not re&oca$e then it

sha $e taxa$e for the transferor.

-. S-./+o) "0110++1, An indi&id#a is char%ea$e to tax in respect of an! saar!, commission, fees or an! other form of rem#neration recei&ed $! the spo#se froa concern in

which the indi&id#a has s#$stantia interest except in case where income of spo#se is earned on! d#e to appication of technica or professiona :nowed%e or experience.

4. S-./+o) "0110+v1, if person has transferred an asset to spo#se and spo#se earns some income from s#ch asset then s#ch income sha $e taxa$e for the transferor of the

asset.

8. Income on the asset transferred is c#$$ed $#t not the income on accretion to the asset.

6. S-./+o) "01A17 An! income accr#in% or arisin% to a minor chid is ia$e to $e c#$$ed with the income of father or mother whose so e&er has hi%her tota income $efore

s#ch c#$$in%.

,. Income deri&ed $! a minor chid o#t of s:i and taent or $! wa! of saar! and wa%es sha not $e c#$$ed. .owe&er, if s#ch income is in&ested and income is earned

thereon, s#ch income sha $e c#$$ed.

8. "#$$in% ceases to operate when the minor $ecomes a ma6or.

9. There is no c#$$in% of income in the case of a minor chid who is ei%i$e for ded#ction #/s. 8=0.

1=. )imiar!, where a minor chid does not ha&e parents, c#$$in% of income does not arise. The minor chid wi $e assessa$e in his own case. >#ardian wi $e

representati&e assessee for assessment p#rposes.

11. If the income is to $e c#$$ed then it sha $e comp#ted first in the hands of recei&er #nder ree&ant head and then it sha $e inc#ded in the tota income indi&id#a #nder

same head.

)0CCA<G 31 T.* 11

th

".A4T*<

SET OFF G CARR% FORWARD OF !OSSES

1. S-./+o) 70, Aoss from one so#rce can $e set-off a%ainst income from another so#rce #nder the same head in the same !ear except

1. )pec#ation oss.

2. Aon%-term capita oss.

-. Aoss from ownin% and maintainin% racehorses.

4. Bo oss to $e set off from income, which is exempt from tax.

8. Bo oss to $e set off from income of otteries, card %ames, races etc.

6. Aoss of 4>54 can not $e set off from saar! income

2. S-./+o) 71, Aoss #nder one head of income can $e set-off a%ainst income #nder another head of income in the same !ear except those which are mentioned in 12

a$o&e.

-. The J#estion of comp#tin% oss #nder the head HsaariesD does not arise. 0nder a other heads, there is a possi$iit! that the net res#t of comp#tation is a oss.

)#ch oss remainin% #na$sor$ed after set-off can $e carried forward #p to 8 assessment !ear /4 !ears in the case of oss from the acti&it! of owin% and

maintainin% race horses and spec#ation $#siness oss2 to $e set-off a%ainst income #nder the same head.

4. )pec#ation oss, on%-term capita oss and oss from the acti&it! of ownin% and maintainin% racehorses can $e set-off on! a%ainst income of the same nat#re.

8. S-./+o) 72A, In the case of ama%amation the #na$sor$ed oss and depreciation is treated as that of the ama%amated compan!. Therefore, carr! forward of oss

is a&aia$e for s#$seJ#ent 8 assessment !ears and depreciation can $e carried forward indefinite!. This period of 8 !ears is irrespecti&e of the period of oss,

which has $een, carr! forwarded $! ama%amatin% compan!.

6. In the case of demer%er, the oss attri$#ta$e to the res#tin% compan! sha $e carried forward for the #nexpired period of 8 !ears.

,. If $#siness is s#cceeded $! wa! of inheritance, oss of the predecessor from s#ch $#siness can $e carried forward $! the s#ccessor.

8. S-./+o) 7$, "ose! hed compan! can carr! forward oss on! if 81I of &otin% ri%ht is hed $! the same sharehoders.

9. "arr! forward $enefit of $#siness oss9 spec#ation oss9 oss #nder Hcapita %ainsD and oss from the acti&it! of ownin% and maintainin% race horses can $e

a&aied on! if the ret#rn of oss is f#rnished within the d#e date #/s. 1-9/12. This condition does not app! to #na$sor$ed depreciation #/s. -2/22 and oss from

ho#se propert! #/s. ,15.

SUMMAR% OF THE 12

TH

CHAPTER

IB"3C* 1<3C A><I"0AT0<* IB"3C*

1. As per section 1=/12 a%ric#t#re income is exempt from income tax if a%ric#t#ra and is sit#ated in India. If a%ric#t#re and is o#tside India

then the a%ric#t#ra income sha $e taxa$e.

2. 4ower to tax a%ric#t#re income has $een %i&en to state %o&ernments $! the constit#tion of India.

-. ;efinition of a%ric#t#re income is %i&en in section 2/1A2.

4. To term an! acti&it! as a%ric#t#ra acti&it! $oth $asic conditions and s#$seJ#ent conditions ha&e to $e satisfied as was decided $! )" in the

case of <a6a 5ino! R#mar )ahas <o!.

8. Acti&ities which are aied acti&ities to a%ric#t#re s#ch as anima h#s$andr!, dair! farmin%, fisher! etc. are not re%arded as a%ric#t#ra

acti&ities and therefore income from these so#rces are not exempt. The! are taxa$e as income from $#siness and profession.

6. If a partnership is ha&in% main acti&it! of a%ric#t#re then rem#neration and interest recei&ed $! the partners from s#ch firm sha $e re%arded

as a%ric#t#re income and hence not char%ea$e to tax $#t share in the post tax profits of firm is not a%ric#t#re income as was decided $! the

in the case of <. C. "hidam$aram 4iai.

,. Income from sae of r#$$er, coffee and tea sha $e $if#rcated as $#siness income and a%ric#t#re income as per r#e ,, r#e ,5 and r#e 8.

8. In case of Indi&id#a, .01, A34 and 53I a%ric#t#re income and non a%ric#t#re income ha&e to $e c#$$ed to%ether to cac#ate tax on the

non a%ric#t#re income. This sha $e done when a%ric#t#re income exceeds <s. 8=== pa and non a%ric#t#re income exceeds $asic exempt

imit. This eads to partia taxation of a%ric#t#re income.

9. (e can sa! that a%ric#t#re income is not f#! exempt from tax $#t it is partia! taxa$e in some specia cases.

SUMMAR% OF THE 1#

TH

CHAPTER

DEDUCTIONS FROM GTI

1. ;ed#ctions #nder section 8=" to 8=0 are not aowed to $e ded#cted from Aon% Term "apita >ain and cas#a incomes s#ch as winnin% of

Aotteries, races etc.

2. A%%re%ate of a ded#ctions cannot exceed >TI. In other words we can not ha&e oss d#e to ded#ctions.

-. U)*-2 (-./+o) 80C ded#ction sha $e aowed to an indi&id#a /whether resident or non resident2 or .01 /whether resident or non resident2.

Indi&id#a can $e a forei%n nationa.

4. ;ed#ction #nder section 8=" is aowed for sa&in%s and in&estments done. These sa&in%s and in&estments can $e made from taxa$e income

or from exempted income. .owe&er maxim#m ded#ction aowed is <s. 1=====.

8. U)*-2 (-./+o) 80CCC ;ed#ction is a&aia$e on! to an Indi&id#a who can $e either resident or can $e a non-resident or can $e a forei%n

nationa. ;ed#ction is a&aia$e if indi&id#a has in the 4G deposited an! amo#nt o#t of his taxa$e income /which can $e from c#rrent !earDs

income or preceedin% !earDs income2 towards ann#it! pan of AI" or an! other ins#rer for recei&in% pension. Caxim#m ded#ction aowed is

<s. 1=====.

6. U)*-2 (-./+o) 80CCD ded#ction is aowed to indi&id#a who is empo!ee of centra %o&ernment or an! other empo!er, for the contri$#tion

to new pension scheme. ;ed#ction is aowed s#$6ect to maxim#m contri$#tion of 1=I of saar! $! empo!ee and empo!er.

,. A( ;-2 (-./+o) 80CCEE a%%re%ate ded#ction #nder section 8=", 8=""", 8=""; can not $e more than <s. 1=====.

8. U)*-2 (-./+o) 80D ded#ction is aowed to indi&id#a and .01 whether resident or non resident for the medica ins#rance premi#m paid $!

an! mode other cash. ;ed#ction aowed sha $e maxim#m of <s. 18=== $#t in case of senior citi'en <s. 2====.

9. U)*-2 (-./+o) 80DD ded#ction is aowed to indi&id#a and .01 whether resident or non resident for the medica, reha$iitation, n#rsin%

expenses inc#rred for the dependent who is s#fferin% form disa$iit!. ;ed#ction aowed is <s. 8==== $#t in case of se&ere disa$iit!

ded#ction aowed is <s. ,8===.

1=. U)*-2 (-./+o) 80DDB ded#ction is aowed to resident Indi&id#a or resident .01 for the medica expenses inc#rred on the treatment of

dependent. ;ed#ction aowed is maxim#m of <s. 4==== $#t in case of senior citi'en ded#ction aowed is maxim#m of <s. 6====.

11. U)*-2 (-./+o) 80E ded#ction is aowed to resident or non resident indi&id#a for the interest paid on the oan ta:en for the hi%her ed#cation

for the st#dies of sef, spo#se or chidren. 3n! interest is aowed as a ded#ction for the consec#ti&e period of 8 !ears.

12. U)*-2 (-./+o) 80G ded#ction is aowed to a assessees whether resident or non resident for the donations %i&en. Bo ded#ction is aowed

for the donations %i&en in :ind. )ome donations %i&en are aowed 1==I ded#ction and some other are aowed 8=I ded#ction.

1-. U)*-2 (-./+o) 80GG ded#ction is aowed to indi&id#a who is resident or a non resident for the rent paid for a sef occ#pied residentia

ho#se where he is not entited to .<A from his empo!er. Caxim#m ded#ction aowed is <s. 2=== pm.

14. U)*-2 (-./+o) 80GGA ded#ction is aowed to a assesses whether resident or non resident for the 1==I of donations %i&en for scientific

research where assessee is not ha&in% income from $#siness or profession.

18. U)*-2 (-./+o) 80GGB a)* 80GGC ded#ction is aowed for the donations %i&en to poitica part! $! Indian compan! and other assessees.

16. U)*-2 (-./+o) 80KKA ded#ction is aowed for 1==I of profits earned from the $#siness of coection and processin% of $io-de%rada$e

waste. ;ed#ction is aowed to a assessees for consec#ti&e period of 8 !ears.

1,. U)*-2 (-./+o) 80KKAA ded#ction is aowed on! to Indian "ompan! which has the $#siness of man#fact#rin% an! artice or thin%.

;ed#ction aowed is -=I of the saar! for - !ears paid to wor:men who ha&e $een empo!ed after initia 1== wor:men.

18. U)*-2 (-./+o) 80!A ded#ction is aowed to $an:in% companies ha&in% $ranch ocated in offshore area or )*+. ;ed#ction aowed is 1==I

of the profits earned for first 8 !ears and 8=I of the profits earned for next 8 !ears.

19. U)*-2 (-./+o) 80P ded#ction is aowed to co-operati&e societ!.

2=. U)*-2 (-./+o) 80''B ded#ction is aowed to resident indi&id#a who is a professiona a#thor. ;ed#ction aowed is for the ro!at! income

earned from sae of $oo:s s#$6ect to maxim#m of <s. -=====.

21. U)*-2 (-./+o) 80RRB ded#ction is aowed to resident indi&id#a who is an in&entor of a technoo%! which is re%istered #nder 4atents Act

19,=. ;ed#ction aowed is for the ro!at! income earned from s#ch in&ention s#$6ect to maxim#m of <s. -=====.

22. U)*-2 (-./+o) 80U ded#ction is aowed to resident indi&id#a who is s#fferin% from a ph!sica disa$iit!. ;ed#ction aowed is <s. 8====

$#t in case of se&ere disa$iit! ded#ction aowed is <s. ,8===.

SUMMAR% OF THE 1

TH

CHAPTER

EXEMPTED INCOMES

1. S-./+o) 10, A of the foowin% incomes are exempt from tax

1. A%ric#t#re income from and in India.

2. )hare of income of .01 for mem$er of .01.

-. )hare of income of firm for the partner of firm.

4. "ompensation from disasters Uw.e.f section 1= /1=5"2V.

8. Amo#nt recei&ed on the mat#rit! of ife ins#rance poic!.

6. )choarships recei&ed for meetin% cost of ed#cation.

,. Income from awards.

8. Income from di&idends from shares and #nits of m#t#a f#nds.

9. Income from internationa sportin% e&ents.

2. S-./+o) 10A, 4ro&isions for new! esta$ished #nderta:in%s in free trade 'ones, or specia economic 'one.

-. S-./+o) 10AA, )pecia pro&isions in respect of new! esta$ished #nits in specia econom! 'one.

4. S-./+o) 10B, 4ro&isions in respect of new! esta$ished 1==I export oriented #nderta:in%.

8. S-./+o) 10BA, ;ed#ction in respect of export of artistic handmade wooden artices

SUMMAR% OF THE 1&

TH

CHAPTER

ASSESSMENT PROCEDURE

1. SECTION 1#$011, It is comp#sor! for e&er! compan! and a partnership firm to fie its ret#rn of income on or $efore d#e date irrespecti&e of e&e

of income. 1#rther in case of oss aso the! ha&e to fie ret#rn of income in the prescri$ed format.

2. It is comp#sor! for e&er! person other than a compan! and partnership firms to fie ret#rn of income on or $efore the d#e date if his tota Income or

tota income of some other person in respect of which he is assessa$e d#rin% the !ear exceeds the $asic exempt imit.

-. (here the assessee is compan!, partnership firm, a person /other than compan!2 whose acco#nts are reJ#ired to $e a#dited, a co-operati&e, the

person is wor:in% partner of a firm whose acco#nts are reJ#ired to $e a#dited, d#e date is -1/)eptem$er/AG and in an! other case d#e date is -1/

@#!/AG.

4. If an assessee has defa#ted in fiin% ret#rn of income then he sha $e ia$e to pa! interest #nder section 2-4A and to pa! penat! #nder section

2,11.

8. If the <3I is f#rnished after the d#e date or is not f#rnished at a then assessee has to pa! interest #nder section 2-4A K 1I pm or part of the month.

Interest sha $e paid for the period startin% from the date next to the d#e date of <3I and endin% on the date when <3I is fied.

6. S-./+o) 1#$0#1, It is not mandator! to fie a ret#rn of oss, as there is no taxa$e income. .owe&er osses of OBon spec#ati&e $#siness #nder section

,2/12P 9 O)pec#ati&e $#siness #nder section ,-/22 9 O"apita >ains #nder section ,4P 9 Oosses from the acti&it! of ownin% and maintainin% of race

horses #nder section ,4AP can $e carried forward on! if a ret#rn of oss is fied. .owe&er, Aoss #nder O.o#se 4ropert!P and O0na$sor$ed

;epreciationP can $e carried forward e&en if ret#rn of oss is fied after d#e date.

,. S-./+o) 1#$01, If <3I is not fied within the time aowed #/s 1-9/12 the A3 can iss#e a notice reJ#irin% the assessee to f#rnish <3I within the time

specified $! him. If the ret#rn is not f#rnished within time aowed #/s 1-9/12 or within the time aowed #nder notice iss#ed $! A3 sti assessee can

fie <3I and s#ch <3I sha $e :now as $eated ret#rn. 5eated <3I can $e fied $efore7

0+1 *nd of one !ear from the end of ree&ant AG or

0++1 5efore competion of assessment C7+.7-v-2 +( -a26+-2.

8. S-./+o) 1#$0&1, If assessee disco&ers an! omission or wron% statement in ret#rn fied #/s 1-9 /12 or #/s142 /12 he ma! f#rnish a re&ised ret#rn. <3I

can $e re&ised

+1 5efore the end of one !ear from the end of the ree&ant assessment !ear 3<

++1 5efore the competion of assessment C7+.7-v-2 +( -a26+-2.

$. B-6a/-* 2-/52) .a)L/ 3- 2-v+(-* a( Ca( *-.+*-* 3y SC +) .a(- o9 HUMAR KAGDISH CHANDRA SINHA.

10. R-/52) o9 6o(( .a) 3- 2-v+(-* a)* a( 4a)y )543-2 o9 /+4-( a( o)- *-(+2-( 35/ +9 *o)- C+/7+) /7- /+4- 6+4+/ (;-.+9+-*

11. *&er! person who has $een aotted 4AB sha J#ote it7

1. (hie recei&in% income on which T;) has to $e done and sha $e tod to the person doin% T;). This is not reJ#ired where income is not char%ea$e

to tax.

2. In a ret#rn and correspondence with income tax dept.

-. )ae/4#rchase of Cotor ?ehice /*xc#din% 2 wheeers2.

4. )ae/4#rchase of an! immo&a$e propert! for 8 a:hs or more.

8. )ae/4#rchase of sec#rities exceedin% <s. 1 a:hs.

6. Appication for teephone connection.

,. 3penin% of a 5an: Acco#nt.

8. 4a!ment to hotes or resta#rant of $i exceedin% <s. 28,=== at one time.

,. Time deposits with a $an: or post office exceedin% <s.8=,===.

8. 4a!ment in cash for the $an: draft for <s. 8==== or more.

9. "ash deposit of <s. 8==== or more in a $an: in one da!.

1=. 4a!ment in cash exceedin% <s. 28=== in connection with the tra&e to the forei%n co#ntr!.

121 T!pes of ret#rn forms appica$e are7

Fo24 )o. 1orm appica$e to

ITR 1

Indi&id#a ha&in% income from one or more of the foowin% so#rces7

1. )aar!.

2. 1ami! pension.

-. Interest income char%ea$e as income from other so#rces.

ITR 2 An indi&id#a or .01 not ha&in% income #nder the head of 4>54

ITR # An indi&id#a or .01 $ein% a partner in a partnership firm and whose income #nder the head

4>54 comprises on! of interest or rem#neration recei&ed or recei&a$e from that firm.

ITR Indi&id#a or .01 deri&in% income from proprietar! $#siness or profession.

ITR &

An! person other than

1. Indi&id#a

2. .01

-. "ompan!.

4. 4erson for whom IT<L is appica$e

In other words this form is appica$e to partnership firms, A34/53I and artificia 6#ridica

persons.

ITR " "ompan! except that compan! for which IT<, is appica$e.

ITR 7 An! person inc#din% compan! /whether or not re%istered #nder section 28 of the companies act

19862 reJ#ired to fie a ret#rn #nder section 1-9/4A2, /452, /4"2 or /4;2

ITR 8 A person who is not reJ#ired to f#rnish the ret#rn of income $#t is reJ#ired to f#rnish the ret#rn

of frin%e $enefits.

SUMMAR% OF THE 1"

TH

CHAPTER

ADVANCE TAX AND INTEREST PA%AB!E

1. S-./+o) 207, Ad&ance tax is pa!a$e on the income of the c#rrent !ear inc#din% on the income of capita %ains and cas#a incomes.

2. S-./+o) 208, Ad&ance tax is pa!a$e if the income tax after T;) is <s. 8=== or more.

-. S-./+o) 20$, 1rom the income tax ia$iit!, T;) has to $e red#ced and the $aance sha $e pa!a$e as per instaments mentioned in

section 211.

4. S-./+o) 210, income tax is pa!a$e $! the assessee if assessin% officer sends him a notice for the same. This notice can $e sent atest

$! the ast da! of the 1e$r#ar! of the pre&io#s !ear.

8. S-./+o) 211, Ad&ance tax sha $e pa!a$e as per foowin% instaments.

D5- *a/- o9 +)(/a664-)/ A4o5)/ ;aya36-

Co4;a)+-(

3n or $efore 18/=6/4G

3n or $efore 18/=9/4G

3n or $efore 18/12/4G

3n or $efore 18/=-/4G

18I of ad&ance tax pa!a$e

48I of ad&ance tax pa!a$e as red#ced $! an! amo#nt aread! paid.

,8I of ad&ance tax pa!a$e as red#ced $! an! amo#nt aread! paid.

1==I of ad&ance tax pa!a$e as red#ced $! the amo#nt aread! paid.

O/7-2 /7a) Co4;a)+-(

3n or $efore 18/=9/4G

3n or $efore 18/12/4G

3n or $efore 18/=-/4G

-=I of ad&ance tax pa!a$e

6=I of ad&ance tax pa!a$e as red#ced $! an! amo#nt aread! paid.

1==I of ad&ance tax pa!a$e as red#ced $! the amo#nt aread! paid

1. S-./+o) 211B, If assessee does not pa! ad&ance tax when he is ia$e to pa! then he wi $e deemed to $e assessee in defa#t.

2. "onseJ#ences for non-pa!ment of ad&ance tax sha $e

1. Assessee is :nown as assessee in defa#t.

2. Assessee sha $e ia$e to pa! interest #nder section 2-4" and section 2-45.

-. Assessee sha $e ia$e to pa! penat! #nder section 14=A/-2 which can $e maxim#m of 1==I of s#ch tax.

8. S-./+o) 2#A, If the <3I is f#rnished after the d#e date or is not f#rnished at a then assessee has to pa! interest #nder section 2-4A

K 1I pm or part of the month. Interest sha $e paid for the period startin% from the date next to the d#e date of <3I and endin% on

the date when <3I is fied.