Professional Documents

Culture Documents

Financial Globalization: Some Conceptual Problems

Uploaded by

Alexandra Ştefania OpreaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Globalization: Some Conceptual Problems

Uploaded by

Alexandra Ştefania OpreaCopyright:

Available Formats

Working Paper No.

360

Financial Globalization: Some Conceptual Problems

by

Philip Arestis

Levy Economics Institute of Bard College, New York

p.arestis@levy.org

Santonu Basu

London South Bank University

We are grateful to Ilene Grabel and Ajit Singh for helpful comments. They are in no

way responsible for any remaining errors.

1. INTRODUCTION

In recent years financial liberalization, although not necessarily able to deliver a higher growth rate or for that matter to bring

efficiency in the financial sector (Arestis and Demetriades, 1997), has brought a new twist in the process by introducing a highly

politicized term, that of financial globalization. The term financial globalization refers to the process by which financial markets of

various countries of the globe are integrated as one.

We wish to argue that although financial liberalization is a necessary condition for financial globalization, it is not a sufficient

condition for it. The introduction of a worldwide single currency managed by a single international monetary authority is the

sufficient condition. The first age of unregulated financial globalization that spans over the period from the 1870s to 1913, (when

London arguably acted as the center of financial activity), was marred by a series of banking crises, a period which can also be

categorized as the early stage of the development of international financial institutions and markets (Eichengreen and Bordo,

2002). The crises principally arose from speculation, excessive lending, poorly managed funds, ill-regulated banking systems and

non-disclosure of information. The history of international financial sector development in the inter-war period, 1919 to 1939,

was not a particularly happy one either; in fact it was deeply scarred by the stock market collapse in the late 1920s, followed by

the Great Depression. The post World-War II period was characterized by a number of financial controls and fixed exchange rates.

Banking crises were absent during the period from 1945 to the early 1970s, although currency crises were in evidence. From then

onwards the process of financial liberalization began, and banking crises re-emerged in a new era of broadly flexible exchange

rates, which brought about an era of free movement of capital. In this paper we seek to define the current epoch of financial

globalization, and examine more closely the conditions that are required for its emergence.

2. FINANCIAL DEREGULATION

The detrimental aspects of free flow of financial capital following the experience of the Great Depression was recognized by

many countries across the World. Accordingly, not only developed but also newly-formed countries undertook various measures

in order to prevent financial instability. It was recognized that to prevent the latter, there was a need to control financial flows that

were purely speculative in nature, and to ensure that possible expansion of aggregate expenditure in the productive aspect of the

economy was not constrained by inadequate financial flows. Consequently, regulations within national boundaries took the form

of preventing financial flows that were mainly geared for speculative activity. The specificity of the regulations may have

differed from country to country, but the aim of those regulations was to ensure that credit would be allocated to industry and

trade (Sayers, 1960; Basu, 2002).

In addition to those regulations almost every country made further provisions to ensure that the productive sectors were neither

constrained by the price of finance nor by inadequate financial flows. These often arose either as a result of lenders' incomplete

knowledge about a particular sector, or as a result of borrowers' inability to meet lenders' credit standards.

1

As a result, the ceiling

on interest rates was introduced in order to ensure that borrowers were not constrained by the price, and specialized banks were

developed to ensure that the lenders' lack of knowledge did not prevent the financial flows to specific sectors. Furthermore, in

certain countries the government stood as guarantor, and in other countries banks were instructed to reduce the credit standard

requirements. That was aimed at ensuring that certain groups of borrowers were not constrained by interruptions to the financial

flows that arose from their inability to meet banks' credit standard requirements.

On the international side, a variety of controls were established in order to ensure that foreign financial flows were mainly

concentrated on the productive side of the economy. In order to prevent free financial flow and exit, those controls also

embraced the purchase of foreign currency. In some instances, governments stood as a direct guarantor between the foreign lenders

and the domestic borrowers. The reason was to ensure that the growth of local industries was not constrained by inadequate foreign

financial flows arising from their inability to meet the foreign lenders' credit standard requirements.

The main objective of those regulations was to bring financial stability and to promote governments' economic and social

objectives. This was the case for developed as well as for developing countries. An important implication of those regulations was

to undermine the independence of the financial sector as a profit-seeking economic unit. A further implication was that, since banks

were prohibited by regulation from advancing loans to certain areas of economic activity, there was the opportunity for new

institutions to emerge in order to capture that end of the loan market. Banks' share of the loan market fell as a result, thereby

affecting the effectiveness of the traditional tools of monetary control (Basu, 2002). This was mainly because these new institutions

were not subject to the same regulations as the banks. Policies that were implemented in order to promote the access of smaller

borrowers to the loan market at a cheaper rate, largely remained ineffective and adversely affected whatever limited access they

may have had to this loan market in the past.

Serious doubts were also raised about the merits of administrative controls over interest rates, typically in developing countries, as

a vehicle for a higher volume of savings at low interest rates, thereby inaugurating the well-known 'financial repression' thesis

(McKinnon, 1973, Shaw, 1973). The view was taken that government intervention itself distorts the determination of the price of

loans, thereby adversely affecting not only the allocation of loans but also savings. This led to the 'financial liberalization' thesis,

initiated in McKinnon (1973) and Shaw (1973) and further developed by Fry (1995, 1997), King and Levine (1993a and 1993b)

and others.

2

It was argued that in the absence of intervention, market forces would determine the interest rate, which in turn would

govern the allocation of loans. The presumption was that interest rate plays a crucial linking and causal role amongst savings,

investment and growth. Government intervention either distorts or de-emphasizes the role of interest rates, which produces lower

savings and thus lower growth rates than otherwise.

3. CONDITIONS FOR FINANCIAL GLOBALIZATION

The crucial message of the financial liberalization thesis is that it is the lack of competition, which brings inefficiency to this

sector. Interest rate liberalization is a first step, but it is recognized that this alone is not likely to generate competition in this

market, in view of its oligopolistic nature. Consequently, not only is there a need to increase the number of players in this market,

but also to tap a larger pool of savings for which a country may be required to go beyond their own domestic boundary. To

increase the number of players there is a need to remove entry restrictions so that Non-Bank Financial Intermediaries (NBFI), as

well as overseas banks can enter into this market. In order to tap a larger pool of savings, there is a need to not only remove

controls over the purchase and sale of foreign currency, but also to relax laws relating to takeover and merger activities. This

implies that there is a need to liberalize the external sector of the financial system.

A view emerged similar to that of the school of financial liberalization. Government intervention in the determination of the price of

the currency causes a distortion in the allocation of exports and imports, thereby bringing an imbalance between them (Friedman,

1953; Krueger, 1974; Cordon, 1981). This problem might be further aggravated by the undue restriction on foreign direct

investment, which may cause debt to rise to an unnecessarily high level which otherwise could be addressed via foreign direct

investment. It was argued that if the currency was allowed to float then the mechanism of its appreciation and depreciation would

ultimately bring a balance between exports and imports.

3

The remaining trade imbalance could be addressed by attracting foreign

direct investment.

Accordingly, country after country started to float its currency, financial controls were removed and laws relating to takeover and

merger activities were relaxed in anticipation that the threat of a takeover may improve the performance of those not performing

as expected. In other words and as argued above, the external sector of the financial system also had to be liberalized. Internal and

external liberalization of the financial sector was thus undertaken under the presumption that this in turn would bring efficiency to

this sector, and would improve the growth performance of the countries concerned. In the process it opened up the opportunity for

financial capital to move freely from one country to another. The speed of this movement in recent years has been further

enhanced by the advancement in information technology. The combination of these two developments in recent years has given

rise to the view that financial markets are now perhaps truly globalised. This belief might have originated from the assumption

that the interest rate alone governs the allocation of loanable funds.

Consequently, it is the flexibility of interest rate movements that would bring the lending and borrowing countries into one market,

thereby integrating all the financial markets across the globe. Hence, the word globalization was introduced which technically

means the integration of the whole world into one; that different parts of the globe should be merged into one. But what was not

recognized was that the loan market operates under conditions of uncertainty, and as a result interest rate variation alone cannot

clear this market. This means that interest rates by themselves cannot bring lending and borrowing countries into one market.

Lenders will ask for collateral or some form of security as an alternative means to recoup the loan, should the borrowers' projects

fail. This alternative way of recouping the loan, is what we have already referred to as the credit standard (Basu, 2002). Therefore

any nation wishing to borrow from the international financial markets would have to meet the credit standard requirements which

are appropriate for these markets.

This problem is further complicated by the existence of different currencies with their different degrees of acceptability in the

international financial markets which implies that loans have to be paid in currencies that are acceptable to both parties. Countries

other than those whose currencies are internationally recognized, would have to pay their loans in some foreign currency. The

problem here is a critical one for those countries whose currencies are not recognized in the international markets. As these

countries are required to repay their loans in a foreign currency, they have to offer assets as collateral, and these should be traded in

international markets. This is required in that should they default on loans, these assets can be sold in the international markets to

recoup the loan in foreign currency. This segregates the domestic financial markets from the international financial markets for

these countries' borrowers. The borrowers who wish to raise funds domestically would normally be required to offer collateral

against which they can raise loans. If these borrowers wish to raise funds from the international market then they will be required to

offer as collateral assets that are acceptable in international markets. As opposed to this, countries whose currencies are recognized

internationally are not required to repay the foreign loans in foreign currencies. As a result no distinction is required between their

domestic assets and international assets; they can borrow from the international markets by offering either of these assets.

This distinction in the credit standard requirements between the domestic and international markets in some cases, but not in other

cases, suggests that not only are we far from integration, but at best this market can be described as 'fractured'.

4

Consequently, in

some cases large sections of the financial markets are able to integrate with the international financial markets, while in other cases

only a small fraction is able to integrate. Furthermore, this difference between the credit standard requirements not only causes

differential access to the international financial markets for different countries, but it may have far reaching consequences for the

world economy.

The majority of countries whose currencies are either not recognized or have a low degree of recognition in international financial

markets, would have very limited access to international financial markets, essentially because of their very small export sector and

since they can only accumulate internationally recognized means of payment. Thus, countries with low export potential will have

lower access to international financial markets than otherwise; as a result their growth rates may be retarded. Although the access of

countries, with high export potential, to international financial markets would increase, the assets of their export sector would also

enter as collateral. As the value of these assets are also related to export earnings, it follows that a fall in export earnings would not

only cause a problem in maintaining the repayment rate, but would also cause a problem in recouping the loans from selling these

assets. This is because a fall in the export earnings will adversely affect the value of these assets. The problem is that this collateral

does not constitute alternative means of payment, because its value is directly related to the performance of the export sector. Such

form of collateral arrangements at best can be described as an alternative expression for equity finance and loses the attributes that

are necessary to fulfil the task of credit standard (see, also, p. 5 above). In other words, these loans carry a high level of credit risk,

thereby introducing the seeds for financial crises.

It follows that although the current free movement of financial capital may have opened up the possibility for the emergence of

integrated financial markets, it has also introduced the seeds for inequality in the world economy, and has increased the occurrence

of financial crises. To avoid such conflict it is necessary to introduce a single currency that would allow international financial

markets to adopt a uniform credit standard for all countries. To introduce a single currency and to implement uniform credit

standard requirements, there is a need to establish a world central bank for the global financial markets. As it stands now we are

not only far away from integration, but also in the absence of a single currency and a world central bank this process may reverse,

as it happened in the past.

5

4. CONCLUSION

The analysis that has been conducted here suggests that unregulated opportunities for free financial flows between countries are

by-products of financial liberalization. But this opportunity for free financial flows between countries does not alone constitute

financial globalization. To complete the process of financial globalization there is a need to develop a global institution that can

play the central coordinating role. Of equal importance, there is a further need to develop a single currency, which neither depends

on gold nor on any national currency. It is the single currency that will allow the global financial market to develop uniform credit

standard requirements. In the absence of the latter, this process will bring periodical financial crises and will further aggravate the

unequal distribution of income and wealth, which directly contravenes the true meaning of the word globalization. In short, as it

stands now, we are still a long way from true financial globalization.

NOTES

1. As this market operates in the presence of uncertainty, lenders ask for collateral or some form of security in order to ensure

that should the borrowers default on loans there remain some alternative means to enable lenders to recoup their loan

capital. This is referred to as the credit standard (Basu, 2002).

2. See also Greenwood and Jovanic (1990), Levine and Zervos (1996 and 1998), Rajan and Zingales (1998), Roubini and Sala-

i-Martin (1992) and Saint-Paul (1992) in this line of work. See also Arestis and Demetriades (1997), Basu (1994 and 2002),

Diaz-Alecjandro (1985), Morisset (1993) and Singh (1997) who argue that the financial liberalization thesis is neither

empirically nor theoretically tenable.

3. This adjustment process is referred to as the J-curve effect, which suggests that it will adversely affect the current

account deficit initially, but ultimately it will improve it (Cordon, 1981).

4. The word 'fractured' is borrowed from Harris (1998), who argues that the developments discussed in the text produced

'regionalism' rather than financial globalization.

5. Historically speaking, the only time the world ever came close to such a situation was during the late 19th century, when

Britain ruled the world. Banking crises in the late 19

th

century brought about an end to what appeared to have been the

beginnings of financial globalization. Since then an attempt was made in 1944 but it collapsed in 1973, with the abolition

of the fixed exchange rate by the USA. This led to the emergence of regionalism, which is perhaps still in a transitional

phase (Harris, 1998).

REFERENCES

Arestis, P. and Demetriades, P. 1997. "Financial Development and Economic Growth: Assessing the Evidence." Economic

Journal 107: 783-799.

Basu, S. 1994. "Deregulation of the Australian Banking Sector: A Theoretical Perspective." Australian Economic Papers 33:

272-285.

---. 2002. Financial Liberalization and Intervention: A New Analysis of Credit Rationing. Ccheltenham: Edward Elgar.

Cordon, W.M. 1981. Inflation Exchange Rates and the World Economy Lectures on The International Monetary Economics ,

Second Edition, Oxford: Clarendon Press.

Diaz-Alecjandro, C.F. 1985. "Good-Bye Financial Repression, Hello Financial Crash." Journal of Development Economics 19: 1-

24.

Eichengreen, B. and Bordo, M.D. 2002. "Crises Now and Then: What Lessons From the Last Era of Financial Globalization?"

NBER Working Paper No. 8716.

Friedman, M. 1953. "The Case for Flexible Exchange Rates." In Essays in Positive Economics. Chicago: University of Chicago

Press. 157-203.

Fry, M.J. 1995. Money, Interest and Banking in Economic Development. Second Edition, Baltimore: John Hopkins University

Press.

---. 1997 "In Favor of Financial Liberalization." Economic Journal 107: 754-770.

Greenwood, J. and Jovanovic, B. 1990. "Financial Development, Growth, and the Distribution of Income." Journal of Political

Economy 98: 1076-1108.

Harris, L 1998 "The Dynamics of Globalization: Eight Skeptical Theses." Presented at the United Nations University and

African Economic Research Consortium Conference, Asia and Africa in the Global Economy , Tokyo, 3-4 August.

King, R.G. and Levine, R. 1993a. "Finance and Growth: Schumpeter Might be Right." Quarterly Journal of Economics 108:

717-737.

---. 1993b. "Finance, Entrepreneurship, and Growth: Theory and Evidence." Journal Monetary Economics 32: 513-542.

Krueger, A.O. 1974. "The Political Economy of the Rent-Society." American Economic Review 64.

Levine, R. and Zervos, S. 1996. "Stock Market Development and Long-Run Growth." World Bank Economic Review 10:

323-339.

---. 1998. "Stock Markets, Banks, and Economic Growth." American Economic Review 88: 537-558.

McKinnon, R.I. 1973. Money and Capital in Economic Development. Washington D.C.: Brooking Institutions.

Morisset, J. 1993. "Does Financial Liberalization Really Improve Private Investment in Developing Countries?" Journal of

Development Economics 40: 133-140.

Rajan, R.G. and Zingales, L. 1998. "Financial Dependence and Growth." American Economic Review 88: 559-586.

Roubini, N. and Sala-i-Martin, X. 1992. "Financial Repression and Economic Growth." Journal of Development Economics 39: 5-

30.

Saint-Paul, G. 1992. "Technological Choice, Financial Markets and Economic Development." European Economic Review 36:

763-781.

Sayers, R.S. 1960. Modern Banking. 5

th

Edition, Oxford: Clarendon Press.

Shaw, E. 1973. Financing Deepening in Economic Development. New York: Oxford University Press.

Singh, A. 1997. "Financial Liberalization, Stock Markets and Economic Development." Economic Journal 107: 771-782.

You might also like

- European Financial Supervision PDFDocument18 pagesEuropean Financial Supervision PDFChiliban CristieanNo ratings yet

- De Larosiere Report enDocument86 pagesDe Larosiere Report enMortimer37No ratings yet

- Key Regional and International Bodies and Fora For The Financial MarketsDocument9 pagesKey Regional and International Bodies and Fora For The Financial MarketsdanoantaNo ratings yet

- OECDocument3 pagesOECAncaIlieNo ratings yet

- When The Crowd Fights CorruptionDocument8 pagesWhen The Crowd Fights CorruptionAlexandra Ştefania OpreaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- US Internal Revenue Service: p1438Document518 pagesUS Internal Revenue Service: p1438IRSNo ratings yet

- Inter-regional disparities in industrial growthDocument100 pagesInter-regional disparities in industrial growthrks_rmrctNo ratings yet

- Ud. Wirastri Jurnal Penerimaan Kas Desember 2015Document40 pagesUd. Wirastri Jurnal Penerimaan Kas Desember 2015Raihan FatihaNo ratings yet

- Neoliberalising The Urban New Geographies of Power and Injustice in Indian CitiesDocument13 pagesNeoliberalising The Urban New Geographies of Power and Injustice in Indian CitiesHash SinghNo ratings yet

- Chapter One - Part 1Document21 pagesChapter One - Part 1ephremNo ratings yet

- Optional Credit RemovalDocument3 pagesOptional Credit RemovalKNOWLEDGE SOURCENo ratings yet

- Travel Insurance CertificateDocument2 pagesTravel Insurance CertificateLee Mccray100% (1)

- 12 Jun 2019 PDFDocument12 pages12 Jun 2019 PDFAnonymous dy7g4jzo7No ratings yet

- Preparing The Philippines For The 4th Industrial Revo PIDS Report 2017-2018Document120 pagesPreparing The Philippines For The 4th Industrial Revo PIDS Report 2017-2018Rico EstarasNo ratings yet

- Dissertation Ulrich BobeDocument5 pagesDissertation Ulrich BobeBuyPapersForCollegeOnlineCanada100% (1)

- 2012 - Communities Cagayan Incorporated Vs Nanol, GR 176791, November 14, 2012Document1 page2012 - Communities Cagayan Incorporated Vs Nanol, GR 176791, November 14, 2012Lyka Lim Pascua100% (1)

- Recovery Catalytic Converters RefiningDocument20 pagesRecovery Catalytic Converters RefiningAFLAC ............80% (5)

- Week 8Document2 pagesWeek 8Nikunj D Patel100% (1)

- Employment Growth Informalisation and Other IssuesDocument23 pagesEmployment Growth Informalisation and Other IssuesRiya Singh100% (1)

- Immelt's Reinvention of GEDocument5 pagesImmelt's Reinvention of GEbodhi_bg100% (1)

- Form 32 A Central: Treasury or Sub TreasuryDocument1 pageForm 32 A Central: Treasury or Sub TreasuryMuhammad AsifNo ratings yet

- Prime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutiveDocument3 pagesPrime HR & Security Solutions PVT LTD: SUB: Appointment As HR ExecutivesayalikNo ratings yet

- More Unanswered QuestionsDocument8 pagesMore Unanswered QuestionspermaculturistNo ratings yet

- Monopoly: Principles of Microeconomics Douglas Curtis & Ian IrvineDocument36 pagesMonopoly: Principles of Microeconomics Douglas Curtis & Ian IrvineNameNo ratings yet

- PDFDocument16 pagesPDFAnil KhadkaNo ratings yet

- Booking ConfirmationDocument5 pagesBooking ConfirmationAnonymous uqL4XaNo ratings yet

- Time-Table - BBA 3rd SemesterDocument2 pagesTime-Table - BBA 3rd SemesterSunny GoyalNo ratings yet

- Steel CH 1Document34 pagesSteel CH 1daniel workuNo ratings yet

- Case 03 - Walmart Case NoteDocument3 pagesCase 03 - Walmart Case Notemarcole198440% (5)

- Comparative Analysis of Public & Private Bank (Icici &sbi) - 1Document108 pagesComparative Analysis of Public & Private Bank (Icici &sbi) - 1Sami Zama100% (1)

- Local Business EnvironmentDocument3 pagesLocal Business EnvironmentJayMoralesNo ratings yet

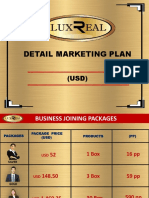

- Luxreal Detail Marketing Plan (2019) UsdDocument32 pagesLuxreal Detail Marketing Plan (2019) UsdTawanda Tirivangani100% (2)

- Portfolio Management - Chapter 7Document85 pagesPortfolio Management - Chapter 7Dr Rushen SinghNo ratings yet

- Can China Keep Rising Despite US PushbackDocument9 pagesCan China Keep Rising Despite US PushbackVidas ŽūkasNo ratings yet

- Opportunity CostDocument1 pageOpportunity Costvaibhav67% (3)