Professional Documents

Culture Documents

Chapter 1 Notes Global Business Today Asia Pacific Edition

Uploaded by

NaomiGraham0 ratings0% found this document useful (0 votes)

521 views13 pagesInternational Business

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInternational Business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

521 views13 pagesChapter 1 Notes Global Business Today Asia Pacific Edition

Uploaded by

NaomiGrahamInternational Business

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 13

Chapter 1: Globalization

Komatsu Case Study

Ironworks, machine tools, mining equipment etc. for Japanese market

Post WWII advantage of increasing demand for construction

equipment moved headquarters to Tokyo for government contract,

skilled labour.

Post war market protected from foreign competition by barriers.

Expanded to enter foreign markets.

Limited domestic market US dominated Caterpillar.

Threatened by Mitsubishi & Caterpillar JV

Considered inferior overseas to US products collaborative

agreements to improve image gained knowledge and sold products

in same market as licensor.

Manufacturing plants globally Japan, China, Europe, US

47% international production

Large revenue from foreign markets, including emerging economies.

Wanted to produce superior products

o Mother and daughter plants

o R&D concentrated in mother plants each different

o Cost reduction built in at design stage cost-efficiency

o Technology transferred to daughter plants

Remained in Japan high manufacturing capacity, growth, suppliers,

staff, technologies.

Daughter plants allow localisation of products

Product support operations important after market strategy.

Introduction

Away from self-contained national economies, isolated by barriers to

cross-border trade and investment, distance, time zones, language,

differences in government regulation, culture and business systems.

Towards declined barriers to trade, perceived distance shrinking due to

transport and telecommunication advances, homogeneity of material

culture, national economies becoming interdependent, integrated

global economic systems.

Shift towards a more integrated and interdependent world economy.

Volume of goods, services and investments crossing national borders

has expanded faster than world output consistently for over 50 years.

As Internet penetrates more regions and information flows become

mostly instantaneous and almost costless, global integration is

becoming more individualized, rather than being between institutions or

businesses.

GFC evidence for single economic world downturn in global

economic activity. Internationalisation activities of firm curtailed,

difficult to raise finance for investment, grim market prospects. FDI fell

14% in 2008 vs. usually annual growth 35% 2004-2007

o Initial cause deflated US housing market and associated

decline in US sub-prime mortgage market.

o Fundamental causes low US interest rates due to US

monetary policy, high level of international liquidity due to global

imbalances

o China, Singapore & oil exporters in ME accumulated large

financial surpluses from international receipts, and Americans

international payments deficit expanded.

o Chinese etc. had money, looking to invest, chose America

(residential market)

o Low interest rates because of lots of money people not fighting

for it global level.

o Low interest rates happy to invest fuelled share markets

and houses bought.

o Low returns on mainstream investments e.g. US Treasury

Bonds people wanted higher returns

o Weaker the borrower, higher the yeidl high risk (bad jobs),

high interest rate. Overall, rates lower than before, but still

higher for high-risk clients, benefitting banks.

o Investors were source of funds, allowing sub-prime lenders to

increase number of loans.

o Sub-prime loans created by banks, packaged, sold to

investment banks, pension funds etc.

Bank paid out for them by middle man

Expectation bank had low risk of losing money,

because house prices were rising (loan at under what

people payed for it), meaning % of value of house the

bank originally invested/lent is decreased. E.g. start

house value $500,000, bank lent 90%. House value

increased to $1million 45% loan.

o But housing market reverse value of house became less than

the value of the mortgage/loan (undermined)

o Value of debt exceeded value of asset for the bank. When

people walk out on houses, they dont receive payments, so

they sell, but money from sale is less than initial loan debt.

o All funds dried up no money to lend other parts of economy

e.g. government for roads, or business for machines

RECESSION (credit squeeze)

Offshoring is increasing trend form of outsourcing; task previously

performed in one country now being undertaken abroad.

Outsourcing tasks previously preformed in-house now purchased

from another firm.

LO1.1. Explain the process and drivers of globalisation and the

opportunities and challenges it creates for business.

Globalisation

Globalisation shift towards a more integrated and interdependent

world economy.

Globalisation of markets merging of historically distinct and separate

national markets into one huge marketplace.

o Converging consumer tastes

o Falling barriers to cross-border trade

o Difference in consumer taste brake to globalization

o Largest global markets commodities e.g. iron ore, oil, wheat;

industrial products e.g. microprocessors; commercial jet aircraft;

financial assets e.g. Eurobonds.

o Companies use similar strategies across markets

homogeneity

o Small and large MNEs benefitting e.g. 42% AU goods exporters

are small firms (<20 employees)

o Cant push idea too far that national markets are giving way

entirely to a global market.

o Differences in global markets consumer preference,

distribution channels, political and legal systems, economic

development.

Globalisation of production sourcing goods and services from

locations around the globe to take advantage of national differences in

the cost and quality of various factors of production (components e.g.

technology, labour, land and capital)

o Lowers overall cost structure, improves quality or functionality

more competitive.

o International outsourcing superior product, and higher chance

of getting orders from the supplying countries.

o Modern ICT (internet) facilitates outsourcing service activities to

low-cost producers overseas, in a timely manner e.g.

radiologists in UK/AU hospitals (12hr time difference)

Outsourcing medical services heavily restricted by

national and state licensing and accreditation rules. E.g.

British trained, licensed doctors in AU for British patients.

o Dispersing value-creation activities offshore compresses time,

lowers costs.

o Creation of global products

o Barriers barriers to trade, FDI, transportation and supply chain

management costs, issues re economic/political risk.

Global Institutions

To manage, regulate, police global marketplace, establish multinational

treaties.

General Agreement of Tariffs & Trade (GATT) An international treaty

that committed signatories to lowering barriers to the free flow of goods

across national borders. Predecessor of WTO.

WTO organisation succeeded GATT, acts to police world trading

system. 2012 157 nations

IMF international institution set up to maintain order in the

international monetary system. Created 1944, 44 nations.

o Lender of last resort to nation-states whose economies are in

turmoil, currencies losing value against other nations.

o Usurps sovereignty of nation-states must comply for loan

World Bank international organisation set up to promote economic

development, primarily by offering low-interest loans to governments of

poor nations. Created 1944, 44 nations

o Less controversial than IMF. Focus on financial and technical

assistance to improve living standards & reduce poverty.

o IMF & World Bank to prevent recurrence of trade wars

1920s/30s, where international trade/investment were restricted

by tariffs and exchange rate devaluations when governments

sought to protect own economies form Great Depression.

UN international organisation of 192 countries charged with keeping

international peace, developing cooperation between nations and

promoting human rights.

o Maintain international peace & security

o Develop friendly relations among nations

o To cooperate in solving international problems and promoting

respect for human rights

o Be a centre for harmonising the actions of nations.

o Central mandate higher living standards, full employment,

conditions for economic/social progress & development UN

Conference on Trade and Development (UNCTAD) promotes

integration of developing countries into world economy as a

means of attaining sustainable economic development.

Drivers of Globalisation

Micro consumers accepting global products, outsourcing production,

pressure on business to compete globally, match rivals

Macro decline in barriers to free flow of goods, services & capital;

technological change (ICT & transport)

Declining trade & investment barriers

International trade when a firm exports goods or services to buyers in

another country.

FDI when a firm invests resources in business activities outside of

home country, giving it some control over these activities.

High tariffs on imports of manufactured goods protect domestic

industries from foreign competition.

o countries retaliating, barriers against each other

depressed world demand.

Post WWII GATT lower barriers, now 4%. Low in US, EU, Japan.

Not AU (11%), China, Brazil, India etc.

o Discrepancy between old and emerging economic powers

(BRIC)

o Current round cut tariffs on industrial goods, services &

agricultural products; phase out subsidies to agricultural

producers; reduce barriers to cross-border investment; limit use

of antidumping laws.

Lowered restrictions to FDI 90% changes between 1992-2008

created more favourable market to FDI. Reduced after GFC cushion

economies from impacts.

Lower trade barriers world as the market, not one country.

Lower trade & investment barriers base production at optimal

location for activity.

Volume world merchandise trade (trade in manufactured, agricultural

and mining goods) grown consistently at a faster rate than world

production (GDP). Continual growth in trade of services too.

4 main points:

o More production by firms destined for export markets

o More outsourcing dispersing production to cut costs and

increase quality

o World economies becoming more intertwined

o World become wealthier rising trade helped global economy

along.

FDI has increasing role firms increasing cross-border investment

o FDI flow amount of FDI undertaken over a given time

o FDI stock total accumulated value of foreign-owned assets at

given time

o FDI outflow flow of FDI out of a country

o FDI inflow flow of FDI into a country

FDI inflows pre-GFC grew consistently more rapidly than world exports.

Fragile global economic recovery uncertainty.

o Because business feared protectionist pressures FDI as a way

of circumventing trade barriers.

o Increase in FDI driven by political and economic changes in

developing countries. Shift to democratic politics and free

market economies encourages FDI.

o Globalisation of economy whole world as market. FDI

presence in various regions.

Technological Change

Microprocessors and telecommunications

o Microprocessor enabled growth of high power, low cost

computing increased amount of info individuals/firms can

process. Foundation of other technologies.

o Cost of microprocessors fall, power increases (Moores Law

power doubles, cost drops by half every 18 months)

decreased cost of global communication.

Internet and WWW

o 2011 70% developed households, 20% developing w/ www

o Take up of Internet in developing countries promise for IB to

exploit growth potential of markets in these economies.

o ICT advancements small firms sell to international markets

reach wide audience w/o expense of physical shops.

o Facilitating increase in offshoring of production.

o Means to coordinate flow of component parts in global supply

chains and production systems.

o E.g. Rio Tinto outsourcing legal work. Save 20% annual legal

costs. CPA Global (India) contract drafting, legal research etc.

o Web = equalizer. No location, scale, time zone constraints.

o Businesses expand global presence at lower cost.

Transport Technology

Jet aircraft reduced time needed, effectively shrinking globe. Retain

competitiveness as costs/time reduced.

Containerisation increased efficiency transport costs decreased.

Cost-savings of these are lost if customs-checks or poor quality of port

infrastructure causes long waiting times.

Logistics performance factors

o Efficiency of clearance process by border control agencies,

o Quality of trade- and transport-infrastructure (roads, rail, ports),

o Ease of arranging competitively priced shipments,

o Competence and quality of transport operators and customs,

o Ability to track consignments, timeliness of delivery.

Firms international competitiveness is being able to access an efficient

logistics chain. Many weak links (e.g. trade procedures, transport and

telecommunication infrastructure) are within a country. Firm wont

choose country with inadequate transport, logistics and trade-related

infrastructure and services.

Implications for Globalization of Production & Markets

Production

Firms better able to respond to customer demand

Low transport costs dispersal of production more economical.

Decreased cost of information processing and communication

create and manage globally dispersed and networked production

system

Jet aircraft able to travel overseas. Managers oversee globally

dispersed production systems

Increase in trade in intermediate inputs including services, rather than

trade in final goods.

Markets

Low cost global communication (www) global marketplace.

Low cost transport economical to ship globally, creating global

markets. E.g. Ecuador roses sold I US 2 days later.

Low cost air travel mass movement of people overseas reduces

cultural distance convergence of consumer taste/preference

Global communication networks & global media global culture

LO1.2. Illustrate how the global economy has changed over the past 50

years.

US, Western Europe, Japanese dominance in world economy.

Dominance by these countries in FDI

Dominance of large MNEs from these countries in IB

Half globe (centrally planned economies of Communist world) off limits

Changing World Output and World Trade Picture

Decrease in US industrial power (from 40% to 20% since 1960)

Germany, France, UK all experienced relative decline (first to

industrialise) still grew

China & India significant growth

1960s trade as bipolar US & Western Europe

1990s tripolar with Japan

Now China & India contribute more than any Western European

country. Share of world output > Japan. Brazil & Russia dominant.

As BRIC grows, relative decline in share of world output & exports by

US and other industrialised countries is likely. Reflects economic

development and industrialisation of world economy but strong US

economy necessary to support growth and development.

Parallel decline in political power in global forums. G20 favoured over

G8.

o G8 international forum of government reps of Western

industrial economies Canada, France, Germany, Italy, Japan,

US, UK, Russia

o G20 gov reps of G8 and others including emerging economies

e.g. Brazil, India, China reflects their rising global economic

and political power.

Shift in economic geography of world opportunities in developing

nations despite attendant risks, and will be a source of competitors.

Changing FDI Picture

US firms accounted for 60% FDI flows accumulated considerable

stock of productive assets abroad.

Decreased barriers non-US firms investing across borders, to

disperse production activities to optimal locations and build direct

presence in major foreign markets.

Stock of FDI generated by rich industrial countries has been on a

steady decline

Been a sustained growth in cross-border flows of FDI

Flow of FDI has been directed at developing nations, especially China.

Not all FDI held by privately owned, commercial businesses new

investor, the sovereign wealth fund (SWF) government-controlled

fund that manages and invests government savings

o Investment in foreign government bonds and non-controlling

holdings of company shares

o Scrutinized because increasing participation in FDI

(geographically and industry specific UK, US, oil, business,

mining); most growth from balance of payments surpluses run

by China and East Asian countries; many of investing SWFs

based in China, Russia, West Africa authoritarian

governments rule.

Changing Nature of MNEs

MNEs any business that has productive activities in 2+ countries

Rise of non-US multinationals

Growth of MNEs form Japan, Europe, Australia and NZ post WWII

Declining dominance of US firms reflects global change stock of FDI

assets accounted for by developed countries fallen.

Expected growth of new MNEs from worlds developing nations

Most MNEs from US and developed nations, but from developing

nations starting to make presence in global economy. I.e. equal

number from Japan and developing.

Rise of mini-multinationals

Rise of Internet lowered barriers that small firms face in providing

products and services internationally and in building international sales.

Number of mini-multinationals on the rise

Changing World Order

No communism freer, market based economies, previously off limits

to IB

Collapse of communism in Eastern Europe host of export and

investment opportunities for Western businesses

Economic development of China poses huge opportunities and risks, in

spite of continued Communist control

Mexico and Latin America present new opportunities, as markets and

sources of materials and production. Previously ruled by dictators,

closed to Western IB; and debt and inflation are down, governments

sold state-owned enterprises, FDI welcome.

o E.g. Brazil, Mexico, Chile.

GFC changed things previously, free markets, private ownership and

reduced government regulation. GFC state intervention, buying

controlling shares

LO1.3. Justify the labelling of the twenty-first century as the Emerging

Markets Century.

Opportunities and Risks

The more integrated the global economy with many opportunities

political and economic disruptions that may disrupt plans.

Move to global economy strengthened by widespread adoption of

liberal economic policies deregulation, privatisation, removed barriers

i.e. market oriented economies

GFC and SWFs increasing trade and investment protectionist

sentiment.

Emerging Market Economies

Investors looking for somewhere exciting to put their money not too

rich, not too poor, not too closed to foreign capital.

High population, national production, economic growth, rising living

standards, attraction to investors and increasing MNEs

Chinas growth 2x US growth

Emerging = developing

UN developed, developing, transition

IMF advanced, developing, emerging

World Bank low income, lower-middle income, upper-middle etc.

Emerging countries that arent the 34 advanced economies.

Emerging if meet standards related to 1+ of following:

o Size of economy in terms of population and national production

o Wealth of country in terms of rising per capita incomes,

burgeoning middle class, reduced poverty

o Openness of country to foreign trade & investment

o Rate of growth of economy

o Prospect of further growth and development, indicated by quality

of people and resources and maturity and stability of economic,

political and social institutions

o Transition to a more business-friendly, market economy.

LO1.4. Debate the impact of globalisation on issues such as job

security, income inequality and the environment.

Is the shift to a more integrated, interdependent global economy good?

Yes politicians, economists etc. falling barriers to trade &

investment economic prosperity, jobs, raises incomes etc.

Anti-Globalisation Protests

Highlight disruptive forces of globalisation job losses through foreign

competition, downward pressure on wage rates for unskilled workers,

environmental degradation, cultural imperialism of global media and

MNEs.

Turn up at major meetings of global institutions

Fear that globalization is forever changing the world in a negative way

E.g. Occupy Wall Street symbol of corporate and financial power.

Fought corporate corruption of political systems, takeover of

democracy, manipulation of globalisation to benefit corporation,

environmental degradation etc.

Main concern exporting jobs overseas

Globalisation, jobs and income inequality

Critics worry jobs are being lost to low-wage nations

Argue expanded labour force and expanding international trade

depressed wages in developed nations.

Supporters argue that free trade countries specialising in production

of goods and services they can produce most efficiently, while

important goods and services they cant produce efficiently.

By outsourcing to cheaper areas, cost structures are cut, meaning

prices in Australia can be cut for consumers, spending more on other

goods. Also, more money in India, China etc. (outsource country)

locals more money to spend on Australian goods more jobs in AU.

Relocation effect offshored jobs lost

Scale effect when increased productivity from offshoring creates

more jobs.

Causing income inequality

o Jobs offshored from developed to developing low-skill

intensive jobs from developed POV but high-skill-intensive from

developing POV increases demand for high-skilled labour in

developed and developing countries increasing inequality.

o If low-income workers work for low-productivity, low-profit firms,

and these firms suffer most from import competition, trade will

increase income inequality by reducing employment

opportunities, and lowering relative wages of low-income

workers.

Globalisation, labour policies and the environment

Critics argue that free trade encourages firms form advanced nations to

move manufacturing facilities offshore to less developed countries with

lax environmental and labour regulations.

Following environmental regulations increases costs competitive

disadvantage

Transported goods further more greenhouse emissions

Hump shape relationship between income and pollution levels. As

economy grow sand income levels rise, initially pollution does too. But

past some point, rising income demands for greater environmental

protection pollution falls. Occurs before pre capita income reached

USD$8,000.

o Except for CO2 emissions, rising steadily with incomes.

o Soln: get nations to agree to tougher standards on limiting

emissions little success because

It could undermine international competitiveness of

domestic industry

Monitoring of progress impinges on their national

sovereignty

Concerned about carbon leakage carbon emission will

shift from parts of the planet that will undertake carbon

reduction to other areas that wont.

Supporters of free trade highlight that tougher environmental regulation

and stricter labour standards go hand in hand with economic progress

and that foreign investment often helps a country raise standards.

Globalisation and National Sovereignty

Critics worry that economic power is shifting away from national

government and towards supranational organisations e.g. WTO, EU

and UN.

Unelected bureaucrats imposing policies on democratically elected

governments of nation-states undermines sovereignty.

E.g. WTO signatories must comply with policies. If not, other states

allowed to impose appropriate trade sanctions on transgressor.

Supporters argue power is limited to what nation-states collectively

agree to grant them, and they serve the collective interests of the state.

If not, they withdraw support.

Globalisation and the worlds poor

Critics argue that the gap between rich and poor is widening and the

benefits of globalisation havent been shared equally

International income inequality measure of the income inequality

based on average income per capita of country in which they live

o Decreased since 1980-2010

o High economic growth rates in BRIC countries and developing

countries contributed to this.

Global inequality measure of income inequality based on individuals

income regardless of country they live in

o Income inequality increased between 1980-2005, using not

country averages, but individual incomes.

o Differs because GI takes account of changing income inequality

with nations, in developed and developing economies.

Supporters of free trade suggest actions of governments have brought

limited economic improvement in many countries poor governance,

corruption, macroeconomic stability, social welfare safety nets,

education, health services etc.

Argued wealth from international trade and investment favours rich

nations who set rules. E.g. global food crisis rules enforcing trade

liberalisation prevented developing countries from supporting local

farmers and ensuring national food security.

LO1.5. Compare how the management of international business differs

from the management of domestic business.

Managing an IB different from domestic business

International business any firm that engages in international trade or

investment

Countries differ culture, political, legal, economic systems.

Differences vary practises between countries. E.g. marketing.

Managers face greater and more complex range of problems e.g. rival

competition more intense, no home advantage; where to locate

activities; how to minimize costs; which market to enter; how to enter;

etc.

International companies must work within the limits imposed by

government intervention and the global trading system

International transactions require converting funds and being

susceptible to exchange rate changes.

You might also like

- International Business Strategy EBC2027 Chapter Summary - StudyDriveDocument46 pagesInternational Business Strategy EBC2027 Chapter Summary - StudyDrivecherikokNo ratings yet

- Advantages and Disadvantages of International TradeDocument8 pagesAdvantages and Disadvantages of International TradeNainesh Pandare100% (2)

- Incentive ManagementDocument30 pagesIncentive Managementdeepankarrao100% (1)

- Chapter 1 - International Business: Environments and Operations - SummaryDocument10 pagesChapter 1 - International Business: Environments and Operations - SummarySimón Acuña López100% (1)

- Chapter 6 - Political and Legal Environment Notes MGMT1101Document11 pagesChapter 6 - Political and Legal Environment Notes MGMT1101NaomiGrahamNo ratings yet

- Rise of A Gig Economy in IndiaDocument33 pagesRise of A Gig Economy in IndiaJivyansh Mittal100% (1)

- IB Psychology Abnormal and Human Relationships Options Studies SheetDocument13 pagesIB Psychology Abnormal and Human Relationships Options Studies SheetNaomiGrahamNo ratings yet

- 1st QTR Exam-Entrep 2019Document5 pages1st QTR Exam-Entrep 2019Ai RangNo ratings yet

- IB Geography Paper 1 Sample Answer QuestionsDocument4 pagesIB Geography Paper 1 Sample Answer Questionsngraham95100% (1)

- Relationship Between Work Readiness PDFDocument5 pagesRelationship Between Work Readiness PDFAlyssa Mae LunodNo ratings yet

- Mba201 PDFDocument71 pagesMba201 PDFnikhil100% (1)

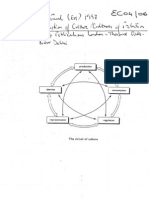

- Du Gay 1997 - Production of CultureDocument12 pagesDu Gay 1997 - Production of CultureAlejandro100% (2)

- CHAPTER 2 The Food Service SystemDocument5 pagesCHAPTER 2 The Food Service SystemLaiyah Delfin Beato67% (18)

- Business EthicsDocument7 pagesBusiness EthicsPranay BaruaNo ratings yet

- Ib 1Document23 pagesIb 1Divik TyagiNo ratings yet

- Ibm Chapter OneDocument28 pagesIbm Chapter OneGeleta ChalaNo ratings yet

- International BusinessDocument11 pagesInternational BusinesspremchandraNo ratings yet

- Topic 1: The Global Economy: EconomicsDocument10 pagesTopic 1: The Global Economy: EconomicsPavsterSizNo ratings yet

- International Business Summary WuDocument57 pagesInternational Business Summary Wu08.reap-sendersNo ratings yet

- Int Bus Trade-NotesDocument19 pagesInt Bus Trade-NotesRaynon AbasNo ratings yet

- Meaning of International BusinessDocument13 pagesMeaning of International BusinessGaurav KakkarNo ratings yet

- Meaning of International BusinessDocument13 pagesMeaning of International Businesssanju2k9bitNo ratings yet

- What's Special About International Finance?Document6 pagesWhat's Special About International Finance?Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- International Business - Meaning, Importance, Nature and ScopeDocument5 pagesInternational Business - Meaning, Importance, Nature and ScopeAdi ShahNo ratings yet

- MKTG209 Textbook NotesDocument7 pagesMKTG209 Textbook Notesmisshiddles0% (1)

- International Trade and Finance in The Era of GlobalizationDocument38 pagesInternational Trade and Finance in The Era of GlobalizationMohit GandotraNo ratings yet

- Part 1-International Finance and The Multinational Firm.Document57 pagesPart 1-International Finance and The Multinational Firm.MUSABYIMANA DeogratiasNo ratings yet

- Drivers of International BusinessDocument4 pagesDrivers of International Businesskrkr_sharad67% (3)

- IBM Part B Unitwise AnswersDocument57 pagesIBM Part B Unitwise AnswersVickyNo ratings yet

- International Business NotesDocument63 pagesInternational Business Notessuhanisonam334No ratings yet

- Trade Between Developed and Developing CountriesDocument9 pagesTrade Between Developed and Developing CountriesBest ProviderNo ratings yet

- Benefits of International TradeDocument2 pagesBenefits of International Tradeasifmahmud20diuNo ratings yet

- Lecture 1Document32 pagesLecture 1RegNo ratings yet

- International Business - BBA 6th SemDocument36 pagesInternational Business - BBA 6th Semsharma.harshita2019No ratings yet

- IBT NotesDocument18 pagesIBT NotesCarlito DiamononNo ratings yet

- Economice SS3 Second Term NoteDocument42 pagesEconomice SS3 Second Term NotenwabuezecnwosuNo ratings yet

- International BusinessDocument8 pagesInternational BusinessDrRahul ChopraNo ratings yet

- Unit 1Document55 pagesUnit 1VickyNo ratings yet

- 2 Why Do Nation TradeDocument4 pages2 Why Do Nation TradeAfrina JannatNo ratings yet

- English LcciDocument6 pagesEnglish LcciHorváthDávidNo ratings yet

- Q1. Write A Note On Globalization. AnsDocument7 pagesQ1. Write A Note On Globalization. AnsBiplab KunduNo ratings yet

- International Economic NotesDocument57 pagesInternational Economic NotesAamale KhanNo ratings yet

- Competing in Global Markets: Lecturer: S M Shahidul Alam Date: 01/08/2018Document26 pagesCompeting in Global Markets: Lecturer: S M Shahidul Alam Date: 01/08/2018mahfuzNo ratings yet

- Assignment - 1 SolutionDocument5 pagesAssignment - 1 SolutionMuskan singh RajputNo ratings yet

- Development PT 2 Employment Structure and GlobalisationDocument9 pagesDevelopment PT 2 Employment Structure and GlobalisationTadiwa MawereNo ratings yet

- MB0053Document7 pagesMB0053garima bhatngar100% (1)

- International Management: TransportationDocument34 pagesInternational Management: TransportationSanghamitra DasNo ratings yet

- 01 GlobalizationDocument19 pages01 GlobalizationsakibNo ratings yet

- Chapter 6Document7 pagesChapter 6Abdul Aziz Khan AfridiNo ratings yet

- The Global Economy NotesDocument14 pagesThe Global Economy NotesAlvi100% (1)

- Integrating Poor Countries Into World Trading System 2Document29 pagesIntegrating Poor Countries Into World Trading System 2ashishsingNo ratings yet

- Chap 2,5Document16 pagesChap 2,5Trâm PhạmNo ratings yet

- Trade Policies For The Developing NationsDocument17 pagesTrade Policies For The Developing NationsNadeem JonaidNo ratings yet

- Econ Notes 7Document16 pagesEcon Notes 7Engineers UniqueNo ratings yet

- International Business - NotesDocument57 pagesInternational Business - NotesJoju JohnyNo ratings yet

- IBM NotesDocument8 pagesIBM Notessiddhartha jhaNo ratings yet

- Introduction To International Finance IkVR8pOHotDocument48 pagesIntroduction To International Finance IkVR8pOHotNikitha NithyanandhamNo ratings yet

- CH 01 Introd. To InternationalDocument15 pagesCH 01 Introd. To InternationalManish JangidNo ratings yet

- International Trade-Written ReportDocument18 pagesInternational Trade-Written ReportKyotNo ratings yet

- IntroductionDocument22 pagesIntroductionADHADUK RONS MAHENDRABHAINo ratings yet

- c1 IBTDocument7 pagesc1 IBTCyrishNo ratings yet

- 78603Document30 pages78603oduor wanenoNo ratings yet

- Global Marketing Strategies 1Document12 pagesGlobal Marketing Strategies 1Leo Aditya LodhaNo ratings yet

- Chapter 1 GlobalizationDocument8 pagesChapter 1 GlobalizationElizabeth ChanNo ratings yet

- Ie I - HandDocument80 pagesIe I - HandTaju MohammedNo ratings yet

- 1 PageDocument2 pages1 Pagevaidyajayesh006No ratings yet

- Chapter 7 - Teams: 7.1. Define The Term Group and Describe The Stages of Group DevelopmentDocument10 pagesChapter 7 - Teams: 7.1. Define The Term Group and Describe The Stages of Group DevelopmentNaomiGrahamNo ratings yet

- Chapter 5 Study Notes MGMT1101Document9 pagesChapter 5 Study Notes MGMT1101NaomiGrahamNo ratings yet

- Chapter 5 Summary MGMT1101Document1 pageChapter 5 Summary MGMT1101NaomiGrahamNo ratings yet

- Nuevo Mapa Del MundoDocument1 pageNuevo Mapa Del MundoverarexNo ratings yet

- Outline W ReadingDocument2 pagesOutline W ReadingNaomiGrahamNo ratings yet

- Lecture Notes Globalization IntroductionDocument2 pagesLecture Notes Globalization IntroductionNaomiGrahamNo ratings yet

- Chapter 1 SummaryDocument8 pagesChapter 1 SummaryNaomiGrahamNo ratings yet

- Lecture Notes Globalization IntroductionDocument2 pagesLecture Notes Globalization IntroductionNaomiGrahamNo ratings yet

- Hot Zones - Journey To Planet EarthDocument3 pagesHot Zones - Journey To Planet EarthNaomiGrahamNo ratings yet

- Ch1 With Stats and CasesDocument18 pagesCh1 With Stats and CasesNaomiGrahamNo ratings yet

- IB Abnormal Psychology Flash Cards (Study Names & Dates)Document26 pagesIB Abnormal Psychology Flash Cards (Study Names & Dates)NaomiGrahamNo ratings yet

- I Felt A Funeral RevisedDocument7 pagesI Felt A Funeral RevisedNaomiGrahamNo ratings yet

- Kubla KhanDocument5 pagesKubla KhanNaomiGrahamNo ratings yet

- Short List of English TechniquesDocument4 pagesShort List of English Techniquesngraham95No ratings yet

- Bulanon V MendcoDocument12 pagesBulanon V MendcoAnathema DeviceNo ratings yet

- Impact of Work Environment On Performance ofDocument4 pagesImpact of Work Environment On Performance ofdion syahraniNo ratings yet

- Motors Liquidation Company - Strategic Analysis Review: Company Snapshot Company OverviewDocument5 pagesMotors Liquidation Company - Strategic Analysis Review: Company Snapshot Company OverviewAmanda ZhaoNo ratings yet

- Job Summary:: Human Resources GeneralistDocument2 pagesJob Summary:: Human Resources GeneralistSiddu BalaganurNo ratings yet

- Unit I Introduction To Organisational Behaviour Lesson - 1 Importance of Organisational BehaviourDocument217 pagesUnit I Introduction To Organisational Behaviour Lesson - 1 Importance of Organisational BehaviourAnnonymous963258No ratings yet

- Swan Mundaring Reform Project Management Plan LGNSW Amalgamation ToolkitDocument140 pagesSwan Mundaring Reform Project Management Plan LGNSW Amalgamation ToolkitSyed Mujahid AliNo ratings yet

- BSBHRM521 - Facilitate Performance Development ProcessesDocument37 pagesBSBHRM521 - Facilitate Performance Development ProcessesNASIB HOSSAINNo ratings yet

- Crisp: Preventing Gun Violence in The WorkplaceDocument40 pagesCrisp: Preventing Gun Violence in The WorkplaceJumpsuitNo ratings yet

- Task Force Report 2006Document79 pagesTask Force Report 2006noorulmustafaNo ratings yet

- GazelleannpptDocument30 pagesGazelleannpptJeffrey MaderaNo ratings yet

- IAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopeDocument5 pagesIAS 26 Accounting and Reporting by Retirement Benefit Plans: ScopevicsNo ratings yet

- A Study of Empowerment and Engagement of ITESBPO Professionals in Delhi & NCRDocument9 pagesA Study of Empowerment and Engagement of ITESBPO Professionals in Delhi & NCRfayazalamaligNo ratings yet

- Comprehensive Evaluation of The Impact of Increased Key Imports-Exports and Regulatory Changes Resulting From Vietnam's WTODocument303 pagesComprehensive Evaluation of The Impact of Increased Key Imports-Exports and Regulatory Changes Resulting From Vietnam's WTOHo Uyen0% (1)

- Chapter 4 - Lecture SlidesDocument16 pagesChapter 4 - Lecture SlidesfirasNo ratings yet

- SBC - PresentationDocument25 pagesSBC - PresentationIsmajl RamaNo ratings yet

- Resistance To Organisational Change A Case Study oDocument12 pagesResistance To Organisational Change A Case Study oLaxmiNo ratings yet

- Presented By: Ms. Simran Kaur: Assistant Professor, DSPSRDocument31 pagesPresented By: Ms. Simran Kaur: Assistant Professor, DSPSRsimranarora2007No ratings yet

- ECSR - D - Group 9Document10 pagesECSR - D - Group 9sheetal mehtaNo ratings yet

- Bihar Tax On Professions Trades Callings and Employments Act2011Document11 pagesBihar Tax On Professions Trades Callings and Employments Act2011Latest Laws TeamNo ratings yet

- HR Manual: IndexDocument39 pagesHR Manual: IndexSairam SaiNo ratings yet

- Retention of Passports by Employers - Legal PositionDocument2 pagesRetention of Passports by Employers - Legal PositionArn VelascoNo ratings yet

- Lesson 1, 2, 3 DiscussionDocument8 pagesLesson 1, 2, 3 DiscussionIrl AlcabazaNo ratings yet

- Integrated Talent ManagementDocument34 pagesIntegrated Talent ManagementAbdul MalikNo ratings yet