Professional Documents

Culture Documents

Rent Certificate

Uploaded by

sir_63012630 ratings0% found this document useful (0 votes)

124 views3 pagesRent Certificate template

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRent Certificate template

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

124 views3 pagesRent Certificate

Uploaded by

sir_6301263Rent Certificate template

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

CAUTION:

Schedule H or H-EZ must be completed

and filed with this rent certificate

1 Name

2 Social security number

3 Address of rental property (property must be in Wisconsin)

4 Time you actually lived here in 2012

From (mo./day) To (mo./day)

5 Do not sign your rent certifcate. If your landlord wont sign,

complete lines 2 and 6 to 13, attach rent verifcation (see instructions),

and check this box.

1 Total rent paid (line 1a) . . . . . . . . . . . . . . . . . . . 1

2 Shared living expenses

you paid (line 5b) . . . . . . . . . . 2

3 Total shared living

expenses (line 5a) . . . . . . . . . 3

4 Divide line 2 by line 3. Fill

in decimal amount . . . . . . . . . . . . . . . . . . . . . . . 4 x .

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . . . . 5

6 Value of food and services provided by

landlord (line 12 above) . . . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5. This is your allowable

rent. Fill in here and on line 14a or 14c of

Schedule H (line 9a or 9c of Schedule H-EZ) . . 7

6 Name

7 Address

8 Telephone number

Renter (Claimant)

Rent Certifcate

2012

Wisconsin Department of Revenue

NOTE: Alterations on lines 1 to 13 or the signature line (whiteouts, erasures, etc.) will void this

rent certifcate. A rent certifcate with an error should be discarded and a new one completed.

Need an additional rent certifcate? Go to www.revenue.wi.gov, select Forms.

NEED HELP? 6082668641 (Madison) or 4142274000 (Milwaukee) REMINDERS FOR RENTERS:

If line 11d above is 2 or more and each occupant did

not pay an equal share of the rent, see instructions

for Shared Living Expenses Schedule.

Schedule H or HEZ must be completed and fled

with this rent certifcate.

/ / 2012 / / 2012

Complete lines 1, 3, and 4. Complete line 2

after your landlord flls in lines 6 to 13 and signs.

Landlord Fill in lines 6 to 13 and sign and print your name.

9 a Is the rental property (line 3) subject to property taxes?

Yes No

b If 9a is No and you are a sec. 66.1201

municipal housing authority that makes

payments in lieu of taxes, check this box.

Signature (by hand) of landlord or authorized representative Date

I certify that the information shown on this rent certifcate

is true, correct, and complete to the best of my knowledge.

Sign

here

11 Fill in lines 11a to 11e based on the period of time this rental

unit was occupied by this renter. Use the additional columns

on lines 11a and 11b only if rent rates changed during the year

(see instructions). Do not include amounts received directly from

a governmental agency.

a Rent collected per

month for this rental

unit for 2012 . . . . . . $ $ $ $

b Number of months this

rental unit was rented

to this renter in 2012

c Total rent collected for this

rental unit for 2012 . . . . . . . . . . . . . . . . . . $

d Number of occupants in this rental unit

do not count spouse or children under 18 . .

e This renters share of total 2012 rent . . . . . $

12 Value of food and services provided

by landlord (this renters share) . . . . . . . . . $

13a Rent paid for occupancy only

Subtract line 12 from line 11e . . . . . . . . . . $

b Was heat included in the rent? Yes No

c If a longterm care facility/CBRF/nursing home,

check the method used to compute line 13a:

Standard rate ($100 per week).

Percentage formula (fll in percentage) %.

Other method approved by Department of Revenue.

I017i

Shared Living Expenses Schedule

Step 1: List name(s) of other occupants:

Step 2: List the total amount (not the monthly amount) of

all shared living expenses (rent, food, utilities, and other)

paid by all occupants and the amount that you paid:

Shared Living

Expenses

Rent 1a) 1b)

Food 2a) 2b)

Utilities 3a) 3b)

Other 4a) 4b)

Total 5a) 5b)

Amount

You Paid

Total Paid by

All Occupants

Step 3: Using the amounts listed in Step 2, compute your allow-

able rent paid for occupancy only:

10a Is this rent certifcate for rent of:

A mobile or manufactured home? Yes No

A mobile or manufactured home site? Yes No

b Mobile or manufactured home taxes or municipal permit fees

you collected from this renter for 2012. $

Name of landlord or authorized representative (print)

Instructions

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or Enter.

Save Print Clear

Example: You rented this unit for $300 per month for 7 months

and $325 per month for 5 months. Fill in lines 11a 11c as follows:

a Rent collected per

month for this rental

unit for 2012 . . . . . . $ $ $ $

b Number of months this

rental unit was rented

to this renter in 2012

c Total rent collected for

this rental unit for 2012 . . . . . . . . . . . . . . . . . $

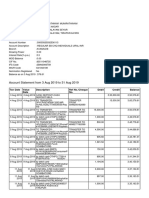

A rent certifcate is used to verify the rent paid to occupy a

Wisconsin homestead in 2012. A homestead could be a

room, apartment, mobile or manufactured home, house, farm,

or nursing home room.

Instructions for Renter (Claimant)

Complete lines 1, 3, and 4. Then give the rent certifcate to

your landlord to complete lines 6 to 13 and sign. A separate

rent certifcate must be completed for each homestead you

rented in 2012 if used in computing your homestead credit.

If your landlord will not sign your rent certifcate, check

the box on line 5. Complete lines 2 and 6 to 13, and attach

a copy of each canceled check or money order receipt you

have to verify your rent. Any portion of your rent paid that is

not verifed will not be allowed.

After you receive the completed rent certifcate from your

landlord, complete line 2 and then fll in the allowable amounts

from lines 10b and 13a on lines 13, 14a, and 14c of Sched-

ule H (lines 8, 9a, and 9c of Schedule HEZ), as appropriate.

Note: If line 11d is 2 or more, see Renter Instructions for

Shared Living Expenses Schedule in the next column.

Attach all rent certifcates to one Schedule H or HEZ. If you

claim less than 12 months of rent and/or property taxes, also

attach a note explaining where you lived for the balance of

2012.

Instructions for Landlord/Authorized Representative

Fill in a separate rent certifcate for each renter (claimant)

requesting one for homestead credit. Fill in line 1 if it is not

already completed. Fill in lines 6 to 13, sign and print your

name, and give the completed rent certifcate to the renter.

Note: You may not charge a fee for flling in a rent certifcate.

Line 9b If you checked No on line 9a, do not complete

the rent certifcate unless you are a sec. 66.1201 municipal

housing authority that makes payments in lieu of property

taxes. If this applies to you, check the box on line 9b.

Line 11a Fill in the rent you actually collected per month for

this rental unit (apartment, room, onehalf of a duplex, etc.)

for 2012, for the time this renter occupied it in 2012. Include

in the monthly rate any separate amounts the renter paid

to you for items such as a garage, parking space, utilities,

appliances, or furnishings. Do not include rent for a prior

year or amounts you received directly from a governmental

agency through a subsidy, voucher, grant, etc., for the unit

(except amounts an agency paid as a claimants representa-

tive payee). If the monthly rent for this unit changed in 2012,

use the extra columns to fll in each monthly rate separately.

Line 11b Fill in the number of months (or partial months)

you rented the unit to this renter in 2012. If you flled in more

than one amount on line 11a, fll in the number of months or

partial months each rate applied. For partial months, fll in the

number of days rather than a fraction or a decimal.

Line 11c Fill in the total rent collected for this unit for the

period of time the unit was occupied by this renter in 2012

(generally, multiply line 11a by 11b).

Rent Certifcate Instructions

Line 11d Fill in the total number of occupants in this rental unit

during the rental period. Note: Do not count the renters spouse

or children under age 18 as of December 31, 2012.

Line 11e Fill in this renters share of the total 2012 rent paid. Do

not include rent paid for other renters, or amounts you received

directly from a governmental agency (except amounts an agency

paid as a claimants representative payee).

Line 12 Fill in this renters share of the value of food, medical,

and other personal services, including laundry, transportation,

counseling, grooming, recreational, and therapeutic services, you

provided for this rental unit. Do not include utilities, furnishings, or

appliances. If you did not provide any of the items, fll in 0.

Signature Review the rent certifcate to be sure that line 1 and

each of the lines 6 to 13b (and 13c, if applicable) has an entry.

Sign (by hand) and date, print your name, and return the rent

certifcate to the renter. Signature stamps, photocopied signatures,

etc., are not acceptable.

Renter Instructions for Shared Living Expenses Schedule

Complete this schedule if line 11d shows more than one occupant

and each occupant did not pay an equal share of the rent. You

may claim only the portion of rent that refects the percentage of

shared living expenses you paid.

Example: You and your roommate paid shared living expenses

as shown below. Your landlord provided services and flled in $300

as your share on line 12.

300 325

7 5

3,725

Shared Living

Expenses

Rent 1a) 1b)

Food 2a) 2b)

Utilities 3a) 3b)

Other 4a) 4b)

Total 5a) 5b)

Amount

You Paid

Total Paid by

All Occupants

$4,800

2,400

600

200

$8,000

$4,800

1,200

-0-

-0-

$6,000

Your allowable rent for occupancy only is $3,300, computed as

follows:

1 Total rent paid (line 1a) . . . . . . . . . . . . . . . . . . . 1

2 Shared living expenses

you paid (line 5b) . . . . . . . . . . 2

3 Total shared living

expenses (line 5a) . . . . . . . . . . 3

4 Divide line 2 by line 3. Fill

in decimal amount . . . . . . . . . . . . . . . . . . . . . . . . 4 x .

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . . . . 5

6 Value of food and services provided by

landlord (line 12 above). . . . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5. This is your allowable

rent. Fill in here and on line 14a or 14c of

Schedule H (line 9a or 9c of Schedule H-EZ) . . . 7

$4,800

$6,000

75

$3,600

$ 300

$3,300

$8,000

Return to Form

You might also like

- Dated: 20 Tenant's Signature(s) : Owner's Signature(s) : Dated: 20Document2 pagesDated: 20 Tenant's Signature(s) : Owner's Signature(s) : Dated: 20Elsie HuppNo ratings yet

- Renewal LeaseDocument29 pagesRenewal LeaseAicha CamaraNo ratings yet

- Rental Agreement (Month To Month)Document7 pagesRental Agreement (Month To Month)Arthur BorgesNo ratings yet

- What Does The Word BIBLE Mean Rev 1Document1 pageWhat Does The Word BIBLE Mean Rev 1Kurozato CandyNo ratings yet

- Caution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateDocument3 pagesCaution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateVedvyasNo ratings yet

- Installment Agreement RequestDocument2 pagesInstallment Agreement Request0scarNo ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- L1 - Instructions. Ontario Landlord Tenant Board.Document11 pagesL1 - Instructions. Ontario Landlord Tenant Board.RockwellNo ratings yet

- BilndDocument3 pagesBilndxabehe6146No ratings yet

- Irs Form 9465 ExampleDocument2 pagesIrs Form 9465 ExampleScottNo ratings yet

- Rent PaidDocument2 pagesRent PaidArchibald BareassoleNo ratings yet

- L9 InstructionsDocument10 pagesL9 InstructionsJoe SlimNo ratings yet

- Covid 19 Hardship RequestDocument2 pagesCovid 19 Hardship RequestThitta Raphael EspinosaNo ratings yet

- Rent Application FormDocument4 pagesRent Application Formrickn9982No ratings yet

- Tenant Rent Record Template: PurposeDocument8 pagesTenant Rent Record Template: PurposeWanjiNo ratings yet

- FX FINACC 2 A KeyDocument9 pagesFX FINACC 2 A KeyEzekiel MalazzabNo ratings yet

- Sierra Wireless AirPrime EM SeriesDocument4 pagesSierra Wireless AirPrime EM SeriesNguyễn Thế PhongNo ratings yet

- Uniform Residential Loan Application: I. Type of Mortgage and Terms of LoanDocument13 pagesUniform Residential Loan Application: I. Type of Mortgage and Terms of Loanmalinda_haneyNo ratings yet

- L1 L9 Application Information UpdateDocument3 pagesL1 L9 Application Information UpdateCody GroseNo ratings yet

- 1980-19 Guaranteed Loan Closing ReportDocument4 pages1980-19 Guaranteed Loan Closing ReportthenjhomebuyerNo ratings yet

- Residential Tenancy AgreementDocument4 pagesResidential Tenancy AgreementDaniel WhiteNo ratings yet

- DVLA Refund ApplicationDocument2 pagesDVLA Refund ApplicationWan Ahmad Hilfi JunaidiNo ratings yet

- TMP Lease Documents 20211004122641Document57 pagesTMP Lease Documents 20211004122641Luis SalinasNo ratings yet

- River Place 2Document7 pagesRiver Place 2zzsnoopyNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- Greenburgh Complex LeaseDocument27 pagesGreenburgh Complex LeaseNewsdayNo ratings yet

- F1040se DFTDocument3 pagesF1040se DFTjyoti06ranjanNo ratings yet

- US Internal Revenue Service: F5500ez - 1993Document1 pageUS Internal Revenue Service: F5500ez - 1993IRSNo ratings yet

- Bankruptcy QuestionnaireDocument7 pagesBankruptcy QuestionnaireArasto FarsadNo ratings yet

- Manhattan Valley Realty LLC: C/O T&D Management Services IncDocument4 pagesManhattan Valley Realty LLC: C/O T&D Management Services IncAri RaskinNo ratings yet

- Sample Lease For VADocument22 pagesSample Lease For VASaad QureshiNo ratings yet

- Solved Examples On Lease AccountingDocument1 pageSolved Examples On Lease AccountingSoumen Sen100% (4)

- L2 - Application To Evict A Tenant (N12 Etc)Document7 pagesL2 - Application To Evict A Tenant (N12 Etc)RockwellNo ratings yet

- US Internal Revenue Service: f2441 - 1991Document2 pagesUS Internal Revenue Service: f2441 - 1991IRSNo ratings yet

- RTB 1Document6 pagesRTB 1Alicia TangenNo ratings yet

- 2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6Document1 page2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6bmptechnicianNo ratings yet

- RTB 1Document6 pagesRTB 1AA SpamsNo ratings yet

- Landlord Verification FormDocument3 pagesLandlord Verification FormSHESHE JONESNo ratings yet

- Standard Form LeaseDocument0 pagesStandard Form LeasePramod M ChauguleNo ratings yet

- Form 12 C Cum Declaration Form To Claim Housing Loan DeductionsDocument3 pagesForm 12 C Cum Declaration Form To Claim Housing Loan DeductionsBhooma ShayanNo ratings yet

- Residential Tenancy Agreement BetweenDocument6 pagesResidential Tenancy Agreement BetweenkushNo ratings yet

- Homestead Recind FormDocument1 pageHomestead Recind FormgernNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument25 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- HSRA Landlord Verification FormDocument1 pageHSRA Landlord Verification Formjohn yorkNo ratings yet

- ResalesDocument11 pagesResalesapi-212566936No ratings yet

- Washington Rental Agreement Legal Blank Template PrintableDocument7 pagesWashington Rental Agreement Legal Blank Template Printablemiranda criggerNo ratings yet

- Household Member / Shelter / Utility VerificationDocument1 pageHousehold Member / Shelter / Utility VerificationlarryNo ratings yet

- Rental Agreement and LeaseDocument42 pagesRental Agreement and LeaseKiana HinesNo ratings yet

- Wa State Rental Lease TemplateDocument7 pagesWa State Rental Lease Templatekristin17170% (1)

- Fifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)Document3 pagesFifteen Day Notice To Pay Rent or Quit: (Rent Demand For February 1, 2021 Through June 30, 2021)LOLANo ratings yet

- CXC It Sba 2015Document6 pagesCXC It Sba 2015Wayne WrightNo ratings yet

- US Internal Revenue Service: f941 - 2000Document4 pagesUS Internal Revenue Service: f941 - 2000IRSNo ratings yet

- RTB 1 CDocument6 pagesRTB 1 CPayam LotfiNo ratings yet

- Residential Tenancy Agreement: Form 1aaDocument11 pagesResidential Tenancy Agreement: Form 1aa历史见证No ratings yet

- Residential Tenancy AgreementDocument6 pagesResidential Tenancy Agreementtrajan77777No ratings yet

- Form E-2 - For Initials+signaturesDocument4 pagesForm E-2 - For Initials+signaturesAlexa KarolinskiNo ratings yet

- rc685 Fill 22eDocument4 pagesrc685 Fill 22ePreetpaul ThiaraNo ratings yet

- Real Estate Recapture TaxDocument5 pagesReal Estate Recapture TaxmpboxeNo ratings yet

- Print Preview - Full Application: Project DescriptionDocument24 pagesPrint Preview - Full Application: Project DescriptionRyan SloanNo ratings yet

- TPA Rental ApplicationDocument2 pagesTPA Rental ApplicationPatrick NolanNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Misplaced ModifiersDocument1 pageMisplaced Modifierssir_6301263No ratings yet

- Tenancy Contract: Signed by The LandlordDocument2 pagesTenancy Contract: Signed by The Landlordsir_6301263No ratings yet

- From Old Man To The SeaDocument3 pagesFrom Old Man To The Seasir_6301263No ratings yet

- FragmentDocument2 pagesFragmentsir_6301263No ratings yet

- IntonationDocument2 pagesIntonationsir_6301263100% (3)

- Diagnostic Test in English IVDocument4 pagesDiagnostic Test in English IVsir_6301263No ratings yet

- FragmentDocument2 pagesFragmentsir_6301263No ratings yet

- Waiting Between The TreesDocument2 pagesWaiting Between The Treessir_6301263No ratings yet

- Final Ccsso English - PoetryDocument8 pagesFinal Ccsso English - PoetryAlnorita IjiranNo ratings yet

- Misplaced ModifiersDocument1 pageMisplaced Modifierssir_6301263No ratings yet

- The Tell TaleDocument2 pagesThe Tell Talesir_6301263No ratings yet

- Preposition Going PlacesDocument9 pagesPreposition Going PlacesAiman IzharNo ratings yet

- Pgp26 Cma 4 CostsheetDocument15 pagesPgp26 Cma 4 CostsheetRaghav khannaNo ratings yet

- CFO1Document6 pagesCFO1vivekNo ratings yet

- Suri SlidesDocument46 pagesSuri Slidesseehari100% (2)

- AmortizationDocument2 pagesAmortizationSonuBajajNo ratings yet

- CSDocument26 pagesCSAnjuElsaNo ratings yet

- Free Online Trading Tools: by Andrew FlemingDocument29 pagesFree Online Trading Tools: by Andrew FlemingIntraday FortuneNo ratings yet

- Rbi Monetary PolicyDocument5 pagesRbi Monetary PolicyRohit GuptaNo ratings yet

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- ZBB Energy Corporation: Form S-1Document53 pagesZBB Energy Corporation: Form S-1Ankur DesaiNo ratings yet

- 2023 - FRM - PI - PE2 - 020223 - CleanDocument171 pages2023 - FRM - PI - PE2 - 020223 - CleanRaymond Kwong100% (1)

- BRM-choice of Subjects in 2nd Year of MBADocument18 pagesBRM-choice of Subjects in 2nd Year of MBANikita SinghaniaNo ratings yet

- Shivesh Sanction LetterDocument11 pagesShivesh Sanction LetterRR RajNo ratings yet

- IBA Karachi - Fee Voucher - PDF - FallDocument1 pageIBA Karachi - Fee Voucher - PDF - FallAbdul Rahim0% (1)

- Thanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooDocument33 pagesThanks For Downloading This Sample Business: Your Business Is Unique. Your Business Plan Should Be TooEva LopenaNo ratings yet

- Ch03 6th Ed Narayanaswamy Financial AccountingDocument13 pagesCh03 6th Ed Narayanaswamy Financial AccountingRam Kishore100% (2)

- Business Math Profit or LossDocument1 pageBusiness Math Profit or LossAnonymous DmjG6o100% (2)

- CA. Naresh Aggarwal's Classes: Chapter-1 Basic Concepts of Cost AccountingDocument8 pagesCA. Naresh Aggarwal's Classes: Chapter-1 Basic Concepts of Cost AccountingNistha BishtNo ratings yet

- TCDNDocument6 pagesTCDNDiep NguyenNo ratings yet

- Income Taxation-FinalsDocument14 pagesIncome Taxation-FinalsTheaNo ratings yet

- May Bank Kim Eng PDFDocument19 pagesMay Bank Kim Eng PDFFerry PurwantoroNo ratings yet

- SSS v. MoonwalkDocument2 pagesSSS v. MoonwalkGian MadridNo ratings yet

- International Financial Markets: South-Western/Thomson Learning © 2006Document30 pagesInternational Financial Markets: South-Western/Thomson Learning © 2006akhil107043No ratings yet

- Sip PresentationDocument11 pagesSip Presentationgourav patwekarNo ratings yet

- Applied Soft Computing: Donghyun Cheong, Young Min Kim, Hyun Woo Byun, Kyong Joo Oh, Tae Yoon KimDocument10 pagesApplied Soft Computing: Donghyun Cheong, Young Min Kim, Hyun Woo Byun, Kyong Joo Oh, Tae Yoon KimChris RichmanNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- Walmart-Flipkart Acquisition: A Case Study Flipkart Acquisition: A Case StudyDocument11 pagesWalmart-Flipkart Acquisition: A Case Study Flipkart Acquisition: A Case Studychandu johnNo ratings yet

- Ncert Solution Class 11 Accountancy Chapter 10Document68 pagesNcert Solution Class 11 Accountancy Chapter 10Prakal 444No ratings yet

- 1569974603267g4SdkiBXnw22cLKZ PDFDocument4 pages1569974603267g4SdkiBXnw22cLKZ PDFSelvarathnam MuniratnamNo ratings yet

- PDIC LawDocument5 pagesPDIC LawDiscord HowNo ratings yet