Professional Documents

Culture Documents

The Characteristics of Market Economy

Uploaded by

RalluRalucaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Characteristics of Market Economy

Uploaded by

RalluRalucaCopyright:

Available Formats

Academia de Studii Economice

Facultatea de Comert

The Characteristics of

Market Economy

Lector doctor: Autori:

Virginia Mihaela Dumitrescu Precup Corina

Proca Raluca

Radu Stefan

Rotaru Simona

Saviuc Alin

Bucuresti

- 20-

The Market Ecomony

The market economy, also called free market economy or free enterprise economy is, proaly,

the est sustitute for economical freedom! Among history "e had many e#amples of different types of

systems, like socialist, capitalist or planned economy ut the one "ho seemed to function most "as the

market economy! People emrace it ecause it gives them the freedom, as a producer, of choosing "hat

goods to produce, ho", "hen and to "hom to sell them, and as a consumer, it offers the opportunity

also to choose et"een competing goods and services and freedom as a "orker to choose among

different $os or careers! %asically, it goes y the principle of competition, "here every seller has to lay

out his merchandise at a price estalished y the market itself!

&n the real "orld, market economies do not e#ist in pure form, as societies and governments

regulate them to varying degrees rather than allo" full self'regulation y market forces! The term free

market economy is sometimes used synonymously "ith market economy,

ut, as (ud"ig )rhard once

pointed out, this does not preclude an economy from having social attriutes opposed to a laisse*'faire

system!

The !rinci!les of market economy

+! Free markets ' the production and distriution of goods and services takes place through the

mechanism of free markets!&n a market economy, the price of each product is estalished

according to a mutual consent et"een the uyer and the seller, in opposite to the planned

economy "here the price, ,uantity and distriution of products are set y the government,

"hich practically controls the market!

-! Free !rice system ' the prices are set y the interchange of supply and demand, meaning the

matching of the sellers asking prices "ith the uyers id prices, as a result of su$ective value

$udgment! &s an economic system "here prices are set y the interchange of supply and

demand, "ith the resulting prices eing understood as signals that are communicated et"een

producers and consumers "hich serve to guide the production and distriution of resources!

Through the free price system, supplies are rationed, income is distriuted, and resources are

allocated! A free price system contrasts "ith a controlled or fi#es price system "here prices are

set y government, "ithin a controlled market or planned economy!

.! The inter!lay of su!!ly and demand ' The theory of supply and demand is important in the

functioning of a market economy in that it e#plains the mechanism y "hich many resource

allocation decisions are made!

%asically, in a market economy the relation et"een the supply and the demand estalishes its

direction, the prices and the eventual risks oth parties may take "hen engaging in an

interchange process! Supply and demand is an economic model of price determination in a

market! &t concludes that in a competitive market, the unite price for a particular good "ill vary

until it settles at a point "here the ,uantity demanded y consumers /at current price0 "ill

e,ual the ,uantity supplied y producers /at current price0, resulting in an economic

e,uilirium of price and ,uantity!

1! "roducers self-interest ' %y follo"ing their o"n self'interest in open and competitive

markets, consumers, producers, and "orkers are led to use their economic resources in "ays

that have the greatest value to the national economy '' at least in terms of satisfying more of

people2s "ants! The first person to point out this fact in a systematic "ay "as the Scottish

philosopher Adam Smith, "ho pulished his most famous ook, An Inquiry Into the Nature

and Causes of the Wealth of Nations, in +334! Smith "as the first great classical economist,

and among the first to descrie ho" an economy ased on a system of markets could promote

economic efficiency and individual freedom, regardless of "hether people "ere particularly

industrious or la*y!

&t has een proved among the years that the production ,uality and ,uantity reaches its est

"hen people produce not only for the common good ut, especially, for their o"n good! Self'

interest serves as an important factor "hich motivates the producers to use their resources more

efficient, in the purpose of e#panding their enterprise or simply raising more money!

5! #o $o%ernment inter%ention ' the role of government is not to take the place of the

marketplace, ut to improve the functioning of the market economy! 6urther, any decision to

regulate or intervene in the play of market forces must carefully alance the costs of such

regulation against the enefits that such intervention "ill ring!

&n a market economy, the government interferes only to prevent market failure, maintain

stale currency and thus comating the inflation, and protect market competition and the

consumers! 7evertheless, its intervention must e limited, in order not to influence the t"o

parties the uyer and the seller, nor the market price or products distriution!

8ne important point to ear in mind is that the effects of different forms of government

intervention in markets are never neutral 9 financial support given y the government to one set of

producers rather than another "ill al"ays create :"inners and losers;! Ta#ing one product more than

another "ill similarly have different effects on different groups of consumers!

4! Com!etition ' &n a free market economy, competition "orks to ensure the efficient and

effective operation of usiness! Competition also ensures that a firm "ill survive only if it

serves its customers "ell!

Com!etition in economics is a term that encompasses the notion of individuals and firms striving

for a greater share of a market to sell or uy goods and services! Merriam'<ester defines competition

in usiness as =the effort of t"o or more parties acting independently to secure the usiness of a third

party y offering the most favorale terms!= &t "as descried y Adam Smith in The <ealth of 7ations

/+3340 and later economists as allocating productive resurces to their most highly'valued uses, and

encouraging efficiency! (ater microeconomics theory distinguished et"een perfect competition and

imperfect competition, concluding that no system of resource allocation is more Pareto efficient than

perfect competition! Competition, according to the theory, causes commercial firms to develop ne"

products, services and technologies, "hich "ould give consumers greater selection and etter products!

The greater selection typically causes lo"er prices for the products, compared to "hat the price "ould

e if there "as no competition /monopoly0 or little competition /oligopoly0!

A mono!oly is a market structure in "hich there is only one producer>seller for a product! &n other

"ords, the single usiness is the industry! )ntry into such a market is restricted due to high costs or

other impediments, "hich may e economic, social or political! 6or instance, a government can create a

monopoly over an industry that it "ants to control, such as electricity! Another reason for the arriers

against entry into a monopolistic industry is that oftentimes, one entity has the e#clusive rights to a

natural resource! 6or e#ample, in Saudi Araia the government has sole control over the oil industry! A

monopoly may also form "hen a company has a copyright or patent that prevents others from entering

the market!

&n an oli$o!oly, there are only a fe" firms that make up an industry! This select group of firms has

control over the price and, like a monopoly, an oligopoly has high arriers to entry! The products that

the oligopolistic firms produce are often nearly identical and, therefore, the companies, "hich are

competing for market share, are interdependent as a result of market forces! Assume, for e#ample, that

an economy needs only +?? "idgets! Company @ produces 5? "idgets and its competitor, Company A,

produces the other 5?! The prices of the t"o rands "ill e interdependent and, therefore, similar! So, if

Company @ starts selling the "idgets at a lo"er price, it "ill get a greater market share, therey forcing

Company A to lo"er its prices as "ell!

There are t"o e#treme forms of market structureB monopoly and, its opposite, !erfect

com!etition! "erfect com!etition is characteri*ed y many uyers and sellers, many products that are

similar in nature and, as a result, many sustitutes! Perfect competition means there are fe", if any,

arriers to entry for ne" companies, and prices are determined y supply and demand! Thus, producers

in a perfectly competitive market are su$ect to the prices determined y the market and do not have

any leverage! 6or e#ample, in a perfectly competitive market, shoulda single firm decide to increase its

selling price of a good, the consumers can $ust turn to the nearest competitor for a etter price, causing

any firm that increases its prices to lose market share and profits!

Bi&lio$ra!hy:

The Characteristics of the Market Economy ' (ud"ig von Mises,

Human Action: A Treatise on Economics, vol. 2 (LF e.! C+DD4E

<""!"ikipedia!org

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Group Process in The Philippine SettingDocument3 pagesGroup Process in The Philippine Settingthelark50% (2)

- Why-Most Investors Are Mostly Wrong Most of The TimeDocument3 pagesWhy-Most Investors Are Mostly Wrong Most of The TimeBharat SahniNo ratings yet

- Introduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF VersionDocument62 pagesIntroduction To Professional School Counseling Advocacy Leadership and Intervention Ebook PDF Versionmary.krueger918100% (50)

- Personal Development: Quarter 2 - Module 2: Identifying Ways To Become Responsible in A RelationshipDocument21 pagesPersonal Development: Quarter 2 - Module 2: Identifying Ways To Become Responsible in A RelationshipTabada Nicky100% (2)

- Character Skills Snapshot Sample ItemsDocument2 pagesCharacter Skills Snapshot Sample ItemsCharlie BolnickNo ratings yet

- Theology and Pipe Smoking - 7pDocument7 pagesTheology and Pipe Smoking - 7pNeimar HahmeierNo ratings yet

- The First Step Analysis: 1 Some Important DefinitionsDocument4 pagesThe First Step Analysis: 1 Some Important DefinitionsAdriana Neumann de OliveiraNo ratings yet

- San Beda Alabang School of Law: Syllabus inDocument3 pagesSan Beda Alabang School of Law: Syllabus inLucia DielNo ratings yet

- Tutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFDocument729 pagesTutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFBadunoniNo ratings yet

- Neuromarketing EssayDocument3 pagesNeuromarketing Essayjorge jmzNo ratings yet

- TreeAgePro 2013 ManualDocument588 pagesTreeAgePro 2013 ManualChristian CifuentesNo ratings yet

- Singular & Plural Nouns: Regular PluralsDocument4 pagesSingular & Plural Nouns: Regular PluralsМарина ВетерNo ratings yet

- Sosa Ernest - Causation PDFDocument259 pagesSosa Ernest - Causation PDFtri korne penal100% (1)

- Appraising The Secretaries of Sweet Water UniversityDocument4 pagesAppraising The Secretaries of Sweet Water UniversityZain4uNo ratings yet

- Lesson Plan Earth and Life Science: Exogenic ProcessesDocument2 pagesLesson Plan Earth and Life Science: Exogenic ProcessesNuevalyn Quijano FernandoNo ratings yet

- Long Range Plans ReligionDocument3 pagesLong Range Plans Religionapi-266403303No ratings yet

- Occupant Response To Vehicular VibrationDocument16 pagesOccupant Response To Vehicular VibrationAishhwarya Priya100% (1)

- LabDocument11 pagesLableonora KrasniqiNo ratings yet

- Pemphigus Subtypes Clinical Features Diagnosis andDocument23 pagesPemphigus Subtypes Clinical Features Diagnosis andAnonymous bdFllrgorzNo ratings yet

- Calculation For Service Platform & Pump Shelter StructureDocument36 pagesCalculation For Service Platform & Pump Shelter Structuretrian33100% (1)

- Hanssen, Eirik.Document17 pagesHanssen, Eirik.crazijoeNo ratings yet

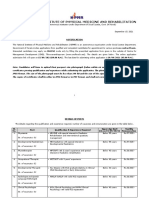

- School Based CPPDocument11 pagesSchool Based CPPjocelyn g. temporosa100% (1)

- Endogenic Processes (Erosion and Deposition) : Group 3Document12 pagesEndogenic Processes (Erosion and Deposition) : Group 3Ralph Lawrence C. PagaranNo ratings yet

- Winifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementDocument279 pagesWinifred Breines The Trouble Between Us An Uneasy History of White and Black Women in The Feminist MovementOlgaNo ratings yet

- LITERATURE MATRIX PLAN LastimosaDocument2 pagesLITERATURE MATRIX PLAN LastimosaJoebelle LastimosaNo ratings yet

- Disorders of NewbornDocument4 pagesDisorders of NewbornBRUELIN MELSHIA MNo ratings yet

- NIPMR Notification v3Document3 pagesNIPMR Notification v3maneeshaNo ratings yet

- Landow - The Rhetoric of HypermediaDocument26 pagesLandow - The Rhetoric of HypermediaMario RossiNo ratings yet

- ECON 4035 - Excel GuideDocument13 pagesECON 4035 - Excel GuideRosario Rivera NegrónNo ratings yet

- English 7 Compare Contrast The People Could Fly Harriet TubmanDocument3 pagesEnglish 7 Compare Contrast The People Could Fly Harriet Tubmanapi-508729334No ratings yet