Professional Documents

Culture Documents

Corporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD Principle

Uploaded by

Rashmi Ranjan Panigrahi100%(3)100% found this document useful (3 votes)

586 views22 pagesCorporate Governance: Meaning, Historical Perspective, Theoretical basis of CG, CG Mechanism, CG System, Good CG.

Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle, Sarbanes, Oxley act-2002, Indian Committees and guidelines, CII Initiatives.

Original Title

Corporate Governance:CG Mechanism, CG System, Good CG, Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporate Governance: Meaning, Historical Perspective, Theoretical basis of CG, CG Mechanism, CG System, Good CG.

Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle, Sarbanes, Oxley act-2002, Indian Committees and guidelines, CII Initiatives.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

100%(3)100% found this document useful (3 votes)

586 views22 pagesCorporate Governance:CG Mechanism, CG System, Good CG, Land Mark in The Emergence of CG: CG Committees, World Bank On CG, OECD Principle

Uploaded by

Rashmi Ranjan PanigrahiCorporate Governance: Meaning, Historical Perspective, Theoretical basis of CG, CG Mechanism, CG System, Good CG.

Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle, Sarbanes, Oxley act-2002, Indian Committees and guidelines, CII Initiatives.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 22

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Corporate Governance and Business Ethics

UNIT -1:

Corporate Governance: Meaning, Historical Perspective, Issues in CG, Theoretical basis

of CG, CG Mechanism, CG System, Good CG.

Corporate governance is.

A means whereby society can be sure that large corporations are well-run institutions to

which investors and lenders can confidently commit their funds.

Corporate governance are the policies, procedures and rules governing the relationships

between the shareholders, (stakeholders), directors and managers in a company, as defined

by the applicable laws, the corporate charter, the companys bylaws, and formal policies.

!rimarily it is about managing top management, building in checks and balances to ensure

that the senior e"ecutives pursue strategies that are in accordance with the corporate mission.

Corporate governance governs the relationship among the many players involved (the

stakeholders) and the goals for which the corporation is governed.

Corporate governance is the set of processes, customs, policies, laws, and institutions affecting

the way a corporation (or company) is directed, administered or controlled. Corporate

governance also includes the relationships among the many stakeholders involved and the goals

for which the corporation is governed. #he principal stakeholders are the shareholders,

management, and the board of directors. $ther stakeholders include employees, customers,

creditors, suppliers, regulators, and the community at large.

Corporate governance is a multi-faceted sub%ect. An important theme of corporate governance is

to ensure the accountability of certain individuals in an organi&ation through mechanisms that

try to reduce or eliminate the principal-agent problem.

'

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Accountability

Fundamental Pillars of Corporate

Governance

Corporate

Governance

TransparencyResponsibility

Fairness

Accountability

Clarifying governance roles ( responsibilities, and supporting voluntary efforts to ensure the

alignment of managerial and shareholder interests and monitoring by the board of directors

capable of ob%ectivity and sound %udgment.

Transparency

)e*uiring timely disclosure of ade*uate information concerning corporate financial

performance..

Responsibility-: +nsuring that corporations comply with relevant laws and regulations that

reflect the societys values

Fairness-, +nsuring the protection of shareholders rights and the enforceability of contracts

with service-resource providers.

Principles of corporate governance:

.ey elements of good corporate governance principles include honesty, trust and integrity,

openness, performance orientation, responsibility and accountability, mutual respect and

commitment to the organi&ation of importance is how directors and management develop a

model of governance that aligns the values of the corporate participants and then evaluate this

model periodically for its effectiveness. /n particular, senior e"ecutives should conduct

themselves honestly and ethically, especially concerning actual or apparent conflicts of interest,

and disclosure in financial reports.

Commonly accepted principles of corporate governance include:

Rights and equitable treatment of shareholders, $rgani&ations should respect the rights

of shareholders and help shareholders to e"ercise those rights. #hey can help shareholders

e"ercise their rights by effectively communicating information that is understandable and

accessible and encouraging shareholders to participate in general meetings.

0

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Interests of other stakeholders, $rgani&ations should recogni&e that they have legal and

other obligations to all legitimate stakeholders.

Role and responsibilities of the board, #he board needs a range of skills and

understanding to be able to deal with various business issues and have the ability to review

and challenge management performance. /t needs to be of sufficient si&e and have an

appropriate level of commitment to fulfill its responsibilities and duties. #here are issues

about the appropriate mi" of e"ecutive and non-e"ecutive directors.

Integrity and ethical behaviour, +thical and responsible decision making is not only

important for public relations, but it is also a necessary element in risk management and

avoiding lawsuits. $rgani&ations should develop a code of conduct for their directors and

e"ecutives that promotes ethical and responsible decision making. /t is important to

understand, though, that reliance by a company on the integrity and ethics of individuals is

bound to eventual failure. 1ecause of this, many organi&ations establish Compliance and

+thics !rograms to minimi&e the risk that the firm steps outside of ethical and legal

boundaries.

Disclosure and transparency, $rgani&ations should clarify and make publicly known the

roles and responsibilities of board and management to provide shareholders with a level of

accountability. #hey should also implement procedures to independently verify and

safeguard the integrity of the company2s financial reporting. 3isclosure of material matters

concerning the organi&ation should be timely and balanced to ensure that all investors have

access to clear, factual information.

THEORETICAL BASIS OF CORPORATE GOVERNANCE

#here are four broad theories to e"plain and elucidate corporate governance. #hese are, (i)

Agency #heory (ii) 4tewardship #heory (iii) 4takeholder #heory and (iv) 4ociological #heory.

A. AGENCY THEORY

#he fundamental theoretical basis of corporate governance is agency costs. Adam Smith had

identified the agency problem (managerial negligence and profusion). 4hareholders are the

owners and the principals too. #he management, the board, chosen by the shareholders are the

agents. !rincipals may want to carry out the ob%ectives of the company but the agents may not

*uite e"actly match the re*uirements. #he cost of the 5dissonance6 caused by the agency

problem is the agency cost. #here are many a way through which the management go counter to

the ob%ectives of the shareholders such ma"imi&ing shareholder returns. $stentatious life styles

of directors, empire building etc. are e"amples.

#7+ 1A4/4 8$) #7+ A9+:C; #7+$); /4 #7+ 4+!A)A#/$: $8 $<:+)47/! A:3

C$:#)$=.

!)/:C/!A= (47A)+7$=3+)4) $<: #7+ C$>!A:; 1?# #7+ A9+:#4 (>A:A9+)4)

C$:#)$= /#.

>A:A9+)4 >?4# >A@/>/A+ #7+ 47A)+7$=3+)4 <+A=#7.

B

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

#7+ >A/: C$:C+): /4 #$ 3+C+=$! )?=+4 A:3 /:C+:#/C+4, 1A4+3 $: />!=/C/#

+@!=/C/# C$:#)AC#4, #$ +=/>/:A#+ $) A# =+A4#, >/:/>/A+ #7+ C$:8=/C# $8

/:#+)+4#4 1+#<++: $<:+)4 A:3 >A:A9+)4.

#he Agency problem occurs when,

#he desires or a goal of the principal and agent conflict and it is difficult or e"pensive for the

principal to verify that the agent has behaved appropriately.

Example: $ver diversification because increased product diversification leads to lower

employment risk for managers and greater compensation

Solution: !rincipals engage in incentive-based performance contracts, monitoring mechanisms

such as the board of directors and enforcement mechanisms such as the managerial labor market

to mitigate the agency problem

Mechanisms that help reduce agency costs:

1. Fair and accurate financial disclosures

2. Efficient and independent board of directors

B. THE STEWARDSHIP THEORY

#he theory defines situations in which managers are not motivated by individual goals, but

rather they are stewards whose motives are aligned with the ob%ectives of their principals. /t

assumes that managers are trustworthy and have high reputations. #herefore their behavior will

not run counter to the interests of the company. #here is a significant emphasis on the

responsibility of the board to the shareholders in a corporate governance model that is

emboldened by stewardship and trusteeship. #hese concepts of stewardship and trusteeship are

traceable in the scriptures of /ndia and Christendom.

Steward is a person who manages other`s property and financial affairs and is entrusted

with the responsibility of proper utilization and development of organization`s resources.

>A:A9+)4 A4 4#+<A)34

A44?>+3 #$ <$). +88/C/+:#=; A:3 7$:+4#=; /: #7+ /:#+)+4#4 $8 C$>!A:;

A:3 $<:+)4.

4+=8 3/)+C#+3 A:3 >$#/CA#+3 1; 7/97 AC7/+C+>+:#4 A:3 )+4!$:4/1/=/#; /:

3/4C7A)9/:9 #7+ 3?#/+4.

>A:A9+)4 A)+ 9$A= $)/+:#+3

8++= C$:4#)A/:+3 /8 #7+; A)+ C$:#)$==+3 1; $?#4/3+ 3/)+C#$)4

BASIC BEHAVIORAL DIFFERENCES BETWEEN AGENCY & STEWARDSHIP

THEORIES

D

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

4tewardship theory can be reduced to the following basics,

#he theory defines situation in which managers are not motivated by individual goals,

but rather they are stewards whose motives are aligned with the ob%ectives of their

principles.

9iven a choice between self-serving behaviour and pro-organi&ational behavior, a

stewards behaviour will not depart from the interests of his organi&ation.

Control can be potentially counterproductive, because it undermines the pro-

organi&ational behaviour of the steward, by lowering his motivation.

C. THE STAKEHOLDER THEORY

>anagers are responsible to ma"imi&e the total wealth of all stakeholders of the firm, rather

than only the shareholders wealth. /t deals with the common interests of employees,

customers, dealers, government, and the society at large and draws all of them into corporate-

mi". /t is often critici&ed as 5wooly minded liberalism6 because it is not applicable in practice

by companies. 1ut the defense is that managers can act efficiently only by drawing upon the

resources of the stakeholders and as such there is a 5contract6 between the company and the

stakeholders

#he primary feature of the stakeholder theory of corporate governance is that those who have a

stake in the functioning of the firm are made up of large and diverse groups.

4imply put, stakeholders are those who seek some benefit from the optimum running of the

firm. 4takeholders have different goals and seek different benefits from the firm. <orkers seek

%ob security, the /)4 wants its ta" payments, investors want dividends, and the community

wants a solid economic base. #he stakeholder theory holds that these different interests do, in

E

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

fact, control the firm in their own specific ways, and none has any better right to have its voice

heard than any other.

Function-, #he stakeholder theory is both a descriptive and a normative theory. /t is descriptive

in that it functions as a way of describing how a company is constituted and controlled. /n

this case, one can see how customers or investors all have their say in how the firm

markets its products, for e"ample. /t is a normative theory in that it suggests how a firm

should be run.

Benefits-: 4takeholder theory is a highly democratic and participatory concept of corporate

governance. ?nder this model, the firm is not merely a profit-making machine for elite

investors and ma%or e"ecutives. /t is a profoundly social institution that is meant to serve

more than its shareholders. /t is a communal institution that benefits large segments of the

local population. #housands of lives are potentially connected to and dependent upon the

proper workings of the firm.

D. SOCIOLOGICAL THEORY

#he sociological approach has focused mostly on board composition and implications for power

and wealth distribution in the society. ?nder this theory, board composition, financial reporting,

and disclosure and auditing are of utmost importance to reali&e the socio-economic ob%ectives of

corporations.

MECHANISMS AND CONTROLS

Corporate governance mechanisms and controls are designed to reduce the inefficiencies that

arise from moral ha&ard and adverse selection. 8or e"ample, to monitor managers2 behaviour, an

independent third party (the e"ternal auditor) attests the accuracy of information provided by

management to investors. An ideal control system should regulate both motivation and ability.

INTERNAL CORPORATE GOVERNANCE CONTROLS

/nternal corporate governance controls monitor activities and then take corrective action to

accomplish organisational goals. +"amples include,

Monitoring by the board of directors, #he board of directors, with its legal authority to

hire, fire and compensate top management, safeguards invested capital. )egular board

meetings allow potential problems to be identified, discussed and avoided. <hilst non-

e"ecutive directors are thought to be more independent, they may not always result in more

effective corporate governance and may not increase performance.

FGH

3ifferent board

structures are optimal for different firms. >oreover, the ability of the board to monitor the

firm2s e"ecutives is a function of its access to information. +"ecutive directors possess

superior knowledge of the decision-making process and therefore evaluate top management

on the basis of the *uality of its decisions that lead to financial performance outcomes, ex

ante. /t could be argued, therefore, that e"ecutive directors look beyond the financial criteria.

Internal control procedures and internal auditors, /nternal control procedures are

policies implemented by an entity2s board of directors, audit committee, management, and

other personnel to provide reasonable assurance of the entity achieving its ob%ectives related

to reliable financial reporting, operating efficiency, and compliance with laws and

regulations. /nternal auditors are personnel within an organi&ation who test the design and

implementation of the entity2s internal control procedures and the reliability of its financial

reporting

G

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Balance of power, #he simplest balance of power is very commonI re*uire that the

!resident be a different person from the #reasurer. #his application of separation of power is

further developed in companies where separate divisions check and balance each other2s

actions. $ne group may propose company-wide administrative changes, another group

review and can veto the changes, and a third group check that the interests of people

(customers, shareholders, employees) outside the three groups are being met.

Remuneration, !erformance-based remuneration is designed to relate some proportion of

salary to individual performance. /t may be in the form of cash or non-cash payments such

as shares and share options, superannuation or other benefits. 4uch incentive schemes,

however, are reactive in the sense that they provide no mechanism for preventing mistakes

or opportunistic behaviour, and can elicit myopic behaviour.

EXTERNAL CORPORATE GOVERNANCE CONTROLS

+"ternal corporate governance controls encompass the controls e"ternal stakeholders e"ercise

over the organisation. +"amples include,

competition

debt covenants

demand for and assessment of performance information (especially financial statements)

government regulations

managerial labour market

media pressure

takeovers

CORPORATE GOVERNANCE SYSTEM:

#he role of the management is to run the enterprise while the role of the board is to see that it is

being run well and in the right direction. Corporate governance systems vary around the world.

4cholars tend to suggest three broad versions,

#he Anglo-American model

#he 9erman model

#he Japanese model

THE ANGLO-AMERICAN MODEL

#his is also known as unitary board model, in which all directors participate in a single board

comprising both e"ecutive and non-e"ecutive directors in varying proportions. #his approach to

governance tends to be shareholder oriented. /t is also called the KAnglo-4a"on approach to

corporate governance being the basis of corporate governance in America, 1ritain, Canada,

Australia and other Commonwealth law countries including /ndia.

#he ma%or features of this model are as follows,

#he ownership of companies is more or less e*ually divided between individual

shareholders and institutional shareholders.

3irectors are rarely independent of management.

Companies are typically run by professional managers who have negligible ownership

stake. #here is a fairly clear separation of ownership and management.

L

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

>ost institutional investors are reluctant activists. #hey view themselves as portfolio

investors interested in investing in a broadly diversified portfolio of li*uid securities. /f

they are not satisfied with a companys performance, they simply sell the securities in

the market and *uit.

#he disclosure norms are comprehensive, the rules against insider trading tight, and the

penalties for price manipulations stiff, all of which provide ade*uate protection to the

small investors and promote general market li*uidity. #hey also discourage large

investors from taking an active role in corporate governance.

GERMAN MODEL

Corporate governance in the 9erman model is e"ercised through two boards, in which the upper

board supervises the e"ecutive board on behalf of stakeholders and is typically societal oriented.

/n this model, although shareholders own the company, they do not entirely dictate the

governance mechanism. #hey elect EM percent of members of supervisory board and the other

half is appointed by labour unions, ensuring that employees and labourers also en%oy a share in

governance. #he supervisory board appoints and monitors the management board.

THE 1APANESE MODEL

#his is the business network model, which reflects the cultural relationships seen in the Japanese

keiretsu network, in which boards tend to be large, predominantly e"ecutive and often ritualistic.

#he reality of power in the enterprise lies in the relationships between top management in the

companies in the keiretsu network. /n this model the financial institution has accrual role in

governance. #he shareholders and the main bank together appoint board of directors and the

president.

The distinctive features of the Japanese corporate governance mechanisms are as follows,

#he president who consults both the supervisory board and the e"ecutive management is

included.

/mportance of the lending bank is highlighted.

INDIAN MODEL OF GOVERNANCE

/ndian corporate is governed by the Companys Act 'NEG which follows more or less the ?.

model. #he pattern of private companies is mostly that of closely held or dominated by a

founder, his family and associates. /ndia has adopted the key tenets of Anglo-American e"ternal

and internal control mechanisms after economic liberali&ation.

ANGLO AMERICAN GERMAN 1APANESE

4hare holders 4hareholders and employees

-unions

4hareholders and banks

+lects +lects +lects

1oard of 3irectors 4upervisory 1oard 4upervisory 1oard appoints

!resident And !resident

O

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Appoints Appoints Appoints

$fficers-+"ecutive >anagement 1oard +"ecutive 1oard

>anage >anage >anage

Company Company Company

INDIAN MODEL ANGLO AMERICAN MODEL +GERMAN MODEL

ELEMENTS OF GOOD CORPORATE GOVERNANCE

9ood corporate governance is characteri&ed by a firm commitment and adoption of ethical

practices by an organi&ation across its entire value chain and in all of its dealings with a wide

group of stakeholders encompassing employees, customers, vendors, regulators and

shareholders (including the minority shareholders), in both good and bad times. #o achieve this,

certain checks and practices need to be whole-heartedly embraced. 9ood governance deals with

certain obligation to society at large, obligation to investors, obligation to employees, obligation

to customers ( >anagerial obligations which are as follow -,

OBLIGATION TO SOCIETY AT LARGE

A corporation is a creation of law as an association of persons forming part of a society in which

it operates. /ts activities are bound to impact the society as the societys value would have an

impact on the corporation. #herefore, they have mutual rights and obligations to discharge for

the benefit of each other.

National interest: A company (and its management) should ne committed in all its actions

to benefit the economic development of the countries in which it operates and should not

engage in any activity that would militate against such an ob%ective.

Political non-alignment: A company should be committed to and support a functioning

democratic constitution and system with a transparent and fair electoral system and should

not support directly or indirectly any specific political party or candidate for political office.

Legal compliances: #he management of a company should comply with all applicable

government laws, rules and regulations. =egal compliance will also mean that corporations

should abide by the ta" laws of the nations in which they operate and these should be paid

on time and as per the re*uired amount.

Rule of law: 9ood governance re*uires fair, legal frameworks that are enforced impartially.

/t also re*uires full protection of rights, particularly those of minority shareholders. /mpartial

enforcement of laws re*uires an independent %udiciary and regulatory authorities.

Honest and ethical conduct: +very officer of the company including its directors,

e"ecutives and non e"ecutive directors, managing director, C+$, C8$ and CC$ should deal

on behalf of the company with professionalism, honesty, commitment and sincerity as well

as high moral and ethical standards.

Corporate citizenship: A corporate should be committed to be a good corporate citi&en not

only in compliance with all relevant laws and regulations but also by actively assisting in the

N

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

improvement of the *uality of life of the people in the communities in which it operates with

the ob%ective of making them self reliant and en%oy a better *uality of life.

Ethical behaviour: Corporations have a responsibility to set e"emplary standards of ethical

behaviour, both internally within the organi&ations, as well as in their e"ternal relationships.

Social concern, #he Company should have concerns towards the society. /t can help the

needy people ( show its concern by not polluting the water, air ( land. #he waste disposal

should not affect any human or other living creatures.

Healthy and safe working environment: A company should be able to provide a safe and

healthy working environment and comply with the conduct of its business affairs with all

regulations regarding the preservations of environment of the territory it operates in.

Competition: A company should market its products ( services on its own merits ( should

not resort to unethical advertisements or include unfair ( misleading pronouncements on

competitors products ( services.

Timely responsiveness: 9ood governance re*uires that institutions ( processes try to serve

all stakeholders within a reasonable time frame.

Corporations should uphold the fair name of the country.

OBLIGATION TO INVESTORS

#he investors as shareholders and providers of capital are of paramount importance to a

corporation. A company has following obligations to investors,

Towards shareholders: A company should be committed to enhance shareholder value and

comply with all regulations and laws that govern shareholders rights. #he boaErd of

directors of the company shall and fairly inform its shareholders about all relevant aspects of

the companys business and disclose such information in accordance with the respective

regulations and agreements. +very employee shall strive for the implementation of and

compliance with this in his professional environment. 8ailure to adhere to the code could

attract the most severe conse*uences including termination of employment or directorship as

the case may be.

Measures promoting transparency and informed shareholder participation: A related

issue of e*ual importance is the need to bring about greater levels of informed attendance

and meaningful participation by shareholders in matters relating to their companies without

such freedom being abused to interfere with management decision. An ideal corporate

should address this issue and relate it to more meaningful and transparent accounting and

reporting.

#ransparency means that information is freely available and directly accessible to those who

will be affected by such decisions and their enforcement. /t also means that enough

information is provided and that it is provided in easily understandable forms and media.

Financial reporting and records: A company should prepare and maintain accounts of its

business affairs fairly and accurately in accordance with the financial and accounting

reporting standards, laws and regulations of the country in which it conducts the business

affairs.

<ilful material misrepresentation of and-or misinformation on the financial accounts and

reports shall be regarded as the violation of the firms ethical conduct and also will invite

appropriate civil or criminal action under the relevant laws.

OBLIGATION TO EMPLOYEES

'M

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

/n the conte"t of enhanced awareness of better governance practices, managements should

reali&e that they have their obligations towards their workers too.

Fair employment practices: An ideal corporate should provide e*ual access and fair

treatment to all employees on the basis of meritI the success of the company will be

improved while enhancing the progress of individuals and companies. #he applicable labour

and employment laws should be followed wherever it operates.

Equal opportunities: A company should provide e*ual opportunity to all its employees and

all *ualified applicants for employment without regard to their race, caste, religion, colour,

marital status, se", age, nationality and disability.

Humane treatment: Companies should treat employees as their first customers and above

all as human. #hey have to meet the basic needs of all employees in the organi&ation. #here

should be a friendly, healthy and competitive environment for the workers to prove their

ability.

Participation: !articipation of both men and women is a key cornerstone of corporate

governance. !articipation could be either direct or through representatives. /t needs to be

informed and organi&ed. #his means freedom of association and e"pression on one hand and

an organi&ed civil society on the other.

Empowerment: +mpowerment unleashes creativity and innovation throughout the

organi&ation by truly vesting decision making powers at the most appropriate levels in the

organi&ational hierarchy.

Equity and inclusiveness: A corporation is a miniature of a society whose well being

depends on ensuring that all its employees feel that they have a stake in it and do not feel

e"cluded from the main stream. #his re*uires all groups, particularly the most vulnerable,

have opportunities to improve or maintain their well being.

Participative and collaborative environment: #here should not be any form of human

e"ploitation in the company. #here should be e*ual opportunities for all levels of

management in any decision-making. #he management should cultivate the culture where

employees should feel they are secure and are being well taken care of. Collaborative

environment would bring peace and harmony between the working community and the

management, which in turn, brings higher productivity, higher profits and higher market

share.

OBLIGATION TO CUSTOMERS

A companys e"istence cannot be %ustified without its catering to the needs of its customers. #he

companies have an obligation to its employees, without whose assistance they cannot reali&e

their ob%ectives.

Quality of products and services: #he Company should be committed to supply goods and

services of the highest *uality standards, backed by efficient after sales service consistent

with the re*uirements of the customers to ensure their total satisfaction. #he *uality

standards of companys goods and services should meet not only the re*uired national

standards but also should endeavour to achieve international standards.

Products at affordable prices: Companies should ensure that they make available to their

customers *uality goods at affordable prices while making normal profit is %ustifiable,

profiteering and fattening on the miseries of the poor consumers is unacceptable. Companies

must constantly endeavour to update their e"pertise, technology and skills of manpower to

cut down costs and pass on such benefits to customers. #hey should not create a scare in the

midst of scarcity or by themselves create an artificial scarcity to make undue profits.

''

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

Unwavering commitment to customer satisfaction: Companies should be fully committed

to satisfy their customers and earn their goodwill to stay long in the business. #hey should

encourage the warranties and guarantees given on their products and in case of harmful or

sub-standard products should replace them with good ones.

MANAGERIAL OBLIGATIONS

Protecting company`s assets: #he assets of the company should not be dissipated or

misused but invested for the purpose of conducting the business for which they are duly

authori&ed. #hese include tangible as well as intangible assets.

Behaviour toward government agencies: A companys employees should not offer or give

any of the firms funds or property as donation to any government agencies or their

representatives directly or through intermediaries in order to obtain any favourable

performance of official duties.

Control: control is a necessary principal of governance that the freedom of management

should be e"ercised within a framework of appropriate checks and balances. Control should

prevent misuse of power, facilitate timely management response to change and ensure that

business risks are pre-emptively and effectively managed.

Consensus oriented: 9ood governance re*uires mediation of the different interests in

society to reach a broad consensus on what is in the best interest of the whole community

and how this can be achieved.

Gifts and donations: #he Companys employees should neither receive nor make directly

or indirectly any illegal payments, remuneration, gifts, donations or comparable benefits

which are intended to or perceived to obtain business or uncompetitive favours for the

conduct of its business.

Unit- II

=and mark in the emergence of C9, C9 Committees, <orld 1ank on C9, $+C3 !rinciple,

4arbanes, $"ley act-0MM0, /ndian Committees and guidelines, C// /nitiatives.

Landmarks in the Emergence of Corporate Governance

'0

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

$ver a period of time, a change had come in the perception of people about corporate

governance from the e"clusive benefits of shareholders to the benefit of all stakeholders.

Developments in the US -, Corporate governance gained importance in the ?4 after the

<atergate scandal that involved ?4 corporate making political contributions and offering

bribes to government officials.

Developments in the UK -, /n +ngland, seeds of modern corporate governance were sown

in the aftermath of the Bank of Credit and Commerce International (1CC/) scandal.

1CC/, a global bank was made up of holding companies, affiliates, subsidiaries, banks-with-

in-banks. #he 1CC/ entities flagrantly evaded legal restrictions in the movement of capital

and goods almost on a daily routine.

Another landmark that heightened peoples awareness and sensitivity on the issue and

resolve the rot of corporate misdeeds. <hich leads to failure of 1arings 1ank, 1ritains

oldest merchant bank failed because of unhealthy trades on behalf of its customers and lost

P'.D billion and pulled its shutter down.

CG COMMITTEES

#hroughout the ?4, ?., and other countries a number of committees got appointed to

recommend reforms and regulations in corporate governance. #hey are all known by the names

of the individuals that had chaired the committees.

The Cadbury Committee on Corporate Governance, 1992 - Sir Adrian Cadbury

4tated $b%ective was 5to help raise the standards of corporate governance and the level of

confidence in financial reporting and auditing by setting out clearly what it sees as the

respective responsibilities of those involved and what it believes is e"pected of them6.

#he Cadbury committee investigated the accountability of the board of directors to

shareholders and to the society. #he Cadbury Code of best !ractices had 'N

recommendations in the nature of 9uidelines to the board of directors, none"ecutive

directors, e"ecutive directors and such other officials.

CORPORATE GOVERNANCE COMMITTEES

1. Cadbury committee Report

The report was mainly divided into three parts:-

A. )eviewing the structure and responsibilities of 1oards of 3irectors and recommending a

Code of 1est !ractice

'B

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

1. Considering the role of Auditors and addressing a number of recommendations to the

Accountancy !rofession

C. 3ealing with the )ights and )esponsibilities of 4hareholders

A. Reviewing the structure and responsibilities of Boards of Directors and

recommending a Code of Best Practice

1. Board of directors:

meet regularly, retain full and effective control over the company and monitor the

e"ecutive management

balance of power and authority

2. Non-Executive Directors

independent %udgment

independent of management and free from any business

3. Executive Directors

full and clear disclosure of directors total emoluments

4. Financial Reporting and Controls

a balanced and understandable assessment of their companys position should report that the

business

should ensure that an ob%ective and professional relationship is maintained with the auditors.

B. Considering the role of Auditors and addressing a number of

recommendations to the Accountancy Profession

o e"ternal and ob%ective check

o professional and ob%ective relationship between the board of directors and auditors should be

maintained

o to design audit

o regular rotation of audit partners to prevent unhealthy relationship.

Accountancy Profession should take the lead in:-

(i) 3eveloping a set of criteria for assessing effectivenessI

(ii) 3eveloping guidance for companies on the form in which directors should reportI and

(iii) 3eveloping guidance for auditors on relevant audit procedures and the form in which

auditors should report.

C. Dealing with the Rights and Responsibilities of Shareholders

+lect the directors to run the business on their behalf

Appoint the auditors to provide an e"ternal check

Committee2s report places particular emphasis on the need for fair and accurate reporting of a

company2s progress to its shareholders

#$ make greater use of their voting rights and take positive interest in the board functioning

+ffectiveness of general meetings could be increased.

2. The Paul Ruthman Committee

#he committee was constituted later to deal with the said controversial point of Cadbury )eport.

/t watered down the proposal on the grounds of practicality. /t restricted the reporting

re*uirement to internal financial controls only as against 5the effectiveness of the companys

'D

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

system of internal control6 as stipulated by the Code of 1est !ractices contained in the Cadbury

)eport.

#he final report submitted by the Committee chaired by )on 7ampel had some important and

progressive elements, notably the e"tension of directors responsibilities to 5all relevant control

ob%ectives including business risk assessment and minimi&ing the risk of fraudQ.6

3. The Greenbury Committee 1995

#his committee was setup in January 'NNE to identify good practices by the Confederation of

1ritish /ndustry (C1/), in determining directors remuneration and to prepare a code of such

practices for use by public limited companies of ?nited .ingdom.

#he committee aimed to provide an answer to the general concerns about the accountability by

the proper allocation of responsibility for determining directors remuneration, the proper

reporting to shareholders and greater transparency in the process.

#he committee produced the 9reenbury Code of 1est !ractice which was divided into the four

sections, Remmuneration Committee, Disclosures, Remuneration Policy and Service

Contracts and Compensation.

#he 9reenbury committee recommended that ?. companies should implement the code as set

out to the fullest e"tent practicable, that they should make annual compliance statements, and

that investor institutions should use their power to ensure that the best practice is followed.

4. The Hampel Committee 1995

#he 7ampel committee was setup in :ovember 'NNE to promote high standards on Corporate

9overnance both to protect investors and preserve and enhance the standing of companies listed on

the =ondon 4tock +"change. #he committee developed further the Cadbury report. And it made

the following recommendations.

i) The auditors should report on internal control privately to the directors.

ii) The directors maintain and review all controls.

iii) Companies should time to time review their need for internal audit function and control.

/t also introduced the combined code that consolidated the recommendation of earlier corporate

governance reports (Cadbury Committee and 9reenbury Committee).

5. The Combined Code 1998

#he combined code was subse*uently derived from )on 7ampel Committees 8inal )eport,

Cadbury )eport and the 9reenbury )eport. #he combined code is appended to the listing rules

of the =ondon 4tock +"change. As such, compliance of the code is mandatory for all listed

companies in ?.. #he stipulations contained in the Combined Code re*uire, among other

things, that the boards should maintain a sound system of internal control to safeguard

shareholders investments and the companys assets. #he directors should, at least annually,

conduct a review of the effectiveness of the groups system of internal control covering all

controls, including financial, operational and compliance and risk management, and report to

shareholders that they have done so.

6. The Turnbull Committee

#he #urnbull Committee was set up by the /nstitute of Chartered Accountants in +ngland and <ales

(/CA+<) in 'NNN to provide guidance to assist companies in implementing the re*uirements of the

Combined Code relating to internal control.

'E

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

#he committee

!rovided guidance to assist companies in implementing the re*uirements of the Combined

Code relating to internal control.

/t recommended that where companies do not have an internal audit function, the board

should consider the need for carrying out an internal audit annually.

#he committee also recommended that board of directors confirm the e"istence of

procedures for evaluation and managing key risks.

Corporate 9overnance is constantly evolving to reflect the current corporate economic and legal

environment. #o be effective, corporate governance practices need to be tailor to particular

needs, ob%ectives and risk management structure of an organi&ation.

WORLD BANK ON CORPORATE GOVERNANCE

#he <orld 1ank, involved in sustainable development was one of the earliest economic

organi&ation o study the issue of corporate governance and suggest certain guidelines. #he

<orld 1ank report on corporate governance recogni&es the comple"ity of the concept and

focuses on the principles such as transparency, accountability, fairness and responsibility that

are universal in their applications.

Corporate governance is concerned with holding the balance between economic and social goals

and between individual and communal goals. #he governance framework is there to encourage

the efficient use of resources and e*ually to re*uire accountability for the stewardship of those

resources. #he aim is to align as nearly as possible, the interests of individuals, organi&ations

and society.

#he foundation of any corporate governance is disclosure. $penness is the basis of public

confidence in the corporate system and funds will flow to those centers of economic activity,

which inspire trust. #his report points the way to establishment of trust and the encouragement

of enterprise. /t marks an important milestone in the development of corporate governance.

OECD PRINCIPLES

$rgani&ation for +conomic Co-operation and 3evelopment ($+C3) was one of the earliest non-

governmental organi&ations to work on and spell out principles and practices that should govern

corporate in their goal to attain long-term shareholder value.

#he $+C3 were trend setters as the Code of 1est practices are associated with Cadbury report.

#he $+C3 principles in summary include the following elements.

i) #he rights of shareholders

ii) +*uitable treatment of shareholders

iii) )ole of stakeholders in corporate governance

iv) 3isclosure and #ransparency

v) )esponsibilities of the board

i) THE RIGHTS OF SHAREHOLDERS

The corporate governance ra!e"or# sho$l% protect sharehol%ers& rights.

A. 1asic shareholder rights include the right to, ') secure methods of ownership registrationI 0)

convey or transfer sharesI B) obtain relevant information on the corporation on a timely and

regular basisI D) participate and vote in general shareholder meetingsI E) elect members of the

boardI and G) share

'G

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

in the profits of the corporation.

B. 4hareholders have the right to participate in, and to be sufficiently informed on, decisions

concerning fundamental corporate changes such as,

') amendments to the statutes, or articles of incorporation or similar governing documents of the

companyI 0) the authorisation of additional sharesI and B) e"traordinary transactions that in

effect result in the sale of the company.

C. 4hareholders should have the opportunity to participate effectively and vote in general

shareholder meetings and should be informed of the rules, including voting procedures, that

govern general shareholder meetings,

'. 4hareholders should be furnished with sufficient and timely information concerning the date,

location and agenda of general meetings, as well as full and timely information regarding the

issues to be decided at the meeting.

0. $pportunity should be provided for shareholders to ask *uestions of the board and to place

items on the agenda at general meetings, sub%ect to reasonable limitations.

B. 4hareholders should be able to vote in person or in absentia, and e*ual effect should be given

to votes whether cast in person or in absentia.

D. Capital structures and arrangements that enable certain shareholders to obtain a degree of

control disproportionate to their e*uity ownership should be disclosed.

E. >arkets for corporate control should be allowed to function in an efficient and transparent

manner.

F. 4hareholders, including institutional investors, should consider the costs and benefits of

e"ercising their voting rights.

ii) THE EQUITABLE TREATMENT OF SHAREHOLDERS

The corporate governance framework should ensure the equitable treatment of all

shareholders, including minority and foreign shareholders. All shareholders should have

the opportunity to obtain effective redress for violation of their rights.

A. All shareholders of the same class should be treated e*ually.

'. <ithin any class, all shareholders should have the same voting rights. All investors should be

able to obtain information about the voting rights attached to all classes of shares before they

purchase. Any changes in voting rights should be sub%ect to shareholder vote.

0. Cotes should be cast by custodians or nominees in a manner agreed upon with the beneficial

owner of the shares.

B. !rocesses and procedures for general shareholder meetings should allow for e*uitable

treatment of all shareholders. Company procedures should not make it unduly difficult or

e"pensive to cast votes.

B. /nsider trading and abusive self-dealing should be prohibited.

C. >embers of the board and managers should be re*uired to disclose any material interests in

transactions or matters affecting the corporation.

iii) THE ROLE OF STAKEHOLDERS IN CORPORATE GOVERNANCE

The corporate governance ra!e"or# sho$l% recognise the rights o sta#ehol%ers as

establishe% by la" an% enco$rage active co-operation bet"een corporations an% sta#ehol%ers

in creating "ealth' (obs' an% the s$stainability o inancially so$n% enterprises.

A. #he corporate governance framework should assure that the rights of stakeholders that are

protected by law are respected.

'L

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

B. <here stakeholder interests are protected by law, stakeholders should have the opportunity to

obtain effective redress for violation of their rights.

C. #he corporate governance framework should permit performance-enhancing mechanisms for

stakeholder participation.

D. <here stakeholders participate in the corporate governance process, they should have access

to relevant information.

iv) DISCLOSURE AND TRANSPARENCY

#he corporate governance framework should ensure that timely and accurate disclosure is made

on all material matters regarding the corporation, including the financial situation, performance,

ownership, and governance of the company.

A. 3isclosure should include, but not be limited to, material information on,

'. #he financial and operating results of the company.

0. Company ob%ectives.

B. >a%or share ownership and voting rights.

D. >embers of the board and key e"ecutives, and their remuneration.

E. >aterial foreseeable risk factors.

G. >aterial issues regarding employees and other stakeholders.

L. 9overnance structures and policies.

B. /nformation should be prepared, audited, and disclosed in accordance with high *uality

standards of accounting, financial and non-financial disclosure, and audit.

C. An annual audit should be conducted by an independent auditor in order to provide an

e"ternal and ob%ective assurance on the way in which financial statements have been prepared

and presented.

D. Channels for disseminating information should provide for fair, timely and cost-efficient

access to relevant information by users.

v) THE RESPONSIBILITIES OF THE BOARD

#he corporate governance framework should ensure the strategic guidance of the company, the

effective monitoring of management by the board, and the boards accountability to the

company and the shareholders.

A. 1oard members should act on a fully informed basis, in good faith, with due diligence and

care, and in the best interest of the company and the shareholders.

B. <here board decisions may affect different shareholder groups differently, the board should

treat all shareholders fairly.

C. #he board should ensure compliance with applicable law and take into account the interests

of stakeholders.

D. #he board should fulfil certain key functions, including,

'. )eviewing and guiding corporate strategy, ma%or plans of action, risk policy, annual budgets

and business plansI setting performance ob%ectivesI monitoring implementation and corporate

performanceI and overseeing ma%or capital e"penditures, ac*uisitions and divestitures.

0. 4electing, compensating, monitoring and, when necessary, replacing key e"ecutives and

overseeing succession planning.

B. )eviewing key e"ecutive and board remuneration, and ensuring a formal and transparent

board nomination process.

D. >onitoring and managing potential conflicts of interest of management, board members and

shareholders, including misuse of corporate assets and abuse in related party transactions.

'O

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

E. +nsuring the integrity of the corporations accounting and financial reporting systems,

including the independent audit, and that appropriate systems of control are in place, in

particular, systems for monitoring risk, financial control, and compliance with the law.

G. >onitoring the effectiveness of the governance practices under which it operates and making

changes as needed.

L. $verseeing the process of disclosure and communications.

#he $+C3 guidelines are somewhat general and both the Anglo-American system and

Continental +uropean (or 9erman) system would be *uite consistent with it.

SARBANES- OXLEY ACT, 2002

#he 4arbanes-$"ley Act (4$@) is a sincere attempt to address all the issues associated with

corporate failure to achieve *uality governance and to restore investors confidence. #he Act

was formulated to protect investors by improving the accuracy and reliability of corporate

disclosures, made precious to the securities laws and for other purposes. #he act contains a

number of provisions that dramatically change the reporting and corporate directors governance

obligations of public companies, the directors and officers. #he important provisions in the 4$@

Act are briefly given below.

i) Establishment of Public Company Accounting Oversight Board (PCAOB): 4$@ creates a

new board consisting of five members of whom two will be certified public accountants. All

accounting firms have to get registered with the board. #he board will make regular inspection

of firms. #he board will report to 4+C. #he report will be ultimately forwarded to Congress.

ii) Audit Committee: #he 4$@ provides for new improved audit committee. #he committee is

responsible for appointment, fi"ing fees and oversight of the work of independent auditors. #he

registered public accounting firms should report directly to audit committee on all critical

accounting policies.

iii) Conflict of Interest: #he public accounting firms should not perform any audit services for a

publically traded company.

iv) Audit Partner Rotation: #he act provides for mandatory rotation of lead audit or co-ordinating

partner and the partner reviewing audit once every E years.

v) Improper influence on conduct of Audits , According to act, it is unlawful for any e"ecutive or

director of the firm to take any action to fraudulently influence, coerce or manipulate an audit.

vi) Prohibition of non-audit services : ?nder 4$@ act, auditors are prohibited from providing non-

audit services concurrently with audit financial review services.

vii) CEOs and CFOs are required to affirm the financials : C+$s and C8$s are re*uired to

certify the reports filed with the 4ecurities and +"change Commission (4+C).

viii) Loans to Directors: The act prohibits ?4 and foreign companies with 4ecurities traded

within ?4 from making or arranging from third parties any type of personal loan to directors.

'N

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

i") Attorneys : #he attorneys dealing with publicly traded companies are re*uired to report

evidence of material violation of securities law or breach of fiduciary duty or similar violations

by the company or any agent of the company to Chief Counsel or C+$ and if C+$ does not

respond then to the audit committee or the 1oard of 3irectors.

") Securities Analysts: #he 4$@ has provision under which brokers and dealers of securities

should not retaliate or threaten to retaliate an analyst employed by broker or dealer for any

adverse, negative or unfavorable research report on a public company. #he act further provides

for disclosure of conflict of interest by the securities analysts and brokers or dealers.

"i) Penalties: #he penalties are also prescribed under 4$@ act for any wrong doing. #he

penalties are very stiff. #he Act also provides for studies to be conducted by 4ecurities and

+"change

Commission or the 9overnment Accounting $ffice in the following area,

i) Auditors )otation

ii) $ff balance 4heet #ransactions

iii) Consolidation of Accounting firms ( its impact on industry

iv) )ole of Credit )ating /ndustry

v) )ole of /nvestment 1ank and 8inancial Advisers.

INDIAN COMMITTEES AND GUIDELINES & CII INITIATIVES

Corporate Governance Initiatives in India / Historical Perspective/ Corporate Governance

of India Has Undergone A Paradigm Shift

#here have been several ma%or corporate governance initiatives launched in /ndia since the mid-

'NNMs. #he FIRST was by the Confederation of /ndian /ndustry (C//), /ndias largest industry

and business association, which came up with the first voluntary code of corporate governance

in 'NNO. #he SECOND was by the 4+1/, now enshrined as Clause DN of the listing agreement.

#he THIRD was the :aresh Chandra Committee, which submitted its report in 0MM0. #he

FOURTH was again by 4+1/ R the :arayana >urthy Committee, which also submitted its

report in 0MM0. 1ased on some of the recommendation of this committee, 4+1/ revised Clause

DN of the listing agreement in August 0MMB. 4ubse*uently, 4+1/ withdrew the revised Clause DN

in 3ecember 0MMB, and currently, the original Clause DN. FIFTH was )ecent 3evelopments in

/ndia C// #askforce on Corporate 9overnance 0MMN SIXTH was Corporate 9overnance

Coluntary 9uidelines 0MMN.

1. THE CII CODE- :

>ore than a year before the onset of the Asian crisis, C// set up a committee to e"amine

corporate governance issues, and recommend a voluntary code of best practices. #he committee

was driven by the conviction that good corporate governance was essential for /ndian companies

to access domestic as well as global capital at competitive rates. #he first draft of the code was

prepared by April 'NNL, and the final document (3esirable Corporate 9overnance, A Code),

was publicly released in April 'NNO. #he code was voluntary, contained detailed provisions, and

focused on listed companies.

0M

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

2. KUMAR MANGALAM BIRLA COMMITTEE REPORT AND CLAUSE 49-:

<hile the C// code was well-received and some progressive companies adopted it, it was 8elt

that under /ndian conditions a statutory rather than a voluntary code would be more !urposeful,

and meaningful. Conse*uently, the second ma%or corporate governance initiative in the country

was undertaken by 4+1/. /n early 'NNN, it set up a committee under .umar >angalam 1irla to

promote and raise the standards of good corporate governance. /n early 0MMM, the 4+1/ board

had accepted and ratified key recommendations of this committee, and these were incorporated

into Clause DN of the =isting Agreement of the 4tock +"changes.

3. THE NARESH CHANDRA COMMITTEE REPORT ON CORPORATE GOVERNANCE-:

#he :aresh Chandra committee was appointed in August 0MM0 by the 3epartment of Company

Affairs (3CA) under the >inistry of 8inance and Company Affairs to e"amine various

corporate governance issues. #he Committee submitted its report in 3ecember 0MM0. /t made

recommendations in two key aspects of corporate governance, financial and non-financial

disclosures, and independent auditing and board oversight of management.

4. NARAYANA MURTHY COMMITTEE REPORT ON CORPORATE GOVERNANCE-:

#he fourth initiative on corporate governance in /ndia is in the form of the recommendations of

the :arayana >urthy committee. #he committee was set up by 4+1/, under the chairmanship of

>r. :. ). :arayana >urthy, to review Clause DN, and suggest measures to improve corporate

governance standards. 4ome of the ma%or recommendations of the committee primarily related

to audit committees, audit reports, independent directors, related party transactions, risk

management, directorships and director compensation, codes of conduct and financial

disclosures.

5. CII TASKFORCE ON CORPORATE GOVERNANCE 2009-:

4atyam is a one-off incident - especially considering the si&e of the malfeasance. #he

overwhelming ma%ority of corporate /ndia is well run, well regulated and does business in a

sound and legal manner. 7owever, the 4atyam episode has prompted a relook at our corporate

governance norms and how industry can go a step further through some voluntary measures.

<ith this in mind, the C// set up a #ask 8orce under >r. :aresh Chandra in 8ebruary 0MMN to

recommend ways of further improving corporate governance standards and practices both in

letter and spirit. #he report enumerates a set of voluntary recommendations with an ob%ective to

establish higher standards of probity and corporate governance in the country.

#he recommendations in brief are as under,

1. Appointment of Independent

Director

a. Nomination Committee

2. Duties, liabilities and

remuneration of independent

directors

a. Letter of Appointment to

Directors

b. Fixed Contractual

Remuneration

c. Structure of Compensation to

NEDs

3. Remuneration Committee of

Board

4. Audit Committee of Board

5. Separation of the offices of the

Chairman and the Chief Executive

Officer

6. Attending Board and Committee

Meetings through Tele-

conferencing and

Video conferencing

7. Executive Sessions of

Independent Director

0'

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

CORPORATE GOVERNANCE MFC 4TH SEM.

ARYA SCHOOL OF MANAGEMRENT & IT,

BBSR

8. Role of board in shareholders

and related party transactions

9. Auditor Company

Relationship

10. Independence to Auditors

11. Certificate of Independence

12. Auditor Partner Rotation

13. Auditor Liability

14. Appointment of Auditors

15. Qualifications of Auditors

Report

16. Whistle Blowing Policy

17. Risk Management Framework

18. The legal and regulatory

standards

19. Capability of Regulatory

Agencies - Ensuring Quality in

Audit Process

20. Effective and Credible

Enforcement

21. Confiscation of Shares

22. Personal Liability

23. Liability of Directors and

Employees

24. Institutional Activism

25. Media as a stakeholder

According to the report, much of best-in-class corporate governance is

voluntary of companies taking conscious decisions of going beyond the

mere letter of law.

6. CORPORATE GOVERNANCE VOLUNTARY GUIDELINES 2009

>ore recently, in 3ecember 0MMN, the >inistry of Corporate Affairs (>CA)

published a new set of 5Corporate 9overnance Coluntary 9uidelines 0MMN6,

designed to encourage companies to adopt better practices in the running of

boards and board committees, the appointment and rotation of e"ternal

auditors, and creating a whistle blowing mechanism. #he guidelines are divided

into the following si" parts,

'. 1oard of 3irectors

0. )esponsibilities of the 1oard

B. Audit Committee of the 1oard

D. Auditors

E. 4ecretarial Audit

G. /nstitution of mechanism for <histle 1lowing

#hese guidelines provide for a set of good practices which may be voluntarily

adopted by the !ublic companies. !rivate companies, particularly the bigger

ones, may also like to adopt these guidelines. #he guidelines are not intended to

be a substitute for or additions to the e"isting laws but are recommendatory in

nature.

00

MR. RASHMIRAN1AN PANIGRAHI, LECTURER IN FINANCE, ASMIT

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Corporate Governance- Corporate Governance: Meaning, Historical Perspective, Theoretical basis of CG, CG Mechanism, CG System, Good CG,Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle, Sarbanes, Oxley act-2002Document23 pagesCorporate Governance- Corporate Governance: Meaning, Historical Perspective, Theoretical basis of CG, CG Mechanism, CG System, Good CG,Land mark in the emergence of CG: CG Committees, World Bank on CG, OECD Principle, Sarbanes, Oxley act-2002Rashmi Ranjan PanigrahiNo ratings yet

- The Human in Human ResourceFrom EverandThe Human in Human ResourceNo ratings yet

- Pre Issue ManagementDocument19 pagesPre Issue Managementbs_sharathNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Q. 16 Functions of A Merchant BankerDocument3 pagesQ. 16 Functions of A Merchant BankerMAHENDRA SHIVAJI DHENAKNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- The Leadership Shift: How to Lead Successful Transformations in the New NormalFrom EverandThe Leadership Shift: How to Lead Successful Transformations in the New NormalNo ratings yet

- AUDIT BasicDocument10 pagesAUDIT BasicKingo StreamNo ratings yet

- Financial Management in Psu'sDocument14 pagesFinancial Management in Psu'sAkshaya Mali100% (1)

- Mba III Financial Services (14mbafm302) NotesDocument93 pagesMba III Financial Services (14mbafm302) NotesSyeda GazalaNo ratings yet

- Issue ManagementDocument30 pagesIssue Managementmohanbkp100% (2)

- Ethics NotesDocument52 pagesEthics NotesRam KrishnaNo ratings yet

- Steps in A Pre and Post Public IssueDocument8 pagesSteps in A Pre and Post Public Issuearmailgm100% (1)

- OB-Workplace ViolenceDocument16 pagesOB-Workplace ViolenceNeha ShelkeNo ratings yet

- Factors Influencing Business EthicsDocument16 pagesFactors Influencing Business EthicsAparna Devi67% (3)

- Project Report On "Types of Allowances and Their Permissible LimitsDocument34 pagesProject Report On "Types of Allowances and Their Permissible LimitsPooja Jain100% (1)

- Increased Concern of HRMDocument30 pagesIncreased Concern of HRMAishwarya Chachad33% (3)

- MBFS Question Bank & AnswersDocument17 pagesMBFS Question Bank & AnswersArunkumar JwNo ratings yet

- Auditing VouchingDocument6 pagesAuditing VouchingDivakara ReddyNo ratings yet

- Role and Responsibilities of Independent DirectorsDocument31 pagesRole and Responsibilities of Independent DirectorsLavina ChandwaniNo ratings yet

- Principles of ManagementDocument8 pagesPrinciples of Managementecemurali210% (1)

- Management Accounting 5th SemDocument24 pagesManagement Accounting 5th SemNeha firdoseNo ratings yet

- 10.methods of Cost VariabilityDocument14 pages10.methods of Cost VariabilityNeel Gupta100% (1)

- HDFC Life InsuranceDocument68 pagesHDFC Life InsuranceAnand ChavanNo ratings yet

- Working Capital Management of EscortDocument74 pagesWorking Capital Management of EscortKavita NadarNo ratings yet

- Role of Auditors in Corporate GovernanceDocument9 pagesRole of Auditors in Corporate GovernanceDevansh SrivastavaNo ratings yet

- Unit - 5 (Special Areas of Audit)Document3 pagesUnit - 5 (Special Areas of Audit)Meghaa KabraNo ratings yet

- Notes On Consumer MotivationDocument13 pagesNotes On Consumer MotivationPalak AgarwalNo ratings yet

- Presentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDDocument12 pagesPresentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDEra ChaudharyNo ratings yet

- PCA & RD Bank PDFDocument86 pagesPCA & RD Bank PDFmohan ks100% (2)

- Systematic Risk of Select Banking Scripts Traded in NSE MBA ProjectDocument83 pagesSystematic Risk of Select Banking Scripts Traded in NSE MBA ProjectSuresh Raghav100% (2)

- Ethics Unit I NotesDocument43 pagesEthics Unit I NotesscubhaNo ratings yet

- Final Project On SaharaDocument196 pagesFinal Project On SaharaDevika SarkarNo ratings yet

- Company Secretaryship Training Project Report: Amalgamations & Mergers - A Detailed AnalysisDocument31 pagesCompany Secretaryship Training Project Report: Amalgamations & Mergers - A Detailed Analysissony pandiaNo ratings yet

- Risk ManagementDocument35 pagesRisk Managementfafese7300No ratings yet

- Working Capital Black BookDocument35 pagesWorking Capital Black Bookomprakash shindeNo ratings yet

- FM Sheet 4 (JUHI RAJWANI)Document8 pagesFM Sheet 4 (JUHI RAJWANI)Mukesh SinghNo ratings yet

- Entrepreneurship Development NotesDocument11 pagesEntrepreneurship Development Notessourav kumar ray100% (1)

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- Synergy and DysergyDocument2 pagesSynergy and DysergyTitus ClementNo ratings yet

- Recruitment, SelectionDocument63 pagesRecruitment, SelectionAkshay Shah100% (1)

- CCA Current Cost Accounting Theory 2021Document4 pagesCCA Current Cost Accounting Theory 2021PradeepNo ratings yet

- Portfolio Performance EvaluationDocument15 pagesPortfolio Performance EvaluationMohd NizamNo ratings yet

- Social Relevance Project-2Document62 pagesSocial Relevance Project-2DivyeshNo ratings yet

- SBI NPA SynopsisDocument4 pagesSBI NPA SynopsisDon Iz BackNo ratings yet

- Resource Planning in A Development BankDocument16 pagesResource Planning in A Development BankLaveena BachaniNo ratings yet

- Unit-Iii Fundamental AnalysisDocument36 pagesUnit-Iii Fundamental Analysisharesh KNo ratings yet

- HRM NotesDocument63 pagesHRM NotesDhananjay Sharma100% (1)

- CHP 2 - Issue ManagementDocument32 pagesCHP 2 - Issue ManagementFalguni MathewsNo ratings yet

- Nature and Significance of Capital Market ClsDocument20 pagesNature and Significance of Capital Market ClsSneha Bajpai100% (2)

- Research Report On HRMDocument40 pagesResearch Report On HRMFaizan Billoo KhanNo ratings yet

- Project CertificateDocument79 pagesProject CertificatemahenderNo ratings yet

- Synopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceDocument3 pagesSynopsis of WORKING CAPITAL ANALYSIS of Bajaj Allianz Life InsuranceHemchandra KhoisnamNo ratings yet

- Innovative Financial Instrument - FinalDocument6 pagesInnovative Financial Instrument - FinalRinse JohnNo ratings yet

- Manegerial Economics For Quick RevisionDocument220 pagesManegerial Economics For Quick Revisionamritha_dixitNo ratings yet

- Corporate Governance - MargaretDocument37 pagesCorporate Governance - MargaretMargaret BrittoNo ratings yet

- Corporate Governance MAINDocument26 pagesCorporate Governance MAINAditya SawantNo ratings yet

- Rashmi1 3498Document1,545 pagesRashmi1 3498Rashmi Ranjan Panigrahi50% (2)

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Document8 pagesGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiNo ratings yet

- Foreign Institutional Investors - A STUDY OF Indian Firms & Investors PDFDocument10 pagesForeign Institutional Investors - A STUDY OF Indian Firms & Investors PDFRashmi Ranjan PanigrahiNo ratings yet

- DEMONETIZATION at Innovations Cashless PDFDocument8 pagesDEMONETIZATION at Innovations Cashless PDFRashmi Ranjan PanigrahiNo ratings yet

- Basel Iii PDFDocument141 pagesBasel Iii PDFprashant1kumar1malviNo ratings yet

- Question of Environmental StudiesDocument3 pagesQuestion of Environmental StudiesRashmi Ranjan PanigrahiNo ratings yet

- MCQ Questions For MFCDocument4 pagesMCQ Questions For MFCRashmi Ranjan PanigrahiNo ratings yet

- Gouranga Final Project 3Document108 pagesGouranga Final Project 3Rashmi Ranjan PanigrahiNo ratings yet

- ArabunisaDocument11 pagesArabunisaRashmi Ranjan PanigrahiNo ratings yet

- Principle of Business Management (4 Year Question)Document2 pagesPrinciple of Business Management (4 Year Question)Rashmi Ranjan Panigrahi100% (1)

- Rules For Melodi On (Antakshari)Document3 pagesRules For Melodi On (Antakshari)Rashmi Ranjan Panigrahi100% (1)

- Arya School of Management & It: Event-: B Quiz (Final Round)Document4 pagesArya School of Management & It: Event-: B Quiz (Final Round)Rashmi Ranjan PanigrahiNo ratings yet

- Shalu 1Document10 pagesShalu 1Rashmi Ranjan PanigrahiNo ratings yet

- B S M, Docx Unit-3Document15 pagesB S M, Docx Unit-3Rashmi Ranjan PanigrahiNo ratings yet

- Business Ethics: Course ObjectivesDocument2 pagesBusiness Ethics: Course ObjectivesRashmi Ranjan PanigrahiNo ratings yet

- MCQ Questions For MFCDocument4 pagesMCQ Questions For MFCRashmi Ranjan PanigrahiNo ratings yet

- Lecture Notes On Environmental Studies: Institute of Aeronautical EngineeringDocument72 pagesLecture Notes On Environmental Studies: Institute of Aeronautical EngineeringRashmi Ranjan PanigrahiNo ratings yet

- Business EthicsDocument10 pagesBusiness EthicsRashmi Ranjan Panigrahi100% (1)

- My Projet EditedDocument57 pagesMy Projet EditedRashmi Ranjan PanigrahiNo ratings yet

- Shalu 1Document10 pagesShalu 1Rashmi Ranjan PanigrahiNo ratings yet

- BCC 602-Principles and Practice of AuditingDocument3 pagesBCC 602-Principles and Practice of AuditingRashmi Ranjan PanigrahiNo ratings yet

- MB0048-Q2. A. Linear Programming Is A Mathematical Technique of Optimizing A LinearDocument3 pagesMB0048-Q2. A. Linear Programming Is A Mathematical Technique of Optimizing A LinearRashmi Ranjan Panigrahi100% (1)

- Seminar Presentation On MAKE in INDIADocument7 pagesSeminar Presentation On MAKE in INDIARashmi Ranjan PanigrahiNo ratings yet

- Project Report On Performance Appraisal of BSNLDocument71 pagesProject Report On Performance Appraisal of BSNLRashmi Ranjan Panigrahi100% (1)

- BS 02Document32 pagesBS 02Rashmi Ranjan PanigrahiNo ratings yet

- Principle of Business Management (4 Year Question)Document2 pagesPrinciple of Business Management (4 Year Question)Rashmi Ranjan PanigrahiNo ratings yet

- Rules For Melodi On (Antakshari)Document3 pagesRules For Melodi On (Antakshari)Rashmi Ranjan Panigrahi100% (1)

- Creation of CreditDocument9 pagesCreation of CreditRashmi Ranjan PanigrahiNo ratings yet

- Melodi On - (Antakshari)Document19 pagesMelodi On - (Antakshari)Rashmi Ranjan PanigrahiNo ratings yet

- Project Synopsis Of"financial Performance AnalysisDocument5 pagesProject Synopsis Of"financial Performance AnalysisRashmi Ranjan Panigrahi100% (3)

- Mathematical Modeling in Finance: Assignment # 01Document10 pagesMathematical Modeling in Finance: Assignment # 01Shahban ktkNo ratings yet

- BSBDIV501 Assessment 1Document7 pagesBSBDIV501 Assessment 1Junio Braga100% (3)

- Pastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesDocument2 pagesPastor Bonus Seminary: Fr. Ramon Barua, S.J. Street, Tetuan, P.O. Box 15 7000 Zamboanga City PhilippinesJeremiah Marvin ChuaNo ratings yet

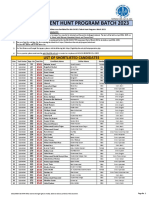

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- Safety Data Sheet: Ubstance and Ource DentificationDocument6 pagesSafety Data Sheet: Ubstance and Ource DentificationMuhNo ratings yet

- Classroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFDocument4 pagesClassroom Objects Vocabulary Esl Unscramble The Words Worksheets For Kids PDFLocky HammerNo ratings yet

- Salary and Leave Policy in IndiaDocument7 pagesSalary and Leave Policy in IndiaAditya SrivastawaNo ratings yet

- Florentino V SupervalueDocument2 pagesFlorentino V SupervalueVener Angelo MargalloNo ratings yet