Professional Documents

Culture Documents

BOI - Brochure

Uploaded by

Sagar AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BOI - Brochure

Uploaded by

Sagar AgarwalCopyright:

Available Formats

SME City Centre

S. No.

1

2

3

4

5

Contents

Topic

Bank of India - SME City

Centre, MNZ

SME Classification

Takeover Norms

Products

Contact Us

Page No.

2

4

5

6

9

2|Page

Bank of India - SME City Centre, MNZ

Bank of India has been playing a vital role in the development of small scale industries. The Bank has

developed a wide array of products to meet the changing needs of the industry. It provides end -to -end

solutions for the financial needs of the industry.

Apart from the general working capital requirements (like Cash credit, Bill Discounting limits, LC, BG

etc) to meet the day to day requirements and term loans to take care of investment needs for acquiring

fixed assets, Bank has an array of products/schemes to cater to the enterprise specific requirements

of SME Units both in Manufacturing and Trade and services sectors.

Bank of India has now come-up with a different vertical dedicated exclusively for SME. This exclusive

vertical is "SME City Centre" at Bank of India.

Ours is a dedicated processing house for Business Proposals above Rs. 1 Crores (both FB and Non-FB).

Disbursal of amount takes place from the desired branch of the customer covered under Mumbai North

Zone of Bank of India. There are about 48 branches that are covered under Mumbai North Zone.

3|Page

SME Classification

New Existing Companies

Companies

Sales

Project Cost

Based Rule

Turnover

based rule

Exceptions to the rule (Sector-based)

Following sectors with the net block of Fixed Assets

> Rs. 100 Crores

Hospitality

Large

Corporat

e

Mid

Corporat

e

SME City

Centre

> Rs. 100

Crores

Rs. 10-100

Crores

< Rs. 10

Crores

> Rs. 500

Crores

Rs. 100-500

Crores

< Rs. 100

Crores

Logistics

Hospital

Educational Institutions

Real Estate (only project cost, not net block)

Job works

Other sectors (irrespective of net block) - NBFCs,

Infrastructure Companies, PSUs

Following sectors with the net block of Fixed Assets

between Rs. 10 Crores and Rs. 100 Crores

Hospitality

Logistics

Hospital

Educational Institutions

Real Estate (only project cost, not net block)

Job works

Other sectors (irrespective of net block) - Diamond

and Jewellery, Capital Market

Following sectors with the net block of Fixed

Assets < Rs. 10 Crores

Hospitality

Logistics

Hospital

Educational Institutions

Real Estate (only project cost, not net

block)

Job works

4|Page

Takeover Norms

When it comes to Takeover of account from other banks, Bank of India has specified norms for

the same, which are mentioned as under:

1. The accounts to be taken over should be standard accounts with the existing Bank.

2. The firm/company continuously registering increasing trend in sales volume and making

cash profit for at least last three years.

3. Maximum debt equity ratio of 4:1 in the case of MSME Units and 3:1 in the case of

Medium and Large Enterprises.

4. Maximum debt equity ratio of 3:1 in the case of Medium Enterprises irrespective of the

WC limit.

5. Current Ratio of 1.25:1 for accounts with limits up to Rs 5 crores, where Turnover

Method alone would be applied for assessment of the Working Capital (as against 1.30

prescribed normally).

6. Minimum Interest Service Coverage Ratio (ISCR) of 1.75

7. If Term Loan is also proposed to be taken over, the minimum Debt:Service Coverage

Ratio (DSCR) should be 1.50.

8. The Asset Coverage Ratio should not be less than 1.50.

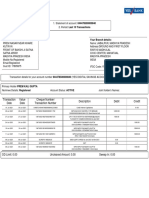

Below is a small snap Shot which will clarify the Norms of BOI

Criteria Takeover Norms Non-Takeover cases

Above 5 Cr Below 5 Cr

Current Ratio 1.30 1.25 1.00

ISCR 1.75 1.75 N.A.

Debt Equity 3:1(in case of

MSME)

4:1(in case of

Medium &

Large)

4:1 (Quasi equity is also

considered)

Sales turnover Increasing Increasing N.A.

Profit Net Profit

making

Net Profit

making

Operating Profit

Asset Coverage ratio 1.50 1.50 Depends on Sanctioning

Authority

DSCR 1.50 1.50 1.25

Products

Brief details of some of the schemes are as under:

"STAR SME VYAPAR"

Rate of Interest depends on the extent of Collateral Coverage

Market Value of Security Rate of Interest (linked to Base Rate)

110% - 149% B.R + 2.50 %

150% - 175% B.R. + 2.25 %

More than - 175% B.R.+ 2.00 %

Target Group

Eligibility

Purpose

Nature of facility

Quantum of

Limit

Appraisal of loan

Margin

Security

Traders

All enterprises engaged in Trading in Investments in equipments as

defined by MSMED Act 2006

Satisfactory experience of business and having minimum two years of

Preceding Financial Statements

For meeting working capital needs

Cash Credit

Minimum Rs. 25 lakhs and Maximum Rs.200 lakhs

1. As per Nayak Committee recommendation i.e. 20% of sales

turnover

2. Projected turnover should not be higher than 30% of

Compounded Annual Growth Rate

Against Stock and Book Debts - 25%

Primary:

1. Hypothecation of Stocks and Book Debts(not older than 4 months).

Collateral

Minimum 110% (Market Value) of the loan amount in the form of

mortgage of immovable property

6|Page

Target Group

Eligibility

Purpose

Nature of facility

Quantum of

Limit

Appraisal of loan

Margin

Security

Target Group

Eligibility

Purpose

Items to be

7|Page

STAR SME CONTRACTOR CREDIT LINE

Civil Contractors, Mining Contractors, Engineering Contractors,

Transport Contractors etc established as Proprietorship/Partnership

firms, Limited Companies

1. Engaged in the business line at least for the last 3 years

2. Having Audited Financial Statements

3. Entry level credit rating should be SBS 5. No deviation to be

considered

For meeting working capital needs

Line of Credit by way of fund based working capital limit, Bank

Guarantee/letters of credit

Minimum Rs. 10 lakhs and Maximum Rs.500 lakhs

1. 30% of last two years average turnover

2. Of this, 2/3

rd

will be used for Fund based facility and 1/3

rd

for Non-

fund based facility such as BG/LC

Minimum 20% for fund based facility. Though the limit will be treated

as unsecured, contractors will have receivables which should be charged to the

Bank and a margin of 20% maintained there against.

Minimum 15% cash margin for non-fund based facility

Primary:

2. First charge on the unencumbered assets of the company/firm both

current and fixed assets.

3. Margin on non fund based limits

STAR SME AUTO EXPRESS

All existing SME units, as per new definition, run by Individuals,

Proprietorship/Partnership firms, Limited Company, Trust, Society

The unit/borrower should have sufficient net worth/ source of funds to

pay for the margin and initial recurring expenses. Conduct of the existing

account must have been satisfactory.

To purchase transport vehicles for delivering their products/services.

Educational Institutions also eligible for transport vehicles for providing

transportation services to students/faculty/staff. Only new vehicles will be

considered. Second hand vehicles not permitted under the scheme.

Chassis + Body building costs + registration, insurance, road tax,

financed

Nature of facility

Repayment

Security

Target Group

Eligibility

Purpose

accessories AMC etc.

Term Loan

To be repaid in 84 equated monthly instalments inclusive of

moratorium, of maximum 3 months

1. Primary: Hypothecation of the vehicle purchased out of the

proceeds of the loan. Bank's name as charge holder to be got entered in

the books of the RTO and also the Registration certificate.

2. Collateral: Micro and Small (Services Enterprises), can be sanctioned

collateral free term loan up to Rs. 100 lakhs, subject to coverage under

guarantee provided by Credit Guarantee Fund Trust for Micro & Small

Enterprises(CGTMSE). For loans above Rs. 100 lakhs, suitable

collateral security to be obtained depending upon the

merits of individual cases

STAR SME LIQUID PLUS

Proprietorship/Partnership firms, Limited Companies falling within the

new definition of SME, engaged in the business for the past 3 years with

audited financial statement of accounts

The borrower should have known source of funds to pay for the margin

and initial recurring expenses.

General purpose term loan for SME constituents Viz., for R&D activity,

marketing and advertisement expenses, Purchase of Preliminary

expenses etc

Nature of facility Term Loan

Repayment To be repaid in 84 equated monthly instalments within a period of 7

years inclusive of moratorium period of up to 12 months. Interest to be serviced

as and when debited.

Appraisal of Loan 50% of unencumbered value of the property under offer or 75% of

actual requirement for the stated purpose whichever is less

Minimum: Rs. 10 lakhs

Maximum: Rs. 500 lakhs

Note: Extant guidelines with regard to valuation of property, title

clearance and inspection by two different officials etc. must be strictly adhered

to.

Average DSCR should be minimum 1.25

Margin As stated above

8|Page

Security

Target Group

Eligibility

Purpose

1. Primary: Hypothecation of assets or mortgage of land, if loan is

considered for the purpose. If no assets are created then it should be treated

as clean.

2. Collateral: EQM or Registered Mortgage of Residential/commercial

property (first charge) either of borrower or of guarantor. However

following conditions with regard to property under offer should be

fulfilled:

a. It should not be an agricultural property

b. It should not be a vacant land

STAR SME EDCUATION PLUS

Educational Institutions viz., Universities Colleges, Schools

1. The Institutions must have got necessary approval from Government

agencies for running the educational institution

2. They should submit 3 years audited financial statements

3. They should be profit making for continuous 2 years

4. New and upcoming educational institutions can also be considered

whose projections financially must be reasonable and justified.

5. Entry level credit rating is SBS 5. No deviation to be allowed.

1. Construction/Renovation/Repair of building. Approval for

construction/ addition/alteration from all the concerned authorities must be

in place for considering the credit facility.

2. Purchase of Computer lab equipment, Furniture & Fixtures, books

etc.

Nature of Facility Term Loan

Quantum of Minimum Rs. 10 lakhs and Maximum Rs. 500 lakhs

Loan

Repayment Term Loan to be repaid in maximum 8 years inclusive of initial

moratorium of 12 to 18 months. Periodicity of instalments to be

determined on the basis of cash flow.

Appraisal of Loan The proponent should have sufficient cash flow to service both

instalment and interest. DSCR should be minimum 1.25.

Margin Minimum 20%

Security Primary:

1. Hypothecation of assets, if loan is considered for

machineries/equipments.

9|Page

2. Mortgage of land & building over which construction is proposed

Collateral.

3. Suitable collateral to be obtained so that minimum Asset Cover of

1.50 is available. Guarantee of key person/promoter/trustee must

be taken

Contact Person

Nilesh Pawar

Marketing Manager

Bank of India - SME City Centre

nilesh.pawar@bankofindia.co.in

+91- 9967944426

Office Address

Bank of India - SME City Centre

2nd floor

Flexcel Park (Near 24 Karat Multiplex)

S.V. Road

Jogeshwari (West) Mumbai - 400 102

Phone: 022-2677 0111 / 112 / 114 / 115

Fax: 2677 0113

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Lord BlackheathDocument16 pagesLord BlackheathrealtimetruthNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Irs 941 2011Document4 pagesIrs 941 2011Wayne Schulz100% (1)

- Senior Auditor MCQsDocument118 pagesSenior Auditor MCQsZia Ud Din81% (32)

- Bil U MobileDocument6 pagesBil U MobileTeruna ImpianNo ratings yet

- People Vs Concepcion (Case Digest 44 Phil)Document1 pagePeople Vs Concepcion (Case Digest 44 Phil)Lemuel Angelo M. EleccionNo ratings yet

- AEGON RELIGARE Premium Payment Receipt 2013Document1 pageAEGON RELIGARE Premium Payment Receipt 2013tusharmithaiNo ratings yet

- DocumenteDocument5 pagesDocumentemaxim caldarasanNo ratings yet

- LRD Information RequirementDocument3 pagesLRD Information RequirementSagar AgarwalNo ratings yet

- CARE Reaffirms Ratings for Biostadt India LimitedDocument3 pagesCARE Reaffirms Ratings for Biostadt India LimitedSagar AgarwalNo ratings yet

- Letter of ComfortDocument1 pageLetter of ComfortSagar AgarwalNo ratings yet

- Classic Marble Company Private LimitedDocument3 pagesClassic Marble Company Private LimitedSagar AgarwalNo ratings yet

- JobDocument9 pagesJobSagar AgarwalNo ratings yet

- Working Capital & Its AssessmentDocument22 pagesWorking Capital & Its AssessmentSagar AgarwalNo ratings yet

- LRD Information RequirementDocument3 pagesLRD Information RequirementSagar AgarwalNo ratings yet

- MbaDocument3 pagesMbaSagar AgarwalNo ratings yet

- How To Assess Working Capital RequirementDocument34 pagesHow To Assess Working Capital RequirementSanket AiyaNo ratings yet

- PrintDocument5 pagesPrintSagar AgarwalNo ratings yet

- Financial Terms and Their MeaningsDocument13 pagesFinancial Terms and Their MeaningsSagar AgarwalNo ratings yet

- Home Loan Requirement List - For Salary EeDocument1 pageHome Loan Requirement List - For Salary EeSagar AgarwalNo ratings yet

- Company profile checklist for bank submissionDocument3 pagesCompany profile checklist for bank submissionSagar AgarwalNo ratings yet

- List of Documents RequiredDocument1 pageList of Documents RequiredSagar AgarwalNo ratings yet

- Process Flow - LCBDDocument4 pagesProcess Flow - LCBDSagar Agarwal100% (2)

- LC Board Resolution FormatDocument2 pagesLC Board Resolution FormatSagar Agarwal0% (1)

- List of PgaDocument3 pagesList of PgaSagar AgarwalNo ratings yet

- Process Flow - LCBDDocument4 pagesProcess Flow - LCBDSagar Agarwal100% (2)

- Financial Products and Their MeaningsDocument23 pagesFinancial Products and Their MeaningsSagar AgarwalNo ratings yet

- Letter of ComfortDocument1 pageLetter of ComfortSagar AgarwalNo ratings yet

- LC Board Resolution FormatDocument2 pagesLC Board Resolution FormatSagar Agarwal0% (1)

- Latest Jet AirwaysDocument11 pagesLatest Jet AirwaysSagar Agarwal0% (1)

- Latest Jet AirwaysDocument11 pagesLatest Jet AirwaysSagar Agarwal0% (1)

- Financial FiguresDocument1 pageFinancial FiguresSagar AgarwalNo ratings yet

- Research Paper With GraphsDocument10 pagesResearch Paper With GraphsSagar AgarwalNo ratings yet

- Investment Banking: Basic InformationDocument4 pagesInvestment Banking: Basic InformationSagar AgarwalNo ratings yet

- FacebookDocument4 pagesFacebookSagar AgarwalNo ratings yet

- Latest Jet AirwaysDocument11 pagesLatest Jet AirwaysSagar Agarwal0% (1)

- Presentation TuthillDocument25 pagesPresentation TuthillSagar AgarwalNo ratings yet

- 2010 Mandaue City Purchase OrderDocument146 pages2010 Mandaue City Purchase OrderjhaNo ratings yet

- Í (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanDocument4 pagesÍ (Zkfè Pagayunan Lemuelâââââ R Ç 3) 24lî Mr. Lemuel Rutaquio PagayunanJohn Robertson DayaoNo ratings yet

- SBI Project ReportDocument14 pagesSBI Project ReportNick IvanNo ratings yet

- Rating Evaluation Case AnalysisDocument7 pagesRating Evaluation Case AnalysisNikhil ChipadeNo ratings yet

- Brazilian Sovereign Bonds in DollarsDocument6 pagesBrazilian Sovereign Bonds in DollarsquiquemoNo ratings yet

- Research MethodologyDocument45 pagesResearch MethodologyutuutkarshNo ratings yet

- Tender 58800Document213 pagesTender 58800adhirajn4073No ratings yet

- H Theory of Money SupplyDocument3 pagesH Theory of Money SupplyShofi R Krishna100% (17)

- TAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Document84 pagesTAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Dushyant SinghaniaNo ratings yet

- Banking ItesDocument19 pagesBanking Itesanky2205No ratings yet

- Explanation of deductions for certain payments under Section 37Document2 pagesExplanation of deductions for certain payments under Section 37NISHANTH JOSENo ratings yet

- Secured PayoutDocument2 pagesSecured PayoutVishal BawaneNo ratings yet

- ApplicationformDocument5 pagesApplicationformRuby KeddieNo ratings yet

- Intermediate Course Study Material: TaxationDocument27 pagesIntermediate Course Study Material: TaxationBharath WajNo ratings yet

- Aparchit 8&9th October English Super Current Affairs MCQ With FactsDocument29 pagesAparchit 8&9th October English Super Current Affairs MCQ With FactsSiva KumarNo ratings yet

- An Internship Report of Mutual Trust Bank Ltd.Document73 pagesAn Internship Report of Mutual Trust Bank Ltd.Nazmul Amin Aqib0% (1)

- Bangladesh Bank: Financial Stability DepartmentDocument165 pagesBangladesh Bank: Financial Stability DepartmentAsif NawazNo ratings yet

- Determinants Of Household Access To Formal Credit In Rural VietnamDocument33 pagesDeterminants Of Household Access To Formal Credit In Rural VietnamGunk Alit Part IINo ratings yet

- Aviva Easy Life PlusDocument14 pagesAviva Easy Life PlusManju LoveNo ratings yet

- Purchase and Payment Cycle: Learning ObjectivesDocument21 pagesPurchase and Payment Cycle: Learning ObjectivesJoseph PamaongNo ratings yet

- ISI 911 CompleteDocument221 pagesISI 911 Completebhatty100% (8)

- Poverty Alleviation Through Micro Finance in India: Empirical EvidencesDocument8 pagesPoverty Alleviation Through Micro Finance in India: Empirical EvidencesRia MakkarNo ratings yet

- Statement of account transactionsDocument1 pageStatement of account transactionsSagar GuptaNo ratings yet