Professional Documents

Culture Documents

Zakat Calculator

Uploaded by

Imran VohraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zakat Calculator

Uploaded by

Imran VohraCopyright:

Available Formats

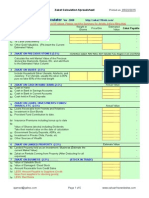

Zakat Calculation Spreadsheet

Printed on 5/28/2014

Weight in

Grams

Price/Gm

Estimated

Value

Zakat Payable

1 ZAKAT ON GOLD (2.5%)

1a 24 Carat Gold/Jewelry . -

1b 22 Carat Gold/Jewelery . -

1c 18 Carat Gold/Jewelry . -

1d Other Gold Valuables. (Pls insert the Current

Estimated Value) -

2 ZAKAT ON PRECIOUS STONES (2.5%) (Contentious subject. Refer Notes. Dont Calculate if you disagree or are uncomfortable.)

Calculate the nett Market Value of the Precious

stones like Diamonds, Rubies, Etc. and add them

to the Estimated Value Column -

3 ZAKAT ON SILVER (2.5%)

Include Household Silver Utensils, Artefacts, and

Jewelery. For Utensils, usually the silver is 90%

pure so take 90% of the total weight - -

4 ZAKAT ON CASH IN HAND /BANK (2.5%) Actual Value

4a Cash in Hand -

4b Cash in Bank in Savings Accounts -

4c Cash in Bank in Current Accounts -

4d Cash held in Fixed Deposits -

5

ZAKAT ON LOANS / INVESTMENTS/ FUNDS/

SHARES, ETC (2.5%)

Actual Value

5a Loans Receivable from Friends and Relatives -

5b Investment in Govt Bonds -

5c Provident Fund Contribution to date. -

5d Insurance Premiums including bonus up to date -

5e

Value of Shares (stocks) including Dividends.

Take their market value on the date of calculation -

5f Government Security Deposits, ADRs, etc -

5g Investment in Private Chits, Funds, etc -

5f Other Sources of Wealth -

6 ZAKAT ON LANDED PROPERTY (2.5%) Estimate Value

6a

-

6b

-

7 ZAKAT ON BUSINESS (2.5%) ---------- (STOCK-IN-TRADE)

7a Value of Saleable Stock

7b Value of Damaged / Dead Stock

7c Amount Receivable from Credit Sales

7d LESS: Amount Payable to Suppliers (Credit

taken from suppliers for stocking goods)

7e LESS: Bad Debts

TOTAL VALUE OF STOCK ( 7a+7b+7C-7d-7e) . -

Zakat Calculator

(Use Only YELLOW cells to fill Values. Please read the Summary for details, before filling this)

Landed Property held as an Investment / Business (Estimate the

current Maket Value)

Zakat on Rentals Coming from Property (After Deducting for all

expenses)

Page 1 of 5

Zakat Calculation Spreadsheet

Printed on 5/28/2014

Weight in

Grams

Price/Gm

Estimated

Value

Zakat Payable

8

8a Capital Balance as per Last balance Sheet

8b Loans Advanced by you to the Firm as of Date

8c

8d

NETT TOTAL WORTH CALCULATED . -

9

Value of Produce

9a

-

9b

-

9c

-

10

Total Value

Animals/ Birds more than 6 months Old - @ 1

Animal or Bird PER 40 either in Kind or Value

thereof. -

11

11a Loans taken from from Friends / Relatives

11b Loans Taken from Banks / Institutions

11c Income Tax / Wealth Tax Payable

TOTAL LIABILITIES . .

TOTAL ZAKAT PAYABLE

IMPORTANT: PLEASE READ BELOW SUMMARY FOR INSTRUCTIONS & NOTES:

GENERAL LIABILITIES - You need to deduct your direct Payables or

Liabilities which have not been deducted earlier - Usage of the loan should

have been on Zakatable Wealth only.

ZAKAT ON AGRICULTURAL PRODUCE (10%, 7.5%, 5%)

ZAKAT ON ANIMALS & POULTRY & FISH FARMING

Produce totally dependent on Artificial Irrigation like Canal, Tank,

Borewell, etc. @ 5% of Produce (crop) in Value or in Kind

Produce dependent Partially on Rain Water and Partially on

Artificial Irrigation @ 7.5% of the produce Value or in Kind

Produce Dependent on Rain Water - @ 10% of product (crop) in

Value or Kind

Accumulated Profit from the date of Balance Sheet to this Date

(Estimate the Profit Value as it is difficult to get exact figures in

the middle of Accounting Year)

LESS: Withdrawals made by you during the current Year.

ZAKAT ON SHARE IN PARTNERSHIP FIRMS (2.5%)

Page 2 of 5

Zakat Calculation Spreadsheet

Printed on 5/28/2014

Weight in

Grams

Price/Gm

Estimated

Value

Zakat Payable

Zakat on Precious and Semi-Precious Stones

There is considerable contention on whether these are to be considered for valuation. In my humble opinion if

they have a value, then they calculate towards your wealth, and it is on the wealth that Zakat is mandatory.

However please consult with Moulvi, before acting on this section. Most Ulema contend that a diamond is a piece

of carbon and its value varies, unlike that of gold or silver.

One may calculate the Saleable Value of Items-at-hand on the date of Zakat Calculation.

Zakat on Silver.

Dear Brothers & Sisters,

Details of Each Section to be used in conjunction with the Calculation Spreadsheet.

Zakat on Pure Gold and Gold Jewellery

Zakat should be calculated at 2.5% of the market value as on the date of valuation (In our case we consider 1st

of Ramadhan). Most Ulema favour the Market Value prevailing as on the date of Calculation and not the

purchase price.

Alhamdulillah, the month of Ramadhan has been bestowed upon us by Allah. ZAKAT is one of the five

fundamental pillars of Islam, mandatory on all muslims who are of eligible wealth. Zakat is due from and payable

by a person on his wealth (and not his income), which has remained with him/her for one Islamic year.

It is difficult to calculate the completion of one year on each item of wealth, because purchase dates may vary.

To overcome this difficulty, a practical method is to fix a date (e.g. 1st of Ramadhan), compute your total wealth

on that date and calculate Zakat, thereon.

Zakat is to be paid on Silver in Pure form or Jewellery, Utensils, Decorative items and all household items

including crockery, cutlery made of silver at 2.5% of the prevailing market rates.

Zakat on Cash and Bank Balances

Zakat should be paid at 2.5% on all cash balance and bank balances in your savings, current or FD accounts.

The amount technically should be in the bank for one year. Usually it happens that the balance keeps on

changing as per personal requirements.

Page 3 of 5

Zakat Calculation Spreadsheet

Printed on 5/28/2014

Weight in

Grams

Price/Gm

Estimated

Value

Zakat Payable

Zakat on Loans Given, Funds, etc

Zakat is payable by you on loans you have given to your friends and relatives. It should be treated as Cash in

Hand. You may deduct Loans Payable by you to arrive at the nett present value of your wealth. However, if you

are in doubt, on the return of your money, then you may not calculate it as your wealth. You can add it to your

wealth, if and when your receive your money.

Zakat is payable on all Govt Bonds, Public Sector Bond, paid-up Insurance premiums, your paid-up portion of

Provident Funds, Govt Bills receivables, etc. Pls remember you need to be aware of what the sharia says about

Insurance and other types of investments. It is outside od the scope of this Zakath Calculator.

Zakat on Landed Property

You may make your best judgement and the best way is to pay on remaining amount on the day of calculation

Deduct the Amounts due to your suppliers and deduct the loans on stock on the date of calculation. Dead Stock

should be calculated on scrap value or its saleable value. Damaged stock should also be valued at its scrap

value.

Be honest in the calculations, as ZAKAT is an INSURANCE on your STOCK directly from ALLAH and who better

an insurer than Him.

There is no Zakat on Factory Buildings or any kind of machinery, but there is zakat on products produced in the

factory (i.e. finished goods value). Please refer to a competent Moulvi or a scholar who can shed more light on

your specific issues.

Zakat on Partnership Firms.

Zakat is not payable on personal residential House even if you have more than one and meant for residential

purpose only. Also Zakat is not applicable on the value of Property given on rent irrespective of how many.

However Zakat is payable on the rental income itself after deducting the maintenance and other expenses.

However if your intention of holding properties is to sell at a future date for a profit or as an investment, then

Zakat is payable on the Market Value of the property. Also, if your intention of holding properties changes in the

current year, I.e. from self use to business then you need to pay Zakat on that Property Value.

This is for Business Persons only. No matter what business you are into, you've got to pay Zakat on all STOCK-

Zakat on Business:

The Consensus formula for Zakat calculation on Agriculture is as follows:

On crops dependent purely on rain water it will be 10% of produce, On crops not irrigated through rain water but

use Canal Water, Tank Water, Borewell and Open wells, the Zakat is 5% of the produce. For Crops dependent

partly on Rain Water and partly on other water, the Zakat applicable would be 7.5% of produce.

Zakat can be paid EITHER by the firm OR separately by the owners. If the firm is not paying, and the partner

wants to calculate his share, he should take the amount standing to his capital and loan account as per the last

balance sheet. Add his estimated share of profit till the date zakat is calculated.

This can only be estimated as it is difficult to calculate the exact profit or loss between an accounting year.

Zakat on Agricultural Product

Zakat is payable on all Agricultural produce including fruits, commercially grown flowers, vegetables and all types

of grains at the harvest time itself. The passing of One year does not apply for agrultural produce. If there are

two or more crops on the same land per year, then Zakat has to be paid as many times on the crop, irrespective

of the time.

Page 4 of 5

Zakat Calculation Spreadsheet

Printed on 5/28/2014

Weight in

Grams

Price/Gm

Estimated

Value

Zakat Payable

Zakat on Animals

On all grazing animals like goats, sheep, camel, cows, broiler chickens, the consensus Zakat payable is one

animal/bird for every 40 animals owned. However you may wish to give cash in lieu of the animal/bird itself.

COPYRIGHT NOTICE: You are free to distribute this Calculator, by email, by print or by posts over the Internet.

My intention in creating this was to make the task of Zakat as simple and easy as the act of Zakat itself. However

if you are making any modifications or changes please keep me informed.

FOOTNOTE: Please note that RIBA in any form is Haram and strictly prohibited. So please stay away from

taking Loans on Interests AND Collection of Interests from any body or institution or other forms of RIBA'.

For those who would like more details there is a good site which gives all details on Zakat. Please visit

http://www.islamsa.org.za/library/books/bzewar/part3/zakaat.htm

Please consult your local Scholar or Maulvi or Imaam who can guide you to the right direction, or refer to books of

Fiqh if you would like to have first hand confirmation of the situation.

Liabilities Deductions

If you have any pending tax payable to the govt, as of the date of Zakat Calculation, then the same may be

deducted before arriving at the net worth. If you have taken any loans from any person or institution, and if you

have not already deducted the same from any of the above sections, then you can deduct your Payables over

here. Please be truthful, as Zakat is a sure way of protecting ones wealth if Zakat has been paid on it regularly

and fully.

LOANS taken only for Zakatable-Wealth should be deducted. Cars, Houses, etc are not Zakatable wealth. So

any loan taken for these purposes are not to be deducted

Page 5 of 5

You might also like

- Zakat Calculator For AllDocument6 pagesZakat Calculator For AllHasnut ZamilNo ratings yet

- Problems of Pakistan RailwayDocument1 pageProblems of Pakistan RailwayNauman BilalNo ratings yet

- Al Arafah Bank LTD MGT351Document18 pagesAl Arafah Bank LTD MGT351ArnobNo ratings yet

- Zakah Core PrinciplesDocument44 pagesZakah Core PrinciplesadelNo ratings yet

- Thesis Book For Basal TeamDocument42 pagesThesis Book For Basal Teammohamed ahmed salaad100% (1)

- Fundamentals of Accounting Urdu CourseDocument4 pagesFundamentals of Accounting Urdu CourseBabar Abbas0% (1)

- Zakat in IslamDocument36 pagesZakat in IslamSajjad AliNo ratings yet

- JOIFA Journal 2018 Final Approval For Web3Document68 pagesJOIFA Journal 2018 Final Approval For Web3mariemkraiemNo ratings yet

- Module 1 - Overview of SukukDocument36 pagesModule 1 - Overview of SukukArun Kumar MurugasuNo ratings yet

- Pre-Entry Proficiency Test, General Information, Sample Test Paper & Answer SheetDocument8 pagesPre-Entry Proficiency Test, General Information, Sample Test Paper & Answer SheetJawad RazaNo ratings yet

- Islamic Financing Mode - Musharakah PartnershipDocument25 pagesIslamic Financing Mode - Musharakah PartnershipNaveed SaeedNo ratings yet

- Convince A Non-Muslim of Islamic Economic PrinciplesDocument4 pagesConvince A Non-Muslim of Islamic Economic Principlesthasneem_2001No ratings yet

- Zakat Calculator: 1a 1b 1c 1dDocument5 pagesZakat Calculator: 1a 1b 1c 1dsayeedkhanNo ratings yet

- Zakat Calculator Ver 2005Document5 pagesZakat Calculator Ver 2005u1umarNo ratings yet

- Zakath CalculatorDocument5 pagesZakath CalculatorShageerNo ratings yet

- Zakat Calculator Ramadan2010-1Document26 pagesZakat Calculator Ramadan2010-1Sajid AhamedNo ratings yet

- ZakatDocument5 pagesZakatUsman SiddiquiNo ratings yet

- Zakat - Calculation SheetDocument24 pagesZakat - Calculation SheetMuhammad Nadeem SheikhNo ratings yet

- Zakat Calculator GuideDocument10 pagesZakat Calculator GuideAsim DarNo ratings yet

- Zakat Calculator in ExcelDocument5 pagesZakat Calculator in ExcelAbdullah AljammalNo ratings yet

- Zakat CalculatorDocument3 pagesZakat Calculatorapi-3759337No ratings yet

- Appendix: Explanations To Be Used in Conjunction With The Spreadsheet On Zakat CalculatorDocument25 pagesAppendix: Explanations To Be Used in Conjunction With The Spreadsheet On Zakat CalculatorAmeen SyedNo ratings yet

- Zakat FormDocument6 pagesZakat Formmdalt9180No ratings yet

- Zakat Calculator For MuslimDocument10 pagesZakat Calculator For MuslimKhayaal100% (3)

- Zakat CalculatorDocument10 pagesZakat CalculatorAmliyatNo ratings yet

- Missed Zakat: Your Guide To Understanding and CalculatingDocument20 pagesMissed Zakat: Your Guide To Understanding and CalculatingHnia UsmanNo ratings yet

- ZakatDocument4 pagesZakattahirnqsh4596No ratings yet

- Zakat Calculation SpreadsheetDocument6 pagesZakat Calculation SpreadsheetelmechanaNo ratings yet

- Zakat Calculator: Enter Your NameDocument12 pagesZakat Calculator: Enter Your Namehaja21No ratings yet

- Zakat Calculater ML Ilyas GhumanDocument6 pagesZakat Calculater ML Ilyas GhumanAung Zin OoNo ratings yet

- Zakat CalculatorDocument5 pagesZakat CalculatorErfan KhanNo ratings yet

- Calculate Zakat Due with this Self-Assessment FormDocument3 pagesCalculate Zakat Due with this Self-Assessment FormAlexander Sebastian GorinNo ratings yet

- Zakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?Document4 pagesZakat Self-Assessment: Section 1 - Do You Have To Pay Zakat This Year ?Shumon Mohammad Moazzem HossainNo ratings yet

- Own Your Gold: Major AttractionsDocument17 pagesOwn Your Gold: Major AttractionsJohn K SamuelNo ratings yet

- !!stilson Financial Template 2015-11-02Document27 pages!!stilson Financial Template 2015-11-02Rahul AgnihotriNo ratings yet

- Ratio AnalysisDocument113 pagesRatio AnalysisDevyansh GuptaNo ratings yet

- Exam #2 NotesDocument3 pagesExam #2 NotesMoreskyNo ratings yet

- KID - Alpha RLC Ventures Fund - June 2018Document4 pagesKID - Alpha RLC Ventures Fund - June 2018sky22blueNo ratings yet

- Brief Guidelines On Zakat 23Document2 pagesBrief Guidelines On Zakat 23mimunaaneNo ratings yet

- Conversion Method or Final Accounts Method 21-04-2020Document14 pagesConversion Method or Final Accounts Method 21-04-2020BOHEMIAN GAMINGNo ratings yet

- File your income tax return online with Gorsi Law AssociatesDocument10 pagesFile your income tax return online with Gorsi Law AssociatesMuhammad DanishNo ratings yet

- ACCOUNTING & FINANCE FOR BANKERSDocument41 pagesACCOUNTING & FINANCE FOR BANKERSNidhi RanjanNo ratings yet

- Hero Honda Motors: Submitted To: Professor Seema DograDocument19 pagesHero Honda Motors: Submitted To: Professor Seema Dograpriyankagrawal7No ratings yet

- Accounting & Finance For Bankers-Jaiib-Module D: Presentation by S.D.Bargir Joint Director-IIBFDocument41 pagesAccounting & Finance For Bankers-Jaiib-Module D: Presentation by S.D.Bargir Joint Director-IIBFGuru Prasad PNo ratings yet

- HL SilverDocument1 pageHL SilverPRATIK297No ratings yet

- Zakat On Business FormulaDocument5 pagesZakat On Business Formulanasir10118b100% (1)

- A Simple Guide To Fixed DepositDocument1 pageA Simple Guide To Fixed DepositchiragdedhiaNo ratings yet

- Zakah For IFIsDocument24 pagesZakah For IFIsfahmiNo ratings yet

- Ratio Analysis - PresDocument31 pagesRatio Analysis - Pressamarth chawlaNo ratings yet

- Compare The Tax Regime of Nepal and The United States of AmericaDocument6 pagesCompare The Tax Regime of Nepal and The United States of AmericaBikesh MaharjanNo ratings yet

- Arctos I KID PRIIPS Series A - v6Document3 pagesArctos I KID PRIIPS Series A - v6FooyNo ratings yet

- Vantage Key FeaturesDocument6 pagesVantage Key FeaturesAlviNo ratings yet

- Ratio AnalysisDocument22 pagesRatio AnalysisHemantsinh ParmarNo ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- Finance For Non FinanceDocument21 pagesFinance For Non FinanceHari PurwadiNo ratings yet

- Farm Financial StatementDocument17 pagesFarm Financial StatementTsedeke GirmaNo ratings yet

- BUSI 2001 Int. AccountingDocument3 pagesBUSI 2001 Int. AccountingJoshNo ratings yet

- Zakat Ch01Document19 pagesZakat Ch01KhalidNo ratings yet

- 3D Market View Kajaria Ceramics LTDDocument2 pages3D Market View Kajaria Ceramics LTDImran VohraNo ratings yet

- AFMCDocument1 pageAFMCImran VohraNo ratings yet

- MCI Eligibility Criteria (MBBS Admission Abroad) : Send To: Gold India Education Services (P) LTDDocument4 pagesMCI Eligibility Criteria (MBBS Admission Abroad) : Send To: Gold India Education Services (P) LTDImran VohraNo ratings yet

- How To Trade Using Moving Avgs.Document12 pagesHow To Trade Using Moving Avgs.Imran Vohra100% (3)

- Club Protected PDF 1206 Moving Avgs Excerpt GenericDocument12 pagesClub Protected PDF 1206 Moving Avgs Excerpt GenericImran VohraNo ratings yet

- Final Exam 2015 Version 1 CombinedDocument9 pagesFinal Exam 2015 Version 1 CombinedMichael AyadNo ratings yet

- Guidance Before Work in JapanDocument24 pagesGuidance Before Work in JapanHasim Al MajidNo ratings yet

- Project Report: Master of Management Studies (MMS)Document55 pagesProject Report: Master of Management Studies (MMS)Nitesh BaglaNo ratings yet

- Hadley E.M. Memoir of A Trustbuster.. A Lifelong Adventure With Japan (University of Hawaii Press, 2003) (ISBN 0824825896) (185s) - GHDocument185 pagesHadley E.M. Memoir of A Trustbuster.. A Lifelong Adventure With Japan (University of Hawaii Press, 2003) (ISBN 0824825896) (185s) - GHBozhidar Malamov PetrovNo ratings yet

- Analysis of Indonesia Planned Personal Data Protection Law (RUU PDP) Article 54Document11 pagesAnalysis of Indonesia Planned Personal Data Protection Law (RUU PDP) Article 54Muhammad ArifinNo ratings yet

- Bata India Case StudyDocument2 pagesBata India Case StudyKhan BasharatNo ratings yet

- BUSI 353 Assignment #4: Calculating Inventory Write-Downs and Loss from FireDocument2 pagesBUSI 353 Assignment #4: Calculating Inventory Write-Downs and Loss from FireAbdur Rahman50% (2)

- World Bank Uganda Poverty Assessment Report 2016Document178 pagesWorld Bank Uganda Poverty Assessment Report 2016The Independent MagazineNo ratings yet

- Gmail - Receipt For Your Payment To Zhangcheng@Sure-electronicsDocument3 pagesGmail - Receipt For Your Payment To Zhangcheng@Sure-electronicsIonut Daniel FigherNo ratings yet

- Econ 313 Handout 3 Basic Economy Study MethodsDocument41 pagesEcon 313 Handout 3 Basic Economy Study MethodsKyle RagasNo ratings yet

- L0193 Neuberger Berman Profile EmeaDocument4 pagesL0193 Neuberger Berman Profile EmeaBenz Lystin Carcuevas YbañezNo ratings yet

- NexperiaDocument9 pagesNexperiaMerly Arias RicafortNo ratings yet

- Guna Fibres Case Study: Financial Forecasting and Debt ManagementDocument2 pagesGuna Fibres Case Study: Financial Forecasting and Debt ManagementvinitaNo ratings yet

- Chapter 4: Understanding The Global Context of BusinessDocument23 pagesChapter 4: Understanding The Global Context of BusinessPradana MarlandoNo ratings yet

- Objective of Assignment: To Be Unique and The Market Leader Providing QualityDocument15 pagesObjective of Assignment: To Be Unique and The Market Leader Providing QualityPRIYA GHOSHNo ratings yet

- China Strategy 2011Document178 pagesChina Strategy 2011Anees AisyahNo ratings yet

- Rural Industrialization in IndiaDocument3 pagesRural Industrialization in Indiasanjaya beheraNo ratings yet

- Value Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsDocument1 pageValue Propositions Customer Relationships Customer Segments Key Activities Key PartnershipsBenedictus Anindita SatmokoNo ratings yet

- Charlotte Regional Business Alliance - Return To Office Survey June 2021Document8 pagesCharlotte Regional Business Alliance - Return To Office Survey June 2021Mikaela Thomas100% (1)

- Sub Prime Resolved - A New Book by Anil SelarkaDocument28 pagesSub Prime Resolved - A New Book by Anil SelarkaAnil Selarka100% (2)

- Macro-Economic Principles and Macro-Economic Objectives of A CountryDocument46 pagesMacro-Economic Principles and Macro-Economic Objectives of A Countrydush_qs_883176404No ratings yet

- Cost of Cap More QuestionsDocument4 pagesCost of Cap More QuestionsAnipa HubertNo ratings yet

- Methods of BudgetingDocument30 pagesMethods of BudgetingShinjiNo ratings yet

- Food Waste in Rst. Pakistan PDFDocument21 pagesFood Waste in Rst. Pakistan PDFKaruna DhuttiNo ratings yet

- HSBC Personal Banking Hotline GuideDocument3 pagesHSBC Personal Banking Hotline GuideSaxon ChanNo ratings yet

- ECO202-Practice Test - 15 (CH 15)Document4 pagesECO202-Practice Test - 15 (CH 15)Aly HoudrojNo ratings yet

- SyllabusDocument4 pagesSyllabusraghuvardhan41No ratings yet

- Round: 5 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 5 Dec. 31, 2024: Selected Financial StatisticsYadandla AdityaNo ratings yet

- Vale Annual ReportDocument255 pagesVale Annual Reportkrishnakant1No ratings yet

- Issue 57Document139 pagesIssue 57dgupta246859100% (1)