Professional Documents

Culture Documents

Aviva Life Insurance

Uploaded by

umashankarsinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva Life Insurance

Uploaded by

umashankarsinghCopyright:

Available Formats

5/14/2014 Aviva Life Insurance

http://www.six-steps.in/webpqis/Result.aspx 1/3

Aviva Lif e Insurance Company India Limited

Premium Quotation

V ersion Number: 49.0

Prepared on: 14/5/2014

Proposed Date of Commencement:14/5/2014

Proposal Number:

A ge of the Child (On DOC):0Years

A ge of the Life I nsured (Parent):35Years

Gender of the Life I nsured (Parent): Male

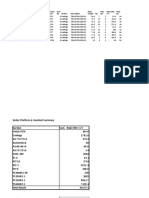

Product Features

1. Name of the Product: A viva Young Scholar Secure

2. UI N:122N092V 02

3. Plan Option: Diamond

4. Premium Paying Frequency: A nnual

5. Premium as per Plan Option:100,000

6. Maturity Sum A ssured :2,550,000

7. Cover Description and Premium:

Coverage

Sum

Assured

Coverage

Term

Premium

Payment

Term

Modal

Premium

Service

Tax

(Year

1)

Service

Tax

(Year 2

onwards)

Total

Amount

(Year 1)

Total

Amount

(Year 2

onwards)

Base Cover 2550000 21 13 100000 3090 1545 103090 101545

A viva Term

Plus Rider

Not

Opted

Total A mount :103,090 101,545

Illustration Benef its

Policy Year Annualised

Premium

(excl Rider

Premium,

taxes and any

other extra

premium)

Guaranteed

Survival Benef it

(At year end)

Guaranteed

Death Benef it

(Base Plan During

the year)

Guaranteed

Maturity

Benef it

(At year end)

Guaranteed

Surrender

Value (GSV)

Special Surrender

Value (SSV)

(At year end)

1 100,000 2,550,000

2 100,000 2,550,000 60,000 105,923

3 100,000 2,550,000 90,000 176,538

4 100,000 2,550,000 200,000 258,923

5 100,000 2,550,000 250,000 353,077

6 100,000 2,550,000 300,000 447,231

7 100,000 2,550,000 350,000 549,231

8 100,000 2,550,000 400,000 659,077

9 100,000 2,550,000 513,000 776,769

10 100,000 2,550,000 650,000 921,923

11 100,000 2,550,000 737,000 1,100,423

12 100,000 2,550,000 900,000 1,294,615

13 100,000 40,000 2,550,000 974,000 1,455,800

14 40,000 2,550,000 960,000 1,531,400

15 40,000 2,550,000 1,050,000 1,603,800

16 40,000 2,550,000 1,075,000 1,720,800

17 40,000 2,550,000 1,100,000 1,786,000

18 250,000 2,550,000 1,045,000 1,680,000

19 2,550,000 1,175,000 1,806,000

20 2,550,000 1,305,000 1,953,000

21 2,550,000 2,100,000 1,435,000 2,100,000

Notes:

1. A ll the benefits shown in the above table are guaranteed provided all the due premiums are paid.

2. Service Tax or any other applicable taxes will be charged and/or deducted on/from the premium at the prevailing

rate. Tax laws are subject to change.

3. I n case of A viva Term Plus Rider, rider cover ceases from the policy anniversary when life insured attains age 70

years last birthday or at the end of Premium Paying Term (PPT), whichever is earlier.

4. This illustration does not include any additional premium payable due to underwriting.

5. The policy will acquire a minimum guaranteed surrender value provided all due premiums of first two policy years

have been paid. Guaranteed Surrender V alue (GSV ) equal to GSV factor X all premiums paid till date of surrender

5/14/2014 Aviva Life Insurance

http://www.six-steps.in/webpqis/Result.aspx 2/3

excluding rider premium, extra premium and taxes, if any less survival benefits already paid, if any.

6. I f all due premiums pertaining to the first two policy years have not been paid before the expiry of the grace

period, the policy will lapse without acquiring any paid-up value and all risk covers will cease.

7. I f a lapsed policy is not revived within the Revival Period of two years, then 30% of all the premiums paid

(excluding rider premium, extra premium and taxes, if any) will be payable at the end of the revival period and the

policy will be terminated.

8. I f death of the Life I nsured occurs under a lapsed policy, 30% of all the premiums paid (excluding rider premium,

extra premium and taxes, if any) will be payable and the policy will terminate.

9. For more details on Benefits and terms & conditions please read sales brochure carefully before concluding a

sale.

I ______________________, having received the information with respect to the above, have understood the above

statement before entering into the contract.

Signature of I ntermediary

Place:

Date:

Policyholders Signature:

Place:

Date:

Aviva Young Scholar Secure

Important points you must know about this policy

What is Aviva Young Scholar

Secure?

Aviva Young Scholar Secure is a lif e insurance plan that helps you secure your childs education by

giving you guaranteed lump sum payouts f or your childs high school, college admission & post-

graduation expenses.

What is the guarantee under this

plan?

The death benefit and payouts for educational milestones for the child are guaranteed if all due

premiums have been paid.

What is the Term of this policy?

The policy term would be equal to 21 minus the entry age of child.

Your policy term is True years.

What are the Premium Payment

Term options under this plan?

The Premium Paying Term would depend on the age of the child:

For entry age 0 to 8 of child: 13 minus age of child

For entry age 9 to 12 of child: Fixed 5 years

The premium payment frequency allowed is Yearly, Half-Yearly and Monthly (For monthly mode only

ECS or Direct Debit is allowed).

Since your childs age is 0 years, you will have to pay premiums regularly f or years at Annual

f requency as opted by you.

What are the benef its under this

plan?

Death Benef it:Death Sum A ssured will be paid immediately and the policy will continue without any

liability to pay future premiums till maturity for the benefit of your child. A ll survival benefits will

continue to be paid as per schedule.

Survival & Maturity Benef it:

TFS: Tuition Fee Support Paid every year starting end of premium paying term till age 17 of child

CAF: College Admission Fund A t age 18 of child

HER: Higher Education Reserve Maturity at age 21 of child

The payments are made on the policy anniversary after the child attains the specified payout age.

Please ref er to the Key Feature brochure f or details

Rider Benef its: A re applicable as per the riders opted by you

What happens if I stop paying

my premiums?

I f you discontinue paying premiums before atleast first two policy year's premiums have been paid,

the policy will be lapsed without any benefit or value.

I f you discontinue paying premiums after atleast first two policy years premiums have been paid,

your policy becomes a paid-up policy with reduced sum assured i.e. Paid up sum assured and will

acquire Paid up value.

Please ref er to the Key Feature brochure f or details.

Can I cash in (surrender) the

policy during the term of the

policy?

You do have an option to cash-in (surrender) this policy provided all due premiums of at least two

policy years have been paid. The surrender amount will be less than the amount of premiums paid in

most cases.

Please ref er the Key Feature brochure f or details.

What is not covered under this

policy (Exclusions)?

I n case of your death due to suicide within 12 months:

1. from the date of inception of the policy, your nominee or beneficiary shall be entitled to 80%

of the premiums paid excluding any payment for taxes, rider premium and extra premiums,

provided the policy is in force, or

5/14/2014 Aviva Life Insurance

http://www.six-steps.in/webpqis/Result.aspx 3/3

2. from the date of revival of the policy, your nominee or beneficiary shall be entitled to an

amount which is higher of 80% of the premiums paid excluding any payment for taxes, rider

premium and extra premiums or the Surrender V alue as available on the date of death.

Do I have a right to review my

purchase?

You have Freelook Period of 15 days from the date of receipt of the policy document. I f you disagree

to any of those terms or conditions, you have option to return the policy stating the reason of your

objection, then you shall be entitled to a refund of the premium paid after deducting expenses

incurred on medicals, if any, and stamp duty.

We request you to personally f ill the proposal f orm and provide accurate inf ormation to ensure that your claim is not reduced or

declined because of non-disclosure or misrepresentation of inf ormation.

Please note: A viva is not liable for any claim until receipt of premium in full, completion of underwriting and acceptance of risk.

This document does not contain the full terms and conditions of the Policy.Details of the terms and conditions, and exclusions of

the insurance contract are contained in the Key Feature brochure. I t is important that you read the entire Key Feature brochure.

I confirm that I have read the Key Feature brochure and the Official I llustration of the insurance product along with this document and

understand the features such as policy benefits, premium payable including the number of years for which premium is required to be

paid, lock-in period, whether any guarantee is available and if yes then subject to what conditions.

Signature of the Proposer

Signature of Life A ssured

(I n case different from Proposer)

Proposer name Name of Life A ssured

Proposal number Proposal Date

You might also like

- 25 Premium Calculation For Life-InsuranceDocument2 pages25 Premium Calculation For Life-Insuranceanujsharma0001No ratings yet

- Insurance PolicyDocument13 pagesInsurance PolicyMeAnn TumbagaNo ratings yet

- Aviation Fuelling Liability PdsDocument3 pagesAviation Fuelling Liability PdsNoraini Mohd Shariff100% (1)

- Reinsurance Glossary 3Document68 pagesReinsurance Glossary 3أبو أنس - اليمنNo ratings yet

- Rate Making: How Insurance Premiums Are SetDocument4 pagesRate Making: How Insurance Premiums Are SetSai Teja NadellaNo ratings yet

- Elements of Good Life Insurance PolicyDocument4 pagesElements of Good Life Insurance PolicySaumya JaiswalNo ratings yet

- Benefits, Compensation and RetirementDocument59 pagesBenefits, Compensation and RetirementAndrew NeuberNo ratings yet

- Keyman Insurance Policy-White PaperDocument12 pagesKeyman Insurance Policy-White PaperbeingviswaNo ratings yet

- Sector Risk Assessment For Registered BanksDocument56 pagesSector Risk Assessment For Registered BanksmutasimNo ratings yet

- Group InsuranceDocument17 pagesGroup InsurancerahulNo ratings yet

- Insurance BehaviourDocument21 pagesInsurance Behaviourmohini vaityNo ratings yet

- InsuranceDocument29 pagesInsuranceAzifNo ratings yet

- Project On Maxlife InsuranceDocument41 pagesProject On Maxlife Insurancejigna kelaNo ratings yet

- Pre-Contract Training Course (PCTC) : GlossaryDocument12 pagesPre-Contract Training Course (PCTC) : Glossaryazire carlosNo ratings yet

- Tata AIA Life Insurance Smart Sampoorna Raksha TandCDocument31 pagesTata AIA Life Insurance Smart Sampoorna Raksha TandCAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Project InsuranceDocument13 pagesProject InsuranceRohan Raj MishraNo ratings yet

- Patuck Gala College of Commerce & ManagementDocument16 pagesPatuck Gala College of Commerce & Managementvijesh_29967% (12)

- Insurance ManagementDocument76 pagesInsurance ManagementDurga Prasad DashNo ratings yet

- Module 3 Yr. 2017Document89 pagesModule 3 Yr. 2017Xaky ODNo ratings yet

- Bajaj Allianz Life Insurance Company.Document19 pagesBajaj Allianz Life Insurance Company.HaniaSadia100% (1)

- The Pricing of Group Life Insurance Schemes PDFDocument53 pagesThe Pricing of Group Life Insurance Schemes PDFMula PrasadNo ratings yet

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- How To Prepare For Institute Exams HandbookDocument36 pagesHow To Prepare For Institute Exams Handbookbanu_mageswariNo ratings yet

- Covernote SA665687 1630735019386Document2 pagesCovernote SA665687 1630735019386Firoj ShaikhNo ratings yet

- Credit InsuranceDocument15 pagesCredit Insurancem_dattaias0% (1)

- Casualty Actuarial Society - Re Insurance - Ch7Document142 pagesCasualty Actuarial Society - Re Insurance - Ch7NozibolNo ratings yet

- Basic of Reinsurance 03 June 21 Munch ReDocument24 pagesBasic of Reinsurance 03 June 21 Munch ReFernand DagoudoNo ratings yet

- Commercial Credit Insurance PDFDocument3 pagesCommercial Credit Insurance PDFvinaysekhar0% (1)

- Texas: Auto PolicyDocument40 pagesTexas: Auto PolicyMakKamNo ratings yet

- Executive SummaryDocument53 pagesExecutive SummaryRohit VkNo ratings yet

- Role of Actuaries & Exclusion of PerilsDocument19 pagesRole of Actuaries & Exclusion of PerilsKunal KalraNo ratings yet

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)

- Policy Owners Protection Scheme PPF Scheme For Life InsuranceDocument16 pagesPolicy Owners Protection Scheme PPF Scheme For Life InsuranceAlan PohNo ratings yet

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- 2005RMSWebDesign GlossaryofActuarialTermsDocument8 pages2005RMSWebDesign GlossaryofActuarialTermsMarhadi LeonchiNo ratings yet

- Table No 133Document2 pagesTable No 133ssfinservNo ratings yet

- Basic Ratemaking - Chapter 2Document19 pagesBasic Ratemaking - Chapter 2djqNo ratings yet

- Condolence and Requirement Letter PDFDocument2 pagesCondolence and Requirement Letter PDFWaseemNo ratings yet

- Charlote Rep. FINANCIAL RISK MANAGEMENTDocument18 pagesCharlote Rep. FINANCIAL RISK MANAGEMENTJeanette FormenteraNo ratings yet

- Adap - LifebasixDocument13 pagesAdap - LifebasixKat EspanoNo ratings yet

- Claim Settlement of GICDocument51 pagesClaim Settlement of GICSusilPandaNo ratings yet

- Module 5 Yr. 2017Document85 pagesModule 5 Yr. 2017Xaky ODNo ratings yet

- PRUlink One EngDocument11 pagesPRUlink One Engsabrewilde29No ratings yet

- Insurance Manual Ver 1Document82 pagesInsurance Manual Ver 1api-3743824No ratings yet

- Ahm 250 5 HmoDocument10 pagesAhm 250 5 Hmodeepakraj610No ratings yet

- Professional Indemnity Zurich PolicyDocument16 pagesProfessional Indemnity Zurich Policykalih krisnareindraNo ratings yet

- Casualty InsuranceDocument27 pagesCasualty InsuranceAthena BlakeNo ratings yet

- Auotmobile Insurance: HistoryDocument8 pagesAuotmobile Insurance: HistoryDeepanshu KhuranaNo ratings yet

- Insular Life Insurance FormDocument2 pagesInsular Life Insurance FormEarl Cortez0% (1)

- Fire ClausesDocument62 pagesFire ClauseschriscalarionNo ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinNo ratings yet

- Tata Aig Marine BrochureDocument8 pagesTata Aig Marine Brochurechaitanyabarge100% (2)

- SYLLABUS of Health InsuranceDocument10 pagesSYLLABUS of Health InsuranceSuchetana SenNo ratings yet

- RiskTransferStrategytoHelpProtectYour BusinessDocument12 pagesRiskTransferStrategytoHelpProtectYour BusinessPritipawarNo ratings yet

- Credit Risk ManagementDocument4 pagesCredit Risk ManagementlintoNo ratings yet

- Marine Insurance FinalDocument21 pagesMarine Insurance FinalPratik RambhiaNo ratings yet

- Product LiabilityDocument7 pagesProduct Liabilityestheryoo96No ratings yet

- AR Educare Advantage Insurance Plan 5 May 2014Document6 pagesAR Educare Advantage Insurance Plan 5 May 2014ÌmřańNo ratings yet

- Kotak Endowment PlanDocument2 pagesKotak Endowment PlanMichael GreenNo ratings yet

- eEASY Save FAQs PDFDocument6 pageseEASY Save FAQs PDFterrygohNo ratings yet

- TATAMOTORS Share Price Target - Tata Motors Limited NSE INDIA Chart AnalysisDocument4 pagesTATAMOTORS Share Price Target - Tata Motors Limited NSE INDIA Chart AnalysisumashankarsinghNo ratings yet

- XL Dairy v2015Document790 pagesXL Dairy v2015umashankarsinghNo ratings yet

- EICHERMOT Share Price Target - Eicher Motors Limited NSE INDIA Chart AnalysisDocument4 pagesEICHERMOT Share Price Target - Eicher Motors Limited NSE INDIA Chart AnalysisumashankarsinghNo ratings yet

- Eligibility Criteria EngDocument4 pagesEligibility Criteria EngumashankarsinghNo ratings yet

- Boiler StructureDocument100 pagesBoiler StructureumashankarsinghNo ratings yet

- Coupling PDFDocument1 pageCoupling PDFumashankarsinghNo ratings yet

- Hemant ResumeDocument3 pagesHemant ResumeumashankarsinghNo ratings yet

- Farm Model Project of Dairy Unit of 10 Buffaloes: OwnerDocument4 pagesFarm Model Project of Dairy Unit of 10 Buffaloes: OwnerumashankarsinghNo ratings yet

- Project Report For Dairy Farm Ten CowsDocument10 pagesProject Report For Dairy Farm Ten CowsumashankarsinghNo ratings yet

- Project Report Dary FarmDocument7 pagesProject Report Dary FarmAbdul Hakim ShaikhNo ratings yet

- Growth Charts MetricDocument33 pagesGrowth Charts MetricumashankarsinghNo ratings yet

- SL Bs Cob Bs CDCP Items COB A Level 1 AutomationDocument2 pagesSL Bs Cob Bs CDCP Items COB A Level 1 AutomationumashankarsinghNo ratings yet

- Hilti CatalougeDocument7 pagesHilti CatalougeumashankarsinghNo ratings yet

- Alumina Dense Castable 60percentDocument1 pageAlumina Dense Castable 60percentumashankarsinghNo ratings yet

- Steel BridleDocument4 pagesSteel BridleumashankarsinghNo ratings yet

- CSK bOLTDocument11 pagesCSK bOLTumashankarsinghNo ratings yet

- ACCO320Midterm Fall2013FNDocument14 pagesACCO320Midterm Fall2013FNzzNo ratings yet

- Philippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Document9 pagesPhilippine Income Taxation - Supplemental Quizzes Part 1 (CHAPTERS 1-6)Wag mong ikalatNo ratings yet

- 1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?Document163 pages1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?sudhakarNo ratings yet

- Citizen Surety CaseDocument2 pagesCitizen Surety CaseKent UgaldeNo ratings yet

- Sale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGODocument6 pagesSale and Purchase Agreement OSCAR ALEJANDRO GALVIS SANTIAGOTinktas pcsNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- SamCERA PE Perf Report Q1 20 SolovisDocument1 pageSamCERA PE Perf Report Q1 20 SolovisdavidtollNo ratings yet

- Director of Finance and Administration TFF JOB DESCRIPTIONDocument2 pagesDirector of Finance and Administration TFF JOB DESCRIPTIONJackson M AudifaceNo ratings yet

- 3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeDocument6 pages3c83c989a - Market Hypothesis Testing in Istanbul Stock ExchangeMutahar HayatNo ratings yet

- Traders Dynamic Indicator TDIDocument26 pagesTraders Dynamic Indicator TDIPurity G. Mugo100% (1)

- Contract of Lease 23B TRION 3 MADELAINE MATEODocument7 pagesContract of Lease 23B TRION 3 MADELAINE MATEOChad VillaverdeNo ratings yet

- rf1 - PhilhealthDocument6 pagesrf1 - PhilhealthAngelica Radoc SansanNo ratings yet

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuNo ratings yet

- Valuasi Saham MppaDocument29 pagesValuasi Saham MppaGaos FakhryNo ratings yet

- Avoiding Fraudulent TransfersDocument8 pagesAvoiding Fraudulent TransfersNamamm fnfmfdnNo ratings yet

- BBS 4th Year Final WorkDocument48 pagesBBS 4th Year Final WorkNamuna Joshi88% (8)

- 2009 CFA Level 1 Mock Exam MorningDocument38 pages2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Budget 2024 HighlightsDocument14 pagesBudget 2024 HighlightsSunnyNo ratings yet

- G Izekf - KR FD K TKRK Gs FD BL Foi DK Vko' D Bunzkt DS'K CQD O Fmiksftv JFTLVJ Esa DJ FN K X K GsaaDocument4 pagesG Izekf - KR FD K TKRK Gs FD BL Foi DK Vko' D Bunzkt DS'K CQD O Fmiksftv JFTLVJ Esa DJ FN K X K GsaaRakesh AryaNo ratings yet

- Cryptocurrencies and Blockchain Technology - The Future of FinanceDocument14 pagesCryptocurrencies and Blockchain Technology - The Future of FinanceBenjo HodzicNo ratings yet

- 3 Sept 2018Document50 pages3 Sept 2018siva kNo ratings yet

- HDFC Life Youngstar Super PremiumDocument6 pagesHDFC Life Youngstar Super PremiumabbastceNo ratings yet

- Advance Accounting Installment Sales Manual MillanDocument14 pagesAdvance Accounting Installment Sales Manual MillanHades AcheronNo ratings yet

- Greenfield Vs MeerDocument4 pagesGreenfield Vs MeerTinersNo ratings yet

- Bài TTDocument3 pagesBài TTPhạm Như HuỳnhNo ratings yet

- Intermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFchanelleeymanvip100% (11)

- Revenue Memorandum Circular No. 09-06: January 25, 2006Document5 pagesRevenue Memorandum Circular No. 09-06: January 25, 2006dom0202No ratings yet

- ACKNOWLEDGMENT RECEIPT With UndertakingDocument1 pageACKNOWLEDGMENT RECEIPT With UndertakingwengmenciasNo ratings yet

- UAE ConfDocument20 pagesUAE ConfAkshata kaleNo ratings yet

- New Zealand 2009 Financial Knowledge SurveyDocument11 pagesNew Zealand 2009 Financial Knowledge SurveywmhuthnanceNo ratings yet