Professional Documents

Culture Documents

Exchage Rate Volatility Forecast

Uploaded by

AnaR9Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exchage Rate Volatility Forecast

Uploaded by

AnaR9Copyright:

Available Formats

1

THE ACADEMY OF ECONOMIC STUDIES

FACULTY OF FINANCE INSURANCE BANKS AND CAPITAL MARKETS

MASTER DAFI FINANCIAL MANAGEMENT AND CAPITAL MARKETS

Exchage rate volatility forecast

TEACHER COORDINATOR:

CONF. DR. LAURA OBREJA BRASOVEANU

STUDENT:

EUGENIA VASILICA BATIR

BUCHAREST, 2008

2

The purpose of this paper is to evidence main factors of exchange rate volatility

and the way we can forecast that volatility. Exchange rate volatility is an important fact

when dealing with foreign currencies transactions. As economic theories are showing

different determinants may influence exchange rate movements and it is important to

know those factors and to find a way to predict how exchange rates will affect your

business. The factors are grouped based on the approaches considered: traditional

approach, purchasing power parity, interest rate parity and others.

Along the time many economists tried to find the best way of forecasting

exchange rate volatility. Some of empirical researches carried on are exemplified in

Chapter 2.

Autoregressive Conditional Heteroskedasticity (ARCH) models are specifically

designed to model and forecast conditional variances. The model has the following

properties:

1) Auto regression - uses previous estimates of volatility to calculate subsequent (future)

values. Hence volatility values are closely related.

2) Heteroskedasticity - the probability distributions of the volatility varies with the

current value.

Formally, an ARCH(m) process may be expressed mathematically as

=

+ =

m

i

i n i n

x

1

2 2

(6)

The most common ARCH(m) process used to model asset price volatility dynamics is the

ARCH(1) model where

2

1

2

* *

+ =

n long n

x S (7)

or

2

1

2

) 1 (

+ =

n long n

x S (8)

The GARCH(p,q) model may be written as

= =

+ + =

p

i

q

j

j n i i n i n

x

1 1

2 2 2

(9)

The p and q denote the number of past observations of x

n-j

and

n-j

, respectively,

used to estimate

n

.

3

In the standard GARCH (1, 1) specification:

2

1

2

1

2

+ + =

+ =

t t t

t t t

x y

(8)

The first equation is the mean equation; it is written as a function of exogenous

variables with an error term. Since is the one-period ahead forecast variance based on

past information, it is called the conditional variance. The second is the conditional

variance equation; it is a function of three terms:

The mean: ;

News about volatility from the previous period, measured as the lag of the squared

residual from the mean equation:

2

1 t

(the ARCH term).

Last periods forecast variance:

2

1 t

(the GARCH term).

Some empirical studies are quoted:

Authors: Christopher J. Neely and Paul A. Weller

Models

GARCH (1,1)

2 2

1

2

t t t

+ + =

RiskMetrics one day ahead volatility

2 2

1

2

) 1 (

t t t

+ =

1 = + , = 0, = 0.94 (J.P. Morgan, 1996)

Genetic algorithms - based on the principles of natural selection; these procedures

were developed for genetic algorithms by Holland (1975) and extended to genetic

programming by Koza (1992).

Author: Robert J. Hodrick

Models

I. Estimation of Univariate Models with Monthly Data

II. An Exchange Rate Model with Weekly Data

Conclusions: there are better models for forecasting exchange rate volatility such as

RiskMetrics or Genetic Programs, even so GARCH is suitable for volatility forecast if no

other models available.

4

Chapter 3 illustrates an econometric model based on RON/EUR exchange rate

series, over January 1999 to the 15

th

of May 2008.

1.2

1.6

2.0

2.4

2.8

3.2

3.6

4.0

4.4

500 1000 1500 2000 2500 3000

RON_EUR

The model was carried on using EViews 4.1 version. The models actually used

where GARCH models.

The results showed something evident, that RON/EUR exchange rate has a high

volatility; news are quickly absorbed into exchange rate value and do not produce

persistent changes of trend.

Five variants of GARCH models were drawn up based on past information and

series descriptive statistics, correlation and stationary (mean reverting) characteristics.

In order to obtain a stationary series it were necessary two operations: logarithm

and first difference. First difference of RON/EUR logarithm series was the stationary

series considered when GARCH models were projected.

5

-.06

-.04

-.02

.00

.02

.04

.06

.08

500 1000 1500 2000 2500 3000

DL_RON_EUR

Of all five models, according to Akaike info criterion, the best model for

predicting RON/EUR volatility was chosen.

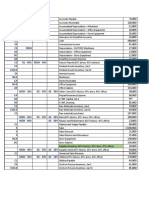

Terms GARCH1 GARCH2 GARCH3 GARCH4 GARCH5

C 0.0002360 0.0002400 0.0002380 0.0002340 0.0002330

AR(1) - 0.0519310 -0.1985470 0.0530310 0.2814410

MA(1) - - 0.2540670 - -0.2286930

MA(2) - - - -0.0308490 -0.0448840

Akaike info criterion -7.6671990 -7.6688350 -7.6683980 -7.6688140 -7.6681380

Schwarz criterion -7.6574830 -7.6566860 -7.6538190 -7.6542350 -7.6511290

Durbin-Watson stat 1.8297000 1.9248780 1.9326890 1.9292170 1.9289060

GARCH2 model [finally validated]:

Estimation Command:

=====================

ARCH DL_RON_EUR AR(1) C @

Estimation Equation:

=====================

DL_RON_EUR =C(1) +[AR(1)=C(2)]

Substituted Coefficients:

=====================

DL_RON_EUR =0.000239577877 +[AR(1)=0.0519312513]

6

Dependent Variable: DL_RON_EUR

Method: ML - ARCH (Marquardt)

Date: 06/25/08 Time: 07:24

Sample(adjusted): 3 2378

Included observations: 2376 after adjusting endpoints

Convergence achieved after 21 iterations

Variance backcast: ON

Coefficient Std. Error z-Statistic Prob.

C 0.000240 9.47E-05 2.528737 0.0114

AR(1) 0.051931 0.019674 2.639552 0.0083

Variance Equation

C 2.89E-07 5.20E-08 5.549140 0.0000

ARCH(1) 0.136413 0.007422 18.38059 0.0000

GARCH(1) 0.870345 0.006321 137.7006 0.0000

R-squared 0.005164 Mean dependent var 0.000431

Adjusted R-squared 0.003485 S.D. dependent var 0.006192

S.E. of regression 0.006181 Akaike info criterion -7.668835

Sum squared resid 0.090578 Schwarz criterion -7.656686

Log likelihood 9115.576 F-statistic 3.076649

Durbin-Watson stat 1.924878 Prob(F-statistic) 0.015387

Inverted AR Roots .05

Probability associated to mean and variance equations coefficients are less than

5%;

0

100

200

300

400

500

600

-6 -4 -2 0 2 4 6

Series: Standardized Residuals

Sample 3 2378

Observations 2376

Mean 0.009750

Median -0.050999

Maximum 6.081587

Minimum -6.097107

Std. Dev. 1.000536

Skewness 0.502920

Kurtosis 6.043210

J arque-Bera 1017.011

Probability 0.000000

Standardized residuals series is leptokurtosis; right skewed and the probability

associated to Jarque-Bera test rejects the hypothesis of a normal distributed series.

7

.000

.005

.010

.015

.020

.025

.030

500 1000 1500 2000

Conditional Standard Deviation

The equations of the model chosen are:

RON/EUR

t

= 0.0002400 + 0.0519310 RON/EUR

t-1

mean equation

RON/EURt

= 2.89E-07 + ARCH (1) 0.136413 + GARCH (1) 0.870345 variance

equation.

Based on GARCH2 model RON/EUR exchange rate is forecasted, using a

dynamic procedure, and the outputs are the following:

8

-600

-400

-200

0

200

400

600

500 1000 1500 2000 2500 3000

DL_RON_EURF2

Forecast: DL_RON_EURF2

Actual: DL_RON_EUR

Forecast sample: 1 3000

Adjusted sample: 3 3000

Included observations: 2376

Root Mean Squared Error 0.006193

Mean Absolute Error 0.004257

Mean Abs. Percent Error 111.2995

Theil Inequality Coefficient 0.960920

Bias Proportion 0.000951

Variance Proportion 0.996308

Covariance Proportion 0.002741

0

10000

20000

30000

40000

50000

60000

500 1000 1500 2000 2500 3000

Forecast of Variance

As we can see volatility shocks are quite persistent and the forecasts of

conditional variance converge to the steady state quite slowly.

Volatility forecast methods are useful; but not always suitable. The reality shows

that, at least, in Romania the exchange rate is mainly influenced by news, investors

expectations and models based only on historical observations are not so reliable; this is

because history is not likely to happen in the next period based on past information and

the exchange rate evolution can be compared to a random walk model not a predefined

one.

9

PROPOSALS AND CONCLUSIONS

Forecasting exchange rate volatility is an important issue for many financial

market participants. In order to predict exchange rate volatility many econometric models

can be used. I sustained my empirical survey mainly on EViews models such as GARCH.

In this paper I tried to find a suitable model for exchange rate volatility forecast.

I relayed on RON/EUR daily exchange rate observations over January 1999 to the

15

th

of May 2008.

Stationary series and series distribution are two important things to be considered

when making a forecast; so the series were analyzed and finally the forecast was based on

first difference of RON/EUR logarithm series.

Different GARCH models were built up and the equations of the model chosen

are [according to Akaike info criterion value]:

RON/EUR

t

= 0.0002400 + 0.0519310 RON/EUR

t-1

mean equation

RON/EURt

= 2.89E-07 + ARCH (1) 0.136413 + GARCH (1) 0.870345 variance

equation.

All five models showed that exchange rate series is a volatile.

More complex empirical studies were carried on and recently Christopher J. Neely

and Paul A. Weller discovered that genetic programs can better predict exchange rate

volatility than any other applications or models.

Volatility forecast methods are useful; but not always suitable. The reality shows

that, at least, in Romania the exchange rate is mainly influenced by news, investors

expectations and models based only on historical observations are not so reliable; this is

because history is not likely to happen in the next period based on past information and

the exchange rate evolution can be compared to a random walk model not a predefined

one.

Variance forecast obtained shows that volatility shocks are quite persistent and the

forecasts of conditional variance converge to the steady state quite slowly.

10

Bibliography

Andrei, Tudorel and Bourbonnais, Regis - Econometrie, Bucharest: Editura

Economica, 2008

Adrian, Codirlasu Econometrie aplicata utilizand EViews 5.1; coures notes;

October 2007,

<http://www.dofin.ase.ro/acodirlasu/lect/econmsbank/econometriemsbank2007.pdf>

CFA Program Curriculum Economics and Financial Statement Analysis, Volume II,

Level I, CFA Institute, Pearson Custom Publishing, 2006

Christopher J. Neely and Paul A. Weller Predicting Exchange Rate Volatility:

Genetic Programming vs. GARCH and RiskMetrics, Federal Reserve Bank of St.

Louis, Research Division, Revised: September 21, 2001, <

http://research.stlouisfed.org/wp/2001/2001-009.pdf >

Frankel, Jeffrey and Rose, Andrew A survey of empirical research on nominal

exchange rates, NBER Workingpaper series, September 1994

Robert J. Hodrick Risk, Uncertainty and Exchange Rates, NBER Workingpaper

series, November 1987

National Bank of Romania - http://www.bnr.ro/

Quantnotes.com::Fundamentals::

<http://www.quantnotes.com/fundamentals/basics/archgarch.htm>

Monetarism, by Allan H. Meltzer: The concise Encyclopedia of economics: Library

of economics and Liberty <

http://www.econlib.org/LIBRARY/Enc/Monetarism.html>

Lecture notes Monetarism

<http://www.econweb.com/MacroWelcome/monetarism/notes.html>

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Presentation 2Document31 pagesPresentation 2sriramakanthNo ratings yet

- Behavioral Biases in The Decision Making of Individual InvestorsDocument1 pageBehavioral Biases in The Decision Making of Individual InvestorsMuhammadNo ratings yet

- Manual UBS PDFDocument112 pagesManual UBS PDFRonar Bermudez50% (2)

- What Is Supply and Demand Trading?Document7 pagesWhat Is Supply and Demand Trading?mohamad hifzhanNo ratings yet

- Alternative Investments and EquityDocument613 pagesAlternative Investments and EquitySen RinaNo ratings yet

- What Is Debt Sustainability BasicsDocument2 pagesWhat Is Debt Sustainability BasicsR SHEGIWALNo ratings yet

- Eco Assignment 3Document2 pagesEco Assignment 3bushraNo ratings yet

- Market Breadth BrochureDocument10 pagesMarket Breadth BrochureStevenTsaiNo ratings yet

- Home Depot Strategic Audit SampleDocument18 pagesHome Depot Strategic Audit SamplekhtphotographyNo ratings yet

- Factsheet For March 31st FinalDocument6 pagesFactsheet For March 31st FinalSandip PatilNo ratings yet

- Midterm Exam GovaccDocument3 pagesMidterm Exam GovaccEloisa JulieanneNo ratings yet

- NEXT IAS UNION BUDGET 2023-24 MCQsDocument20 pagesNEXT IAS UNION BUDGET 2023-24 MCQsLBKNo ratings yet

- EMS Full ProjectDocument31 pagesEMS Full ProjectSarindran RamayesNo ratings yet

- ImpairmentDocument45 pagesImpairmentnati100% (1)

- A Century of Deutsche Bank in TurkeyDocument74 pagesA Century of Deutsche Bank in Turkeyioannissiatras100% (1)

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Training On Mutual Funds For AMFI Certification: Uma ShashikantDocument162 pagesTraining On Mutual Funds For AMFI Certification: Uma ShashikantDEVAANSH LALWANINo ratings yet

- Angelo Wardana 349655122Document5 pagesAngelo Wardana 349655122Green Sustain EnergyNo ratings yet

- Reporting and Analyzing LiabilitiesDocument50 pagesReporting and Analyzing LiabilitiesDang ThanhNo ratings yet

- FII+ +Form+of+Initial+Board+ConsentDocument7 pagesFII+ +Form+of+Initial+Board+ConsentRick SwordsNo ratings yet

- Unit 4 Dividend DecisionsDocument17 pagesUnit 4 Dividend Decisionsrahul ramNo ratings yet

- Legal Notice Ni ActDocument5 pagesLegal Notice Ni ActSurbhi GuptaNo ratings yet

- Fria Handout PDFDocument13 pagesFria Handout PDFReve Joy Eco IsagaNo ratings yet

- BAUTISTA BAFIMARX ACT181, Activity 2Document3 pagesBAUTISTA BAFIMARX ACT181, Activity 2Joshua BautistaNo ratings yet

- Evercore ISI's Best "Core" IdeasDocument21 pagesEvercore ISI's Best "Core" IdeasJoyce Dick Lam PoonNo ratings yet

- Tarea 2.1 Acco 1050Document8 pagesTarea 2.1 Acco 1050Caroline ClassNo ratings yet

- ACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsDocument1 pageACTBFAR Exercise Set #1 - Ex 5 - FS ClassificationsNikko Bowie PascualNo ratings yet

- Mexico Country Partnership FrameworkDocument129 pagesMexico Country Partnership FrameworkFungsional PenilaiNo ratings yet

- Business Accounting PDFDocument1,108 pagesBusiness Accounting PDFFabiola Henry100% (2)

- Online BankingDocument46 pagesOnline BankingNazmulHasanNo ratings yet