Professional Documents

Culture Documents

RMC No 5-2014 - Clarifying The Provisions of RR 1-2014

Uploaded by

sj_adenip0 ratings0% found this document useful (0 votes)

2K views18 pagesClarrification on the submission of Alphalist

Original Title

RMC No 5-2014 - Clarifying the Provisions of RR 1-2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentClarrification on the submission of Alphalist

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views18 pagesRMC No 5-2014 - Clarifying The Provisions of RR 1-2014

Uploaded by

sj_adenipClarrification on the submission of Alphalist

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

1

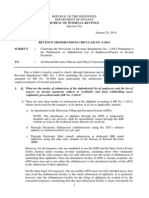

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

January 29, 2014

REVENUE MEMORANDUM CIRCULAR NO. 5-2014

SUBJECT : Clarifying the Provisions of Revenue Regulations No. 1-2014 Pertaining to

the Submission of Alphabetical List of Employees/Payees of Income

Payments

TO : All Internal Revenue Officers and Others Concerned

This is Order is hereby issued to clarify, through Questions and Answers, the provisions of

Revenue Regulations (RR) No. 1-2014 amending the provisions of RR No. 2-98, as further

amended by RR No. 10-2008 more particularly the submission of alphabetical list of

employees/payees of income payments.

1. Q. What are the modes of submission of the alphabetical list of employees and the list of

payees on income payments subject to creditable and final withholding taxes

(alphalist) prescribed under RR No. 1-2014?

A. There are only three modes of submission of the alphalist according to RR No. 1-2014,

which can be used by the taxpayer, at its option, in so far as applicable, namely:

a. As attachment in the Electronic Filing and Payment System (eFPS);

NOTE: The attachment of alphalist through the eFPS is temporarily

disabled and a tax advisory shall be immediately issued through the BIR

website as soon as the technical issues thereon are resolved.

b. Through Electronic Submission (eSubmission) using the BIRs website

address at esubmission@bir.gov.ph; and

c. Through Electronic Mail (email) submission at dedicated BIR email

addresses using the data entry module of the Bureau of Internal Revenue

(BIR).

However, for all taxpayers who are mandated to use the eFPS and the Inter-Active Forms

(IAFs) System under existing revenue regulations, including those who voluntarily

enrolled with the said systems, they are only allowed to use the mode of eSubmission in

submitting their alphalists. Once the attachment facility of eFPS is already available, the

eFPS-users may opt to use either the eSubmission or the attachment facility of the eFPS

in the submission of their alphalists.

On the other hand, for taxpayers who are neither eFPS-users nor IAF-enrolled users, they

may avail the eSubmission facility or the email submission of alphalists. It is preferred,

however, that the eSubmission facility for the filing of alphalists be availed of by the

concerned taxpayers considering that the said submission facility is more convenient for

2

both the taxpayers and the BIR because it requires no manual intervention by the

concerned revenue district offices (RDOs).

Accordingly, the previously prescribed submission of hard or physical copies of

alphalists, including the submission of storage devices such as, but not limited to,

compact diskette (CD), Digital Versatile Diskette (DVD), Universal Serial Bus (USB)

containing the alphalist, which are all considered as manual submission thereof, shall no

longer be allowed.

2. Q. What are the distinctions between each three modes of submission of alphalist

prescribed by RR No. 1-2014?

A. The distinctions between each mode of submission of alphalist are as follows:

eFPS

Attachment

eSubmission

Submission

1. Data entry and

validation

module

requirement?

Yes Yes Yes

2. Who may avail

the three

submission

modes?

Only taxpayers

enrolled with

eFPS

All taxpayers, whether

or not enrolled with

eFPS or IAF

Taxpayers who

are neither

enrolled with

eFPS nor IAF

3. What is the

specific

manner of

submission of

the alphalist?

Through eFPS as

attachment to the

Annual

Information

Return

By email through a

single email address at

esubmission@bir.gov.ph

By email at the

dedicated email

address of the

RDO where the

taxpayer is duly

registered

4. Where will the

alphalist be

initially lodged

before it can be

successfully

uploaded and

stored in the

data

warehouse, for

purposes of

considering the

same as

officially

received by the

BIR?

Revenue Data

Center (RDC)

where the content

of the alphalist

shall undergo an

automated

validation

process

RDC where the content

of the alphalist shall

undergo an automated

validation process

Revenue District

Office where the

content of the

alphalist will

undergo a

manual

validation

process prior to

uploading to the

RDC for the

automated

validation

process

3

3. Q. What is a data entry and validation module?

A. A data entry and validation module is a software application, with a built-in initial

validation facility, where the prescribed information in the alphalist can be filled-up by

the taxpayer and automatically stored in a file according to the prescribed CSV data file

format. The taxpayer may, at its option, save or store the information in another file

format such as text file and excel file formats. The said module can be downloaded by

the taxpayer from the BIR website at www.bir.gov.ph.

The said module can be used on a per withholding agent basis. In case, a taxpayer has

branches that separately withhold and remit their respective withholding taxes, they

shall prepare and file/submit separate alphalists for the head office and each of its

branches as separate withholding agents. For this purpose, the head office shall use the

head office suffix code (-000) in its TIN while each of the branches shall use their

respective branch office suffix codes (-001, 002, etc.).

4. Q. What are the steps to be performed by taxpayers who shall be submitting their alphalists

to the BI R through email for the first time?

A. The steps to be performed by taxpayers who shall be submitting their alphalists to the

BIR for the first time are as follows:

Step 1 - Visit the BIR website and press/click the icon Downloadables as

shown below.

Step 2 - In the Downloadables page as shown below, look for the

Alphalist Data Entry and Validation Module Version 3.4.

Downloadables

Human Resource Information System (HRIS) Templates

Alphalist Data Entry and Validation Module Version 3.4 (New)

Semestral List of Regular Suppliers (SRS) Validation Module

4

eRegistry System Version 1.0

Relief Version 2.1

eFPS Job Aids

Alphalist Job Aid

Technical Specifications of MAP and SAWT

VAT Registration Flyers

BIR Personal Data Sheet Form

BIR Personnel Forms

Alphalist Data Entry and Validation Module Version 3.4 (New)

To download the Alphalist Data Entry & Validation Module Version 3.4

just click on the following:

FTP : alphalist_full_setup_v3_4.exe ATC PATCH : atc_patch.zip

HTML : alphalist_full_setup_v3_4.exe

Step 3 - Select and open FTP: alphalist_full_setup_v3_4.exe or HTML:

alphalist_full_setup_v3_4.exe. to initiate the downloading process

and wait until the same is completed.

After the downloading process has been completed, the file

alphalist_full_setup_v3_4.exe. can be found in the folder

Downloads of the taxpayers computer.

Step 4 - Open the said file and follow the instructions of the Set-up

Wizard for the installation of data entry module in the taxpayers

computer. It is suggested that the icon of the module be set up on

the computers desktop for the convenience of the taxpayer. Two

separate icons will be set-up on the taxpayers computer desktop

for the data entry and the validation module for the alphalist. The

taxpayer may, at its option, store the said file containing the said

modules in a storage device such as CD, DVD or USB for future

use.

Step 5 - Immediately after the module is set-up in the taxpayers computer,

proceed to the computer desktop and press/click the icon for the

alphalist data entry module. The log-in screen, as shown below,

will be displayed to require the taxpayer to create its user name

and password.

5

Step 6 - After successfully creating the user name and password, the main

menu screen, as shown below, will be displayed containing the

icons for the different BIR Forms (e.g. MAP, SAWT and the No.

1604-CF and No. 1604-E) that the taxpayer shall be filling-up.

Step 7 - Select and open the icon for the appropriate BIR Forms (e.g.

MAP, SAWT and the No. 1604-CF and No. 1604-E) to be

accomplished. For the specific form selected, different screens

shall be displayed containing all the prescribed schedules to be

filled-up.

Step 8 - Fill up all the applicable fields and boxes for each of the different

schedules of the alphalist.

Step 9 - After filling-up all the applicable fields and boxes in the last

schedule of the alphalist (Schedule 7.5) in the screen illustrated

below, press the exit button located at the bottom right corner

thereof.

6

The menu for the Annual Information Return for Employees and

Payees will be displayed as shown below:

Step 10. - Press/Click the Generate File button. The SAVE AS screen

shall be displayed on top of the menu for the Annual Information

Return for Employees and Payees as shown below:

7

Step 11 - Press/Click Save button to convert the data contained in the

accomplished schedules into a CSV data file format (DAT file)

and to store the same in the eAlpha Folder. A pop-up message

Do you want to view the file created? shall be displayed on the

screen as shown below:

Step 12 - Press/Click Yes button and the Notepad screen shall appear,

as shown below, containing the DAT file created by the module.

8

Step 13 - Press/Click X button located at the upper right hand corner of

the Notepad screen to return to the main menu screen for the

alphalist data entry module.

Step 14 - Press/Click Exit button of the main menu to close the alphalist

data entry module and to return to the computer desktop.

Step 15 - To validate the information contained in the accomplished

alphalist, press/click the icon for the validation module displayed

in the computer desktop. The main menu for the alphalist

validation module shall appear on the screen as shown below:

The TIN of the taxpayer-filer is automatically populated on the

box provided for the taxpayers TIN.

Check the taxable year indicated in the box provided for the Tax

Year. If the pre-populated tax year is different from the taxable

9

year covered by the alphalist being validated, encode the correct

taxable year in the box.

Step 16 - Select and open the icon for the appropriate BIR Forms (e.g.

MAP, SAWT and the No. 1604-CF and No. 1604-E) to be

validated. The validation screen for the specific form selected shall

be displayed as shown below:

Step 17 - In case the taxpayer desires to validate the entire alphalist, click

the button provided for By Form. However, if the taxpayer

desires to validate the alphalist on a per schedule basis, click the

button provided for By Schedule.

Click the Browse button and the screen containing all the

DAT files created shall be displayed on top of the validation

screen as shown below:

10

Press/Click the desired DAT file and the same shall be

highlighted. Then press/click Ok button and the validation menu

screen shall be displayed with the selected DAT file which is

automatically populated in the said menu. Afterwards, press/click

the Validate File button to initiate the validation process on the

selected file. The Select Directory screen shall appear on top of

the validation menu screen, as shown below.

Step 18 - Press/click the Select button and the Notepad screen shall

appear containing the results of the validation process as

illustrated below:

Step 19 - If there is no error detected, press/click the X button located at

the upper right hand corner of the screen and the screen, as shown

11

below, shall appear with the Validation Successful message.

Press/click Ok button to return to the alphalist validation module

screen.

Note: In case of several DAT files shall be validated, repeat all

the procedures provided for from Steps 15 to 18.

Step 20 - If there is/are error(s) detected, the Notepad screen shall be

displayed, as shown below, indicating the details of the detected

error(s).

12

Note: Since the detected error(s) is/are required to be corrected in

the alphalist data entry module, it is advised that a printed copy of

the above screen be generated by the taxpayer to facilitate the

necessary corrections.

Step 21 - Press/click the X button located at the upper right hand corner of

the screen and the screen, as shown below, shall appear with the

Error for this file still exist message.

Step 22 - Press/click the Ok button at the lower portion of the screen to

return to the alphalist validation module. Then press/click Exit

button to close the said module and return to the computer

desktop.

Step 23 - Proceed to the alphalist data entry module and perform the

necessary corrections on the affected schedules as generated by the

validation module.

NOTE: All the procedures required in Steps 7 to 18 shall be

performed until the message Validation Successful for each

DAT file created has been displayed.

Step 24 - Secure an email account offered by email service providers, such

as Yahoo (Yahoo! Mail), Google (Gmail), Microsoft

(Outlook.com, formerly Hotmail.com), etc., to be used in the

filing/submission of alphalist to the BIR.

13

Step 25 - Proceed to the BIRALPHA34 folder containing the eAlpha

folder and press/click the eAlpha folder to display all the DAT

files created by the data entry and validation module. Select the

specific DAT file(s) to be sent as an attachment, through the

selected email account, to the dedicated email address of the BIR

where the taxpayer is duly registered as indicated in the attached

Annex A of this Circular.

Step 26 - A message shall be displayed immediately after sending the

alphalist acknowledging/confirming the receipt thereof by the

concerned BIR Office.

Generate a printed copy of the computer screen containing

message acknowledging/confirming the receipt of the emailed

alphalist by the concerned BIR Office for purposes of attaching

the same to the Annual Information Returns and/or future

reference.

For further details and for questions that may arise in the accomplishment of the

alphalist, the taxpayer may refer to the job aids by selecting the Alphalist Job-Aid in

the Downloadables page as shown below:

Downloadables

Human Resource Information System (HRIS) Templates

Alphalist Data Entry and Validation Module Version 3.4 (New)

Semestral List of Regular Suppliers (SRS) Validation Module

eRegistry System Version 1.0

Relief Version 2.1

eFPS Job Aids

Alphalist J ob Aid

Technical Specifications of MAP and SAWT

VAT Registration Flyers

BIR Personal Data Sheet Form

5. Q. What shall the taxpayer do if it fails to receive the message of

acknowledging/confirming the receipt of the alphalist by the BI R right after the

emailed alphalist is actually sent to the RDO?

A. Once the alphalist is successfully sent to the BIR, a message shall be automatically

popped-up on the computer screen acknowledging/confirming the receipt of the BIR of

the submitted alphalist.

In cases where the taxpayer failed to receive such message due to technical concerns

such as high email traffic, the erroneous use of RDO email address, the alphalist is not

attached to the email that was sent to the RDO, etc., the taxpayer shall exercise due

diligence to ensure that the alphalist has been actually and timely received by the correct

RDO, and a pop-up message indicating that the filed/submitted alphalist has been

14

received by the RDO.

Accordingly, the taxpayer shall immediately coordinate with the concerned RDO to

determine whether or not the submitted alphalist through email has been received by the

RDO. Otherwise, the taxpayer shall check the correctness of the previously used RDO

email address and re-send the same to the correct RDO email address, as the case may

be.

6. Q. Will the taxpayer also receive an email message that the submitted alphalist has been

successfully uploaded to the BIR data warehouse or, otherwise, failed the prescribed

BI R validation processes?

A. Yes. The taxpayer shall receive an email message that the submitted alphalist has been

successfully uploaded to the BIR data warehouse or, otherwise, failed the prescribed BIR

validation processes. The reasons on the failure from the validation processes shall

likewise be indicated in the message. For this purpose, the taxpayer shall immediately

address these reasons and re-submit, through eSubmission or email, as the case may be,

the corrected and completely filled-up alphalist to the concerned RDO, within five (5)

days from receipt of the said message. Accordingly, in order that the taxpayers email

account is regularly visited and to prevent the taxpayer from denying that it failed to

receive the message, if the RDO has actually sent the message to the email address of the

taxpayer, such message sent by the RDO is deemed received and read by the taxpayer.

7. Q. I s there a need for taxpayers to print the computer screen displaying the

acknowledgement receipt, for those using the eSubmission, or the email message, for

those using the email submission, acknowledging/confirming the receipt of the

emailed alphalist? Why?

A. Yes. The taxpayer should print the computer screen displaying such

acknowledgement/confirmation by the BIR of the receipt of the emailed alphalist. The

printed copy of the computer screen display of the acknowledgement/confirmation of the

BIRs receipt of the alphalist shall serve as documentary proof of filing/submission of

the alphalist, in lieu of the hard or physical copy thereof, which shall be attached to the

hard or physical copy of the Annual Information Returns (BIR Form No. 1604-CF and

No. 1604-E) upon filing thereof to the concerned RDO.

8. Q. Are the Annual I nformation Returns (BIR Form No. 1604-CF and No. 1604-E)

included in the submission of the alphalist through the different modes enumerated

under RR No. 1-2014?

A. Except for taxpayers who are using the eFPS facility in filing the Annual Information

Returns, all other taxpayers are still required to prepare and submit the hard or physical

copies thereof, together with the printed copy of the computer screen display of the

acknowledgement/confirmation of the BIRs receipt of the alphalist, to the RDO where

the concerned taxpayers are duly registered, considering that only the submission of

alphalist through the three different modes (e.g., eFPS, eSubmission and email

submission) is prescribed by the said regulations.

9. Q. What is the presumption on the maintainance by the taxpayer of an email account for

purposes of submission of the alphalist?

15

A. The presumption is that the taxpayer is deemed the owner of the email account used in

submission of the alphalist, and the alphalist submitted to the concerned RDO is deemed

submitted by the taxpayer himself/herself/itself. Accordingly, in case of violations

committed in the submission of the alphalist, either through esubmission or email, the

taxpayer is the one liable to the corresponding penalties therefor.

10. Q. Are the Monthly Alphalist of Payees (MAP) and the Summary Alphalist of

Withholding Taxes (SAWT) also covered by the different modes of submission

prescribed under RR No. 1-2014?

A. Yes. Except for the Monthly Remittance Return for Compensation (BIR Form No. 1601-

C) where the monthly list of recipients of compensation is not required to be attached to

the said monthly remittance return, the submission of the alphalist of income payees,

e.g., Monthly Alphalist of Payees (MAP) and the Summary Alphalist of Withholding

Taxes (SAWT) are likewise required to be filed/submitted to the concerned RDO

through the applicable modes of submission prescribed under the said revenue

regulations.

However, except for taxpayers who are using the eFPS facility in filing the Monthly

Remittance Returns (BIR Form No. 1601-C, etc.), as well as, the Income Tax Returns

(quarterly and annual returns), Value-Added Tax Declarations/Returns (BIR Form No.

2550M and No. 2550Q), Percentage Tax Returns (BIR Form Nos. 2551M and No.

2551Q), all other taxpayers are still required to prepare and submit the hard or physical

copies thereof and pay the corresponding withholding taxes due thereon, if any, together

with the printed copy of the computer screen display of the

acknowledgement/confirmation of the BIRs receipt of the monthly alphalist, to the

Authorized Agent Bank (AAB) or RDO where the concerned taxpayers are duly

registered, as the case may be.

11. Q. What shall the taxpayers do if they have already submitted the hard or physical copies

of annual information returns and alphalists, including those alphalists stored in CD,

DVD, USB and other storage devices according to the prescribed CSV data file format,

before the issuance and effectivity of RR No. 1-2014?

A. In cases of taxpayers who have already filed the requisite alphalist through the

abovementioned storage devices before the effectivity of RR No. 1-2014, they shall no

longer be required to submit the alphalist through any of the different modes prescribed

by the same regulations, if applicable. The information contained in these storage

devices shall be processed by the BIR under the existing guidelines and procedures.

On the other hand, for those alphalists that were submitted in hard or physical copies to

their respective RDOs, the taxpayers are still required to re-submit the said alphalist

through the different applicable modes prescribed under the said regulations. However,

the same shall be re-submitted to the concerned RDOs using the herein the applicable

filing facilities herein prescribed not later than March 1, 2014.

12. Q. I n order that the alphalist can be successfully uploaded into the data warehouse of the

BI R and considered as duly received by the BI R, what are the requirements that all

concerned taxpayers shall strictly observe?

A: All concerned taxpayers shall strictly observe the following requirements in order that

16

their alphalists can be considered as successfully uploaded and duly received by the

BIR:

a. The taxpayer-withholding agent is duly registered with the concerned RDO having

jurisdiction over his/her/its business as a head office or as a branch, as the case may

be.

b. The alphalist is emailed to the correct email address assigned for this purpose to the

RDO where the taxpayer is duly registered.

c. The email address should be the official business email address of the taxpayer, in

case of corporations or partnerships, or the personal email address of the BIR-

registered taxpayer, in case of sole proprietorships. However, for sole

proprietorships, the individual registered taxpayer, for purposes of filing/submitting

his/her alphalist, may authorize his/her subordinate employees to use their

respective personal email accounts; provided, that the latters submission of the

alphalist is deemed the submission of the individual registered taxpayer

himself/herself. Accordingly, in case of violations committed by such subordinate

employees in the submission of the alphalist, the individual registered taxpayer is

the one liable to the corresponding penalties therefor.

d. The latest version of the data entry module which is version no. 3.4 shall be used in

filling up the alphalist. Accordingly, the taxpayers shall visit the BIR website and

download the said latest version of the data entry module.

e. Ensure that the file containing the alphalist is not infected by any virus.

f. The information contained in the alphalist shall not bear special characters such as

but, not limited to, , *, ?, &, etc.

g. The Taxpayer Identification Number(s) indicated in the alphalist is/are valid and

correspondingly issued by the BIR to the employee(s) or payee(s). Accordingly, the

concerned taxpayers are not allowed to submit the alphalist without the

corresponding TIN(s) of each of the employees/payees nor to indicate dummy

TIN(s) 000-000-000-000 as their respective TIN(s).

h. Specify the complete name of the taxpayer(s)/payee(s) with the corresponding

amount of income and withholding tax. Hence, the following word(s) Various

Employees, Various payees, PCD nominees or Others and other similar

word(s) where the total taxes withheld are lumped into one single amount are not

allowed.

i. In case of re-submission of alphalist, after due notification and requirement from the

concerned BIR Office, or submission of amended alphalist, the re-submitted or

amended alphalist shall contain the complete and correct information. Re-submitted

or amended alphalist containing only the changes on the affected line items in the

alphalist cannot be successfully uploaded in the data warehouse.

17

13. Q. I n cases where an alphalist is not successfully uploaded and considered not received

by the BI R pursuant the provisions of RR No. 1-2014, what shall be the penalty to be

imposed to the taxpayer who submitted an unsuccessfully uploaded alphalist?

A: Inasmuch as the said violation is considered as a failure to make/file/submit any return

or supply correct information at the time or times required by law or regulations under

Section 255 of the National Internal Revenue Code of 1997, as amended, the taxpayer is

liable to the criminal penalty of fine of not less than P10,000 and imprisonment of not

less than one (1) year but not more than ten (10) years, or in lieu thereof, to pay the

compromise penalty in the amount that corresponds to the taxpayers gross annual sales,

earnings or receipts, pursuant to the existing Revenue Memorandum Order on Schedule

of Compromise Penalties.

However, in cases where the concerned BIR Office, after conducting the required

validation processes, shall duly inform the taxpayer for non-compliance with any of the

requirements prescribed in Question 12 of this Circular and require the re-submission of

a correct alphalist, a separate penalty shall be imposed against the taxpayer for each

incorrectly accomplished and submitted alphalist.

14. Q. I n cases where the taxpayer has no operations for the preceding taxable year, is the

said taxpayer still required to submit the Annual I nformation Returns and the

alphalist?

A: For taxpayers with no operations during the preceding taxable year, they are still

required to file the Annual Information Returns within the prescribed deadlines with the

phrase No Operations printed clearly on the face of the said returns. However, the

filing/submission of the prescribed alphalist shall be subject to the following policies

and guidelines:

1. If the taxpayer totally has no business operations and at the same time did not incur

any expense, including salaries and wages, for the preceding taxable year, the

taxpayer shall no longer be required to file/submit the prescribed alphalist.

2. If the taxpayer totally has no operational transactions but incurred expenses which

are not subject to the imposition of the applicable withholding taxes during the

preceding taxable year, the filing/subsmission of alphalist is subject further to the

following rules:

a. If the particular expense pertains to compensation of employee(s), the taxpayer-

employer is still required to file/submit the prescribed alphalist with the

accomplished pertinent schedules for employees that are exempt to withholding

taxes even if the compensation of the employee(s) is/are below the taxable

threshold (e.g. compensation of minimum wage earners, total personal

exemptions exceed the taxable compensation, etc.)

b. If the expense incurred is not subject to final and/or creditable withholding taxes

under existing rules and regulations, the taxpayer is not required to file/submit

the prescribed alphalist.

3. If the taxpayer totally has no operational transactions but incurred expenses and

actually withheld and remitted the applicable withholding taxes due thereon during

18

the preceding taxable year, the taxpayer is still required to file/submit the prescribed

alphalist.

15. Q. I f the taxpayer failed to file the alphalist, or may have filed the same but the alphalist

failed the validation requirements of the BIR and the taxpayer failed to address the

issues and re-submit the complete and corrected alphalist to the BI R, can the

taxpayer claim the expenses arising from the alphalist for income tax purposes?

A: No. The taxpayer cannot claim the expenses for income tax purposes due its failure to

file the prescribed alphalist or its failure to re-submit the complete and corrected

alphalist after the validation process conducted by the BIR.

However, in cases where the taxpayer, although the submitted alphalist contains no

erroneous entries and the alphalist has been successfully uploaded in the BIRs data

warehouse, failed to enter some transactions that should have been entered in the

previously submitted alphalist, the taxpayer should not only re-file/re-submit the

missing information to correct the previously submitted alphalist, but should re-file/re-

submit the complete and corrected alphalist to the BIR.

Moreover, in cases of expenses incurred by the taxpayer that is not subject to creditable

or final taxes pursuant to existing rules and revenue regulations, the taxpayer need not

include such expenses in the alphalist.

16. Q. For purposes of email submission of the alphalist to the RDO having jurisdiction over

the concerned taxpayers pursuant to RR No. 1-2014, what are the email addresses of

the different BI R Offices?

A: The email addresses of the different BIR Offices which are dedicated for the receipt of

alphalists submitted through email by taxpayer are contained in the summary list

attached as Annex A hereof.

All revenue officers and employees are hereby enjoined to give this Circular as wide a

publicity as possible.

This Circular shall take effect immediately.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

J-5

You might also like

- Registration of Partnerships and CorporationsDocument6 pagesRegistration of Partnerships and CorporationsPaolo LimNo ratings yet

- Refund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14Document3 pagesRefund of CWT and VAT Upon Dissolution of Company - ICN 9.11.14JianSadakoNo ratings yet

- Limcoma Rural Bank, Inc. June 25, 2010Document4 pagesLimcoma Rural Bank, Inc. June 25, 2010Ronnie RimandoNo ratings yet

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachNo ratings yet

- Itad Bir Ruling No. 294-12Document22 pagesItad Bir Ruling No. 294-12fatmaaleahNo ratings yet

- DOF Local Finance Circular 03-93Document4 pagesDOF Local Finance Circular 03-93Peggy SalazarNo ratings yet

- Rights of HomeownersDocument6 pagesRights of HomeownersELS Labor ConsultantsNo ratings yet

- HGC 2015 - Notes To Financial StatementsDocument34 pagesHGC 2015 - Notes To Financial StatementsDeborah DelfinNo ratings yet

- RR 9-89Document6 pagesRR 9-89papepipupoNo ratings yet

- Agreement On The Supply of Goods and Services - 2015Document1 pageAgreement On The Supply of Goods and Services - 2015fvidal11No ratings yet

- Real Estete PVT Co MOADocument5 pagesReal Estete PVT Co MOADEEPAK GUPTA100% (1)

- Maritime Industry Authority Advisory No 2017-17Document3 pagesMaritime Industry Authority Advisory No 2017-17PortCalls100% (2)

- RMC 102-2016 PDFDocument1 pageRMC 102-2016 PDFMark Cabisada JurillaNo ratings yet

- RR 1-98Document9 pagesRR 1-98Crnc NavidadNo ratings yet

- Application For Closure of BusinessDocument2 pagesApplication For Closure of BusinessallanNo ratings yet

- BIR RMC No. 62-2005Document15 pagesBIR RMC No. 62-2005dencave1No ratings yet

- Joint Venture EOP 6.14.12Document2 pagesJoint Venture EOP 6.14.12NHYNo ratings yet

- Undertaking AritanaDocument1 pageUndertaking AritanaLhess RamosNo ratings yet

- PAGCOR Personal Disclosure Statement FormDocument4 pagesPAGCOR Personal Disclosure Statement FormPennyConsunji100% (1)

- Comparative Tax Incentives Available To Bpo Companies Registered With The Boi and The PezaDocument4 pagesComparative Tax Incentives Available To Bpo Companies Registered With The Boi and The Pezajilliankad100% (1)

- Special License - New - Consortium - Local and ForeignDocument13 pagesSpecial License - New - Consortium - Local and Foreignkairel82No ratings yet

- The Revised Makati Revenue Code City Ordinance No. 2004-A-025Document3 pagesThe Revised Makati Revenue Code City Ordinance No. 2004-A-025marmiedyanNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasArlyn De Las AlasNo ratings yet

- SD-SCD-QF01 Application For PS (FORM) - 19june2014Document4 pagesSD-SCD-QF01 Application For PS (FORM) - 19june2014Mitch EspirituNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Panoril PN Set-2Document2 pagesPanoril PN Set-2Aileen PuerinNo ratings yet

- Rmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeDocument2 pagesRmo 12 2013 List of Unused Expired Orssiscis Annex D Docxdocx PDF FreeShitake Mitsuki100% (1)

- Section 2.57.4 of RR No. 2-98Document2 pagesSection 2.57.4 of RR No. 2-98fatmaaleahNo ratings yet

- SDFGSDF 23 Q 4 SDFGDSFDocument1 pageSDFGSDF 23 Q 4 SDFGDSFAdventist Hospital DavaoNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Memorandum of Agreement: WitnessethDocument2 pagesMemorandum of Agreement: WitnessethOmnibus MuscNo ratings yet

- Guidelines and Instruction For BIR Form No 1702 RTDocument2 pagesGuidelines and Instruction For BIR Form No 1702 RTRahrahrahn100% (2)

- David DeletionDocument3 pagesDavid Deletionjohn dominic aldabaNo ratings yet

- OJT Contract For Clinical SettingDocument5 pagesOJT Contract For Clinical SettingJohn Russell Morales100% (1)

- 2016 Sublicense AgreementDocument1 page2016 Sublicense AgreementnsaoifnasidfnNo ratings yet

- Independent Contractor AgreementDocument8 pagesIndependent Contractor AgreementBobot EscoteNo ratings yet

- InvestmentDocument71 pagesInvestmentJon CarlNo ratings yet

- Draft Service AgreementDocument2 pagesDraft Service AgreementIzo SeremNo ratings yet

- BIR Ruling No. OT-026-20 (RMO 9-14)Document4 pagesBIR Ruling No. OT-026-20 (RMO 9-14)Hailin QuintosNo ratings yet

- Integrity PactDocument7 pagesIntegrity PactHarpreet SinghNo ratings yet

- Application For Cba Registration: PART I. General Information A. PartiesDocument3 pagesApplication For Cba Registration: PART I. General Information A. PartiesHERMAN DAGIONo ratings yet

- Philhealth Circular 2016-0034 PDFDocument4 pagesPhilhealth Circular 2016-0034 PDFjeanvaljean999No ratings yet

- Sample Talent ContractDocument20 pagesSample Talent ContractEunice SagunNo ratings yet

- 1601EDocument7 pages1601EEnrique Membrere SupsupNo ratings yet

- Primary PurposeDocument1 pagePrimary PurposeAngelo LabiosNo ratings yet

- Loan Agreement 3Document1 pageLoan Agreement 3Lj PolcaNo ratings yet

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax Clearancekenneth june reyes100% (1)

- Pro-Forma Application Letter For Enrollment in PEZA Electronic Zone Transfer System (EZTS)Document2 pagesPro-Forma Application Letter For Enrollment in PEZA Electronic Zone Transfer System (EZTS)PortCallsNo ratings yet

- App Name: Luxpowerview: 1. Register An AccountDocument8 pagesApp Name: Luxpowerview: 1. Register An AccountBanjo MirandillaNo ratings yet

- Nino SawtDocument2 pagesNino SawtCarolina VillenaNo ratings yet

- Alpha Global Marketing LTDDocument12 pagesAlpha Global Marketing LTDRich Alex ApuntarNo ratings yet

- Board Resolution FormatDocument2 pagesBoard Resolution FormatPrawyn50% (2)

- RR 16-99Document6 pagesRR 16-99matinikkiNo ratings yet

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceDocument74 pagesCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveNo ratings yet

- Republic of The Philippines Court of Appeals Manila CityDocument11 pagesRepublic of The Philippines Court of Appeals Manila Citymelaniem_1No ratings yet

- Sublease FormatDocument6 pagesSublease FormatNan MallNo ratings yet

- Compromise Agreement CabillageDocument3 pagesCompromise Agreement Cabillagebrad abonadoNo ratings yet

- Master Employment Contract: (On Plain Legal Size Paper) (For Authentication With Phil. Embassy/Consulate)Document2 pagesMaster Employment Contract: (On Plain Legal Size Paper) (For Authentication With Phil. Embassy/Consulate)Arvin Antonio Ortiz100% (1)

- RMC No 5-2014 Clarification RR 1-2014Document18 pagesRMC No 5-2014 Clarification RR 1-2014cherish belle calubNo ratings yet

- eBIR FormsDocument31 pageseBIR FormsAibo GacuLa71% (7)

- 6.4+DSOAR FINAL+4+Easement+form+6Document2 pages6.4+DSOAR FINAL+4+Easement+form+6theengineer3No ratings yet

- 01 RR 10-2002Document3 pages01 RR 10-2002sj_adenipNo ratings yet

- Revenue Memorandum Circular No. 001-18: CD Technologies Asia, Inc. 2018Document3 pagesRevenue Memorandum Circular No. 001-18: CD Technologies Asia, Inc. 2018sj_adenipNo ratings yet

- RMC No 16-2015Document3 pagesRMC No 16-2015sj_adenipNo ratings yet

- RMC No 14-2015Document12 pagesRMC No 14-2015anorith88No ratings yet

- RMO No 8-2017Document32 pagesRMO No 8-2017sj_adenipNo ratings yet

- 13 2015 On Supplemental InformationDocument1 page13 2015 On Supplemental Informationpja_14No ratings yet

- RR No. 02-03Document28 pagesRR No. 02-03sj_adenipNo ratings yet

- RP-Singapore Tax TreatyDocument23 pagesRP-Singapore Tax Treatysj_adenipNo ratings yet

- Receiv: Bureau Internal RevenueDocument1 pageReceiv: Bureau Internal Revenuew8ndblidNo ratings yet

- Revenue Memorandum Circular No. 18-2015Document2 pagesRevenue Memorandum Circular No. 18-2015GMA News OnlineNo ratings yet

- RR 6-2014-1 PDFDocument4 pagesRR 6-2014-1 PDFGreg AustralNo ratings yet

- RMC No 17-2015Document1 pageRMC No 17-2015sj_adenipNo ratings yet

- CE,/vwfr: RE/rEI (UE Memorandum Circular IIDocument1 pageCE,/vwfr: RE/rEI (UE Memorandum Circular IIMel GaneloNo ratings yet

- Revenue Regulations No 2-2015Document4 pagesRevenue Regulations No 2-2015Yaz Carloman0% (1)

- RR 5-2015 Annex ADocument1 pageRR 5-2015 Annex Asj_adenipNo ratings yet

- RR 13-98Document18 pagesRR 13-98Boyet CariagaNo ratings yet

- BB 2015-01Document2 pagesBB 2015-01James Salviejo PinedaNo ratings yet

- Bir RR No 2-2015 Annex CDocument1 pageBir RR No 2-2015 Annex CAnonymous yKUdPvwj67% (6)

- RR 6-2014-1 PDFDocument4 pagesRR 6-2014-1 PDFGreg AustralNo ratings yet

- RR 2-2015 Annex ADocument1 pageRR 2-2015 Annex Asj_adenipNo ratings yet

- RR 2-2015 Annex BDocument1 pageRR 2-2015 Annex Bsj_adenipNo ratings yet

- RR No 3-2015 PDFDocument2 pagesRR No 3-2015 PDFAaron MeyersNo ratings yet

- RMO No 16-2014Document2 pagesRMO No 16-2014sj_adenipNo ratings yet

- RMC No 5-2014 - Clarifying The Provisions of RR 1-2014Document18 pagesRMC No 5-2014 - Clarifying The Provisions of RR 1-2014sj_adenipNo ratings yet

- RR No. 02-03Document28 pagesRR No. 02-03sj_adenipNo ratings yet

- RMC No 22-2015Document2 pagesRMC No 22-2015philippinecpaNo ratings yet

- RMC 7-2014Document2 pagesRMC 7-2014sj_adenipNo ratings yet

- RMO No 9-2014 Request For RulingDocument4 pagesRMO No 9-2014 Request For RulingMervic Al Tuble-NialaNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument1 pagePFMS Generated Print Payment Advice: To, The Branch HeadHarsh VarshneyNo ratings yet

- Form GST REG-06: (Amended)Document5 pagesForm GST REG-06: (Amended)SaurabhNo ratings yet

- Covid Care FacilityDocument5 pagesCovid Care FacilityNDTVNo ratings yet

- UAE Standard Work Visa 2024 (Benefits and Types)Document2 pagesUAE Standard Work Visa 2024 (Benefits and Types)habraraheemNo ratings yet

- Accounting & Control: Cost ManagementDocument40 pagesAccounting & Control: Cost ManagementBusiness MatterNo ratings yet

- RCI Power Limited Vs Union of India UOI and Ors 18a030354COM749318 PDFDocument89 pagesRCI Power Limited Vs Union of India UOI and Ors 18a030354COM749318 PDFavsharikaNo ratings yet

- Positive Role The Indian Youth Can Play in PoliticsDocument2 pagesPositive Role The Indian Youth Can Play in PoliticsArul ChamariaNo ratings yet

- SM-5 Audit Engagement Letter - FormatDocument2 pagesSM-5 Audit Engagement Letter - FormatCA Akash AgrawalNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehicleJonah ReyesNo ratings yet

- Din en Iso 15976Document8 pagesDin en Iso 15976Davi Soares BatistaNo ratings yet

- 4 05A+WorksheetDocument3 pages4 05A+WorksheetEneko AretxagaNo ratings yet

- Intra Court AppealDocument18 pagesIntra Court AppealAdnan AdamNo ratings yet

- Final Exam Bsma 1a June 15Document12 pagesFinal Exam Bsma 1a June 15Maeca Angela SerranoNo ratings yet

- Human Rights Project, 2018Document25 pagesHuman Rights Project, 2018Vishal Jain100% (3)

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- How Do You Umpire in NetballDocument3 pagesHow Do You Umpire in NetballNita NorNo ratings yet

- Final Version Angharad F JamesDocument264 pagesFinal Version Angharad F JamesNandhana VNo ratings yet

- Provisional Selct List Neet-Ug 2021 Round-2Document88 pagesProvisional Selct List Neet-Ug 2021 Round-2Debopriya BhattacharjeeNo ratings yet

- Contract of Lease: Know All Men by These PresentsDocument3 pagesContract of Lease: Know All Men by These PresentsManlapaz Law OfficeNo ratings yet

- Youth Empowerment Grants ApplicationDocument5 pagesYouth Empowerment Grants ApplicationKishan TalawattaNo ratings yet

- Osterhoudt v. Regional Scuba - Decision & Order On Summary Judgment 08-13-2014Document4 pagesOsterhoudt v. Regional Scuba - Decision & Order On Summary Judgment 08-13-2014dgclawNo ratings yet

- Sample Position PapaerDocument1 pageSample Position PapaeremmaldavisNo ratings yet

- Commonwealth Act 141 Powerpoint ReportDocument17 pagesCommonwealth Act 141 Powerpoint ReportVinz G. VizNo ratings yet

- U.S. v. John Earle SullivanDocument28 pagesU.S. v. John Earle SullivanLucas ManfrediNo ratings yet

- CONSTICRUZ-cropped Copy-Part 2 PDFDocument169 pagesCONSTICRUZ-cropped Copy-Part 2 PDFTori PeigeNo ratings yet

- York County Court Schedule Feb. 27, 2014Document11 pagesYork County Court Schedule Feb. 27, 2014York Daily Record/Sunday NewsNo ratings yet

- Prout v. Starr, 188 U.S. 537 (1903)Document7 pagesProut v. Starr, 188 U.S. 537 (1903)Scribd Government DocsNo ratings yet

- M-Xii Corona vs. SenateDocument2 pagesM-Xii Corona vs. SenateFritzie G. PuctiyaoNo ratings yet

- Eng 122 PPT ReportingDocument23 pagesEng 122 PPT ReportingCatherine PedrosoNo ratings yet

- Lifetime License ApplicationDocument2 pagesLifetime License ApplicationBibhaas ojhaNo ratings yet