Professional Documents

Culture Documents

Walmart

Uploaded by

Syed Hussam Haider Tirmazi0 ratings0% found this document useful (0 votes)

68 views19 pagesFinal Paper

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinal Paper

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views19 pagesWalmart

Uploaded by

Syed Hussam Haider TirmaziFinal Paper

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 19

1

Wal-Marts Strategic Plan

Presented By

Samantha Akkad, Tina Chelune, Christina Coppola,

Serina Lacey and Amanda Sentelle

BMGT495-7380

University of Maryland; University College

Professor Christian Berger

November 22, 2011

2

Table of Contents

Company Background 3

Vision & Mission Statement 3

Industry Analysis 4

Competitive Analysis 5

Financial Analysis 6

SWOT & QSPM Analysis 6

Strategy Recommendation 7

Action Plan 9

Conclusion 10

Appendix One- External Factor Evaluation Matrix for Walmart 11

Appendix Two- Internal Factor Evaluation Matrix for Walmart 12

Appendix Three- Walmarts Competitive Profile Matrix (CPM) 13

Appendix Four- Financial Ratios 2010 Fiscal Year 14

Appendix Five- Walmart SWOT Matrix 15

Appendix Six- Porter Five Forces Model 16

Appendix Seven-Action Plan 17

References 18

3

Company Background

Wal-Mart was founded in 1962 by Sam Walton with the first store opening in Rogers,

Arkansas. Incorporated on October 31, 1969 and became publicly traded in 1972. What Sam

Walton set out to accomplish when opening the first Wal-Mart store in 1962 was to save people

money and to help them live better. Wal-Mart serves customers more than 200 million times per

week at over 9,800 retail outlets located in 28 countries (Walmart, 2011). Retail outlets offer a

wide variety of products, with stores having over 30 departments of general merchandise and full

service grocery outlets. This has made Wal-Mart a leader in the general merchandise industry as

well as a top competitor in the grocery industry.

Vision & Mission Statement

The mission statement of Wal-Mart reflects the purpose that Sam Walton set out to

accomplish in 1962. Wal-Marts mission statement is simple and straight forward: Saving

people money to help them live better was the goal that Sam Walton envisioned when he opened

the doors to the first Walmart

. This focus drives everything we do at Walmart. And, for the

millions of customers who shop in our stores around the world each week, it means they can

trust that our brand means we have everyday low prices. (Walmart, 2011).

According to essential components of a mission statement, there are minor changes that

could be made to enhance the current mission statement. Below is the enhanced mission

statement, followed by reasons for some of the changes recommended.

To save people money so they can live better by becoming a one-stop shop for all their

needs. Improving customers shopping experience with up-to-date technology while

reinvesting our profits for future growth and prosperity. Creating inspired employees and

4

offering a wide variety of quality products at low prices; all while being environmentally

friendly and supporting the communities we are located in.

Wal-Marts current mission statement is simple and mentions nothing about what is sold or

offered to customers. An improvement would be: by becoming a one-stop shop for all their

needs. Wal-Mart addresses nothing about technology but should include improving customers

shopping experience with up-to-date technology. Once more, Wal-Marts mission statement

lacks concerns for growth and profitability; so another change is: reinvesting our profits for

future growth and prosperity. Wal-Marts mission statement lacks concern for public image, so

the following is proposed: all while being environmentally friendly and supporting the

communities we are located in. The company does not currently have a vision statement, but the

mission statement can effectively guide employee behavior and decision making to integrate

company values into all aspects of the business.

Industry Analysis

Wal-Mart has many internal and external factors that are key to being successful. The

three important opportunities effecting Walmart are to increase online sales, open new

stores/supercenters and offer a wider variety of items. Without opening new stores, Wal-Mart

stands to lose market share. Increased demand for lower prices and product variety has driven

consumers to internet shopping. Wal-Mart needs to focus on marketing to these customers in

order to retain business from consumers not visiting retail stores. Wal-Mart also needs to focus

on converting regular stores to supercenters to provide more product variety. Some threats that

Wal-Mart faces: fierce competition from competitors. Increases in raw material prices pose a

threat to Wal-Mart as products rise in price if raw materials increase. Wal-Mart faces the threat

of government intervention in trade. This could affect the relationship with suppliers and cause

5

higher prices if tariffs are imposed. Depressed economies have caused lower consumer spending.

With less spending, consumers are substituting brand name products with cheaper products. The

external factor evaluation for Wal-Mart shows that strategists need to focus on many of the

opportunities that could increase sales and need to be aware and manage external threats.

There are also internal factors that help executives make the best decisions about projects.

First, the income and sales figures increasing is a central factor. Without increased revenues, the

company will not have funding to expand or convert outlets into superstores. The strong global

supply chain that Wal-Mart has is also vital; without these relationships Wal-Mart would not be

able to provide low priced products. Limited access to international markets is a weakness that

Wal-Mart faces because currently most of the market share is centered in the US. Another

weakness is high turnover rate of employees which causes gaps in customer service and loss of

customers. High inventory levels cause large amounts of cash to be tied up, which prevents

expansion. Therefore, Wal-Mart has many strengths and weaknesses that can help strategists

plan for current and future business ventures.

Competitive Analysis

The Porter Five Forces model indicates several areas of high level concern. Rivalry

among competing firms, potential for substitute products, and bargaining power of consumers

are all high. Entry of new competitors is an area of lesser concern due to high barriers entering

the industry. Suppliers are a midlevel concern due to competition and risk when dealing with

suppliers abroad. Upon studying the competitive profile matrix, Wal-Mart has the highest

weighted score when compared to competitors. Wal-Mart leads the way in the most important

factors, including advertising and global expansion. Target is a large competitor that should be

6

followed closely. In product quality, Target appears to be the highest, but Wal-Mart has the best

score in market share (See Appendix 3).

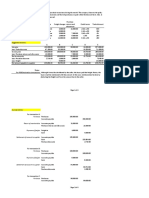

Financial Analysis

Many of Wal-Marts financial ratios can forecast the companys future performance. (See

Appendix 4). The quick and current ratios show some concern that Wal-Mart will not be able to

meet all short term obligations. With low ratios in these areas the company shows that it cannot

meet short term obligations without depending on constant sales of inventories. The assets and

liabilities to net worth ratios show that while Wal-Mart is only slightly higher than desired, it

could put the companys creditors at risk in a situation where sales fall. The assets to sales ratio

shows that Wal-Mart is moving their inventory at a normal speed compared to the industry

average. Low percentage in the accounts payable to sales ratio shows Wal-Mart is not using

suppliers to finance operations. With low return numbers in the profitability ratios, Wal-Mart is

not in a position to handle downturns in sales without running the risk of financial trouble.

Overall, Wal-Marts financials and ratios show the company has increased profits over

the last ten years, there is still work needed to improve their financial position. If these changes

are not made, any recessionary periods could cause Wal-Mart to breakdown financially and

default on payments. Wal-Mart needs to develop new strategies to increase sales.

SWOT & QSPM Analysis

Wal-Mart represents powerful retail brand as noted in the SWOT Analysis in Appendix

Five. Their strong brand presence, customer loyalty, and drive to expand globally can help the

company to grow. Because Wal-Mart is trying to obtain an international presence, the focus on

improving their internal weaknesses so that opportunities do not bypass them is vital. To do this,

7

increasing the online presence should offset their high inventory. Wal-Mart could penetrate the

international market with their discount retail chain.

Wal-Mart can take advantage of their strengths in order to reduce the impact of external

threats. The company could use their brand image and low prices to market to different segments

of consumers. They could look at backward integration to get even lower prices on goods for its

customers. As a part of the WT strategy, they could look into products that are being made in the

U.S. to provide more jobs to Americans and to avoid unethical labor laws abroad. Lastly, they

could offer those living in small towns better jobs and benefits in order to gain their approval of

entering their community with new retail outlets.

According to the QSPM analysis, Wal-Mart should focus on backward integration in

order to better control their suppliers. By doing so, Wal-Mart could reduce the cost of producing

goods to consumers. Consumers will get more for their money as reduced manufacturing costs

reflect prices in stores. Also, Wal-Mart can use backward integration in order to build

relationships with suppliers who manufacture higher quality goods. Consumers today want low

prices, but also want quality products that will last.

Strategy Recommendation

For Wal-Mart to maintain its title as a retail leader, it must constantly develop and

implement new strategies to address present and future obstacles. CNN Money recently stated

that Wal-Marts, chief rival Target has been beating Wal-Marts prices on some groceries and

household products (Kavilanz, 2011). This intense competition illustrates the need for Wal-

Mart to develop alternative strategies, in areas of integration, intensity, and diversification.

Integration strategies allow Wal-Mart to gain capable suppliers, acquire mergers and

acquisitions, and remain competitive amongst their rivals. Wal-Mart should consider both

8

backward integration and a horizontal integration. A backward integration allows Wal-Mart to

increase control of the firms suppliers. This benefits the organization by reducing costs,

increasing quality, and gaining greater control of suppliers. Horizontal integration allows Wal-

Mart to benefit from mergers and acquisitions.

Wal-Mart can benefit from intensive strategies through the use of market penetration,

market development, and product development. Wal-Mart has an edge over its competitors

through market penetration by running marketing ads and offering discounts or rollbacks.

Market development can benefit Wal-Mart through entrance into emerging markets. Lastly, Wal-

Mart can focus its effort in product development to increase the quality of its products. Next,

Wal-Mart should consider related and unrelated diversification to continue its mission to be a

one-stop-shop for customers. These approaches allow Wal-Mart to remain competitive by

offering a wider variety of products, brands, and services. A greater variety of options available

in one location offers convenience to customers and increases revenues.

Strategy selection must be based on the incorporation of several factors. The financial

analysis gives a picture that Wal-Mart should better position itself to address financial

obligations and work to increase sales. This is supported by the fact that, Wal-Mart has

struggled with seven straight quarters of sales declines in its stores. (Kavilanz, 2011) Thus,

when determining a strategy, the organization must consider its financial flexibility and the

effects it faces in sales from the economic recession.

Wal-Mart can benefit from opportunities such as increasing online shopping, opening

new stores and supercenters, and offering a wide variety of products. Therefore, Wal-Mart

should focus on further expansion of its online shopping and greater entrance into new markets.

Wal-Marts products can be enhanced through greater availability with online shopping. The

9

website currently offers over, 1,000,000 products, plus easy-to-use music downloads, and one

hour photo service. (Walmart, 2011) Wal-Mart should seek opportunities for mergers and

acquisitions with retailers in markets such as India or China. Wal-Mart has only 352 retail units

in China and 9 in India. (Walmart, 2011) This is minimal when compared to over 30,000

locations in the US. Wal-Mart must utilize strategies of horizontal and backward integration,

market development, and product development. The objective is to offer a variety of low priced

consumer goods to global markets, both in store and online, and reduce dependence on only a

few markets areas.

Action Plan

Wal-Mart will continue to refine the e-commerce website by adding products daily, as

well as include new services like online books and movies. The forecasted sales from these

services range from $25 to $45 billion. Wal-Mart should invest in training managers to be sent

overseas to work with international suppliers. This would bridge the gap in communication with

leadership and provide greater efficiency, decreases in excess inventory, and increased profits.

These profits are achieved by clearer communication, less error in product development, reduced

manufacturing costs, and hands on information about production processes (Zager, 2009). These

changes have a combined net profit of over $10.5 billion dollars and should take about three

years from application to evaluation. The risks include the costs of making new online products

and services available, and the threat of increased taxes and tariffs. The plan is to mitigate these

risks first by ensuring R&D provides detailed information about the potential profits from adding

the new products and services. By conducting thorough research on the countrys business

standards and confirming that the benefits outweigh the costs, additional risks will be minimized.

Building a good rapport with manufacturing countries and their management will avoid risks. To

10

determine the timeline of events, task assignments, specific metrics, risk and risk mitigation

please refer to Appendix Seven.

Conclusion

While developing a strategic plan to address Wal-Marts objectives for the future, several

factors must be considered. These include financial constraints, growing competition, economic

downturn, and growing threats of government interventions in trade. Despite this, the

organization must work to seize opportunities in the areas of online shopping, new global stores

and supercenters, and offering an increased variety of products online. Therefore, collaboration

of the two strategies of backward integration and related diversification of products must be

used. The related diversification strategy allows Wal-Mart to provide more services and products

on their website which increases on-line sales. Similarly, backward integration, allows Wal-

Mart to develop stronger relationships with suppliers in an effort to reduce costs.

11

Appendix One

External Factor Evaluation Matrix for Walmart

Key External Factors Weight Rating Weighted

Score

Opportunities

1. Increase online shopping .10 3 .3

2. Economic conditions cause greater demand for

low priced products

.07 2 .14

3. Increased use of mobile/social marketing to

increase purchasing by consumers

.05 2 .10

4. Growth plan to open new supercenters in US &

abroad

.10 4 .40

5. Conversion of regular stores into Supercenters .08 3 .24

6. Wide variety of products available to consumers .10 3 .3

7. Decline in consumer loyalty to one store for

needs based purchases

.05 2 .10

Threats

8. Increased competition from online retailers .07 4 .28

9. Product substitution .05 2 .10

10. Economic Downtown-lower consumer spending .07 2 .14

11. Raw material increases can cause product price

increases

.07 3 .21

12. Government regulations on trade/importing .04 2 .08

13. Political problems in foreign governments .04 2 .08

14. Currency Fluctuation .04 2 .08

15. Consumer opposition to opening new stores in

small towns

.07 1 .07

Total 1.0 2.62

12

Appendix Two

Internal Factor Evaluation Matrix for Walmart

Key Internal Factors Weight Rating Weighted

Score

Strengths

1. Powerful Retail Brand .08 4 .32

2. Diverse Workforce .05 3 .15

3. Competitive Benefits Package .05 4 .20

4. Provide thousands with first job/skills training

each year

.03 3 .09

5. 75% of store managers were promoted from

within

.05 3 .15

6. Sales and Net Income increased over past 10

years

.10 4 .40

7. Strong buyback program for stock with over 1

million shares being purchased back each year

.07 4 .28

8. Strong Global Supply Chain .09 4 .36

Weaknesses

9. High levels of inventory .07 1 .07

10. Sell products manufactured in countries with

unethical labor laws

.04 2 .08

11. Strong consumer dislike for putting smaller

community retailers out of business

.05 1 .05

12. Many part time staff not receiving benefits .04 2 .08

13. Standardized approach for each country .04 1 .04

14. Sensitive to government trade regulations .06 1 .06

15. Limited access to international markets .09 1 .09

16. High employee turnover rates .09 1 .09

Total 1.0 2.51

13

Appendix Three

Walmarts Competitive Profile Matrix (CPM)

Walmart Target K-Mart

Critical Success

Factors

Weight Rating Weighted

Score

Rating Weighted

Score

Rating Weighted

Score

Advertising 0.20 4 0.80 3 0.60 2 0.40

Product Quality 0.10 2 0.20 4 0.40 3 0.30

Price

Competitiveness

0.10 1 0.10 1 0.10 1 0.10

Management 0.50 3 0.15 4 0.20 3 0.15

Financial

Position

0.10 4 0.40 3 0.30 2 0.20

Customer

Loyalty

0.10 4 0.40 3 0.30 1 0.10

Global

Expansion

0.10 4 0.40 1 0.10 2 0.20

Inventory

Systems

0.10 3 0.30 3 0.30 3 0.30

Market Share 0.05 4 0.20 3 0.15 2 0.10

Customer

Service

0.10 3 0.30 4 0.40 3 0.30

TOTAL 1.00 3.25 2.85 2.15

14

Appendix Four

Financial Ratios 2010 Fiscal Year

Ratios Walmart Industry

Quick Ratio .2 .7

Current Ratio .9 2.9

Current Liabilities to Net Worth 31.2% 34.9%

Total Liabilities to Net Worth 59.9% 53.7%

Fixed Assets to Net Worth 82.5% 26.1%

Collection Period Days 4 Days 4.8 Days

Sales to Inventory Ratio 11.62 5.1

Assets to Sales Ratio 42.8% 45.2%

Sales to Net Working Capital 64.00 5.1

Accounts Payable to Sales Ratio 7.9% 4.9%

Return on Sales Ratio 4.0% 2.2%

Return on Assets Ratio 9.4% 5.3%

Return on Net Worth Ratio 24.8% 9.3%

(Forbes.com, 2011)

15

Appendix Five

SWOT Matrix

Strengths Weaknesses

1.Powerful Retail Brand 1. High levels of inventory

2. Diverse Workforce 2. Sell products

manufactured in

countries w/ unethical

labor laws

3. Competitive Benefit Package 3. Putting smaller retailers

out of business

4. Provides thousands of jobs 4. Standardized approach

and skills training

5. 75% of store managers 5. Sensitive to government

promoted from within trade regulations

6. Sales & Net Income 6. Limited access to int'l

increased over past 10 yrs. Markets

7. Strong global supply chain 7. High employee

turnover rate

Opportunities SO Strategies WO Strategies

1. Increase online shopping 1. Mergers and acquisitions 1. Increase online

presence to offset high

inventory

2. Demand for low price 2. Use social media to increase 2. Open new stores

products brand image and loyalty globally

3. Increased use of social 3. Use benefit package to

marketing to reach consumers facilitate growth in market

4. Growth plan for supercenters in

U.S. and abroad

5. Conversion of regular stores

into supercenters

6. Wide variety of products

7. Decline in consumer loyalty

to one store for necessities

Threats ST Strategies WT Strategies

1. Increased competition from 1. Use brand and "rollback" 1. Manufacture more in

online retailers to bring in customers the U.S.

2. Product substitution 2. Use backward integration 2. Create a more sound

to reduce costs market globally

3. Economic downturn-lower 3. Supply jobs to small towns

consumer spending to gain loyalty to brand

4. Raw material increase can

cause product price increase

5. Political problems in foreign

governments

6. Currency fluctuation

7. Opposition of new stores in small

Towns

16

Appendix Six

Porter Five Forces Model

Rivalry among

competing firms

Potential entry of new competitors:

We should always be on the lookout for new

companies entering the market. Barriers to this

industry are low due to many on-line stores that can

reach out to a very broad audience. Some on-line

grocery stores deliver directly to peoples homes

which can be a potential threat to Wal-Mart.

Potential development of substitute

products:

Although Wal-Mart has cheaper

products, we can easily have items

substituted by other stores; therefore,

potential threat of substitutes is

relatively high. Wal-Mart offers name

brand clothing in our stores for less than

other retail stores. In contrast, many

retail stores are now offering rewards to

shop. Consumers may just substitute

Wal-Marts prices to get the rewards

from other stores.

Bargaining power of consumers:

This is very high because of the current state of the economy.

Consumers are shopping around more in hopes to find the same

items for less. Consumers can easily compare item pricing on-line

or from their phone. This can hurt store loyalty but the consumer

wants the best prices available to them.

Bargaining power of suppliers:

Wal-Mart should be working hand in

hand with their suppliers in an effort to

benefit both Wal-Mart and the supplier.

Wal-Mart can shop around for suppliers

who meet their standards, but this may

not be easy to come by especially since

they need many different suppliers due

to their wide variety of merchandising.

17

Appendix Seven

Action Plan

Metrics Related Diversification (Expanding Online Shopping Services)

Sales over 18 month period should range from

$25,000,000 to $450,000,000

Industry averages on similar sales during the

same 18 month period

Backward Integration

Supply costs decrease 10% in first year

Reduce error in product development to 2%

Reduced manufacturing costs by 9%

Overall product price decrease 6%

Excess inventory decrease by 11%

Risks &

Corresponding

Risk Mitigation

Plan

Risks

Costs of making

new online

products/services

available

Threat of increase

taxes and tariffs for

moving

management

overseas

Corresponding Risk Mitigation Plan

Ensure R&Ds projected profits for

adding new products/services

outweigh costs

Conduct thorough research on the

countries business standards for such

a move of American workers and

ensuring benefits outweigh the costs,

as well as build good rapport with

manufacturing countries and leaders

Year 1 Year 2 Year 3

R&D to start on new online services and find requirements

for sending Management overseas (18 m.)

Seek contracts with publishers and

movie studios to offer books and

movies online. (18 m.)

HR to hire/select employees to work with suppliers

overseas and determine whether to contract training or

create it (1 yr.).

Web designers post new products/

services online (18 m.)

Begin training overseas management

(18 m.)

HR to relocate management

to global suppliers (1 y.)

Finance measures growth

to forecasts and reports to

CEO (1yr.)

18

References

Fish Info & Services Co.Ltd, (2011). Wal-Mart / Wal-Mart Stores, Inc. Supermarket -

Headquarter. Retrieved from

http://fis.com/fis/companies/details.asp?l=e&company_id=154597

Forbes.com (2011). Walmart Stock Report. Retrieved from

http://finapps.forbes.com/finapps/jsp/finance/compinfo/FinancialIndustrial.jsp?tkr=wmt&

period=qtr

Kavilanz, P. (2011).CNN Money. Walmart: Our shoppers are running out of money Retrieved

from

http://money.cnn.com/2011/04/27/news/companies/walmart_ceo_consumers_under_pres

sure/index.htm

Kavilanz, P. (2011).CNN Money. Walmarts ready to do battle. Retrieved from

http://money.cnn.com/2011/04/11/news/companies/walmart_prices_products_changes/in

dex.htm?iid=EAL

Rapid Business Intelligence Success. (2008). Examples of Vision Statements. Retrieved from

http://www.rapid-business-intelligence-success.com/examples-of-vision-statements.html

Target.com (2011). Creating Diversity. Retrieved from

http://sites.target.com/site/en/company/page.jsp?contentId=WCMP04-031762

Walmart (2011). Corporate Facts Sheet. Retrieved from

http://walmartstores.com/pressroom/factsheets/

WalMart Corporate (2011). About us. Retrieved from https://walmartstores.com/AboutUs/

Walmartstores.com (2008). 2008 Annual Report. Retrieved from

http://walmartstores.com/sites/annualreport/2008/docs/wal_mart_annual_report_2008.pdf

19

Zager, Marsha. (7 Oct 2009). For The Children's Place, Complexity Is Child's Play. Apparel:

Technology and Business Insight. Retrieved from http://apparel.edgl.com/news/For-The-

Children-s-Place,-Complexity-Is-Child-s-Play63004

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Business Restructuring and Industrial SicknessDocument4 pagesBusiness Restructuring and Industrial SicknessSyed Hussam Haider TirmaziNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- APA FormattingDocument59 pagesAPA FormattingSyed Hussam Haider TirmaziNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Purdue Owl-Apa Sample PaperDocument11 pagesPurdue Owl-Apa Sample PaperCalvin WirawanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Cost of CapitalDocument12 pagesCost of CapitalSyed Hussam Haider TirmaziNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Practice Problems: Chapter 11, Supply-Chain Management: Problem 1Document2 pagesPractice Problems: Chapter 11, Supply-Chain Management: Problem 1Richar Copacondori QuispeNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Supply Chain Management 2Document3 pagesSupply Chain Management 2Syed Hussam Haider TirmaziNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Firm Case AnalysisDocument10 pagesFirm Case Analysis411hhapNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Standard CostingDocument65 pagesStandard CostingSyed Hussam Haider Tirmazi100% (2)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Human Resource Management PresentationDocument14 pagesHuman Resource Management PresentationSyed Hussam Haider TirmaziNo ratings yet

- Pest AnalsisDocument28 pagesPest AnalsisSyed Hussam Haider TirmaziNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Managerial AccountingDocument30 pagesManagerial AccountingSyed Hussam Haider TirmaziNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- CPMDocument3 pagesCPMSyed Hussam Haider TirmaziNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Competitive Profile MatrixDocument1 pageThe Competitive Profile MatrixCik aNaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- IndividualsDocument5 pagesIndividualsSyed Hussam Haider TirmaziNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Secondary DataDocument19 pagesSecondary DataSyed Hussam Haider TirmaziNo ratings yet

- Principles of ManagementDocument23 pagesPrinciples of ManagementSyed Hussam Haider TirmaziNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Principles of ManagementDocument23 pagesPrinciples of ManagementSyed Hussam Haider TirmaziNo ratings yet

- Organizational Planning Goal SettingDocument29 pagesOrganizational Planning Goal SettingSyed Hussam Haider Tirmazi75% (4)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Pros of CapitalismDocument2 pagesThe Pros of CapitalismSyed Hussam Haider Tirmazi0% (1)

- Ten Manager Roles AssignmentDocument5 pagesTen Manager Roles AssignmentSyed Hussam Haider Tirmazi0% (1)

- C MMMMM MM MMMM MMMMDocument4 pagesC MMMMM MM MMMM MMMMSyed Hussam Haider TirmaziNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Are You Ready To Start A BusinessDocument40 pagesAre You Ready To Start A BusinessSyed Hussam Haider Tirmazi100% (1)

- What Is StevedoringDocument10 pagesWhat Is StevedoringMinhaj KmNo ratings yet

- PTPL Ir 2018Document383 pagesPTPL Ir 2018Guan WenhaiNo ratings yet

- ESUR Guidelines 10.0 Final VersionDocument46 pagesESUR Guidelines 10.0 Final Versionkon shireNo ratings yet

- Business English IDocument8 pagesBusiness English ILarbi Ben TamaNo ratings yet

- Thesis Final 2 Number c1-c5Document167 pagesThesis Final 2 Number c1-c5Kimverly DomaganNo ratings yet

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Free Vibration of SDOFDocument2 pagesFree Vibration of SDOFjajajajNo ratings yet

- Lesson Plan - Organization and ManagementDocument5 pagesLesson Plan - Organization and ManagementBilly Joe80% (15)

- LADA Niva 1600rebuild1Document39 pagesLADA Niva 1600rebuild1Douglas Antonio Paredes MarquinaNo ratings yet

- North-South Railway Project - South LineDocument49 pagesNorth-South Railway Project - South LinesuperNo ratings yet

- Grade 7 - R & C - Where Tigers Swim - JanDocument15 pagesGrade 7 - R & C - Where Tigers Swim - JanKritti Vivek100% (3)

- Service Instruction Selection of Suitable Operating Fluids For ROTAX Engine Type 916 I (Series), 915 I (Series), 912 I (Series), 912 and 914 (Series)Document15 pagesService Instruction Selection of Suitable Operating Fluids For ROTAX Engine Type 916 I (Series), 915 I (Series), 912 I (Series), 912 and 914 (Series)Martin PilatiNo ratings yet

- Commissioning 1. Commissioning: ES200 EasyDocument4 pagesCommissioning 1. Commissioning: ES200 EasyMamdoh EshahatNo ratings yet

- New Life in Christ - Vol05 - Engl - Teacher GuideDocument29 pagesNew Life in Christ - Vol05 - Engl - Teacher GuideOliver Angus100% (1)

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Pset 2Document13 pagesPset 2rishiko aquinoNo ratings yet

- NCS V5 1.0 Layer Name FormatDocument4 pagesNCS V5 1.0 Layer Name FormatGouhar NayabNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hatchery Practice: InternationalDocument40 pagesHatchery Practice: Internationalabhe prasetyaNo ratings yet

- Report Text The Duck Billed Platypus: (Ornithorhynchus Anatinus)Document2 pagesReport Text The Duck Billed Platypus: (Ornithorhynchus Anatinus)Lilis IndriyaniNo ratings yet

- Pengaruh Promosi Dan Brand Image (Citra Produk) Terhadap Loyalitas Pembelian Produk Pepsodent Di Ramayana Plaza, Jalan Aksara, Medan Dita AmanahDocument13 pagesPengaruh Promosi Dan Brand Image (Citra Produk) Terhadap Loyalitas Pembelian Produk Pepsodent Di Ramayana Plaza, Jalan Aksara, Medan Dita AmanahAhmad HerdandiNo ratings yet

- Republic of The Philippines Department of Education Deped Complex, Pasig City Science Iii K To 12 Curriculum Guide Planner / Budget of WorkDocument3 pagesRepublic of The Philippines Department of Education Deped Complex, Pasig City Science Iii K To 12 Curriculum Guide Planner / Budget of WorkLedie Lou Cetoy SuperalesNo ratings yet

- 3.6 A 40Nm Cmos Highly Linear 0.4-To-6Ghz Receiver Resilient To 0Dbm Out-Of-Band BlockersDocument3 pages3.6 A 40Nm Cmos Highly Linear 0.4-To-6Ghz Receiver Resilient To 0Dbm Out-Of-Band Blockershaoyue huangNo ratings yet

- Doyennés Et Granges de L'abbaye de Cluny (A. Guerreau)Document45 pagesDoyennés Et Granges de L'abbaye de Cluny (A. Guerreau)theseus11No ratings yet

- My TestDocument18 pagesMy TestBlessmore Chitanha100% (1)

- Historic Trial of Ali Brothers and Shankaracharya-1921Document276 pagesHistoric Trial of Ali Brothers and Shankaracharya-1921Sampath Bulusu100% (3)

- Competency #14 Ay 2022-2023 Social StudiesDocument22 pagesCompetency #14 Ay 2022-2023 Social StudiesCharis RebanalNo ratings yet

- Andre Bazin, The Ontology of The Photographic Image From His Book What Is Cinema Vol. IDocument8 pagesAndre Bazin, The Ontology of The Photographic Image From His Book What Is Cinema Vol. IAnkit LadiaNo ratings yet

- Lac MapehDocument4 pagesLac MapehChristina Yssabelle100% (1)

- Vertical Transportation: Commercial, Hotel, Hospital, Etc)Document5 pagesVertical Transportation: Commercial, Hotel, Hospital, Etc)fdarchitectNo ratings yet

- Lecture 4 EMADocument36 pagesLecture 4 EMAYai IbrahimNo ratings yet

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessFrom EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessRating: 5 out of 5 stars5/5 (456)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesFrom EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesRating: 5 out of 5 stars5/5 (1635)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsFrom EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsRating: 4.5 out of 5 stars4.5/5 (383)

- Summary of 12 Rules for Life: An Antidote to ChaosFrom EverandSummary of 12 Rules for Life: An Antidote to ChaosRating: 4.5 out of 5 stars4.5/5 (294)