Professional Documents

Culture Documents

22

Uploaded by

Rahul AroraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

22

Uploaded by

Rahul AroraCopyright:

Available Formats

American International Journal of Contemporary Research Vol. 2 No.

5; May 2012

Removing the Constraining Assumption of No Joint Products in Breakeven Analysis

Enyi Patrick Enyi

Babcock Business School

Babcock University, Ilishan-Remo

Ogun State, Nigeria.

Abstract

ne of the ma!or assumptions of the "rea#$e%en concept is that there is only one pro&uct line. 'his assumption

thou(h) has helpe& in perfectin( the e*istin( mathematical mo&el for fin&in( the "rea#e%en point of a firm an& for

analy+in( the implications of a firm,s acti%ity le%el on its costs an& profits) has seriously re&uce& an& hin&ere&

consi&era"ly the use of the concept in analy+in( the economic implications of %olume in a multi$pro&uct "usiness

or(ani+ation of to&ay,s competiti%e "usiness en%ironment. 'he nee& to re%erse this tren& prompte& the researcher

to usin( the Re%erse& Contri"ution to -ales Ratio .RC-R/ approach to perfect a ne0 formula for analy+in( multi

pro&ucts "rea#$e%en points. 'his paper uses a fairly$easy$to$un&erstan& approach to present the ne0 mo&el. 'he

test result usin( the pro&uct moment correlation coefficient re%eale& a perfect in%erse relationship "et0een the

normal Contri"ution to -ales Ratio .C-R/ an& the associate& RC-R for in&i%i&ual pro&ucts thus pro%in( that the

ne0 mo&el 0as hi(hly effecti%e an& precise in the allocation of the !oint$pro&ucts "rea#$e%en sales to the

in&i%i&ual mem"er pro&ucts. 'he implication of this &e%elopment is that the assumption of 1only one product

line no lon(er hol& in "rea#e%en analysis an& hence) recommen&e& for pe&a(o(ical purposes.

Introduction

It is not, often that you see a manufacturing or trading firm dealing ith only one !roduct line in modern times.

"his may be so in earlier business ages hen com!etition is minimal and com!etitors are fe. #odern day

business re$uires the s!irit of com!etitiveness hich a single !roduct line can no longer satisfy.

In trying to fit into a com!etitive orld, a business has to decide hich of its o!erating costs are relevant and

hich are not. %ortunately, accounting theorists of the !ast earlier came u! ith the conce!t of marginal costing

&fashioned after the economy theory of marginal cost and marginal revenue' and there conse$uent break-even

!oint theory and analysis. (oing by the economists custom of holding other things constant hile dealing ith a

!articular variable as in their !enchant use of the !hrase ceteris paribus, the break even analysis is su!!osed to

deal ith only one !roduct line as !ortrayed by the assum!tion that) there is only on product line &-amuelson)

1230'. "his assum!tion, though, has been used successfully over the years to aid the analysis of o!erational

budgets and short term decision making !rocesses, has seriously limited the use of the break-even analysis in

!roviding solutions to short term decision making !roblems in our !resent economic orld of multi-!roduct

businesses. "he idea for this !a!er arose from the need to offer a better model that can deal holistically ith

break-even analysis in order to ade$uately address the !roblem associated ith *oint or multi-!roducts es!ecially

during o!erational budget !re!arations.

Multi Products Break!Even Point

"o calculate the normal break-even !oint all that is re$uired are)

&+' "he se!aration of fi,ed and variable costs from estimated total costs.

&-' "he estimate of the total out!ut ca!acity

&.' "he variable cost !er unit

&/' "he selling !rice !er unit0 and

&1' "he total estimated fi,ed costs

"his means that you can determine the single !roduct break-even !oint in units or in 2ollar sales using either)

b+ 3 f4c &+'

for break-even

$ty.

b

-

3 !f4c &-'

for break-even

sales

5here

-6/

Centre for 4romotin( I&eas) 5-A 000.ai!crnet.com

b

+

3 break even-!oint in units

b

-

3 break-even !oint in 2ollar

Sales f 3 total fi,ed costs

c 3 ! - v 3 contribution !er unit

! 3 Unit Selling 7rice

v 3 Unit 8ariable cost

Or, break-even !oint can e$ually be determined using the 9ost, 8olume, 7rofit &987' charts &2rury, -66.0

:orngren, +;<-0 =ucy, +;;;'. But for no this can only ha!!en for a single !roduct or overall firm>s *oint

!roducts breakeven !oint. Until no it is only !ossible to find a single *oint or multi!le !roducts break-even

!oint0 the !roblem of finding the break-even !oint for the individual !roduct members of the *oint grou! becomes

another challenge hich the e,isting model has been unable to meet. ? recent mathematical e,!eriment by the

author of this !a!er offered a solution to this age long !roblem using a Reversed Contribution to Sales Ratio

&RC"R' a!!roach blended ith a !erfected algebraic inter!olation formula.

"he reversed contribution to sales ratio is a figure derived from an attem!t to fashion out a *oint !roducts

breakeven !oint sharing ratio beteen the individual !roducts making u! the grou! using the inverse value of

each !roduct>s normal contribution to sales ratio &9SR'.

"he ne model orks by first analy@ing the budgeted o!erations data into)

&+' 'otal 6u&(ete& -ales &"urnover Astimate'0

&-' 'otal 6u&(ete& profit;

&.' 'otal fi*e& Costs0

&/' Contri"ution per pro&uct per unit &this can be easily derived from subtracting the unit variable cost !er

!roduct from the unit selling !rice) p - v as defined earlier'0 and

&1' Contri"ution to sales ratio - using the total sales !er !roduct to divide the total contribution !er !roduct

line &Omolehina, +;;+'.

5ith the above data ready, e can no !roceed to make the attendant theoretical assum!tions and derive the ne

mathematical model as follos)

=et c 3 total contribution

3 original contribution to Sales Ratio &9SR' i.e. 3 contribution 4

sales

d 3 !ro!ortional 9SR

e 3 reverse value

y 3 Reversed 9ontribution to Sales Ratio &R9SR'

such that)

d

t

3 +66 #

t

$ % &.'

e

t

3 +66 - d

t &/'

y

t

3 +66 #e

t

$ % &1'

here)

c 3 contribution !er !roduct

n 3 number of !roducts

t 3 n

th

!roduct

9arrying our assum!tions further,

=et b 3 Boint !roducts BA7 in 2ollar Sales

s 3 "otal sales &all !roducts'

f 3 total fi,ed

costs

Such that)

b 3 fs4c &C'

b

!t

3 &y

t

b'4+66 &D'

5here

b

!t

3individual break-even sales for the t !roduct

&he proof of the pudding

"o see ho the model orks, e shall use the folloing case data to do the analysis)

-61

American International Journal of Contemporary Research Vol. 2 No. 5; May 2012

Malaika 'td is engaged in the manufacture and sale of 1 !roducts namely ?, B, 9, 2, and A. "he folloing data

relate to its !ro!osed budget for the first $uarter of -6+-)

&+' "otal fi,ed costs estimate 3 E+/<,666

&-' Other o!erational data are tabulated as follos)

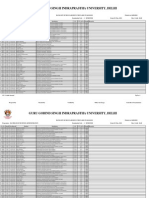

&able () Malaika 'td*s +perational Budget ,ata -irst .uarter /0(/

7roduct Sales 8ariable 9osts US7 U89

? -16,666 -66,666 -1 -6

B 1+6,666 /16,666 ./ .6

9 1C6,666 //6,666 -< --

2 -<6,666 -16,666 -< -1

A -/6,666 +<6,666 -6 +1

Required - ?naly@e the given data above ith a vie to !resenting)

&+' "he over-all break-even !oint in 2ollar sales for the firm0 and

&-' "he individual !roducts breakeven !oint -

&+' In 2ollar sales

&-' In units

&.' "he over-all margin of safety and the individual !roducts margin of safety

Solution

"he re$uired ste!s in solving this !roblem are to do an e,tended analysis of the data in a tabular format using the

formulae earlier derived as in table - belo. "he !rimary !rocedure is)

Step 1 F 9om!ute the overall contribution for the firm0

Step 2 F 9om!ute the contribution !er !roduct line

Step 3 F 9om!ute the 9ontribution to Sales Ratio &9SR'

Step 4 F 9om!ute the !ro!ortional 9SR using the formula as !er e$uation

&.' Step 5 F 9om!ute the Reverse 8alue &R8' of the 9SR using e$uation &/'

Step 6 F 9om!ute the Reversed 9ontribution to Sales Ratio &R9SR' using e$uation &1' formula.

Step F 9om!ute the *oint !roducts breakeven !oint in 2ollar sales using e$uation &C' formula.

Step ! F ?!!ortion the *oint !roducts breakeven !oint in 2ollar sales com!uted in ste! D to the individual !roduct

line using the formula in e$uation &D'.

Step " F 2ivide the value com!uted in ste! < by the !roduct unit selling !rice &US7' to get the breakeven !oint in

$uantity of !roducts.

Note) ?ll the nine ste!s above can easily be !resented ith the use a table as hen doing a statistical analysis.

"able - belo ca!tured all the calculations from ste! + to ste! C. Ste!s D to ; are !resented on table ..

&able /) Computation -ormat for Reversed Contribution$"ales Ratio #RC"R%

Product "ales 1ariable Contribution C"R PC"R R1 RC"R

Costs &2' &d' &e' &y'

? -16,666 -66,666 16,666 -6.6 --.1 DD.1 +;./

B 1+6,666 /16,666 C6,666 ++.DC +..- <C.< -+.D

9 1C6,666 //6,666 +-6,666 -+./. -/.+ D1.; +;.6

2 -<6,666 -16,666 .6,666 +6.D+ +-.6 <<.6 --.6

A -/6,666 +<6,666 C6,666 -1.6 -<.- D+.< +D.;

&otal #3% (45604000 (47/04000 8/04000 559: (0090 60090 (0090

:aving obtained the values of y as in the above table, e no calculate the *oint !roducts break-even sale in

2ollar as follos)

b 3 &+/<,666 , +,</6,666' $ .-6,666

3 <1+, 666 in 2ollar sales

"o a!!ortion this figure to the *oint !roducts on individual !roducts basis, e use the value of y from the above

table)

-6C

&able 8) Computation of ;ndividual Product*s Breakeven Points

7roduc

t y 8alue Boint BA7 7roduct BA7 7roduct US7 BA7 in units

&g' &h' &i' &*' &k'

&derived' &derived' &gh4+66' &given' &i4*'

? +;./ <1+,666 +C1,6;/ -1 C,C6/

B -+.D <1+,666 +</,CCD ./ 1,/.-

9 +;.6 <1+,666 +C+,C;6 -< 1,DD1

2 --.6 <1+,666 +<D,--6 -< C,C<D

A +D.; <1+,666 +1-,.-; -6 D,C+D

Margin of "afety on BEP Analysis

"he margin of safety is the distance beteen the breakeven !oint and the budgeted achievable ca!acity. It may be

re!resented in 2ollar of sales, units of sales or in !ercentage of the budgeted out!ut. "he margin of safety

measures the e,tent to hich a !roduct>s comfort @one can be stretched before the budgeted estimate is e,hausted.

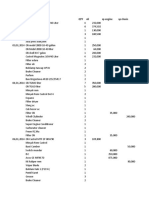

&able 6) Computation of Margin of "afety

7roduct Sales

BA

7 #OS

G of

#OS

Boint +,</6,666 <1+,666 ;<;,666 1..D1G

? -16,666 +C1,6;/ </,;6C ...;CG

B 1+6,666 +</,CCD .-1,... C..D;G

9 1C6,666 +C+,C;6 .;<,.+6 D+.+.G

2 -<6,666 +<D,--6 ;-,D<6 ...+/G

A -/6,666 +1-,.-;

<D,CD

+ .C.1.G

Comparative &ests

"hough, the knoledge of the margin of safety on each !roduct is a useful guide, e are more interested on ho

the individual !roduct>s breakeven !oint relates to the overall budgeted sales figures. "his can be done by dividing

each !roducts breakeven !oint in 2ollar sales by the total budgeted sales as e have done in table 1 belo)

&able 7) Computation of Ratio of Product BEP to &otal "ales

7roduct Sales

BA

7 G of BA7

Boint +,</6,666 <1+,666 /C.-1G

? -16,666 +C1,6;/ <.;DG

B 1+6,666 +</,CCD +6.6/G

9 1C6,666 +C+,C;6 <.D;G

2 -<6,666 +<D,--6 +6.+DG

A -/6,666 +1-,.-; <.-<G

7lease note that the *oint ratio of /C.-1G is also e$ual to the summation of the individual !roducts> ratios.

"o find a sufficient measure of association, e com!are the original !roducts 9SR ith the !ercentages derived

above on one hand and the R9SR on the other hand using the !roduct moment coefficient correlation formula and

the multi!le regression analysis as shon belo)

-6

D

American International Journal of Contemporary Research

Vol. 2 No. 5; May

2012

&able <) Multiple 1ariables Regression Analysis

7roduct BA74Sales Ratio 7roduct 9SR Reversed 9SR

? <.;D -6 +;./

B +6.6/ ++.DC -+.D

9 <.D; -+./. +;

2 +6.+D +6.D+ --

A <.-< -1 +D.;

Regression =ine H I 3 6.+<1</a F 6>66+;<,

+

J 6./1/;D,

-

R

/

3 6.;;;;<+;C

Boint 9orrelation 9oefficient 3 6.;;;;;;6;<

"AS" O% SI(NI%I9?N9A O% R

/

9alculated % &to-tailed test' 3 11/-C.CD/6C..D

9alculated % &one-tailed test' 3 ++6<1.../<+-CD/

&able =) Correlation Coefficient Analysis #BEP Ratio and Product C"R%

7roduct BA7-Ratio

9S

R

? <.;D

-

6

B +6.6/

++.

DC

9 <.D;

-+.

/.

2 +6.+D

+6.

D+

A <.-< -1

"he 9oefficient of 9orrelation is) !(900

"his coefficient indicates that there is #er$ect %e&ative correlation beteen the individual !roduct>s breakeven

!oint ratios and the normal 9ontribution to Sales ratios of the individual !roducts.

&able 5) Correlation Coefficient Analysis #BEP Ratio and Reversed C"R%

7roduct BA7-Ratio

R9

SR

? <.;D

+;.

/

B +6.6/

-+.

D

9 <.D; +;

2 +6.+D --

A <.-<

+D.

;

"he 9oefficient of 9orrelation is) (900

"his coefficient indicates that there is #er$ect #ositive correlation beteen the individual !roduct>s breakeven

!oint ratios and the normal 9ontribution to Sales ratios of the individual !roducts.

,iscussions

"he tabulation in table . shos the individual !roduct break-even !oint both in 2ollar sales as ell as in $uantity.

5e observed from the $uestion that no information is given about ho the fi,ed costs relate to the individual

!roducts. :oever, given the relationshi! that e have been able to establish, it is easy to !ro-rate the fi,ed cost

using the com!uted break-even !oints.

One may ant to ask here 'hy use the reverse CSR approach(

"o anser this $uestion, e shall first of all look at ho break-even !oint is determined ordinarily. It is evident

from the solutions given to many cases of single !roduct 987 analysis that the sli))er the contribution )ar&in,

the hi&her the brea*+even point and vice versa. "his sim!ly means that you re$uire larger volume of activity to

be able to recover total cost hen your !roduct>s contribution margin is slim than hen it is ithin comfortable

level. #any high com!etitive !roducts are noted for having slim contribution margin oing to the fear of !ricing

one>s !roducts out of the market. But !roducts in a mono!olistic or oligo!olistic market &from e,!erience' usually

carry high contribution margin.

-6<

Centre for 4romotin( I&eas) 5-A 000.ai!crnet.com

Relating the above analogy to the use of the reverse 9SR in com!uting individual !roduct>s BA7 in a multi-

!roduct setting !oints to the fact that those products 'ith lo'er contribution )ar&in )ust have contributed

)ore to the derived ,oint brea*+even position for the com!any than those that have higher margins &#oore, +;;<0

#orse K Limmerman, +;;D0 Solomon, -66+'. ?s a result, the effect of the contribution margin for each !roduct

ill be inversely !ro!ortional to the over-all &*oint' break-even !oint in relation to the original contribution to

sales ratio. Oing to the fact that this !osition has never been considered in the !ast it became almost im!ossible

to ascertain individual !roduct>s break-even !oint using a com!uted *oint or multi-!roducts break-even !oint.

=ooking at the statistical test of significance of the breakeven !oints com!uted using the model, it ill seem

obvious that a !erfect solution to the *oint !roducts breakeven analysis has been found. 5ith a !erfectly negative

correlation co-efficient of -+, it is evident that the com!uted break-even !oint relate !erfectly to the individual

!roducts BA7 using the *oint BA7 figure as a base. %rom a test of multi-variable regression analysis using the

com!uted individual !roduct>s breakeven to sales ratio as the de!endent variable and the 9SR and the R9SR as

the inde!endent variables, it is evident from the coefficient of multi!le determination &R

-

' of 6.;;;;<+;C and the

high - ratio that the 9SR and the R9SR are to sides of the same coin &:illier K =ieberman, -66D'. "hat being

the case, there is no gain saying the fact that R9SR is the true key to the determination of individual !roduct>s

breakeven !oint in a multi-!roduct breakeven analysis scenario.

Conclusion $Recommendation

:aving !erused through many analytical considerations of the break-even conce!t, it is !ertinent that a modern

and more scientific a!!roach be ado!ted in unknotting thorny issues found in sim!le theories that a!!arently

a!!ear to be !reviously unsolvable. "he Reversed 9ontribution to Sales Ratio &R9SR' a!!roach introduced and

ado!ted in this !a!er is a milestone in resolving one of such log*am in break-even analysis. 5ith this method, the

assum!tion of Monly one sin&le products lineN no longer holds and should therefore, be e,!unged from the break-

even analysis assum!tions.

Re$erences

2rury, 9. &-66.', MANA78M8N' AN9 C-' ACC5N'IN7, =ondon) "homson =earning Books.

:orngren, 9. ". &+;<-', C-' ACC5N'IN7 : A Mana(erial 8mphasis, Angleood 9liffs) 7rentice :all

International

:illier, %. S. K (. B. =ieberman, &-66D', IN'R95C'IN ' 48RA'IN- R8-8ARC;, D

th

Adition, Ne

2elhi) "ata #c(ra-:ill

=ucey, ". &+;;;', MANA78M8N' ACC5N'IN7, &.

R2

edn', =ondon) A=S"

#oore, ". &+;;<', ';8 ANA'M< = 98CI-IN-, %lorida, US?) Brace 9ollege 7ublishers

#orse, 2.9. K Limmerman, B.=. &+;;D', MANA78RIA> ACC5N'IN7, Boston #?, Irin #c(ra :ill

Omolehina, O. A. &+;;+', C4IN7 ?I'; C-' ACC5N'IN7, =agos) 2un #ark 7ublishers

Samuelson, 7. ?. &+;<6', 8CNMIC-, "okyo) #c(ra :ill

Solomon, 7. &-66+', IN=RMA'IN =R 98CI-IN MA@IN7, Bang!ura, India) 8ikas 7ublishing :ouse

-6

;

You might also like

- Mithai Lite Case Study CompiledDocument16 pagesMithai Lite Case Study CompiledRahul Arora50% (2)

- Chulha Tiffin Service Business Model AnalysisDocument7 pagesChulha Tiffin Service Business Model AnalysisR.s. Mahadevan Iyer100% (1)

- Calculate Amway Agent Commission Monthly EarningsDocument1 pageCalculate Amway Agent Commission Monthly EarningsRahul AroraNo ratings yet

- Quiz 3 - AnsDocument3 pagesQuiz 3 - AnsRahul AroraNo ratings yet

- HCF N LCM'Document3 pagesHCF N LCM'Rahul AroraNo ratings yet

- Top Indian Ceo'sDocument8 pagesTop Indian Ceo'sRahul AroraNo ratings yet

- InterpretationDocument7 pagesInterpretationRahul AroraNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your CustomerRahul AroraNo ratings yet

- Gap Analysis As Is To BeDocument1 pageGap Analysis As Is To BeRahul AroraNo ratings yet

- Land your internship, summer job, or part-time positionDocument23 pagesLand your internship, summer job, or part-time positionHarsha GowdaNo ratings yet

- Sound Advertising: A Review of Experimental EvidenceDocument42 pagesSound Advertising: A Review of Experimental EvidenceSIVVA2No ratings yet

- Sex Appeal in AdvertisementsDocument28 pagesSex Appeal in AdvertisementsRahul AroraNo ratings yet

- Mckinsey Quarterly September 2012 Yuval Atsmon, Jean-Frederic Kuentz and Jeongmin Seong Reviewed By: Vipul NairDocument9 pagesMckinsey Quarterly September 2012 Yuval Atsmon, Jean-Frederic Kuentz and Jeongmin Seong Reviewed By: Vipul NairRahul AroraNo ratings yet

- QUESTIONNAIRE (Retailers) : Name of Shop Location Type of OutletDocument2 pagesQUESTIONNAIRE (Retailers) : Name of Shop Location Type of OutletRahul AroraNo ratings yet

- Baskin RobbinsDocument1 pageBaskin RobbinsRahul AroraNo ratings yet

- IV Trimester MarketingDocument24 pagesIV Trimester MarketingRahul AroraNo ratings yet

- Women Sales Force at Tupperware-1Document4 pagesWomen Sales Force at Tupperware-1Rahul AroraNo ratings yet

- Women Sales Force at Tupperware-1Document4 pagesWomen Sales Force at Tupperware-1Rahul AroraNo ratings yet

- Case 1 Allergo SolutionDocument3 pagesCase 1 Allergo SolutionRahul AroraNo ratings yet

- AMUL pRESENTATIONDocument21 pagesAMUL pRESENTATIONRahul AroraNo ratings yet

- Industry AnalysisDocument1 pageIndustry AnalysisRahul AroraNo ratings yet

- Deepak Final ReportDocument48 pagesDeepak Final ReportRahul AroraNo ratings yet

- Baskin RobbinsDocument1 pageBaskin RobbinsRahul AroraNo ratings yet

- Chap 001Document11 pagesChap 001Rahul AroraNo ratings yet

- Market Size CalculationDocument4 pagesMarket Size CalculationRahul AroraNo ratings yet

- Ranking 4Document34 pagesRanking 4Deepti BhatiaNo ratings yet

- Hospitality Vol ListDocument3 pagesHospitality Vol ListRahul AroraNo ratings yet

- Arvind Mills Annual Report - 2012-13Document36 pagesArvind Mills Annual Report - 2012-13Rahul AroraNo ratings yet

- ArmDocument1 pageArmRahul AroraNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pike River Case StudyDocument7 pagesPike River Case StudyGale HawthorneNo ratings yet

- Shri Siddheshwar Co-Operative BankDocument11 pagesShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- English 8-Q3-M3Document18 pagesEnglish 8-Q3-M3Eldon Julao0% (1)

- Why Companies Choose Corporate Bonds Over Bank LoansDocument31 pagesWhy Companies Choose Corporate Bonds Over Bank Loansতোফায়েল আহমেদNo ratings yet

- 3000W InverterDocument2 pages3000W InverterSeda Armand AllaNo ratings yet

- Exam Venue For Monday Sep 25, 2023 - 12-00 To 01-00Document7 pagesExam Venue For Monday Sep 25, 2023 - 12-00 To 01-00naveed hassanNo ratings yet

- Company Profi Le: IHC HytopDocument13 pagesCompany Profi Le: IHC HytopHanzil HakeemNo ratings yet

- Localization Strategy in Vietnamese Market: The Cases ofDocument25 pagesLocalization Strategy in Vietnamese Market: The Cases ofHồng Thy NguyễnNo ratings yet

- WPB Pitch DeckDocument20 pagesWPB Pitch Deckapi-102659575No ratings yet

- Request Letter To EDC Used PE PipesDocument1 pageRequest Letter To EDC Used PE PipesBLGU Lake DanaoNo ratings yet

- Wheat as an alternative to reduce corn feed costsDocument4 pagesWheat as an alternative to reduce corn feed costsYuariza Winanda IstyanNo ratings yet

- DS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDocument2 pagesDS 20230629 SG3300UD-MV SG4400UD-MV Datasheet V16 ENDragana SkipinaNo ratings yet

- Movie Review TemplateDocument9 pagesMovie Review Templatehimanshu shuklaNo ratings yet

- Process ValidationDocument116 pagesProcess ValidationsamirneseemNo ratings yet

- De Thi Thu THPT Quoc Gia Mon Tieng Anh Truong THPT Hai An Hai Phong Nam 2015Document10 pagesDe Thi Thu THPT Quoc Gia Mon Tieng Anh Truong THPT Hai An Hai Phong Nam 2015nguyen ngaNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- Proprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie AutovehiculDocument3 pagesProprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie Autovehicultranspol2023No ratings yet

- Managing operations service problemsDocument2 pagesManaging operations service problemsJoel Christian Mascariña0% (1)

- Design of Shear Walls Using ETABSDocument97 pagesDesign of Shear Walls Using ETABSYeraldo Tejada Mendoza88% (8)

- RCA - Mechanical - Seal - 1684971197 2Document20 pagesRCA - Mechanical - Seal - 1684971197 2HungphamphiNo ratings yet

- The Earthing of Zenner BarrierDocument4 pagesThe Earthing of Zenner BarrierFatholla SalehiNo ratings yet

- VSP-12Way - Is Rev.03Document55 pagesVSP-12Way - Is Rev.03Marcelo AlmeidaNo ratings yet

- Sound Wave Interference and DiffractionDocument79 pagesSound Wave Interference and DiffractionMuhammad QawiemNo ratings yet

- Business Advantage Pers Study Book Intermediate PDFDocument98 pagesBusiness Advantage Pers Study Book Intermediate PDFCool Nigga100% (1)

- Youtube AlgorithmDocument27 pagesYoutube AlgorithmShubham FarakateNo ratings yet

- ProkonDocument57 pagesProkonSelvasatha0% (1)

- Hilti X-HVB SpecsDocument4 pagesHilti X-HVB SpecsvjekosimNo ratings yet

- Product Data: Airstream™ 42BHC, BVC System Fan CoilsDocument40 pagesProduct Data: Airstream™ 42BHC, BVC System Fan CoilsMaxmore KarumamupiyoNo ratings yet

- FilesDocument12 pagesFilesRajesh TuticorinNo ratings yet

- A Research About The Canteen SatisfactioDocument50 pagesA Research About The Canteen SatisfactioJakeny Pearl Sibugan VaronaNo ratings yet