Professional Documents

Culture Documents

Patent, R & D and Technological Spillovers

Uploaded by

ganeshone0 ratings0% found this document useful (0 votes)

10 views16 pagesRelationship between technological acitivities and Patents

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRelationship between technological acitivities and Patents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views16 pagesPatent, R & D and Technological Spillovers

Uploaded by

ganeshoneRelationship between technological acitivities and Patents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS

AT THE FIRM LEVEL: SOME EVIDENCE FROM

ECONOMETRIC COUNT MODELS

FOR PANEL DATA

MICHELE CINCERA

+

Universite Libre de Bruxelles CP 140, Ave F.D. Roosevelt, 50, 1050 Bruxelles, Belgium

SUMMARY

This paper analyses the relationship between the main determinants of technological activity and patent

applications. To this end, an original panel of 181 international manufacturing rms investing substantial

amounts in R&D during the late 1980s has been constructed. The number of patent applications by rms is

explained by current and lagged levels of R&D expenditures and technological spillovers. Technological and

geographical opportunities are also taken into account as additional determinants. In order to examine this

relationship, several econometric models for count panel data are estimated. These models deal with the

discrete nature of patents and rm specic unobservables arising from the panel data context. The main

ndings of the paper are rst, a high sensitivity of results to the specication of patent distribution. Second,

the estimates of the preferred GMM panel data method suggest decreasing returns to scale in technological

activity and nally a positive impact of technological spillovers on rm's own innovation. #1997 by John

Wiley & Sons, Ltd.

J. Appl. Econ., 12, 265280 (1997)

No. of Figures: 0. No. of Tables: 7. No. of References: 27.

1. INTRODUCTION

Recent economic studies on Research and Development (R&D) activities indicate an increasing

interest in the relationship between rms' R&D investment and patent applications. Though

patents are not a perfect measure of R&D output (Griliches, 1990), they constitute a relevant

measure of the technological eectiveness of R&D activities. Over the past years, several authors

have examined the dynamic structure of the patentR&D relationship

1

by considering the

number of patent applications as a function of present and lagged levels of R&D expenditures.

The purpose of this paper is to further explore the link between patent applications and rms'

R&D activities by applying recently developed econometric techniques on a new international

data set of R&D rms over the period 198391. Besides the international feature of the dataset,

the paper extends the framework of previous studies on the patentR&D relationship by taking

into account additional determinants of patenting. These determinants are a measure of

CCC 08837252/97/03026516$17

.

50 Received 15 June 1995

#1997 by John Wiley & Sons, Ltd. Revised 3 February 1997

JOURNAL OF APPLIED ECONOMETRICS, VOL. 12, 265280 (1997)

+

Correspondence to: Michele Cincera, DULBEA, CP 140, 40, Ave F.D. Roosevelt, B-1050 Bruxelles, Belgium.

Contract grant sponsor: Universite Libre de Bruxelles.

1

For example, see Hausman, Hall and Griliches, henceforth HHG, (1984, 1986), Montalvo (1993), Blundell, Grith

and Windmeijer, henceforth BGW, (1995), and Cre pon and Duguet (1993, 1997) for studies measuring the eects of

R&D on patents with rms' panel data. In Blundell, Grith and Van Reenen, henceforth BGVR, (1995), the dependent

variable is the count of the number of innovations.

technological spillovers, i.e. technological knowledge borrowed by one rm from other rms, as

well as technological and geographical opportunities. Despite all diculties encountered when

measuring technological spillovers, evidence of their importance has been found in many

empirical studies.

2

Moreover, such eects take time to be expressed in new patents and it is worth

giving attention to their precise timing.

In order to treat appropriately specic issues arising from the discreteness of patent counts in

the context of panel data, ad hoc econometric models for count panel data have to be

implemented.

3

For instance, the discrete non-negative nature of the dependent patent variable

generates non-linearities that make the usual linear regression models inappropriate. Moreover,

in panel data, the presence of rm-specic unobservables or unobserved `heterogeneity' such as

the aptitude of engineers to invent new products are not uncommon and these unobservables

inuence the way by which rms decide to apply for patents. It is well known from the analysis of

panel data that the treatment of these rm unobserved specic eects leads to the so-called `xed'

and `random' eects models. Although the question of whether to treat the eects as xed or

random is not an obvious one,

4

when rm-specic eects are correlated with some right-hand-

side explanatory variables, the random eects model is no longer consistent. In the context of

the patentR&D relationship, there are reasons to believe that the unobservables are not

independent of the regressors. For instance, if the aptitude to invent is high, then R&D

investments will be higher. This (positive) correlation shows itself in upward-biased estimates and

the random specication is no longer valid. In order to get around this problem, one possibility is

to consider the conditional maximum likelihood estimator developed by HHG (1984). However,

this xed eects approach relies on the assumption of strong exogeneity of the right-hand-side

variables. As will be discussed below, this assumption is hard to maintain in the patentR&D

relationship and hence a more general approach allowing for both correlated eects and

predetermined variables is also estimated. Finally, some issues related to the specication of the

explanatory variables are examined. In particular, it is ascertained that these variables are not

reecting neglected serial correlation and dynamic misspecication.

The paper is organized as follows. Section 2 presents the specication of the patentR&D

relationship to be estimated as well as some econometric count models for panel data and their

properties. To begin, the basic Poisson model is introduced as a benchmark model. Then, the

more General Event Count model and a semi-parametric estimator both based on a random

eects specication of the unobservables are presented. In order to allow for correlated rm-

specic eects, a conditional maximum likelihood estimator and a non-linear GMM estimator

are discussed. These estimators are based on xed eects specications and later model relaxes

the strict-exogeneity assumption of the regressors. Finally, the specication issues raised above

are investigated by imposing restrictions on serial correlation in the previous GMM estimator

and by considering an alternative one based on a dynamic specication of the patenting process.

The construction of some variables and the main characteristics of the data sample are exposed in

Section 3. Section 4 summarizes the main empirical ndings. Section 5 concludes with the

economic and methodological implications of the paper.

2

For a review, see Griliches (1992). It should be noted that with the exception of Cre pon and Duguet (1993) who

estimated the impact of technological spillovers on patents with a simpler model (no distributed lag in R&D and

spillovers), none of the cited papers above consider this additional variable.

3

For a discussion of count data models, see Gourie roux, Monfort and Trognon, henceforth GMT, (1984b), Cameron

and Trivedi (1986) and Winkelmann and Zimmermann (1991, 1995).

4

See Hsiao (p. 41, 1986).

266 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

2. PATENTR&D SPECIFICATION AND COUNT MODELS FOR PANEL DATA

2.1. The Knowledge Production Function and the Basic Poisson Model

In order to investigate the dynamics of the rms' patenting process, I adopt a specication along

the lines of Pakes and Griliches (1984), HHG (1984, 1986), Montalvo (1993), and BGW (1995).

These authors consider that patents, the dependent variable, is a function of contemporary and

lagged ow of the rms' annual R&D expenditures. In this paper, three additional technological

determinants are included in the knowledge-production function. These variables are the annual

ow of technological spillovers and the technological and geographical opportunities.

Technological opportunity and spillovers have often been described as technology-push forces,

i.e. the exogenous technological factors which exercise pressures on the innovative activity

(Rosenberg, 1983; Griliches, 1979, 1992). The technological opportunity represents the costs or

the diculties linked with technological activity. Such diculties vary with technological areas

because of the physical properties inherent to technology and the stock of scientic knowledge

available at a certain time. Also, if the costs of doing R&D vary among countries, then the

geographical opportunities can be expected to be important. Important variations in techno-

logical and geographical opportunity eects should be reected in dierent propensities to patent

among technological areas and countries. The technological spillovers are also an important

determinant of R&D activities. Technological spillovers are often divided into competitive and

diusion spillovers. In the theoretical literature of patent races models (Loury, 1979), competitive

spillovers have a negative rivalry eect on a rm's likelihood to apply for a patent to the extent

that the more competitors invest in R&D, the less a rm is likely to invent a new product rst.

Following Griliches (1992), diusion spillovers can be dened as the potential benets of the

research activity of other rms for a particular rm. Because the returns of R&D are not entirely

appropriable, the fruits of a rm's research activity may benet or spill over to other rms.

Hence, diusion spillovers have a positive impact on own R&D and, as a result, on patenting.

In order to assess the impacts of these determinants on the number of patent applications, the

discreteness of this variable has to be taken into account. For instance, because of diculties and

uncertainty inherent to R&D activities, rms do not always apply for patents and hence a zero

value is a natural outcome of this variable. Because of this property, the use of conventional

linear regression models may be inappropriate. The reasons are that some basic assumptions such

as the normality of residuals or the linear adjustment of data are no longer fullled. The usual

way to deal with the discrete non-negative nature of the patent dependent variable is to consider

the simple Poisson regression model. Let P

it

be this variable which represents the number of

patent applications by rm i at time t where i = 1; . . . ; N indexes rms and t = 1; . . . ; T indexes

time periods. The P

it

are assumed to be independent and have Poisson distributions with

parameters l

it

. Parameters l

it

depend on a set of explanatory variables which are in this case the

determinants of the knowledge production function:

l

it

= exp(x

it

b) = exp b

0

X

4

t=0

b

1tt

log(k

it t

)

X

4

t=0

b

2tt

log(s

it t

)

X

d

m

TD

m

X

g

n

GD

n

!

(1)

where x

it

5

represents the set of explanatory variables, b is the vector of parameters to be

estimated, k

it

is the annual ow of R&D investment, s

it

is the annual ow of spillovers, TD and

5

Because of data constraints and in order to allow for comparison with previous studies, a four-lag period has been

considered for explanatory variables.

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 267

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

GD are respectively technological and geographical time-invariant dummies which are intended

to pick up technological and geographical opportunities.

6

The dependent patent variable is

related to this function through the conditional mean of the Poisson model. An important

property of the Poisson model is the equality between its rst two conditional moments:

E(P

it

[ x

it

;b) = V(P

it

[ x

it

;b) = l

it

(2)

For panel data such as patents, the failure to include individual specic eects may lead to

`overdispersion', i.e. conditional variance exceeds conditional mean, when estimating a cross-

section model such as Poisson. For instance, in the patentR&D relationship the presence of

rms unobserved eects like the uncertainty inherent to R&D activities, the ability of engineers

to discover new products or the commercial risk of selling an invention, nd expression in the fact

that only a few successful rms are likely to apply for a large number of patents in a given time

period while for a majority of rms the importance of patenting may be limited or even nil. As

Winkelmann and Zimmermann (1995) stressed, overdispersion can arise for reasons such as

unobserved heterogeneity and this situation is not well suited by the Poisson model given the

property of equality between its two rst conditional moments. Therefore, more general

econometric models have to be considered.

2.2. Negative Binomial and QGPML Models

In order to take into account the unobserved heterogeneity, one possible extension of the Poisson

model is to include a rm unobserved specic eect e

i

into the l

it

parameters. This rm-specic

eect which is assumed to be invariant over time can be treated as random or as xed. In the case

of random eects, the Poisson's parameters become:

~

l

it

= exp(x

it

b e

i

) (3)

The random terms e

i

take into account possible specication errors of

~

l

it

. The precise form of the

distribution of the compound Poisson model depends upon the specic choice of the probability

distribution of exp(e

i

). In fact, dierent negative binomial models can be generated according to

the way the parameters of the gamma distribution are linked to the x

it

. For instance, in the

formulation of Winkelmann and Zimmermann (1991), the variancemean relationship of the

negative binomial model

7

is dened as:

V(P

it

[ x

it

) = (s

2

1)E(P

it

[ x

it

)

k1

E(P

it

[ x

it

) (4)

where s

2

and k, which are independent of b, represent, respectively, the dispersion parameter and

the non-linearity in the variancemean relationship. This more general full parametric specica-

tion allows for overdispersion. Furthermore, it embraces the Poisson model (for s

2

= 1) and

negative binomial models such as the so-called Negbin I (for s

2

> 1 and k = 0) and Negbin II

8

(for s

2

> 1 and k = 1) as special cases. Using the estimated value of s

2

and k, it is possible to

6

The construction of these variables is discussed in Section 3.

7

The authors call this model the General Event Count (GEC) model. A similar variance function is given by Cameron

and Trivedi (1986, p. 33).

8

For a discussion of these models, see Cameron and Trivedi (1986).

268 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

discriminate between the Poisson and both negative binomial models or to reject them rather

than to choose one of them a priori.

The models presented so far can all be estimated by maximum likelihood (ML) techniques.

However, the knowledge production function (1) has also been estimated by a Quasi-Generalized

Pseudo Maximum Likelihood (QGPML) estimator developed by GMT (1984a,b). The main

advantage of such a semi-parametric approach is that it requires fewer distributional assumptions

regarding exp(e

i

). However, it leads generally to less accurate estimates than those obtained by

the ML method if the chosen model is the true one.

2.3. CML and GMM Estimators

In the previous models, rm-specic eects are introduced into the Poisson parameter l

it

in order

to take into account the heterogeneity arising from the panel structure of data. Assuming that

these specic eects are random, the compounded Poisson model leads to more general models

such as the negative binomial and the QGPML ones. Nevertheless, as stressed by BGVR (1995),

this way of introducing the heterogeneity relies on the strong assumption that the rms'

unobserved eects are independent of the explanatory variables. If this assumption is not

satised, the previous estimators are not consistent and we know, from panel data analysis, that

in this case the xed eect specication has to be used. In order to allow for xed eects to be

correlated with regressors, I consider two alternative econometric approaches, the conditional

maximum likelihood estimator developed by HHG (1984) and a non-linear GMM estimator

proposed by Montalvo (1993) following Chamberlain (1992) and applied by BGVR (1995),

BGW (1995) and Cre pon and Duguet (1997). Both approaches rely on a xed eect specication

of the rm unobserved heterogeneity. Finally, the `robustness' of the spillover specication is

investigated by imposing stronger assumptions on the residuals of the previous GMM estimator

and by considering an alternative one based on a linear feedback model.

HHG (1984) developed xed-eects Poisson and negative binomial models based on the

conditional maximum likelihood approach of Anderson (1970). The key point of this approach

consists of conditioning on the sum over time of patents for a given rm. This allows removal of

the rms' specic eects from the distribution of the dependent patent variable conditionally to

the sum of patents over the whole period. Moreover, the authors showed that the derivation of

the Poisson xed-eect model leads to a multinomial logit distribution while a negative multi-

variate hypergeometric distribution is obtained from the negative binomial xed-eect model. It

should be noted that although these CML estimators allow one to get around the problem of

correlated rm-specic eects, their consistency relies on the crucial assumption of strict

exogeneity of explanatory variables (Montalvo, 1993; BGVR, 1995). This assumption is hard to

justify in the patentR&D relationship where the patenting of an innovation is likely to call for

further R&D. For instance, activities such as developing, testing, or improving a new product are

in many cases undertaken after the patent application itself. Hence the technological deter-

minants of the patenting process should be considered more as weakly exogeneous or predeter-

mined rather than strictly exogeneous.

The last approach investigated in this paper still allows for correlated xed eects but relaxes

the strict exogeneity assumption of the regressors. This approach departs from the multiplicative

xed-eects model (MFEM):

P

it

= exp(x

it

b e

i

) u

it

(5)

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 269

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

From this expression, the generalized method of moments (GMM) framework of Hansen (1982)

can be implemented by forming the following set of conditional mean restrictions:

E(P

it

[ z

is

;e

i

) = exp(x

it

b e

i

); \s 4 t (6)

where z

is

represents any set of instruments such that equation (6) holds. This raises the question

of the choice of the optimal instruments set. As in Montalvo (1993) and BGVR (1995), I consider

the following instruments:

z

is

= (1; k

i1

; . . . ; k

is

; s

i1

; . . . ; s

is

) (7)

though eciency gains of the GMM estimator could be achieved by considering additional

instruments.

9

Conditions (6) cannot be used directly because they depend on the unobserved xed eects.

However, these eects can be removed by the following quasi-dierenced transformation

proposed by Chamberlain (1992):

E{P

it

P

it1

exp[(x

it

x

it 1

)b] [ z

is

] = 0; \s 4 t (8)

Since the conditioning set is dated at period s, these orthogonality conditions remain valid under

weak exogeneity of the regressors. Moreover, if the instruments are strictly exogeneous, then

observations for all periods become valid instruments and this implies additional orthogonality

conditions in equation (8).

10

Following Arellano and Bond (1991) and Mairesse and Hall (1996),

the validity of these additional conditions can be tested by performing Sargan dierence tests in a

sequential way.

The GMM method based on equation (8) has several advantages with respect to the full

parametric Poisson xed-eect model. First, it does not impose the equality of the rst two

conditional moments. Second, it allows for heteroscedasticity and any serial correlation pattern

of the error terms. Finally, it relaxes the strict exogeneity assumption of the regressors. However,

this greater exibility comes at the price of less ecient estimators in general. However, following

Cre pon and Duguet (1997) more structure can be put on the GMM estimator, in particular in

terms of restricted serial correlation, by imposing additional conditions in equation (8) whose

validity can in turn be tested using Sargan dierence tests.

11

Besides the question of eciency gains, Cre pon and Duguet put forward an economic

motivation for testing restrictions on residual correlation as well. On the one hand, once the xed

eects are accounted for, the estimates of current and past values of R&D and spillovers could

reect the existence of correlated random shocks in the knowledge-production function due to

9

See Cre pon and Duguet (1997) for an application.

10

Given equations (1), (7) and (8), there are 2T 1 instruments (including the constant term) and (T 5) quasi-

dierences, where T = 9. Two cases have to be distinguished. First, in the case of weak exogeneity of the z

is

, the number

of orthogonality conditions as in equation (8) is (T 5)[2(T 4)=2 2(T 4 t) 1], where t represents the extent to

which the z

is

are weakly exogeneous, i.e. t = 1(t = 2; . . .) means that s = t (t 1; . . .) in equation (8). Second, if the z

is

are strictly exogeneous, then equation (8) implies (T 5)(2T 1) orthogonality conditions, that is, (T 5)[(2T 1)

2(T 4)=2 2(T 4 t) 1] additional conditions.

11

In order to restrict serial correlation, the authors suggest two methods, one of which consists of adding past values of

the dependent variable in the set of instruments:

z

+

is

= (1; x

i1

; . . . ; x

is

; P

i1

; . . . ; P

is1

) (9)

This implies (T 5)[(T 4)=2 (T 5 t)] additional orthogonality conditions in the case of weakly exogeneous z

is

.

270 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

the presence of serially correlated residuals. On the other hand, if the hypothesis of no serial

correlation cannot be rejected, then this function should rather be viewed as a steady process.

This argument is actually more crucial than it may appear at rst because of the presence of

current and lagged values of technological spillovers in the knowledge-production function.

Indeed, these variables are characterized by outside R&D, and hence, they might reect neglected

serial correlation to the extent that the total amount of R&D performed outside a given rm at

dierent time periods picks up such random innovation shocks.

Furthermore, the presence of serial correlation may also be viewed as an issue of dynamic

misspecication. For instance, if the past patenting activity is an important determinant of

current outcomes, then the omission of this determinant may be reected in correlated residuals.

Here also, if no restriction is imposed on serial correlation, these eects may again be picked up

by the spillover variables. In order to investigate this last issue, an alternative dynamic specica-

tion of the knowledge production function has been estimated in line with BGVR (1995). The

authors propose a linear feedback model (LFM) which leads to the following quasi-dierenced

orthogonality conditions:

E (P

it

P

+

it1

r

P

it 1

P

+

it

r)exp x

++

it

x

++

it1

b

+

[ z

+

is

= 0; \s 4 t (10)

where P

+

it

= (P

it

; P

it1

; P

it2

); r

/

= (r

1

; r

2

; r

3

); x

++

it

= (k

it

; s

it

) and b

/+

= (b

k

; b

s

).

The specication on which equation (10) is based is characterized by the presence of lagged

values of the patent variable among the regressors. In this particular case, we know from the

literature of panel data that if the xed eects are removed by rst (or quasi) dierencing and if

t 2 lagged and higher values of P

it

are used as instrument for DP

it 1

, then consistent estimates

can be obtained as long as the residuals are not serially correlated. Using the same GMM

framework as before, it is possible to test nested hypotheses regarding serial correlation by

performing Sargan dierence test statistics. Finally performing a non-nested J test a la

DavidsonMacKinnon, it is possible to compare this last model with the previous one.

3. DATA SOURCES AND DESCRIPTIVE STATISTICS

In this paper, the annual R&D expenditures, the technological spillovers as well as technological

and geographical opportunities are assumed to be the relevant explanatory variables of patent-

ing. The next section presents the main empirical ndings regarding the patentR&D relation-

ship. These estimates are based on the dierent econometric models that have been discussed in

the previous section. Before presenting the results, I detail the construction and the properties of

the sample of rms used in this paper.

The data sample was constructed in order to constitute a representative sample of the most

important international rms conducting R&D over the period 198391. The size of the sample

is 181 rms for which information is available for at least nine consecutive years. For each rm,

besides its corporate name and the country of its registered oce, three kinds of variables were

collected. These variables are the annual R&D investment expenditures, the industrial sectors of

activity, and the total number of patent applications for each year. The sources of R&D are

Standard & Poor's Compustat Services and the rm's annual reports. Fifteen manufacturing

sectors were considered according to the Standard Industrial Classication. The source for this

information is Dun & Bradstreet International. Given the international nature of the sample,

four geographical areas, i.e. the EU, Japan, the USA, and the Rest of the world, were also

distinguished. The number of rms in each area is, respectively, 28, 12, 140 and 1.

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 271

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

The source for patent applications is the European Patent Oce database. Total national

R&D expenditures at the manufacturing sector-based level were also collected from the OECD's

Anberd database. The R&D investment has been deated by gross domestic product price indices

of the countries. They have also been converted to constant 1990 dollars.

According to Mohnen (1991), ve approaches can be distinguished for constructing a measure

of technological spillovers. In the present work, for each rm, the spillovers are constructed as the

manufacturing sector-based amount of R&D reported in the Anberd database less its own R&D

investment. It should be noted that this approach considers only intra-sector spillovers. This

approach also gives an identical weight for the R&D of all other rms. Jae (1986, 1988)

developed a more sophisticated methodology in which the R&D spillovers are constructed by

positioning the rms in the technological space. The distribution of the rm's patents over patent

classes are used to characterize their positions in the technological space. The more two rms are

close in such a space, the more the potential spillovers are assumed to be important. The main

drawback of this methodology is that it can only be applied for rms that apply for patents. The

technological and geographical dummies have been constructed by assigning each rm to its

main industrial sector and to the geographical area the rm is domiciled respectively.

Table AI in the Appendix indicates the representativeness of the whole sample compared to the

Annual National Business Enterprise R&D published by OECD. It appears that 45% of the

whole R&D for the six major countries is covered by the rm's sample in 1990. Table AII in the

Appendix exhibits the R&D distribution of rms among manufacturing sectors. Some descript-

ive statistics are given in Table I. On average, there were 60

.

8 annual patent applications over the

period 198391. The standard deviation is quite high. This observation is to be related to the

overdispersion associated with this sort of variable. For 19

.

0% of the sample, at most one patent

has been applied. The bottom-right corner of Table I shows a high correlation between the lagged

R&D investments.

12

Such high multicollinearity of data may lead to some estimation problems.

An alternative specication based on polynomial R&D lagged structure (Almon-type weighted

variables) has been tested but the results did not improve signicantly.

4. EMPIRICAL FINDINGS

Table II presents the estimation results of the patentR&D relationship for alternative count

panel data econometric models. The patentR&D specication allows us to examine the time

pattern of the lag between R&D investment and technological spillovers on patenting activity. As

can be observed, the results are quite sensitive to the selected econometric model, especially

among the four last models. The General Event Count and the QGPML models lead one to

conclude that the estimates relative to the lag of the R&D investment are characterized by

positive and large coecients in the rst and last years and by imprecisely estimated coecients

in the intermediate years. It is worth noting that this `U-shaped' lag distribution has already been

brought to the fore in previous studies (Pakes and Griliches, 1984; HHG, 1984, 1986) using

dierent data sets and specications relating patents to R&D. These authors concluded to a

possible lag-truncation bias because of the neglect of pre-sample R&D investment. Another

telling argument put forward by HHG (1986) is the possible correlation of the rms' specic

eects with the right-hand-side variables. The estimates related to the lag of technological

12

Such high correlation has also been encountered in others studies. For instance, HHG (1986) found a correlation

greater than 097 for their lagged R&D variables.

272 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

spillovers are from an economic point of view somewhat disturbing. The estimated coecients

are not only unstable across the models but they are also characterized by low signicance levels.

Such a phenomenon associated with jointly highly signicant coecients is symptomatic of

multicollinearity.

13

The high signicance of technological and geographical dummies which are

supposed to pick up the technological and geographical opportunities indicates that patenting

behaviours vary substantially across countries and sectors.

From a methodological point of view, the estimated value of the GEC parameter s

2

indicates

that the basic Poisson model has to be rejected (H

0

: s

2

= 1; t = 80). The rejection of this model

is due to the situation of overdispersion which is associated with unobserved heterogeneity.

Therefore, more general models which allow for rms' unobservables have to be considered. The

data sample is consistent with the hypothesis that s

2

is higher than one (H

0

: s

2

> 1; t = 79)

and that k is not dierent from one (H

0

: k = 1; t = 05). These hypotheses vindicate the use of

the so-called Negbin II model and QGPML estimation technique. Although the QGPML

estimation is less restrictive in regard to the shape of the probability distribution, the estimated

parameters of these two models are very similar.

Column (3) of Table II presents the results for the conditional Poisson model. These results

appear to be substantially dierent from those observed in the two previous models. Indeed, we

know from the analysis of panel data that if the rms' specic eects are correlated with the

explanatory variables then neither the GEC model nor the QGPML estimator are consistent.

This is due to the fact that these models rely on random specications of their specic eects. On

the other hand, the conditional xed-eect Poisson model leads to consistent eects even in

presence of correlated xed eects. Hence, the dierent estimates obtained from this model give

clues for the presence of such a correlation. Using a Hausman test and comparing the Negbin II

and conditional Poisson estimates, it is possible to test whether the rms' specic eects are

correlated or not. The value of the test's statistic (H

0

: random effects; X

2

(10) = 1710) leads one

to conclude that the random eect model has to be rejected. The estimates of the conditional

Poisson model show that the U-shaped structure of the R&D coecients is to a large extent

attenuated. In fact, the coecients associated with the current and last lagged R&D still exhibit

the largest estimates, but in this case only the current R&D is signicant. However, the estimated

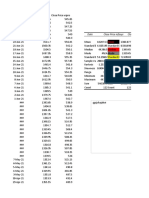

Table I. Characteristics of the sample

Mean Standard error Minimum value Maximum value

P

it

60

.

8 121

.

6 0 925

ln(k

it

) 5

.

3 1

.

3 3 8

.

7

ln(s

it

) 9

.

5 0

.

9 6

.

9 10

.

8

Correlation

P

it

ln(k

it

) ln(k

it 1

) ln(k

it 2

) ln(k

it3

)

ln(k

it

) 0

.

55

ln(k

it1

) 0

.

55 0

.

99

ln(k

it2

) 0

.

55 0

.

98 0

.

99

ln(k

it3

) 0

.

55 0

.

97 0

.

98 0

.

99

ln(k

it4

) 0

.

55 0

.

95 0

.

96 0

.

97 0

.

99

13

Correlation between the lagged ow of spillovers is close to unity.

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 273

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

elasticities concerning the technological spillovers are not convincing. The current and lagged

values of this variable are still marked by a sign change from one year to another. In addition, the

signicant positive elasticity of the current spillovers variable is puzzling. Indeed, these eects

take time to show up in new patents and, consequently, it is doubtful that they are immediate.

Because of the way the conditional Poisson is constructed, the time-invariant individual

technological and geographical opportunities can no longer be estimated. More fundamentally,

the consistency of the parameters in this model relies on the assumption of strict exogeneity of the

explanatory variables. As has already been discussed, such an assumption is hard to maintain in

the context of the patentR&D relationship.

In order to overcome this last issue, an alternative non-linear GMM estimator is considered in

the fourth column of Table II. This estimator still allows for correlated eects but relaxes the

strict exogeneity condition of the right-hand-side variables. The exogeneity assumption of

instruments has been tested systematically by estimating any combination of both predetermined

and strictly exogeneous explanatory variables. As can be seen in Table AIII in the Appendix, the

weak exogeneity hypothesis of R&D is always rejected (at the 5% level and whatever hypothesis

is made regarding the exogeneity of the spillover variables) in favour of lag 1 and higher values of

instruments associated with this variable, while for the technological spillovers, the hypothesis of

strict exogeneity is never rejected (again, whatever exogeneity hypothesis is made for R&D).

These ndings corroborate the idea that, on the one hand, patents are induced by R&D

expenditures but also patents themselves lead to future R&D activities. On the other hand,

accepting the strict exogeneity of technological spillovers supports the view that they are a result

of exogenous technological factors on the supply side of innovation.

The result of the test for restricted serial correlation is displayed in Table AIV in the Appendix.

The statistic associated with this test leads to the conclusion that the hypothesis of no serial

correlation cannot be rejected. Hence, we cannot conclude for the presence of correlated random

shocks in the knowledge production function and therefore such eects should not be reected in

the explanatory variables.

Column (4) of Table II presents the results of the GMM model with restricted serial correlation

imposed. The estimated value of the chi-square statistic of the overidentication test shows no

clear indication of misspecication. The rejection of the weak exogeneity assumption shows that

the previously estimated models are no longer valid. Indeed, the estimated elasticities of the

GMM model lead to dierent economic conclusions. The U-shaped structure has disappeared

since strong returns on R&D investment are now observed for the current and one-year-lagged

coecients while for the t-2 and t-4 lagged value of R&D small but negative and signicant

impacts are found. This result conrms the ndings of previous studies and leads one to conclude

that patenting occurs at an early stage of the R&D sequence. Indeed, the estimated elasticities of

patents with respect to current and rst lag R&D variables say that when a rm spends 10% more

R&D in t-1, it applies for 6% more patents in t, while an increase of 10% of current R&D implies

an increase of 3.5% of patent applications in the same year.

The interpretation of the timing of technological spillovers indicates that only the t-3 lagged

value of this variable is not statistically dierent from zero. An important impact of this variable

is observed for its current and t-2 lagged values (estimated elasticities of 1

.

2 and 0

.

85, respect-

ively). It should be noted that the lag structure of spillovers is relatively similar in both the

Conditional Poisson and GMM models while this is clearly not the case for R&D. One

explanation could be that the hypothesis of strict exogeneity has been accepted for spillovers but

not for R&D. Hence, only the former variables satisfy the strict exogeneity hypothesis required

274 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

for consistency of the Conditional Poisson model. However, considering the sum of the

coecients related to this variable, an important stimulating eect favourable to patenting

activities is observed (estimated elasticity of 2

.

6) while negative eects were characterized in the

two rst models. This empirical result supports the view that diusion spillovers are more

important than competitive ones to the extent that the former exercise a positive impact on

patenting while the second are characterized by a negative eect on the output of the techno-

logical production function. Interestingly is the opposite ndings of Cre pon and Duguet (1993).

These authors estimate an elasticity of the spillovers variable of 02. Two arguments can be put

forward to explain this dierent result. On the one hand, the dataset of this study consists of a

Table II. Parameter estimates of the knowledge-production function (t-statistics in parentheses)

(2) (3) (4) (5)

Econometric (1) QGPML- Conditional GMM

c

- GMM

c

-

model GEC gamma Poisson MFEM

d

LFM

d

log(k

t

) 0

.

44 (3

.

5)

a

0

.

44 (4

.

3) 0

.

29 (1

.

6) 0

.

35 (6

.

9) 0

.

31 (5

.

8)

log(k

t 1

) 0

.

14 (1

.

1) 0

.

11 (0

.

8) 0

.

06 (0

.

8) 0

.

62 (15

.

0)

log(k

t 2

) 0

.

04 (0

.

4) 0

.

03 (0

.

2) 0

.

07 (0

.

5) 027 (45)

log(k

t 3

) 023 (24) 023 (17) 018 (14) 006 (15)

log(k

t 4

) 0

.

51 (4

.

7) 0

.

54 (5

.

3) 0

.

11 (0

.

8) 016 (58)

Sum of k 0

.

90 (26

.

2)

b

0

.

89 (53

.

7) 0

.

35 (6

.

3) 0

.

48 (4

.

8)

log(s

t

) 0

.

70 (6

.

6) 0

.

66 (1

.

2) 1

.

2 (2

.

8) 1

.

2 (9

.

9) 2

.

5 (9

.

7)

log(s

t1

) 039 (07) 055 (09) 011 (03) 0

.

26 (2

.

7)

log(s

t2

) 0

.

00 (0

.

0) 0

.

22 (0

.

4) 0

.

83 (2

.

9) 0

.

85 (10

.

8)

log(s

t3

) 076 (11) 070 (13) 073 (23) 0

.

03 (0

.

4)

log(s

t4

) 0

.

13 (0

.

4) 0

.

19 (0

.

5) 0

.

24 (0

.

9) 0

.

22 (3

.

2)

Sum of s 032 (5

.

5) 018 (11

.

0) 1

.

5 (14

.

5) 2

.

6 (14

.

0)

P

t 1

0

.

10 (4

.

8)

P

t 2

0

.

07 (4

.

0)

P

t 3

0

.

16 (5

.

0)

Sum of P 0

.

34 (6

.

3)

s

2

1

.

42 (26

.

9)

k 1

.

02 (25

.

3)

loglikelihood 4047 6237 3493

LR test techn. 212 313

dummies

LR test geogr. 32 67

dummies

Hausman test 171.0

Overidentication test

e

69

.

0 (73) [0

.

61] 87

.

8 (78) [0

.

21]

J-test:

f

^a 1

.

02 (455) 002 (86)

a

Heteroscedastic-consistent t-statistic.

b

t-statistics performed by means of the `delta method'.

c

Two-step GMM estimator, z

+

is used as instruments.

d

Restricted serial correlation imposed.

e

Chi-square statistic, degree of freedom in parentheses, signicance level in square brackets.

f

DavidsonMacKinnon non-nested test (OLS on: (P

it

^

P

it(4)

) = a((

^

P

it(5)

^

P

it(4)

)) in column (4), (P

it

^

P

it(5)

) =

a((

^

P

it(4)

^

P

it(5)

)) in column (5)).

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 275

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

larger number of rms (451 French manufacturing rms) operating in a single domestic market

so that higher levels of competition can be expected among these rms. On the other hand, the

construction of the spillovers variable rests on an industry-sector-based stock of R&D and only

the current impact of this stock on patents is considered. Two more comments are worth

mentioning when we compare R&D and spillovers eects. First, the positive and signicant eect

of total spillovers reveal that social rates of return of knowledge is above private rates. Second,

these eects appear to take more time to materialize than own R&D returns.

The last GMM estimator investigated in this paper rests on a dynamic specication of the

knowledge-production function. The statistic of the Sargan dierence test reported in Table AV

in the Appendix indicates that the hypothesis of serially uncorrelated residuals cannot be

rejected. Hence, all current and past values of P

it 1

can be used to implement the GMM-LFM

estimator. However, as can be seen in column (5) of Table II, all lags of the patent variable are

found to be signicant with an overall eect of 0

.

34. Though the J-test statistic indicates that the

model of column (5) is preferred to the GMM-MFEM one, no contradiction appears when

comparing the elasticities of R&D and spillovers of both models. One interpretation of this

nding could be that the lag specication of our explanatory variables is not inappropriate to

take into account the dynamics of the patenting process.

Finally, considering the sum of all R&D coecients for each model, it is possible to compare

the results of this paper with those found in other empirical studies examining the patentR&D

relationship. In the Pakes and Griliches (1984) study, the sum of R&D coecients is equal to 0

.

6,

while HHG (1984, 1986) estimate elasticities varying from 0

.

29 to 0

.

6 according to the regression

model and to the number of lags. Montalvo (1993) and BGVR (1995) nd evidence of correlated

(xed) eects and weak exogeneity of regressors. They estimate by GMM a similar total R&D

elasticity of 0

.

56 which is close to the value of 0

.

48 obtained in this paper. Cre pon and Duguet

(1997) do not reject the hypothesis of strict exogeneity which might explain their lower elasticity

of 0

.

26.

5. CONCLUSION

This paper has attempted to measure the impact of the technological factors on patenting activity

at the rm level. The main determinants of this activity, i.e. R&D expenditures, technological

spillovers, as well as technological and geographical opportunities, come from an original repre-

sentative sample of 181 international large R&D rms over the 198391 period. The specication

of the patentR&D relationship relies on a lagged structure of the explanatory variables and

attempts to explain the patenting behaviour of rms over time.

In order to deal with some econometric problems arising from the panel data structure and

from the discrete nature of the dependent variable, alternative econometric models for count

panel data were investigated. The General Event Count model allows for a more exible

conditional meanvariance relationship than the Poisson and the negative binomial. The

QGPML estimator provides consistent estimates with less restrictive assumptions regarding the

distribution of the random rms' specic eects. However, these models are only valid if the

random eects are not correlated with the right-hand-side variables. In order to allow for

correlated specic eects, a conditional Poisson model and two non-linear GMM estimators

were considered as well. The last two estimators are more general since they relax the strict

exogeneity assumption of the regressors which is hard to maintain in the patentR&D

relationship.

276 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

The main ndings of the empirical analysis are a high sensitivity of the results among the

dierent econometric models. Returns to scale in research activity are characterized by a

`U-shaped' structure in the random eects specications and to some extent in the xed-eect

conditional Poisson model. This pattern of the R&D lag structure is no more present in the

GMM-MFEM estimates. Furthermore, Sargan dierence tests have been performed in a

sequential way in order to examine the exogeneity hypothesis of both R&D and spillovers

variables as well as the presence of serially correlated residuals. The conclusion is that the strict

exogeneity of spillovers is not rejected, which is not the case for R&D. This last result invalidates

the conditional Poisson model. Regarding the serial correlation assumption, no evidence of

correlated residuals is found in the knowledge-production function. The GMM-MFEM

estimates suggest an important contemporaneous and one-year-lagged eects of R&D, indicat-

ing that the bulk of such activity is performed during the two years before the patent application.

Also, this result leads one to conclude that patenting activity occurs in an early stage of the

knowledge-production process. As far as technological spillovers are concerned, the results reveal

an important positive impact when the sum of lagged eects is considered, i.e. outside R&D gives

an incentive to patent. The positive elasticity of total spillovers indicates that social returns of

knowledge are more important than the private ones. Moreover, when the timing of such eects

is examined, it appears that the impacts of technological spillovers are less immediate than the

corresponding ndings for R&D. Finally, the last GMM-LFM estimator investigated in this

paper indicates that rst, the hypothesis of no serial correlation is not rejected, second, the

estimated elasticities of R&D and spillovers are not inconsistent with the GMM-MFEM

corresponding estimates, and third, the feedback eects of past patents on current outcomes are

positive and signicant.

APPENDIX

Table AI. Representatives of the sample: proportion of Annual National Business Enterprises R&D

realized by rms of the sample

a

1983 1984 1985 1986 1987 1988 1989 1990 1991

France 42

.

2 45

.

2 46

.

4 45

.

9 50

.

5 51

.

8 51

.

0 52

.

4

Germany 42

.

5 43

.

3 46

.

8 48

.

5 50

.

4 52

.

2 60

.

5 57

.

6

Italy 16

.

3 14

.

0 13

.

4 12

.

7 15

.

4 15

.

2 16

.

8 17

.

9

Japan 26

.

6 28

.

1 28

.

6 29

.

9 29

.

8 29

.

8 29

.

7 29

.

7

UK 3

.

3 3

.

0 3

.

0 3

.

2 3

.

8 3

.

8 3

.

9 4

.

1

USA 47

.

4 51

.

2 50

.

0 52

.

2 52

.

7 55

.

2 59

.

5 61

.

2

Total 35

.

4 37

.

8 40

.

0 39

.

9 41

.

6 43

.

7 45

.

6 45

.

0 42

.

3

a

based on OECD's ANBERD database.

Table AII. Manufacturing sector-based distribution of rms included in the sample

Aerospace Chemistry Computers Drugs Electricity Food Fuel and Mining Glass

12 28 20 13 29 9 11 3

Instruments Machinery Metals Other Paper Software Vehicles TOTAL

13 10 3 8 5 2 15 181

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 277

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

Table AIII. Strict versus weak exogeneity of instruments

Model and exogeneity

of instruments (k

it

; s

it

)

a

Overidentication test

b

Sargan dierence test

c

(0, 0) 74

.

5 (65) [0

.

20] (0, 0)(0, 1) 7

.

4 (10) [0

.

62] (0, 0)(1, 0) 10

.

5 (10) [0

.

40]

(0, 1) 67

.

1 (55) [0

.

13] (0, 1)(0, 2) 1

.

9 (4) [0

.

07] (1, 0)(2, 0) 14 (4) [0

.

01]

(0, 2) 65

.

2 (51) [0

.

09] (0, 2)(0, 3) 8

.

6 (4) [0

.

76] (2, 0)(3, 0) 0

.

7 (4) [0

.

95]

(0, 3) 56

.

7 (47) [0

.

16] (0, 3)(0, 4) 2

.

7 (4) [0

.

68] (3, 0)(4, 0) 8

.

9 (4) [0

.

06]

(0, 4) 54

.

0 (43) [0

.

12]

(1, 0) 64

.

0 (55) [0

.

19] (1, 0)(1, 1) 7

.

6 (10) [0

.

67] (0, 1)(1, 1) 10

.

6 (10) [0

.

39]

(1, 1) 56

.

5 (45) [0

.

12] (1, 1)(1, 2) 1

.

7 (4) [0

.

80] (1, 1)(2, 1) 10

.

8 (4) [0

.

03]

(1, 2) 54

.

8 (41) [0

.

07] (1, 2)(1, 3) 4

.

8 (4) [0

.

30] (2, 1)(3, 1) 0

.

9 (4) [0

.

92]

(1, 3) 50

.

0 (37) [0

.

08] (1, 3)(1, 4) 5

.

0 (4) [0

.

29] (3, 1)(4, 1) 7

.

6 (4) [0

.

11]

(1, 4) 44

.

9 (33) [0

.

08]

(2, 0) 50

.

0 (51) [0

.

51] (2, 0)(2, 1) 4

.

3 (10) [0

.

93] (0, 2)(1, 2) 10

.

4 (10) [0

.

41]

(2, 1) 45

.

7 (41) [0

.

28] (2, 1)(2, 2) 3

.

9 (4) [0

.

41] (1, 2)(2, 2) 13

.

1 (4) [0

.

01]

(2, 2) 41

.

7 (37) [0

.

27] (2, 2)(2, 3) 4

.

9 (4) [0

.

30] (2, 2)(3, 2) 0

.

8 (4) [0

.

94]

(2, 3) 36

.

8 (33) [0

.

30] (2, 3)(2, 4) 2

.

9 (4) [0

.

58] (3, 2)(4, 2) 9

.

6 (4) [0

.

05]

(2, 4) 33

.

9 (29) [0

.

24]

(3, 0) 49

.

3 (47) [0

.

38] (3, 0)(3, 1) 4

.

5 (10) [0

.

92] (0,3)(1,3) 6

.

7 (10) [0

.

75]

(3, 1) 44

.

8 (37) [0

.

18] (3, 1)(3, 2) 4

.

0 (4) [0

.

41] (1,3)(2,3) 13

.

2 (4) [0

.

01]

(3, 2) 40

.

9 (33) [0

.

16] (3, 2)(3, 3) 5

.

2 (4) [0

.

27] (2,3)(3,3) 1

.

1 (4) [0

.

89]

(3, 3) 35

.

7 (29) [0

.

18] (3, 3)(3, 4) 2

.

9 (4) [0

.

57] (3,3)(4,3) 6

.

9 (4) [0

.

14]

(3, 4) 32

.

8 (25) [0

.

14]

(4, 0) 40

.

4 (43) [0

.

59] (4, 0)(4, 1) 3

.

2 (10) [0

.

98] (0, 4)(1, 4) 9

.

1 (10) [0

.

52]

(4, 1) 37

.

2 (33) [0

.

28] (4, 1)(4, 2) 5

.

9 (4) [0

.

21] (1, 4)(2, 4) 11

.

0 (4) [0

.

03]

(4, 2) 31

.

3 (29) [0

.

35] (4, 2)(4, 3) 2

.

6 (4) [0

.

63] (2, 4)(3, 4) 1

.

1 (4) [0

.

89]

(4, 3) 28

.

8 (25) [0

.

27] (4, 3)(4, 4) 0 (4) [1

.

00] (3, 4)(4, 4) 4 (4) [0

.

41]

(4, 4) 28

.

8 (21) [0

.

12]

a

(t; t

/

) represents the extent to which k

it

and s

it

are strictly (t; t

/

= 0) or weakly exogeneous (t; t

/

= 1; . . . ; 4). For

instance t = 2 and t

/

= 0 indicates that only one-year-lag and higher lags of k

it

are valid instruments and that

observations for all periods are valid instruments for s

it

.

b

Chi-square statistic, degree of freedom in parentheses, signicance level in square brackets.

c

(t

1

; t

/

1

) (t

2

; t

/

2

) represents the additional orthogonality conditions when we go from set of instruments implied by

(t

2

; t

/

2

) to the one implied by (t

1

; t

/

1

). Under the null that all additional conditions hold, the test statistic is chi-square

distributed with degree of freedom and signicance level in parentheses and square brackets.

Table AIV. Restricted versus non-restricted serial correlation

Model Overidentication test

b

Sargan dierence test

c

Restricted serial correlation (RSC) 69

.

0 (73) [0

.

61] (RSC)(USC) 19

.

0 (22) [0

.

65]

Unrestricted serial correlation (USC) 50

.

0 (51) [0

.

51]

bc

See Table AIII.

278 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

Table AV. LFM model: serial correlation test

Model and exogeneity of P

it

a

Overidentication test

b

Sargan dierence test

c

(1) 87

.

8 (78) [0

.

21] (1)(2) 6

.

2 (4) [0

.

19]

(2) 81

.

6 (71) [0

.

25] (2)(3) 20 (4) [1

.

00]

(3) 83

.

6 (70) [0

.

13] (3)(4) 5

.

1 (4) [0

.

28]

(4) 78

.

6 (60) [0

.

14]

a

(t) means that E[Du

it

P

itt1

] = 0, t = 1; . . . ; T and t = 1; . . . ; 4.

b

See Table AIII.

c

(t) (t 1) represents the additional orthogonality conditions when we go from the set of instruments implied by

(t 1) to the one implied by (t).

ACKNOWLEDGEMENTS

I am indebted to Henri Capron, Renato Flo res, Bronwyn H. Hall, Lars Muus, Pravin Trivedi,

Bruno Van Pottelsberghe, and two anonymous referees for valuable suggestions. Helpful

comments were received from participants of the 7th ESWC and the 6th Biennial International

Conference on Panel Data as well as seminars at University of Aahrus and Hong Kong

University of Science and Technology. Financial support of Universite Libre de Bruxelles is

gratefully acknowledged. All opinions and remaining errors are my own.

REFERENCES

Anderson, E. B. (1970), `Asymptotic properties of conditional maximum likelihood estimators', Journal of

the Royal Statistical Society, 32, 283301.

Arrellano, M. and S. Bond (1991), `Some tests of specication for panel data: Monte Carlo evidence and an

application to employment equations', Review of Economic Studies, 58, 277297.

Blundell, R., R. Grith and J. Van Reenen (1995), `Dynamic count data models of technological

innovation', Economic Journal, 105, 333344.

Blundell, R., R. Grith and F. Windmeijer (1995), `Individual eects and dynamics in count data models',

Working Paper 95/15, Institute for Fiscal Studies, London.

Cameron, A. C. and P. K. Trivedi (1986), `Econometric models based on count data: comparisons and

applications of some estimators and tests', Journal of Applied Econometrics, 1, 2953.

Chamberlain, G. (1992), `Comment: Sequential moment restrictions in panel data'. Journal of Business,

Economics and Statistics, 10, 2026.

Cre pon, B. and E. Duget (1993), `Research and development, competition and innovation: what patent data

show', Working Paper 9314, Institut National de la Statistique et des Etudes Economiques, Paris.

Cre pon, B. and E. Duguet (1997), `Estimating the innovation function from patent numbers: GMM on

count panel data', Journal of Applied Econometrics, this issue.

Gourie roux, C., A. Monfort and A. Trognon (1984a), `Pseudo maximum likelihood methods: theory',

Econometrica, 52, 681700.

Gourie roux, C., A. Monfort and A. Trognon (1984b), `Pseudo maximum likelihood methods: applications

to Poisson models', Econometrica, 52, 701720.

Griliches, Z. (1979), `Issues in assessing the competition of R&D to productivity growth', Bell Journal of

Economics, 10, 92116.

Griliches, Z. (1990), `Patent statistics as economic indicators: a survey', Journal of Economic Literature, 28,

16611701.

Griliches, Z. (1992), `The search for R&D spillovers', Scandinavian Journal of Economics, 94, 2948.

Hansen, L. P. (1982), `Large sample properties of methods of moments estimators', Econometrica, 52,

10291054.

Hausman, J., B. H. Hall and Z. Griliches (1984), `Econometric models for count data with an application to

the patentsR&D relationship', Econometrica, 52, 909938.

PATENTS, R&D, AND TECHNOLOGICAL SPILLOVERS 279

#1997 by John Wiley & Sons, Ltd. J. Appl. Econ., 12, 265280 (1997)

Hausman, J., B. H. Hall and Z. Griliches (1986), `Patents and R&D: is there a lag?' International Economic

Review, 27, 265283.

Hsiao, C. (1986), `Analysis of panel data', in Econometric Society Monographs, Cambridge University Press,

Cambridge.

Jae, A. B. (1986), `Technological opportunity and spillovers of R&D', American Economic Review, 76,

9841001.

Jae, A. b. (1988), `R&Dintensity and productivity growth', Reviewof Economics and Statistics, 70, 431437.

Loury, G. (1979), `Market structure and innovation', Quarterly Journal of Economics, 93, 395410.

Mairesse, J. and B. H. Hall (1996), `Estimating the productivity of research and development: an exploration

of GMM methods using data on French and United States Manufacturing Firms', Working Paper 5501,

National Bureau of Economic Research, Cambridge.

Mohnen, P. (1991), `Survol de la litte rature sur les externalite s technologiques', in J. de Bandt and D. Foray

(eds), L'Evaluation Economique de la Recherche et du Changement Technique, CNRS.

Montalvo, J. G. (1993), `Patents and R&D at the rm level: a new look', Revista Espanola de Economa,

67, 81.

Pakes, A. and Z. Griliches (1984), `Patents and R&D at the rm level: a rst look', in Z. Griliches (ed.),

R&D, Patents and Productivity, University of Chicago Press, Chicago.

Rosenberg, N. (1983), Inside the Black Box: Technology and Economics, Cambridge University Press,

Cambridge.

Winkelmann, R. and K. F. Zimmermann (1991), `A new approach for modelling economic count data',

Economics Letters, 37, 139143.

Winkelmann, R. and K. F. Zimmerman (1995), `Recent developments in count data modelling: theory and

application', Journal of Economic Surveys, 9, 124.

280 M. CINCERA

J. Appl. Econ., 12, 265280 (1997) #1997 by John Wiley & Sons, Ltd.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Solutions For Homework 4: Two-Way ANOVA: Response Versus Solution, DaysDocument13 pagesSolutions For Homework 4: Two-Way ANOVA: Response Versus Solution, DaysVIKRAM KUMARNo ratings yet

- FAI Lecture - 23-10-2023 PDFDocument12 pagesFAI Lecture - 23-10-2023 PDFWeixin07No ratings yet

- ENGR 371 GradesaversDocument25 pagesENGR 371 Gradesaversasdfg0% (1)

- Bs ProjectDocument5 pagesBs ProjectVaibhav ThakkarNo ratings yet

- Biostats QBDocument4 pagesBiostats QBVarun kariyaNo ratings yet

- Lecture 19 PDFDocument2 pagesLecture 19 PDFSarah SeunarineNo ratings yet

- Rayalaseema Institute of Information and Management Sciences (RIMS)Document1 pageRayalaseema Institute of Information and Management Sciences (RIMS)Pallamala Kalyan PKNo ratings yet

- ZXXZXXZZDocument8 pagesZXXZXXZZPerry FranciscoNo ratings yet

- Email Classification: Roll No-41463 (LP-3)Document5 pagesEmail Classification: Roll No-41463 (LP-3)fgfsgsgNo ratings yet

- Topic 3: Simple Linear RegressionDocument19 pagesTopic 3: Simple Linear RegressionSouleymane CoulibalyNo ratings yet

- Introduction To Clinical Research Survival Analysis - Getting Started Karen Bandeen-Roche, Ph.D. July 20, 2010Document33 pagesIntroduction To Clinical Research Survival Analysis - Getting Started Karen Bandeen-Roche, Ph.D. July 20, 2010NehaKarunyaNo ratings yet

- Beck y Katz 2011Document24 pagesBeck y Katz 2011María Marta MarotoNo ratings yet

- Math Module PDFDocument72 pagesMath Module PDFvince casimeroNo ratings yet

- IE2152 Statistics For Industrial Engineers Problem Solving SessionsDocument57 pagesIE2152 Statistics For Industrial Engineers Problem Solving SessionsKutay ArslanNo ratings yet

- Idiosyncratic Risk and The Cross-Section of Expected Stock ReturnsDocument14 pagesIdiosyncratic Risk and The Cross-Section of Expected Stock ReturnsFosterAnandaNo ratings yet

- Sample Size R ModuleDocument85 pagesSample Size R ModulesdbitbihacNo ratings yet

- Quantitative Methods of Economics MCQ'SDocument7 pagesQuantitative Methods of Economics MCQ'SGuruKPO100% (1)

- R Lab - Probability DistributionsDocument10 pagesR Lab - Probability DistributionsPranay PandeyNo ratings yet

- Wilcoxon Signed-Ranks TestDocument16 pagesWilcoxon Signed-Ranks TestLayan MohammadNo ratings yet

- Chapter 7, Part 1Document19 pagesChapter 7, Part 1Oona NiallNo ratings yet

- Econometrics PS9Document10 pagesEconometrics PS9laurice wongNo ratings yet

- Linear RegressionDocument188 pagesLinear RegressionApoorv AgrawalNo ratings yet

- Chapter 2: Tables and Graphs For Summarizing DataDocument21 pagesChapter 2: Tables and Graphs For Summarizing DatasanjayNo ratings yet

- Untitled1.ipynb - ColaboratoryDocument12 pagesUntitled1.ipynb - ColaboratoryDaniel ErgawantoNo ratings yet

- Demand ForecastingDocument13 pagesDemand ForecastingManohari RdNo ratings yet

- Presentation 3Document37 pagesPresentation 3Swaroop Ranjan Baghar100% (1)

- University of Central Punjab Faculty of EngineeringDocument3 pagesUniversity of Central Punjab Faculty of EngineeringYasirNo ratings yet

- Practical Research 2 Fourth Summative Test-Second QuarterDocument2 pagesPractical Research 2 Fourth Summative Test-Second QuarterRam Christian VizarraNo ratings yet

- An Introduction To T-Tests - Definitions, Formula and ExamplesDocument9 pagesAn Introduction To T-Tests - Definitions, Formula and ExamplesBonny OgwalNo ratings yet

- Assignment 2Document5 pagesAssignment 2Niharika Pradhan I H21O32No ratings yet